The Mechanics of the Bitcoin Halving: Bitcoin Halving 2025 April

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. It’s a crucial element of Bitcoin’s design, influencing its scarcity and the economics of its mining ecosystem.

The technical process involves a simple adjustment to the code. Every 210,000 blocks, the reward paid to miners for successfully adding a block to the blockchain is halved. Initially, the reward was 50 BTC per block. After the first halving, it became 25 BTC, then 12.5 BTC, and currently stands at 6.25 BTC. The next halving in April 2025 will reduce this to 3.125 BTC. This reduction is hardcoded into the Bitcoin protocol and cannot be altered without a significant consensus change across the network.

Impact on Bitcoin Mining, Bitcoin Halving 2025 April

The reduced block reward directly impacts miner profitability. With fewer Bitcoins awarded for each block mined, miners must rely more heavily on transaction fees to cover their operational costs, including electricity, hardware, and maintenance. This increased reliance on transaction fees can incentivize miners to prioritize transactions with higher fees, potentially affecting transaction confirmation times and network congestion. The profitability shift compels miners to optimize their operations – upgrading hardware for increased efficiency, exploring cheaper energy sources, or consolidating operations to achieve economies of scale. A significant drop in profitability could lead to some miners exiting the network, reducing overall hash rate and potentially impacting network security.

Effects on Miner Profitability and Network Security

The halving’s effect on miner profitability is complex and depends on several factors, including the Bitcoin price, electricity costs, mining hardware efficiency, and the volume of transaction fees. If the Bitcoin price remains stable or increases after the halving, the reduced block reward might be offset by higher revenue from transaction fees. However, if the price declines, miners could face significant financial pressure. A decrease in miner profitability could lead to a reduction in the network’s hash rate – the computational power securing the Bitcoin blockchain. A lower hash rate makes the network potentially more vulnerable to 51% attacks, where a malicious actor controls a majority of the network’s hash power and can potentially manipulate the blockchain. However, the history of previous halvings shows that the network has adapted and maintained its security, often through increased efficiency and technological advancements in mining hardware.

Mining Centralization After the Halving

The halving’s impact on mining centralization is a subject of ongoing debate. Some argue that reduced profitability could favor larger, more established mining operations with economies of scale, leading to increased centralization. These larger operations might be better equipped to weather the reduced block rewards due to their lower operating costs per Bitcoin mined. Conversely, others suggest that the halving could incentivize innovation and the emergence of new, more efficient mining technologies, potentially leading to a more decentralized network. The outcome will likely depend on the interplay of various factors, including technological advancements, regulatory changes, and the overall economic climate. For example, the increasing dominance of large-scale mining operations in certain regions like China before the regulatory crackdown illustrates the potential for centralization, while the subsequent geographical diversification suggests a possible counter-trend.

Impact on Bitcoin Supply and Scarcity

The Bitcoin halving is fundamental to Bitcoin’s deflationary monetary policy. By reducing the rate of new Bitcoin creation, the halving contributes to its long-term scarcity. The total supply of Bitcoin is capped at 21 million coins. The halving ensures that this limit is reached gradually, maintaining a controlled rate of inflation. This controlled supply, combined with increasing demand, is a key driver of Bitcoin’s price appreciation in the long run. The predictable nature of the halving, occurring at fixed intervals, allows investors to anticipate the potential impact on Bitcoin’s scarcity and price, making it a significant factor in market dynamics. The halving events in the past have historically been followed by periods of price increase, though this is not guaranteed. The limited supply and increasing demand are often cited as key factors contributing to Bitcoin’s value proposition.

Investing and Trading Strategies Around the Halving

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, historically precedes periods of significant price volatility. Understanding this volatility is crucial for developing effective investment and trading strategies. While past performance doesn’t guarantee future results, analyzing previous halvings provides valuable insights for navigating the 2025 event.

Long-Term and Short-Term Investment Strategies

Long-term investment strategies typically involve accumulating Bitcoin over an extended period, weathering short-term price fluctuations to benefit from anticipated long-term growth. This approach minimizes the impact of short-term market volatility and relies on the belief in Bitcoin’s underlying value proposition. Short-term strategies, conversely, focus on exploiting price movements in the period surrounding the halving, often involving more active trading and higher risk tolerance. Successful execution requires a deep understanding of market dynamics and technical analysis. For example, a long-term investor might dollar-cost average (DCA) into Bitcoin throughout the year leading up to the halving, while a short-term trader might engage in leveraged trading based on predicted price movements.

Examples of Successful and Unsuccessful Investment Approaches During Past Halvings

The 2012 halving saw Bitcoin’s price rise gradually in the following months, rewarding patient long-term holders. Conversely, those who attempted aggressive short-term trading based on speculative price predictions might have experienced losses if the market didn’t move as anticipated. The 2016 halving resulted in a more dramatic price increase, benefiting both long-term holders and those who timed their entry and exit points effectively. However, many who bought at the peak before the price surge experienced significant losses. The 2020 halving presented a more complex scenario, with a period of consolidation followed by a substantial price increase. Those who held through the consolidation period were rewarded, while those who panicked and sold at a loss missed out on the subsequent price appreciation. These examples highlight the importance of risk management and understanding your own risk tolerance.

Comparison of Trading Strategies Around the Halving

Several trading strategies can be employed around the halving. These include trend following, where traders attempt to capitalize on established price trends; mean reversion, where traders bet on prices returning to their average; and arbitrage, which exploits price discrepancies across different exchanges. Each strategy has its own risk-reward profile. Trend following, while potentially highly profitable, can lead to significant losses if the trend reverses unexpectedly. Mean reversion strategies require accurate identification of support and resistance levels. Arbitrage opportunities are often short-lived and require rapid execution. The optimal strategy depends on individual risk tolerance, market knowledge, and trading expertise.

Creating a Diversified Portfolio Including Bitcoin

A well-diversified portfolio reduces overall risk. A step-by-step guide to incorporating Bitcoin might include: 1) Assessing risk tolerance and investment goals; 2) Determining the percentage of the portfolio to allocate to Bitcoin, considering its volatility; 3) Choosing a secure storage method for Bitcoin (hardware wallet, reputable exchange); 4) Implementing a buying strategy (e.g., lump sum, DCA); 5) Regularly reviewing and rebalancing the portfolio based on market conditions and personal financial goals; 6) Diversifying further with other asset classes (stocks, bonds, real estate) to mitigate risk associated with Bitcoin’s price fluctuations. It’s crucial to remember that Bitcoin is a highly volatile asset and should only be a part of a larger investment strategy, not the entirety of it.

The Impact on the Broader Cryptocurrency Market

The Bitcoin halving, a significant event in the Bitcoin lifecycle, doesn’t exist in a vacuum. Its effects ripple outwards, impacting the entire cryptocurrency ecosystem, influencing investor sentiment and the performance of altcoins. Understanding these broader impacts is crucial for navigating the market effectively during and after the halving.

The halving’s primary impact stems from its effect on Bitcoin’s scarcity and potential price appreciation. Reduced supply, coupled with sustained or increased demand, typically leads to price increases. This price action can trigger a variety of responses in the broader cryptocurrency market, creating both opportunities and risks for investors in altcoins.

Altcoin Price Correlation with Bitcoin

Historically, altcoins exhibit a strong correlation with Bitcoin’s price movements. During periods of Bitcoin price appreciation, many altcoins tend to follow suit, experiencing their own price increases, although often to a lesser degree. Conversely, when Bitcoin’s price declines, altcoins typically experience a corresponding downturn. The degree of this correlation varies, however, depending on several factors, including the specific altcoin’s market capitalization, its underlying technology, and overall market sentiment. The 2012 and 2016 halvings saw significant price increases in Bitcoin, followed by a subsequent “altcoin season” where many alternative cryptocurrencies experienced substantial gains relative to Bitcoin. This occurred because some investors, having profited from Bitcoin’s rise, sought out other projects with potential for growth.

Investor Sentiment Shifts Following Halvings

The Bitcoin halving often influences investor sentiment across the cryptocurrency market. A successful halving, leading to a sustained Bitcoin price increase, can boost overall confidence in the cryptocurrency space. This positive sentiment can spill over into altcoins, leading to increased investment and potentially higher prices. However, a halving that fails to produce significant price appreciation, or is followed by a Bitcoin price correction, could negatively impact investor confidence in the entire market, causing a broader sell-off across altcoins. The psychological impact of the halving is significant, shaping market narratives and influencing trading behavior.

Scenario-Based Analysis of Bitcoin-Altcoin Correlation

Let’s consider two scenarios:

Scenario 1: A successful halving leads to a sustained Bitcoin price increase. In this scenario, we would expect a strong positive correlation between Bitcoin and altcoins. Many altcoins would likely experience price increases, mirroring Bitcoin’s upward trajectory. Investors, encouraged by Bitcoin’s success, might allocate capital to altcoins perceived as having growth potential. This could be similar to the period following the 2016 halving.

Scenario 2: The halving is followed by a Bitcoin price correction or stagnation. In this case, the correlation between Bitcoin and altcoins might weaken or even become negative. Investors might shift their focus away from riskier altcoins, opting for safer assets or even exiting the cryptocurrency market altogether. This could result in a significant sell-off in altcoins, even if their underlying fundamentals remain strong. The market reaction to the 2012 halving, which saw a more muted Bitcoin price response, might offer some parallels, although market conditions are always unique.

Regulatory Landscape and its Influence

The 2025 Bitcoin halving will occur within a complex and evolving regulatory environment. Governmental responses to cryptocurrencies vary widely, and these differences will significantly influence Bitcoin’s price, adoption rate, and the overall health of the market. Existing regulations and anticipated future policies will play a crucial role in shaping the halving’s impact.

The impact of cryptocurrency regulation on the 2025 Bitcoin halving will be multifaceted. Stringent regulations could suppress price increases following the halving by limiting investment inflows. Conversely, a more lenient regulatory framework might foster increased investor confidence and lead to a more pronounced price surge. The level of regulatory clarity will also be a significant factor; uncertainty can deter investment, while clear rules, even if restrictive, provide a predictable environment for market participants.

Varying Regulatory Approaches and their Influence on Bitcoin’s Price and Adoption

Different jurisdictions are adopting diverse approaches to regulating cryptocurrencies. Some countries have embraced a relatively permissive stance, viewing cryptocurrencies as a potential driver of innovation and economic growth. Others have taken a more cautious approach, implementing stricter regulations to mitigate risks associated with money laundering, tax evasion, and market manipulation. For example, El Salvador’s adoption of Bitcoin as legal tender contrasts sharply with China’s outright ban. These differing approaches create a fragmented global landscape, influencing Bitcoin’s price through variations in trading volume and investment flows. A country with stringent regulations might see reduced trading activity, while a more open market might attract greater investment, influencing the overall price.

Increased Scrutiny of Bitcoin Mining Operations Post-Halving

The Bitcoin halving reduces the reward for miners, potentially leading to increased scrutiny of their operations. Regulators might focus on energy consumption, environmental impact, and the potential for illicit activities within mining pools. This increased scrutiny could manifest in stricter licensing requirements, carbon emission regulations, or more stringent anti-money laundering (AML) and know-your-customer (KYC) compliance checks. The implementation of such measures could increase operational costs for miners, potentially affecting the network’s hashrate and its overall security. A hypothetical scenario could be a region imposing a carbon tax on Bitcoin mining, increasing operational costs and potentially shifting mining operations to regions with more lenient regulations.

Regulatory Uncertainty and its Impact on Investor Confidence and Market Stability

Regulatory uncertainty poses a significant risk to investor confidence and market stability. The lack of clear, consistent rules across jurisdictions can create confusion and deter investment. Investors may hesitate to commit capital to Bitcoin if they are unsure about future regulatory changes that could impact their holdings or investment strategies. This uncertainty can lead to increased market volatility, with price swings potentially amplified around the halving event. For example, if a major jurisdiction unexpectedly introduces a sweeping ban on Bitcoin trading, it could trigger a significant market downturn, regardless of the halving’s impact on supply. Conversely, the announcement of a clear and supportive regulatory framework could bolster investor confidence and drive significant price increases.

Bitcoin Halving 2025

The Bitcoin halving, a significant event in the cryptocurrency’s lifecycle, occurs approximately every four years. This event reduces the rate at which new Bitcoins are created, impacting the supply and potentially influencing the price. Understanding the historical trends surrounding previous halvings provides valuable insights into potential future price movements.

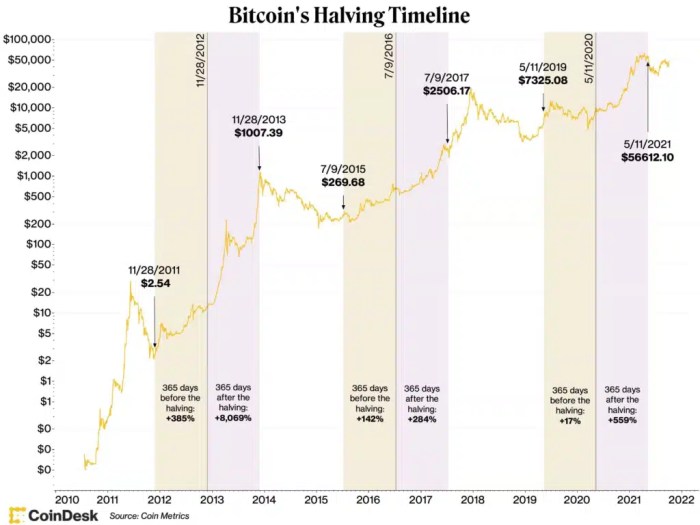

Bitcoin Halving Price Action: A Historical Chart

The following chart illustrates the price action of Bitcoin in the periods leading up to and following previous halvings. The chart would visually depict Bitcoin’s price on a time series graph, showing the price trajectory for several months before and after each halving event (2012, 2016, 2020). Key data points, such as the halving date itself, would be clearly marked. Furthermore, the chart would incorporate contextual information like significant market events or macroeconomic factors that may have influenced the price during these periods. For example, the chart might highlight the period leading up to the 2017 bull run following the 2016 halving, or the impact of the COVID-19 pandemic on the price in 2020. The visual representation would aim to show a correlation, not causation, between halving events and subsequent price movements. Note that past performance is not indicative of future results.

Bitcoin Halving Metrics Comparison

The table below compares key metrics across different Bitcoin halving cycles. This allows for an analysis of historical trends and potential predictions for the 2025 halving.

| Halving Date | Block Reward (BTC) | Mining Difficulty (approx.) | Price Before Halving (USD) | Price 1 Year After Halving (USD) | Price Change (%) |

|---|---|---|---|---|---|

| November 2012 | 50 BTC | Low | ~$13 | ~$600 | ~4500% |

| July 2016 | 25 BTC | Medium | ~$650 | ~$4,000 | ~515% |

| May 2020 | 12.5 BTC | High | ~$9,000 | ~$9,000 (approx.) | ~0% (Note: Market volatility impacted this period) |

| April 2025 (Projected) | 6.25 BTC | Very High (Projected) | (To be determined) | (To be determined) | (To be determined) |

Bitcoin Supply Schedule Post-2025 Halving

A visual representation would show a graph depicting the total supply of Bitcoin over time. The x-axis would represent time (in years), and the y-axis would represent the total number of Bitcoins in circulation. A line graph would illustrate the gradual increase in supply, with a clear visual indication of the reduced rate of Bitcoin creation after the 2025 halving. The graph would show the asymptotic approach to the maximum supply of 21 million Bitcoins. This visualization would clearly demonstrate the increasing scarcity of Bitcoin over time, a key factor potentially influencing its value. The graph would include clear labels and a legend to explain the different phases of Bitcoin’s supply schedule. The visual would highlight the point at which the halving occurs and the subsequent slower rate of new Bitcoin emission. The impact of this reduced issuance on the overall scarcity of Bitcoin would be emphasized.

Frequently Asked Questions (FAQs)

This section addresses some common queries regarding the Bitcoin halving, providing clarity on its mechanics, impact, and implications for investors. Understanding these key aspects is crucial for navigating the complexities of this significant event in the Bitcoin ecosystem.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, cutting the block reward (the amount of Bitcoin miners receive for verifying transactions) in half. This built-in deflationary mechanism is designed to control Bitcoin’s supply and potentially influence its price.

Timing of the Next Bitcoin Halving

The next Bitcoin halving is expected to occur in April 2025. The precise date will depend on the time it takes for miners to solve the cryptographic puzzles required to add new blocks to the blockchain. However, April 2025 is the widely accepted projection based on the current block time averages.

Bitcoin Halving’s Price Impact

Historically, Bitcoin’s price has shown a tendency to increase following previous halvings. This is often attributed to the reduced supply of newly mined Bitcoin, potentially increasing scarcity and driving demand. However, it’s important to note that other factors, such as market sentiment, regulatory changes, and macroeconomic conditions, also significantly influence Bitcoin’s price. The 2012 and 2016 halvings were followed by substantial price increases, but this doesn’t guarantee a similar outcome in 2025. External factors could easily outweigh the halving’s impact.

Investment Risks During a Bitcoin Halving

Investing in Bitcoin around a halving carries inherent risks. While historical trends suggest potential price appreciation, there’s no guarantee of profits. The market is volatile, and price movements can be unpredictable. Investors should carefully assess their risk tolerance and only invest what they can afford to lose. The period leading up to a halving often sees increased speculation, potentially creating price bubbles that can burst, resulting in significant losses.

Long-Term Implications of the Halving

The halving contributes to Bitcoin’s long-term scarcity. The fixed supply of 21 million Bitcoin means that the rate of new Bitcoin entering circulation steadily decreases over time. This scarcity is a key argument for Bitcoin’s value proposition, suggesting that its price could appreciate significantly in the long run as demand continues to grow. The halving reinforces this scarcity, potentially strengthening Bitcoin’s position as a store of value and influencing its market dominance among cryptocurrencies.

Bitcoin Halving 2025 April – The Bitcoin Halving in April 2025 is a significant event for the cryptocurrency, expected to impact its price volatility. Understanding this event requires a comprehensive look at the broader implications of the 2025 halving, which you can explore further by visiting this insightful resource on 2025 Halving Bitcoin. Returning to the April 2025 halving specifically, its effects will likely be felt throughout the year and beyond, shaping the future trajectory of Bitcoin.

The Bitcoin Halving in April 2025 is a significant event for the cryptocurrency’s future, impacting its supply and potentially its price. Understanding this event requires a comprehensive look at the broader implications of the halving cycle, which you can explore further by visiting this informative resource on Halving Bitcoin 2025. Returning to the April 2025 halving, analysts are already predicting various market reactions based on past trends and current economic conditions.

The Bitcoin Halving in April 2025 is a significant event, reducing the rate of new Bitcoin creation. This naturally leads to speculation about its market impact; to understand the potential consequences, it’s helpful to consider what might follow. For insightful analysis on this, check out this article: What Will Happen After Bitcoin Halving In 2025. Ultimately, the April 2025 Bitcoin Halving’s effects will unfold over time, shaping the cryptocurrency’s future trajectory.

The Bitcoin Halving in April 2025 is a significant event, reducing the rate of new Bitcoin creation. This naturally leads to speculation about its market impact; to understand the potential consequences, it’s helpful to consider what might follow. For insightful analysis on this, check out this article: What Will Happen After Bitcoin Halving In 2025. Ultimately, the April 2025 Bitcoin Halving’s effects will unfold over time, shaping the cryptocurrency’s future trajectory.

The Bitcoin Halving in April 2025 is a significant event, reducing the rate of new Bitcoin creation. This naturally leads to speculation about its market impact; to understand the potential consequences, it’s helpful to consider what might follow. For insightful analysis on this, check out this article: What Will Happen After Bitcoin Halving In 2025. Ultimately, the April 2025 Bitcoin Halving’s effects will unfold over time, shaping the cryptocurrency’s future trajectory.