Bitcoin Halving 2025: Bitcoin Halving 2025 Binance

The Bitcoin halving, a programmed event occurring approximately every four years, is a significant occurrence in the cryptocurrency’s lifecycle. This event reduces the rate at which new Bitcoins are created, effectively decreasing the inflation rate of the Bitcoin network. Historically, these halvings have been followed by periods of significant price appreciation, though this is not guaranteed and other factors significantly influence price. The 2025 halving, anticipated to occur in the spring, is generating considerable interest and speculation within the cryptocurrency community.

Bitcoin Halving Mechanics and Historical Impact

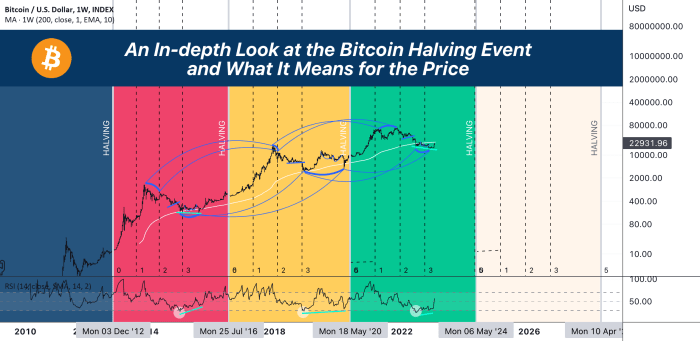

The Bitcoin halving mechanism is embedded within the Bitcoin protocol. Every 210,000 blocks mined, the reward given to miners for verifying transactions and adding new blocks to the blockchain is cut in half. This began with a 50 BTC reward, reduced to 25 BTC in 2012, then 12.5 BTC in 2016, and currently stands at 6.25 BTC. After the 2025 halving, this reward will be reduced to 3.125 BTC. Historically, the halvings of 2012 and 2016 were followed by substantial increases in Bitcoin’s price, although the timing and magnitude of these price increases varied. These price increases are often attributed to the decreased supply of new Bitcoins entering the market, increasing scarcity and potentially driving up demand. However, it’s crucial to remember that other market forces, such as regulatory changes, technological advancements, and overall market sentiment, also play a significant role in price fluctuations.

Anticipated Effects of the 2025 Halving on Supply and Demand

The 2025 halving will further reduce the rate of Bitcoin inflation. This reduction in new Bitcoin supply is expected to tighten the existing supply, potentially increasing its scarcity and value. The anticipated effect on demand is more complex. Increased scarcity can indeed boost demand, but this is influenced by numerous other factors, including investor confidence, macroeconomic conditions, and the overall cryptocurrency market sentiment. While a price increase is often anticipated following a halving, the extent of this increase remains highly speculative and depends on the interplay of supply, demand, and broader market dynamics. For example, if overall market sentiment is negative due to other economic factors, the positive impact of the halving on price might be muted or even negated.

Potential Price Scenarios for Bitcoin Leading Up To and Following the 2025 Halving

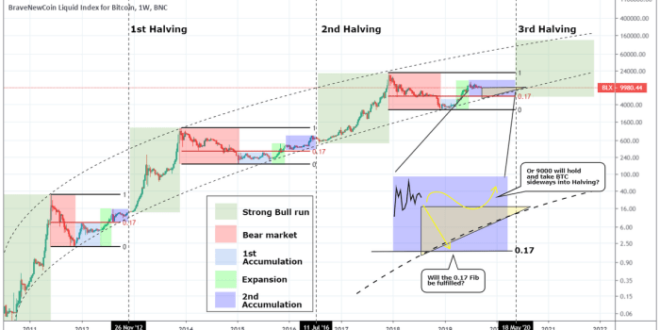

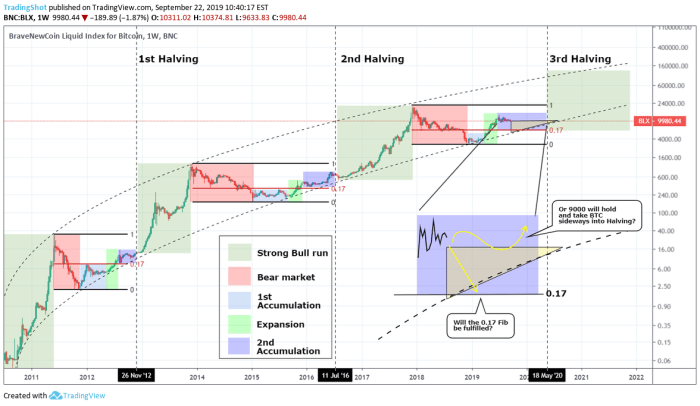

Several price scenarios are possible leading up to and following the 2025 halving. A bullish scenario could see Bitcoin’s price steadily increasing in anticipation of the halving, followed by a significant surge after the event. This scenario is supported by the historical price movements following previous halvings. A more neutral scenario might involve a period of sideways price movement leading up to the halving, with a more moderate price increase following the event. This scenario acknowledges the influence of other market forces that can offset the impact of the halving. A bearish scenario could involve a price decline leading up to the halving, potentially due to negative market sentiment or other factors. The price might recover after the halving, but the recovery might be slower and less pronounced than in bullish scenarios. The actual outcome will likely depend on a complex interplay of factors, making precise prediction extremely difficult. The 2012 halving, for instance, saw a gradual price increase leading up to the event, while the 2016 halving saw a more volatile period before a significant price surge.

Comparison of the 2025 Halving to Previous Halving Events

The 2025 halving shares similarities with previous halvings in that it will reduce the rate of Bitcoin creation. However, there are also key differences. The cryptocurrency market is significantly more mature and regulated in 2025 compared to 2012 or 2016. The overall market capitalization and institutional involvement are also substantially higher. These factors could influence the market’s reaction to the halving differently than in the past. Furthermore, the macroeconomic environment and regulatory landscape are vastly different now, introducing new uncertainties and influencing investor behavior. The 2025 halving will not be a simple repeat of past events; the interplay of these factors will determine the unique characteristics of its impact on Bitcoin’s price.

Binance’s Role in the Bitcoin Halving

Binance, as the world’s largest cryptocurrency exchange by trading volume, plays a significant role in shaping the Bitcoin market, particularly during events like the halving. Its actions and market influence can significantly impact Bitcoin’s price and overall market sentiment. Understanding Binance’s position and strategies is crucial for comprehending the broader dynamics surrounding the Bitcoin halving.

Binance’s Market Influence and Potential Impact on Bitcoin’s Price During the Halving

Binance’s massive trading volume directly correlates with Bitcoin’s price volatility. A significant portion of global Bitcoin trades occurs on Binance, meaning the exchange’s activities can amplify or dampen price fluctuations. During the halving, when supply reduction is expected to increase demand, Binance’s role in facilitating this increased demand becomes amplified. Its trading platform’s stability and order book depth are vital factors determining how smoothly the market absorbs this increased demand. A surge in trading activity on Binance during the halving could potentially drive Bitcoin’s price higher, while conversely, any signs of instability or manipulation could lead to price corrections. Historical data from previous halvings can be analyzed to assess the correlation between Binance’s trading volume and Bitcoin’s price movements around those events. For example, comparing the trading volume on Binance before, during, and after the 2016 and 2020 halvings with the corresponding Bitcoin price changes could provide valuable insights.

Binance’s Trading Volume and Its Correlation with Bitcoin’s Price Fluctuations

The correlation between Binance’s trading volume and Bitcoin’s price movements is strong, though not perfectly deterministic. Periods of high trading volume on Binance often coincide with significant price swings in Bitcoin, whether upward or downward. This is because Binance acts as a major price discovery mechanism; large orders executed on the platform can significantly influence the market price. Analyzing the order book depth on Binance during periods of high volatility can reveal insights into market sentiment and potential price movements. For instance, a deep order book suggests a stable market with less susceptibility to manipulation, while a shallow order book may indicate increased vulnerability to price swings. Furthermore, comparing Binance’s trading volume with that of other major exchanges during previous halvings can provide a more comprehensive understanding of its market influence.

Binance’s Strategies and Initiatives Related to Bitcoin Trading and Investment

Binance actively promotes Bitcoin trading through various initiatives. These include offering a wide range of Bitcoin trading pairs, providing advanced charting tools and analytical resources for traders, and implementing robust security measures to protect user assets. Furthermore, Binance’s involvement in the broader Bitcoin ecosystem, including its participation in industry conferences and its support of Bitcoin-related projects, strengthens its position as a key player. Binance also offers various investment products related to Bitcoin, such as futures contracts and leveraged trading, catering to a diverse range of investor risk appetites. These products can amplify both gains and losses, making Binance’s role in managing risk during the halving particularly important. The exchange’s commitment to regulatory compliance and its efforts to mitigate risks associated with volatile markets also influence its overall strategy.

Comparison of Binance’s Approach to the Halving with Other Major Cryptocurrency Exchanges

While other major cryptocurrency exchanges also play a role in the Bitcoin market, Binance’s sheer size and trading volume set it apart. Compared to exchanges like Coinbase or Kraken, Binance typically handles a significantly larger proportion of global Bitcoin trades. This means its actions and policies have a more pronounced effect on Bitcoin’s price and market dynamics. The differences in the regulatory environments in which these exchanges operate can also influence their approaches to the halving. For instance, exchanges operating in more heavily regulated jurisdictions might adopt more conservative strategies compared to those operating in regions with less stringent regulatory oversight. Analyzing the differences in trading fees, available products, and security measures offered by these exchanges can further illustrate the varied approaches to managing the halving’s impact.

Market Predictions and Speculation

The Bitcoin halving, a significant event in the Bitcoin blockchain’s lifecycle, invariably sparks intense speculation about its impact on the cryptocurrency’s price. Predicting the precise effect is inherently challenging, given the complex interplay of factors influencing Bitcoin’s value. However, by analyzing historical trends, considering macroeconomic conditions, and assessing regulatory developments, we can explore a range of potential scenarios.

The halving reduces the rate at which new Bitcoins are created, effectively decreasing the supply. Historically, this has led to price increases in the months following previous halvings, but the magnitude of the increase has varied significantly. Several factors contribute to this variability, and understanding them is crucial for forming informed predictions.

Bitcoin Price Predictions Post-Halving

Various analysts offer diverging predictions for Bitcoin’s price after the 2025 halving. Some analysts predict a significant price surge, potentially exceeding previous all-time highs, while others foresee more modest gains or even a period of consolidation or decline. The disparity reflects the inherent uncertainty and complexity of the cryptocurrency market.

| Bullish Predictions | Bearish Predictions |

|---|---|

| Some analysts predict Bitcoin could reach $100,000 or even higher by the end of 2025, fueled by increased scarcity and renewed institutional interest. This prediction is often based on extrapolating historical price increases following previous halvings, although this approach is inherently simplistic. | Conversely, some bearish analysts suggest that the price increase might be less dramatic than in previous cycles, or even nonexistent. They point to macroeconomic factors like inflation, interest rates, and potential regulatory crackdowns as countervailing forces. They might forecast a price range between $50,000 and $70,000, representing a more modest increase. |

| These bullish predictions often incorporate the assumption of continued adoption and growing institutional investment. They also often factor in the potential for further technological advancements within the Bitcoin ecosystem, increasing its utility and attractiveness. | Bearish predictions often emphasize the potential for regulatory uncertainty to dampen investor enthusiasm. They may also consider the possibility of a broader cryptocurrency market downturn, which could negatively impact Bitcoin’s price regardless of the halving. |

Factors Influencing Bitcoin’s Price, Bitcoin Halving 2025 Binance

Numerous factors contribute to the volatility and price fluctuations of Bitcoin. Understanding these influences is critical for navigating the complexities of market predictions.

Bitcoin Halving 2025 Binance – Regulatory Changes: Government regulations worldwide significantly impact the cryptocurrency market. Stringent regulations can stifle innovation and adoption, potentially leading to price decreases. Conversely, clear and supportive regulatory frameworks can foster growth and increase investor confidence, potentially driving prices higher. For example, the differing regulatory approaches in the US and El Salvador have demonstrably influenced Bitcoin’s price at different times.

Binance, a major cryptocurrency exchange, is expected to play a significant role in the Bitcoin Halving 2025. The event itself will drastically alter Bitcoin’s inflation rate, a topic extensively covered in this insightful article on the Bitcoin Halving Event 2025. Understanding this event is crucial for anyone involved in the crypto market, and its impact will undoubtedly be felt on platforms like Binance.

Macroeconomic Conditions: Global economic factors such as inflation, interest rates, and recessionary fears heavily influence investor sentiment and risk appetite. During periods of economic uncertainty, investors may flock to safe-haven assets like Bitcoin, driving up its price. Conversely, periods of economic stability might lead investors to seek higher returns elsewhere, potentially causing Bitcoin’s price to fall.

Binance, a major player in the crypto market, will undoubtedly see increased activity surrounding the Bitcoin Halving in 2025. Pinpointing the exact date is crucial for strategizing, and you can find that information by checking out this helpful resource: When Is The Bitcoin Halving 2025 Date. Knowing the precise timing will allow Binance and its users to better prepare for the anticipated market shifts following the Bitcoin Halving 2025 event.

Technological Advancements: Improvements in blockchain technology, the development of new applications, and the expansion of the Bitcoin ecosystem can positively influence its price. For example, the development of the Lightning Network, which aims to improve transaction speed and reduce fees, could attract more users and increase demand.

Bitcoin Halving 2025 is a significant event anticipated by many Binance users and the broader crypto community. Precise timing is crucial for strategic investment planning, so knowing exactly when this reduction in Bitcoin’s block reward will occur is key. To determine the precise date, consult this helpful resource: When In 2025 Is The Next Bitcoin Halving? Understanding this date allows for better preparation and informed decisions regarding Bitcoin Halving 2025 Binance trading strategies.

Investor Sentiment and Strategies

Investor sentiment surrounding Bitcoin in the lead-up to the 2025 halving is likely to be a complex mix of optimism, caution, and speculation. The halving event, which reduces the rate of new Bitcoin creation, historically has been associated with price increases due to decreased supply. However, macroeconomic conditions and overall market sentiment will play significant roles in shaping investor behavior. The anticipation of scarcity, combined with potential regulatory changes or economic shifts, will create a dynamic environment for Bitcoin investment.

Prevailing Investor Sentiment

Leading up to the 2025 halving, investor sentiment will likely be influenced by several factors. Bullish sentiment will be fueled by the historical correlation between halvings and price appreciation. However, bearish sentiment might arise from macroeconomic uncertainty, regulatory concerns, or potential market corrections preceding the halving. The overall sentiment will depend on the interplay of these conflicting forces, and it’s unlikely to be uniformly bullish or bearish. For example, if the global economy is experiencing a period of stability or growth, investor confidence in Bitcoin might be higher, leading to a more optimistic outlook. Conversely, a period of economic downturn could dampen investor enthusiasm.

Investment Strategies in Anticipation of the Halving

Investors may employ a variety of strategies to capitalize on the anticipated price movements around the halving. Some may adopt a “buy and hold” strategy, accumulating Bitcoin over time and holding it through the halving event, anticipating a price increase afterward. Others may opt for dollar-cost averaging (DCA), investing a fixed amount of money at regular intervals, mitigating the risk of buying at a market peak. More sophisticated strategies could involve the use of derivatives, such as options or futures contracts, to speculate on price movements. Leveraged trading, however, carries significant risk and is only suitable for experienced investors with a high risk tolerance. Finally, some investors may utilize strategies like stacking sats (accumulating small amounts of Bitcoin regularly) as a long-term investment approach.

Risk and Reward Comparison of Investment Strategies

The “buy and hold” strategy, while simple, carries the risk of significant losses if the price declines unexpectedly. DCA mitigates this risk somewhat but may result in lower overall returns if the price appreciates significantly. Derivatives trading offers high potential rewards but comes with equally high risks, potentially leading to substantial losses if market predictions are inaccurate. Leveraged trading amplifies both gains and losses, making it particularly risky. Stacking sats, while a low-risk approach, might yield slower returns compared to more aggressive strategies. The optimal strategy depends on individual risk tolerance, investment goals, and market outlook. For instance, a risk-averse investor might prefer DCA or stacking sats, while a more aggressive investor might consider derivatives trading (although with extreme caution).

Advice for Investors Considering Bitcoin Investments Around the Halving

Before investing in Bitcoin, investors should:

- Conduct thorough research and understand the risks involved.

- Only invest what you can afford to lose.

- Diversify your portfolio to mitigate risk.

- Consider your risk tolerance and investment timeline.

- Avoid making emotional investment decisions.

- Stay informed about market trends and regulatory developments.

- Consult with a qualified financial advisor before making any significant investment decisions.

Technical Analysis and Chart Patterns

Technical analysis offers a framework for predicting Bitcoin’s price movements by studying historical price and volume data, identifying patterns, and using indicators. While not foolproof, it provides valuable insights, especially when considered alongside fundamental analysis. Understanding common chart patterns and indicators can help investors gauge potential price trends leading up to and following the 2025 Bitcoin halving.

Potential Technical Indicators

Several technical indicators could offer clues about Bitcoin’s price behavior around the halving. The Relative Strength Index (RSI) measures momentum, indicating overbought or oversold conditions. A reading above 70 suggests overbought conditions, potentially signaling a price correction, while a reading below 30 suggests oversold conditions, potentially indicating a price rebound. Moving averages, such as the 50-day and 200-day moving averages, can identify trends and potential support and resistance levels. A bullish crossover occurs when a shorter-term moving average crosses above a longer-term moving average, suggesting a potential uptrend. Conversely, a bearish crossover suggests a potential downtrend. Volume analysis can confirm price movements; high volume during a price increase strengthens the bullish signal, while high volume during a price decrease strengthens the bearish signal. The Bollinger Bands, which show price volatility, can signal potential breakouts or reversals. A price moving outside the bands often suggests a strong trend, while a price consolidating within the bands indicates lower volatility.

Common Chart Patterns Around Previous Halvings

Historical Bitcoin price data shows recurring chart patterns around previous halving events. Head and shoulders patterns, characterized by three peaks (the left shoulder, head, and right shoulder), often precede a significant price decline. Double tops and double bottoms, characterized by two similar price peaks or troughs, can signal potential trend reversals. Triangles, characterized by converging trendlines, represent periods of consolidation before a potential breakout, either upward or downward. Flags and pennants, characterized by short periods of consolidation within a larger trend, usually signal a continuation of the existing trend. For example, the period leading up to the 2021 halving saw a period of consolidation in a triangle pattern, followed by a significant price increase after the breakout.

Illustrative Chart Patterns

A head and shoulders pattern might appear as a gradual price increase (left shoulder), followed by a higher peak (head), and then a slightly lower peak (right shoulder), before a sharp price drop. This suggests a potential bearish reversal. A double bottom pattern shows a price decline to a low point, a bounce back, and then another decline to roughly the same low point, before a significant price increase. This indicates a potential bullish reversal. An ascending triangle pattern shows a series of higher lows and a horizontal resistance line. A breakout above the resistance line would signal a bullish trend. A descending triangle pattern shows a series of lower highs and a horizontal support line. A breakdown below the support line would signal a bearish trend.

Limitations of Technical Analysis

Technical analysis is not a perfect predictor of future price movements. It relies on historical data, which may not accurately reflect future market conditions. The interpretation of chart patterns is subjective, and different analysts may reach different conclusions. External factors, such as regulatory changes, macroeconomic events, and technological advancements, can significantly impact Bitcoin’s price and are not directly reflected in technical indicators. Over-reliance on technical analysis without considering fundamental factors can lead to poor investment decisions. For instance, while technical indicators might suggest a bullish trend, a significant regulatory crackdown could override these signals and lead to a sharp price decline.

Regulatory Landscape and its Impact

The 2025 Bitcoin halving, while a significant technical event, will inevitably be influenced by the evolving global regulatory landscape. Governmental approaches to cryptocurrencies vary widely, impacting Bitcoin adoption, market sentiment, and ultimately, its price. Understanding these regulatory nuances is crucial for navigating the post-halving market.

The regulatory landscape significantly impacts Bitcoin’s price and adoption. Stringent regulations can stifle innovation and reduce market participation, potentially leading to lower prices. Conversely, clear and supportive frameworks can foster growth and attract institutional investment, potentially driving prices higher. The interplay between the halving’s supply-side impact and regulatory pressures will shape the market’s trajectory.

Varying Regulatory Approaches Across Jurisdictions

Different countries adopt vastly different approaches to regulating cryptocurrencies. Some, like El Salvador, have embraced Bitcoin as legal tender, while others maintain a more cautious stance, implementing strict regulations or outright bans. This divergence creates a complex global ecosystem with varying levels of Bitcoin adoption and associated market volatility. For example, the relatively lax regulatory environment in some jurisdictions has fostered significant Bitcoin mining activity, while stricter regulations in others have limited growth. This uneven distribution of activity affects the overall market dynamics.

Impact on Market Sentiment and Investor Strategies

Regulatory clarity or uncertainty profoundly impacts investor sentiment. Positive regulatory developments, such as the establishment of clear licensing frameworks, often boost investor confidence and attract institutional capital. Conversely, ambiguous or restrictive regulations can lead to uncertainty and capital flight, potentially depressing prices. This is especially relevant during the 2025 halving, a period already characterized by price volatility due to the reduced supply of newly mined Bitcoin. Investors will likely adjust their strategies based on the regulatory outlook in key markets. For instance, a significant regulatory crackdown in a major market could trigger a sell-off, regardless of the halving’s technical implications.

Regulatory Stance of Major Countries Towards Bitcoin

| Country | Regulatory Approach | Key Features | Impact on Bitcoin Adoption |

|---|---|---|---|

| United States | Evolving, fragmented | Varying state-level regulations, SEC scrutiny of crypto assets. | Mixed; significant institutional interest but regulatory uncertainty remains. |

| China | Restrictive | Outright ban on cryptocurrency trading and mining. | Significantly reduced adoption within the country, but some Chinese mining operations have relocated. |

| El Salvador | Supportive | Bitcoin is legal tender. | Increased adoption, but challenges persist in infrastructure and education. |

| European Union | Developing comprehensive framework | Markets in Crypto-assets (MiCA) regulation aims to standardize rules across member states. | Potential for increased clarity and adoption, pending implementation and enforcement. |

FAQs about Bitcoin Halving 2025 and Binance

The Bitcoin halving is a significant event in the cryptocurrency world, and Binance, as one of the largest cryptocurrency exchanges, plays a crucial role in its impact. Understanding the mechanics of the halving, Binance’s involvement, and potential market consequences is essential for investors navigating this period. This section addresses frequently asked questions regarding the 2025 halving and Binance’s influence.

The Bitcoin Halving and its Price Effect

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, cutting the block reward in half. Historically, halvings have been followed by periods of increased Bitcoin price, though this is not guaranteed. The reduced supply, coupled with continued (or increased) demand, can create upward price pressure. However, other market factors, such as macroeconomic conditions and regulatory changes, also significantly influence price. For example, the 2012 and 2016 halvings were followed by substantial price increases, but the market dynamics differed considerably. The 2020 halving saw a period of price appreciation, but it was followed by a significant correction. This illustrates the complexity of predicting price movements solely based on the halving.

Binance’s Influence on the Bitcoin Halving

Binance’s role is multifaceted. As a major exchange, it facilitates a substantial volume of Bitcoin trading. Its operational stability and security during the halving period are crucial for market confidence. Any significant disruptions on Binance could impact Bitcoin’s price negatively. Conversely, Binance’s proactive measures, such as enhanced security protocols and improved liquidity management, could contribute to a smoother transition and potentially mitigate negative price swings. Furthermore, Binance’s initiatives related to Bitcoin derivatives and other financial instruments could also influence market sentiment and trading activity surrounding the halving.

Risks and Rewards of Investing in Bitcoin Around the Halving

Investing in Bitcoin carries inherent risks. Price volatility is a significant concern, especially around major events like the halving. The potential for significant price drops exists, even if a price increase is anticipated. However, the potential rewards can be substantial if the historical trend of price appreciation after halvings continues. Successful investment requires careful risk assessment, diversification, and a long-term perspective. For instance, an investor might allocate a small portion of their portfolio to Bitcoin, hedging against potential losses with other asset classes. Conversely, a more aggressive investor might allocate a larger percentage, believing in the long-term potential of Bitcoin despite the short-term risks.

Strategies for Navigating Market Volatility

Navigating the market volatility surrounding the halving requires a well-defined strategy. This includes thorough research, risk management, and a clear understanding of personal investment goals. Dollar-cost averaging (DCA), a strategy involving regular investments regardless of price fluctuations, can help mitigate risk. Similarly, setting stop-loss orders to limit potential losses is crucial. Diversification across different asset classes reduces the overall portfolio risk. Finally, staying informed about market trends and regulatory developments is vital for making informed investment decisions. Staying abreast of news and analysis from reputable sources can aid in developing a more informed strategy.

Binance, a major cryptocurrency exchange, will undoubtedly play a significant role in the Bitcoin Halving 2025. Understanding the precise timing of this event is crucial for market participants. To find out exactly when the halving will occur, you should check this resource: What Time Is Bitcoin Halving 2025. Knowing this date allows Binance and its users to better prepare for the potential market volatility associated with the Bitcoin Halving 2025.

Binance, a major player in the crypto market, is anticipating significant activity surrounding the Bitcoin Halving 2025. This event, which will reduce the rate of new Bitcoin creation, is expected to impact price volatility. For detailed information on the precise timing of this halving event, you might find the article on the Bitcoin April 2025 Halving helpful.

Understanding this date is crucial for anyone trading Bitcoin on Binance or other platforms in the lead-up to and following the Bitcoin Halving 2025.

Binance, a major cryptocurrency exchange, will undoubtedly play a significant role in the Bitcoin Halving 2025. Understanding the precise timing is crucial for market participants, and to find out more about that, check the definitive resource on the Halving Bitcoin Date 2025. This date will significantly impact trading volumes and price volatility on Binance, making it a key event for investors monitoring the platform.