Bitcoin Halving 2025: Bitcoin Halving 2025 Chart

The Bitcoin halving, scheduled for sometime in 2025, is a significant event in the cryptocurrency’s lifecycle. This programmed reduction in the rate at which new Bitcoins are created fundamentally alters the dynamics of supply and demand, influencing price and mining profitability. Understanding the mechanics and historical context of these halvings is crucial for navigating the potential market shifts.

Bitcoin Halving Mechanics and Supply Impact

The Bitcoin halving mechanism is hardcoded into the Bitcoin protocol. Approximately every four years, the reward given to Bitcoin miners for verifying transactions and adding new blocks to the blockchain is cut in half. This halving directly reduces the rate of Bitcoin inflation. Before the first halving in 2012, miners received 50 BTC per block. This reduced to 25 BTC in 2012, then 12.5 BTC in 2016, and currently stands at 6.25 BTC. The 2025 halving will further decrease this reward to 3.125 BTC per block. This controlled reduction in supply is a core element of Bitcoin’s deflationary design.

Historical Impact of Bitcoin Halvings

Previous Bitcoin halvings have demonstrably influenced both price and market sentiment. The halvings of 2012 and 2016 were followed by significant price increases, although the timing and magnitude of these increases varied. The 2012 halving saw a gradual price rise over the subsequent year, while the 2016 halving led to a more pronounced bull run starting approximately a year later. These increases are generally attributed to the decreased supply of newly minted Bitcoin interacting with relatively consistent or increasing demand. However, it is important to note that other factors, such as regulatory changes, technological advancements, and overall market conditions, also played a role in price movements. Attributing price changes solely to halvings would be an oversimplification.

Expected Changes in Bitcoin Mining Profitability Post-2025 Halving

The 2025 halving will significantly impact Bitcoin mining profitability. With the block reward halved, miners will receive less Bitcoin for each block they successfully mine. This reduction will likely lead to increased pressure on miners to maintain profitability. Several responses are anticipated: increased mining efficiency through the adoption of more advanced and energy-efficient hardware, consolidation of mining operations among larger players, and potentially an increase in the Bitcoin price to offset the reduced block reward. The exact impact on profitability will depend on several factors, including the Bitcoin price, the cost of electricity, and the hash rate (the computational power dedicated to Bitcoin mining). A scenario similar to previous halvings, where a price increase follows, could mitigate the profitability concerns for miners. Conversely, if the price remains stagnant or decreases, many miners could be forced to shut down operations, leading to a reduction in the overall hash rate.

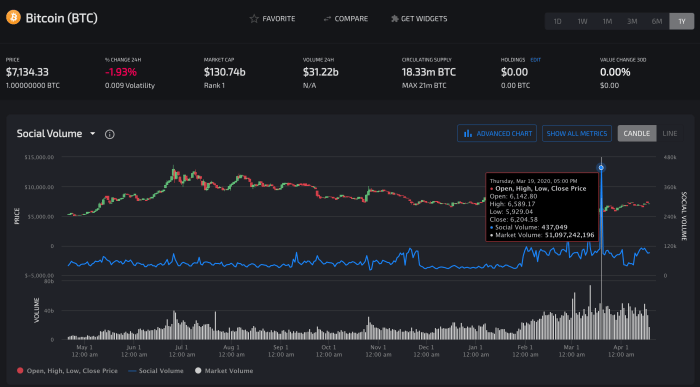

Analyzing the 2025 Halving Chart

The Bitcoin halving event, scheduled for 2025, is a significant event anticipated to impact the cryptocurrency’s price. Analyzing potential price movements requires considering various factors and scenarios, comparing it to past halvings, and factoring in macroeconomic conditions. This analysis aims to provide a hypothetical overview of possible price trajectories, acknowledging the inherent unpredictability of the cryptocurrency market.

Hypothetical Bitcoin Price Chart Scenarios

This section presents three hypothetical scenarios for Bitcoin’s price leading up to and following the 2025 halving: bullish, bearish, and neutral. These scenarios are illustrative and do not constitute financial advice. The charts would be represented graphically, but since visual representation is not possible in this text-based format, we will describe them.

* Bullish Scenario: A bullish scenario would show a gradual price increase in the months leading up to the halving, driven by anticipation. The halving itself would act as a catalyst, potentially triggering a sharp price surge. Post-halving, the price would likely experience further growth, though potentially with periods of consolidation or minor corrections. The chart would show a clear upward trend, potentially exceeding previous all-time highs. This scenario is reminiscent of the price action following the 2016 and 2020 halvings, although the magnitude of the price increase is always uncertain.

* Bearish Scenario: A bearish scenario would depict a prolonged period of price stagnation or even decline before the halving. The halving might offer temporary support, but the overall trend would remain downward. Macroeconomic factors, such as persistent inflation or a global recession, could contribute to this bearish outlook. The chart would show a downward or sideways trend, potentially failing to reach previous highs. This scenario is less common, but the crypto market has demonstrated periods of significant downturn in the past.

* Neutral Scenario: A neutral scenario would portray a relatively flat price movement leading up to the halving. The halving itself might trigger a short-term price increase, but this increase would be relatively modest and followed by a return to a range-bound price action. The chart would show a relatively flat line with minor fluctuations, representing a period of market uncertainty. This scenario represents a less dramatic, more conservative outlook on the market’s response to the halving.

Comparison of Bitcoin Price Performance After Previous Halvings

Understanding the historical impact of halvings is crucial for predicting future price movements. A comparative chart would visually present Bitcoin’s price performance after the 2012, 2016, and 2020 halvings. The chart’s x-axis would represent time (months or years post-halving), and the y-axis would represent the Bitcoin price. Each halving would be represented by a separate line, allowing for a direct comparison of price trends. The chart would highlight similarities, such as an initial price surge after each halving, and differences, such as the duration and magnitude of the price increase. For instance, the 2016 halving saw a significant price increase, but the price took a longer time to reach new all-time highs compared to the 2020 halving. The comparison would show the varying market conditions and investor sentiment surrounding each halving.

Impact of Macroeconomic Factors on Bitcoin Price, Bitcoin Halving 2025 Chart

Macroeconomic factors, such as inflation and interest rates, significantly influence Bitcoin’s price. A visual representation could be a line graph showing the correlation between Bitcoin’s price (y-axis) and inflation/interest rate levels (second y-axis) leading up to the 2025 halving. For example, a period of high inflation might drive investors towards Bitcoin as a hedge against inflation, resulting in a price increase. Conversely, rising interest rates might decrease the attractiveness of riskier assets like Bitcoin, leading to a price decline. This visual would highlight the interplay between macroeconomic conditions and Bitcoin’s price trajectory, demonstrating how external factors can influence the halving’s impact. The chart would ideally show historical data and potential projections based on current economic forecasts. For example, a period of high inflation coupled with low interest rates might lead to a stronger bullish effect than high inflation and high interest rates.

Factors Influencing Bitcoin’s Price After the Halving

The 2025 Bitcoin halving, reducing the block reward for miners by half, is a significant event expected to impact Bitcoin’s price. However, the price movement isn’t solely determined by the halving itself; numerous other factors play a crucial role in shaping the post-halving trajectory. Understanding these interconnected elements is vital for navigating the complexities of the Bitcoin market.

The interplay between supply and demand, fundamentally altered by the halving, will be heavily influenced by several key factors. These factors can act as catalysts for price increases or, conversely, exert downward pressure, creating a dynamic and unpredictable market environment.

Adoption Rate’s Influence on Bitcoin Price

Increased adoption, both from institutional and individual investors, is a powerful driver of Bitcoin’s price. Institutional adoption, characterized by large-scale investments from corporations and financial institutions, often brings significant capital inflows and enhances Bitcoin’s legitimacy. For example, MicroStrategy’s substantial Bitcoin holdings have been cited as a positive influence on the market. Conversely, a decline in institutional interest or negative sentiment from major players could lead to price corrections. Individual adoption, driven by increasing awareness and accessibility, broadens the user base and contributes to organic demand. The growth of user-friendly wallets and exchanges plays a significant role in this aspect. A surge in individual adoption, particularly in emerging markets, can fuel substantial price appreciation. Conversely, a lack of widespread individual adoption can limit upward price momentum.

Regulatory Changes and Their Impact

Regulatory landscapes surrounding Bitcoin vary significantly across jurisdictions. Positive regulatory developments, such as clearer guidelines for Bitcoin trading and custody, can boost investor confidence and attract more institutional investment. Conversely, overly restrictive regulations or outright bans can severely hinder adoption and negatively impact the price. The example of China’s crackdown on cryptocurrency mining in 2021 serves as a stark reminder of the potential for negative regulatory impact. The regulatory environment in the US, Europe, and other major economies will be closely watched in the lead-up to and following the 2025 halving. Clarity and favorable regulations are generally considered bullish for Bitcoin’s price, while uncertainty and restrictive measures can create volatility and downward pressure.

Technological Advancements and Bitcoin’s Price

Technological advancements, particularly in layer-2 scaling solutions, are crucial for improving Bitcoin’s scalability and transaction speed. Solutions like the Lightning Network aim to alleviate congestion and reduce transaction fees, making Bitcoin more practical for everyday use. Successful implementation and widespread adoption of these solutions can significantly increase Bitcoin’s utility and appeal, potentially driving price appreciation. Conversely, setbacks or limitations in the development and adoption of these technologies could hinder Bitcoin’s growth and negatively impact its price. The ongoing development and refinement of layer-2 solutions will be a key factor to monitor in the post-halving period, with successful implementation potentially leading to a more robust and efficient network, fostering broader adoption and increased demand.

Bitcoin Halving and Mining

The Bitcoin halving, a programmed event occurring approximately every four years, significantly impacts the economics of Bitcoin mining. This event reduces the block reward miners receive for verifying transactions and adding new blocks to the blockchain, directly affecting profitability and influencing the network’s overall dynamics.

The halving’s immediate effect is a decrease in miner revenue. With fewer bitcoins awarded per block, miners must either increase their efficiency or face reduced profitability. This pressure often leads to a period of consolidation and adjustment within the mining industry. The network’s inherent difficulty adjustment mechanism plays a crucial role in navigating this transition.

Mining Difficulty Adjustment

The Bitcoin network automatically adjusts its mining difficulty every 2016 blocks (approximately two weeks) to maintain a consistent block generation time of around 10 minutes. After a halving, the reduced block reward initially lowers the profitability of mining. This leads to some miners shutting down their operations due to unprofitability. The network’s difficulty adjustment mechanism then kicks in, reducing the difficulty of mining new blocks. This makes it easier for the remaining miners to find and solve the complex mathematical problems required to validate transactions and earn the reduced block reward, restoring the block generation time to its target. This adjustment is crucial for maintaining the network’s security and stability despite the halving-induced reduction in miner revenue. The adjustment process isn’t instantaneous; it takes time for the difficulty to fully adjust to the new market conditions.

Geographical Distribution of Bitcoin Mining

The halving can influence the geographical distribution of Bitcoin mining. Before the halving, regions with cheaper electricity and favorable regulatory environments tend to attract more mining operations. However, after a halving, regions with less competitive electricity costs might become less viable for mining, potentially leading to a shift in mining activity. For instance, after previous halvings, we’ve seen a shift from regions with higher energy costs towards those with access to cheaper hydropower or other renewable energy sources. This dynamic reallocation of mining resources is driven by the need to maintain profitability in the face of reduced block rewards. Factors such as government regulations and the availability of skilled labor also play a significant role in determining the location of mining operations.

Impact on Bitcoin Network Energy Consumption

The halving’s impact on the Bitcoin network’s energy consumption is complex and not directly proportional to the block reward reduction. While reduced miner profitability might lead to some miners exiting the network, the overall energy consumption isn’t necessarily reduced in a linear fashion. The difficulty adjustment mechanism plays a significant role here. As the difficulty adjusts downward, it becomes slightly easier to mine, potentially offsetting some of the reduction in miners. Furthermore, more efficient mining hardware and more sustainable energy sources could partially mitigate the overall increase in energy usage. However, a significant drop in the price of Bitcoin following the halving could lead to a reduction in the overall hash rate and therefore a decrease in energy consumption. Predicting the precise impact on energy consumption requires considering multiple factors, including the price of Bitcoin, the adoption of more efficient hardware, and the global energy mix powering the Bitcoin network.