Bitcoin Halving 2025: Bitcoin Halving 2025 Clock

The Bitcoin halving, an event that occurs approximately every four years, reduces the rate at which new Bitcoins are created. This programmed scarcity is a core element of Bitcoin’s design, intended to control inflation and potentially impact its price. The 2025 halving, expected around April, will be the fourth in Bitcoin’s history, and understanding its potential effects requires examining past trends and considering current market dynamics.

Historical Impact of Previous Halvings

Previous Bitcoin halvings have demonstrated a correlation, though not a guaranteed causation, with subsequent price increases. The first halving in 2012 saw Bitcoin’s price rise from around $12 to over $1,000 within a year and a half. The second halving in 2016 resulted in a price increase from approximately $650 to nearly $20,000 within two years. The third halving in 2020 saw a price rise from around $9,000 to over $60,000 within a year. While these price increases followed the halvings, other market factors undoubtedly played a role, including increased adoption, regulatory changes, and overall market sentiment. It’s crucial to avoid assuming a direct causal link, instead recognizing the halving as one factor among many influencing price.

Economic Factors Influencing the 2025 Halving

Several economic factors could significantly impact the 2025 halving’s effects. Macroeconomic conditions, such as inflation rates and interest rate policies implemented by central banks globally, will influence investor sentiment towards risk assets like Bitcoin. Regulatory developments, particularly in major economies, could significantly affect Bitcoin’s accessibility and adoption. The overall state of the global economy, including recessionary fears or periods of strong growth, will also play a role. Furthermore, the level of institutional adoption and the development of Bitcoin-related financial products will continue to shape market dynamics.

Comparison of Market Conditions Leading Up to Previous Halvings

The market conditions leading up to the 2025 halving differ significantly from those preceding previous events. The 2012 halving occurred during Bitcoin’s early stages, with relatively low adoption and market capitalization. The 2016 and 2020 halvings took place in more mature markets with increased institutional interest and regulatory scrutiny. In 2025, the market is further developed, with a larger and more sophisticated investor base, making it challenging to draw direct parallels. The current regulatory landscape is also more complex and varies considerably across jurisdictions. The overall level of macroeconomic uncertainty is also a key differentiator, influencing risk appetite and investment decisions.

Potential Price Scenarios Post-2025 Halving

Predicting Bitcoin’s price is inherently speculative, but considering past trends and current market conditions allows for outlining potential scenarios.

A bullish scenario could see Bitcoin’s price significantly increase following the 2025 halving. This could be driven by increased institutional adoption, positive regulatory developments, and sustained macroeconomic recovery. In this scenario, Bitcoin could potentially reach prices well above its previous all-time high, possibly exceeding $100,000 or more, mirroring, but exceeding, the proportional price increases seen after previous halvings. This assumes a continuation of positive trends in adoption and overall market sentiment.

A bearish scenario, however, could see a more muted price response or even a price decline following the halving. This could result from persistent macroeconomic uncertainty, negative regulatory actions, or a general loss of investor confidence in cryptocurrencies. In this scenario, Bitcoin’s price might remain relatively stagnant or even decline below its current levels, especially if the overall economic environment remains challenging. This scenario highlights the risks inherent in cryptocurrency investments.

The Bitcoin Halving Clock

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and significantly impacts the inflation rate of the cryptocurrency. Understanding the halving clock, therefore, offers valuable insight into potential market trends.

Bitcoin Halving Mechanics and Supply Impact

The Bitcoin halving mechanism is designed to control Bitcoin’s inflation. Initially, the reward for mining a block of transactions was 50 BTC. Every 210,000 blocks mined (approximately every four years), this reward is halved. This means that after the first halving, the reward became 25 BTC, then 12.5 BTC after the second, and currently stands at 6.25 BTC. This controlled reduction in the rate of new Bitcoin creation contributes to Bitcoin’s scarcity, a key factor influencing its value. The total number of Bitcoins that will ever exist is capped at 21 million. The halving mechanism ensures this limit is reached asymptotically, meaning it will never quite reach 21 million, but will get incredibly close over time.

Countdown to the 2025 Halving: A Visual Representation

The following table provides a visual countdown to the 2025 Bitcoin halving, showcasing key dates and anticipated milestones. Note that these dates are estimates based on the current block mining rate, and slight variations are possible.

| Milestone | Estimated Date | Significance | Market Impact (Potential) |

|---|---|---|---|

| Previous Halving | May 11, 2020 | Reward reduced from 12.5 BTC to 6.25 BTC | Led to a significant price increase in the following months. |

| Current Block Reward | 6.25 BTC | Current reward per block mined. | Influences miner profitability and network security. |

| Estimated Block Height at Halving | 840,000 | Approximate number of blocks mined before the next halving. | Used to predict the approximate date of the halving. |

| Estimated Halving Date | Early to Mid 2025 | Reward will be reduced to 3.125 BTC. | Historically associated with increased price volatility and potential bull market. |

The Halving Clock as a Market Indicator

The halving clock, while not a perfect predictor, serves as a significant market indicator for investors. The anticipation of reduced supply often leads to increased demand, potentially driving up the price of Bitcoin. This is because the halving represents a fundamental shift in the Bitcoin supply dynamics. Many investors view the halving as a catalyst for a bull market, though past performance does not guarantee future results. The halving’s influence on market sentiment is a key factor to consider.

Historical Accuracy of Halving-Based Predictions

The accuracy of predictions based on previous halving clocks has been mixed. While the halvings themselves have occurred precisely as programmed, the subsequent price movements have been highly variable. The 2012 and 2016 halvings were followed by periods of significant price appreciation, but the market dynamics are influenced by many other factors besides the halving, including macroeconomic conditions, regulatory changes, and overall investor sentiment. Therefore, relying solely on the halving clock for investment decisions is risky. It’s crucial to consider a wide range of factors when making investment choices.

Mining and the 2025 Halving

The Bitcoin halving, occurring approximately every four years, significantly impacts the profitability of Bitcoin mining. The 2025 halving, reducing the block reward by half, will necessitate adjustments within the mining industry to maintain operational viability. This analysis explores the anticipated effects on mining profitability, energy consumption, geographic distribution, and the role of technological advancements.

The reduction in block reward directly affects miners’ revenue. Prior to the halving, miners receive a certain number of newly minted Bitcoins for each block they successfully mine. After the halving, this reward is cut in half, meaning miners will earn less Bitcoin per block. This decrease necessitates either a reduction in operational costs or an increase in mining efficiency to maintain profitability. Miners will likely respond by optimizing their operations, potentially consolidating operations, upgrading hardware, or shifting to more energy-efficient locations.

Bitcoin Mining Profitability After Halving

The profitability of Bitcoin mining is a complex interplay of several factors, including the Bitcoin price, the difficulty of mining, electricity costs, and the efficiency of mining hardware. Past halvings have resulted in temporary dips in mining profitability, followed by periods of recovery as the Bitcoin price adjusts or more efficient mining hardware is introduced. The 2025 halving is expected to follow a similar pattern, although the precise impact will depend on these aforementioned factors. For example, if the Bitcoin price rises significantly following the halving, miners may still be profitable despite the reduced block reward. Conversely, a stagnant or declining Bitcoin price could lead to a more substantial decrease in profitability, potentially forcing some miners to shut down operations.

Energy Consumption Trends in Bitcoin Mining

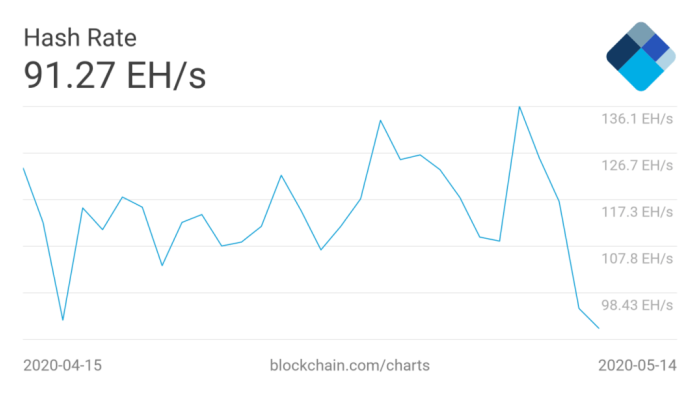

Bitcoin mining is an energy-intensive process. The total energy consumption of the Bitcoin network has fluctuated significantly throughout its history, largely correlating with the Bitcoin price and the difficulty of mining. While precise figures are difficult to obtain and verify, analyses suggest that energy consumption tends to increase in periods of high Bitcoin prices and difficulty, and decreases when either of these factors falls. Comparing the energy consumption before and after previous halvings is challenging due to variations in mining hardware efficiency, the Bitcoin price, and the hash rate. However, a general trend of increased energy efficiency per Bitcoin mined over time is often observed, suggesting that technological advancements may offset some of the increased energy demand due to network growth.

Geographic Distribution of Bitcoin Mining

The geographic distribution of Bitcoin mining has shifted considerably over time, influenced by factors such as energy costs, regulatory environments, and access to specialized hardware. Regions with low electricity costs, supportive regulations, and readily available infrastructure have tended to attract more mining operations. Previous halvings have sometimes accelerated these shifts, as miners seek out more cost-effective locations to maintain profitability. The 2025 halving may trigger further changes in the geographic distribution, with miners potentially relocating to areas with lower electricity costs or more favorable regulatory environments. For instance, a shift away from regions with stricter environmental regulations or higher energy prices towards regions with abundant hydroelectric power or other inexpensive energy sources could be observed.

Technological Advancements in Mining Hardware

The development of more efficient mining hardware plays a crucial role in mitigating the effects of the reduced block reward. The ongoing advancements in semiconductor technology and specialized ASIC (Application-Specific Integrated Circuit) design constantly improve the energy efficiency and hash rate of Bitcoin mining hardware. This allows miners to maintain or even increase their profitability despite the lower block reward. For example, the introduction of more powerful and energy-efficient ASICs in the years following previous halvings has enabled miners to compensate for the reduced reward by mining more efficiently. The ongoing development of next-generation ASICs is expected to continue this trend, helping to sustain the Bitcoin mining industry in the face of reduced block rewards.

Investor Sentiment and Market Speculation

Investor sentiment surrounding Bitcoin in the lead-up to the 2025 halving will be a complex interplay of various factors, ranging from macroeconomic conditions to technological advancements within the Bitcoin ecosystem itself. Understanding these influences is crucial for navigating the inherent volatility of the cryptocurrency market.

Key Factors Influencing Investor Sentiment

Several key factors will significantly shape investor sentiment. These include the prevailing macroeconomic environment (inflation rates, interest rate policies, geopolitical stability), the overall performance of the global stock market, regulatory developments impacting cryptocurrencies globally, and technological advancements within the Bitcoin network (such as the Lightning Network’s adoption rate and scalability improvements). A strong positive correlation between traditional markets and Bitcoin’s price has been observed historically, suggesting that a bullish stock market could positively influence Bitcoin’s price. Conversely, periods of economic uncertainty often lead to risk-aversion, impacting Bitcoin’s price negatively. Regulatory clarity or uncertainty in key jurisdictions also plays a crucial role. For example, a positive regulatory shift in the US could boost investor confidence, while increased regulatory scrutiny in other major markets might have the opposite effect.

Comparison of Market Predictions, Bitcoin Halving 2025 Clock

Predicting Bitcoin’s price after the halving is inherently speculative, with a wide range of opinions among analysts and commentators. Some analysts, basing their predictions on historical halving cycles, anticipate a significant price surge following the 2025 event, potentially reaching prices exceeding $100,000 or even more. These predictions often point to the halving’s impact on Bitcoin’s scarcity and the subsequent reduction in new Bitcoin supply as primary drivers for price appreciation. Conversely, other analysts are more cautious, highlighting the potential for macroeconomic factors and regulatory risks to dampen any price increase. They might predict a more moderate price appreciation or even a period of sideways trading following the halving. PlanB’s stock-to-flow model, for instance, has been cited in the past as a bullish predictor, although its accuracy has been debated extensively. Ultimately, the actual price movement will depend on a confluence of factors that are difficult to predict with certainty.

The Role of Social Media and News Coverage

Social media platforms and traditional news outlets play a significant role in shaping investor expectations. Positive news coverage and enthusiastic social media discussions can create a “fear of missing out” (FOMO) effect, driving up demand and price. Conversely, negative news or widespread skepticism can trigger sell-offs and price declines. The amplification effect of social media, particularly through influential personalities and communities, can significantly influence market sentiment. For example, a tweet from a prominent figure in the crypto space could trigger a rapid price swing. The 2021 bull run, for instance, saw significant price increases partly fueled by positive social media sentiment and mainstream media coverage.

Hypothetical Scenario: Impact of News Events

Consider a hypothetical scenario: leading up to the 2025 halving, a major global financial institution announces the integration of Bitcoin into its investment portfolio. This positive news would likely boost investor confidence, driving up demand and pushing the price higher. However, if concurrently, a major country announces a complete ban on cryptocurrency trading, this negative news could offset the positive impact, leading to a period of uncertainty and potentially a price correction. Alternatively, if a successful large-scale cyberattack targeting a major cryptocurrency exchange occurs, this could significantly undermine investor confidence and lead to a market-wide sell-off, regardless of the impending halving. The interplay of such events highlights the dynamic and unpredictable nature of the cryptocurrency market.

Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the block reward for miners by half, is anticipated to have significant long-term implications for Bitcoin’s adoption, use cases, and overall market dynamics. While predicting the future with certainty is impossible, analyzing historical trends and current market conditions allows us to formulate plausible scenarios regarding its potential impact.

The reduction in new Bitcoin supply, a core element of the halving mechanism, is expected to exert upward pressure on price, assuming demand remains relatively stable or increases. This effect, however, is not solely determined by the halving itself but also interacts with numerous other factors including regulatory changes, macroeconomic conditions, and overall investor sentiment.

Bitcoin’s Adoption and Use Cases

The 2025 halving could accelerate Bitcoin’s adoption by making it a more attractive store of value. Increased scarcity, driven by the reduced supply, could lead to higher prices, potentially attracting both individual and institutional investors seeking to hedge against inflation or diversify their portfolios. This increased price could also drive further adoption in countries with unstable fiat currencies, where Bitcoin offers a more reliable alternative. The potential for increased price stability, after the initial price volatility following the halving, could also broaden its appeal as a medium of exchange, particularly in cross-border transactions where traditional banking systems are inefficient or costly. Past halvings have shown a correlation between the halving event and increased price volatility followed by a period of price appreciation, suggesting a similar pattern might emerge in 2025.

Comparison with Previous Halvings

The 2025 halving will be the fourth halving event in Bitcoin’s history. Previous halvings in 2012, 2016, and 2020 have shown varying degrees of impact on price and adoption. While the 2012 halving saw a more gradual price increase, the 2016 and 2020 halvings were followed by significant price rallies, albeit with periods of considerable volatility. The long-term effects, however, have consistently been positive for Bitcoin’s price, demonstrating a general upward trend following each halving event. Comparing the market conditions and technological advancements surrounding each halving provides valuable insights into the potential outcomes of the 2025 event. For instance, the increased institutional interest in Bitcoin in recent years suggests that the 2025 halving could have a more pronounced impact on price and adoption than previous halvings.

Increased Institutional Investment

The reduced supply of Bitcoin post-halving is expected to increase its attractiveness to institutional investors. Large financial institutions are often drawn to assets with limited supply and predictable scarcity. The halving mechanism provides this predictability, potentially leading to greater institutional adoption and investment. This could involve increased allocation of Bitcoin in diversified portfolios, the creation of Bitcoin-focused investment funds, and greater participation in the Bitcoin ecosystem by traditional financial players. The growing acceptance of Bitcoin by regulatory bodies in certain jurisdictions could further incentivize institutional investment. For example, the increasing number of publicly traded companies holding Bitcoin on their balance sheets indicates a growing acceptance of Bitcoin as a legitimate asset class.

Influence on Bitcoin-Related Technologies and Services

The anticipated price increase following the halving could stimulate innovation and development within the Bitcoin ecosystem. The higher price could incentivize the creation and adoption of Bitcoin-related technologies and services, such as improved wallet solutions, enhanced security measures, and more user-friendly interfaces. This could include advancements in lightning network technology, making Bitcoin transactions faster and cheaper, potentially leading to wider adoption as a medium of exchange. Furthermore, increased investment in Bitcoin mining infrastructure could lead to advancements in mining efficiency and sustainability, contributing to the long-term health and stability of the Bitcoin network.

Frequently Asked Questions (FAQ)

This section addresses common queries regarding the Bitcoin halving, focusing on its mechanics, impact, and associated risks. Understanding these aspects is crucial for anyone interested in Bitcoin’s future.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, or every 210,000 blocks mined. It’s a fundamental part of Bitcoin’s design intended to control inflation and maintain scarcity. The halving directly impacts the reward miners receive for verifying transactions and adding new blocks to the blockchain.

Timing of the Next Halving

The next Bitcoin halving is expected to occur in the Spring of 2025. The precise date depends on the rate of block creation, which can fluctuate slightly. However, based on historical data and current mining activity, a date around April or May 2025 is widely anticipated.

Bitcoin Price Impact of the Halving

Historically, Bitcoin halving events have been followed by periods of significant price appreciation. The 2012 and 2016 halvings were both followed by substantial bull markets, although other factors also contributed to these price increases. The reduced supply of newly minted Bitcoins, coupled with consistent demand, is often cited as a key driver behind this price increase. However, it’s crucial to remember that past performance is not indicative of future results. Experts have differing opinions on the extent of the price impact, with some predicting substantial gains and others highlighting the influence of broader market conditions. For instance, the 2020 halving saw a period of price increase but also experienced significant volatility and corrections before reaching new all-time highs.

Investment Risks Associated with Bitcoin Halvings

Investing in Bitcoin around a halving event carries significant risks. While the halving itself might contribute to a bullish market sentiment, the price can be extremely volatile. The period leading up to and following a halving can experience substantial price swings due to speculation and market manipulation. Furthermore, macroeconomic factors, regulatory changes, and technological developments can all significantly influence Bitcoin’s price, regardless of the halving. Investors should be prepared for potential losses and only invest what they can afford to lose. The “buy the dip” mentality, common around halvings, should be approached with caution, as “dips” can become prolonged bear markets. For example, the 2012 halving was followed by a prolonged period of price stagnation before the significant bull run of 2017.