Bitcoin Halving 2025

The Bitcoin halving is a programmed event within the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This event, occurring approximately every four years, is a crucial component of Bitcoin’s deflationary monetary policy and is anticipated to have significant implications for the cryptocurrency’s price and overall market dynamics. Understanding the mechanics of the halving and its historical impact is key to comprehending its potential influence in 2025.

Bitcoin Halving Mechanism and its Impact on Supply

The Bitcoin halving mechanism is embedded within the Bitcoin blockchain’s code. It dictates that the reward given to Bitcoin miners for verifying transactions and adding new blocks to the blockchain is cut in half at regular intervals. Initially, the block reward was 50 BTC. After the first halving, it became 25 BTC, then 12.5 BTC, and the next halving in 2025 will reduce it to 6.25 BTC. This halving mechanism directly impacts the supply of Bitcoin, slowing down the rate of new Bitcoin creation. This controlled reduction in supply is designed to create scarcity, potentially influencing the price through basic economic principles of supply and demand. The predictable nature of the halving, unlike many other cryptocurrencies, adds to its perceived stability and long-term value proposition for investors.

Historical Context of Bitcoin Halvings and Price Effects

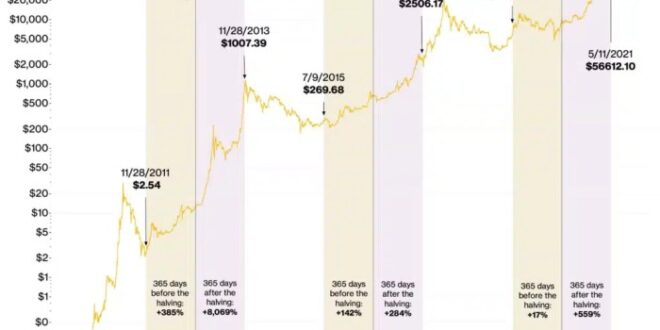

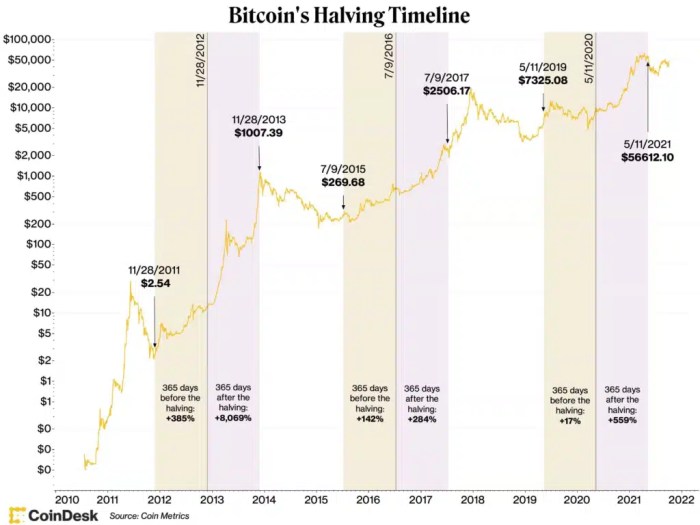

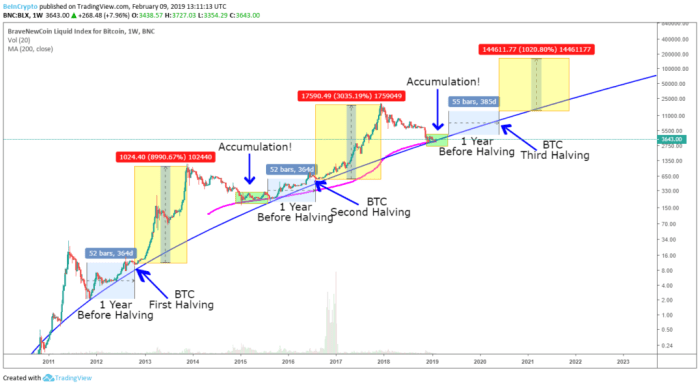

The Bitcoin network has undergone two previous halvings: one in November 2012 and another in July 2016. Following the 2012 halving, the price of Bitcoin experienced a significant surge over the subsequent year. Similarly, after the 2016 halving, Bitcoin’s price saw a considerable increase, albeit with periods of volatility. It’s important to note that while a price increase has followed previous halvings, this correlation doesn’t guarantee a similar outcome in 2025. Numerous other factors influence Bitcoin’s price, including regulatory changes, market sentiment, technological advancements, and macroeconomic conditions. Attributing price movements solely to the halving would be an oversimplification. The historical data, however, does suggest a potential positive influence on price due to the reduced supply.

Timeline of Events Surrounding the 2025 Halving

A precise date for the 2025 Bitcoin halving cannot be definitively stated until the exact block height is reached. However, based on the current block generation time, it’s projected to occur sometime in the Spring or early Summer of 2025. The period leading up to the halving is likely to see increased market speculation and volatility. The event itself will be closely monitored by investors and analysts worldwide. The months following the halving will be crucial in observing its actual impact on the price and the overall market. While a timeline is difficult to provide with exact dates, the anticipation and subsequent analysis will undoubtedly dominate the cryptocurrency news cycle during this period. The impact of this halving will likely be analyzed and debated for years to come, much like the previous events.

Impact on Bitcoin Price and Volatility

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, is anticipated to significantly impact the cryptocurrency’s price and volatility. While history suggests a correlation between halvings and subsequent price increases, the extent of this impact remains a subject of ongoing debate among market analysts. Several factors, including macroeconomic conditions and overall investor sentiment, complicate any precise prediction.

The 2025 halving will reduce the block reward miners receive from approximately 6.25 BTC to 3.125 BTC. This reduction in the supply of newly minted Bitcoin is often cited as a bullish factor, as it potentially creates a scarcity effect, driving up demand and, consequently, price. However, it’s crucial to acknowledge the complexities of the cryptocurrency market and the multitude of factors influencing Bitcoin’s price beyond the halving itself.

Historical Halving Events and Price Movements

Analyzing the previous halvings reveals a mixed picture. The 2012 halving was followed by a period of gradual price appreciation, while the 2016 halving preceded a significant bull run. The 2020 halving also resulted in a substantial price increase, though the timing wasn’t perfectly aligned with the event itself. This historical data suggests a positive correlation between halvings and price increases, but not a direct or immediate causal relationship. Other factors, including regulatory changes, technological advancements, and overall market sentiment, play a significant role in shaping Bitcoin’s price trajectory. For instance, the 2020 halving occurred amidst a period of increasing institutional adoption and growing mainstream awareness of Bitcoin, contributing to the subsequent price surge. It is important to avoid assuming a direct linear correlation.

Market Conditions Leading Up to the 2025 Halving

The market conditions leading up to the 2025 halving differ significantly from previous events. The current macroeconomic environment, characterized by high inflation and rising interest rates, presents a unique challenge. Investor sentiment, influenced by regulatory uncertainty and geopolitical events, also plays a significant role. Compared to previous halvings, the 2025 event occurs in a market with increased institutional involvement and a more mature regulatory landscape, factors that can influence both the price reaction and the timing of any subsequent price movement. The level of overall market maturity and the increased sophistication of trading strategies are significant differences compared to previous halvings.

Potential for Increased Price Volatility

The period surrounding the 2025 halving is likely to witness increased price volatility. The anticipation of the event itself can lead to significant price swings, as investors position themselves for a potential price surge or correction. The uncertainty surrounding the interplay of various market forces, coupled with the reduced supply of newly minted Bitcoin, can amplify these price fluctuations. This volatility presents both opportunities and risks for investors, requiring a cautious and well-informed approach. Historical examples of significant price swings around previous halvings underscore the potential for market turbulence during this period. The increased participation of institutional investors, while potentially contributing to price stability in the long term, could also exacerbate short-term volatility due to their trading strategies and risk management practices.

Mining and Miner Behavior: Bitcoin Halving 2025 Explained

The Bitcoin halving, scheduled for 2025, significantly impacts Bitcoin miners’ profitability and subsequently their operational strategies. The halving reduces the block reward miners receive for successfully adding new blocks to the blockchain, directly affecting their revenue stream. This necessitates a reassessment of their operations and potential adaptation strategies to maintain profitability.

The halving’s effect on miner profitability is straightforward: a 50% reduction in block rewards means less income per block mined. This decrease in revenue can lead to several potential responses from miners, ranging from operational adjustments to complete withdrawal from the network. The scale of these responses depends on several factors, including the prevailing Bitcoin price, energy costs, and the efficiency of mining hardware.

Miner Exodus and Consolidation

A reduction in profitability could trigger a miner exodus, particularly for those operating with less efficient equipment or higher energy costs. Less profitable miners might choose to shut down their operations, leading to a decrease in the total hashrate. Conversely, the halving could accelerate consolidation within the mining industry. Larger, more efficient mining operations with access to cheaper energy and more advanced technology might be better positioned to withstand the reduced rewards, potentially acquiring the assets of smaller, less profitable miners. This would lead to a more centralized mining landscape. This dynamic is not unprecedented; previous halvings have shown similar patterns of consolidation. For instance, the 2021 halving saw a period of consolidation as larger mining pools gained market share.

Hashrate and Network Security

The hashrate, a measure of the total computational power dedicated to securing the Bitcoin network, is directly linked to miner profitability. A decline in profitability can lead to a decrease in the hashrate, potentially impacting the network’s security. A lower hashrate makes the network more vulnerable to 51% attacks, where a malicious actor controls a majority of the network’s hashrate to manipulate transactions or reverse them. However, the Bitcoin network’s security also depends on the price of Bitcoin. A higher Bitcoin price, even with a reduced block reward, could offset the decreased profitability and potentially maintain or even increase the hashrate. The 2016 halving, for example, saw a period of initial hashrate decline followed by a substantial increase as the Bitcoin price rose.

Miner Adaptation Strategies, Bitcoin Halving 2025 Explained

Miners are likely to employ various strategies to adapt to the reduced block rewards. These strategies could include optimizing their mining operations for increased efficiency, seeking access to cheaper energy sources, and diversifying their revenue streams. Improving mining efficiency through the use of more advanced hardware or more sophisticated mining techniques can help offset the lower block rewards. Securing access to cheaper energy sources, such as hydroelectric power or renewable energy, is another crucial factor in maintaining profitability. Finally, diversification into other revenue streams, such as offering Bitcoin mining services or engaging in staking other cryptocurrencies, could provide a buffer against reduced block rewards. The long-term success of these strategies will depend on the overall market conditions and the evolving landscape of the cryptocurrency industry.

Impact on Bitcoin Adoption and Network Growth

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, is anticipated to have a significant impact on Bitcoin’s adoption and network growth. This event, historically associated with price increases, can indirectly influence broader adoption through increased media attention and investor interest. However, the true effect on long-term adoption depends on several interacting factors beyond just the halving itself.

The halving’s effect on Bitcoin’s adoption hinges on its perceived value proposition as both a store of value and a medium of exchange. A scarcity-driven price increase, often following a halving, could solidify Bitcoin’s position as a store of value, attracting investors seeking inflation hedges and long-term growth potential. Conversely, transaction fees, which may increase due to the reduced miner reward, could impact its viability as a medium of exchange, potentially slowing adoption in everyday transactions. This is a crucial balancing act, as higher prices can improve store-of-value appeal but also hinder its usability for everyday payments.

Institutional Investment in Bitcoin Following the Halving

Historically, Bitcoin halvings have coincided with periods of increased institutional interest in Bitcoin. The reduced supply, coupled with potential price appreciation, can make Bitcoin a more attractive asset for large investors seeking diversification and exposure to the burgeoning cryptocurrency market. For example, the halving in 2020 saw a notable surge in institutional adoption, with companies like MicroStrategy making significant Bitcoin purchases. This trend is expected to continue in 2025, although the extent will depend on prevailing macroeconomic conditions and regulatory clarity. Increased regulatory certainty, for instance, could significantly boost institutional confidence and lead to even larger investment inflows.

Impact of the Halving on Bitcoin-Related Technologies and Applications

The halving’s impact on Bitcoin’s network is likely to spur further development of Bitcoin-related technologies and applications. The reduced miner reward may incentivize innovation in areas such as layer-2 scaling solutions, which aim to improve transaction speed and reduce fees. The Lightning Network, for instance, is one such technology already gaining traction, enabling faster and cheaper Bitcoin transactions off the main blockchain. Furthermore, the increased scarcity and potential price appreciation could drive the development of new applications and services built on the Bitcoin blockchain, further expanding its utility and fostering broader adoption. This could include decentralized finance (DeFi) applications tailored to Bitcoin, enhancing its functionality beyond simple store-of-value capabilities. The overall success of these advancements will depend on their ability to overcome technical challenges and achieve widespread user adoption.

Economic and Market Factors

The Bitcoin halving, a predictable event reducing the rate of new Bitcoin creation, significantly impacts the cryptocurrency’s price and overall market dynamics. However, the halving’s effect is not isolated; it interacts with broader economic and market conditions to shape the ultimate outcome. Understanding these intertwined factors is crucial for navigating the period surrounding the 2025 halving.

Macroeconomic Factors Influencing Bitcoin’s Price

Macroeconomic conditions, such as inflation rates, interest rates, and overall economic growth, significantly influence Bitcoin’s price. High inflation often drives investors towards alternative assets like Bitcoin, perceived as a hedge against inflation. Conversely, rising interest rates can decrease Bitcoin’s attractiveness as investors shift towards higher-yielding assets. Recessions or periods of economic uncertainty can also lead to increased Bitcoin investment, as some see it as a safe haven asset. For example, the 2020 COVID-19 pandemic saw increased Bitcoin adoption partly due to economic uncertainty and government stimulus packages. The economic climate in 2025, characterized by factors such as inflation levels, interest rate policies, and global economic growth forecasts, will heavily influence Bitcoin’s price trajectory before and after the halving.

Impact of Global Regulatory Changes on the Bitcoin Market

Regulatory developments worldwide play a pivotal role in shaping the Bitcoin market. Favorable regulations, such as clear guidelines for cryptocurrency trading and taxation, can boost investor confidence and increase market liquidity. Conversely, stringent or uncertain regulations can lead to price volatility and reduced investor participation. The regulatory landscape is constantly evolving, with different countries adopting varying approaches. The ongoing debate about Bitcoin’s regulatory status in major economies like the US, China, and the EU will continue to influence its price. A more unified and clear global regulatory framework could lead to increased stability, while conflicting regulations across jurisdictions may introduce increased volatility.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation are powerful forces shaping Bitcoin’s price. Positive news, technological advancements, or endorsements from prominent figures can fuel bullish sentiment and price increases. Conversely, negative news, security breaches, or regulatory crackdowns can trigger bearish sentiment and price drops. The period surrounding the halving is particularly susceptible to speculation, with many investors anticipating a price surge. This anticipation can create a self-fulfilling prophecy, driving up demand and price even before the halving occurs. However, disappointment if the price doesn’t rise as anticipated could lead to a significant correction. The level of hype and speculation surrounding the 2025 halving will significantly determine the actual impact on price.

Comparison of Economic Climates Surrounding Previous Halvings

The economic climate surrounding each Bitcoin halving has been unique, influencing the price before and after the event. Comparing these periods helps illustrate the complex interplay of factors.

| Year | Macroeconomic Conditions | Bitcoin Price Before Halving (USD) | Bitcoin Price After Halving (USD) |

|---|---|---|---|

| 2012 | Global economic recovery post-2008 financial crisis; relatively low inflation | ~10 | ~100 |

| 2016 | Slow global economic growth; low interest rates; Brexit uncertainty | ~650 | ~20,000 |

| 2020 | COVID-19 pandemic; global economic slowdown; unprecedented government stimulus | ~9,000 | ~60,000 |

| 2025 (Projected) | [To be determined based on prevailing economic conditions in 2025; potential factors include inflation, interest rates, global economic growth, geopolitical events] | [To be determined] | [To be determined] |

Predictions and Speculations (with cautionary notes)

Predicting the future price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative. While the 2025 halving is a significant event with predictable effects on Bitcoin’s supply, the market’s reaction is influenced by numerous interconnected factors, many of which are unpredictable. The following predictions should be viewed with extreme caution and considered only as potential scenarios, not guaranteed outcomes. Remember, past performance is not indicative of future results.

Bitcoin Price Predictions Post-Halving

Several analysts and firms have offered price predictions for Bitcoin following the 2025 halving. These predictions vary significantly, reflecting the inherent uncertainty in the cryptocurrency market. It’s crucial to remember that these are just educated guesses, based on various models and assumptions, and none should be taken as financial advice.

| Source | Predicted Price Range (USD) | Limitations and Potential Biases |

|---|---|---|

| Analyst A (Example) | $100,000 – $150,000 | |

| Firm B (Example) | $50,000 – $80,000 | |

| Analyst C (Example) | $200,000+ |

Uncertainties in Cryptocurrency Market Prediction

Predicting cryptocurrency market movements is incredibly challenging due to several factors. The market is highly volatile and susceptible to unpredictable events, such as regulatory changes, technological advancements, macroeconomic shifts (inflation, recession), and large-scale investor sentiment swings (fear, greed). Furthermore, the relatively young age of the cryptocurrency market means there is limited historical data to draw robust conclusions from, making predictive modeling inherently less reliable compared to established markets like stocks or bonds. The lack of transparency and the decentralized nature of cryptocurrencies also make it difficult to accurately assess the overall market sentiment and future trends. Even sophisticated models often fail to accurately predict short-term price fluctuations. For instance, the 2022 crypto winter caught many predictions off guard, highlighting the inherent unpredictability of the market.

FAQs

This section addresses frequently asked questions regarding the Bitcoin halving event expected in 2025. Understanding these key aspects can help navigate the complexities surrounding this significant event in the Bitcoin ecosystem.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created and added to the circulating supply. This occurs approximately every four years, and it cuts the block reward – the amount of Bitcoin miners receive for verifying transactions – in half. The halving mechanism is designed to control inflation and maintain the scarcity of Bitcoin.

Expected Date of the 2025 Bitcoin Halving

While the exact date depends on the Bitcoin network’s block time variability, the Bitcoin halving in 2025 is anticipated to occur sometime in the Spring or early Summer. Precise prediction requires monitoring the block generation rate in the weeks leading up to the projected date. Predicting the exact date several months in advance remains challenging due to the stochastic nature of block creation times.

Impact of the Halving on Bitcoin’s Price

Historically, Bitcoin halvings have been followed by periods of increased price appreciation. This is largely attributed to the reduced supply of new Bitcoins entering the market. However, it’s crucial to understand that this is not a guaranteed outcome. Many other factors, including macroeconomic conditions, regulatory changes, and overall market sentiment, significantly influence Bitcoin’s price. The price increase after previous halvings has varied considerably, highlighting the inherent uncertainty. For example, the 2012 halving was followed by a gradual price increase, while the 2016 halving saw a more dramatic rise.

Risks Associated with Investing Around a Halving

Investing in Bitcoin around a halving carries considerable risk. The price volatility tends to increase leading up to and following the event, creating opportunities for both significant gains and substantial losses. Furthermore, the market is susceptible to manipulation, with large holders potentially influencing price movements through strategic buying and selling. The speculative nature of the cryptocurrency market amplifies these risks. It’s essential to carefully assess one’s risk tolerance before making any investment decisions.

Price Increase Guarantee After a Halving

There is no guarantee that the price of Bitcoin will increase after a halving. While historical data suggests a correlation between halvings and subsequent price appreciation, this is not a causal relationship. Numerous factors can affect Bitcoin’s price, and market dynamics can be unpredictable. Therefore, any investment decisions made based solely on the expectation of a price increase after a halving are inherently speculative and carry a high degree of risk. Treating Bitcoin as a long-term investment, rather than a short-term trading vehicle, is often advised.

Illustrative Example

Understanding the impact of Bitcoin halvings on inflation requires visualizing the data. The following description Artikels a chart illustrating the decreasing rate of Bitcoin issuance over time.

The chart would be a line graph, plotting Bitcoin’s inflation rate (percentage increase in the circulating supply per year) against time, specifically focusing on the periods leading up to and following each halving event.

Bitcoin Inflation Rate Over Time

The x-axis of the chart represents time, measured in years, starting from Bitcoin’s inception. Key points on the x-axis would highlight the dates of each halving event (approximately every four years). The y-axis represents the annual inflation rate of Bitcoin, expressed as a percentage. Each data point on the graph would represent the annual inflation rate calculated for a given year. For example, in the years leading up to the first halving, the inflation rate would be relatively high, reflecting the faster rate of Bitcoin creation. Following the halving, the line would sharply decrease, reflecting the halving’s impact on the rate of new Bitcoin entering circulation. This pattern would repeat itself for each subsequent halving. The line would show a clear stepwise decrease in the inflation rate, with each step corresponding to a halving event. The chart would clearly demonstrate how the halving mechanism progressively reduces Bitcoin’s inflation rate over time, moving towards a state of scarcity. A legend could be included to clearly label the halving events. For illustrative purposes, let’s assume the following simplified data (actual figures vary slightly due to block time variations):

Before the first halving (approximately 2012-2016): Inflation rate approximately 9.5%

After the first halving (approximately 2016-2020): Inflation rate approximately 4.75%

After the second halving (approximately 2020-2024): Inflation rate approximately 2.375%

After the projected third halving (approximately 2024-2028): Inflation rate approximately 1.1875%

This visual representation would effectively communicate the deflationary nature of Bitcoin’s monetary policy as implemented through the halving mechanism. The chart would visually demonstrate the significant impact of each halving event on the rate at which new Bitcoins are introduced into the market, showcasing its intended effect on scarcity and potential value appreciation. The steepness of the decline after each halving would be visually striking, emphasizing the magnitude of the reduction in Bitcoin’s inflation rate.

Understanding the Bitcoin Halving 2025 Explained requires grasping the core mechanics of Bitcoin’s reward system. A key aspect of this is pinpointing the precise date of the halving, which significantly impacts the supply and potential price. To find out exactly when this event will occur, consult this resource on the Bitcoin Halving Time 2025 , as it provides a detailed breakdown.

Knowing the precise timing allows for better forecasting and analysis of the Bitcoin Halving 2025 Explained.

Understanding the Bitcoin Halving 2025 Explained requires examining the halving’s impact on Bitcoin’s supply and price. A key resource for this is the comprehensive analysis provided by Halving De Bitcoin 2025 , which offers valuable insights into the event’s potential consequences. Returning to Bitcoin Halving 2025 Explained, we can then better predict market reactions based on historical data and this detailed resource.

Understanding the Bitcoin Halving 2025 Explained requires examining the halving’s impact on Bitcoin’s supply and price. A key resource for this is the comprehensive analysis provided by Halving De Bitcoin 2025 , which offers valuable insights into the event’s potential consequences. Returning to Bitcoin Halving 2025 Explained, we can then better predict market reactions based on historical data and this detailed resource.

Understanding the Bitcoin Halving 2025 Explained requires examining the halving’s impact on Bitcoin’s supply and price. A key resource for this is the comprehensive analysis provided by Halving De Bitcoin 2025 , which offers valuable insights into the event’s potential consequences. Returning to Bitcoin Halving 2025 Explained, we can then better predict market reactions based on historical data and this detailed resource.

Understanding the Bitcoin Halving 2025 Explained requires examining the halving’s impact on Bitcoin’s supply and price. A key resource for this is the comprehensive analysis provided by Halving De Bitcoin 2025 , which offers valuable insights into the event’s potential consequences. Returning to Bitcoin Halving 2025 Explained, we can then better predict market reactions based on historical data and this detailed resource.

Understanding the Bitcoin Halving 2025 Explained requires knowing the precise date of the event, which significantly impacts Bitcoin’s supply and price. To find the projected date, you can check out this helpful resource on the 2025 Bitcoin Halving Date. This date is crucial for forecasting potential market fluctuations following the halving, a key element in fully grasping the Bitcoin Halving 2025 Explained.