Understanding the Supply Dynamics

The Bitcoin halving, occurring approximately every four years, is a crucial event that fundamentally alters the cryptocurrency’s supply dynamics. This process directly impacts the rate at which new Bitcoin enters circulation, consequently influencing its price and overall market behavior. Understanding these dynamics is key to comprehending Bitcoin’s long-term value proposition.

The halving mechanism reduces the reward miners receive for verifying transactions and adding new blocks to the blockchain. Before the first halving, miners received 50 Bitcoin per block. After each halving, this reward is cut in half. This means that the rate at which new Bitcoin is introduced into the circulating supply decreases significantly. This controlled reduction in supply is a core feature designed into the Bitcoin protocol. This controlled scarcity is intended to mimic the scarcity of precious metals like gold, which have historically held their value due to limited supply.

The Impact of Reduced Supply on Scarcity

A reduced supply of Bitcoin directly increases its scarcity. Scarcity, in the context of economics, refers to the limited availability of a resource relative to its demand. When demand remains high or increases while the supply is constricted, the price of the asset tends to rise. This fundamental principle of economics is applicable to Bitcoin, making the halving events significant price catalysts. The predictable nature of the halving further contributes to its impact, allowing investors to anticipate and react to the changing supply dynamics.

Historical Examples of Scarcity Influencing Asset Prices

Numerous historical examples demonstrate the relationship between scarcity and asset price appreciation. The price of gold, for instance, has historically been driven by its limited supply and consistent demand. Similarly, rare collectibles, such as limited-edition stamps or vintage cars, often command high prices due to their scarcity. These assets share a common thread with Bitcoin: a finite or limited supply that drives up their value as demand increases. The inherent scarcity built into Bitcoin’s protocol, coupled with increasing adoption and institutional investment, creates a powerful combination that potentially drives its value upwards.

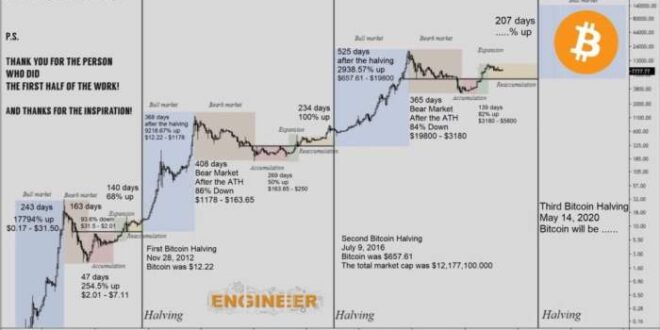

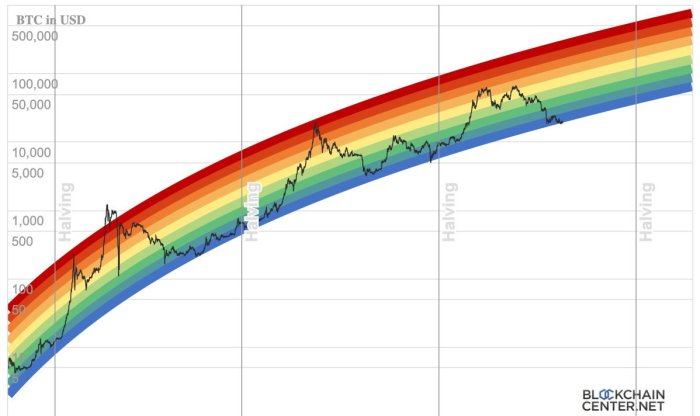

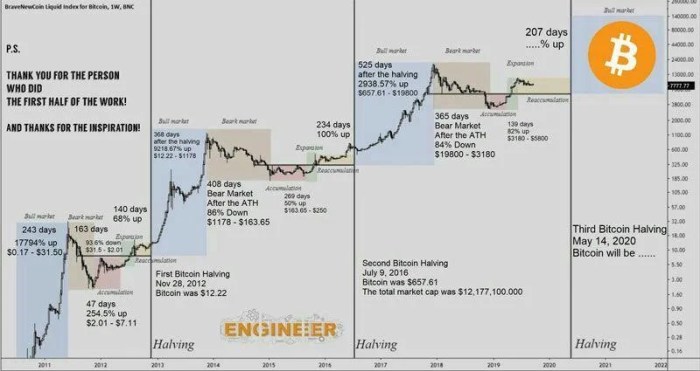

Bitcoin Supply and Price: A Visual Representation

Imagine a graph with two axes. The horizontal axis represents the total supply of Bitcoin (in millions), starting from zero and increasing over time. The vertical axis represents the price of Bitcoin (in US dollars). Initially, the graph would show a relatively flat line representing the early years of Bitcoin with a large increase in supply and relatively low price. As the halvings occur (marked on the horizontal axis), the slope of the line representing the price (vertical axis) would become increasingly steep. This illustrates how, despite the continued increase in the total supply of Bitcoin, the rate of increase slows down significantly after each halving, while the price tends to increase, showcasing the interplay between supply and price. The graph would not be a straight line; market forces, technological advancements, and regulatory changes would all influence the exact shape of the curve, but the overall trend of a steeper upward slope following each halving should be apparent.

Market Reactions and Predictions

The Bitcoin halving event, scheduled for 2025, is anticipated to significantly impact the cryptocurrency market. While predicting the precise market reaction is impossible, analyzing expert opinions and considering influencing factors provides valuable insight into potential price movements. Understanding these diverse perspectives and underlying assumptions is crucial for informed decision-making.

Predicting Bitcoin’s price after a halving is notoriously difficult, as numerous factors beyond the reduced supply interact. These factors can range from regulatory changes to macroeconomic trends, and even unpredictable events such as geopolitical instability. Therefore, any prediction should be considered with a degree of caution.

Expert Opinions on Price Movements

Several analysts offer differing predictions regarding Bitcoin’s price trajectory following the 2025 halving. These predictions are often based on historical data, technical analysis, and fundamental assessments of the Bitcoin network. However, the inherent volatility of the cryptocurrency market makes it challenging to pinpoint an exact price target. For example, some analysts predict a significant price surge, referencing the price increases observed after previous halvings. Others are more cautious, citing potential headwinds such as regulatory uncertainty or macroeconomic downturns.

Influencing Factors on Market Response

Beyond the halving itself, several factors could significantly influence the market’s response. Regulatory changes, for example, could either boost or dampen investor enthusiasm. Stringent regulations might limit institutional investment, while supportive regulations could attract significant capital inflow. Macroeconomic conditions, such as inflation rates, interest rates, and overall economic growth, also play a critical role. A strong global economy generally favors risk-on assets like Bitcoin, while a recessionary environment might lead to investors seeking safer havens. Furthermore, technological advancements within the Bitcoin ecosystem, such as the Lightning Network’s expansion, could impact adoption and price.

Comparison of Prediction Models

Different prediction models utilize varying methodologies and underlying assumptions. Some models rely heavily on historical price data and technical indicators, while others incorporate macroeconomic factors and sentiment analysis. For instance, models based purely on historical price trends might oversimplify the complexity of the market and fail to account for unique circumstances in 2025. In contrast, models that integrate macroeconomic factors offer a more nuanced perspective but might be susceptible to inaccuracies in economic forecasting. The reliability of any prediction model is therefore contingent on the accuracy of its underlying assumptions and the validity of its methodology.

Summary of Predictions

A table summarizing various predictions could be structured as follows:

| Analyst/Source | Prediction | Reasoning |

|—|—|—|

| Analyst A | Price increase of X% | Based on historical halving price increases and anticipated institutional investment. |

| Analyst B | Price increase of Y%, followed by correction | Considers potential regulatory headwinds and macroeconomic uncertainty. |

| Analyst C | Price remains relatively stable | Believes current market sentiment and technological adoption will offset the impact of reduced supply. |

| Analyst D | Price decrease due to Z | Negative outlook on the global economy and regulatory pressures. |

Mining and the Halving

The Bitcoin halving, a pre-programmed event reducing the block reward paid to miners, significantly impacts the profitability and operational strategies of the Bitcoin mining industry. This reduction in reward necessitates adjustments to maintain profitability and operational viability. Understanding these adaptations is crucial to forecasting the overall health of the Bitcoin network.

The halving directly affects miners’ revenue. With fewer bitcoins awarded for each successfully mined block, miners’ income decreases unless the price of Bitcoin increases proportionally or operational costs are significantly reduced. This economic pressure forces miners to re-evaluate their business models, potentially leading to consolidation within the industry.

Miner Profitability and Adaptation Strategies

Miners will employ several strategies to navigate the reduced block rewards. These strategies range from operational efficiencies to exploring alternative revenue streams. For example, miners may upgrade to more energy-efficient mining hardware to lower their operational costs per Bitcoin mined. They may also seek out jurisdictions with lower electricity costs or explore partnerships to share resources and reduce overhead. Diversification into other cryptocurrencies with more lucrative mining rewards is another possible strategy, though this comes with its own set of risks and complexities. Finally, some miners might choose to consolidate their operations by merging with larger mining pools to achieve economies of scale. The success of these strategies will depend on various factors, including the price of Bitcoin and the overall competitiveness of the mining landscape.

Consequences of Decreased Mining Activity

A significant decrease in mining activity following a halving could have several repercussions for the Bitcoin network. Reduced mining power could increase the time it takes to confirm transactions, leading to higher transaction fees. This could potentially make Bitcoin less attractive for everyday transactions, impacting its usability and adoption rate. Furthermore, a less secure network becomes more vulnerable to 51% attacks, jeopardizing the integrity of the blockchain. The network’s overall resilience and security depend heavily on a healthy and active mining community. Historical data from previous halvings can provide some insight, though the specific outcomes will vary based on prevailing market conditions and technological advancements.

Scenario: Large-Scale Miner Shutdown

Imagine a scenario where a substantial portion of Bitcoin miners shut down their operations after the 2025 halving due to sustained low Bitcoin prices and high operational costs. This could lead to a sharp decrease in the Bitcoin network’s hash rate, potentially causing significant delays in transaction confirmations and increasing transaction fees. The resulting network vulnerability could attract malicious actors attempting 51% attacks. The price of Bitcoin could potentially plummet further as the market reacts to the reduced network security and slower transaction speeds. This scenario highlights the interconnectedness of miner profitability, network security, and Bitcoin’s overall market value. However, it is important to note that this is just one possible outcome, and the actual consequences could vary considerably depending on several factors, including the resilience of the remaining miners, technological advancements in mining hardware, and the overall market sentiment towards Bitcoin.

Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the block reward for miners by half, is a significant event with potentially profound long-term implications for Bitcoin’s role in the global financial landscape. Its impact will ripple through various aspects of the Bitcoin ecosystem, affecting its price, adoption, and overall positioning within the broader market. Understanding these implications is crucial for investors and stakeholders alike.

The halving’s primary effect is the reduction in the rate of new Bitcoin entering circulation. This controlled scarcity, a core tenet of Bitcoin’s design, is expected to exert upward pressure on its price, assuming demand remains relatively constant or increases. However, the extent of this price increase is highly debated and depends on numerous intertwined factors, including macroeconomic conditions, regulatory changes, and technological advancements.

Bitcoin as a Store of Value and Medium of Exchange

The halving’s impact on Bitcoin’s position as a store of value is arguably more significant than its effect on its role as a medium of exchange. Reduced supply inherently increases scarcity, a key characteristic of a successful store of value. Historically, halvings have been followed by periods of increased Bitcoin price volatility, but often culminating in significant price appreciation over the long term. Conversely, Bitcoin’s usability as a medium of exchange is largely dependent on factors like transaction fees, network speed, and overall adoption. While the halving might indirectly influence these factors through its impact on price and network security, its direct effect is less pronounced. The long-term viability of Bitcoin as a medium of exchange depends more on scalability solutions and broader societal acceptance than on the halving itself.

Risks and Opportunities Associated with Bitcoin Investment

Investing in Bitcoin around a halving event carries inherent risks and opportunities. Before the halving, investors might anticipate price increases, leading to a potential buying frenzy. However, this could also create a “buy the rumor, sell the news” scenario where prices rise in anticipation but subsequently decline after the event. During the halving, volatility is typically heightened, presenting both opportunities for quick profits and significant losses. After the halving, the price might experience a period of consolidation before resuming its upward trend, provided demand remains strong. A crucial risk lies in the unpredictability of the market, influenced by factors beyond the halving itself, such as regulatory crackdowns or macroeconomic downturns. Opportunities arise from the potential for long-term price appreciation based on the decreasing supply and increasing demand, but this potential is counterbalanced by the inherent volatility and risks associated with cryptocurrency investment. For example, the 2012 and 2016 halvings were followed by significant price increases, but the timing and magnitude of these increases were not predictable.

Comparison with Other Cryptocurrencies

Many other cryptocurrencies employ similar mechanisms to control supply, although often with different approaches. Some, like Litecoin, also have a halving mechanism, albeit with different parameters. Others use different methods like burning tokens to reduce circulating supply. However, Bitcoin’s halving mechanism is unique due to its established network effect, brand recognition, and its position as the first and most prominent cryptocurrency. This makes its halving event significantly more impactful than similar events in other cryptocurrencies. The comparison highlights Bitcoin’s first-mover advantage and the significance of its established network in influencing the market’s reaction to supply adjustments.

Technological Advancements and Their Impact

Technological advancements, such as the Lightning Network, could significantly alter the impact of the halving. If the Lightning Network gains widespread adoption, it could reduce transaction fees and increase transaction speeds, thereby enhancing Bitcoin’s usability as a medium of exchange. This increased utility might amplify the positive price effects of the halving. Conversely, the development of more energy-efficient mining technologies could reduce the overall cost of mining, potentially mitigating the impact of the reduced block reward. However, these advancements are not guaranteed and their timelines are uncertain, adding further complexity to predicting the halving’s overall impact. For instance, the adoption rate of Layer-2 scaling solutions like the Lightning Network remains a key variable in determining the overall impact of the halving on Bitcoin’s utility and price.

Frequently Asked Questions (FAQs): Bitcoin Halving 2025 Là Gì

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, impacting its supply, price, and mining ecosystem. Understanding these impacts is crucial for anyone interested in Bitcoin, whether as an investor or simply as an observer of the cryptocurrency market. This section addresses some of the most frequently asked questions surrounding the halving.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event that reduces the rate at which new Bitcoins are created and added to the circulating supply. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism is a core component of Bitcoin’s design, intended to control inflation and maintain its scarcity over time. Each halving cuts the block reward in half, which is the amount of Bitcoin awarded to miners for successfully verifying and adding transactions to the blockchain.

Timing of the 2025 Halving

The precise date of the 2025 Bitcoin halving is not known in advance but is predicted to occur sometime in the spring of 2025. The actual date depends on the rate at which miners solve complex cryptographic puzzles to add new blocks to the blockchain. While the halving is expected around this time, slight variations are possible. Historical data from previous halvings can be used to create reasonable estimates, but predicting the exact block height and date with absolute certainty remains challenging.

Halving’s Effect on Bitcoin Price

Historically, Bitcoin’s price has tended to increase in the period following a halving. This is primarily attributed to the reduction in new Bitcoin supply, creating a potential scenario of increased scarcity and higher demand. However, it’s crucial to understand that this is not a guaranteed outcome. Other market forces, such as overall economic conditions, regulatory changes, and investor sentiment, significantly influence Bitcoin’s price. The 2012 and 2016 halvings saw significant price increases in the months and years that followed, but these were also periods of increasing adoption and general bullish market sentiment. The 2020 halving saw a less dramatic immediate price impact.

Risks Associated with Investing Around the Halving, Bitcoin Halving 2025 Là Gì

Investing in Bitcoin, particularly around a halving, carries inherent risks. Price volatility is a significant factor; while historical trends suggest potential upward movement, the market can be unpredictable. Furthermore, there’s no guarantee that a price increase will materialize, and investors could experience losses. Regulatory uncertainty and potential market manipulation also add to the overall risk profile. Consider diversification of investment portfolios and only invest what you can afford to lose. Past performance is not indicative of future results.

Impact of the Halving on Bitcoin Miners

The halving directly impacts Bitcoin miners’ profitability. The reduced block reward means they earn less Bitcoin for each block mined. This can lead to some miners becoming unprofitable, potentially causing them to exit the network. However, miners can adapt by improving their efficiency, lowering operating costs, or switching to more profitable mining operations. The long-term effects on the mining ecosystem are complex and depend on factors such as the price of Bitcoin and the cost of electricity. The halving can also lead to a consolidation of the mining industry, with larger, more efficient mining operations gaining a competitive advantage.

Formatting Considerations

Effective formatting is crucial for presenting complex information like Bitcoin halving analysis in a clear and engaging manner. A well-structured article improves readability and comprehension, allowing readers to quickly grasp key concepts and data. This section details formatting best practices for creating a visually appealing and informative piece.

Article Structure

A clear article structure uses headings to organize information hierarchically. The main topic should be introduced with an H1 heading, followed by H2 headings for major sections, and H3 headings for subsections. This creates a logical flow, guiding the reader through the content. Bullet points can be used effectively within sections to highlight key takeaways or list specific items. For example, a section on market reactions could use bullet points to list predicted price movements, trading volume changes, and investor sentiment shifts.

Using Tables to Organize Data

Tables are excellent for presenting data in a structured and easily comparable format. They should have clear column headers that precisely define the data contained within each column. Rows represent individual data points, and the data itself should be aligned appropriately (e.g., numbers aligned to the right, text aligned to the left). For example, a table could compare Bitcoin’s price and mining difficulty before and after previous halvings. Each column could represent a specific metric (price, difficulty, date), and each row could represent a different halving event. This allows for easy comparison and identification of trends.

Creating Visually Appealing Charts and Graphs

Charts and graphs are essential for visualizing data trends and patterns. A *line chart* can effectively display Bitcoin’s price fluctuations over time, highlighting the impact of halving events. A *bar chart* could compare mining profitability before and after a halving. For instance, a bar chart could show the mining revenue per block before and after the halving, visually demonstrating the impact of the reduced block reward. Remember to clearly label axes, include a title explaining the chart’s purpose, and use a legend to explain different data series if necessary. A visually appealing chart utilizes consistent colors, clear fonts, and avoids clutter. *Pie charts* are useful for showing proportions, such as the distribution of Bitcoin holdings among different groups of holders.

Emphasis Using Bold and Italics

Bold text (bold) should be used to emphasize key terms, findings, or important statistics. Italics (*italics*) can be used to highlight specific phrases, quotes, or definitions. For example, the phrase “Bitcoin halving” should be bolded throughout the article to ensure consistent emphasis. Similarly, *predictions about future price movements* should be italicized to distinguish them from factual data. Overuse of bold and italics, however, should be avoided to maintain readability.

Understanding “Bitcoin Halving 2025 Là Gì” involves grasping the halving event’s impact on Bitcoin’s supply. This significant event, where the reward for mining Bitcoin is cut in half, is a key part of Bitcoin’s design. To learn more about the precise date and implications, you can check out the specifics on Bitcoin Halving Day 2025. Ultimately, understanding this day helps clarify what “Bitcoin Halving 2025 Là Gì” truly means in terms of the cryptocurrency’s future.

Understanding “Bitcoin Halving 2025 Là Gì” requires grasping the core concept of Bitcoin’s halving events. Essentially, it refers to the scheduled reduction in Bitcoin’s block reward, a key mechanism governing its inflation rate. For a comprehensive understanding of this significant event, further information can be found on the specifics at 2025 Bitcoin Halving. This resource provides valuable insight into how the 2025 halving will impact the Bitcoin ecosystem and ultimately answers the question, “Bitcoin Halving 2025 Là Gì?”

Understanding “Bitcoin Halving 2025 Là Gì” requires grasping the core concept of Bitcoin’s reward halving. This event, which significantly impacts the cryptocurrency’s inflation rate, is a key topic for investors. To further explore the specifics of the timing and potential market effects, you can check out a detailed analysis at Bitcoin Halving 2025 Daye. Returning to “Bitcoin Halving 2025 Là Gì,” remember that this halving is predicted to influence Bitcoin’s price volatility and long-term value proposition.

Understanding “Bitcoin Halving 2025 Là Gì” requires knowing the precise timing of the event. This reduction in Bitcoin’s block reward is a significant occurrence, impacting its inflation rate and potentially its price. To determine the exact date, you’ll need to consult a reliable resource, such as this helpful page: What Day Is The Bitcoin Halving 2025. Knowing this date is crucial for anyone trying to fully grasp the implications of the Bitcoin Halving 2025 Là Gì.

Understanding “Bitcoin Halving 2025 Là Gì” involves grasping the halving’s impact on Bitcoin’s inflation rate. To keep track of the countdown to this significant event, you can utilize a helpful resource like the Bitcoin Halving 2025 Clock , which provides a real-time visual representation. This clock helps visualize the time remaining until the next halving, further clarifying the implications of “Bitcoin Halving 2025 Là Gì” for the cryptocurrency’s future.

Understanding “Bitcoin Halving 2025 Là Gì” requires knowing the precise timing of the event. To clarify, a crucial aspect is determining exactly when the next halving will occur, and you can find that information by checking this helpful resource: When Is Bitcoin Halving 2025. This date is fundamental to understanding the potential impact of the Bitcoin Halving 2025 Là Gì on the cryptocurrency’s future price and overall market dynamics.