Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event in the Bitcoin protocol, is anticipated to occur in 2025. This event significantly impacts the cryptocurrency’s supply and, historically, has been followed by periods of price appreciation. Understanding the mechanics of this event and its potential consequences is crucial for anyone involved in the Bitcoin ecosystem.

Bitcoin Halving Mechanics and Historical Price Impact

The Bitcoin halving reduces the reward given to Bitcoin miners for successfully validating and adding new blocks to the blockchain. This reward, initially set at 50 BTC per block, is halved approximately every four years. This programmed scarcity is a core tenet of Bitcoin’s design. Historically, previous halvings have been followed by significant price increases, although the timeframes and magnitudes of these increases have varied. The 2012 halving saw a substantial price rise in the following year, while the 2016 halving was followed by a period of consolidation before a significant price surge in 2017. The 2020 halving also preceded a substantial price increase, though market conditions and external factors always play a role. It’s important to note that correlation does not equal causation; other factors, such as increased adoption, regulatory changes, and macroeconomic conditions, influence Bitcoin’s price.

Bitcoin Scarcity and Price Appreciation

The halving directly impacts Bitcoin’s scarcity. By reducing the rate at which new Bitcoins are created, the halving makes the existing supply relatively more valuable. This mechanism is similar to how limited-edition items or rare collectibles appreciate in value due to their restricted availability. The predictable and pre-programmed nature of the halving contributes to this scarcity, as it is a known and anticipated event. The reduced supply, combined with continued or increased demand, can theoretically push the price upwards. The extent of this price appreciation, however, remains speculative and depends on a multitude of factors beyond just the halving itself. For example, the 2020 halving occurred during a period of increasing institutional adoption, which likely contributed to the subsequent price surge.

2025 Halving: Expected Block Reward Reduction and Miner Implications

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This reduction in miner revenue will directly impact the profitability of Bitcoin mining. Miners will need to adapt to the reduced reward, potentially by increasing efficiency, upgrading their equipment, or focusing on operations in regions with lower energy costs. The overall effect on the mining landscape is uncertain, with some predicting a consolidation of mining operations and an increase in the average hash rate as more efficient miners dominate the network. Others anticipate a potential negative impact on the security of the network if the profitability of mining falls too low, leading some miners to cease operations. The interplay between these factors will be crucial in determining the long-term consequences of the 2025 halving.

Historical Analysis of Past Halvings

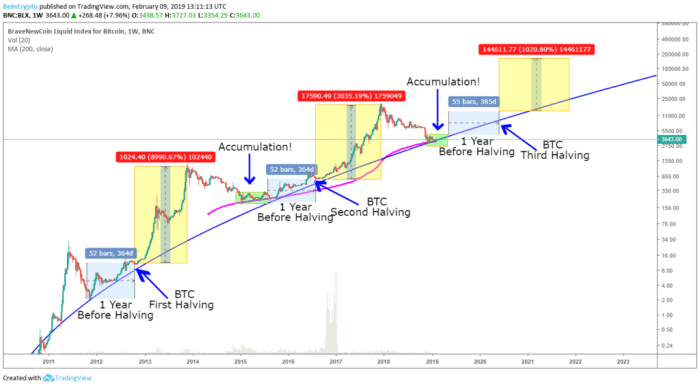

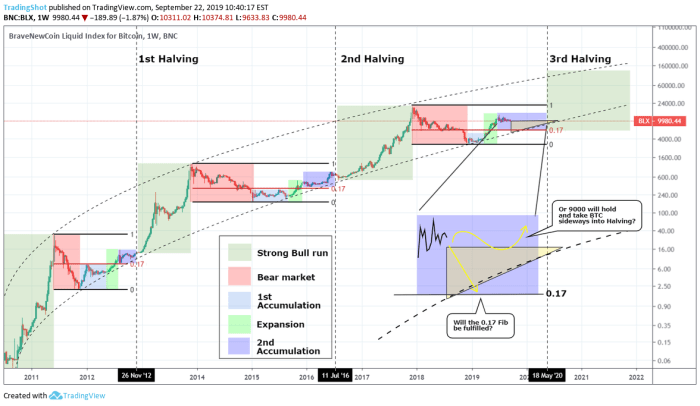

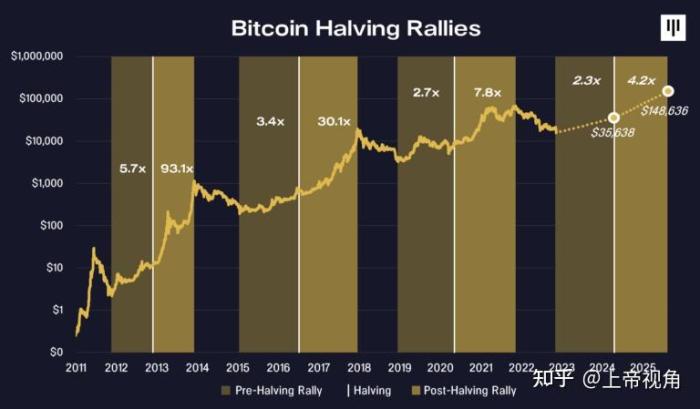

Analyzing Bitcoin’s price behavior around previous halving events offers valuable insights into potential future trends. While past performance doesn’t guarantee future results, understanding these historical patterns can inform expectations and risk assessment. The reduction in Bitcoin’s inflation rate, caused by the halving, has consistently been followed by periods of significant price volatility.

The impact of Bitcoin halvings on its price can be observed by examining the three previous events. Each halving has been followed by a period of increased price, although the timing and magnitude of these increases have varied considerably. Several factors, including macroeconomic conditions, regulatory changes, and overall market sentiment, interact with the halving’s impact to shape the resulting price movements.

Price Movements Before, During, and After Previous Halvings

The first Bitcoin halving occurred in November 2012, reducing the block reward from 50 BTC to 25 BTC. Leading up to this event, Bitcoin’s price experienced a gradual increase. During the halving itself, the price remained relatively stable, followed by a significant bull run that lasted for several months. The second halving, in July 2016 (reducing the reward to 12.5 BTC), saw a similar pattern: a period of price appreciation before the event, relative stability during, and a subsequent price surge. The third halving in May 2020 (reducing the reward to 6.25 BTC) was also followed by a substantial price increase, though it was preceded by a more pronounced price increase and subsequently experienced a period of consolidation. Comparing these events highlights the consistent upward trend after each halving, though the duration and intensity of the subsequent bull market varied.

Significant Market Trends and Influencing Factors

Several factors besides the halving itself have influenced Bitcoin’s price. The increasing adoption of Bitcoin by institutional investors and growing awareness of its potential as a store of value have contributed to price increases. Conversely, regulatory uncertainty and periods of broader market downturn have exerted downward pressure. For example, the 2018 bear market, which followed the 2016 halving, underscores the interplay between macroeconomic conditions and Bitcoin’s price. Similarly, the global pandemic in 2020 influenced both the lead-up and the aftermath of the third halving, showcasing the interconnectedness of global events and cryptocurrency markets. The narratives surrounding each halving – the anticipation, the event itself, and the subsequent market reaction – also significantly influence investor sentiment and price action.

Long-Term Impact on Bitcoin’s Price and Market Capitalization

Historically, Bitcoin halvings have had a long-term positive impact on its price and market capitalization. The reduction in the supply of newly minted Bitcoin creates a deflationary pressure, potentially increasing its scarcity and value over time. This effect, however, is often not immediately apparent, with the price increase often manifesting months or even years after the halving event. The long-term impact is further amplified by the compounding effect of increasing demand and limited supply. For instance, the market capitalization of Bitcoin has steadily increased since the first halving, demonstrating the long-term effects of reduced inflation on the asset’s overall value. This illustrates the long-term growth potential associated with the fundamental supply-demand dynamics shifted by the halving events.

Predicting the 2025 Halving’s Impact

The Bitcoin halving event, scheduled for 2025, is a significant event anticipated to impact Bitcoin’s price. Predicting the exact outcome is impossible, but analyzing historical data and considering macroeconomic and regulatory factors allows us to formulate potential price scenarios. The reduction in Bitcoin’s inflation rate, coupled with external market forces, will likely be the primary drivers of price movement in the period following the halving.

Potential Price Scenarios Following the 2025 Halving

The impact of the 2025 halving on Bitcoin’s price is highly dependent on various interacting factors. While past halvings have generally been followed by price increases, the magnitude of these increases has varied considerably. Several scenarios are possible, ranging from modest gains to substantial price appreciation, depending on the prevailing market sentiment and global economic conditions.

Price Scenarios Based on Market Conditions

Several factors will influence Bitcoin’s price after the halving. A bullish market, characterized by high investor confidence and increased demand, could lead to significant price appreciation. Conversely, a bearish market, marked by uncertainty and decreased demand, could limit price increases or even lead to price declines. For example, the 2012 halving saw a gradual price increase over the following year, while the 2016 halving led to a more dramatic surge in price. The 2020 halving saw a period of consolidation before a significant price rise. These differing outcomes highlight the complexity of predicting the exact price movement after a halving. A conservative estimate might suggest a price range between $100,000 and $250,000 within a year of the halving under a bullish scenario, while a more bearish scenario could see a range of $50,000 to $150,000, depending on global market conditions.

Macroeconomic Factors and Bitcoin’s Price

Macroeconomic factors such as inflation and recession significantly influence Bitcoin’s price. High inflation, eroding the value of fiat currencies, can drive investors towards Bitcoin as a hedge against inflation. Conversely, a recession could lead to risk aversion, causing investors to sell their Bitcoin holdings to cover losses in other assets. For instance, during periods of high inflation, such as those experienced in 2021 and 2022, Bitcoin often saw increased demand and price appreciation. However, during periods of economic uncertainty, such as the early stages of the 2022 bear market, Bitcoin prices experienced significant corrections. The interplay between Bitcoin’s deflationary nature and the inflationary pressures of a global economy will be crucial in determining its price trajectory after the 2025 halving.

Regulatory Changes and Bitcoin’s Price Trajectory

Regulatory clarity and changes in government policies concerning cryptocurrencies will significantly affect Bitcoin’s price. Favorable regulations could increase institutional investment and mainstream adoption, driving up prices. Conversely, stricter regulations or outright bans could suppress price growth. The example of China’s crackdown on cryptocurrencies in 2021 demonstrates the potential for negative regulatory impact on Bitcoin’s price. Conversely, the increasing acceptance of Bitcoin by institutional investors and the growing number of countries exploring regulatory frameworks for cryptocurrencies suggest a potential for positive regulatory influence on price. The regulatory landscape in 2025 will be a key factor in shaping the post-halving price trajectory.

Factors Influencing Bitcoin’s Price

Beyond the halving, numerous factors will interplay to determine Bitcoin’s price trajectory in 2025 and beyond. These factors are complex and often interconnected, making precise prediction challenging. However, understanding their potential influence allows for a more informed perspective on the cryptocurrency’s future value.

Bitcoin Halving 2025 Prediction – The interplay between adoption rates, technological advancements, and market sentiment significantly shapes Bitcoin’s value. Increased adoption leads to higher demand, pushing prices up. Technological improvements, such as layer-2 scaling solutions, can enhance usability and efficiency, attracting more users and potentially increasing value. Conversely, negative market sentiment, fueled by regulatory uncertainty or security breaches, can trigger price drops. These factors rarely act in isolation; they dynamically interact, creating a constantly shifting landscape.

Predicting the Bitcoin Halving 2025 impact is a complex undertaking, involving numerous factors influencing price. To gain a clearer understanding of potential price movements, it’s helpful to examine analyses focused specifically on price predictions, such as those found on this insightful resource regarding Bitcoin Halving 2025 Preis. Ultimately, Bitcoin Halving 2025 Prediction remains speculative, but informed analysis can provide valuable insights.

Influence of Macroeconomic Conditions

Macroeconomic factors, such as inflation rates, interest rates, and global economic growth, significantly impact Bitcoin’s price. High inflation often drives investors towards alternative assets like Bitcoin, perceiving it as a hedge against inflation. Conversely, rising interest rates can make holding Bitcoin less attractive compared to higher-yielding bonds. Recessions or periods of economic uncertainty can also impact investor risk appetite, potentially influencing Bitcoin’s price. For example, during the 2022 economic downturn, many investors moved away from riskier assets, including Bitcoin, leading to a significant price correction.

Regulatory Landscape and Government Actions

Government regulations and policies play a crucial role in shaping Bitcoin’s price. Favorable regulations, such as the clear legal framework for cryptocurrency trading and investment, can boost investor confidence and increase adoption. Conversely, restrictive regulations or outright bans can negatively impact Bitcoin’s price and limit its growth potential. The differing regulatory approaches taken by various countries, from outright bans in some nations to more welcoming stances in others, demonstrate the significant impact of government actions on the cryptocurrency market. The regulatory environment surrounding Bitcoin is constantly evolving, making it a critical factor to consider.

Technological Advancements and Scalability

Technological advancements within the Bitcoin ecosystem itself can significantly influence its price. Improvements in scalability, transaction speed, and energy efficiency can make Bitcoin more attractive to a wider range of users and businesses. The development and adoption of layer-2 scaling solutions, for instance, aim to address Bitcoin’s current limitations in transaction throughput, potentially increasing its appeal and driving up its price. Conversely, a failure to address scalability issues could hinder Bitcoin’s growth and limit its price appreciation.

Market Sentiment and Investor Behavior

Market sentiment, encompassing investor confidence, fear, and greed, profoundly affects Bitcoin’s price volatility. Positive news, such as large institutional investments or widespread adoption by businesses, can fuel bullish sentiment and drive price increases. Conversely, negative news, such as security breaches or regulatory crackdowns, can trigger panic selling and price drops. The influence of social media and news cycles on market sentiment is particularly notable, highlighting the importance of understanding investor psychology in predicting Bitcoin’s price movements. For example, Elon Musk’s tweets have repeatedly demonstrated a significant impact on Bitcoin’s short-term price volatility.

Relative Influence of Factors on Bitcoin’s Price Volatility

| Factor | Short-Term Influence | Long-Term Influence | Volatility Impact |

|---|---|---|---|

| Halving | High | Medium | High (cyclical) |

| Macroeconomic Conditions | Medium | High | Medium to High |

| Regulation | Medium to High | High | High (event-driven) |

| Market Sentiment | High | Medium | Very High |

Alternative Cryptocurrencies and the Bitcoin Halving

The Bitcoin halving, a significant event in the cryptocurrency world, doesn’t exist in a vacuum. Its impact ripples throughout the broader crypto market, influencing the performance of alternative cryptocurrencies (altcoins) in complex and often unpredictable ways. Understanding this interconnectedness is crucial for navigating the post-halving landscape.

The Bitcoin halving typically reduces the rate at which new Bitcoins are created, potentially leading to decreased selling pressure and increased scarcity. This, in theory, could drive up Bitcoin’s price. However, the effect on altcoins is less straightforward and often depends on the specific characteristics of the altcoin and the overall market sentiment.

Altcoin Price Correlation with Bitcoin

The price movements of many altcoins are strongly correlated with Bitcoin’s price. A significant price increase in Bitcoin often leads to a “bull run” across the altcoin market, while a Bitcoin price drop typically results in a market-wide correction. The 2021 Bitcoin bull run, for example, saw substantial gains across many altcoins, while the subsequent bear market significantly impacted their prices. This correlation suggests that a positive impact from the 2025 halving on Bitcoin’s price could potentially lead to positive price action in many altcoins, although the magnitude of the effect might vary considerably. However, this correlation is not absolute; some altcoins may decouple from Bitcoin’s price, particularly those with unique technological features or strong community support.

Impact on Overall Cryptocurrency Market Capitalization, Bitcoin Halving 2025 Prediction

The cryptocurrency market capitalization is a sum of the market values of all cryptocurrencies. A significant Bitcoin price increase following a halving could increase the overall market cap, as Bitcoin typically accounts for a large portion of the total. For instance, if Bitcoin’s market dominance increases after the halving, the overall market capitalization will likely rise proportionally. Conversely, a less significant or negative impact on Bitcoin’s price could lead to a less pronounced or even negative impact on the overall market capitalization. The effect is intertwined with broader macroeconomic factors and investor sentiment, making precise prediction challenging.

Altcoin Market Share Potential

While a Bitcoin halving might initially boost Bitcoin’s dominance, it also presents opportunities for altcoins to gain market share. This can happen in several ways. Firstly, investors might allocate a portion of their profits from Bitcoin to altcoins, seeking higher returns. Secondly, altcoins with innovative technologies or strong community engagement might attract new investors independent of Bitcoin’s price movements. Finally, periods of market uncertainty following a halving might lead investors to seek diversification, potentially boosting the performance of altcoins with unique value propositions. The 2017 halving, for example, saw a significant increase in the market share of Ethereum and other altcoins following an initial Bitcoin price surge.

Mining and the Halving’s Effect: Bitcoin Halving 2025 Prediction

The Bitcoin halving, a programmed event that reduces the block reward paid to miners by half, significantly impacts the economics of Bitcoin mining and, consequently, the network’s security and decentralization. Understanding these effects is crucial for predicting Bitcoin’s future trajectory.

The halving directly affects miners’ profitability by reducing their revenue stream. With fewer newly minted Bitcoins awarded for each block mined, miners must rely more heavily on transaction fees to cover their operational costs, including electricity, hardware maintenance, and personnel. This decrease in profitability can lead to a reduction in the overall hashrate, as less profitable miners may choose to shut down their operations or switch to mining other cryptocurrencies with more lucrative rewards.

Miner Adaptation Strategies

Miners will likely employ several strategies to adapt to the reduced block reward. These adaptations aim to maintain profitability and competitiveness within the mining landscape. Some miners might consolidate operations, merging smaller mining pools to achieve economies of scale and reduce overhead costs. Others may invest in more energy-efficient mining hardware to lower their operating expenses. This could involve upgrading to newer ASICs (Application-Specific Integrated Circuits) designed for improved power efficiency or exploring alternative energy sources like hydropower or solar power to reduce electricity costs. Some might also explore diversifying their revenue streams by engaging in other activities, such as offering Bitcoin node hosting services or participating in liquidity provision on decentralized exchanges. The success of these strategies will depend on various factors, including the prevailing Bitcoin price, the overall energy costs, and the level of competition within the mining sector.

Consequences for Network Security and Decentralization

A decrease in hashrate following a halving could potentially compromise the security of the Bitcoin network. The hashrate represents the computational power dedicated to securing the network and preventing malicious attacks like 51% attacks. A lower hashrate means the network is theoretically more vulnerable to such attacks. However, the impact on security is complex and depends on various factors. For example, the existing hashrate before the halving, the price of Bitcoin, and the development of new, more efficient mining hardware all play a role. A sustained decline in the hashrate could also potentially lead to a less decentralized network, as larger, more well-funded mining operations might gain a disproportionate share of the mining power. This could raise concerns about centralization and the network’s resilience to potential attacks or censorship. Historically, however, halvings have not resulted in catastrophic declines in hashrate, and the network has adapted. The 2012 and 2016 halvings, for example, were followed by periods of adjustment, but the Bitcoin network’s security remained largely intact. The 2025 halving will likely follow a similar pattern, though the exact impact will depend on various market forces.

Investor Sentiment and Market Speculation

Investor sentiment surrounding Bitcoin is currently a complex mix of optimism and caution. While the upcoming halving event is widely anticipated to be bullish, uncertainty regarding macroeconomic factors and regulatory landscapes temper this enthusiasm. Many investors view the halving as a historically significant event, potentially leading to a price increase, while others remain skeptical, citing past instances where the expected price surge didn’t fully materialize.

The potential reaction to the 2025 halving is highly dependent on various factors, including the overall state of the global economy, regulatory developments, and the adoption rate of Bitcoin. Predicting the exact price movement is impossible, but analyzing past halving cycles and current market conditions offers valuable insights. Several analysts have offered price predictions ranging from conservative estimates to extremely bullish projections, highlighting the significant range of potential outcomes.

Potential Risks and Opportunities for Investors

The wide range of Bitcoin price predictions for post-halving presents both significant opportunities and considerable risks for investors. Bullish predictions, often based on historical precedent and the reduced supply of newly mined Bitcoin, suggest substantial profit potential. However, pessimistic forecasts, often linked to macroeconomic headwinds or unforeseen regulatory challenges, highlight the potential for significant losses. For example, if the price were to remain stagnant or even decline after the halving, investors who bought in anticipation of a price surge could experience substantial losses. Conversely, investors who bought at lower prices before the halving and hold onto their assets during the anticipated price increase could realize significant gains. The risk-reward profile varies greatly depending on the entry point, investment horizon, and individual risk tolerance. Diversification within a portfolio is crucial to mitigate risk.

The Role of Market Speculation and FOMO

Market speculation and the fear of missing out (FOMO) play a crucial role in shaping Bitcoin’s price, particularly around major events like the halving. Speculative trading often amplifies price movements, leading to both sharp increases and rapid declines. As the halving approaches, anticipation builds, and FOMO can drive up demand, pushing the price higher. This effect is often exacerbated by social media hype and news coverage, creating a self-reinforcing cycle. Conversely, if the expected price increase fails to materialize, the resulting disappointment can lead to a sharp sell-off, driven by investors’ fear of further losses. The 2016 and 2020 halvings both witnessed periods of significant price volatility influenced by this interplay between speculation and FOMO. Understanding this dynamic is crucial for investors to navigate the market effectively and avoid impulsive decisions based solely on emotional factors.

Illustrative Scenarios

Predicting the precise impact of the 2025 Bitcoin halving on price is inherently challenging due to the complex interplay of market forces. However, by examining potential scenarios, we can gain a better understanding of the range of possibilities. The following illustrations depict contrasting outcomes, highlighting the uncertainty involved.

Positive Halving Scenario: Significant Price Increase

Imagine a graph charting Bitcoin’s price over time. Before the halving, the price shows a steady, perhaps slightly upward, trend. As the halving approaches, anticipation builds, and the line begins a steeper ascent. The halving event itself acts as a catalyst, sharply increasing the slope of the line. The price continues to climb significantly in the months following the halving, potentially reaching new all-time highs. This upward trajectory is fueled by reduced supply, increased institutional investment driven by the halving’s deflationary effect, and positive media coverage emphasizing the scarcity of Bitcoin. The visual would clearly show a dramatic price surge post-halving, exceeding any prior price increase in the preceding year. This surge is not a linear increase but rather an exponential growth curve, mirroring the historical price increases observed after previous halvings, albeit potentially at a different rate. This scenario assumes a positive macroeconomic environment and continued faith in Bitcoin as a store of value and a hedge against inflation. Similar to the price increase seen after the 2021 halving, though the magnitude of this increase remains uncertain.

Negative Halving Scenario: Minimal or Negative Price Impact

In this scenario, the graph depicts a different story. Leading up to the halving, the price might show stagnation or even a slight decline, reflecting a bearish market sentiment. The halving event itself has a minimal impact on the price, with the line showing only a minor, almost imperceptible, blip. The price might even continue to decline in the months following the halving. This could be visually represented by a flat or slightly downward-sloping line, contrasting sharply with the previous scenario. This negative scenario could be attributed to various factors, including a global economic downturn, increased regulatory scrutiny of cryptocurrencies, or a significant loss of investor confidence. This would be similar to the limited impact seen in the period immediately following the 2016 halving, when Bitcoin’s price did not immediately surge. The visual would show a clear absence of the typical post-halving price increase, potentially even depicting a continued bear market.

Predicting the Bitcoin Halving in 2025 involves analyzing various factors, including mining difficulty adjustments and network hash rate. Understanding the precise timing is crucial, and a helpful resource for this is the article detailing Halving Bitcoin When 2025 , which provides valuable insights into the event’s schedule. This information is then used to refine Bitcoin Halving 2025 predictions and their potential impact on the market.

Predicting the Bitcoin Halving in 2025 involves analyzing various factors influencing its price. A key aspect of this prediction hinges on understanding the precise timing of the event, which is crucial for market analysis. To find out exactly when this halving will occur, you can check this informative resource: When. Is. Bitcoin.

Halving. 2025. Knowing the date allows for more accurate predictions about the potential impact on Bitcoin’s value and overall market trends after the halving.

Predicting the Bitcoin Halving 2025 impact on price is a complex endeavor, with various factors influencing the outcome. Understanding the mechanics of the halving itself is crucial for informed predictions; for a detailed explanation, check out this helpful resource: Bitcoin Halving 2025 Explained. Ultimately, while predictions abound, the actual effect on Bitcoin’s price in 2025 remains to be seen.

Predicting the Bitcoin Halving 2025’s impact on price is a complex undertaking, involving numerous factors beyond the reduced block reward. A key aspect to understanding potential price movements is knowing the precise date of the halving. To find out exactly when this significant event will occur, you should consult a reliable resource such as this article: When Does Bitcoin Halving 2025.

Ultimately, accurate Bitcoin Halving 2025 predictions depend heavily on this date’s certainty and subsequent market reactions.

Predicting the Bitcoin Halving 2025 impact is a complex endeavor, with analysts offering varied forecasts on price movements. Understanding the mechanics of the halving is crucial for these predictions, and a thorough examination of the Bitcoin Halving Period 2025 provides valuable context. Ultimately, Bitcoin Halving 2025 Prediction remains speculative, though informed analysis based on historical data and market trends can offer some insights.