Market Predictions and Speculation: Bitcoin Halving 2025 Shiba Inu

The Bitcoin halving in 2025 is a significant event anticipated to impact the cryptocurrency market considerably. Its effect on Bitcoin’s price is generally considered positive in the long term, due to the reduced supply of newly mined coins. However, the impact on altcoins like Shiba Inu is less predictable and depends on various factors, including market sentiment and the overall economic climate. Expert opinions diverge on the extent of this impact, creating a landscape of both optimism and caution for investors.

Expert Opinions on the 2025 Halving’s Impact

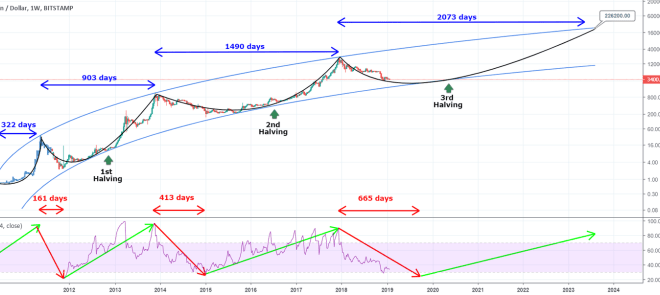

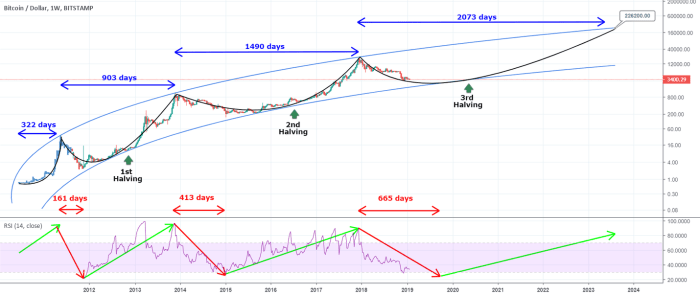

Several experts predict a bullish trend for Bitcoin following the 2025 halving, mirroring past halving cycles. Some analysts suggest a price surge, potentially reaching new all-time highs, citing the historical precedent of price increases following previous halvings. However, other experts caution against over-optimism, pointing to the influence of macroeconomic factors and regulatory uncertainty that could temper any price increase. The impact on Shiba Inu is largely seen as dependent on Bitcoin’s performance, with some suggesting a potential positive correlation, while others argue that Shiba Inu’s price is more susceptible to market sentiment and speculative trading. For instance, PlanB, a well-known on-chain analyst, has historically made price predictions based on Bitcoin’s stock-to-flow model, while other analysts like Willy Woo utilize different metrics and offer contrasting viewpoints.

Risks and Opportunities Associated with Investing

Investing in Bitcoin and Shiba Inu around the 2025 halving presents both significant opportunities and substantial risks. The potential for substantial price appreciation is a major draw, particularly for Bitcoin given its historical performance post-halving. However, the cryptocurrency market is inherently volatile, and unforeseen events, such as regulatory crackdowns or a major market correction, could lead to significant losses. Shiba Inu, being a meme coin, carries additional risk due to its speculative nature and dependence on market sentiment. The opportunity lies in potentially high returns, but the risk is amplified by the coin’s volatility and lack of inherent value compared to Bitcoin’s established position. The risk-reward profile differs significantly between the two assets.

Influence of Macroeconomic Factors

Macroeconomic factors, such as inflation and regulatory changes, play a crucial role in shaping market predictions. High inflation can drive investors towards Bitcoin as a hedge against inflation, potentially increasing its demand and price. Conversely, stringent regulatory frameworks could dampen market enthusiasm and negatively impact prices. For example, the tightening of monetary policy by central banks globally could influence the flow of capital into risk assets like cryptocurrencies. Similarly, increased regulatory scrutiny, like the recent actions taken by the SEC in the US, can create uncertainty and volatility in the market. These macroeconomic factors are interconnected and can influence the cryptocurrency market in complex ways.

Potential Catalysts Influencing Prices

Several catalysts could positively or negatively influence the prices of Bitcoin and Shiba Inu. Positive catalysts for Bitcoin could include widespread institutional adoption, increased regulatory clarity, and successful integration into mainstream financial systems. Conversely, negative catalysts might include a major security breach affecting a major exchange, increased government regulation leading to trading restrictions, or a significant downturn in the global economy. For Shiba Inu, positive catalysts could involve significant partnerships, the launch of new utility features, or a resurgence in meme coin popularity. Negative catalysts could be a lack of innovation, increased competition from other meme coins, or a general decline in investor interest in speculative assets.

Market Scenarios and Their Impact

The following table illustrates three potential market scenarios and their likely impact on Bitcoin and Shiba Inu:

| Scenario | Bitcoin Price | Shiba Inu Price | Rationale |

|---|---|---|---|

| Bullish Market | Significant increase, potentially exceeding previous all-time highs | Moderate to significant increase, correlated with Bitcoin’s performance | Strong macroeconomic conditions, widespread adoption, positive regulatory developments. |

| Neutral Market | Moderate increase or sideways movement | Limited price movement or slight decrease | Stable macroeconomic conditions, limited regulatory changes, mixed investor sentiment. |

| Bearish Market | Significant decrease | Sharp decrease, potentially exceeding Bitcoin’s percentage decline | Negative macroeconomic conditions, increased regulatory scrutiny, loss of investor confidence. |

Investment Strategies and Risk Management

Investing in cryptocurrencies like Bitcoin and Shiba Inu presents significant opportunities but also carries substantial risks. The 2025 Bitcoin halving, a predictable event reducing Bitcoin’s inflation rate, is expected to impact market dynamics, influencing both Bitcoin and potentially correlated assets like Shiba Inu. Understanding various investment strategies and implementing robust risk management techniques are crucial for navigating this volatile landscape.

Investment Strategies for Bitcoin and Shiba Inu

The Bitcoin halving often leads to increased scarcity and potential price appreciation in the long term. However, short-term market reactions can be unpredictable. For Bitcoin, a long-term “buy and hold” strategy, focused on accumulating Bitcoin over time regardless of short-term price fluctuations, is a common approach. Alternatively, a dollar-cost averaging (DCA) strategy involves investing a fixed amount of money at regular intervals, mitigating the risk of investing a lump sum at a market peak. For Shiba Inu, given its higher volatility, a more cautious approach might involve smaller, strategically timed investments based on technical analysis or market sentiment. Diversification across multiple cryptocurrencies and asset classes is also recommended to reduce overall portfolio risk.

Risk Management and Diversification

Risk management in cryptocurrency investing is paramount. Diversification across different asset classes (cryptocurrencies, stocks, bonds, etc.) is a fundamental principle to reduce the impact of losses in any single asset. It’s crucial to only invest capital you can afford to lose, as significant price drops are common in the cryptocurrency market. Furthermore, understanding your own risk tolerance is key. Are you comfortable with potentially losing a substantial portion of your investment in the short term for the potential of higher long-term gains? This self-assessment guides investment decisions.

Strategies to Mitigate Potential Losses

Several strategies can help mitigate potential losses. Setting stop-loss orders, which automatically sell an asset when it reaches a predetermined price, can limit potential losses during a market downturn. Similarly, diversifying your portfolio across multiple cryptocurrencies reduces the impact of a single asset’s decline. Regularly reviewing and rebalancing your portfolio ensures that your asset allocation remains aligned with your risk tolerance and investment goals. Finally, staying informed about market trends and news through reputable sources helps make more informed investment decisions.

Appropriate Risk Tolerance Levels

Risk tolerance is subjective and depends on individual circumstances. Bitcoin, while less volatile than Shiba Inu, still carries significant risk. Investors with a high-risk tolerance might allocate a larger portion of their portfolio to Bitcoin and Shiba Inu, aiming for potentially higher returns. Conversely, investors with a low-risk tolerance should allocate a smaller portion, prioritizing capital preservation. A balanced approach involves diversifying across different asset classes, including less volatile options, to manage overall portfolio risk. For example, an investor with a moderate risk tolerance might allocate a small percentage of their portfolio to Shiba Inu, while a larger percentage is allocated to Bitcoin and traditional assets.

Investment Strategies, Risks, and Potential Returns

| Strategy | Risk Level | Potential Return | Investor Profile Suitability |

|---|---|---|---|

| Bitcoin Buy and Hold (Long-term) | Medium | High (long-term) | Long-term investors with moderate risk tolerance |

| Bitcoin Dollar-Cost Averaging | Medium-Low | Medium (long-term) | Risk-averse investors seeking steady growth |

| Shiba Inu Speculative Trading | High | High (potential) / Low (likely) | High-risk tolerance investors comfortable with potential losses |

| Diversified Crypto Portfolio | Medium | Medium (long-term) | Investors seeking balanced growth and risk mitigation |

Frequently Asked Questions

The upcoming 2025 Bitcoin halving is a significant event in the cryptocurrency world, expected to impact both Bitcoin and other cryptocurrencies, including Shiba Inu. Understanding the mechanics of the halving and its potential effects is crucial for informed investment decisions. This section addresses common questions surrounding the halving and its implications.

Bitcoin Halving and its Price Effect, Bitcoin Halving 2025 Shiba Inu

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years. Historically, Bitcoin halvings have been followed by periods of increased price appreciation, although this is not guaranteed. The reduced supply of newly mined Bitcoin, coupled with persistent demand, can create upward pressure on the price. The scarcity of Bitcoin is a key factor influencing its value. However, other macroeconomic factors and market sentiment also play significant roles. For example, the 2012 and 2016 halvings were followed by substantial price increases, but other factors contributed to these rises, including increasing adoption and institutional investment.

Impact of the 2025 Halving on Shiba Inu’s Price

The 2025 Bitcoin halving’s impact on Shiba Inu’s price is indirect and uncertain. Shiba Inu, unlike Bitcoin, is not subject to a halving mechanism. However, a significant Bitcoin price increase could lead to a broader positive sentiment within the cryptocurrency market, potentially boosting the price of other cryptocurrencies, including Shiba Inu. This is due to a phenomenon known as “correlation,” where the price movements of different cryptocurrencies tend to influence one another, particularly during periods of high volatility. Conversely, a negative market reaction to the halving could negatively impact Shiba Inu. Predicting the exact effect is difficult and speculative.

Risks of Investing in Bitcoin and Shiba Inu Around the 2025 Halving

Investing in cryptocurrencies, particularly around major events like a Bitcoin halving, carries substantial risk. Bitcoin’s price is highly volatile and can experience significant swings in short periods. Shiba Inu, being a meme coin, is even more volatile than Bitcoin. Market manipulation, regulatory changes, and security breaches are additional risks to consider. The potential for substantial losses is very real. Furthermore, the timing of the halving’s impact on price is unpredictable. A price increase might not occur immediately after the halving, or the increase might be less dramatic than anticipated.

Strategies for Mitigating Risk

Diversification is a key risk mitigation strategy. Instead of investing all your funds in Bitcoin or Shiba Inu, spread your investments across multiple assets, including traditional investments like stocks and bonds. Dollar-cost averaging, a strategy involving investing a fixed amount of money at regular intervals regardless of price fluctuations, can help mitigate the risk of investing at a market peak. Thorough research and understanding of the underlying technology and market dynamics are also essential. Only invest what you can afford to lose, and avoid emotional decision-making.

Reliable Information Sources

Reliable information about the 2025 Bitcoin halving and its potential effects can be found from reputable sources such as established financial news outlets, cryptocurrency research firms, and the Bitcoin whitepaper itself. Be wary of sources promoting unrealistic gains or making unsubstantiated predictions. Cross-referencing information from multiple credible sources is crucial to forming a well-informed perspective. Consider seeking advice from a qualified financial advisor before making any investment decisions.

Bitcoin Halving 2025 Shiba Inu – The anticipated Bitcoin Halving in 2025 is a significant event that will likely impact various cryptocurrencies, including Shiba Inu. Its effects on the broader market are still debated, but understanding the mechanics of the halving itself is crucial. For a detailed explanation of this pivotal event, check out this informative resource on the 2025 Bitcoin Halving.

Ultimately, the 2025 Bitcoin Halving’s consequences on Shiba Inu’s price and market position remain to be seen, making it a compelling area for ongoing analysis.

The Bitcoin Halving in 2025 is a significant event anticipated to impact various cryptocurrencies, including Shiba Inu. Its effects on the broader market remain a topic of discussion, and understanding the timeline is crucial. For a detailed countdown to this pivotal moment, check out the comprehensive resource on the Halving Bitcoin 2025 Countdown website. Analyzing this countdown is key to predicting potential consequences for Shiba Inu and other altcoins post-halving.

The anticipated Bitcoin Halving in 2025 is a significant event that will likely impact various cryptocurrencies, including Shiba Inu. Predicting the exact consequences on Shiba Inu’s price is challenging, but understanding the precise timing of the halving is crucial for analysis. To find out the exact date and time, check this resource: Bitcoin Halving 2025 Date And Time.

Knowing this date will help better assess potential market reactions and their effect on Shiba Inu’s future trajectory.

The anticipated Bitcoin Halving in 2025 is generating considerable buzz, particularly regarding its potential impact on altcoins like Shiba Inu. Understanding the mechanics of this event is crucial; a key resource for this is the comprehensive analysis available at Bitcoin Halving April 2025. This deeper understanding of the Bitcoin Halving in April 2025 will help investors better predict its ripple effects on the Shiba Inu market and other cryptocurrencies.

The Bitcoin Halving in 2025 is a significant event anticipated to impact the cryptocurrency market, potentially affecting even altcoins like Shiba Inu. To understand its potential influence, it’s crucial to know the exact date; you can find that information by checking this resource on When Is The 2025 Bitcoin Halving. Therefore, keeping an eye on the halving’s timing is key for assessing the future trajectory of Bitcoin and its ripple effects on assets like Shiba Inu.

The Bitcoin Halving in 2025 is a significant event anticipated to impact the cryptocurrency market, potentially affecting even altcoins like Shiba Inu. To understand its potential influence, it’s crucial to know the exact date; you can find that information by checking this resource on When Is The 2025 Bitcoin Halving. Therefore, keeping an eye on the halving’s timing is key for assessing the future trajectory of Bitcoin and its ripple effects on assets like Shiba Inu.