Long-Term Implications and Future Outlook

The 2025 Bitcoin halving, reducing the block reward for miners by half, is a significant event with potentially profound long-term consequences for the Bitcoin ecosystem. Its impact will ripple through various aspects of the market, influencing price volatility, mining dynamics, and the overall adoption of Bitcoin as a store of value and a medium of exchange. Understanding these potential implications is crucial for navigating the future of this evolving digital asset.

The reduced block reward directly impacts the profitability of Bitcoin mining. This could lead to a consolidation of the mining industry, with smaller, less-efficient miners exiting the market and larger, more technologically advanced operations dominating. This could, in turn, potentially centralize the network’s hash rate, although the development of more energy-efficient mining hardware might mitigate this effect. Simultaneously, the scarcity of newly minted Bitcoin, a core tenet of its value proposition, will likely intensify.

Post-Halving Market Dynamics

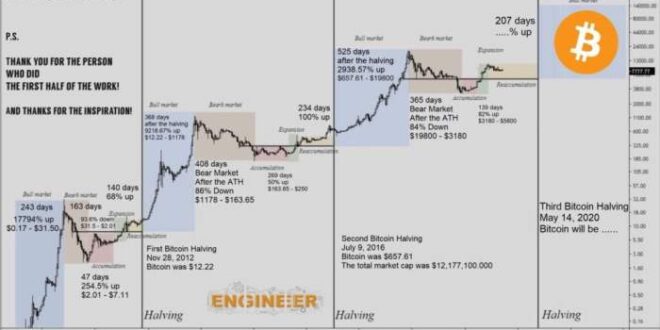

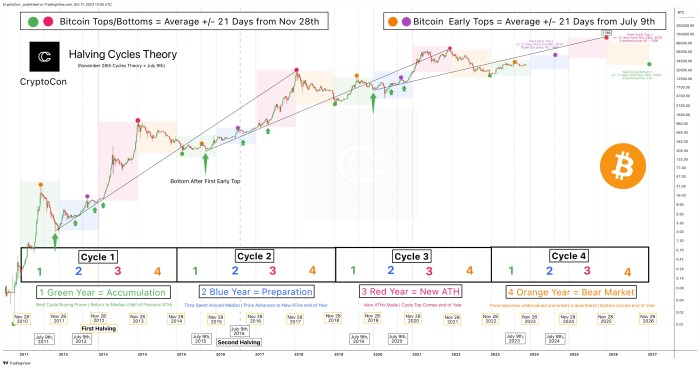

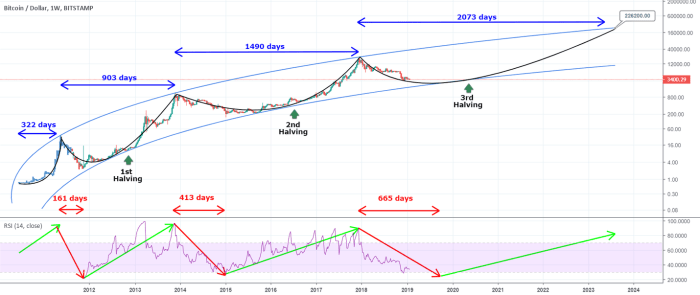

The period following the halving typically witnesses increased price volatility. Historically, Bitcoin’s price has shown a tendency to rise after halving events, driven by the decreased supply and increased demand. However, this is not guaranteed. Macroeconomic factors, regulatory changes, and overall market sentiment also play significant roles. For example, the 2012 and 2016 halvings were followed by periods of significant price appreciation, though the timing and magnitude varied considerably. The 2020 halving saw a similar trend, but also experienced periods of correction. Predicting the exact price trajectory after the 2025 halving is therefore impossible, though the historical precedent suggests a potential for upward pressure.

Timeline of Potential Milestones

The years following the 2025 halving could witness several key milestones. Within the first year (2026), we might see a period of heightened price volatility, potentially reaching new all-time highs or experiencing significant corrections, depending on various market forces. By 2027, we could observe a clearer trend, with either sustained price growth or a period of consolidation. The period from 2028-2030 could witness increased institutional adoption, further development of Bitcoin-related infrastructure (such as Lightning Network scaling solutions), and the emergence of new use cases for Bitcoin beyond its traditional role as a store of value. This timeline, however, is speculative and subject to change based on unforeseen circumstances.

Bitcoin’s Future Considering the 2025 Halving

The 2025 halving serves as a key event shaping Bitcoin’s long-term trajectory. While the immediate impact might be primarily on the mining industry and price volatility, the long-term implications extend to the broader adoption and integration of Bitcoin into the global financial system. The increasing scarcity of Bitcoin, coupled with growing awareness and acceptance of its decentralized and censorship-resistant nature, could contribute to its position as a significant asset class. However, challenges remain, including regulatory uncertainty, scalability issues, and the ongoing debate surrounding its energy consumption. Nevertheless, the halving event acts as a significant catalyst, emphasizing the inherent scarcity and strengthening the long-term value proposition of Bitcoin.

FAQ: Bitcoin Halving Cycle 2025

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, occurring approximately every four years. Understanding its mechanics and potential impact is crucial for anyone involved in or observing the Bitcoin ecosystem. This section addresses common questions surrounding the 2025 halving.

Bitcoin Halving Significance

The Bitcoin halving is a programmed reduction in the rate at which new Bitcoins are created. This occurs roughly every 210,000 blocks mined, reducing the reward paid to miners for successfully adding new transactions to the blockchain. This built-in deflationary mechanism is intended to control Bitcoin’s supply and potentially influence its long-term value. The significance lies in its impact on the scarcity of Bitcoin and its potential influence on price and network security.

Bitcoin Halving’s Price Effect

Historically, Bitcoin’s price has experienced periods of significant growth following previous halvings. This is often attributed to the reduced supply of new coins entering the market, potentially increasing demand relative to supply. However, it’s important to note that other factors, such as market sentiment, regulatory changes, and technological advancements, also significantly influence Bitcoin’s price. The 2025 halving’s price effect is uncertain, with predictions ranging from modest increases to substantial price surges. For example, the halving in 2012 was followed by a period of price consolidation, while the 2016 halving preceded a significant price rally. The 2020 halving also led to a substantial price increase, but this was followed by a period of market correction. Therefore, past performance is not indicative of future results.

2025 Halving Timing

The exact date of the 2025 halving is difficult to predict with absolute certainty due to variations in block mining times. However, based on the current average block time and the known block reward reduction trigger, it’s anticipated to occur sometime in the first half of 2025. More precise estimations will become available as the halving approaches and more data on block generation times becomes available. The halving will occur at block height 840,000.

Risks and Opportunities of the 2025 Halving, Bitcoin Halving Cycle 2025

The 2025 halving presents both risks and opportunities. A potential opportunity lies in the possibility of increased price appreciation driven by decreased supply. However, a risk is the potential for a market correction following any price surge, as seen historically. Another risk is the possibility that the halving’s impact on price might be less significant than in previous cycles, leading to disappointment among investors. Furthermore, macroeconomic factors and regulatory environments could significantly influence the overall market conditions, impacting the actual outcome regardless of the halving. Successful navigation of these uncertainties requires careful analysis and risk management.

Impact on Bitcoin Miners

The halving will significantly impact Bitcoin miners. The reduction in block rewards will reduce their revenue per block mined. This could lead to increased competition, forcing less efficient miners to shut down operations or adapt their strategies. Possible adaptations include increasing mining efficiency through upgrades to hardware or exploring alternative revenue streams, such as transaction fees. The halving could also lead to consolidation within the mining industry, with larger, more efficient operations gaining market share. The impact on miners will depend on several factors, including the price of Bitcoin, the cost of electricity, and the efficiency of their mining operations.

Illustrative Data Presentation (Example using HTML table structure)

Analyzing Bitcoin’s price behavior following each halving event provides valuable insights into potential future trends. While past performance is not indicative of future results, examining historical data allows us to identify patterns and assess the impact of reduced block rewards on market dynamics. The following table presents a simplified overview of past halvings, focusing on key dates and price movements. Note that these price movements are complex and influenced by numerous factors beyond just the halving.

Bitcoin Halving Cycle 2025 – The table below uses a responsive design, adapting to different screen sizes. It displays the date of each halving, the resulting block reward reduction, and the approximate Bitcoin price before and after the halving. It is important to remember that these are simplified representations and do not capture the nuances of market fluctuations during these periods.

Bitcoin Halving Events and Subsequent Price Movements

| Halving Date | Block Reward Reduction (BTC) | Approximate Price Before Halving (USD) | Approximate Price After Halving (USD) |

|---|---|---|---|

| November 28, 2012 | 50 BTC to 25 BTC | 13.40 | 77.80 |

| July 9, 2016 | 25 BTC to 12.5 BTC | 650 | 20000+ |

| May 11, 2020 | 12.5 BTC to 6.25 BTC | 8700 | 64000+ |

Visual Representation of Key Metrics

Understanding the relationship between Bitcoin halving events and subsequent price movements requires a clear visual representation. A well-designed chart can effectively communicate complex data, allowing for easier comprehension of historical trends and potential future implications. This section details a suitable visualization for this purpose.

A combined line and bar chart would be the most effective way to display the data.

Bitcoin Halving Cycle and Price Performance Chart

The chart will depict Bitcoin’s price performance alongside its halving events. The x-axis represents time, showing the dates of each halving event (2012, 2016, 2020, and the projected 2025 halving). The y-axis will represent Bitcoin’s price in USD, using a logarithmic scale to better visualize the significant price fluctuations. A line graph will track Bitcoin’s price over time, connecting data points representing the price at regular intervals (e.g., monthly averages). Vertical bars will be overlaid on the line graph, visually highlighting the exact dates of each halving event. Each bar’s height will correspond to the Bitcoin price at the time of the halving. Furthermore, shaded areas could be used to demarcate the periods between halvings, making the cycles visually distinct. The chart’s title should be “Bitcoin Price Performance and Halving Cycles,” and a clear legend should differentiate between the price line and the halving event bars. The use of a logarithmic scale on the y-axis is crucial to accurately represent the wide range of price variations over the years. For example, it allows for a more accurate visual comparison between the relatively small price increase after the first halving and the much larger price increase following subsequent halvings. Adding data points showing the all-time high and all-time low prices within each halving cycle would further enhance the chart’s informative value. The data used would be sourced from reputable cryptocurrency price tracking websites like CoinMarketCap or CoinGecko.