Bitcoin Halving 2025

The Bitcoin halving is a significant event in the cryptocurrency world, occurring approximately every four years. It’s a programmed reduction in the rate at which new Bitcoins are created, directly impacting the cryptocurrency’s supply and, historically, its price. Understanding this event is crucial for anyone invested in or interested in the future of Bitcoin.

Bitcoin Halving: A Supply Reduction Mechanism

The Bitcoin halving is a core component of Bitcoin’s design, intended to control inflation. Every 210,000 blocks mined, the reward given to miners for verifying transactions is cut in half. This halving mechanism ensures that the total supply of Bitcoin will never exceed 21 million coins. This controlled scarcity is a key factor driving Bitcoin’s value proposition. The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC.

Impact on Bitcoin’s Supply and Price

The halving directly impacts Bitcoin’s supply by reducing the rate of new Bitcoin entering circulation. This reduction in supply, coupled with relatively consistent demand, often leads to an increase in price. Historically, we’ve seen periods of price appreciation following previous halvings, though the timing and magnitude of these increases have varied. It’s important to note that while the halving is a significant factor, other market forces, such as regulatory changes, technological advancements, and overall economic conditions, also play a substantial role in determining Bitcoin’s price. The price increase isn’t guaranteed, but it’s a commonly observed trend.

Historical Trends Following Bitcoin Halvings

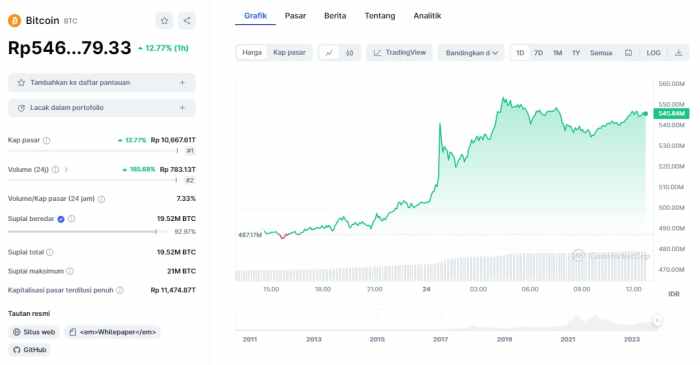

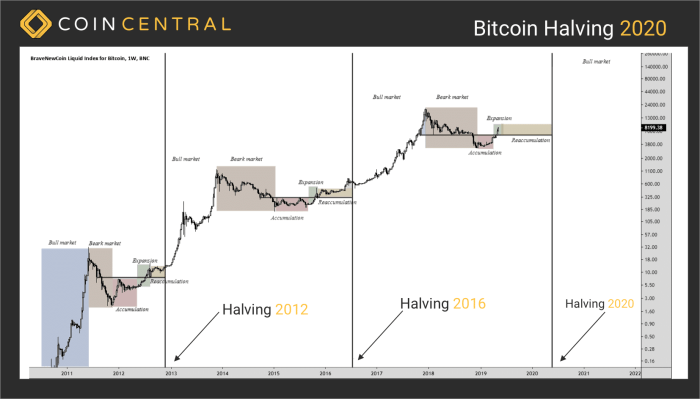

The first Bitcoin halving occurred in November 2012, reducing the block reward from 50 BTC to 25 BTC. The second halving took place in July 2016, reducing the reward from 25 BTC to 12.5 BTC. The third halving occurred in May 2020, reducing the reward from 12.5 BTC to 6.25 BTC. Following each halving, we observed a period of increased price volatility, often followed by a significant price increase. However, the time it took for these increases to materialize varied considerably. For example, the price surge after the 2012 halving was more gradual compared to the more rapid increase seen after the 2020 halving.

Comparison of Anticipated Effects of the 2025 Halving with Past Halvings, Bitcoin Halving Date 2025

Predicting the exact impact of the 2025 halving is impossible. However, by analyzing historical data and considering current market conditions, we can make some informed observations. The 2025 halving is likely to cause increased market volatility, similar to previous events. The extent of the price increase, if any, will depend on several factors, including overall market sentiment, macroeconomic conditions, and regulatory developments. Unlike previous halvings, the cryptocurrency market is significantly more mature in 2024, with increased institutional involvement and a broader range of cryptocurrencies available. This increased maturity may influence the market’s response to the halving, potentially leading to a less dramatic, or differently timed, price reaction compared to previous cycles. The anticipation of the halving itself may also lead to price movements in the months leading up to the event.

The 2025 Halving Date

The Bitcoin halving, a significant event in the cryptocurrency’s lifecycle, is anticipated to occur in 2025. However, pinpointing the precise date remains a subject of ongoing speculation and prediction, influenced by several dynamic factors within the Bitcoin network. This section delves into the various predictions and the elements contributing to their variance.

Factors Influencing Halving Date Predictions

The primary factors determining the Bitcoin halving date are the average block time and the network’s overall hash rate. The halving occurs approximately every four years, triggered when a specific number of blocks (210,000) have been mined since the previous halving. The time it takes to mine these blocks is variable, influenced by the computational power (hash rate) dedicated to mining. A higher hash rate leads to faster block generation, potentially accelerating the halving. Conversely, a lower hash rate extends the time to reach the required block count, delaying the halving. For instance, periods of increased miner profitability might lead to a higher hash rate and a slightly earlier halving, while periods of low Bitcoin price or increased energy costs could reduce the hash rate and delay it.

Timeline of Key Events Leading to the 2025 Halving

Predicting a precise timeline is challenging due to the inherent volatility of the Bitcoin network. However, we can Artikel key events and milestones that will shape the approach to the halving. The period leading up to the event will likely witness increased media attention and market speculation, influencing Bitcoin’s price and mining activity. We can expect to see analysts and commentators publishing their predictions based on various models and historical data, often focusing on the evolving hash rate and block times. The months directly preceding the halving will be characterized by intense observation of the approaching block count, with the final days providing a definitive countdown. The halving itself will be a significant news event, likely impacting Bitcoin’s price and market sentiment.

Potential Impact of Unforeseen Circumstances

Several unforeseen events could significantly impact the 2025 halving date. A major technological advancement in mining hardware could dramatically increase the network’s hash rate, potentially leading to a slightly earlier halving. Conversely, a significant regulatory crackdown on mining operations in major jurisdictions could decrease the hash rate, delaying the halving. Furthermore, a prolonged period of extremely low Bitcoin price could dissuade miners, leading to a lower hash rate and a delayed halving. Similarly, a large-scale attack or a major network security breach could disrupt the mining process and affect the block generation time, ultimately impacting the halving date. These are just some examples; unforeseen circumstances are, by their nature, unpredictable and could introduce significant variations to the predicted timeline.

Market Impact and Price Predictions

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, has historically shown a correlation with subsequent price increases. However, predicting the precise market impact of the 2025 halving remains challenging, as various factors beyond the halving itself influence Bitcoin’s price. This section will explore the potential market impact and examine diverse price predictions.

The halving’s effect on price stems from the basic economics of supply and demand. Reducing the supply of newly minted Bitcoin increases scarcity, potentially driving up demand and, consequently, the price. This effect is not immediate, however; it usually takes several months, even years, for the full impact to manifest.

Historical Price Movements Following Halvings

Analyzing the previous halving events provides valuable insights. The 2012 halving was followed by a period of relative price stability before a significant bull run began in late 2013. The 2016 halving saw a more gradual price increase leading up to the 2017 bull market. The 2020 halving, however, exhibited a different pattern, with a significant price increase preceding the event, followed by a period of consolidation before a subsequent price surge. These varying responses highlight the complexity of predicting the outcome of the 2025 halving. The preceding market conditions, regulatory changes, and overall macroeconomic environment all play crucial roles.

Market Predictions and Analyses from Financial Experts

Numerous financial analysts and institutions offer diverse predictions for Bitcoin’s price after the 2025 halving. Some predict a substantial price increase, potentially reaching six-figure values, based on historical precedent and the anticipated increase in scarcity. Others offer more conservative estimations, citing factors like macroeconomic uncertainty and potential regulatory hurdles. For example, some analysts point to the potential impact of global inflation and interest rate hikes, suggesting these factors could dampen the impact of the halving. Conversely, proponents of a significant price increase highlight the growing institutional adoption of Bitcoin as a store of value and the increasing scarcity of the asset. The range of predictions underscores the inherent uncertainty in forecasting future market movements.

Potential Price Scenarios After the 2025 Halving

Considering both bullish and bearish scenarios, several potential outcomes exist. A bullish scenario envisions a significant price increase following the halving, driven by increased demand and scarcity. This could lead to a new all-time high, potentially exceeding previous peaks, mirroring the patterns observed after previous halvings, albeit potentially with a time lag. A more conservative bullish scenario suggests a gradual, sustained price increase over an extended period, reflecting a more measured market response.

A bearish scenario, however, considers the possibility of a less pronounced price reaction, or even a temporary price decline. This could be due to various factors, including macroeconomic headwinds, regulatory uncertainty, or a general market correction. This scenario doesn’t necessarily negate the long-term positive effects of the halving, but suggests a more prolonged and less dramatic price response. The price might consolidate or even dip temporarily before resuming an upward trend. The 2020 halving, with its preceding price surge and subsequent consolidation, offers a potential example of a less immediate, but ultimately positive, outcome. It’s crucial to remember that these are just potential scenarios, and the actual outcome will depend on a confluence of factors.

Mining and Miner Behavior

The Bitcoin halving, a scheduled event that reduces the block reward miners receive for verifying transactions, significantly impacts their profitability and, consequently, their behavior. Understanding these impacts is crucial for predicting the network’s future security and decentralization. The 2025 halving, in particular, will be a critical test of the Bitcoin network’s resilience.

The halving directly cuts the revenue stream for Bitcoin miners in half. This reduction forces miners to reassess their operational costs and profitability. Those operating with high electricity costs or inefficient mining equipment may find themselves unable to maintain operations profitably. This could lead to miners shutting down their operations, reducing the overall hash rate of the network. Conversely, miners with lower operational costs or more efficient equipment may see an opportunity to gain market share by outcompeting less efficient miners.

Miner Profitability and Operational Adjustments

The profitability of Bitcoin mining is determined by the interplay of several factors: the block reward, the price of Bitcoin, the cost of electricity, and the efficiency of the mining hardware. The halving directly impacts the block reward, reducing miner revenue. To maintain profitability, miners must adapt. This could involve upgrading to more energy-efficient hardware (ASICs), negotiating lower electricity rates, or diversifying revenue streams by engaging in activities like providing mining pool services. For example, a miner previously making a profit with older ASICs and high electricity costs might be forced to upgrade their equipment or relocate to a region with cheaper energy. Conversely, a miner already using cutting-edge equipment and enjoying low electricity costs might find their profitability slightly impacted but still remain operational.

Consequences of Miners Leaving or Entering the Network

Miners leaving the network after a halving reduces the overall network hash rate, which is a measure of the computational power securing the blockchain. A lower hash rate makes the network more vulnerable to 51% attacks, where a malicious actor could control a majority of the network’s hash power and potentially manipulate the blockchain. Conversely, new miners entering the network, attracted by potentially higher Bitcoin prices or the elimination of less-efficient competitors, could increase the hash rate and enhance network security. The net effect of miners leaving and entering the network following the halving will significantly determine the network’s overall security posture. Historically, past halvings have seen periods of adjustment before the network hash rate stabilizes at a new equilibrium.

Miner Strategies for Adapting to Reduced Block Rewards

Miners employ various strategies to navigate the reduced block rewards. These strategies range from optimizing their operational efficiency to diversifying their revenue sources. Optimizing efficiency involves upgrading to newer, more powerful, and energy-efficient ASICs, negotiating better electricity rates with providers, or relocating their mining operations to regions with lower energy costs. Diversification includes offering services such as mining pool hosting, providing cloud mining services, or investing in other cryptocurrencies with potentially higher returns. Some miners may also choose to consolidate their operations by merging with other mining entities to achieve economies of scale and reduce operational costs.

Impact on Network Security and Decentralization

The halving’s impact on network security and decentralization is a complex issue. While a reduction in the number of miners could theoretically decrease decentralization and increase vulnerability to attacks, it could also lead to a more efficient and resilient network with only the most technologically advanced and economically viable miners remaining. This could result in a more consolidated, yet potentially more secure network. The long-term effects will depend on the balance between miners leaving and entering the network, the overall market price of Bitcoin, and technological advancements in mining hardware. The extent to which the network maintains a distributed hash rate will be a key indicator of its continued decentralization and security.

Long-Term Implications for Bitcoin

The 2025 Bitcoin halving, reducing the block reward for miners by half, will have profound and long-lasting effects on the Bitcoin ecosystem. Its impact extends beyond the immediate price fluctuations, influencing adoption rates, the network’s security, and Bitcoin’s overall value proposition as a store of value and decentralized digital currency. Understanding these long-term implications is crucial for anyone invested in or observing the cryptocurrency landscape.

The halving’s effect on Bitcoin’s journey towards becoming a prominent store of value is significant. By reducing the supply of newly minted Bitcoin, the halving contributes to a deflationary pressure, a key characteristic often associated with assets considered stores of value, like gold. This scarcity, coupled with increasing adoption and institutional interest, could further solidify Bitcoin’s position in investment portfolios as a hedge against inflation and economic uncertainty. The historical precedent of previous halvings showing price increases supports this expectation, though it’s important to remember past performance is not indicative of future results.

Bitcoin’s Adoption and Value Proposition

The 2025 halving could accelerate Bitcoin’s adoption in several ways. A potential price increase following the halving might attract new investors, leading to increased network activity and transaction volume. Furthermore, the decreased inflation rate could make Bitcoin more appealing as a medium of exchange, particularly in regions with volatile or unstable fiat currencies. The increased security and stability of the Bitcoin network, resulting from the reduced incentive for 51% attacks due to increased miner profitability, also enhances its long-term value proposition. For example, El Salvador’s adoption of Bitcoin as legal tender, despite initial challenges, demonstrates the potential for widespread adoption, even in the face of significant hurdles.

Bitcoin as a Store of Value

The halving plays a crucial role in reinforcing Bitcoin’s position as a store of value. The reduced inflation rate mimics the characteristics of traditional stores of value like gold, which are characterized by limited supply and increasing demand. This scarcity creates an inherent value proposition, making Bitcoin a potentially attractive asset for long-term investment. This is further supported by the increasing institutional investment in Bitcoin, signifying growing confidence in its long-term value and potential as a safe haven asset. The 2025 halving could act as a catalyst for further institutional adoption, particularly as investors seek alternative assets in an uncertain economic climate.

Potential Future Developments Influenced by the Halving

The 2025 halving could trigger several significant developments within the Bitcoin ecosystem. We might see an increase in the development and adoption of the Lightning Network, a layer-two scaling solution aimed at improving transaction speed and reducing fees. This is because, while miners’ block rewards decrease, transaction fees become a more significant revenue source, incentivizing the use of more efficient transaction methods. Furthermore, we might see increased innovation in mining hardware and techniques to maintain profitability in the face of reduced block rewards. This could lead to a more energy-efficient and sustainable Bitcoin mining industry. Finally, the halving could stimulate the development of new financial instruments and services built on the Bitcoin blockchain, further expanding the utility and reach of the cryptocurrency.

Projected Impact of the 2025 Halving

| Aspect | Projected Impact (Short-Term) | Projected Impact (Mid-Term) | Projected Impact (Long-Term) |

|---|---|---|---|

| Price | Potential increase due to reduced supply | Price stabilization, potentially followed by further growth | Long-term appreciation driven by scarcity and adoption |

| Mining | Increased difficulty, potential for consolidation | Adaptation to lower block rewards, increased focus on transaction fees | Shift towards more energy-efficient mining practices |

| Adoption | Increased investor interest, potential for new use cases | Growing mainstream acceptance, broader integration into financial systems | Widespread adoption as a store of value and medium of exchange |

| Network Security | Enhanced security due to higher miner profitability (initially) | Sustained security through a combination of block rewards and transaction fees | Increased resilience against attacks due to a more mature and robust network |

Risks and Uncertainties

The 2025 Bitcoin halving, while anticipated to be a bullish event, is not without significant risks and uncertainties. The interplay of various economic, technological, and regulatory factors could dramatically alter the predicted market response and long-term implications for Bitcoin. Unforeseen events, both positive and negative, possess the potential to significantly impact the outcome, making accurate predictions challenging.

The reduced block reward following the halving will directly affect miners’ profitability. This creates a complex environment where several key risks come into play.

Miner Adaptability and Response

Miners face a critical challenge in adapting to the reduced block reward. The profitability of Bitcoin mining is directly tied to the block reward and the price of Bitcoin. A lower block reward necessitates either a significant increase in the Bitcoin price to maintain profitability or a reduction in mining costs through improved efficiency or the adoption of cheaper energy sources. Failure to adapt could lead to miners shutting down operations, potentially impacting the network’s hash rate and security. This scenario has been observed in previous halvings, where some less-efficient miners were forced to exit the market. The extent of this effect in 2025 will depend heavily on the Bitcoin price and the cost of energy at the time. A prolonged period of low Bitcoin price could lead to a significant decrease in the hash rate, making the network vulnerable to attacks.

Regulatory Uncertainty and Impact

Regulatory landscapes surrounding cryptocurrencies are constantly evolving. Changes in regulations, whether positive or negative, can significantly impact the price of Bitcoin and the overall market sentiment. For instance, stricter regulations in major jurisdictions could suppress demand, negating the positive effects of the halving. Conversely, more favorable regulations could boost investor confidence and amplify the halving’s impact. The ongoing regulatory uncertainty surrounding Bitcoin globally makes predicting the halving’s outcome more challenging. The implementation of new KYC/AML (Know Your Customer/Anti-Money Laundering) regulations or outright bans in key markets could significantly dampen the anticipated price surge.

Unforeseen Events and Black Swan Scenarios

The cryptocurrency market is known for its volatility and susceptibility to unforeseen events. A major global economic downturn, a significant security breach affecting the Bitcoin network, or even a sudden shift in public sentiment could significantly alter the expected outcome of the 2025 halving. For example, a major financial crisis could cause investors to flee risk assets, including Bitcoin, regardless of the halving. Conversely, a major technological breakthrough in Bitcoin mining could drastically alter the cost structure and potentially mitigate the impact of the reduced block reward. These unpredictable events, often termed “black swan” events, highlight the inherent uncertainty associated with predicting the market’s reaction to the halving. The 2020 halving, for example, coincided with the initial phases of the COVID-19 pandemic, highlighting how unexpected global events can significantly impact market dynamics.

FAQ: Bitcoin Halving Date 2025

This section addresses frequently asked questions regarding the Bitcoin halving, providing clarity on this significant event in the Bitcoin ecosystem. Understanding the halving’s mechanics and potential impacts is crucial for anyone invested in or following the cryptocurrency market.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, halving the reward given to Bitcoin miners for successfully verifying and adding transactions to the blockchain. Essentially, it’s a built-in deflationary mechanism designed to control the supply of Bitcoin. Before the first halving, miners received 50 BTC per block. After the first halving, this reduced to 25 BTC, then to 12.5 BTC, and the next halving in 2024 will reduce it to 6.25 BTC.

The Next Bitcoin Halving’s Expected Date

The next Bitcoin halving is anticipated to occur around April 2024. The exact date depends on the time it takes for miners to solve complex cryptographic puzzles and add new blocks to the blockchain. This process fluctuates based on the computing power dedicated to mining, which itself is subject to market conditions and technological advancements. While a precise date cannot be given far in advance, the four-year cycle provides a reliable estimate.

The Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin’s price has tended to increase following a halving. This is largely attributed to the reduced supply of newly minted Bitcoin. The decrease in supply, coupled with generally increasing demand, can create upward pressure on price. However, it’s crucial to note that this is not a guaranteed outcome. Other market factors, such as regulatory changes, macroeconomic conditions, and overall investor sentiment, significantly influence Bitcoin’s price. For example, the 2012 halving was followed by a period of price consolidation, while the 2016 halving preceded a substantial price surge. The 2020 halving saw a significant price increase, followed by a period of volatility. Therefore, while historical trends suggest a potential positive impact, it’s impossible to predict the precise effect with certainty.

Risks Associated with the Halving

While a halving often leads to price increases, it’s important to acknowledge potential downsides. Reduced miner rewards can lead to less profitable mining operations, potentially causing some miners to shut down. This could temporarily reduce the security of the Bitcoin network, although the long-term effects are debatable. Furthermore, the anticipation of a halving can lead to inflated price speculation, creating a bubble that could burst after the event. The market could also experience significant volatility in the period leading up to and following the halving, creating risk for investors. Finally, unexpected external factors unrelated to the halving itself could easily outweigh its impact on the price.

The Bitcoin Halving Date 2025 is a significant event for cryptocurrency investors. Planning your marketing strategy around this event is crucial, and a well-managed Google Ads Account can help you reach a wider audience interested in Bitcoin. Effective advertising leading up to the halving could significantly boost your reach and capitalize on the increased interest surrounding the Bitcoin Halving Date 2025.