Bitcoin Halving 2025

The Bitcoin halving, a programmed event reducing the rate at which new Bitcoins are mined, is scheduled for 2025. This event has historically shown a significant correlation with price increases, although the extent of the impact varies. Understanding the historical context, influencing economic factors, and anticipated market reactions is crucial for navigating this significant event in the cryptocurrency landscape.

Historical Impact of Previous Halvings

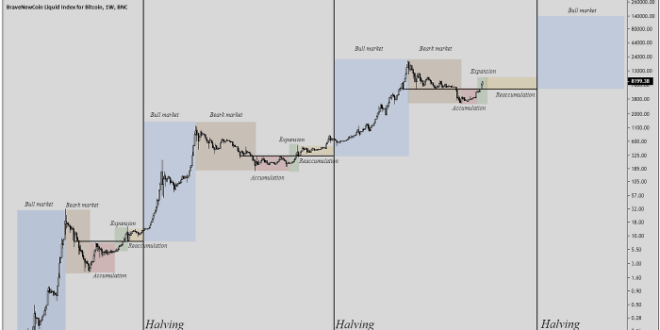

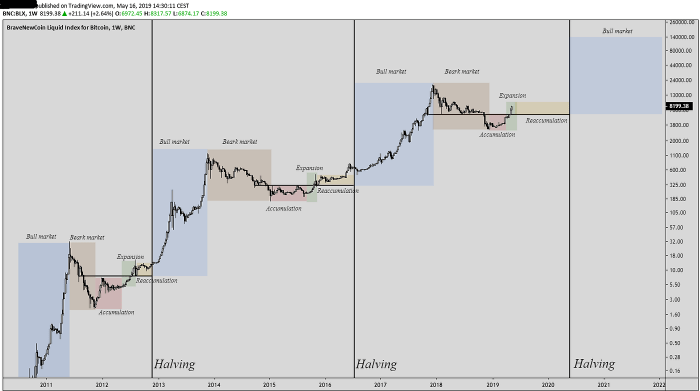

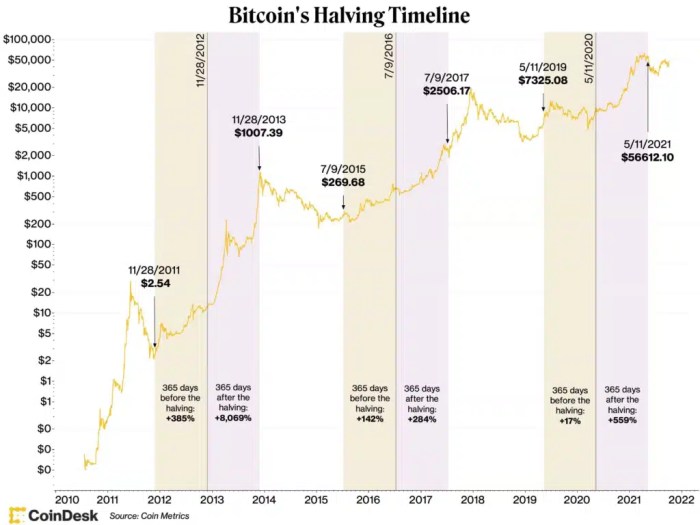

Previous Bitcoin halvings have demonstrably influenced both price and market sentiment. The 2012 halving saw a gradual price increase in the following months. The 2016 halving was followed by a substantial price surge, culminating in the 2017 bull market. The 2020 halving also preceded a significant price appreciation, although the subsequent market behavior was more complex due to external factors. While a direct causal link isn’t definitively proven, the halving consistently coincides with periods of increased investor interest and price volatility. This is largely attributed to the reduction in Bitcoin’s inflation rate, creating a scarcity effect that can drive demand.

Economic Factors Influencing the 2025 Halving

Several economic factors could significantly impact the 2025 halving’s effect. Global macroeconomic conditions, including inflation rates and interest rate policies by central banks, will play a considerable role. Regulatory changes affecting cryptocurrencies in major markets will also influence investor confidence and market liquidity. The overall adoption rate of Bitcoin as a store of value, a medium of exchange, or a speculative asset will be crucial. For instance, increasing institutional adoption could mitigate the impact of potential sell-offs from miners adjusting to the reduced block reward. Conversely, a global recession could dampen investor enthusiasm regardless of the halving.

Comparison of Anticipated Market Reactions

While past halvings provide a useful benchmark, predicting the 2025 reaction with certainty is impossible. The market has matured significantly since the earlier halvings, with increased institutional participation and a more sophisticated understanding of Bitcoin’s fundamentals. While the scarcity effect driven by the reduced supply remains a key factor, the market’s reaction will likely be more nuanced and influenced by the broader economic climate. Unlike previous halvings, where the market was less mature, 2025 will see a more informed and potentially more cautious response from investors. The anticipation leading up to the halving could itself trigger price movements, as speculation plays a significant role in cryptocurrency markets.

Technical Aspects and Implications for Bitcoin’s Supply

The Bitcoin halving is a hard-coded event within the Bitcoin protocol. It reduces the block reward, the amount of Bitcoin awarded to miners for successfully validating transactions, by half. Currently, the block reward is 6.25 BTC; after the 2025 halving, it will decrease to 3.125 BTC. This directly impacts the rate of new Bitcoin entering circulation. The halving mechanism is designed to control Bitcoin’s inflation, ensuring a predictable and controlled supply increase over time. This controlled supply, coupled with increasing demand, is a core argument for Bitcoin’s long-term value proposition. The halving doesn’t instantaneously change the existing supply; it only affects the rate of future Bitcoin creation.

The Timing of the 2025 Bitcoin Halving: Bitcoin Halving Date 2025 Time

The Bitcoin halving, a significant event in the cryptocurrency’s lifecycle, is anticipated to occur in 2025. Predicting the precise date and time requires understanding the underlying mechanics of Bitcoin’s blockchain and its inherent variability. While we can provide a close estimate, absolute certainty is impossible due to the decentralized and unpredictable nature of the network.

The 2025 Bitcoin halving is determined by the rate at which new blocks are added to the blockchain. Bitcoin’s protocol is designed to add a new block approximately every 10 minutes. Once 210,000 blocks have been mined after the previous halving, the reward for miners creating those blocks is cut in half. This predictable yet slightly variable process, governed by the difficulty adjustment algorithm, makes pinpointing the exact date challenging.

Precise Date and Time Estimate

Based on current block generation times and extrapolating from past halvings, a reasonable estimate for the 2025 Bitcoin halving places it around April 2025. However, this is just an approximation. Slight variations in block times, potentially influenced by factors like network congestion or miner participation, can shift the date by a few days or even a week. Reliable sources for tracking block generation and halving estimations include blockchain explorers like Blockchain.com or Blockstream.info. These platforms provide real-time data on block creation, allowing for ongoing estimations. It’s crucial to understand that these are estimations and not definitive predictions.

Factors Determining Halving Timing

The primary factor determining the halving’s precise timing is the average block generation time. While the target is 10 minutes, the actual time fluctuates. This variation is influenced by several factors, including the total computational power (hashrate) dedicated to mining Bitcoin. A higher hashrate leads to faster block creation, potentially accelerating the halving. Conversely, a lower hashrate could delay it. The Bitcoin network’s difficulty adjustment mechanism, designed to maintain the approximate 10-minute block time, plays a critical role. This algorithm dynamically adjusts the computational difficulty required to mine a block, compensating for fluctuations in the network’s hashrate.

Impact on Miners and Network Security

The halving directly impacts Bitcoin miners by reducing their block reward. This reduction, while predictable, can significantly affect their profitability. With half the reward, miners must either increase efficiency or accept reduced revenue. This can lead to a consolidation of mining operations, as less profitable miners might exit the network. However, the halving is often seen as a positive event for long-term network security. A reduced reward incentivizes miners to prioritize network security over short-term profits, as they rely on transaction fees to supplement their income. This ultimately enhances the resilience and robustness of the Bitcoin network.

Consequences of Delays or Unexpected Events

While highly unlikely, significant delays or unexpected events impacting the halving schedule could have unforeseen consequences. A prolonged delay could create uncertainty in the market, potentially leading to price volatility. Conversely, an unexpectedly early halving could trigger a similar market reaction. Such events would highlight the interconnectedness of the halving event with market sentiment and investor confidence. These potential disruptions underscore the importance of closely monitoring the network’s activity and the block generation rate leading up to the anticipated halving.

Market Predictions and Speculation Surrounding the 2025 Halving

The 2025 Bitcoin halving is a significant event anticipated to impact Bitcoin’s price, generating considerable market speculation. Experts offer diverse opinions, influenced by various macroeconomic factors and technical analyses. Understanding these predictions and their underlying assumptions is crucial for navigating the potential volatility surrounding this event.

Diverse Expert Opinions on Bitcoin Price Movements

The cryptocurrency market is known for its volatility, and predicting Bitcoin’s price after the halving remains a challenging task. However, several prominent figures in the space have offered their perspectives. Some analysts, employing models based on historical halving cycles, suggest a substantial price increase following the event, citing the reduced supply as a key driver. Others, more cautious, point to macroeconomic uncertainties like inflation and regulatory pressures as potential countervailing forces, suggesting a more moderate price response or even a period of consolidation. For example, some analysts predict a price surge towards $100,000 or more, while others remain more conservative, projecting a price range between $50,000 and $80,000. The disparity highlights the inherent uncertainty within the market.

Potential Catalysts Influencing Bitcoin Price

Several factors beyond the halving itself could significantly influence Bitcoin’s price trajectory. Before the halving, anticipation and accumulating buying pressure could drive prices upward. During the halving, the event itself may trigger a short-term price spike due to heightened media attention and increased trading activity. After the halving, the reduced supply, coupled with sustained demand, could lead to a gradual price increase. Conversely, negative news regarding regulations, market sentiment shifts, or broader macroeconomic downturns could counteract these positive effects. For example, a major regulatory crackdown could dampen investor enthusiasm, while positive developments in the adoption of Bitcoin by institutional investors could boost the price.

Comparative Analysis of Market Prediction Models

Various prediction models exist, each employing different methodologies. Some rely on historical price data and statistical analysis, attempting to identify patterns and extrapolate them into the future. Others incorporate macroeconomic indicators, such as inflation rates and interest rates, to assess their impact on Bitcoin’s value. Stock-to-flow models, for instance, focus on the relationship between Bitcoin’s supply and demand, often projecting significant price increases after halvings. However, these models are not without limitations, as they often fail to account for unforeseen events or changes in market sentiment. A comparative analysis reveals significant differences in price projections, emphasizing the inherent uncertainties in predicting future market behavior. One model might predict a price of $150,000, while another, based on different assumptions, might predict only $60,000.

Price Prediction Scenarios and Underlying Assumptions, Bitcoin Halving Date 2025 Time

Several price scenarios are possible, each based on different assumptions about the interplay of various factors. A bullish scenario assumes sustained high demand, positive regulatory developments, and increased institutional adoption, leading to a significant price increase after the halving. A neutral scenario assumes a balance between positive and negative factors, resulting in moderate price appreciation or sideways movement. A bearish scenario incorporates negative macroeconomic conditions, regulatory uncertainty, or a significant loss of investor confidence, potentially leading to a price decline. These scenarios illustrate the wide range of potential outcomes, highlighting the need for caution and diversified investment strategies. For example, a bullish scenario might assume continued institutional investment and global adoption, while a bearish scenario might assume a significant regulatory crackdown and a global economic recession.

Impact on Bitcoin Miners and Mining Operations

The Bitcoin halving, a pre-programmed event reducing the block reward paid to miners, significantly impacts the profitability and operational strategies of the Bitcoin mining industry. This event, occurring approximately every four years, necessitates adaptation and often leads to industry consolidation. The 2025 halving will be no different, forcing miners to re-evaluate their operations and potentially leading to significant changes in the landscape.

The halving directly cuts the Bitcoin reward miners receive for successfully adding blocks to the blockchain. This reduction in revenue necessitates miners to adjust their operations to remain profitable. The profitability of mining is directly tied to the price of Bitcoin, the cost of electricity, and the efficiency of the mining hardware. A lower block reward, coupled with fluctuating Bitcoin prices and rising energy costs, can severely impact the bottom line for many mining operations.

Miner Profitability Before and After the Halving

Before the halving, miners enjoy a higher block reward, making mining more profitable, even with relatively high electricity costs or less efficient hardware. Profitability is calculated by comparing the revenue generated from block rewards (and transaction fees) against the operational costs, including electricity, hardware maintenance, and labor. For example, a miner operating with high-efficiency ASICs and access to cheap electricity might have been highly profitable before the halving. However, post-halving, the same operation might become marginally profitable or even unprofitable, depending on the Bitcoin price and the increase in electricity costs. The profitability equation shifts significantly, requiring miners to find ways to improve efficiency or reduce operational costs to maintain a positive margin.

Adaptation Strategies for Bitcoin Miners

Miners will employ several strategies to counter the reduced block reward. This includes upgrading to more efficient mining hardware to reduce energy consumption per unit of hash rate, negotiating lower electricity rates with providers, diversifying revenue streams by offering services such as hosting or participating in other crypto projects, and focusing on operational efficiency by streamlining processes and reducing overhead. Some miners might choose to consolidate operations or shut down entirely if they cannot adapt to the new economic reality.

Industry Consolidation in Bitcoin Mining

The halving often accelerates consolidation within the Bitcoin mining industry. Less efficient or less financially resilient miners may be forced to sell their equipment or cease operations altogether, leading to a smaller number of larger, more efficient mining operations. This consolidation can lead to increased market dominance by the surviving miners, potentially impacting the decentralization of Bitcoin’s network. We can draw parallels to previous halvings where a similar pattern emerged, with smaller players exiting the market and larger, well-capitalized companies gaining market share. This trend is likely to continue in the 2025 halving, shaping the future landscape of Bitcoin mining.

Long-Term Implications of the 2025 Halving for Bitcoin

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, will have profound and long-lasting effects on the cryptocurrency’s trajectory. Its impact extends beyond immediate market fluctuations, shaping Bitcoin’s fundamental value proposition and its position within the broader cryptocurrency landscape for years to come. Understanding these long-term implications is crucial for anyone invested in or observing the digital asset space.

The halving’s primary long-term effect is an increase in Bitcoin’s scarcity. This is a direct consequence of the reduced supply entering the market. As demand remains relatively consistent or increases, the limited supply pushes upward pressure on price, reinforcing Bitcoin’s value proposition as a scarce digital asset, akin to gold. This mechanism contributes significantly to Bitcoin’s narrative as a store of value.

Bitcoin’s Deflationary Nature and the Halving

The halving directly contributes to Bitcoin’s deflationary properties. While not strictly deflationary in the traditional sense (due to potential increases in demand), the halving significantly slows the rate of inflation. This contrasts sharply with fiat currencies, which often experience inflationary pressures due to government policies. The decreasing supply, coupled with potential increasing demand, creates a scenario where each Bitcoin becomes more valuable over time, strengthening its appeal as a hedge against inflation. This is exemplified by historical halving events, where Bitcoin’s price has shown a tendency to increase in the periods following the halving, although this is not guaranteed to repeat. The 2012 and 2016 halvings serve as examples of past instances where the halving influenced price appreciation in the following months and years.

Bitcoin’s Long-Term Prospects Compared to Other Cryptocurrencies

The 2025 halving could further solidify Bitcoin’s dominance within the cryptocurrency market. While other cryptocurrencies offer various functionalities and innovations, Bitcoin’s established network effect, first-mover advantage, and proven track record provide a significant competitive edge. The halving strengthens Bitcoin’s narrative as a reliable and secure store of value, potentially attracting investors seeking long-term stability and reducing their interest in higher-risk, more volatile altcoins. This contrasts with the potentially higher risk and volatility associated with many altcoins, which may experience price fluctuations regardless of Bitcoin’s halving. The long-term success of altcoins depends on their unique value propositions and ability to attract and retain users, which are separate from Bitcoin’s success.

Potential Shift in Bitcoin’s Market Dominance

A scenario where Bitcoin’s market dominance changes after the halving is possible, though not necessarily probable. This could occur if a competing cryptocurrency successfully addresses limitations within the Bitcoin network (such as scalability or transaction fees) or develops a compelling alternative narrative that captures significant market share. However, such a shift would require a cryptocurrency to not only offer superior functionality but also to overcome the substantial network effects and brand recognition that Bitcoin has built over the years. For example, if a new cryptocurrency emerged with significantly improved transaction speeds and lower fees while maintaining a high level of security, it could potentially attract investors and developers away from Bitcoin. This scenario remains hypothetical, however, as no existing cryptocurrency currently possesses all the necessary attributes to meaningfully challenge Bitcoin’s dominance. The established trust and network effect surrounding Bitcoin represent significant barriers to entry for any competitor.

Predicting the precise Bitcoin Halving Date 2025 Time remains a complex task, dependent on block generation times. However, understanding the mechanics behind this significant event is crucial for investors. For a detailed breakdown of projected timelines and their implications, you can consult this informative resource on Bitcoin Halving 2025 Time. Ultimately, pinpointing the exact Bitcoin Halving Date 2025 Time requires ongoing monitoring of the blockchain.

Pinpointing the exact Bitcoin Halving Date 2025 Time requires careful consideration of the blockchain’s block generation times. The anticipated halving event centers around April 2025, and for more detailed information on this specific timeframe, you can consult this helpful resource: Bitcoin April 2025 Halving. Understanding this date is crucial for predicting future Bitcoin price fluctuations and overall market trends related to the Bitcoin Halving Date 2025 Time.

Pinpointing the Bitcoin Halving Date 2025 Time requires understanding the halving cycle. To find out precisely when the next halving will occur, you should consult a reliable resource like this one: When Is The Next Bitcoin Halving 2025. This will help you accurately predict the Bitcoin Halving Date 2025 Time and its potential market impact.

Pinpointing the exact Bitcoin Halving Date 2025 Time is crucial for market analysis. Understanding the potential impact on price is equally important, which is why researching the expected price fluctuations is vital. For insightful predictions on this, check out this resource on Halving Bitcoin 2025 Precio to better understand how the halving date might affect the market.

Ultimately, knowing the halving date helps us anticipate market trends.

Pinpointing the exact Bitcoin Halving Date 2025 Time is crucial for investors. Understanding the impact of this event requires analyzing various market factors, and for insightful predictions, you might find the information at Bitcoin Prediction Halving 2025 helpful. Ultimately, knowing the halving date allows for better preparation regarding potential price fluctuations in the Bitcoin Halving Date 2025 Time frame.

Pinpointing the exact Bitcoin Halving Date 2025 Time requires careful consideration of the blockchain’s block generation times. To understand the specifics of the past halving, you might find this resource helpful: When Was The Bitcoin Halving In 2025. This information provides valuable context for predicting future Bitcoin Halving Date 2025 Time estimations, allowing for more informed speculation.