Bitcoin Halving: Bitcoin Halving Date April 2025

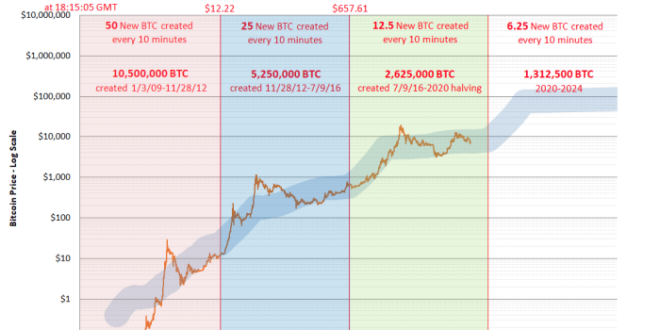

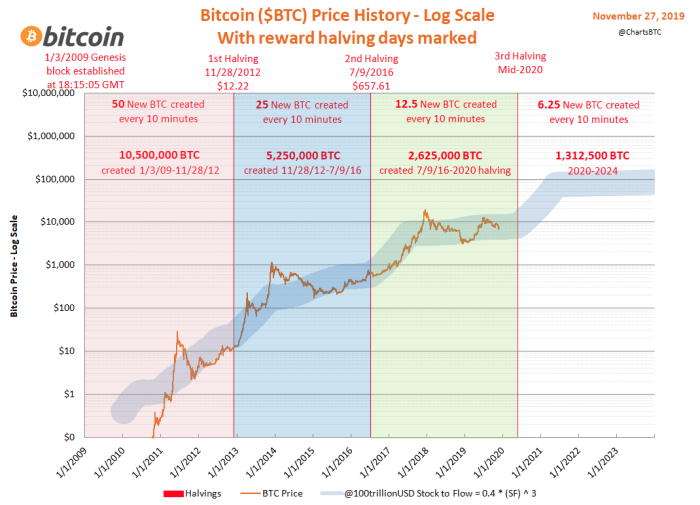

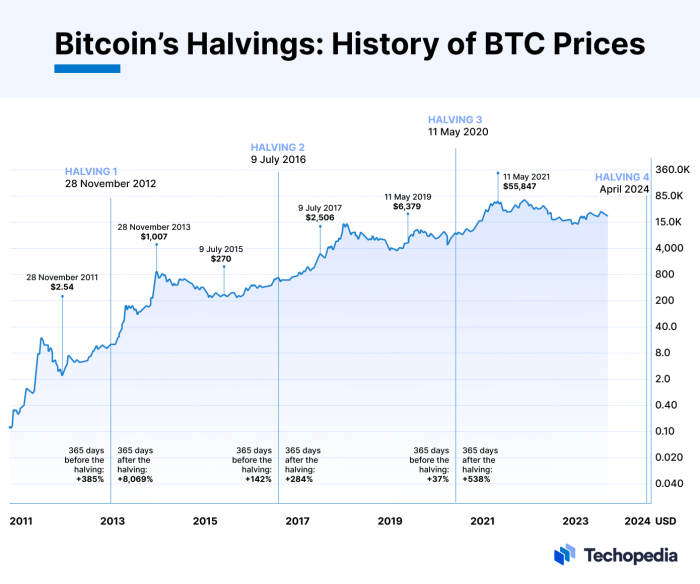

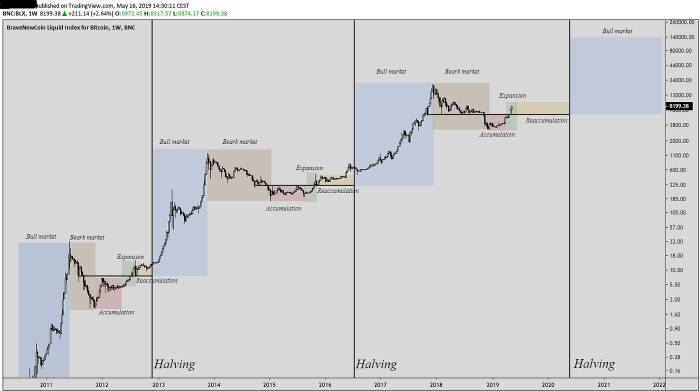

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. The halving cuts the block reward paid to miners in half, thereby reducing the inflation rate of Bitcoin. Historically, these events have been followed by periods of significant price volatility, often leading to substantial price increases in the long term.

The April 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This reduction in newly minted Bitcoin will directly impact the supply and demand dynamics of the cryptocurrency.

Bitcoin Supply and Demand After the Halving

The halving significantly impacts Bitcoin’s supply. By reducing the rate of new Bitcoin entering circulation, the halving theoretically increases scarcity, a key factor influencing asset value. This reduced supply, coupled with sustained or increased demand, could potentially drive up the price of Bitcoin. The effect is not immediate, however; historical data shows a period of price adjustment before a sustained upward trend typically materializes. For example, following the 2016 halving, Bitcoin’s price remained relatively stagnant for several months before experiencing a substantial surge. Similarly, after the 2020 halving, the price experienced a period of consolidation before eventually reaching record highs. It’s important to note that numerous other factors influence Bitcoin’s price, making it impossible to predict the exact outcome.

Consequences for Bitcoin Miners

The halving directly affects Bitcoin miners’ profitability. With a reduced block reward, miners’ revenue decreases. This could lead to several potential consequences. Some miners might choose to shut down operations if their operating costs exceed their revenue, potentially leading to a reduction in the network’s hashrate (computational power). Conversely, the halving could incentivize miners to increase efficiency and lower operating costs to remain profitable. This could involve upgrading to more energy-efficient mining hardware or exploring alternative revenue streams, such as transaction fees. The overall effect on the network’s security and stability will depend on the balance between these competing forces. The 2012 halving saw a temporary drop in mining profitability, but the network ultimately adapted, demonstrating resilience. The 2016 and 2020 halvings also demonstrated similar trends, although the market conditions and technological advancements during these periods differed significantly. The impact of the 2025 halving will depend heavily on the prevailing electricity prices, Bitcoin’s price, and the technological advancements in mining hardware.

Market Predictions and Price Analysis for Bitcoin Halving in April 2025

The Bitcoin halving event in April 2025 is anticipated to significantly impact the cryptocurrency’s price, sparking considerable debate and diverse predictions within the market. Analysts employ various methodologies, ranging from simple historical analysis to complex econometric models, to forecast Bitcoin’s future value. Understanding these approaches and the factors influencing them is crucial for navigating the inherent uncertainty surrounding this event.

Predicting Bitcoin’s price after the halving is inherently challenging due to the asset’s volatility and the influence of numerous intertwined factors. While historical data suggests a price surge following past halvings, extrapolating this trend directly isn’t foolproof. Numerous external forces, beyond the halving itself, significantly impact price movements.

Diverse Analytical Approaches to Price Forecasting

Analysts employ a variety of methods to forecast Bitcoin’s price. Some rely on historical price action, observing patterns and trends following previous halvings. This approach, while seemingly straightforward, ignores potential shifts in market dynamics and macroeconomic conditions. Others integrate technical indicators, such as moving averages and relative strength index (RSI), to identify potential support and resistance levels. Quantitative models, incorporating factors like supply and demand, network effects, and adoption rates, offer a more sophisticated approach, but are susceptible to inaccuracies stemming from unpredictable events. Finally, some analysts utilize fundamental analysis, considering factors such as regulatory changes and macroeconomic trends to arrive at a price prediction. Each approach presents its own limitations and biases, leading to a range of price predictions. For example, a purely historical analysis might predict a significant price increase based on previous cycles, while a model incorporating macroeconomic headwinds might predict a more modest or even negative impact.

Factors Influencing Bitcoin Price Predictions

Several key factors significantly influence Bitcoin price predictions surrounding the 2025 halving. The rate of Bitcoin adoption is paramount; widespread institutional and retail adoption could drive demand, increasing the price. Conversely, decreased adoption could lead to price stagnation or decline. Regulatory changes, both positive and negative, exert a considerable influence. Favorable regulations in major markets could unlock significant investment, while restrictive measures could dampen price growth. Macroeconomic conditions, including inflation rates, interest rates, and overall economic stability, play a significant role. Periods of economic uncertainty often see investors seeking refuge in Bitcoin, potentially driving up its price. Conversely, a robust economy might lead investors to favor more traditional assets, impacting Bitcoin’s value. Finally, the level of competition from alternative cryptocurrencies cannot be ignored. The emergence of new technologies or successful competitors could divert investment away from Bitcoin, affecting its price. The interplay of these factors makes accurate prediction exceptionally difficult. For instance, a scenario with high adoption rates coupled with favorable regulations and a period of economic uncertainty could lead to a substantial price increase, whereas the opposite scenario might result in a significantly lower price.

Examples of Market Predictions

Several prominent analysts and firms have offered price predictions for Bitcoin after the 2025 halving. These predictions vary widely, reflecting the diverse methodologies and assumptions employed. Some predictions suggest prices reaching six-figures, while others remain significantly more conservative. It’s crucial to understand that these are merely speculative forecasts, not guaranteed outcomes. The actual price will depend on the complex interaction of the factors previously discussed. For instance, one prediction might be based on a model assuming high adoption and positive regulatory developments, resulting in a significantly higher price projection compared to a prediction that incorporates more pessimistic assumptions about macroeconomic conditions and regulatory uncertainty. The divergence in these predictions underscores the inherent difficulty in accurately forecasting Bitcoin’s future price.

The Impact of the Halving on Bitcoin Mining

The Bitcoin halving, a pre-programmed event reducing the block reward for miners by half, significantly impacts the economics of Bitcoin mining. This event, scheduled for April 2025, will force miners to adapt their operations to remain profitable in a potentially less lucrative environment. The consequences extend beyond individual miners, affecting the network’s overall security and decentralization.

The reduced block reward means miners will earn significantly less Bitcoin for each block they successfully mine. This directly impacts their revenue stream, potentially forcing less efficient or less capitalized miners to shut down their operations. The resulting changes in the mining landscape will have cascading effects on the network’s health and stability.

Challenges Faced by Bitcoin Miners After the Halving

The halving presents several significant challenges for Bitcoin miners. The most immediate challenge is the reduction in revenue. With half the Bitcoin rewarded per block, miners need to find ways to compensate for this loss to maintain profitability. This might involve increasing mining efficiency, reducing operational costs, or seeking alternative revenue streams. The competitive landscape will intensify, with only the most efficient and well-capitalized miners likely to survive. Furthermore, the halving could lead to increased centralization if smaller miners are forced to consolidate or exit the market. This would potentially impact the network’s resilience against attacks.

Strategies for Maintaining Profitability After the Halving

Miners will employ various strategies to navigate the post-halving landscape. One key strategy is improving mining efficiency. This might involve upgrading to more energy-efficient hardware, optimizing mining pools for better performance, or investing in renewable energy sources to reduce electricity costs. Another approach involves exploring alternative revenue streams, such as offering hosting services for other miners or participating in other blockchain-related activities. Diversification of revenue streams can mitigate the risk associated with relying solely on block rewards. Furthermore, strategic alliances and mergers between mining companies could help them achieve economies of scale and increase their competitiveness. Successful miners will likely need to adopt a multifaceted approach, combining efficiency improvements with cost reduction and revenue diversification.

Impact on Bitcoin Network Security and Decentralization

The halving’s impact on the Bitcoin network’s security and decentralization is complex and uncertain. While a reduction in the number of miners could theoretically weaken the network’s security, the increased difficulty in mining after the halving will likely offset this effect to some extent. The network’s security is determined by the overall hash rate, which is the combined computational power of all miners. If the most efficient miners remain, the overall hash rate might not decrease significantly, thus maintaining a high level of security. However, a significant drop in the number of smaller miners could lead to increased centralization, potentially concentrating mining power in the hands of a few large players. This could raise concerns about the network’s resilience against attacks and its overall decentralization. The long-term effect will depend on the actions taken by miners and the overall adaptation of the industry to the new economic reality. The halving could act as a catalyst for consolidation and innovation within the mining sector, potentially leading to a more efficient and potentially less decentralized network.

Investor Sentiment and Market Volatility Around the Halving

Bitcoin halvings, events that cut the rate at which new Bitcoins are mined in half, have historically been significant catalysts for price volatility and shifts in investor sentiment. Understanding these patterns is crucial for navigating the market around the anticipated April 2025 halving.

The period leading up to a halving often sees a build-up of anticipation. Investors, aware of the reduced supply of new Bitcoins entering the market, may drive demand and price increases, creating a speculative bubble. This is fueled by the belief that scarcity will ultimately increase Bitcoin’s value. Conversely, some investors might take profits before the halving, anticipating a potential price correction afterward. Following the halving, the market typically experiences a period of uncertainty. The actual impact on price depends on a complex interplay of factors, including overall market sentiment, regulatory developments, and adoption rates. While some anticipate a bullish price surge, others remain cautious, leading to fluctuating market conditions.

Typical Investor Behavior Before and After Halvings

Investor behavior around halvings exhibits predictable patterns, though the intensity varies. Before a halving, we often see increased trading volume and price speculation as investors position themselves for potential gains. Some investors might aggressively accumulate Bitcoin, betting on a post-halving price increase. Others, fearing a price correction, might sell their holdings, locking in profits before the event. After the halving, initial price movements can be unpredictable. A period of consolidation often follows, with prices fluctuating based on market sentiment and other macroeconomic factors. Some investors might remain cautious, waiting for confirmation of a sustained upward trend before reinvesting. Others might view the lower supply as a buying opportunity. The 2012 and 2016 halvings saw distinct periods of price appreciation following the events, but these were also interspersed with periods of correction, demonstrating the volatility inherent in the process.

Potential Risks and Opportunities for Investors

The period surrounding a Bitcoin halving presents both significant risks and opportunities for investors. A major risk is the potential for a price correction, either before or after the halving. This correction could be substantial, leading to significant losses for investors who entered the market with high expectations. Another risk is the inherent volatility of the cryptocurrency market, which is susceptible to external factors like regulatory changes and macroeconomic events. Conversely, the halving presents an opportunity for long-term investors to accumulate Bitcoin at potentially lower prices before a potential price appreciation. This strategy relies on the belief that the reduced supply will eventually drive demand and increase value. It’s also an opportunity for short-term traders to capitalize on price fluctuations, but this approach demands careful timing and risk management. Successful navigation requires a deep understanding of market dynamics and risk tolerance.

Market Volatility Comparison Across Previous Halvings, Bitcoin Halving Date April 2025

Comparing the market volatility before, during, and after previous halvings reveals interesting patterns. The 2012 halving saw a relatively subdued price reaction, with a gradual increase in Bitcoin’s price following the event. The 2016 halving, however, was followed by a more significant price surge, albeit with periods of correction. The period leading up to both halvings exhibited increased volatility compared to the periods immediately following them. This suggests that the anticipation leading up to the halving often contributes more significantly to price fluctuations than the halving itself. The actual impact of the halving on price is usually felt over a longer period, rather than immediately after the event. Analyzing these past events helps to inform expectations for the 2025 halving, although it’s crucial to remember that each halving occurs within a unique macroeconomic and market context.