Bitcoin Halving 2025: Bitcoin Halving Date In 2025

The Bitcoin halving, scheduled for approximately April 2025, is a significant event in the cryptocurrency’s lifecycle. This event, programmed into Bitcoin’s code, reduces the rate at which new Bitcoins are created, impacting supply and potentially influencing price dynamics. Understanding the mechanics and historical context is crucial for navigating the market leading up to and following the halving.

Bitcoin Halving Mechanics and Historical Price Impact

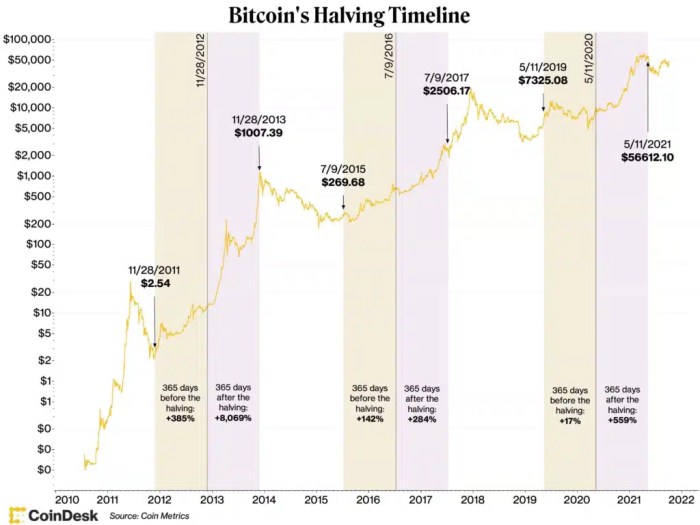

The Bitcoin halving cuts the reward paid to miners for verifying transactions and adding new blocks to the blockchain in half. This occurs approximately every four years, or every 210,000 blocks mined. Historically, halvings have been followed by periods of significant price appreciation, though the timing and magnitude of these price increases vary. The first halving in 2012 saw a gradual price increase over the following year. The second halving in 2016 was followed by a more pronounced price surge in 2017. The third halving in 2020 also saw a price increase, although the market experienced significant volatility in the following period. It’s important to note that while halvings have historically been correlated with price increases, other market factors also significantly influence Bitcoin’s price.

Projected Bitcoin Supply After the 2025 Halving

After the 2025 halving, the block reward will be reduced to 3.125 BTC per block. The total supply of Bitcoin is capped at 21 million coins. While the halving doesn’t directly change the total supply, it significantly slows down the rate at which new coins enter circulation. This reduced supply, combined with potentially increasing demand, could exert upward pressure on the price. The precise impact, however, is subject to numerous market variables.

Potential Scenarios for Bitcoin Price Volatility

Leading up to the 2025 halving, we might see increased price volatility as investors anticipate the event. Some might buy in advance, expecting price appreciation, while others might sell, taking profits before the halving. Following the halving, the price could increase due to the reduced supply. However, a range of scenarios are possible. For example, a sustained bear market could negate any upward pressure from the reduced supply, leading to a prolonged period of low prices. Conversely, a period of high demand could lead to significant price appreciation. The 2020 halving, for instance, saw a significant price increase, but the market also experienced considerable volatility. Predicting the exact price trajectory is impossible.

Comparison of the 2025 Halving to Previous Halving Events

The 2025 halving shares similarities with previous events in its core mechanism: a reduction in the block reward. However, the surrounding macroeconomic conditions and the maturity of the Bitcoin market differ significantly. In 2012, the cryptocurrency market was nascent, with far fewer participants and regulatory clarity. By 2025, Bitcoin has established itself as a major asset class, with increased regulatory scrutiny and institutional adoption. This makes direct comparisons challenging, and the impact of the 2025 halving may differ considerably from previous events.

Impact of the Halving on Bitcoin Mining Profitability

The halving directly impacts the profitability of Bitcoin mining. A reduction in the block reward means miners receive less Bitcoin for each block they successfully mine. To maintain profitability, miners need to adjust their operational costs, possibly by upgrading to more energy-efficient hardware or consolidating operations.

Bitcoin Halving Date In 2025 – Illustration: Imagine a bar chart. The X-axis represents the year of the halving (2012, 2016, 2020, 2025). The Y-axis represents the average miner revenue per block in USD. Each bar represents the average revenue for a given year. The height of the bars would likely show a decrease immediately after each halving, followed by a gradual increase (or decrease depending on the Bitcoin price and energy costs) as the price adjusts. A line graph could be superimposed, showing the Bitcoin price during the same period. This visual would illustrate the correlation (or lack thereof) between the halving, miner revenue, and Bitcoin’s price. Additional data points could include the average cost of electricity per kilowatt-hour for mining in a given year, adding another layer of complexity and illustrating the factors impacting mining profitability.

The 2025 Halving and Market Sentiment

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, significantly impacts market sentiment. Anticipation of this event often leads to periods of both heightened volatility and speculation, influencing investor behavior and trading patterns in the months leading up to and following the halving.

Investor Behavior and Trading Patterns

The anticipation of a halving typically creates a period of increased market activity. Investors often adopt different strategies based on their investment horizons and risk tolerance. Short-term traders might engage in more frequent buying and selling, attempting to profit from price fluctuations. Long-term investors, on the other hand, may view the halving as a buying opportunity, anticipating a future price increase due to the reduced supply of newly mined Bitcoin. This dichotomy creates a dynamic market environment with periods of both bullish and bearish pressure. Historically, we’ve seen price increases leading up to halvings, followed by periods of consolidation or even correction after the event itself. The extent of these price movements, however, varies considerably depending on other market forces.

The Role of News and Social Media

News outlets and social media platforms play a crucial role in shaping market sentiment surrounding the halving. Positive news coverage, often focusing on the scarcity aspect of Bitcoin and the potential for price appreciation, can fuel bullish sentiment. Conversely, negative news, such as regulatory uncertainty or macroeconomic headwinds, can dampen investor enthusiasm. The rapid spread of information and opinions on social media platforms can amplify both positive and negative sentiment, leading to significant price swings. The influence of prominent figures in the crypto space, through their pronouncements and social media activity, also significantly impacts the overall narrative and market psychology. For instance, a tweet from a well-known figure can trigger a cascade of buying or selling, creating short-term volatility.

Factors Beyond the Halving

Market reactions to the 2025 halving will not solely depend on the halving itself. Several external factors could significantly influence Bitcoin’s price. Regulatory changes, for instance, could either boost or hinder investor confidence. Stringent regulations might suppress price growth, while a more favorable regulatory environment could attract new investment. Macroeconomic conditions, such as inflation rates, interest rates, and overall economic growth, will also play a crucial role. A period of high inflation, for example, could drive investors towards Bitcoin as a hedge against inflation, potentially increasing demand. Conversely, rising interest rates could make alternative investments more attractive, potentially diverting capital away from Bitcoin. Geopolitical events and unforeseen crises could also influence investor sentiment and market volatility.

Psychological Impact on Investors

The halving exerts a powerful psychological impact on both long-term and short-term investors. Long-term holders, or “hodlers,” often view the halving as a validation of their investment strategy, reinforcing their conviction in Bitcoin’s long-term value proposition. This reinforces their “buy and hold” strategy. Short-term investors, however, might be more susceptible to emotional responses driven by price fluctuations. Fear of missing out (FOMO) can lead to impulsive buying during periods of rapid price increases, while fear of losing money (FUD) can trigger panic selling during market corrections. Understanding these psychological factors is crucial for navigating the volatility surrounding the halving.

Market Predictions Post-Halving

| Prediction | Price Range (USD) | Supporting Arguments | Potential Risks |

|---|---|---|---|

| Bullish | $100,000 – $250,000 | Increased scarcity due to reduced supply, continued institutional adoption, growing mainstream awareness, potential inflation hedge. Similar to previous halving cycles, where price increases followed the event. | Regulatory uncertainty, macroeconomic downturn, unforeseen technological disruptions. Overly optimistic projections based solely on past performance, neglecting other market factors. |

| Bearish | $20,000 – $50,000 | Regulatory crackdowns, a prolonged bear market in broader financial markets, potential for Bitcoin to lose market share to competing cryptocurrencies. The previous halving cycle didn’t lead to immediate and sustained price appreciation. | Underestimating the long-term value proposition of Bitcoin, ignoring potential positive developments such as institutional adoption or positive regulatory changes. |

Technical Analysis of Bitcoin Before and After the Halving

Predicting Bitcoin’s price movements is inherently challenging, yet technical analysis offers a framework for understanding potential price trajectories before and after the 2025 halving. By examining historical data, identifying key support and resistance levels, and employing various technical indicators, we can formulate informed hypotheses about Bitcoin’s future price action. This analysis, however, should be considered speculative and not financial advice.

Key Support and Resistance Levels Leading Up to the 2025 Halving

Analyzing Bitcoin’s price charts leading up to the 2025 halving requires identifying significant support and resistance levels. Support levels represent price points where buying pressure is expected to outweigh selling pressure, preventing further price declines. Conversely, resistance levels represent price points where selling pressure is expected to dominate, hindering upward momentum. Historical data from previous halving cycles can be used to project potential support and resistance zones. For instance, observing the price action around the 2016 and 2020 halvings, we can identify potential price ranges that might act as support or resistance in 2025. These ranges would need to be adjusted based on current market conditions and overall macroeconomic factors. A detailed analysis would involve charting software and examination of various timeframes (daily, weekly, monthly).

Potential Trading Strategies Based on Historical Price Action

Historical price action surrounding previous halvings reveals potential trading strategies. Many investors adopt a “buy-the-dip” strategy, anticipating a price increase following the halving. This strategy involves purchasing Bitcoin when the price drops to a perceived support level, hoping to profit from the subsequent price appreciation. Conversely, a “sell-the-hype” strategy involves selling Bitcoin before the halving, capitalizing on the pre-halving price surge and then potentially re-entering the market after the halving at a lower price. The effectiveness of these strategies is not guaranteed and depends on various market factors. For example, the 2012 halving saw a significant price increase following the event, while the 2016 and 2020 halvings showed more complex price patterns, demonstrating the variability of market reactions.

The Use of Moving Averages and RSI in Price Prediction

Technical indicators like moving averages (MAs) and the Relative Strength Index (RSI) can provide insights into price trends and momentum. Moving averages, such as the 50-day and 200-day MAs, smooth out price fluctuations and identify potential trend changes. A bullish crossover occurs when a shorter-term MA crosses above a longer-term MA, suggesting a potential upward trend. Conversely, a bearish crossover signals a potential downward trend. The RSI, a momentum oscillator, measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 generally suggests an overbought market, while an RSI below 30 suggests an oversold market. These indicators, used in conjunction with other forms of analysis, can aid in predicting price movements, but they are not foolproof predictors.

Comparing Different Technical Analysis Approaches

Different technical analysis approaches, such as candlestick charting, Elliott Wave theory, and Fibonacci retracements, offer various perspectives on Bitcoin’s price movements. Candlestick charting provides visual representations of price action, highlighting potential reversal patterns. Elliott Wave theory attempts to predict price movements based on recurring patterns in market psychology. Fibonacci retracements identify potential support and resistance levels based on mathematical ratios. Combining these methods can provide a more comprehensive picture, although it’s crucial to remember that each approach has its limitations and subjective interpretations. The accuracy of these predictions relies heavily on the analyst’s experience and skill.

Timeline of Key Events and Predicted Price Movements

Predicting precise price movements is impossible, but a timeline incorporating key events can help contextualize potential price shifts.

| Date | Event | Predicted Market Sentiment | Potential Price Movement |

|---|---|---|---|

| Q3 2024 – Q1 2025 | Increased anticipation of the halving | Bullish | Potential gradual price increase |

| April 2025 (approx.) | Bitcoin Halving | Mixed – initially bullish, potential correction later | Sharp price increase initially, followed by a possible period of consolidation or correction |

| Q2 2025 – Q4 2025 | Post-halving market reaction | Potentially bullish, depending on macroeconomic factors | Continued price increase or sideways trading, potential volatility |

Note: This timeline and predicted price movements are speculative and subject to change based on various market factors. The actual price movements may differ significantly from these predictions.

Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, is a significant event with potentially profound long-term implications for the cryptocurrency’s scarcity, value, and the broader crypto market. Understanding these implications is crucial for investors and participants in the digital asset ecosystem.

Bitcoin’s inherent scarcity, limited to 21 million coins, is a core element of its value proposition. The halving mechanism directly reinforces this scarcity by slowing the influx of new Bitcoins into circulation. This controlled scarcity is often compared to precious metals like gold, where limited supply contributes to value appreciation over time. The 2025 halving will further tighten this supply, potentially driving increased demand and price appreciation.

Impact on Bitcoin’s Scarcity and Value Proposition

The halving’s impact on Bitcoin’s scarcity is arguably its most significant long-term implication. As the rate of new Bitcoin creation diminishes, the existing supply becomes increasingly valuable. This dynamic, coupled with growing adoption and institutional investment, could lead to a significant increase in Bitcoin’s price over the long term. Historically, previous halvings have been followed by periods of price appreciation, though the extent and duration of these price increases vary. For example, the 2012 halving was followed by a substantial price surge, while the 2016 halving led to a more gradual increase. Predicting the exact price movement after the 2025 halving remains challenging, but the underlying principle of increasing scarcity remains a powerful driver of potential value appreciation.

Impact on Bitcoin’s Adoption and Use as a Store of Value

The halving’s influence on Bitcoin’s adoption as a store of value is multifaceted. Increased scarcity could bolster its appeal as a hedge against inflation, particularly in uncertain economic climates. This could attract more institutional investors seeking to diversify their portfolios and protect against inflation. Simultaneously, increased price volatility following a halving could also deter some individuals from using Bitcoin as a medium of exchange due to price uncertainty. However, the long-term trend of increasing scarcity and potential value appreciation might outweigh short-term volatility concerns for many long-term investors. The adoption of Bitcoin as a store of value depends not only on the halving but also on broader macroeconomic factors and regulatory developments.

Impact on the Overall Cryptocurrency Market

The 2025 halving is unlikely to be isolated to Bitcoin; its ripple effects could extend throughout the broader cryptocurrency market. A significant price increase in Bitcoin could trigger a positive sentiment across the entire market, leading to increased investment in other cryptocurrencies. This effect, often referred to as the “Bitcoin effect,” can lead to a broader market rally. Conversely, a significant price correction after the halving could negatively impact the entire market, creating a sell-off across different crypto assets. The interconnectedness of the crypto market means that the performance of Bitcoin significantly influences the performance of other cryptocurrencies.

Impact on Bitcoin-Related Technologies

The 2025 halving could indirectly stimulate the development and adoption of Bitcoin-related technologies. Increased demand for Bitcoin might lead to greater investment in infrastructure supporting Bitcoin transactions, such as improved scaling solutions (like the Lightning Network) and enhanced security measures. Furthermore, increased attention to Bitcoin following the halving might encourage the development of new applications and services built on top of the Bitcoin blockchain, fostering innovation within the Bitcoin ecosystem.

Projected Growth of Bitcoin’s Market Capitalization, Bitcoin Halving Date In 2025

The following is a conceptual description of a visual representation. It would be a line graph showing the projected growth of Bitcoin’s market capitalization over time, specifically focusing on the period after the 2025 halving. The X-axis would represent time (in years, starting from the halving date), and the Y-axis would represent Bitcoin’s market capitalization (in USD). The graph would incorporate different scenarios, represented by separate lines, illustrating potential growth under various assumptions about adoption rates, macroeconomic conditions, and regulatory developments. For example, a conservative scenario might show a gradual, steady increase, while a more optimistic scenario might depict exponential growth. The graph would include annotations indicating key milestones, such as significant price increases or market events, to provide context. Data used to generate these projections would be based on historical data, market analysis, and econometric modeling, with clear disclaimers acknowledging the inherent uncertainty in making long-term predictions. The different scenarios would be clearly labeled and described, allowing viewers to understand the range of possible outcomes. The visual representation would avoid making definitive predictions but rather illustrate potential outcomes based on different assumptions.

Frequently Asked Questions about the Bitcoin Halving in 2025

The Bitcoin halving is a significant event in the cryptocurrency world, occurring approximately every four years. It significantly impacts the rate at which new Bitcoins are introduced into circulation, potentially influencing market dynamics and price. Understanding this event is crucial for anyone invested in or interested in Bitcoin.

Bitcoin Halving: Significance and Mechanism

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the reward given to Bitcoin miners for successfully verifying and adding new transactions to the blockchain. This reward, initially 50 BTC per block, is cut in half with each halving. The significance lies in the reduced supply of newly minted Bitcoin entering the market, potentially creating a scarcity effect. This mechanism is designed to control inflation and maintain the long-term value of Bitcoin.

Expected Date of the 2025 Bitcoin Halving

While the exact date is dependent on the block time, which can fluctuate slightly, the Bitcoin halving in 2025 is expected to occur around April 2025. This prediction is based on the consistent block generation rate and the predictable nature of the halving algorithm. Various cryptocurrency news outlets and blockchain explorers consistently track the approaching halving, providing updated estimates as the event draws closer.

Impact of the Halving on Bitcoin’s Price

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. The 2012 and 2016 halvings, for example, were followed by substantial bull markets. This correlation is often attributed to the reduced supply of newly minted Bitcoin, increasing its scarcity and potentially driving up demand. However, it’s crucial to remember that numerous other factors influence Bitcoin’s price, and past performance is not indicative of future results. The 2020 halving, while leading to a price increase, also saw periods of volatility and correction.

Risks and Potential Downsides Associated with the Halving

While the halving is often viewed positively, it’s important to acknowledge potential downsides. The price increase following a halving isn’t guaranteed, and the market could experience volatility or even a price decrease. Furthermore, the halving doesn’t negate other market forces, such as regulatory changes, macroeconomic conditions, or overall investor sentiment. A significant negative event unrelated to the halving could outweigh its positive effects on price. Finally, increased miner difficulty, potentially resulting from reduced block rewards, could impact the security and stability of the network.

Investor Preparation for the 2025 Halving

Investors should approach the 2025 halving with a balanced and informed perspective. Conduct thorough research and understand the potential risks and rewards. Diversification is crucial; don’t invest more than you can afford to lose. Consider your personal risk tolerance and investment goals before making any decisions. Long-term investors might view the halving as a positive catalyst, while short-term traders should be prepared for potential market volatility. Staying updated on market news and technical analysis is also vital for informed decision-making. It’s also prudent to have a well-defined exit strategy, regardless of market conditions.

The Bitcoin Halving Date in 2025 is a significant event for the cryptocurrency, impacting the supply of newly mined Bitcoin. Predicting the precise consequences is challenging, but understanding potential price movements is crucial. To gain insights into potential price trajectories following the halving, you might find this resource helpful: Bitcoin Price After Halving 2025. Ultimately, the Bitcoin Halving Date in 2025 will likely be a catalyst for considerable market fluctuations.

Determining the precise Bitcoin Halving Date in 2025 requires careful consideration of block generation times. For those seeking Spanish-language resources on this topic, a helpful site is available: Cuando Es El Halving De Bitcoin 2025. This resource can provide additional context and clarity surrounding the anticipated date of the next Bitcoin halving event in 2025.

Pinpointing the exact Bitcoin Halving Date in 2025 requires careful consideration of the blockchain’s block generation times. To fully understand the mechanics behind this significant event, it’s helpful to consult a resource explaining the halving process, such as this informative article: Que Es Halving Bitcoin 2025. Understanding the halving’s impact is crucial for accurately predicting the 2025 Bitcoin Halving Date and its subsequent effects on the cryptocurrency market.

Pinpointing the exact Bitcoin Halving Date in 2025 requires careful consideration of the block reward halving mechanism. To stay updated on the precise timing and to follow the progress towards this significant event, you can consult a reliable countdown resource like the Bitcoin Halving Countdown 2025 website. This will help you accurately anticipate the Bitcoin Halving Date in 2025 and its potential market impact.

Determining the precise Bitcoin Halving Date in 2025 requires careful consideration of the blockchain’s block generation times. To find out exactly when this significant event will occur, you can consult a reliable resource such as this helpful page: When Is The Next Bitcoin Halving 2025. Understanding this date is crucial for predicting potential market impacts surrounding the Bitcoin Halving Date in 2025.