Predicting the 2025 Halving’s Impact: Bitcoin Halving Prediction 2025

The Bitcoin halving event of 2025, scheduled for approximately April, is a significant event anticipated to influence Bitcoin’s price trajectory. Understanding the potential impact requires considering a range of factors, from macroeconomic conditions to regulatory developments and technological advancements. While predicting the future price of any asset is inherently speculative, analyzing historical trends and current market dynamics can provide a framework for potential scenarios.

Potential Bitcoin Price Scenarios in 2025

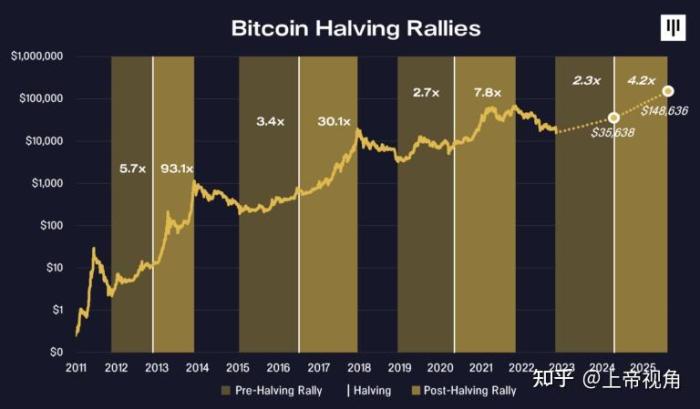

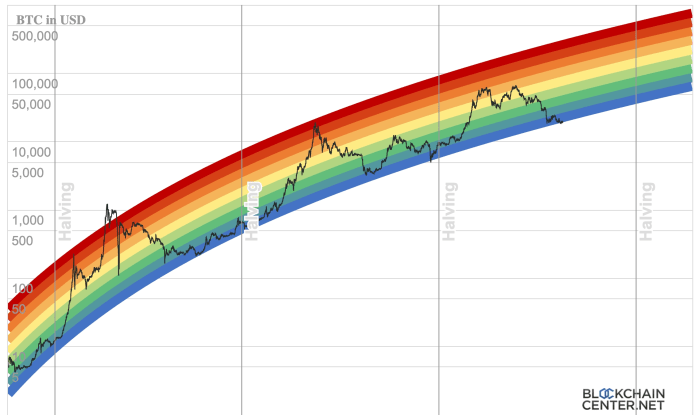

Several factors will determine Bitcoin’s price in 2025. Historical data shows that halvings have often preceded periods of price appreciation, although the timing and magnitude of these increases have varied. Considering the reduced supply following the halving, coupled with various market sentiments, several price scenarios are plausible. A conservative estimate might place Bitcoin’s price somewhere between $100,000 and $200,000 by the end of 2025, assuming moderate growth and relatively stable macroeconomic conditions. A more bullish scenario, factoring in increased institutional adoption and sustained demand, could see the price exceeding $200,000, potentially reaching even higher levels. Conversely, a bearish scenario, driven by significant macroeconomic headwinds or regulatory crackdowns, might see the price remain within or below the current price range. These scenarios are not mutually exclusive; the actual price will likely depend on a complex interplay of these and other factors. For example, the 2017 bull run saw a price increase of over 1000% before crashing significantly, while the 2021 bull run saw more moderate gains followed by a considerable price drop. This illustrates the volatility inherent in Bitcoin’s price.

Influence of Macroeconomic Factors, Bitcoin Halving Prediction 2025

Macroeconomic conditions significantly influence Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against inflation, increasing demand and potentially pushing the price higher. Conversely, rising interest rates, which make holding non-yielding assets less attractive, could exert downward pressure on Bitcoin’s price. Global economic uncertainty or recessionary fears might also negatively impact Bitcoin’s price, as investors seek safer havens. The strength of the US dollar, a major global reserve currency, also plays a role, as a stronger dollar can decrease demand for Bitcoin, expressed in USD terms. The interplay of these factors is complex and often unpredictable. For example, the 2008 financial crisis led to increased interest in Bitcoin as an alternative to traditional financial systems, while more recent periods of high inflation have shown a mixed relationship between Bitcoin’s price and inflation rates.

Role of Regulatory Changes and Technological Advancements

Regulatory clarity and technological advancements are crucial factors shaping Bitcoin’s future. Positive regulatory developments, such as clear guidelines for Bitcoin trading and custody, could boost institutional investment and increase market confidence. Conversely, restrictive regulations or outright bans could stifle growth and depress the price. Technological advancements, such as the development of the Lightning Network, improving transaction speed and scalability, could enhance Bitcoin’s usability and appeal, potentially driving price appreciation. Conversely, technological setbacks or security breaches could negatively impact investor confidence and the price. The regulatory landscape is constantly evolving, with different jurisdictions adopting varying approaches to cryptocurrencies. Similarly, technological innovation in the Bitcoin ecosystem is continuous, with new developments regularly emerging. The interplay of these advancements and regulatory changes will play a key role in shaping Bitcoin’s price and adoption in the coming years.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of various factors, making it notoriously volatile. Understanding these influences is crucial for navigating the cryptocurrency market. While predicting the precise price is impossible, analyzing these factors provides valuable insights into potential price movements. This section will explore key drivers of Bitcoin’s price fluctuations.

Influence of Various Factors on Bitcoin’s Price

The following table summarizes the impact of several key factors on Bitcoin’s price. The influence of each factor can vary significantly over time and is often interconnected.

| Factor | Positive Influence on Price | Negative Influence on Price | Overall Impact |

|---|---|---|---|

| Adoption Rate | Increased user base, wider merchant acceptance, growing institutional investment leads to higher demand. | Slow adoption, limited usability, lack of mainstream acceptance reduces demand. | High; Increased adoption generally drives price upwards. |

| Mining Difficulty | Increased difficulty makes mining more expensive, potentially slowing inflation and increasing scarcity. | Significant difficulty adjustments can impact profitability for miners, potentially leading to sell-offs. | Moderately High; Generally a positive influence in the long term, but short-term effects can be negative. |

| Regulatory Landscape | Clear and favorable regulations create stability and attract institutional investors. | Uncertain or restrictive regulations increase risk and uncertainty, potentially deterring investment. Examples include outright bans or excessive taxation. | High; Regulatory clarity is paramount for long-term price stability and growth. |

| Macroeconomic Trends | Inflationary pressures, economic uncertainty, or geopolitical instability can drive investors towards Bitcoin as a hedge against risk. | Strong economic growth, low inflation, and increased investor confidence in traditional assets can divert investment away from Bitcoin. Examples include periods of strong stock market performance. | High; Bitcoin’s price is often correlated with broader economic conditions. |

Institutional Investment and Retail Investor Sentiment

Institutional investment, such as that from large corporations and hedge funds, significantly impacts Bitcoin’s price. Large purchases can drive prices up rapidly, while large sell-offs can trigger significant price drops. Retail investor sentiment, reflected in trading volume and social media activity, also plays a substantial role. Periods of strong retail enthusiasm can lead to price rallies, while widespread fear or uncertainty can cause sharp declines. For example, the 2021 Bitcoin bull run saw substantial participation from both institutional and retail investors, leading to record highs. Conversely, market crashes are often characterized by panic selling from retail investors.

Bitcoin’s Network Security and Hashrate

Bitcoin’s value is intrinsically linked to the security and stability of its underlying network. The hashrate, representing the total computational power securing the network, is a key indicator of its resilience. A high hashrate makes it exponentially more difficult for attackers to manipulate the blockchain or conduct a 51% attack. A decline in the hashrate could signal vulnerabilities and potentially undermine investor confidence, leading to price decreases. Conversely, a consistently high and growing hashrate reinforces the network’s security and contributes to the long-term value proposition of Bitcoin. The 2021 China mining crackdown, which led to a temporary decline in hashrate, illustrates the potential impact of such events on Bitcoin’s price.

Alternative Cryptocurrencies and the Halving

The Bitcoin halving, a significant event in the cryptocurrency world, doesn’t exist in a vacuum. Its impact reverberates throughout the broader crypto market, influencing the performance of alternative cryptocurrencies (altcoins) in complex and often unpredictable ways. Understanding these ripple effects is crucial for navigating the post-halving landscape.

The Bitcoin halving reduces the rate at which new Bitcoins are created, potentially increasing its scarcity and driving up demand. This, in turn, can have a variety of effects on altcoins, depending on their market position, correlation with Bitcoin, and underlying utility.

Altcoin Price Correlations with Bitcoin Halving

Historically, Bitcoin price movements have significantly influenced altcoin prices. A rising Bitcoin price often leads to a “bullish” sentiment across the crypto market, boosting altcoin prices as well. Conversely, a Bitcoin price downturn can trigger a widespread sell-off, impacting altcoins negatively. The 2025 halving’s impact on altcoins will likely depend on the strength of this correlation leading up to and following the event. For example, during previous halvings, altcoins that demonstrated strong fundamentals and unique value propositions tended to outperform those lacking clear utility or market differentiation, even during periods of Bitcoin price volatility. The extent to which this pattern repeats in 2025 remains to be seen, but it highlights the importance of fundamental analysis when considering altcoin investments around a halving event.

Market Capitalization Shifts After a Bitcoin Halving

The overall cryptocurrency market capitalization is heavily influenced by Bitcoin’s dominance. Bitcoin typically accounts for a significant portion of the total market cap. A Bitcoin price surge following a halving can inflate the overall market cap, benefiting altcoins indirectly through increased investor interest in the broader crypto space. However, a scenario where Bitcoin’s price increases dramatically while altcoins lag could lead to a decrease in altcoin market share, even if the overall market cap grows. The 2016 and 2020 halvings saw periods of both increased and decreased altcoin market share, depending on the specific timeframe and the performance of individual altcoins. Predicting the exact impact on market capitalization is difficult, but analyzing historical data offers valuable insights.

Altcoin Market Share Gains Post-Halving

The halving could present opportunities for altcoins to gain market share. Periods of increased Bitcoin price volatility often lead investors to seek diversification, potentially driving capital flows into altcoins with perceived lower risk or higher potential returns. Furthermore, altcoins offering innovative technologies or solutions that address specific market needs may attract investors looking for exposure beyond Bitcoin. For instance, altcoins focused on decentralized finance (DeFi), non-fungible tokens (NFTs), or scalability solutions might experience increased demand during a period of Bitcoin price consolidation or even a slight downturn, as investors explore other segments of the crypto market. However, this is not guaranteed, and success will depend heavily on individual altcoin projects and their ability to deliver on their promises.

Long-Term Outlook for Bitcoin

Predicting the future of Bitcoin beyond 2025 is inherently speculative, but analyzing current trends and expert opinions allows for a reasoned assessment of potential trajectories. While no one can definitively state Bitcoin’s price in ten or twenty years, several factors suggest a range of possibilities, each with its own set of underlying assumptions. The long-term outlook depends heavily on technological advancements, regulatory developments, and overall market adoption.

Expert opinions on Bitcoin’s long-term price trajectory vary widely. Some analysts, citing its limited supply and increasing institutional adoption, predict exponential growth, potentially reaching six or seven figures per coin. Others are more cautious, highlighting the inherent volatility of cryptocurrencies and the possibility of disruptive technologies rendering Bitcoin obsolete. These predictions often rely on models that incorporate factors like network effects, inflation rates, and technological innovation, with results ranging from highly optimistic to considerably more conservative. For example, some models extrapolate past price increases to predict future growth, while others focus on fundamental valuation metrics like market capitalization and transaction volume. The accuracy of these models is limited by the inherent unpredictability of the cryptocurrency market.

Bitcoin’s Evolutionary Milestones

A timeline outlining potential milestones in Bitcoin’s evolution beyond 2025 must acknowledge the uncertainty inherent in predicting technological advancements. However, several potential developments can be reasonably anticipated. The scaling solutions currently being developed, such as the Lightning Network, could significantly improve transaction speeds and reduce fees, potentially leading to wider adoption. Increased regulatory clarity in various jurisdictions could also boost institutional investment and mainstream acceptance. Conversely, the emergence of competing cryptocurrencies or unforeseen technological breakthroughs could challenge Bitcoin’s dominance.

Bitcoin Halving Prediction 2025 – A possible timeline could include:

- 2025-2030: Widespread adoption of layer-2 scaling solutions, increased institutional investment, potential regulatory frameworks established in major economies.

- 2030-2035: Further technological advancements, potentially including improved privacy features or integration with other blockchain technologies. Increased use of Bitcoin as a store of value and a hedge against inflation.

- 2035-2040: Maturity of the Bitcoin ecosystem, potential emergence of new use cases beyond payments and investment, possibly including decentralized finance (DeFi) applications and supply chain management.

Risks and Opportunities in Long-Term Bitcoin Investment

Investing in Bitcoin for the long term presents both significant opportunities and considerable risks. The potential for high returns is a major draw, but the volatility and uncertainty of the cryptocurrency market necessitate a careful assessment of the risks involved.

A balanced consideration requires understanding the potential downsides:

- Volatility: Bitcoin’s price is highly volatile and subject to significant fluctuations, potentially leading to substantial losses.

- Regulatory Uncertainty: Changes in government regulations could negatively impact Bitcoin’s price and accessibility.

- Technological Disruption: The emergence of superior blockchain technologies or competing cryptocurrencies could diminish Bitcoin’s dominance.

- Security Risks: Bitcoin exchanges and wallets are susceptible to hacking and theft, potentially leading to significant losses for investors.

Conversely, long-term Bitcoin investment offers compelling potential upsides:

- High Growth Potential: Bitcoin’s limited supply and growing adoption could lead to significant price appreciation over the long term.

- Inflation Hedge: Bitcoin’s decentralized nature and limited supply could make it a valuable hedge against inflation.

- Technological Innovation: The Bitcoin network continues to evolve, with ongoing improvements in scalability, security, and functionality.

- Diversification: Bitcoin can serve as a diversifier in a broader investment portfolio, reducing overall risk.

Risk Management and Investment Strategies

Navigating the cryptocurrency market, particularly around significant events like the Bitcoin halving, requires a robust risk management strategy. The halving’s impact on Bitcoin’s price is unpredictable, creating both opportunities and considerable risk. Understanding and implementing effective investment strategies is crucial for mitigating potential losses and maximizing potential gains.

The inherent volatility of Bitcoin necessitates a diversified approach to investing. Relying solely on Bitcoin exposes investors to significant downside risk. A well-structured portfolio balances Bitcoin exposure with other asset classes to reduce overall portfolio volatility.

Diversification and Asset Allocation

Effective risk management begins with diversification. This involves spreading investments across different asset classes, reducing the impact of any single asset’s underperformance. A sample portfolio might include a percentage allocation to Bitcoin, alongside traditional assets like stocks and bonds, and potentially other cryptocurrencies with differing characteristics. For example, a conservative investor might allocate 10% of their portfolio to Bitcoin, 60% to stocks, and 30% to bonds. A more aggressive investor might allocate 30% to Bitcoin, 40% to stocks, and 30% to other cryptocurrencies. The specific allocation depends on individual risk tolerance and financial goals. It’s important to regularly rebalance the portfolio to maintain the desired asset allocation.

Due Diligence Before Investing in Bitcoin

Thorough due diligence is paramount before investing in Bitcoin or any cryptocurrency. This involves a comprehensive understanding of the technology, market dynamics, and associated risks. Several key steps are crucial:

- Understand the Technology: Gain a basic understanding of blockchain technology, Bitcoin’s consensus mechanism (Proof-of-Work), and its limitations. Numerous online resources explain these concepts in accessible terms.

- Analyze Market Trends: Research Bitcoin’s historical price performance, considering factors like previous halvings, regulatory developments, and market sentiment. Examine price charts and analyze market cycles.

- Assess Risk Factors: Bitcoin’s price is highly volatile, influenced by various factors, including regulatory changes, technological advancements, and market speculation. Understand these risks and their potential impact on your investment.

- Secure Storage: Choose a secure method for storing your Bitcoin, such as a hardware wallet, to protect against theft or loss. Understand the security implications of different storage options.

- Consider Tax Implications: Familiarize yourself with the tax implications of Bitcoin investments in your jurisdiction. Cryptocurrency taxation varies widely across different countries.

Investment Strategies for Navigating the 2025 Halving

Several investment strategies can help navigate the volatility around the 2025 halving. These strategies are not financial advice and should be considered in conjunction with your own risk tolerance and financial goals.

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. DCA reduces the risk of investing a large sum at a market peak.

- Position Sizing: Carefully determine the appropriate amount to invest in Bitcoin, considering your overall portfolio and risk tolerance. Avoid investing more than you can afford to lose.

- Trailing Stop-Loss Orders: These orders automatically sell your Bitcoin if the price drops below a predetermined level, limiting potential losses.

- Hedging Strategies: Explore hedging strategies using derivatives, such as Bitcoin futures or options, to mitigate potential price declines.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding the upcoming Bitcoin halving in 2025 and its potential impact on the cryptocurrency market. Understanding these key aspects is crucial for making informed investment decisions.

Bitcoin Halving and its Price Effect

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years. The reduced supply, coupled with generally increasing demand, often leads to upward pressure on the price, as the scarcity of newly mined Bitcoin increases its value. However, it is important to note that other market factors also significantly influence the price.

Timing of the Next Bitcoin Halving

The next Bitcoin halving is expected around April 2025. The precise date depends on the block time, which can fluctuate slightly. This event is significant because it marks a substantial reduction in the inflation rate of Bitcoin, a factor often cited as a driver of long-term price appreciation. The previous halvings in 2012, 2016, and 2020 were followed by periods of significant price increases, although not immediately.

Guaranteed Price Rise After a Halving

It is not guaranteed that the Bitcoin price will rise after a halving. While reduced supply typically contributes to price increases, numerous other factors influence Bitcoin’s price, including macroeconomic conditions, regulatory changes, technological advancements, market sentiment, and competition from other cryptocurrencies. For example, the 2020 halving was followed by a significant price increase, but this was also influenced by broader adoption and institutional investment. Conversely, other external factors can negatively impact price regardless of a halving.

Preparing for the 2025 Bitcoin Halving

Preparing for the 2025 Bitcoin halving involves a multifaceted approach. Thorough research and understanding of market dynamics are paramount. Investors should develop a well-defined investment strategy, considering their risk tolerance and long-term goals. This could include dollar-cost averaging (DCA) to mitigate risk, diversifying investments across various asset classes, and only investing what you can afford to lose. Staying informed about market trends, technological developments, and regulatory updates is also crucial for making informed decisions. Furthermore, consulting with a financial advisor experienced in cryptocurrency investments can provide personalized guidance.

Illustrative Examples

Understanding the historical impact of Bitcoin halvings is crucial for predicting the 2025 event. Analyzing past price movements and market sentiment surrounding these events provides valuable insights into potential future trends, though it’s important to remember that past performance is not indicative of future results.

The following illustrates the price action around previous halvings, offering a visual representation through descriptive text. We will also explore a hypothetical scenario to showcase the potential impact on various investor profiles.

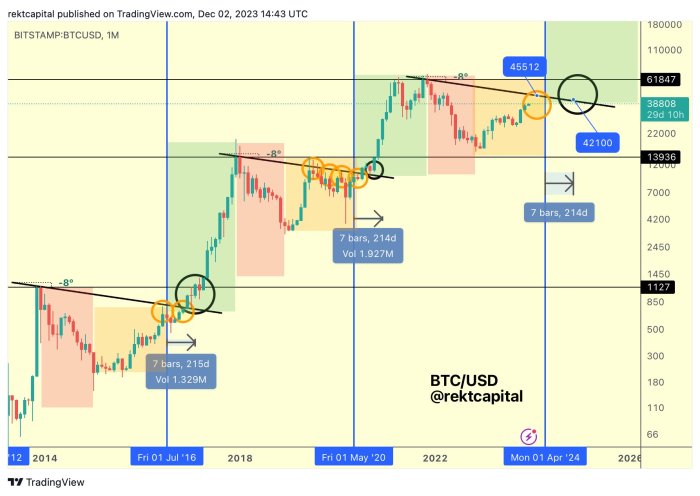

Bitcoin Halving Price Action: A Historical Overview

Imagine a graph charting Bitcoin’s price. The 2012 halving shows a relatively gradual price increase in the months leading up to the event, followed by a period of consolidation and then a significant bull run lasting several months after. Market sentiment during this period shifted from cautious optimism to exuberant bullishness as the halving approached and then the price began its ascent. The 2016 halving shows a similar pattern, though the bull run following this halving was more prolonged and dramatic than in 2012, leading to significantly higher prices. The 2020 halving saw a period of price stagnation before the halving, followed by a sharp increase leading to an all-time high in late 2021. However, this was followed by a significant correction, illustrating the volatility inherent in cryptocurrency markets even after a halving event. The visual representation would show distinct upward price trends following each halving, though the timing and magnitude of these increases varied.

Hypothetical Impact of the 2025 Halving on Different Investor Profiles

Let’s consider three investor profiles: a long-term holder, a short-term trader, and a new investor. Assume, hypothetically, that the 2025 halving leads to a gradual price increase over six months, followed by a more pronounced bull run, and eventually a correction.

The long-term holder, already invested for years, might see their holdings increase significantly in value. They would likely remain unfazed by short-term price fluctuations, focusing on the long-term potential of Bitcoin. This investor would likely benefit most from the halving’s deflationary pressure.

The short-term trader, on the other hand, might attempt to capitalize on the anticipated price volatility. They would aim to buy low, before the halving, and sell high during the bull run, potentially profiting from the short-term price swings. However, this strategy carries significant risk, as short-term price movements can be unpredictable and could result in losses. The success of this strategy depends on accurately predicting the timing of the market peaks and troughs.

A new investor, entering the market in anticipation of the halving, might face a dilemma. While they could potentially benefit from the price increase, they also risk investing at a market peak, leading to losses if the predicted bull run doesn’t materialize. Their decision would involve balancing the potential rewards with the inherent risks associated with market timing and volatility. This scenario highlights the importance of thorough research and risk management for any investor, regardless of experience level.