Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event in the Bitcoin protocol, is anticipated to occur in 2025. This event significantly impacts the cryptocurrency’s inflation rate and has historically been associated with periods of price appreciation. Understanding the mechanics of the halving and its potential effects is crucial for navigating the evolving Bitcoin market.

Bitcoin Halving Mechanics and Historical Impact

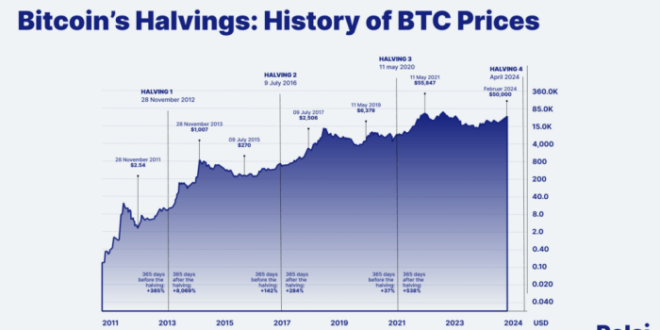

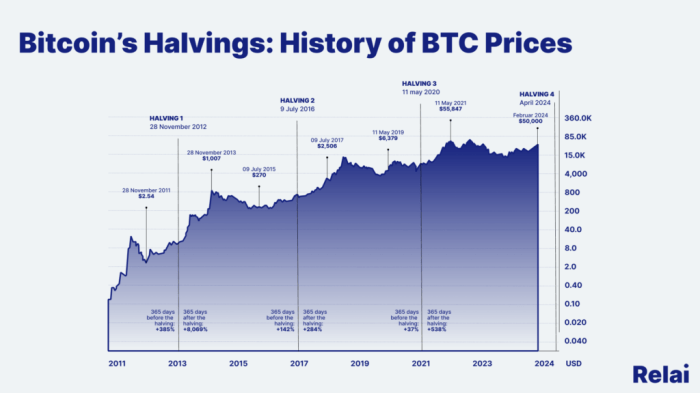

The Bitcoin halving mechanism reduces the rate at which new Bitcoins are created and added to the circulating supply. This occurs approximately every four years, or every 210,000 blocks mined. The reward for miners who successfully add a block to the blockchain is halved. Historically, the halving events of 2012, 2016, and 2020 were followed by substantial price increases, although the timing and magnitude of these increases varied. The price surge isn’t directly caused by the halving itself but rather by the resulting decrease in Bitcoin’s inflation rate, making it potentially more scarce and attractive to investors. The anticipation of the halving often fuels market speculation well in advance of the event.

Anticipated Supply Reduction in 2025 and Potential Consequences

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC per block. This represents a 50% decrease in the rate of new Bitcoin issuance. This reduction in supply, coupled with potentially sustained or increasing demand, could lead to upward pressure on the price. However, it’s important to note that the price is not solely determined by supply; factors such as macroeconomic conditions, regulatory changes, and market sentiment play significant roles. The halving acts as a catalyst, potentially accelerating pre-existing price trends rather than being the sole driver. Similar to previous halvings, we can anticipate increased market volatility surrounding the event.

Factors Influencing Bitcoin Price Post-2025 Halving

Several factors beyond the halving itself will influence Bitcoin’s price in the period following the 2025 event. These include: the overall state of the global economy (inflation, recessionary pressures, etc.), regulatory developments impacting cryptocurrencies in major jurisdictions, the adoption rate of Bitcoin by institutions and individuals, technological advancements within the Bitcoin network (like the Lightning Network’s scalability improvements), and prevailing market sentiment (fear, uncertainty, and doubt, or FUD, versus optimism). For example, a global economic downturn could negatively impact Bitcoin’s price regardless of the halving, while increased institutional adoption could drive significant price appreciation.

Timeline of Key Events Surrounding the 2025 Halving

The following timeline illustrates key events leading up to and following the 2025 Bitcoin halving. Note that these are estimations and subject to change.

| Date | Event | Potential Impact |

|---|---|---|

| 2023-2024 | Increased Market Speculation and Anticipation | Potential price increases driven by anticipation |

| Mid-2025 (estimated) | Bitcoin Halving Event | Significant reduction in Bitcoin supply inflation |

| Late 2025 – 2026 | Post-Halving Price Adjustment | Potential price increase or consolidation, depending on market forces |

| 2026 Onward | Long-term Price Trajectory | Determined by a confluence of macroeconomic and market factors |

Historical Price Analysis: Bitcoin Halving Price 2025

Analyzing Bitcoin’s price performance following past halving events offers valuable insights into potential future price movements. While past performance is not necessarily indicative of future results, studying these trends can reveal recurring patterns and influential factors. By comparing and contrasting the market conditions surrounding each halving, we can gain a better understanding of the complex interplay between supply reduction, market sentiment, and overall economic conditions.

Bitcoin’s price behavior after each halving has shown a mix of immediate increases and subsequent corrections. The magnitude and duration of these price swings vary considerably, highlighting the influence of extraneous factors beyond the halving itself. Understanding these nuances is crucial for forming a balanced perspective on the potential impact of the 2025 halving.

Bitcoin Halving Price Movements: A Comparison

The following table summarizes Bitcoin’s price performance around its previous halving events. Note that the timeframes considered are approximate, as the exact timing of significant price changes varies. The data reflects the general trend rather than precise day-to-day fluctuations.

| Halving Date | Approximate Price Before Halving (USD) | Approximate Price After Halving (USD) | Time to Peak Price (Months) | Peak Price (USD) | Market Conditions |

|---|---|---|---|---|---|

| November 28, 2012 | ~12 USD | ~100 USD | ~12 | ~1147 USD | Relatively low market capitalization, early adoption phase. |

| July 9, 2016 | ~650 USD | ~2000 USD | ~12 | ~19783 USD | Increased mainstream awareness, growing institutional interest. |

| May 11, 2020 | ~8700 USD | ~64000 USD | ~6 | ~64863 USD | Significant institutional investment, DeFi boom, global pandemic-related uncertainty. |

Factors Influencing Price Changes After Halvings

Several interconnected factors contribute to Bitcoin’s price movements following halving events. These include:

- Reduced Supply Inflation: The halving directly reduces the rate at which new Bitcoins are created, theoretically increasing scarcity and potentially driving up demand.

- Market Sentiment and Speculation: Anticipation of the halving often leads to increased buying pressure before the event, creating a price rally. However, this can also lead to a post-halving correction if investors take profits.

- Macroeconomic Conditions: Broader economic trends, such as inflation, interest rates, and geopolitical events, significantly influence investor behavior and Bitcoin’s price.

- Regulatory Developments: Changes in regulatory frameworks governing cryptocurrencies can affect market sentiment and liquidity.

- Technological Advancements: Innovations within the Bitcoin ecosystem, such as the Lightning Network, can positively influence adoption and price.

Similarities and Differences Across Halvings

While each halving event is unique, several common threads emerge. All three previous halvings witnessed an increase in Bitcoin’s price in the months following the event. However, the magnitude of the increase and the time it took to reach a peak varied significantly. This difference is largely attributable to the evolving market conditions surrounding each halving, including the level of institutional adoption, regulatory landscape, and overall macroeconomic environment. The 2020 halving, for instance, occurred during a period of heightened institutional interest and a global pandemic, contributing to a more dramatic price surge than seen in previous halvings.

Predicting the 2025 Halving Price

Predicting Bitcoin’s price at the 2025 halving is inherently speculative, relying on numerous interconnected factors that are difficult to precisely quantify. However, by analyzing key influences, we can construct a more informed, albeit still uncertain, forecast. This analysis will examine macroeconomic conditions, regulatory landscapes, institutional involvement, and technological advancements, all of which will play significant roles in shaping Bitcoin’s value leading up to and following the halving event.

Macroeconomic Factors and Bitcoin’s Price

Global macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, a recession could lead to risk-averse behavior, causing investors to liquidate assets, including Bitcoin, thus depressing its price. The strength of the US dollar, a common benchmark against which Bitcoin is valued, also plays a crucial role. A strong dollar generally puts downward pressure on Bitcoin’s price denominated in USD. The 2008 financial crisis, followed by quantitative easing measures, illustrated how macroeconomic instability can create conditions favorable for Bitcoin’s growth, though its price is still susceptible to broader market downturns.

Regulatory Changes and Governmental Policies

Governmental regulations and policies profoundly affect Bitcoin’s price and adoption. Favorable regulatory frameworks, such as clear guidelines for cryptocurrency exchanges and taxation, can boost investor confidence and increase institutional participation. Conversely, restrictive regulations, including outright bans or excessive taxation, can suppress demand and negatively impact price. The regulatory landscape varies significantly across jurisdictions, with some countries embracing Bitcoin as a potential asset class while others maintain a more cautious, even hostile, stance. For example, El Salvador’s adoption of Bitcoin as legal tender demonstrates the potential positive impact of government support, while China’s crackdown on cryptocurrency mining illustrates the opposite effect.

Institutional Investment and Adoption

The increasing involvement of institutional investors, such as large corporations and hedge funds, has a substantial impact on Bitcoin’s price. Large-scale investments can create significant buying pressure, pushing the price upward. Conversely, mass sell-offs by institutions can lead to sharp price declines. The growing acceptance of Bitcoin as a legitimate asset class by institutional players is a key driver of its long-term price trajectory. Grayscale Investments’ Bitcoin Trust, for instance, demonstrates the growing institutional interest and the resulting influence on market liquidity and price discovery.

Technological Advancements and Network Upgrades

Technological advancements within the Bitcoin network, including scaling solutions and improved security protocols, can positively affect its price. Improvements in transaction speed and reduced fees can enhance the usability and appeal of Bitcoin, potentially leading to increased adoption and higher demand. Conversely, major security breaches or significant technical setbacks could negatively impact investor confidence and suppress price. The successful implementation of the Lightning Network, for example, aims to address scalability challenges and could contribute to increased Bitcoin adoption and price appreciation.

Market Sentiment and Speculation

The Bitcoin market leading up to the 2025 halving is anticipated to be a complex interplay of factors, including the historical performance of Bitcoin around previous halving events, macroeconomic conditions, regulatory developments, and overall investor sentiment. While predicting the precise market sentiment is impossible, we can analyze historical trends and current indicators to form a reasonable expectation.

The prevailing sentiment will likely be a mixture of optimism and caution. Optimism will stem from the historically positive price action following previous halvings, driven by the expectation of reduced Bitcoin supply. This scarcity-driven narrative fuels the belief that the halving will act as a significant bullish catalyst. However, counterbalancing this optimism will be concerns regarding broader macroeconomic uncertainty, potential regulatory crackdowns, and the inherent volatility of the cryptocurrency market. These factors could introduce periods of considerable price correction, even amidst the generally positive expectation surrounding the halving.

Potential Price Volatility Triggers

Several factors could trigger significant price volatility around the 2025 halving. These include unexpected macroeconomic events (e.g., a major recession, significant inflation spikes, or geopolitical instability), regulatory changes impacting cryptocurrency trading or usage, significant technological advancements or setbacks in the Bitcoin ecosystem, and large-scale institutional investment or divestment. The timing of these events relative to the halving itself will play a crucial role in determining their impact on price. For example, a sudden regulatory crackdown close to the halving could trigger a sharp sell-off, while positive news about institutional adoption could amplify the bullish sentiment.

The Influence of Social Media and News Coverage

Social media and news coverage play a significant role in shaping investor expectations and driving market sentiment. Positive news and social media hype can easily fuel speculative bubbles, leading to rapid price increases. Conversely, negative news or social media narratives can create fear, uncertainty, and doubt (FUD), triggering sharp price corrections. The information ecosystem surrounding Bitcoin is often fragmented and prone to misinformation, which makes it crucial for investors to critically evaluate information sources and avoid emotional decision-making based solely on social media trends or sensationalized news headlines. The amplification of both positive and negative narratives through social media platforms, particularly during periods of high volatility, can lead to exaggerated market reactions. For instance, a single tweet from a prominent influencer could trigger a significant price swing.

Market Predictions for Bitcoin’s Price in 2025

The following table summarizes various market predictions for Bitcoin’s price in 2025. It’s important to note that these are merely predictions and should not be considered financial advice. The actual price will depend on numerous interacting factors that are difficult to predict with certainty.

| Prediction Source | Predicted Price (USD) | Rationale | Date of Prediction |

|---|---|---|---|

| Analyst A (Example) | $150,000 | Based on historical halving cycles and anticipated increased institutional adoption. | October 26, 2023 |

| Analyst B (Example) | $75,000 | Considers potential macroeconomic headwinds and regulatory uncertainty. | November 15, 2023 |

| Crypto Research Firm X (Example) | $100,000 – $200,000 | Uses a combination of on-chain metrics and macroeconomic forecasting models. | December 1, 2023 |

| Investment Bank Y (Example) | $50,000 | Predicts a more conservative price increase due to concerns about regulatory pressure. | January 10, 2024 |

Long-Term Bitcoin Price Projections

Predicting the future price of Bitcoin, or any asset for that matter, is inherently speculative. However, by considering various factors and employing different forecasting methodologies, we can construct plausible price scenarios for the years following the 2025 halving. These scenarios are not guarantees, but rather potential outcomes based on a range of assumptions.

Price Scenario Analysis: Bullish, Neutral, and Bearish Cases

We will examine three distinct price scenarios: a bullish case representing significant growth, a neutral case reflecting moderate growth aligned with historical trends, and a bearish case considering potential negative market influences. These scenarios will utilize a combination of on-chain metrics, macroeconomic factors, and adoption rates to build a comprehensive picture.

Bullish Scenario: Exponential Growth

This scenario assumes widespread institutional adoption, positive regulatory developments, and continued technological advancements within the Bitcoin ecosystem. It anticipates a significant increase in demand, exceeding the reduced supply created by the halving. We could see a scenario where Bitcoin’s price reaches $500,000 or more within five years of the 2025 halving. This projection relies heavily on a positive feedback loop: increasing price attracts further investment, driving up demand and price even further. This is analogous to the period leading up to Bitcoin’s previous all-time high.

Neutral Scenario: Gradual Appreciation

The neutral scenario assumes a more moderate pace of growth, reflecting a balance between positive and negative factors. This projection factors in the halving’s impact on supply, but anticipates a more stable, less volatile market. Price appreciation is gradual, with Bitcoin potentially reaching $200,000-$300,000 within five years post-halving. This scenario is based on historical price performance following previous halvings, adjusted for potential macroeconomic conditions. For instance, comparing the growth after the 2016 halving to current market maturity provides a reasonable basis for this prediction.

Bearish Scenario: Price Consolidation or Decline

This scenario considers potential headwinds such as increased regulatory scrutiny, macroeconomic instability, or a loss of investor confidence. A bearish outlook might see Bitcoin’s price consolidate around its pre-halving levels or even experience a decline in the short term. This scenario assumes that the reduced supply created by the halving is not sufficient to offset negative market sentiment or external pressures. In this case, a price range of $50,000-$150,000 within five years post-halving is plausible. This is analogous to market corrections seen in other asset classes, where periods of significant growth are followed by periods of consolidation or decline.

Methodology Comparison: Stock-to-Flow Model vs. Other Approaches

Several methodologies exist for predicting cryptocurrency prices. The Stock-to-Flow (S2F) model, popularized by PlanB, focuses on the scarcity of Bitcoin. While it has shown some correlation with past price movements, its accuracy is debated. Its strength lies in its simplicity and focus on a fundamental metric (supply). However, its weakness is its inability to fully account for market sentiment and external factors. Other approaches, such as technical analysis and fundamental analysis, provide complementary perspectives but also suffer from limitations in predicting long-term price movements. For instance, technical analysis relies on historical price charts and patterns, which may not hold true in a rapidly evolving market. Fundamental analysis assesses intrinsic value, but determining the intrinsic value of a cryptocurrency is challenging.

Comparison with Other Cryptocurrencies

Predicting the relative performance of Bitcoin against other cryptocurrencies is equally challenging. While Bitcoin maintains a dominant market share, alternative cryptocurrencies (altcoins) may experience periods of outperformance. The long-term success of altcoins depends on various factors, including their underlying technology, adoption rates, and the overall cryptocurrency market environment. Some altcoins might exhibit higher growth potential than Bitcoin in specific periods, but their higher risk profiles should be considered. This is similar to how individual stocks within a particular sector might outperform the overall market index.

Risks and Opportunities Associated with Bitcoin in 2025

The Bitcoin halving in 2025 presents a unique confluence of risk and opportunity. While the reduced supply could drive price appreciation, several factors could negatively impact Bitcoin’s value. Understanding these dynamics is crucial for informed investment decisions.

Potential Risks to Bitcoin’s Price

Several factors could negatively impact Bitcoin’s price in 2025. These risks range from technical vulnerabilities to broader macroeconomic and regulatory concerns. Failing to consider these risks could lead to significant financial losses.

- Security Breaches: Large-scale security breaches targeting exchanges or wallets could erode investor confidence and trigger a price drop. The 2021 Mt. Gox hack, which resulted in the loss of hundreds of thousands of Bitcoins, serves as a stark reminder of this risk. Improved security measures are constantly being implemented, but the potential for large-scale breaches remains.

- Regulatory Crackdowns: Increased regulatory scrutiny or outright bans in major markets could significantly reduce Bitcoin’s liquidity and price. The regulatory landscape is constantly evolving, and governments worldwide are grappling with how to regulate cryptocurrencies. A sudden shift in policy could have a dramatic impact.

- Market Manipulation: The relatively small size of the Bitcoin market compared to traditional financial markets makes it potentially susceptible to manipulation by large players. While regulations aim to mitigate this, the risk of coordinated price suppression or artificial inflation remains.

- Technological Risks: The underlying technology of Bitcoin is constantly evolving, and unforeseen bugs or vulnerabilities could lead to disruptions or even a security compromise. While the Bitcoin network is generally robust, the possibility of unexpected technological challenges cannot be entirely discounted.

- Macroeconomic Factors: Global economic downturns or shifts in monetary policy can significantly impact Bitcoin’s price. Bitcoin’s price has historically shown correlation with broader market trends, making it vulnerable to macroeconomic headwinds.

Opportunities Presented by the Halving

Conversely, the 2025 halving presents significant opportunities. The reduction in Bitcoin’s inflation rate, coupled with anticipated increased demand, could create a positive price pressure.

- Increased Scarcity: The halving event directly reduces the rate at which new Bitcoins are created, increasing the scarcity of the existing supply. This increased scarcity is often cited as a key driver of long-term price appreciation.

- Investor Interest: The halving event often generates renewed interest from investors, leading to increased demand and potential price appreciation. Past halvings have been associated with significant price increases in the months and years following the event, although the magnitude of these increases has varied.

- Technological Advancements: The halving could spur further innovation in the Bitcoin ecosystem, leading to improved scalability, usability, and adoption. This could further drive demand and price.

Risk Assessment Matrix

The following matrix illustrates a simplified assessment of the likelihood and potential impact of various risks. Note that these are subjective assessments and actual outcomes may vary.

| Risk | Likelihood (Low, Medium, High) | Impact (Low, Medium, High) |

|---|---|---|

| Major Security Breach | Medium | High |

| Significant Regulatory Crackdown | Medium | High |

| Market Manipulation | Medium | Medium |

| Unexpected Technological Issues | Low | Medium |

| Global Economic Downturn | Medium | High |

Strategies for Mitigating Investment Risks

Several strategies can help mitigate the risks associated with investing in Bitcoin. Diversification, risk tolerance assessment, and thorough research are key elements of responsible Bitcoin investment.

- Diversification: Don’t put all your eggs in one basket. Diversifying your investment portfolio across different asset classes can help reduce the overall risk.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of price fluctuations, can help reduce the impact of market volatility.

- Risk Tolerance Assessment: Understand your own risk tolerance before investing in Bitcoin. Bitcoin is a highly volatile asset, and only invest what you can afford to lose.

- Thorough Research: Stay informed about the latest developments in the Bitcoin market, including regulatory changes, technological advancements, and macroeconomic factors.

- Secure Storage: Use secure wallets and follow best practices to protect your Bitcoin from theft or loss.

Investing Strategies for the 2025 Halving

The Bitcoin halving event, scheduled for 2025, is anticipated to significantly impact the cryptocurrency’s price. Investors are already strategizing their approaches, considering various factors like risk tolerance, investment horizon, and market predictions. Understanding different investment strategies and their associated risks is crucial for navigating this potentially volatile period.

HODLing Strategy

HODLing, or holding onto Bitcoin regardless of short-term price fluctuations, is a popular long-term strategy. This approach relies on the belief that Bitcoin’s value will appreciate significantly over time, particularly after the halving event reduces the rate of new Bitcoin creation. The advantages include simplicity and the avoidance of transaction fees associated with frequent trading. However, the disadvantage is the potential for missed opportunities during periods of short-term price increases and the inherent risk of prolonged market downturns impacting overall returns. The strategy is best suited for investors with a high risk tolerance and a long-term investment horizon.

Dollar-Cost Averaging (DCA) Strategy

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the price. This strategy mitigates the risk of investing a lump sum at a market peak. By consistently purchasing Bitcoin, investors average out their purchase price, reducing the impact of price volatility. The advantage is its simplicity and risk reduction; the disadvantage is the potential for missing out on significant price drops that could allow for larger purchases. This strategy is suitable for investors with a moderate risk tolerance and a medium-to-long-term investment horizon.

Trading Strategy, Bitcoin Halving Price 2025

Active trading involves buying and selling Bitcoin based on short-term price movements and market analysis. This approach aims to capitalize on price fluctuations, potentially generating higher returns than HODLing. However, it requires significant market knowledge, technical analysis skills, and a high risk tolerance. The potential for high returns is offset by the significant risk of losses due to market volatility and the potential for incorrect predictions. This strategy is best suited for experienced investors with a high risk tolerance and the time and expertise to actively monitor the market.

Risk Management Strategies

Effective risk management is paramount for any Bitcoin investment strategy. Diversification, limiting investment to a percentage of one’s overall portfolio, and employing stop-loss orders to automatically sell Bitcoin if the price falls below a predetermined level are essential risk mitigation techniques. Regularly reviewing and adjusting the investment strategy based on market conditions and personal circumstances is also crucial. For instance, a stop-loss order at 20% below the purchase price can help limit potential losses during a sudden market downturn. A diversified portfolio that includes other assets can also reduce the overall impact of Bitcoin price volatility.

Comparison of Investment Strategies

| Strategy Name | Risk Level | Potential Return | Suitable Investor Profile |

|---|---|---|---|

| HODLing | High | High (Long-Term) | Long-term investor with high risk tolerance |

| Dollar-Cost Averaging | Medium | Medium | Medium-term investor with moderate risk tolerance |

| Trading | Very High | Very High (Potentially) | Experienced investor with high risk tolerance and market expertise |

FAQs

This section addresses frequently asked questions regarding the Bitcoin halving event expected in 2025, focusing on its impact on price, timing, prediction factors, investment risks and opportunities, and suitable investment strategies. Understanding these aspects is crucial for anyone considering Bitcoin investment around this significant event.

Bitcoin Halving and its Price Impact

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years. Historically, halvings have been followed by periods of significant price appreciation, although this is not guaranteed. The reduced supply of newly mined Bitcoin, combined with persistent demand, can create upward pressure on the price. However, other market forces, such as regulatory changes, macroeconomic conditions, and overall investor sentiment, also play a crucial role. The 2012 and 2016 halvings were followed by substantial price increases, but this doesn’t guarantee a similar outcome in 2025.

Expected Timing of the 2025 Halving

The Bitcoin halving is expected to occur in the spring of 2025. The precise date depends on the block creation time, which fluctuates slightly. While a precise date can’t be given until closer to the event, it’s widely anticipated to be sometime between March and May 2025, based on the predictable block generation rate. The community closely monitors the blockchain for the exact block height that triggers the halving.

Factors Affecting Post-Halving Price Prediction

Predicting the Bitcoin price after any halving is inherently challenging, as it depends on numerous interconnected factors. Key elements include the overall state of the global economy (inflation, recessionary fears, etc.), regulatory developments impacting cryptocurrency adoption, technological advancements within the Bitcoin network, and the prevailing sentiment among investors (fear, greed, etc.). For example, the 2020 halving coincided with a period of increased institutional interest in Bitcoin, contributing to the subsequent price rise. However, the 2022 bear market demonstrates that other macroeconomic factors can override the impact of the halving.

Risks and Opportunities of Investing Around the Halving

Investing in Bitcoin around a halving presents both significant risks and opportunities. The potential for substantial price appreciation is a major draw, but the cryptocurrency market is highly volatile. The price could decline even after a halving, particularly if broader market conditions are unfavorable. Investors should carefully assess their risk tolerance and only invest what they can afford to lose. The opportunity lies in potentially capitalizing on the historical trend of price increases following halvings, but the risk involves the possibility of significant losses due to market fluctuations.

Investment Strategies Before and After the Halving

Strategies for investing in Bitcoin around the halving vary based on individual risk profiles and investment goals. Some investors might adopt a “dollar-cost averaging” approach, gradually accumulating Bitcoin over time regardless of short-term price fluctuations. Others might choose a more aggressive strategy, investing a larger sum before the halving in anticipation of price appreciation, accepting the higher risk involved. Post-halving, some investors might take profits, while others might hold onto their Bitcoin, anticipating further price increases. It’s crucial to develop a well-defined investment plan and stick to it, adapting only if market conditions significantly change. Professional financial advice should be sought if needed.

Illustrative Example

This hypothetical scenario explores potential Bitcoin price movements in 2025, leading up to and following the halving event. We will consider macroeconomic factors, regulatory changes, and prevailing market sentiment to construct a plausible, though entirely fictional, price trajectory. It is crucial to remember that this is a speculative exercise and does not represent a prediction.

The scenario begins in early 2025 with Bitcoin trading around $40,000. Positive news regarding global adoption, coupled with increasing institutional investment, drives a gradual price increase throughout the first half of the year. This is fueled by a growing narrative surrounding Bitcoin as a hedge against inflation and geopolitical uncertainty.

Market Conditions and Investor Behavior in the Hypothetical Scenario

The initial price rise is relatively steady, with occasional corrections reflecting typical market volatility. However, as the halving approaches, anticipation builds, leading to increased speculation and a more pronounced upward trend. Retail investors, emboldened by previous halving cycles, actively participate in the market, further boosting demand. This period sees a surge in trading volume, accompanied by significant price swings as bullish and bearish sentiments battle for dominance. Larger institutional investors, however, remain more cautious, strategically accumulating Bitcoin throughout this period rather than aggressively chasing price gains. Several large financial institutions publicly announce their increased Bitcoin holdings, further bolstering investor confidence.

Hypothetical Price Movement Graph Description

The hypothetical price graph would show a generally upward trend throughout 2025. Starting at approximately $40,000 in January, the price steadily climbs to around $55,000 by June. The line then shows a period of consolidation before a sharper incline begins in August, driven by increasing halving anticipation. The price peaks at approximately $75,000 in October, shortly after the halving event. Following the peak, the graph depicts a period of moderate correction, with the price retracting to around $60,000 by December. This correction is attributed to profit-taking by some investors and a general cooling of the market after the intense pre-halving rally. The overall shape resembles a somewhat steep upward curve, culminating in a peak shortly after the halving, followed by a less steep downward correction. The volatility is higher during the months leading up to the halving and immediately afterward, reflecting the heightened market uncertainty and speculation. This volatility gradually decreases towards the end of the year.

News Events Shaping the Hypothetical Scenario

Several key news events contribute to the hypothetical price movement. In March, a major financial institution announces a significant Bitcoin purchase, triggering a positive market reaction. Conversely, a regulatory crackdown in a specific country in July leads to a temporary price dip. However, this negative news is quickly overshadowed by positive developments in other jurisdictions, where Bitcoin adoption is gaining momentum. The successful launch of a significant Bitcoin-related project in September further fuels the bullish sentiment leading up to the halving. The overall narrative is one of increasing global adoption and institutional acceptance, despite occasional setbacks.

Bitcoin Halving Price 2025 – The Bitcoin Halving in 2025 is a significant event expected to impact the cryptocurrency’s price. Predicting its exact effect is challenging, however, understanding potential price movements is crucial. For a visual representation of various predictions, check out this helpful resource: Bitcoin Price Prediction 2025 Chart. Ultimately, the Bitcoin Halving’s influence on the 2025 price will depend on several interacting market factors.

The Bitcoin Halving in 2025 is anticipated to significantly impact the cryptocurrency’s price, potentially triggering a bullish cycle. Understanding the potential price trajectory requires considering various factors, and a comprehensive analysis can be found by reviewing this insightful resource on Bitcoin Price 2025 Prediction. Ultimately, the 2025 Bitcoin Halving’s effect on price remains a subject of ongoing discussion and speculation within the crypto community.

The Bitcoin Halving in 2025 is a significant event expected to impact the cryptocurrency’s price. Many analysts are already speculating on the potential consequences, and for a comprehensive overview of predictions, it’s worth checking out this insightful piece on Bitcoin Price Prediction 2025 Forbes. Ultimately, the Bitcoin Halving’s effect on the price in 2025 remains a subject of ongoing debate and analysis within the cryptocurrency community.

Predicting the Bitcoin Halving Price 2025 is a complex endeavor, influenced by numerous factors beyond the halving event itself. Understanding community sentiment is crucial, and a good place to gauge this is by checking out discussions on Bitcoin Price 2025 Reddit , where diverse perspectives are shared. Ultimately, the impact of the halving on the Bitcoin Halving Price 2025 remains a subject of ongoing debate and speculation.

The Bitcoin Halving in 2025 is anticipated to significantly impact Bitcoin’s price, potentially triggering another bull run. To gain insight into potential price movements following the halving, it’s helpful to consult resources such as this Btc Price Prediction December 2025 analysis. Ultimately, the actual price will depend on various market factors, but understanding predicted price trajectories helps to contextualize the impact of the 2025 Bitcoin Halving.