Predicting Bitcoin’s Price Post-Halving

Predicting Bitcoin’s price is notoriously difficult, influenced by a complex interplay of factors ranging from macroeconomic conditions to regulatory changes and technological advancements. The upcoming halving event in 2024, however, presents a significant catalyst that many analysts believe will substantially impact the price in 2025. Understanding the potential price range requires considering various scenarios and the underlying assumptions driving each prediction.

Potential Bitcoin Price Scenarios in 2025

The following table Artikels potential price scenarios for Bitcoin in 2025, categorized as bullish, neutral, and bearish. These predictions are based on various market conditions and expert opinions, and should be viewed as potential outcomes, not guarantees. It’s crucial to remember that cryptocurrency markets are inherently volatile, and significant deviations from these predictions are entirely possible.

| Scenario | Price Range (USD) | Rationale |

|---|---|---|

| Bullish | $150,000 – $250,000 | This scenario assumes sustained institutional adoption, positive regulatory developments, and continued growth in the overall cryptocurrency market. A strong macroeconomic environment, with reduced inflation and increased investor confidence, would also contribute to this bullish outlook. The halving event would act as a catalyst, reducing the supply of new Bitcoins and increasing scarcity. This is similar to the price increase seen after previous halving events, although the magnitude is highly speculative. Examples of factors contributing to this scenario could include a successful Bitcoin ETF approval, major corporations adding Bitcoin to their balance sheets, and increasing global adoption as a store of value. |

| Neutral | $75,000 – $125,000 | This neutral scenario assumes a relatively stable macroeconomic environment, with moderate institutional adoption and a mixed regulatory landscape. While the halving event is expected to have a positive impact, other factors could offset this effect. For example, increased competition from other cryptocurrencies or a period of general market uncertainty could dampen price increases. This scenario anticipates a more gradual price appreciation compared to the bullish scenario, aligning with historical trends following previous halvings, but acknowledging potential headwinds. |

| Bearish | $30,000 – $60,000 | This bearish scenario assumes a negative macroeconomic environment, with increased regulatory scrutiny, significant market corrections, and reduced investor confidence. In this scenario, the positive impact of the halving could be overshadowed by broader economic concerns or negative news events impacting the cryptocurrency market. A potential regulatory crackdown on cryptocurrencies in major jurisdictions, a global recession, or a significant security breach within the Bitcoin ecosystem could contribute to this bearish outlook. This price range assumes a less impactful halving event compared to the bullish and neutral scenarios, potentially due to pre-emptive selling or other market forces. |

Prominent Analyst Predictions and Methodologies

Several prominent cryptocurrency analysts have offered price predictions for Bitcoin in 2025. These predictions often differ significantly due to variations in their underlying assumptions and methodologies. Some analysts rely heavily on on-chain metrics, such as the stock-to-flow model, while others incorporate macroeconomic factors and sentiment analysis. For example, some analysts might emphasize the scarcity of Bitcoin created by the halving, while others focus on the potential impact of inflation on investor behavior. The lack of a universally accepted methodology makes comparing predictions challenging, highlighting the inherent uncertainty in the market. It’s important to critically evaluate the assumptions and data used by each analyst before considering their predictions. Many predictions are often shrouded in uncertainty, making direct comparisons difficult without understanding the complete rationale behind each one. Therefore, a detailed comparison of individual analyst predictions is not provided here due to the complexity and the constantly evolving nature of market analysis.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of macroeconomic conditions, regulatory landscapes, technological advancements, and investor sentiment. While no one can definitively predict the future, analyzing these key factors provides a framework for understanding potential price movements.

Macroeconomic Factors and Their Impact, Bitcoin Halving Price Prediction 2025

Global macroeconomic conditions significantly influence Bitcoin’s price. High inflation, for instance, can drive investors towards alternative assets like Bitcoin, perceived as a hedge against inflation. Conversely, rising interest rates, often implemented to combat inflation, can reduce the attractiveness of Bitcoin as investors shift towards higher-yielding assets. A robust global economic outlook might lead to less demand for Bitcoin as risk appetite decreases, while a recessionary environment could potentially increase its appeal as a safe haven. For example, the 2022 inflationary environment saw increased Bitcoin investment, while subsequent interest rate hikes led to a period of price correction. The overall global economic health in 2025 will therefore be a critical factor in determining Bitcoin’s value.

Regulatory Developments and Bitcoin Adoption

Regulatory clarity and acceptance significantly impact Bitcoin adoption and, consequently, its price. Favorable regulations, such as clear tax frameworks and licensing for cryptocurrency exchanges, can boost institutional and retail investment, driving price increases. Conversely, stringent regulations or outright bans can stifle adoption and lead to price declines. The regulatory landscape varies considerably across countries; a more permissive environment in major economies could significantly boost Bitcoin’s price, while a highly restrictive environment in others could dampen growth. The evolving regulatory landscape in the United States, for example, will play a pivotal role in influencing global Bitcoin adoption and price.

Technological Advancements and Bitcoin’s Network

Technological advancements, particularly in layer-2 scaling solutions, can significantly impact Bitcoin’s network efficiency and transaction speeds. Improvements like the Lightning Network aim to reduce transaction fees and increase throughput, potentially making Bitcoin more practical for everyday use. Wider adoption of such solutions could lead to increased demand and, subsequently, a price increase. The success of layer-2 scaling and its integration into mainstream applications will be crucial in determining Bitcoin’s future usability and, consequently, its price.

Institutional Adoption versus Retail Investor Sentiment

The interplay between institutional and retail investor sentiment is crucial in determining Bitcoin’s price volatility. Large-scale institutional investments, often driven by macroeconomic factors and risk assessment, can provide significant upward pressure on the price. However, retail investor sentiment, often subject to market hype and fear, can contribute to significant price fluctuations, potentially leading to both sharp rises and falls. For example, the 2021 bull run was fueled by a combination of institutional interest and significant retail investor enthusiasm, while subsequent corrections were partly driven by shifting retail sentiment. The balance between these two forces will be a significant factor influencing Bitcoin’s price trajectory in 2025.

Bitcoin’s Long-Term Price Trajectory: Bitcoin Halving Price Prediction 2025

Predicting Bitcoin’s price far into the future is inherently speculative, yet understanding potential influencing factors allows for a reasoned exploration of possible trajectories. While no one can definitively state Bitcoin’s price in 2030 or beyond, examining historical trends, technological advancements, and macroeconomic shifts provides a framework for informed speculation.

Potential Milestones and Events Shaping Bitcoin’s Price Beyond 2025

Several key events and developments could significantly impact Bitcoin’s price in the coming years. These range from technological improvements within the Bitcoin network itself to broader adoption and regulatory changes globally. Considering these factors helps build a more comprehensive picture of potential price movements.

- Increased Institutional Adoption: Further integration of Bitcoin into institutional portfolios could drive significant price increases. This includes larger corporations holding Bitcoin as a reserve asset, similar to MicroStrategy’s strategy.

- Regulatory Clarity: Clear and consistent regulatory frameworks across major global economies could boost investor confidence and lead to greater mainstream adoption. Conversely, overly restrictive regulations could stifle growth.

- Technological Upgrades: Improvements to Bitcoin’s scalability, such as the Lightning Network’s wider adoption, could enhance its usability for everyday transactions, potentially increasing demand.

- Global Economic Shifts: Macroeconomic events, such as inflation or geopolitical instability, could influence Bitcoin’s role as a store of value and potentially drive price volatility.

- Competition from Altcoins: The emergence of competing cryptocurrencies with superior technology or features could potentially divert investment away from Bitcoin, impacting its price.

Bitcoin’s Mainstream Adoption and Price Appreciation

The potential for Bitcoin to become a widely accepted mainstream asset is a key factor in its long-term price trajectory. If Bitcoin achieves widespread adoption as a medium of exchange, a store of value, or both, its price could appreciate significantly. This could be driven by increased demand from individuals and businesses alike, leading to a scarcity effect given Bitcoin’s limited supply of 21 million coins. However, widespread adoption is not guaranteed and depends on several factors, including regulatory developments, technological advancements, and user experience. For example, the success of payment processors integrating Bitcoin could greatly accelerate its adoption as a transactional currency.

Risks Associated with Bitcoin Investment

Investing in Bitcoin carries substantial risks. The cryptocurrency market is notoriously volatile, subject to significant price swings driven by speculation, news events, and market sentiment. Regulatory uncertainty also poses a risk, as governments worldwide are still developing their approaches to regulating cryptocurrencies. This uncertainty can lead to price volatility and potential legal challenges for investors. Further, the potential for hacking, theft, and loss of private keys is a significant concern that needs to be addressed through secure storage practices. The lack of inherent value, compared to assets like gold, also presents a risk as its value is entirely dependent on market perception and demand.

Technological Advancements and Market Conditions Affecting Long-Term Price Projections

Technological advancements within the Bitcoin ecosystem and broader market conditions will significantly influence long-term price projections. For instance, advancements in Layer-2 scaling solutions like the Lightning Network could drastically improve transaction speeds and reduce fees, making Bitcoin more suitable for everyday transactions and potentially driving up demand. Conversely, the emergence of quantum computing poses a potential long-term threat, as it could theoretically break the cryptographic algorithms securing the Bitcoin network. Market conditions, including interest rates, inflation, and overall economic health, will also play a significant role. For example, periods of high inflation could potentially increase demand for Bitcoin as an inflation hedge, driving its price upwards.

Illustrative Scenarios

Predicting Bitcoin’s price with certainty is impossible, but exploring potential scenarios based on various market conditions can offer valuable insights for investors. The following illustrates three distinct price paths for Bitcoin in 2025, post-halving, encompassing bullish, neutral, and bearish outcomes. Each scenario considers factors like adoption rates, regulatory developments, and macroeconomic trends.

Bullish Scenario: Bitcoin Price in 2025

This scenario depicts a significant price surge for Bitcoin in 2025. The visual representation would be a line graph showing a steep upward trajectory. The x-axis represents time (2024-2025), and the y-axis represents Bitcoin’s price in USD. The line starts at a point representing the price at the end of 2024 and then sharply ascends towards a price point significantly higher. The line’s color would be a vibrant green to symbolize growth. A small annotation near the peak could show the projected price, for example, $150,000.

Market conditions assumed for this scenario include widespread institutional adoption, positive regulatory developments globally, and continued growth in the overall cryptocurrency market capitalization. Key indicators supporting this scenario would be consistently high trading volume, increasing on-chain activity, and positive sentiment in both traditional and crypto media. The implications for investors would be substantial profits for early adopters and long-term holders, potentially exceeding returns seen in previous bull markets.

Neutral Scenario: Bitcoin Price in 2025

The visual representation for this scenario would be a line graph showing a relatively flat trajectory. The x-axis and y-axis remain the same as the bullish scenario. The line starts at a point representing the price at the end of 2024 and moves relatively horizontally, with minor fluctuations, across 2025. The line’s color would be a muted blue, representing stability. The projected price at the end of 2025 would be relatively close to the starting point, perhaps a modest increase of 10-20%.

This scenario assumes a period of consolidation in the cryptocurrency market. Regulatory uncertainty remains, and while adoption continues, it does so at a slower pace than in the bullish scenario. Macroeconomic factors like inflation and interest rates could exert influence, dampening significant price movements. Key indicators would include moderate trading volume, relatively stable on-chain activity, and a more cautious sentiment from investors. The implications for investors would be moderate returns, possibly similar to or slightly exceeding traditional market performance. This scenario emphasizes the importance of diversification and risk management.

Bearish Scenario: Bitcoin Price in 2025

This scenario illustrates a significant price decline for Bitcoin in 2025. The visual would be a line graph showing a downward trend. The x-axis and y-axis remain the same. The line starts at a point representing the price at the end of 2024 and then descends, showing a noticeable drop in price by the end of 2025. The line’s color would be red, signifying a bearish trend. A small annotation near the lowest point could show the projected price, for example, $30,000.

This scenario assumes a negative impact from major regulatory crackdowns, a broader cryptocurrency market crash, or significant macroeconomic instability. Key indicators would include sharply decreased trading volume, a drop in on-chain activity, and overwhelmingly negative sentiment from both traditional and crypto media. The implications for investors would be significant losses, potentially wiping out a large portion of their investments. This scenario highlights the importance of careful risk assessment and the potential for substantial downside in volatile markets. It might mirror the market conditions experienced during the 2018 bear market, albeit potentially with different underlying causes.

Frequently Asked Questions (FAQ)

This section addresses common questions regarding the Bitcoin halving and its potential impact on the price of Bitcoin in 2025. Understanding these key aspects is crucial for anyone considering investing in or following Bitcoin’s market trajectory.

Bitcoin Halving Mechanism and Price Impact

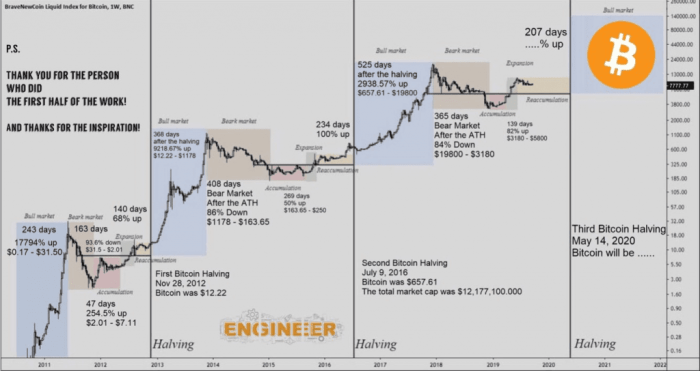

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created by approximately half. This occurs roughly every four years, or every 210,000 blocks mined. The halving mechanism is designed to control inflation and maintain the scarcity of Bitcoin. Historically, halvings have been followed by periods of significant price increases, though the extent and timing of these increases vary. For example, the 2012 and 2016 halvings were followed by substantial bull runs, demonstrating a potential correlation between halving events and price appreciation. However, it’s crucial to remember that other market factors also play a significant role.

Factors Determining Bitcoin’s Price in 2025

Several interconnected factors will significantly influence Bitcoin’s price in 2025. These include: widespread adoption by individuals and institutions; regulatory clarity and acceptance from governments worldwide; macroeconomic conditions, such as inflation rates and overall economic stability; technological advancements in the Bitcoin network and its ecosystem; and the level of competition from alternative cryptocurrencies. For instance, increased institutional adoption could lead to higher demand and consequently, price appreciation. Conversely, stringent regulations could dampen market enthusiasm and potentially suppress prices.

Accuracy of Bitcoin Price Prediction

Accurately predicting Bitcoin’s price is inherently challenging due to its high volatility and the multitude of unpredictable factors influencing its value. The cryptocurrency market is susceptible to speculative bubbles, rapid price swings, and external shocks, making precise forecasting highly improbable. While historical data and technical analysis can offer insights, they are not foolproof predictors of future price movements. Consider the 2017 Bitcoin bubble, which saw a meteoric rise followed by a dramatic crash, highlighting the unpredictable nature of the market.

Risks Associated with Bitcoin Investment

Investing in Bitcoin carries substantial risks. High volatility is a primary concern, with prices experiencing significant fluctuations in short periods. Regulatory uncertainty is another major risk, as governments worldwide are still developing frameworks for cryptocurrencies. Changes in regulations can drastically impact the market. Security risks, including hacking and theft from exchanges or personal wallets, are also significant considerations. Furthermore, the speculative nature of the market means that the value of Bitcoin could decline significantly, potentially leading to substantial financial losses. Therefore, thorough research and risk assessment are crucial before investing.