Bitcoin Price Predictions for 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, relying on extrapolations from current trends and assumptions about future market dynamics. However, by exploring various potential scenarios, we can gain a better understanding of the possible range of outcomes. The following analysis presents three distinct scenarios: bullish, bearish, and neutral, each grounded in specific economic and technological factors.

Bitcoin Price Prediction Scenarios for 2025

Three distinct scenarios illustrate the potential price range of Bitcoin in 2025. These scenarios are not mutually exclusive and the actual price may fall somewhere between or even outside these projections. The methodologies used to arrive at these predictions involve analyzing historical price data, considering macroeconomic factors like inflation and regulatory changes, and assessing the adoption rate of Bitcoin as a payment method and store of value.

Bullish Scenario: Bitcoin Surges to New Heights

This scenario envisions a continued rise in Bitcoin’s price, driven by several factors. Widespread institutional adoption, fueled by increasing confidence in Bitcoin’s stability and scarcity, could lead to significant price appreciation. Furthermore, a global shift towards decentralized finance (DeFi) and increased regulatory clarity in key markets could propel demand. This scenario anticipates a significant increase in Bitcoin’s use as a store of value, especially in emerging markets with unstable currencies. In this bullish case, we might see Bitcoin reaching a price of $200,000 or more by 2025. This is based on the assumption of continued technological advancements, increasing institutional investment, and a growing acceptance of Bitcoin as a legitimate asset class. Similar price increases have been observed in other asset classes like gold throughout history, though it is important to note that Bitcoin’s volatility makes such predictions highly uncertain.

Bearish Scenario: Bitcoin Faces Significant Headwinds

Conversely, a bearish scenario suggests a decline in Bitcoin’s price. This could be triggered by several factors, including increased regulatory scrutiny leading to tighter restrictions on cryptocurrency trading, a major security breach undermining confidence, or a broader economic downturn impacting investor sentiment. Increased competition from alternative cryptocurrencies or technological advancements rendering Bitcoin obsolete could also contribute to a price decline. In this scenario, Bitcoin’s price might fall to $20,000 or even lower by 2025. This outcome is based on a pessimistic outlook for the crypto market, potentially triggered by negative macroeconomic events or technological disruptions. Historical examples like the dot-com bubble burst illustrate how rapid technological shifts can drastically impact asset valuations.

Neutral Scenario: Bitcoin Consolidates and Stabilizes

A neutral scenario suggests that Bitcoin’s price will remain relatively stable, consolidating within a defined range. This scenario anticipates a balance between positive and negative factors. While adoption continues to grow, it might not be as rapid as in the bullish scenario. Regulatory uncertainty could persist, limiting institutional investment. However, Bitcoin’s inherent properties as a decentralized, limited-supply asset could prevent a drastic price collapse. This scenario projects a price range between $50,000 and $80,000 by 2025. This projection assumes a more moderate pace of adoption and a continuation of the current level of regulatory uncertainty.

Comparison of Methodologies and Visual Representation

The methodologies used for these predictions differ in their assumptions about future economic conditions and technological advancements. The bullish scenario relies on optimistic assumptions about widespread adoption and positive regulatory developments, while the bearish scenario assumes negative economic conditions and increased regulatory hurdles. The neutral scenario takes a more balanced approach, acknowledging both potential upsides and downsides.

The strengths of these approaches lie in their consideration of various factors influencing Bitcoin’s price. However, their weaknesses stem from the inherent uncertainty of predicting future events. All three scenarios are subject to significant uncertainty, as unpredictable events could significantly impact Bitcoin’s price.

A line graph would effectively illustrate these scenarios. The X-axis would represent time (2023-2025), and the Y-axis would represent Bitcoin’s price in USD. Three lines would represent the bullish, bearish, and neutral scenarios. The bullish line would show a steep upward trend, reaching $200,000 by 2025. The bearish line would show a downward trend, reaching $20,000 by 2025. The neutral line would show a relatively flat trend, fluctuating within the $50,000-$80,000 range. Key price points and timelines for each scenario would be clearly labeled. The graph would visually represent the range of potential outcomes and the uncertainty inherent in Bitcoin price prediction.

Factors Influencing Bitcoin’s Value in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of macroeconomic factors, regulatory landscapes, and technological advancements. While no one can definitively state the price, understanding these influencing elements allows for a more informed assessment of potential price movements.

Macroeconomic Factors Impacting Bitcoin’s Price

Several significant macroeconomic trends will likely shape Bitcoin’s value by 2025. These factors are interconnected and their combined effect is difficult to precisely predict, but their individual influences are significant.

- Global Inflation and Monetary Policy: High inflation rates, often countered by increased interest rates from central banks, can drive investors towards Bitcoin as a hedge against inflation. The 2022 inflation surge, for instance, saw increased Bitcoin adoption by some investors seeking to preserve their purchasing power. However, rising interest rates can also make holding non-yielding assets like Bitcoin less attractive, creating a countervailing force.

- Economic Recessions and Geopolitical Instability: Periods of economic uncertainty and geopolitical turmoil often lead to increased demand for safe-haven assets, including Bitcoin. Investors might seek refuge in Bitcoin’s decentralized nature, perceiving it as less susceptible to government intervention or economic shocks than traditional financial instruments. The war in Ukraine, for example, saw a surge in interest in Bitcoin in certain regions experiencing high levels of uncertainty.

- The US Dollar’s Strength: The value of the US dollar significantly influences Bitcoin’s price, typically exhibiting an inverse relationship. A strong dollar generally weakens Bitcoin’s value (as Bitcoin is priced in USD), while a weakening dollar can boost Bitcoin’s price. This dynamic is driven by investors shifting between fiat currencies and Bitcoin based on perceived relative value and stability.

- Adoption by Institutional Investors: Growing institutional investment in Bitcoin can significantly impact its price. Large-scale investments from corporations, pension funds, and other institutional players can drive up demand and push prices higher. The increasing acceptance of Bitcoin by some major financial institutions represents a notable shift in this direction.

- Global Energy Prices and Environmental Concerns: Bitcoin’s energy consumption is a significant concern. Fluctuations in global energy prices directly impact Bitcoin mining costs, which can affect its profitability and consequently its price. Furthermore, growing environmental concerns could lead to stricter regulations on energy-intensive crypto mining, impacting Bitcoin’s price and future adoption.

Regulatory Changes and Bitcoin Adoption

Government regulations significantly influence Bitcoin’s adoption and price. Differing regulatory approaches across global markets create diverse impacts.

Bitcoin In 2025 Prediction – For instance, countries embracing a positive regulatory framework, offering clear guidelines for Bitcoin use and trading, are likely to see increased adoption and potentially higher prices within their respective markets. Conversely, nations imposing strict bans or heavy restrictions could suppress local demand and limit price appreciation. The varying regulatory stances in countries like El Salvador (pro-Bitcoin) and China (anti-Bitcoin) illustrate this dynamic.

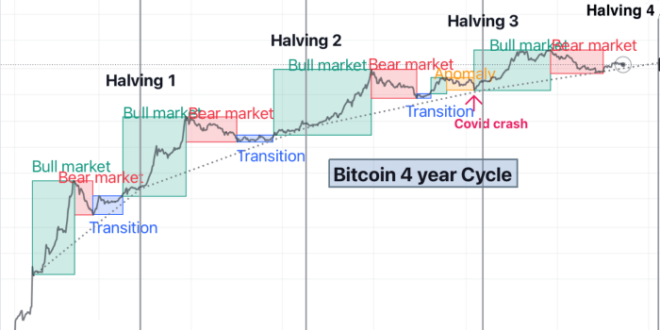

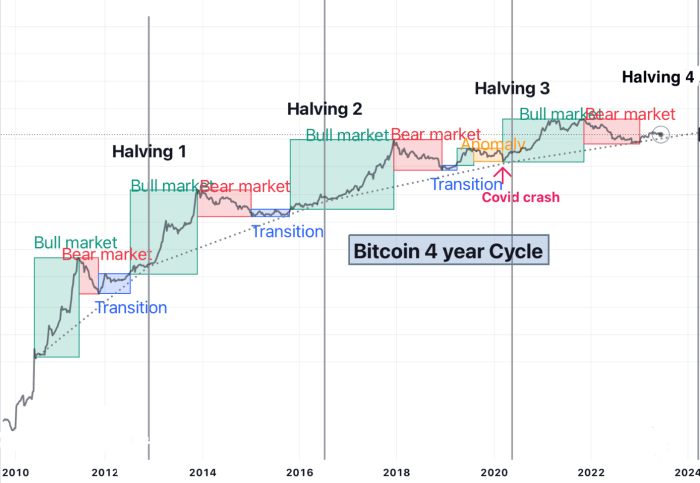

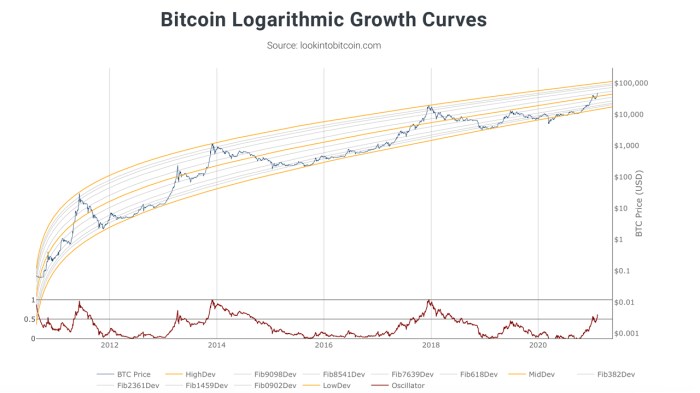

Predicting Bitcoin’s value in 2025 is challenging, with various factors influencing its trajectory. A key event to consider when formulating these predictions is the upcoming Bitcoin halving, significantly impacting the rate of new Bitcoin creation. For detailed information on this crucial event, refer to this insightful resource on Data Halving Bitcoin 2025. Understanding the halving’s potential effects is vital for any comprehensive Bitcoin 2025 prediction.

Technological Advancements and Bitcoin’s Efficiency

Technological advancements, particularly layer-2 scaling solutions, play a crucial role in shaping Bitcoin’s future.

Layer-2 solutions, such as the Lightning Network, aim to improve Bitcoin’s transaction speed and reduce fees without compromising its underlying security. Widespread adoption of these technologies could significantly enhance Bitcoin’s usability and appeal to a broader range of users, potentially driving increased demand and price appreciation. Successful implementation and adoption of such solutions could address some of the scalability challenges currently faced by Bitcoin.

Predicting Bitcoin’s price in 2025 is challenging, with various factors influencing its trajectory. A key event impacting future price predictions is the Bitcoin halving, which significantly affects the rate of new Bitcoin entering circulation. To understand the long-term implications, it’s helpful to know when the next halving events will occur after 2025; you can find that information here: When Is Bitcoin Halving After 2025.

This knowledge is crucial for formulating more accurate Bitcoin In 2025 predictions, considering the reduced inflation post-halving.

Bitcoin’s Role in the Financial Landscape of 2025

By 2025, Bitcoin’s integration into the global financial system is expected to be significantly more pronounced than it is today. While complete mainstream adoption remains uncertain, several key developments will likely shape its role. This includes increased regulatory clarity in various jurisdictions, the maturation of Bitcoin-related financial instruments, and the growing acceptance of Bitcoin as a store of value and a means of payment within specific sectors.

Bitcoin’s influence on traditional finance in 2025 will likely manifest in several ways. We might see increased institutional investment, leading to greater liquidity and price stability. Furthermore, the development of Bitcoin-backed financial products, such as exchange-traded funds (ETFs) and other derivatives, could attract a wider range of investors. The increasing use of Bitcoin for cross-border payments, driven by its lower transaction fees and faster settlement times compared to traditional methods, could also disrupt existing financial infrastructure. However, the extent of this disruption will depend heavily on regulatory frameworks and the overall macroeconomic climate.

Bitcoin’s Position Relative to Other Cryptocurrencies

Bitcoin’s “first-mover advantage” and established network effect will likely solidify its position as the dominant cryptocurrency in 2025. While alternative cryptocurrencies (altcoins) may continue to innovate and attract niche markets, Bitcoin’s market capitalization and brand recognition are expected to remain substantial. Its proven track record, established infrastructure, and wider acceptance among investors and businesses will likely contribute to its continued dominance. However, the emergence of new technologies or unforeseen events could potentially challenge this dominance, though it’s unlikely to be completely overturned within this timeframe. For example, the rise of layer-2 scaling solutions on other networks could improve transaction speeds and reduce fees, potentially attracting users away from Bitcoin. But Bitcoin’s inherent security and established network will still be significant factors.

Bitcoin’s Impact on Global Financial Markets

Bitcoin’s impact on global financial markets in 2025 is likely to be multifaceted and potentially significant. Its increasing adoption as a store of value could lead to a gradual shift in portfolio allocations, with investors diversifying their holdings to include Bitcoin alongside traditional assets. This could lead to increased volatility in traditional markets as investors adjust their positions. Furthermore, the potential for Bitcoin to act as a hedge against inflation or currency devaluation could influence monetary policy decisions by central banks globally. However, the overall impact will depend on several factors, including the pace of Bitcoin adoption, regulatory developments, and macroeconomic conditions. A scenario where Bitcoin becomes widely adopted as a means of payment could drastically alter the landscape of international finance, though this remains a less likely scenario in the short term. The level of Bitcoin’s influence on global markets will be directly proportional to the level of its adoption and integration into the existing financial infrastructure.

Bitcoin Adoption and Usage in 2025

Predicting Bitcoin’s adoption and usage in 2025 requires considering various factors, including technological advancements, regulatory landscapes, and evolving societal attitudes towards digital currencies. While precise figures are impossible, we can extrapolate potential trends based on current growth patterns and emerging use cases. This forecast will examine adoption across demographics and geographic regions, the evolution of Bitcoin’s applications, and its integration into everyday life.

By 2025, Bitcoin adoption is likely to show significant regional disparities. Developed nations with robust financial infrastructure and tech-savvy populations, such as the US, parts of Europe, and certain Asian countries, will likely see higher adoption rates than developing nations where access to technology and financial literacy are more limited. Within these regions, younger demographics (Millennials and Gen Z) are predicted to exhibit higher adoption rates than older generations, driven by their familiarity with digital technologies and a greater openness to decentralized systems. However, a significant portion of the population in all regions will remain outside the Bitcoin ecosystem due to factors like security concerns, regulatory uncertainty, and a lack of understanding. For example, while a significant portion of tech-savvy millennials in major US cities might utilize Bitcoin for transactions or investments, adoption among rural populations in less developed countries will likely remain low.

Bitcoin Adoption Rates Across Demographics and Geographic Regions

Several factors will contribute to varying adoption rates. Technological accessibility, financial literacy levels, regulatory environments, and the perceived risk associated with Bitcoin will all play a role. We can anticipate a gradual increase in adoption across all demographics and regions, but the pace will differ significantly. For instance, while countries like El Salvador, which have already embraced Bitcoin as legal tender, may experience rapid growth, others with strict regulatory frameworks will see slower adoption. Furthermore, the level of financial literacy within a population will heavily influence the rate of Bitcoin adoption. Areas with high financial literacy will likely see faster adoption compared to regions where understanding of cryptocurrency remains limited.

Evolution of Bitcoin’s Use Cases

Bitcoin’s use cases are expected to evolve beyond its initial conception as a purely digital currency. While peer-to-peer payments will continue to be a core application, its role in investment portfolios will likely expand. Decentralized finance (DeFi) applications built on Bitcoin’s blockchain are also poised for significant growth, offering innovative financial products and services without intermediaries. For example, Bitcoin-backed loans and decentralized exchanges (DEXs) will become more mainstream, attracting users seeking alternative financial solutions. This expansion will necessitate improved user interfaces and more user-friendly platforms to facilitate wider adoption across various demographics.

Bitcoin’s Integration into Everyday Life in 2025

By 2025, Bitcoin’s integration into everyday life will likely be more pronounced than it is today. While widespread adoption for daily transactions might still be limited in many regions, specific examples demonstrate its potential impact.

- Microtransactions: Bitcoin’s low transaction fees could make it ideal for microtransactions, such as online content purchases, tipping systems, and in-game purchases. Imagine buying a digital newspaper subscription or sending a small tip to a content creator using Bitcoin, with near-instantaneous and low-cost processing.

- International Remittances: Bitcoin’s borderless nature can facilitate cheaper and faster international money transfers, benefiting migrant workers and individuals sending money across borders. A worker sending money home to their family could experience significantly reduced fees and faster transfer times compared to traditional banking systems.

- Investments and Savings: Bitcoin’s position as a store of value will likely solidify, with more individuals incorporating it into their investment portfolios. This could manifest as direct Bitcoin holdings or through investment products such as Bitcoin ETFs.

- Supply Chain Management: Bitcoin’s blockchain technology could enhance transparency and traceability in supply chains, allowing businesses to track goods and verify their authenticity. Imagine a luxury goods company using Bitcoin’s blockchain to verify the provenance of its materials, providing customers with verifiable proof of authenticity.

Risks and Challenges Facing Bitcoin in 2025

Predicting the future of Bitcoin is inherently complex, involving a confluence of technological, economic, and regulatory factors. While Bitcoin’s potential is vast, several significant risks and challenges could hinder its growth and widespread adoption by 2025. Understanding these potential obstacles is crucial for a realistic assessment of Bitcoin’s future.

Environmental Concerns Surrounding Bitcoin Mining, Bitcoin In 2025 Prediction

The energy consumption associated with Bitcoin mining is a significant and persistent concern. The proof-of-work consensus mechanism requires vast computational power, leading to substantial electricity usage and carbon emissions. This has drawn criticism from environmental groups and regulators, prompting calls for more sustainable mining practices. The potential impact ranges from stricter regulations limiting mining operations in certain regions to a shift in public perception, potentially impacting Bitcoin’s price and adoption. For example, countries with stringent environmental policies might ban or heavily restrict Bitcoin mining, reducing the overall hash rate and potentially increasing transaction fees. Conversely, the development and adoption of more energy-efficient mining technologies, such as those utilizing renewable energy sources, could mitigate some of these concerns. The long-term sustainability of Bitcoin will depend heavily on its ability to address these environmental challenges effectively.

Regulatory Uncertainty and Government Intervention

Varying and evolving government regulations pose a substantial risk to Bitcoin’s future. Different countries have adopted contrasting approaches, ranging from outright bans to regulatory frameworks that aim to control and monitor cryptocurrency transactions. This regulatory uncertainty can create instability in the market, affecting investor confidence and hindering the growth of Bitcoin-related businesses. For instance, a sudden crackdown on cryptocurrency exchanges in a major market could trigger a significant price drop. Similarly, inconsistent regulations across jurisdictions could complicate international transactions and limit the accessibility of Bitcoin for users globally. The lack of a globally unified regulatory framework for cryptocurrencies remains a major obstacle to widespread adoption and stable growth.

Security Vulnerabilities and Hacks

Despite its decentralized nature, Bitcoin is not immune to security vulnerabilities. Exchanges, wallets, and individual users remain susceptible to hacking and theft. High-profile hacks in the past have highlighted the potential for significant financial losses and damage to investor confidence. While advancements in cryptography and security protocols are constantly being made, the sophistication of cyberattacks continues to evolve, posing an ongoing challenge. For example, a successful attack on a major Bitcoin exchange could lead to a massive loss of funds and a significant drop in Bitcoin’s price, potentially eroding trust in the system. Strengthening security measures, including implementing robust multi-factor authentication, improving wallet security, and enhancing the overall resilience of the Bitcoin network, are crucial to mitigating these risks.

Bitcoin’s Technological Development by 2025

By 2025, Bitcoin’s underlying technology is expected to see significant advancements, primarily driven by the need to improve scalability, enhance security, and accelerate transaction speeds. These improvements will likely stem from a combination of on-chain and off-chain solutions, impacting both the efficiency and user experience of the Bitcoin network.

The primary focus of technological development will be on resolving the inherent limitations of the current Bitcoin system. This involves balancing the need for decentralization with the demand for increased throughput and reduced transaction fees. Several promising approaches are being explored, and some are likely to see substantial progress by 2025.

Layer-2 Scaling Solutions

The adoption of Layer-2 scaling solutions, such as the Lightning Network, is anticipated to significantly improve transaction speeds and reduce fees. These off-chain solutions process transactions outside the main Bitcoin blockchain, only settling the final balances on-chain. The Lightning Network, for instance, allows for near-instantaneous micropayments with minimal fees, making Bitcoin more suitable for everyday transactions. By 2025, we can expect wider adoption of the Lightning Network and other similar Layer-2 protocols, leading to a more efficient and user-friendly Bitcoin experience. The increased capacity provided by Layer-2 solutions will address the scalability challenges currently faced by the Bitcoin network. For example, a successful implementation could allow for millions of transactions per second, a significant improvement over the current capacity.

Improved Mining Techniques and Hardware

Advancements in mining hardware and techniques will continue to play a crucial role in enhancing Bitcoin’s security and efficiency. The development of more energy-efficient mining ASICs (Application-Specific Integrated Circuits) is expected, reducing the environmental impact of Bitcoin mining and potentially lowering operational costs for miners. Furthermore, research into alternative consensus mechanisms, while unlikely to fundamentally alter Bitcoin’s core design by 2025, could contribute to improved efficiency and resilience. The exploration of more sustainable energy sources for mining operations will also likely gain momentum, further reducing the carbon footprint associated with Bitcoin.

Enhanced Wallet Functionality and User Interfaces

By 2025, significant improvements in wallet functionality and user interfaces are expected. Wallets will likely become more user-friendly and intuitive, incorporating features such as improved security measures (like multi-signature wallets), simplified transaction processes, and better integration with other financial services. This will make interacting with Bitcoin more accessible to a wider range of users, reducing the technical barrier to entry. For example, we might see wallets that automatically manage transaction fees and provide clear, concise information about transaction status and confirmation times. This improved user experience will be vital for driving broader Bitcoin adoption.

Frequently Asked Questions about Bitcoin in 2025: Bitcoin In 2025 Prediction

Predicting the future of Bitcoin is inherently challenging, but by analyzing current trends and technological advancements, we can formulate reasonable expectations for its role and relevance in 2025. This section addresses some common questions regarding Bitcoin’s future.

Bitcoin’s Relevance in 2025

Bitcoin’s relevance in 2025 hinges on several factors. Its underlying technology, blockchain, continues to evolve, finding applications beyond cryptocurrency. Increased institutional adoption and the maturation of the cryptocurrency ecosystem suggest continued relevance. However, the emergence of competing technologies and regulatory hurdles could impact its dominance. Ultimately, Bitcoin’s continued relevance will depend on its ability to adapt and innovate, while addressing scalability and regulatory concerns. The successful integration of the Lightning Network, for instance, could significantly improve transaction speeds and reduce fees, enhancing its usability and appeal. Conversely, a significant security breach or a major regulatory crackdown could negatively impact its relevance.

Risks to Bitcoin’s Value in 2025

Several risks could negatively affect Bitcoin’s value in 2025. Regulatory uncertainty remains a significant concern, with governments worldwide grappling with how to regulate cryptocurrencies. Stringent regulations could stifle adoption or even lead to outright bans in some jurisdictions. Furthermore, the inherent volatility of Bitcoin, influenced by market sentiment and speculation, poses a risk. Major security breaches, although less likely with increased maturity of the network, could erode trust and significantly impact its price. The emergence of more efficient or technologically superior cryptocurrencies could also challenge Bitcoin’s dominance, potentially leading to a decline in its market share and value. For example, a successful competitor offering faster transaction speeds and lower fees could attract significant investment away from Bitcoin.

Evolution of Bitcoin’s Use Cases

By 2025, Bitcoin’s use cases are expected to diversify beyond simple peer-to-peer transactions. Its role as a store of value might become more pronounced, particularly in regions with unstable fiat currencies. We might see increased adoption in cross-border payments, leveraging its decentralized nature to bypass traditional financial institutions and reduce transaction costs. Furthermore, the development of decentralized finance (DeFi) applications built on top of Bitcoin’s blockchain could unlock new use cases, such as lending, borrowing, and other financial instruments. However, the widespread adoption of Bitcoin as a medium of exchange for everyday transactions remains uncertain due to its volatility and scalability challenges.

Impact of Regulatory Changes

Regulatory changes will undoubtedly shape Bitcoin’s trajectory in 2025. Governments are increasingly focused on regulating cryptocurrencies to mitigate risks associated with money laundering, tax evasion, and market manipulation. Clearer regulatory frameworks could increase institutional investment and mainstream adoption, boosting Bitcoin’s value and legitimacy. Conversely, overly restrictive regulations could stifle innovation and limit Bitcoin’s growth potential. Different jurisdictions will likely adopt varying regulatory approaches, creating a fragmented global landscape that could impact Bitcoin’s usability and liquidity. For example, a country implementing a complete ban on Bitcoin transactions would limit its use within that nation’s borders. Conversely, a country establishing clear guidelines for Bitcoin taxation could encourage wider adoption.

Predicting Bitcoin’s price in 2025 is a complex undertaking, influenced by numerous factors. A key element to consider is the upcoming halving event, and discussions surrounding its impact are abundant online. For instance, you can find a wealth of speculation on the Bitcoin Halving Prediction 2025 Reddit thread. Ultimately, these predictions, alongside macroeconomic conditions and technological advancements, will shape Bitcoin’s trajectory in 2025.

Predicting Bitcoin’s price in 2025 is challenging, with various factors influencing its trajectory. A key event impacting future price predictions is the Bitcoin halving, significantly altering the rate of new Bitcoin creation. To understand the timeline for this crucial event, check out this resource on When Does Bitcoin Halving Happen 2025. The halving’s effect on scarcity and potential price increases will undoubtedly be a major component of any accurate 2025 Bitcoin forecast.

Predicting Bitcoin’s value in 2025 is challenging, with various factors influencing its price. A key event to consider when forecasting is the Bitcoin halving, significantly impacting the rate of new Bitcoin creation. To understand the potential implications of this event on Bitcoin’s future price, checking the precise timing is crucial; you can find this information by visiting the resource on Halving Bitcoin 2025 Time.

Ultimately, this halving will play a significant role in shaping Bitcoin In 2025 Prediction.

Predicting Bitcoin’s value in 2025 is challenging, with various factors influencing its price. A key event impacting these predictions is the Bitcoin halving in 2024, which will significantly reduce the rate of new Bitcoin creation. To understand the potential price implications of this event, it’s helpful to consult resources focusing on the Bitcoin Halving 2025 Price and its projected effects.

Ultimately, analyzing this halving’s impact is crucial for any comprehensive Bitcoin In 2025 Prediction.