Bitcoin Price Predictions for 2025 from Reddit: Bitcoin In 2025 Reddit

Reddit, a vibrant online forum, hosts numerous discussions on Bitcoin’s future price. Analyzing these conversations reveals a wide spectrum of predictions for 2025, ranging from extremely bullish to deeply bearish, reflecting the inherent volatility and uncertainty surrounding the cryptocurrency market. These predictions are often fueled by varying interpretations of macroeconomic factors, technological advancements, and regulatory developments.

Analysis of Reddit Bitcoin Price Predictions for 2025

Reddit discussions regarding Bitcoin’s price in 2025 reveal a complex tapestry of opinions. While concrete numbers are scarce, the general sentiment can be broadly classified into bullish, bearish, and neutral categories. Bullish predictions often cite Bitcoin’s potential as a hedge against inflation, its growing adoption by institutional investors, and the limited supply of 21 million coins. Conversely, bearish predictions point to potential regulatory crackdowns, the emergence of competing cryptocurrencies, and the inherent risk associated with highly volatile assets. Neutral predictions tend to acknowledge the potential for both significant gains and losses, emphasizing the difficulty of accurately forecasting Bitcoin’s price in such a dynamic market.

Comparison of Optimistic and Pessimistic Price Forecasts, Bitcoin In 2025 Reddit

Optimistic forecasts on Reddit often paint a picture of Bitcoin reaching significantly higher price points by 2025, sometimes exceeding $100,000 or even more. These predictions are typically supported by arguments focusing on increasing institutional adoption, growing global acceptance as a store of value, and the potential for Bitcoin to become a mainstream form of payment. In contrast, pessimistic forecasts suggest that Bitcoin’s price could remain stagnant or even decline substantially. These predictions frequently cite concerns about regulatory uncertainty, increased competition from other cryptocurrencies, and the potential for market manipulation. For example, some Reddit users point to past market crashes as evidence that Bitcoin’s price is highly susceptible to unpredictable swings.

Categorization of Reddit User Predictions by Perceived Expertise

Reddit’s user base encompasses a diverse range of individuals, from seasoned investors with years of experience in the cryptocurrency market to casual users with limited knowledge. Experienced investors tend to offer more nuanced predictions, often considering a wider range of factors and presenting more sophisticated analytical frameworks. Their predictions, while still subject to uncertainty, tend to be more data-driven and less reliant on speculation. Casual users, on the other hand, often base their predictions on more subjective factors, such as news headlines or social media trends. This can lead to more volatile and less reliable predictions.

Summary of Bitcoin Price Predictions for 2025 from Reddit

The following table summarizes the range of Bitcoin price predictions found on Reddit for 2025, categorized by user sentiment:

| Prediction Range (USD) | User Sentiment | Frequency | Supporting Arguments |

|---|---|---|---|

| $100,000 – $500,000+ | Bullish | High | Institutional adoption, inflation hedge, scarcity |

| $20,000 – $50,000 | Neutral | Medium | Balanced view considering both upside and downside risks |

| Below $20,000 | Bearish | Low | Regulatory uncertainty, competition, market volatility |

Factors Influencing Bitcoin’s Future on Reddit

Reddit discussions surrounding Bitcoin’s future in 2025 reveal a complex interplay of factors, with users often expressing a range of opinions reflecting both optimism and skepticism. These discussions are significantly shaped by the perceived influence of regulatory landscapes, technological developments, and broader macroeconomic conditions. A comparison with mainstream financial news and expert analysis reveals both convergences and divergences in perspectives.

Regulatory Changes and Their Impact

Reddit users frequently debate the impact of potential regulatory changes on Bitcoin’s price. Concerns about increased governmental oversight, ranging from outright bans to stringent taxation policies, are commonly voiced, often leading to bearish predictions. Conversely, positive regulatory developments, such as the establishment of clearer legal frameworks for cryptocurrency trading and investment, are seen as potential catalysts for price increases. The sentiment varies considerably depending on the specific jurisdiction and the nature of the proposed regulations. For example, discussions surrounding potential US regulatory frameworks often differ significantly from those concerning the regulatory environments in more crypto-friendly jurisdictions like El Salvador. This leads to a wide range of predictions, from a significant price drop under a highly restrictive regulatory environment to substantial growth under a supportive one.

Technological Advancements and Bitcoin’s Scalability

Technological advancements, particularly those related to Bitcoin’s scalability and transaction speed, are another key discussion point. Reddit users often highlight the ongoing development of layer-2 solutions like the Lightning Network, which aim to address Bitcoin’s limitations in terms of transaction throughput and fees. Positive developments in this area are generally met with optimism, with users anticipating increased adoption and a potential surge in price. Conversely, concerns about the effectiveness and widespread adoption of these solutions often fuel more cautious predictions. The success or failure of layer-2 solutions is viewed as crucial in determining Bitcoin’s long-term viability and its ability to compete with faster and more scalable cryptocurrencies. For example, successful implementation of Lightning Network could lead to widespread adoption by merchants and individuals, leading to higher Bitcoin price.

Macroeconomic Conditions and Bitcoin’s Role as a Safe Haven Asset

The influence of macroeconomic conditions, such as inflation, recessionary fears, and geopolitical instability, is a recurring theme in Reddit discussions. Many users view Bitcoin as a potential hedge against inflation and a safe haven asset during times of economic uncertainty. This perspective often leads to bullish predictions, especially when traditional financial markets are experiencing volatility. However, the correlation between Bitcoin’s price and macroeconomic indicators isn’t always clear-cut, leading to conflicting opinions and predictions. For instance, during periods of high inflation, some argue that Bitcoin’s limited supply makes it an attractive alternative to fiat currencies, while others express concern that a broader economic downturn could negatively impact Bitcoin’s price regardless of its inflation-hedging properties. The 2022 bear market, for example, saw a decline in Bitcoin price despite high inflation rates.

Comparison with Mainstream Financial News and Expert Opinions

Reddit discussions often diverge from the perspectives presented in mainstream financial news and by expert analysts. While mainstream sources tend to focus on short-term price fluctuations and regulatory risks, Reddit users often delve into more technical aspects, discussing the underlying technology, network effects, and long-term adoption potential. Furthermore, the level of optimism or pessimism expressed on Reddit can sometimes be more extreme than the cautious and nuanced analyses provided by experts in traditional finance. For instance, while experts might predict a modest price increase based on fundamental analysis, Reddit users might express much more bullish or bearish sentiments based on speculative factors or emotional responses to market events.

Visual Representation of Interconnected Factors

Imagine a central node labeled “Bitcoin Price (2025)”. Three main branches extend from this node, representing the three major factors: “Regulatory Environment” (with sub-nodes like “US Regulations,” “EU Regulations,” “Emerging Market Regulations”), “Technological Advancements” (with sub-nodes like “Layer-2 Solutions,” “Mining Efficiency,” “Privacy Enhancements”), and “Macroeconomic Conditions” (with sub-nodes like “Inflation,” “Interest Rates,” “Global Economic Growth”). Arrows connect these sub-nodes to the central “Bitcoin Price” node, illustrating the direct influence each factor has on the predicted price. Additionally, smaller, connecting arrows indicate the indirect relationships between the factors themselves. For example, a strong regulatory environment could potentially stifle technological innovation, and high inflation could drive interest in Bitcoin as a hedge, thus indirectly affecting the technological development needed for adoption. The thickness of the arrows could represent the perceived strength of the influence of each factor, based on the consensus view expressed within the Reddit community. The overall image depicts a dynamic and interconnected system where the interplay of these factors ultimately shapes the predicted Bitcoin price in 2025.

Reddit’s Sentiment Towards Bitcoin Investment in 2025

Reddit’s sentiment regarding Bitcoin investment in 2025 is complex and multifaceted, reflecting the inherent volatility and uncertainty surrounding cryptocurrency markets. While a purely “bullish,” “bearish,” or “neutral” categorization is an oversimplification, a prevailing sense of cautious optimism seems to permeate many discussions. The overall tone depends heavily on the specific subreddit and the individual user’s risk tolerance and investment timeline.

Predicting the precise sentiment is difficult due to the constantly evolving nature of online discussions. However, analyzing trends and recurring arguments reveals a nuanced perspective on Bitcoin’s future.

Common Arguments Supporting Investment Perspectives

Reddit users supporting Bitcoin investment in 2025 frequently cite its potential for long-term growth, driven by factors such as increasing adoption, institutional investment, and limited supply. Conversely, those expressing bearish sentiments often highlight the inherent volatility of Bitcoin, the potential for regulatory crackdowns, and the emergence of competing cryptocurrencies. Risk assessment is a central theme, with users debating the appropriate level of exposure given the potential for significant gains and losses. Many acknowledge the short-term volatility but emphasize the importance of a long-term strategy. Discussions frequently revolve around the balance between potential rewards and the risks involved.

Examples of Reddit Investment Strategies for Bitcoin in 2025

Numerous investment strategies are debated on Reddit, showcasing the diverse approaches taken by users. These strategies are often tailored to individual risk tolerance and financial goals. For instance, some users advocate for a “Dollar-Cost Averaging” (DCA) approach, regularly investing smaller amounts over time to mitigate the impact of price fluctuations. Others prefer a “HODL” strategy, holding onto their Bitcoin regardless of short-term price movements, believing in its long-term value. Some more adventurous users discuss leveraging, although this strategy carries significantly higher risk. Finally, some users suggest diversifying their crypto portfolios beyond Bitcoin, reducing overall risk.

Categorized List of Bitcoin Investment Strategies Discussed on Reddit

The following list categorizes common Bitcoin investment strategies discussed on Reddit in 2025:

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This reduces the risk of investing a large sum at a market peak. Example: Investing $100 every week into Bitcoin, irrespective of its price.

- HODL (Hold On for Dear Life): This strategy emphasizes long-term investment and ignores short-term price volatility. Users who employ this strategy believe in the long-term potential of Bitcoin and are prepared to ride out market fluctuations. Example: Buying Bitcoin and holding it for 5+ years regardless of price changes.

- Leveraged Trading: This involves borrowing funds to amplify potential gains (and losses). This strategy is highly risky and only suitable for experienced traders with a high risk tolerance. Example: Using margin trading to multiply Bitcoin holdings, potentially resulting in substantial profits or losses.

- Diversification: This involves spreading investments across different cryptocurrencies and asset classes to reduce overall portfolio risk. Example: Investing in Bitcoin, Ethereum, and other altcoins to reduce reliance on a single asset.

Bitcoin Adoption and Usage Discussions on Reddit in 2025

Reddit discussions in 2025 regarding Bitcoin adoption will likely center on its integration into various sectors and the challenges and opportunities involved. The conversations will reflect a blend of optimism from early adopters and skepticism from those hesitant about its volatility and scalability. Analysis of these discussions will provide valuable insights into the potential trajectory of Bitcoin’s mainstream acceptance.

Reddit conversations will explore Bitcoin’s projected role in finance, commerce, and everyday transactions in 2025. The discussions will likely feature case studies of businesses already using Bitcoin, along with predictions about future adoption rates in different industries. For example, the potential for Bitcoin’s use in cross-border payments and its impact on traditional financial institutions will be debated extensively.

Bitcoin Adoption Barriers and Facilitators

Reddit users will likely identify several barriers hindering widespread Bitcoin adoption. These include the complexity of the technology for average users, the volatility of its price, regulatory uncertainty in various jurisdictions, and scalability issues related to transaction speeds and fees. Conversely, facilitators will likely include increased ease of use through improved wallets and user interfaces, growing institutional adoption boosting confidence, the development of layer-2 scaling solutions addressing transaction speed and cost issues, and positive regulatory developments in key markets like the EU or the US. The ongoing debate surrounding Bitcoin’s environmental impact will also feature prominently, with discussions comparing it to traditional financial systems. Examples of successful Bitcoin integrations in specific sectors, such as the growing use of Lightning Network for micro-transactions, will be cited as evidence for both sides of the argument.

Comparison with Other Cryptocurrencies’ Adoption

Reddit discussions will inevitably compare Bitcoin’s projected adoption rate with that of other cryptocurrencies. The superior brand recognition and first-mover advantage of Bitcoin will likely be highlighted, contrasting with the potential for faster transaction speeds and lower fees offered by altcoins like Solana or Cardano. Discussions will often revolve around the niche use cases of different cryptocurrencies, with Bitcoin often positioned as a store of value, while others focus on decentralized finance (DeFi) applications or smart contract functionalities. The relative market capitalization of Bitcoin compared to other cryptocurrencies will serve as a key metric in these comparisons. For example, a comparison might highlight Bitcoin’s dominance despite the emergence of new technologies, illustrating its enduring position in the crypto landscape.

Predicted Stages of Bitcoin Adoption in 2025

Reddit discussions will likely paint a picture of Bitcoin adoption progressing through several distinct stages in 2025.

- Early Adoption Phase (already underway): Characterized by strong interest among tech-savvy individuals and early investors, primarily focusing on speculation and holding.

- Increased Institutional Interest Phase: Larger financial institutions and corporations start integrating Bitcoin into their portfolios, leading to greater price stability and increased legitimacy.

- Mainstream Awareness Phase: Wider public awareness and understanding of Bitcoin’s utility, leading to increased adoption among everyday consumers for payments and transactions. This phase will be marked by a significant increase in merchant adoption and user-friendly applications.

- Widespread Integration Phase: Bitcoin becomes seamlessly integrated into various aspects of the global economy, including cross-border payments, supply chain management, and everyday commerce. This phase will be characterized by the development of robust regulatory frameworks and increased infrastructure supporting Bitcoin transactions.

Risks and Opportunities of Bitcoin in 2025 (Reddit Perspective)

Reddit discussions surrounding Bitcoin in 2025 reveal a complex interplay of potential risks and opportunities, reflecting the inherent volatility and uncertainty associated with cryptocurrency investments. While some users express optimism about Bitcoin’s future, others highlight significant concerns that need careful consideration. Understanding both sides of this coin is crucial for any prospective investor.

Regulatory Uncertainty and its Impact

Regulatory landscapes surrounding cryptocurrencies remain highly fluid and vary significantly across jurisdictions. Reddit users frequently express concerns about potential future regulations that could negatively impact Bitcoin’s price and usability. For example, increased taxation on Bitcoin transactions or outright bans in major economies could drastically reduce its value and accessibility. Conversely, clear and supportive regulations could boost confidence and drive adoption, potentially leading to increased price appreciation. The lack of a universally accepted regulatory framework poses a significant risk, making it difficult to predict Bitcoin’s future trajectory with certainty. This uncertainty is a primary factor contributing to the volatility of Bitcoin’s price.

Market Volatility and Price Fluctuations

Bitcoin’s notorious price volatility is a recurring theme in Reddit discussions. The cryptocurrency market is known for its dramatic price swings, often influenced by news events, market sentiment, and speculative trading. While this volatility presents an opportunity for significant returns, it also carries substantial risk of substantial losses. Reddit users often share anecdotal stories of both massive gains and devastating losses, illustrating the unpredictable nature of Bitcoin investment. The potential for rapid price drops, often amplified by fear, uncertainty, and doubt (FUD) circulating online, is a significant concern for many investors.

Security Concerns and Potential for Hacks

Security breaches and hacks targeting cryptocurrency exchanges and wallets are another prominent concern on Reddit. The decentralized nature of Bitcoin does not inherently guarantee its security. Users frequently discuss the risks of losing their Bitcoin due to phishing scams, exchange failures, or vulnerabilities in their personal wallets. The potential for large-scale hacks or theft further contributes to the overall risk profile of Bitcoin investment. While technological advancements are continuously being made to improve security, the inherent complexity of the technology makes it a constant target for malicious actors.

Technological Advancements and Increased Adoption

Despite the risks, Reddit users also identify significant opportunities associated with Bitcoin. The ongoing development of layer-2 scaling solutions, such as the Lightning Network, aims to address Bitcoin’s scalability limitations, potentially leading to faster and cheaper transactions. Increased adoption by businesses and institutions is also viewed as a major catalyst for price appreciation. As more merchants accept Bitcoin as a form of payment and institutional investors allocate funds to Bitcoin, its value and liquidity are expected to increase. This growing adoption could potentially transform Bitcoin into a mainstream asset class.

Comparison with Other Investment Options

Reddit users frequently compare Bitcoin with other investment options, such as stocks, bonds, and real estate. While Bitcoin offers the potential for higher returns compared to traditional assets, it also carries significantly higher risk. The lack of diversification in a solely Bitcoin portfolio is a major concern. Diversification across various asset classes is often recommended as a risk mitigation strategy. The comparison highlights the need for a well-informed investment strategy that balances risk tolerance with potential rewards.

Risk/Opportunity Table

| Risk/Opportunity | Elaboration |

|---|---|

| Regulatory Uncertainty | Unclear or unfavorable regulations could significantly impact Bitcoin’s price and usability. Conversely, supportive regulations could boost adoption and value. |

| Market Volatility | Bitcoin’s price is highly volatile, leading to potential for both significant gains and substantial losses. |

| Security Concerns | Risks of theft, hacking, and scams associated with Bitcoin exchanges and personal wallets. |

| Technological Advancements | Improvements in scalability and security through technological innovations could enhance Bitcoin’s usability and appeal. |

| Increased Adoption | Growing acceptance by businesses and institutions could drive up Bitcoin’s price and liquidity. |

Frequently Asked Questions about Bitcoin in 2025 (from Reddit)

Reddit discussions surrounding Bitcoin in 2025 are abundant and often passionate, covering a wide range of topics from price predictions to investment strategies. This section addresses some of the most frequently asked questions found within these online conversations, providing a summary of the diverse perspectives and arguments presented.

Bitcoin’s Price Target of $100,000 by 2025

Reddit discussions regarding Bitcoin reaching $100,000 by 2025 are highly polarized. Proponents often point to Bitcoin’s limited supply and increasing adoption by institutional investors as key drivers for potential price appreciation. They cite historical price trends and compare Bitcoin’s market capitalization to that of gold, suggesting significant further growth is possible. Conversely, skeptics highlight the inherent volatility of the cryptocurrency market and the potential impact of regulatory uncertainty or technological disruptions. They argue that predicting such a specific price target is highly speculative and that unforeseen events could easily derail such optimistic projections. Many suggest that while significant growth is possible, a price of $100,000 by 2025 is far from guaranteed and remains a highly debated topic. For example, some users point to the 2017 bull run as a possible precedent, while others highlight the subsequent significant price corrections as a cautionary tale.

Major Concerns Regarding Bitcoin’s Future

Several significant concerns regarding Bitcoin’s future are frequently raised on Reddit. Regulatory uncertainty remains a prominent worry, with discussions often focusing on the potential for government crackdowns or overly restrictive regulations that could stifle Bitcoin’s growth or even lead to its suppression. Technological challenges, such as scalability issues and the ongoing debate around Bitcoin’s energy consumption, are also frequently discussed. The environmental impact of Bitcoin mining is a recurring theme, with some users advocating for more energy-efficient mining solutions. Market volatility is another major concern, with many users acknowledging the inherent risks associated with investing in a highly volatile asset. The possibility of significant price drops, or even a complete market crash, is often discussed, particularly in light of past market downturns. Finally, security concerns, including the risk of hacking and theft from exchanges or individual wallets, are also frequently highlighted.

Common Bitcoin Investment Strategies for 2025

Reddit users discuss a variety of investment strategies for Bitcoin in 2025. “Hodling,” or long-term holding, remains a popular strategy, with many users advocating for a buy-and-hold approach, believing in Bitcoin’s long-term potential. Dollar-cost averaging (DCA), a strategy involving regular purchases of Bitcoin regardless of price fluctuations, is also frequently mentioned as a risk-mitigation technique. This approach aims to reduce the impact of volatility by spreading out investments over time. Short-term trading, while acknowledged as potentially more profitable, is also discussed with warnings about the increased risk involved. Many users caution against attempting to time the market, emphasizing the importance of thorough research and risk management. The choice of investment strategy often depends on individual risk tolerance and financial goals, with a wide range of approaches being debated and discussed on Reddit.

Bitcoin In 2025 Reddit – Discussions on Bitcoin in 2025 are abundant on Reddit, with users speculating on everything from its market dominance to potential regulatory changes. Naturally, related altcoins are also frequently discussed, and understanding their potential trajectory is key; for example, consider checking out this insightful analysis on Baby Bitcoin Price Prediction 2025 to better inform your overall Bitcoin 2025 predictions.

Ultimately, the Reddit conversations reflect a wide range of opinions about Bitcoin’s future.

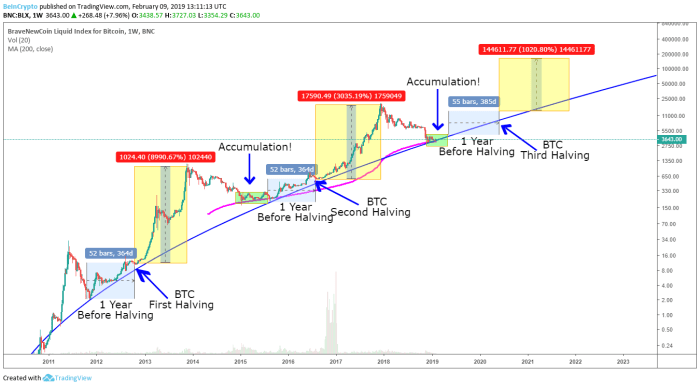

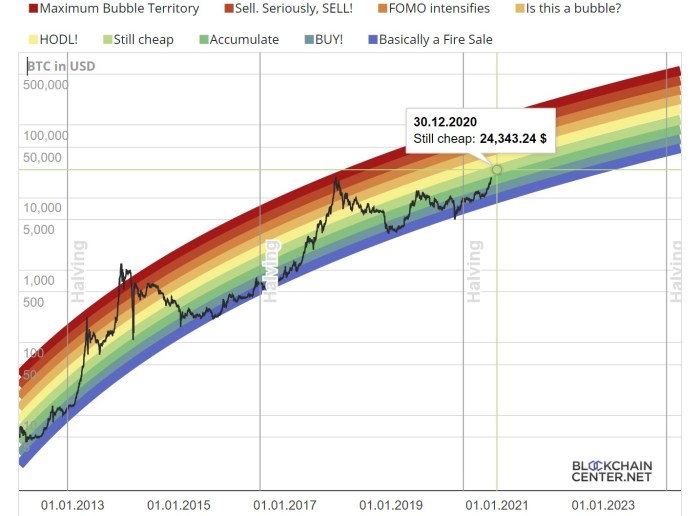

Discussions on Reddit regarding Bitcoin in 2025 often speculate on its price trajectory. A key factor influencing these predictions is the anticipated Bitcoin Halving, and its potential impact on scarcity and value. For detailed analysis on how the halving might affect the price, check out this insightful resource on Bitcoin Halving Price 2025. Ultimately, the Reddit conversations highlight the uncertainty, yet also the significant interest, surrounding Bitcoin’s future value.

Discussions on Bitcoin In 2025 Reddit often cover a wide range of predictions, from price fluctuations to technological advancements. A significant aspect of these conversations frequently involves alternative Bitcoin projects, and understanding their potential value is key; for example, you might find insights into the White Bitcoin Price In 2025 Usd which helps contextualize broader market expectations.

Returning to the Reddit threads, these price projections often influence the overall sentiment surrounding Bitcoin’s future in 2025.

Discussions on Bitcoin in 2025 are rampant on Reddit, with users speculating wildly on its future. Many threads center around trying to gauge the potential price, often referencing external predictions for a clearer picture. To get a sense of those projections, you might find the Latest Bitcoin Price Prediction 2025 useful; after reviewing these forecasts, the Reddit conversations often become even more lively and diverse.

Ultimately, the Bitcoin in 2025 Reddit discussions reflect the uncertainty, yet also the excitement, surrounding this volatile cryptocurrency.

Discussions on Bitcoin In 2025 Reddit often involve speculative price predictions, naturally leading to broader questions about long-term value. To understand potential 2025 scenarios, it’s helpful to consider longer-term projections; for instance, check out this insightful article on What Will Bitcoin Price Be In 2030 to gain perspective. Understanding the potential trajectory beyond 2030 helps contextualize the shorter-term Bitcoin In 2025 Reddit conversations.