Bitcoin Price Prediction: July 2025

Predicting Bitcoin’s price in July 2025 involves navigating a complex interplay of macroeconomic factors, regulatory landscapes, and technological advancements. While no one can definitively state the price, analyzing these influencing factors allows us to construct plausible scenarios and price ranges.

Influencing Factors on Bitcoin’s Price in July 2025

Several key factors will significantly impact Bitcoin’s price trajectory by July 2025. Macroeconomic conditions, such as inflation rates, interest rates, and global economic growth, will play a crucial role. A period of high inflation might drive investors towards Bitcoin as a hedge against inflation, potentially increasing its value. Conversely, a robust global economy might divert investment away from riskier assets like Bitcoin. Regulatory changes, particularly those concerning cryptocurrency adoption and taxation, will also heavily influence market sentiment and investment flows. Stringent regulations could dampen growth, while supportive policies could fuel adoption and price increases. Technological advancements, such as the widespread adoption of the Lightning Network for faster and cheaper transactions, or the development of new scaling solutions, could positively influence Bitcoin’s utility and price.

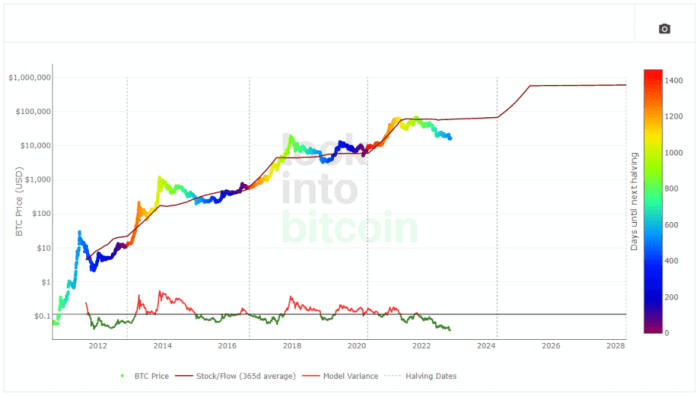

Comparison of Price Prediction Models

Various models exist for predicting Bitcoin’s price, each with its strengths and weaknesses. Some models rely on technical analysis, examining historical price charts and trading patterns to identify trends and predict future movements. These models can be susceptible to market manipulation and may not accurately reflect fundamental factors. Other models employ fundamental analysis, focusing on factors like adoption rates, network growth, and regulatory changes to estimate future value. These models are often more robust but can be less precise due to the inherent unpredictability of the market. Finally, some models use a combination of both technical and fundamental analysis, aiming to leverage the strengths of each approach. For example, a model might combine technical indicators with data on Bitcoin’s market capitalization and transaction volume to arrive at a price forecast. The accuracy of these models varies greatly, and it’s crucial to approach predictions with a healthy dose of skepticism.

Impact of Significant Global Events

Unforeseen global events can significantly alter Bitcoin’s price trajectory. A major geopolitical crisis, for example, could trigger a flight to safety, potentially driving up Bitcoin’s price as investors seek alternative assets. Conversely, a significant technological breakthrough in another asset class could divert investment away from Bitcoin, leading to a price decline. The impact of such events is difficult to predict precisely, highlighting the inherent volatility of the cryptocurrency market. For example, the 2020 COVID-19 pandemic initially caused a sharp drop in Bitcoin’s price, but later saw a significant recovery as investors sought safe haven assets.

Scenario-Based Price Range Analysis

Based on the factors discussed above, we can Artikel several scenarios for Bitcoin’s price in July 2025:

* Bullish Scenario: Favorable macroeconomic conditions, supportive regulations, and widespread adoption of Bitcoin could lead to a price significantly above its current level. In this scenario, a price range of $150,000 to $250,000 or even higher is plausible. This scenario assumes continued technological advancements and increasing institutional adoption.

* Neutral Scenario: A mixed macroeconomic environment, moderate regulatory changes, and steady adoption rates could result in a price range similar to its price in late 2024, potentially fluctuating between $50,000 and $100,000. This scenario assumes a continuation of current market trends with no major disruptions.

* Bearish Scenario: Negative macroeconomic conditions, stringent regulations, and a decrease in adoption rates could lead to a significant price decline. In this scenario, the price might fall to a range of $20,000 to $40,000. This scenario assumes a significant negative shift in investor sentiment and widespread market uncertainty.

Visual Representation of Potential Price Movements

Imagine a graph charting Bitcoin’s price over time. Starting from the present, the line initially shows some volatility, potentially fluctuating between current levels and a slightly higher price. In a bullish scenario, the line then sharply ascends, reaching a peak around $150,000-$250,000 in July 2025. In a neutral scenario, the line shows a more gradual, less dramatic increase, potentially reaching a plateau between $50,000 and $100,000. In a bearish scenario, the line shows a decline, potentially dropping to the $20,000-$40,000 range by July 2025, before possibly showing signs of recovery later. It’s crucial to remember that this is a simplified representation and the actual price movements will likely be far more complex.

Technological Advancements and Bitcoin

The evolution of Bitcoin’s underlying technology is crucial to its long-term viability and potential for mass adoption. By July 2025, several advancements are expected to significantly impact Bitcoin’s transaction speed, scalability, security, and energy consumption. These improvements will not only enhance the user experience but also influence the overall perception and market value of Bitcoin.

Second-Layer Scaling Solutions, Bitcoin July 2025 Prediction

Second-layer scaling solutions, such as the Lightning Network, aim to address Bitcoin’s inherent limitations in transaction speed and scalability. These solutions process transactions off-chain, reducing the load on the main Bitcoin blockchain. By July 2025, we can anticipate widespread adoption of Lightning Network and similar technologies, leading to faster and cheaper transactions. This increased efficiency could attract a broader range of users and businesses, potentially driving up demand and price. For example, the increasing number of Lightning Network nodes and the development of user-friendly interfaces will contribute to its wider adoption, mirroring the growth of similar technologies in other sectors.

Bitcoin Mining Technology Evolution

The evolution of Bitcoin mining technology is a continuous process driven by the pursuit of greater efficiency and profitability. By July 2025, we can expect advancements in hardware, such as more energy-efficient ASICs (Application-Specific Integrated Circuits), leading to a reduction in energy consumption per transaction. This will not only lessen the environmental impact of Bitcoin mining but also make it more economically viable in regions with higher energy costs. Furthermore, improvements in mining pool management and distribution of mining rewards could enhance network security and decentralization. Consider the ongoing development of more sustainable energy sources for mining operations, reflecting a global trend towards environmentally responsible practices.

Cryptographic Technology Advancements

Breakthroughs in cryptographic technology could significantly bolster Bitcoin’s security and functionality. While predicting specific breakthroughs is challenging, advancements in areas such as post-quantum cryptography are likely. The development of cryptographic algorithms resistant to attacks from quantum computers is crucial for the long-term security of Bitcoin and other cryptocurrencies. By July 2025, we might see initial implementations of such advancements, enhancing the resilience of the Bitcoin network against future threats. This proactive approach mirrors the cybersecurity industry’s continuous adaptation to emerging threats.

Development and Adoption of Bitcoin-Related Technologies

The adoption of technologies like Taproot, which improves transaction privacy and efficiency, is expected to be substantial by July 2025. Taproot’s implementation simplifies transaction scripting, reducing transaction fees and improving scalability. The wider adoption of Taproot will not only enhance the user experience but also contribute to the overall security and efficiency of the Bitcoin network. This is similar to how the adoption of improved protocols in other networks leads to better performance and reliability.

Comparison of Technological Advancements and Their Impact

The various technological advancements discussed above will synergistically impact Bitcoin’s adoption and price. The combination of improved scalability through second-layer solutions, enhanced security from advancements in cryptography, and reduced energy consumption from more efficient mining hardware will contribute to a more robust and user-friendly Bitcoin ecosystem. This improved ecosystem will likely attract more users and investors, potentially leading to increased demand and a higher Bitcoin price. The interplay of these factors resembles the combined effect of various technological improvements in the internet infrastructure, leading to its widespread adoption. For instance, faster internet speeds, improved security protocols, and more user-friendly interfaces all contributed to the internet’s exponential growth. Similarly, these advancements in Bitcoin technology are expected to drive its adoption and price appreciation.

Regulatory Landscape and Bitcoin

The regulatory landscape surrounding Bitcoin and cryptocurrencies is rapidly evolving, presenting both opportunities and challenges for the market. By July 2025, we can expect a more defined global regulatory framework, though significant variations between jurisdictions will likely persist. Understanding these variations and the potential for international cooperation is crucial for predicting Bitcoin’s price and market behavior.

Potential Regulatory Changes Worldwide by July 2025

Several key regulatory developments could significantly impact Bitcoin’s market dynamics by July 2025. These include the increasing clarity around taxation of cryptocurrency transactions, the establishment of licensing frameworks for cryptocurrency exchanges and custodians, and the potential for central bank digital currencies (CBDCs) to compete with Bitcoin. The implementation of robust anti-money laundering (AML) and know-your-customer (KYC) regulations will also continue to shape the industry. For example, the European Union’s Markets in Crypto-Assets (MiCA) regulation, while not fully implemented by July 2025, will have a significant impact on the European market and could serve as a model for other jurisdictions. The United States, while lacking a unified national framework, is expected to see increased regulatory scrutiny at both the state and federal levels, impacting trading, custody, and stablecoin issuance.

Comparison of Regulatory Approaches

Different countries are adopting diverse approaches to regulating Bitcoin and cryptocurrencies. Some, like El Salvador, have embraced Bitcoin as legal tender, while others, like China, have implemented outright bans. Many countries are taking a more nuanced approach, focusing on regulating specific aspects of the cryptocurrency ecosystem, such as exchanges, stablecoins, and decentralized finance (DeFi). For instance, Singapore is known for its relatively progressive and supportive regulatory environment, encouraging innovation while mitigating risks. Conversely, countries like India have implemented stricter regulations, potentially hindering the growth of the cryptocurrency market within their borders. These differing approaches will create diverse market dynamics, impacting Bitcoin’s price and adoption rate globally.

Influence of International Regulatory Cooperation

International regulatory cooperation will play a crucial role in shaping the future of Bitcoin. Harmonized standards for AML/KYC compliance, taxation, and consumer protection could foster greater trust and stability in the cryptocurrency market. However, achieving global consensus on regulatory frameworks remains a significant challenge due to differing national priorities and levels of technological understanding. International organizations like the Financial Stability Board (FSB) are working towards increased coordination, but the pace of progress is likely to be gradual. The lack of a unified global approach will continue to present challenges for cross-border transactions and investment in Bitcoin.

Timeline of Potential Key Regulatory Milestones

A potential timeline of key regulatory milestones impacting Bitcoin up to July 2025 could include: 2023-2024: Increased regulatory scrutiny and enforcement actions in various jurisdictions; Mid-2024: Further development and implementation of MiCA in the EU; Late 2024: Potential introduction of significant cryptocurrency regulations in the United States; Early 2025: Implementation of CBDC pilots in several countries; Mid-2025: Increased international cooperation on regulatory frameworks for stablecoins. It is important to note that this timeline is speculative and subject to change based on political and economic factors.

Comparison of Regulatory Landscapes

| Jurisdiction | Regulatory Approach | Potential Influence on Bitcoin |

|———————|—————————————————|—————————–|

| United States | Patchwork of state and federal regulations | Increased scrutiny, uncertainty |

| European Union | MiCA (Markets in Crypto-Assets) | Increased standardization, clarity |

| Singapore | Relatively progressive and supportive | Increased adoption, innovation |

| China | Outright ban | Limited market access |

| India | Strict regulations | Limited market growth |

| El Salvador | Bitcoin as legal tender | Increased adoption locally |

Adoption and Market Sentiment: Bitcoin July 2025 Prediction

Predicting Bitcoin’s adoption and market sentiment by July 2025 requires considering several interwoven factors. While predicting the future with certainty is impossible, analyzing current trends and potential catalysts allows for a reasoned assessment of the likely trajectory. This analysis will explore the influence of individual and institutional investors, media coverage, and the interplay between these factors and price volatility.

Factors Influencing Bitcoin Adoption

Several key factors will likely shape Bitcoin’s adoption rate by July 2025. Increased regulatory clarity in major markets could significantly boost institutional investment and public confidence. Conversely, continued regulatory uncertainty or overly restrictive measures could hinder growth. The development and wider availability of user-friendly Bitcoin wallets and payment solutions will also be crucial in driving mass adoption among individuals. Technological advancements, such as the Lightning Network improving transaction speeds and reducing fees, will also play a vital role. Finally, the overall macroeconomic environment, including inflation rates and economic stability, will influence investor interest in Bitcoin as a hedge against inflation or a store of value.

Evolution of Public Perception and Market Sentiment

Public perception of Bitcoin has evolved dramatically since its inception. Initially viewed with skepticism and associated with illicit activities, Bitcoin has gained increasing recognition as a potential store of value and a decentralized alternative to traditional financial systems. However, periods of significant price volatility continue to fuel both excitement and fear among investors. Positive media coverage, particularly highlighting successful Bitcoin integrations by businesses and the growth of the Bitcoin ecosystem, can foster positive sentiment. Conversely, negative news related to scams, hacks, or regulatory crackdowns can trigger market sell-offs and dampen enthusiasm. The overall narrative surrounding Bitcoin’s long-term viability will heavily influence public opinion and market sentiment.

Institutional Investors’ Role in Shaping Bitcoin’s Price and Adoption

Institutional investors, including large corporations, hedge funds, and asset management firms, have become increasingly interested in Bitcoin. Their participation can significantly influence price movements and overall market adoption. Large-scale investments by these players can drive price increases and attract further institutional and individual investors. Conversely, significant institutional sell-offs can trigger sharp price declines. The strategic decisions made by institutional investors will play a pivotal role in determining Bitcoin’s trajectory in the coming years. For example, MicroStrategy’s significant Bitcoin acquisitions have been seen as a validation of Bitcoin’s potential as a long-term investment.

Impact of Social Media and Mainstream Media Coverage

Social media platforms and mainstream media outlets significantly impact Bitcoin’s market sentiment. Positive news and endorsements from influential figures on social media can create hype and drive price increases. Conversely, negative narratives, FUD (Fear, Uncertainty, and Doubt), or misleading information can lead to sell-offs and decreased investor confidence. Mainstream media coverage, while often lagging behind social media trends, can play a crucial role in shaping the overall public perception of Bitcoin and its legitimacy as an asset class. For instance, a positive article in the Wall Street Journal could significantly influence the sentiment of less informed investors.

Interplay Between Adoption Rates, Market Sentiment, and Price Fluctuations

Adoption rates, market sentiment, and price fluctuations are inextricably linked. Increased adoption often leads to higher demand, pushing prices up and further fueling positive market sentiment. Conversely, negative market sentiment can lead to decreased adoption, triggering price drops and potentially creating a self-reinforcing negative feedback loop. This interplay creates a dynamic market environment, where price movements are heavily influenced by both fundamental factors (adoption, technology) and sentiment-driven speculation. Examples of this interplay can be seen in past Bitcoin bull and bear markets, where rapid price increases were often accompanied by high adoption rates and positive sentiment, while sharp price drops coincided with negative news and decreased investor confidence.

Bitcoin’s Role in the Global Financial System

Bitcoin’s potential impact on the global financial system is a subject of intense debate. Its decentralized nature and inherent resistance to censorship offer a compelling alternative to traditional financial structures, yet its volatility and regulatory uncertainty present significant hurdles to widespread adoption. Analyzing its potential as a store of value, medium of exchange, and investment asset, alongside its risks and challenges, is crucial to understanding its future role.

Bitcoin as a Store of Value, Medium of Exchange, and Investment Asset

Bitcoin’s role in the future financial landscape hinges on its success in fulfilling these three key functions. As a store of value, Bitcoin competes with gold and other precious metals, offering a potential hedge against inflation and currency devaluation. However, its price volatility significantly undermines its reliability in this role. As a medium of exchange, Bitcoin faces challenges related to transaction speed and fees, although technological advancements are continuously addressing these limitations. Its acceptance as an investment asset is growing, driven by its limited supply and increasing institutional interest, but this remains susceptible to market speculation and regulatory changes.

Bitcoin’s Value Proposition Compared to Established Assets

Comparing Bitcoin to established financial assets like gold, government bonds, and stocks reveals both similarities and stark differences. Like gold, Bitcoin offers scarcity as a key value proposition. Unlike gold, however, Bitcoin’s supply is mathematically defined and transparent, eliminating the uncertainty surrounding gold mining and supply chain manipulation. Compared to government bonds, Bitcoin offers a decentralized and censorship-resistant alternative, but lacks the guaranteed returns and stability that government bonds typically provide. When compared to stocks, Bitcoin’s value is not tied to the performance of a specific company or sector, but rather to the overall market sentiment and adoption rate of the cryptocurrency. Its volatility is far higher than that of most established stock market indices.

Risks and Challenges of Bitcoin Integration

Several significant risks and challenges hinder Bitcoin’s seamless integration into the global financial system. Its inherent volatility makes it unsuitable for everyday transactions for many. Regulatory uncertainty varies across jurisdictions, creating legal complexities and hindering widespread adoption. The energy consumption associated with Bitcoin mining remains a significant environmental concern, prompting calls for more energy-efficient mining techniques. Furthermore, the potential for Bitcoin to be used in illicit activities, such as money laundering and financing terrorism, continues to be a major concern for regulators worldwide. The security risks associated with holding and transacting Bitcoin, including the potential for hacking and theft, also present a barrier to wider adoption.

Impact on Traditional Financial Institutions and Monetary Policies

The widespread adoption of Bitcoin could significantly disrupt traditional financial institutions. Banks and other intermediaries could see a reduction in their role as transaction processors and custodians of value. Central banks might face challenges in maintaining monetary policy stability as Bitcoin’s decentralized nature undermines their control over the money supply. The rise of Bitcoin could also lead to increased competition in the financial services sector, forcing traditional institutions to adapt and innovate to remain relevant. However, the extent of this disruption depends heavily on the rate of Bitcoin adoption and the regulatory responses from governments worldwide.

Potential Impacts of Bitcoin on the Global Financial System

| Aspect of Global Financial System | Potential Positive Impacts | Potential Negative Impacts |

|—|—|—|

| Financial Inclusion | Increased access to financial services for the unbanked population | Increased risk of financial exploitation and fraud |

| Monetary Policy | Reduced reliance on centralized control of money supply | Increased volatility and uncertainty in the financial markets |

| Cross-border Payments | Faster, cheaper, and more efficient international transactions | Increased risk of regulatory arbitrage and illicit activities |

| Investment Landscape | Diversification opportunities for investors | Increased market volatility and speculative bubbles |

| Traditional Financial Institutions | Increased competition and innovation | Potential disruption and loss of market share |

Frequently Asked Questions (FAQ)

This section addresses common questions regarding Bitcoin’s price and future prospects in July 2025, considering various influencing factors. We will explore potential price scenarios, significant risks, regulatory impacts, technological advancements, and drivers of adoption.

Bitcoin Price Scenarios in July 2025

Predicting Bitcoin’s price with certainty is impossible. However, considering historical trends, technological advancements, and regulatory developments, several scenarios are plausible. A bullish scenario could see Bitcoin reaching $150,000 or more, fueled by widespread adoption and positive regulatory developments. This scenario assumes continued technological improvements, increasing institutional investment, and a growing understanding of Bitcoin’s utility as a store of value and a medium of exchange. Conversely, a bearish scenario might see Bitcoin trading below $50,000, driven by factors like increased regulatory scrutiny, a major security breach, or a significant macroeconomic downturn. A more moderate scenario could see Bitcoin trading somewhere between $50,000 and $100,000, reflecting a period of consolidation and gradual growth. The likelihood of each scenario depends on the interplay of various factors, making precise probability assessments challenging. For example, a significant global economic crisis could dramatically impact all asset classes, including Bitcoin, regardless of its underlying technology or adoption rate.

Risks Facing Bitcoin in the Coming Years

Bitcoin faces several significant risks. Security breaches, though rare, could severely impact investor confidence and price. Regulatory uncertainty remains a key concern, with differing approaches across jurisdictions potentially hindering growth or creating volatility. Competition from alternative cryptocurrencies and emerging technologies also presents a challenge. Furthermore, macroeconomic factors like inflation, interest rate changes, and geopolitical instability can significantly influence Bitcoin’s price. For instance, increased inflation could drive investors towards Bitcoin as a hedge against inflation, boosting its price, while a global recession could lead to a sell-off across all asset classes.

Impact of Government Regulation on Bitcoin’s Price

Government regulation can significantly impact Bitcoin’s price. Favorable regulations, such as clear guidelines for exchanges and institutional investors, could boost confidence and attract more capital, leading to price appreciation. Conversely, overly restrictive regulations, such as outright bans or excessive taxation, could negatively impact price and adoption. Different jurisdictions are taking varying approaches. Some are actively exploring ways to integrate Bitcoin into their financial systems, while others are taking a more cautious, wait-and-see approach. The overall regulatory landscape is still evolving, making it difficult to predict the precise impact on Bitcoin’s price in the long term. The example of China’s crackdown on cryptocurrency mining in 2021 demonstrates the potential for significant negative price impact from restrictive government actions.

Technological Advancements Impacting Bitcoin’s Future

Technological advancements are crucial for Bitcoin’s future. Improvements in scaling solutions, such as the Lightning Network, could enhance transaction speed and reduce fees, making Bitcoin more practical for everyday use. Developments in privacy-enhancing technologies could address concerns about transparency. Increased integration with other blockchain technologies and decentralized finance (DeFi) platforms could broaden Bitcoin’s utility and appeal. For example, the Taproot upgrade improved Bitcoin’s scalability and privacy, potentially influencing its long-term adoption and price.

Factors Driving Bitcoin Adoption

Several factors could drive Bitcoin adoption. Growing awareness and understanding of its benefits as a decentralized, secure, and transparent store of value are crucial. Increasing institutional investment and integration into traditional financial systems will play a vital role. The development of user-friendly applications and wallets will make Bitcoin more accessible to the average person. Furthermore, its potential use cases beyond investment, such as cross-border payments and microtransactions, could drive wider adoption. The growing adoption of Bitcoin by companies like MicroStrategy and Tesla demonstrates the increasing acceptance of Bitcoin as a legitimate asset within the corporate world.

Bitcoin July 2025 Prediction – Predicting Bitcoin’s price in July 2025 is challenging, influenced by various factors including market sentiment and technological advancements. A key event impacting future price is the Bitcoin halving, and to understand its potential influence, it’s crucial to know exactly when it will occur; you can find that information here: When Will Bitcoin Halving Take Place In 2025.

Understanding the halving’s timing is vital for formulating more accurate Bitcoin July 2025 predictions.

Predicting Bitcoin’s price in July 2025 is challenging, given the inherent volatility of the cryptocurrency market. A key factor influencing this prediction is the upcoming halving event, and understanding its potential impact is crucial. For detailed analysis on this, check out this comprehensive resource on the 2025 Bitcoin Halving Price Prediction. Ultimately, the July 2025 Bitcoin price will depend on a confluence of factors beyond just the halving, including regulatory changes and overall market sentiment.

Predicting Bitcoin’s price in July 2025 is challenging, given the inherent volatility of the cryptocurrency market. A key factor influencing this prediction is the upcoming halving event, and understanding its potential impact is crucial. For detailed analysis on this, check out this comprehensive resource on the 2025 Bitcoin Halving Price Prediction. Ultimately, the July 2025 Bitcoin price will depend on a confluence of factors beyond just the halving, including regulatory changes and overall market sentiment.

Predicting Bitcoin’s price in July 2025 is challenging, given the inherent volatility of the cryptocurrency market. A key factor influencing this prediction is the upcoming halving event, and understanding its potential impact is crucial. For detailed analysis on this, check out this comprehensive resource on the 2025 Bitcoin Halving Price Prediction. Ultimately, the July 2025 Bitcoin price will depend on a confluence of factors beyond just the halving, including regulatory changes and overall market sentiment.

Predicting Bitcoin’s price in July 2025 is challenging, given the inherent volatility of the cryptocurrency market. A key factor influencing this prediction is the upcoming halving event, and understanding its potential impact is crucial. For detailed analysis on this, check out this comprehensive resource on the 2025 Bitcoin Halving Price Prediction. Ultimately, the July 2025 Bitcoin price will depend on a confluence of factors beyond just the halving, including regulatory changes and overall market sentiment.

Predicting Bitcoin’s price in July 2025 is challenging, given the inherent volatility of the cryptocurrency market. A key factor influencing this prediction is the upcoming halving event, and understanding its potential impact is crucial. For detailed analysis on this, check out this comprehensive resource on the 2025 Bitcoin Halving Price Prediction. Ultimately, the July 2025 Bitcoin price will depend on a confluence of factors beyond just the halving, including regulatory changes and overall market sentiment.