Bitcoin Max Price Prediction 2025: Bitcoin Max Price 2025

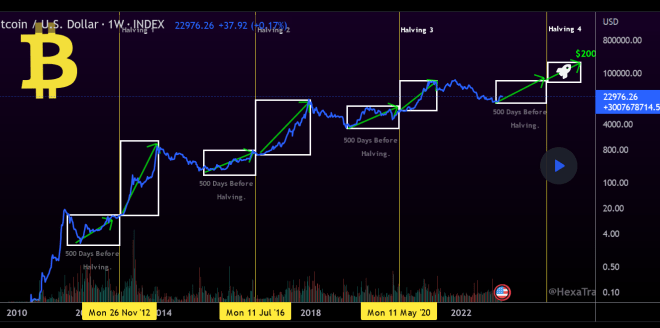

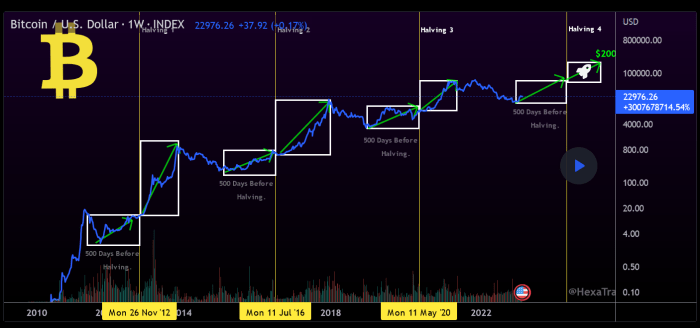

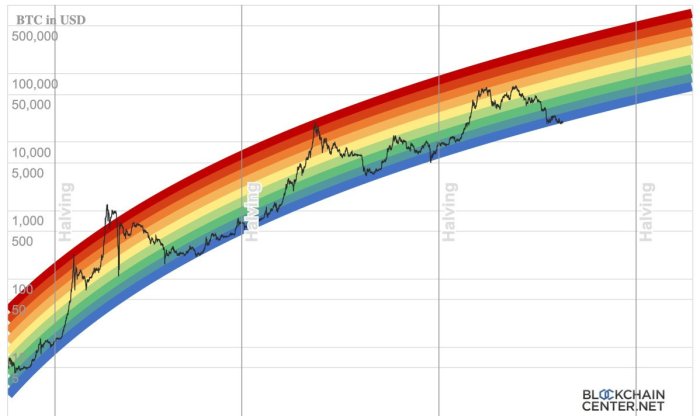

Bitcoin, the pioneering cryptocurrency, has experienced a turbulent yet fascinating journey since its inception in 2009. Its price has been characterized by extreme volatility, swinging from near-zero to record highs and plummeting back down again, often in dramatic fashion. Understanding this volatility is key to attempting any price prediction, even a tentative one for 2025.

Bitcoin’s price is influenced by a complex interplay of factors. These include macroeconomic conditions (like inflation and interest rates), regulatory developments (governmental policies impacting cryptocurrency adoption), technological advancements (scaling solutions and network upgrades), market sentiment (investor confidence and media coverage), and adoption rates (the growing number of businesses and individuals using Bitcoin). The interplay of these elements creates a dynamic and often unpredictable market.

Predicting Bitcoin’s maximum price in 2025 presents significant challenges. The inherent volatility of the cryptocurrency market makes precise forecasting exceptionally difficult. Past price movements are not necessarily indicative of future performance, and unforeseen events – such as major regulatory changes, technological breakthroughs, or global economic crises – can significantly impact Bitcoin’s value. Furthermore, the relatively short history of Bitcoin compared to traditional asset classes limits the availability of historical data for robust predictive modeling. Even sophisticated models, incorporating various factors, often yield widely divergent results. For example, in 2017, many analysts predicted a much higher price than what was ultimately realized, highlighting the limitations of predictive analysis in this volatile market.

Factors Influencing Bitcoin’s Price Volatility, Bitcoin Max Price 2025

The fluctuating nature of Bitcoin’s price stems from its unique characteristics and the broader market forces affecting it. Its limited supply (21 million coins) creates scarcity, potentially driving up demand and price. However, this scarcity is counterbalanced by periods of intense selling pressure, often triggered by negative news cycles or regulatory uncertainty. For example, the 2022 crypto winter, characterized by significant price drops across the board, was largely driven by a combination of macroeconomic factors like rising interest rates and the collapse of major crypto entities. Conversely, periods of positive news, such as the growing acceptance of Bitcoin by institutional investors or the development of innovative applications, can lead to substantial price increases. The inherent speculation within the crypto market further contributes to this volatility, with prices reacting sharply to both positive and negative sentiment.

Challenges in Accurate Price Prediction

The inherent unpredictability of Bitcoin’s price makes accurate predictions extremely challenging. The decentralized and global nature of the cryptocurrency market makes it susceptible to a multitude of unforeseen events. Geopolitical instability, changes in government regulations, technological advancements, and shifts in investor sentiment all contribute to the complexity of predicting its future price. Furthermore, the relatively short history of Bitcoin provides limited data for creating reliable predictive models. Traditional financial models, which rely heavily on historical data, may not be entirely suitable for forecasting the behavior of a relatively young and volatile asset like Bitcoin. The lack of a central authority regulating Bitcoin further complicates the forecasting process, as there is no single entity controlling its supply or influencing its price in a predictable way. The unpredictability is further amplified by the influence of social media and news cycles on investor sentiment.

Factors Affecting Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of economic, regulatory, technological, and market-driven factors. While no one can definitively state the exact price, understanding these influences provides a framework for informed speculation.

Global Economic Conditions and Bitcoin’s Price

Global macroeconomic conditions significantly impact Bitcoin’s price. Periods of high inflation or economic uncertainty often drive investors towards Bitcoin as a hedge against inflation and a store of value, potentially increasing demand and price. Conversely, a robust global economy with low inflation might lead investors to favor traditional assets, reducing Bitcoin’s appeal and potentially lowering its price. For example, the 2020-2021 Bitcoin bull run coincided with increased uncertainty surrounding the global economy due to the COVID-19 pandemic and government stimulus measures. Conversely, periods of economic stability often see a relative decrease in Bitcoin’s price as investors shift their focus to other, more traditional, investment vehicles.

Regulatory Changes and Bitcoin’s Value

Regulatory landscapes surrounding cryptocurrencies are constantly evolving. Clear and favorable regulations in major economies could boost institutional investment and mainstream adoption, driving up Bitcoin’s price. Conversely, stringent or unclear regulations could stifle growth and potentially lead to price decreases. The example of China’s crackdown on cryptocurrency mining and trading in 2021 resulted in a significant short-term price drop. Conversely, positive regulatory developments, such as the increasing acceptance of Bitcoin as a legitimate asset class in certain jurisdictions, can significantly impact its price positively.

Technological Advancements and Bitcoin’s Price

Technological advancements within the Bitcoin ecosystem, such as improvements to scalability, transaction speed, and security, can positively influence its price. The development of the Lightning Network, for instance, addresses scalability concerns and could make Bitcoin more suitable for everyday transactions, increasing demand. Conversely, major security breaches or technological limitations could negatively affect investor confidence and consequently, the price.

Institutional Adoption versus Individual Investor Sentiment

Institutional adoption of Bitcoin, such as investments by large corporations and financial institutions, provides significant legitimacy and can drive substantial price increases. This contrasts with the often volatile sentiment of individual investors, whose trading activity can lead to short-term price fluctuations. A large institutional investment can create a positive feedback loop, increasing confidence and driving further investment. However, a sudden shift in individual investor sentiment, perhaps driven by news or market trends, can cause rapid price changes, independent of underlying fundamentals.

Potential Black Swan Events and Bitcoin’s Price

Unforeseen events, or “black swan” events, can significantly impact Bitcoin’s price. These could include major security breaches, significant regulatory changes, or unexpected geopolitical events. The collapse of FTX in 2022 serves as a recent example of a black swan event that significantly impacted the entire cryptocurrency market, including Bitcoin’s price. Another potential black swan event could be a widespread adoption of a competing cryptocurrency with superior technology or features.

Positive Economic Outlook Scenario

A scenario of sustained global economic growth, coupled with increasing institutional adoption and positive regulatory developments, could lead to a significant increase in Bitcoin’s price in 2025. In this scenario, Bitcoin could be seen as a safe haven asset and a store of value, attracting significant investment from both institutional and individual investors. This could potentially push Bitcoin’s price to significantly higher levels than currently anticipated.

Negative Economic Outlook Scenario

A global recession or significant economic downturn, combined with negative regulatory developments or a loss of investor confidence, could result in a substantial decrease in Bitcoin’s price in 2025. In this scenario, investors might move towards safer assets, leading to a sell-off in the cryptocurrency market. The price could potentially fall significantly below current levels.

Potential Price Ranges for Bitcoin in 2025

Predicting the price of Bitcoin is inherently speculative, given its volatile nature and dependence on numerous interacting factors. However, by analyzing current market trends, technological advancements, and macroeconomic conditions, we can formulate plausible price ranges for Bitcoin in 2025, encompassing both optimistic and pessimistic scenarios. These ranges are not guarantees, but rather informed estimations based on available data and expert opinions.

The following price ranges consider various scenarios, from widespread adoption and positive regulatory developments to negative market sentiment and regulatory crackdowns. Understanding the factors contributing to each range is crucial for interpreting these predictions.

Optimistic Price Range: $150,000 – $250,000

This high-end range assumes significant global adoption of Bitcoin as a store of value and a medium of exchange. Widespread institutional investment, coupled with positive regulatory frameworks in major economies, would likely drive demand and push the price upwards. Technological advancements, such as the successful implementation of the Lightning Network for faster and cheaper transactions, would also contribute to increased usability and adoption. For example, if El Salvador’s Bitcoin adoption proves successful and inspires other nations to follow suit, a substantial increase in demand could be anticipated. Furthermore, if major financial institutions continue to integrate Bitcoin into their services, a surge in institutional investment could easily propel Bitcoin into this price range.

Moderate Price Range: $50,000 – $100,000

This range represents a more conservative outlook, assuming continued growth but with fewer significant catalysts. While Bitcoin adoption continues to increase, it may not reach the exponential levels predicted in the optimistic scenario. Regulatory uncertainty in some regions could dampen investor enthusiasm, limiting price appreciation. However, steady growth in adoption by individuals and businesses, combined with continued technological improvements, could still lead to substantial price increases. This scenario might play out if Bitcoin adoption grows at a consistent pace, but significant regulatory hurdles or macroeconomic downturns prevent a dramatic price surge. The success of Bitcoin ETFs in major markets would contribute to this price level.

Pessimistic Price Range: $20,000 – $40,000

This low-end range considers scenarios involving significant negative market events or regulatory crackdowns. A major global economic recession, for example, could lead to a flight to safety, potentially causing investors to liquidate their Bitcoin holdings. Stringent regulatory actions aimed at suppressing cryptocurrency trading could also significantly impact the price. If, for instance, a major government bans Bitcoin entirely or imposes extremely heavy regulations, a sharp price drop could ensue. A significant security breach impacting a major Bitcoin exchange could also severely erode confidence in the market, pushing the price downwards.