Impact of Macroeconomic Factors

Bitcoin’s price, despite its decentralized nature, is significantly influenced by macroeconomic conditions globally. Understanding these influences is crucial for any prediction about its future value, particularly in the context of a forecast for May 2025. The interplay between Bitcoin and traditional financial systems creates a complex dynamic that needs careful consideration.

Bitcoin’s price often exhibits an inverse relationship with inflation. High inflation erodes the purchasing power of fiat currencies, potentially driving investors towards Bitcoin as a hedge against inflation. Conversely, periods of low inflation or deflation might reduce the appeal of Bitcoin as a safe haven asset. Interest rate hikes, frequently employed by central banks to combat inflation, can also impact Bitcoin’s price. Higher interest rates generally make holding non-yielding assets like Bitcoin less attractive compared to interest-bearing accounts or bonds. Recessions, characterized by economic downturns and decreased consumer spending, can lead to increased volatility in Bitcoin’s price as investors liquidate assets to meet financial obligations. However, some argue that Bitcoin’s scarcity and decentralized nature could make it a relatively resilient asset during economic uncertainty.

Bitcoin’s Correlation with Traditional Markets

Bitcoin’s relationship with traditional financial markets is not always straightforward. While sometimes exhibiting a correlation with equities (stocks) during periods of risk-off sentiment, it has also demonstrated periods of decoupling, showcasing its unique characteristics as a digital asset. For instance, during the 2020 COVID-19 market crash, Bitcoin initially experienced a significant price drop alongside equities but later recovered independently, demonstrating its potential as a separate asset class. Its correlation with gold, often seen as a safe-haven asset, is also inconsistent. While both can act as inflation hedges, their price movements aren’t always perfectly synchronized. The relationship with bonds is generally inverse; rising bond yields often coincide with lower Bitcoin prices, reflecting the opportunity cost of holding a non-yielding asset.

Geopolitical Events and Bitcoin

Geopolitical events can significantly impact Bitcoin’s price and adoption. Periods of political instability, international conflicts, or sanctions can lead to increased demand for Bitcoin as a store of value and a means of transferring wealth outside traditional financial systems. For example, the ongoing conflict in Ukraine led to increased interest in Bitcoin as a way to circumvent sanctions and preserve financial assets. Similarly, countries with unstable economies or hyperinflation may see increased Bitcoin adoption as a hedge against currency devaluation. However, regulatory uncertainty in different jurisdictions can also negatively impact Bitcoin’s price and adoption. Changes in government policies regarding cryptocurrency regulation, taxation, or outright bans can cause significant market fluctuations.

Bitcoin Price and Macroeconomic Indicators: Scatter Plot Illustration, Bitcoin May 2025 Prediction

A scatter plot illustrating the correlation between Bitcoin’s price and key macroeconomic indicators (e.g., inflation rate, interest rates, Consumer Price Index (CPI), Gross Domestic Product (GDP) growth) would visually demonstrate the relationship. While a precise plot cannot be rendered here, a hypothetical illustration would show points scattered across a graph, with the x-axis representing a macroeconomic indicator (e.g., inflation rate) and the y-axis representing Bitcoin’s price. A positive correlation would be indicated by points generally trending upwards from left to right, suggesting that as inflation rises, so does Bitcoin’s price. A negative correlation would be shown by a downward trend, indicating that as inflation rises, Bitcoin’s price falls. In reality, the relationship is likely to be more complex, with periods of both positive and negative correlation depending on various other factors. A strong correlation is not consistently observed, highlighting the multifaceted nature of Bitcoin’s price determination.

Bitcoin’s Role in the Future of Finance: Bitcoin May 2025 Prediction

Bitcoin’s potential impact on the global financial landscape is a subject of ongoing debate and speculation. While its future remains uncertain, its disruptive potential is undeniable, challenging existing financial systems and offering alternative solutions across various sectors. This section will explore Bitcoin’s multifaceted role in shaping the future of finance.

Bitcoin as a Mainstream Payment Method and Store of Value

Bitcoin’s adoption as a mainstream payment method hinges on several factors, including increased price stability, wider merchant acceptance, and improved transaction speed and scalability. While currently not widely used for everyday transactions, its potential as a store of value, particularly during periods of economic uncertainty, is increasingly recognized. The limited supply of Bitcoin, capped at 21 million coins, contributes to its perceived scarcity and potential for long-term value appreciation. However, its volatility remains a significant barrier to mainstream adoption. For example, the significant price fluctuations witnessed in 2021 and 2022 highlight the inherent risk associated with using Bitcoin as a medium of exchange. The development of the Lightning Network, which aims to improve transaction speed and reduce fees, could play a crucial role in boosting Bitcoin’s usability as a payment method.

Bitcoin’s Influence on Decentralized Finance (DeFi)

Bitcoin’s decentralized nature has paved the way for the growth of decentralized finance (DeFi), a rapidly evolving sector offering alternative financial services outside the traditional banking system. Bitcoin serves as a foundational asset within many DeFi protocols, providing collateral for lending and borrowing platforms, as well as powering decentralized exchanges (DEXs). The emergence of wrapped Bitcoin (WBTC), which represents Bitcoin on Ethereum’s blockchain, further enhances its integration into the DeFi ecosystem. This increased interoperability allows Bitcoin holders to participate in DeFi applications without relinquishing ownership of their Bitcoin. The impact on traditional financial institutions is potentially significant, as DeFi platforms offer increased transparency, accessibility, and potentially lower costs compared to traditional counterparts. However, regulatory uncertainty and the inherent risks associated with DeFi platforms remain considerable challenges.

Bitcoin’s Facilitation of Cross-Border Payments and Remittances

Bitcoin’s potential to revolutionize cross-border payments and remittances is substantial. Traditional remittance systems often involve high fees and lengthy processing times. Bitcoin offers a faster, cheaper, and more transparent alternative, bypassing intermediaries and reducing reliance on centralized institutions. Individuals can send and receive Bitcoin across borders with minimal fees and relatively fast transaction times, particularly when utilizing the Lightning Network. This is particularly beneficial for migrants sending money back to their home countries, who often face exorbitant fees with traditional methods. For instance, companies like Paxful have emerged, facilitating peer-to-peer Bitcoin transactions, enabling individuals in developing countries to access financial services more easily. However, regulatory hurdles and concerns about money laundering remain obstacles to widespread adoption for this purpose.

Innovative Use Cases for Bitcoin

Beyond its traditional roles, Bitcoin is finding innovative applications across various sectors. For example, Bitcoin can be used to create secure and transparent supply chains, tracking goods from origin to consumer. Each transaction recorded on the blockchain provides an immutable record, reducing the risk of counterfeiting and fraud. Furthermore, Bitcoin can be integrated into loyalty programs, providing users with rewards in Bitcoin, fostering greater engagement and rewarding customer loyalty. Another example is the use of Bitcoin for microtransactions, enabling smaller, more frequent payments, which may be difficult or expensive with traditional payment methods. The development of smart contracts on the Bitcoin blockchain further expands its potential for innovative applications. These contracts automate the execution of agreements, potentially revolutionizing various industries, from insurance to real estate.

Frequently Asked Questions (FAQ)

This section addresses common questions regarding Bitcoin’s potential price in May 2025, its investment viability, secure handling, and environmental impact. Understanding these aspects is crucial for anyone considering involvement with Bitcoin.

Potential Bitcoin Price in May 2025

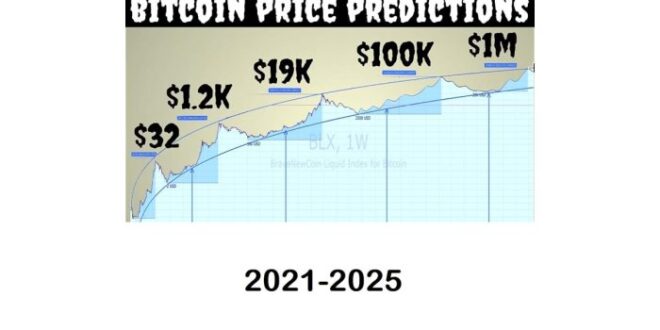

Predicting Bitcoin’s price is inherently speculative, influenced by numerous intertwined factors. However, considering historical trends, technological advancements, regulatory changes, and macroeconomic conditions, we can Artikel potential price scenarios. A conservative estimate might place Bitcoin in a range of $50,000 to $100,000, assuming moderate growth and adoption. A more bullish scenario, factoring in significant technological breakthroughs and widespread institutional adoption, could see prices exceeding $200,000. Conversely, a bearish scenario, considering negative regulatory actions or a major market downturn, could result in prices falling below $30,000. These are merely potential scenarios, and the actual price will depend on a confluence of factors. For example, the 2017 bull run saw Bitcoin reach nearly $20,000, followed by a significant correction. Similar volatility should be expected.

Bitcoin as an Investment

Bitcoin presents both substantial rewards and considerable risks. The potential for high returns is undeniable, particularly given its history of price appreciation. However, it’s also extremely volatile, experiencing significant price swings in short periods. This volatility stems from its decentralized nature, limited supply, and susceptibility to market sentiment and regulatory changes. Investors must be prepared for substantial losses. Diversification within a broader investment portfolio is strongly advised to mitigate risk. Furthermore, understanding the technological underpinnings of Bitcoin and the overall cryptocurrency market is crucial before making any investment decisions. Remember that past performance is not indicative of future results.

Buying and Securely Storing Bitcoin

Acquiring Bitcoin typically involves using cryptocurrency exchanges. These platforms allow users to buy Bitcoin using fiat currency (like USD or EUR). Reputable exchanges are essential to minimize the risk of scams or security breaches. Once purchased, securing Bitcoin is paramount. Hardware wallets, physical devices designed specifically for storing cryptocurrency, offer the highest level of security. Software wallets, which are applications on computers or smartphones, provide a less secure but more convenient option. Regardless of the chosen method, strong passwords and multi-factor authentication are crucial. Avoid storing large amounts of Bitcoin on exchanges, as they are vulnerable to hacking. Always prioritize security measures commensurate with the amount of Bitcoin held.

Environmental Implications of Bitcoin Mining

Bitcoin mining, the process of validating transactions and adding them to the blockchain, consumes significant energy. This energy consumption primarily stems from the computational power required for mining. The environmental impact is a subject of ongoing debate, with concerns about carbon emissions and the use of non-renewable energy sources. However, several factors mitigate these concerns. The transition towards renewable energy sources for mining operations is gaining traction. Furthermore, technological advancements are improving energy efficiency. The overall environmental impact of Bitcoin mining needs to be considered in the context of its broader societal impact and compared to other energy-intensive industries. The ongoing development of more energy-efficient mining techniques and the increasing adoption of renewable energy sources are likely to significantly reduce Bitcoin’s environmental footprint over time.

Bitcoin May 2025 Prediction – Predicting Bitcoin’s price in May 2025 is inherently speculative, but a key factor influencing any forecast is the upcoming halving event. Understanding the potential impact of this reduction in Bitcoin’s issuance rate is crucial, and a helpful resource for this is the analysis provided at 2025 Bitcoin Halving Price. Ultimately, the 2025 Bitcoin halving will significantly shape the market dynamics and therefore influence any accurate prediction for May 2025.

Predicting Bitcoin’s price in May 2025 is challenging, but a key factor to consider is the upcoming halving event. Understanding the impact of this significant reduction in Bitcoin’s block reward is crucial for any forecast, and you can track the progress towards the halving with this countdown: 2025 Bitcoin Halving Countdown. The halving’s effect on scarcity and potential price increase is a major component of many Bitcoin May 2025 predictions.

Predicting Bitcoin’s price in May 2025 is challenging, with various factors influencing its trajectory. A key element to consider when forming any Bitcoin May 2025 Prediction is the impact of the upcoming halving, and understanding the historical data surrounding these events is crucial. For detailed analysis of this, check out the comprehensive resource on Halving Bitcoin Data 2025.

This data can help inform more accurate predictions about Bitcoin’s potential price movement in May 2025, considering the reduced supply after the halving.

Predicting Bitcoin’s price in May 2025 is challenging, with various factors influencing its trajectory. A key element to consider when forming any Bitcoin May 2025 Prediction is the impact of the upcoming halving, and understanding the historical data surrounding these events is crucial. For detailed analysis of this, check out the comprehensive resource on Halving Bitcoin Data 2025.

This data can help inform more accurate predictions about Bitcoin’s potential price movement in May 2025, considering the reduced supply after the halving.

Predicting Bitcoin’s price in May 2025 is challenging, with various factors influencing its trajectory. A key element to consider when forming any Bitcoin May 2025 Prediction is the impact of the upcoming halving, and understanding the historical data surrounding these events is crucial. For detailed analysis of this, check out the comprehensive resource on Halving Bitcoin Data 2025.

This data can help inform more accurate predictions about Bitcoin’s potential price movement in May 2025, considering the reduced supply after the halving.

Predicting Bitcoin’s price in May 2025 is challenging, with various factors influencing its trajectory. A key element to consider when forming any Bitcoin May 2025 Prediction is the impact of the upcoming halving, and understanding the historical data surrounding these events is crucial. For detailed analysis of this, check out the comprehensive resource on Halving Bitcoin Data 2025.

This data can help inform more accurate predictions about Bitcoin’s potential price movement in May 2025, considering the reduced supply after the halving.