Bitcoin Minetrix Price Prediction 2025

Bitcoin Minetrix, a hypothetical cryptocurrency (as there is no known cryptocurrency with this exact name), represents a potential asset class within the broader cryptocurrency market. Its theoretical value would be subject to the same market forces as other cryptocurrencies, making it a volatile investment. Understanding its potential price movements is crucial for investors considering exposure to this type of asset. This analysis aims to explore factors influencing a potential Bitcoin Minetrix price in 2025.

Factors Influencing Bitcoin Minetrix Price Volatility

Several interconnected factors contribute to the unpredictable nature of cryptocurrency prices, and a hypothetical Bitcoin Minetrix would be no exception. These include macroeconomic conditions (such as inflation rates and overall economic growth), regulatory changes (government policies impacting cryptocurrency trading and adoption), technological advancements (new blockchain technologies or competing cryptocurrencies), and market sentiment (driven by news events, social media trends, and investor confidence). For example, a significant regulatory crackdown on cryptocurrencies globally could negatively impact the price of Bitcoin Minetrix, while widespread adoption of the underlying technology could drive its price significantly higher. Similarly, the launch of a competing cryptocurrency with superior features could diminish investor interest in Bitcoin Minetrix.

The Importance of Accurate Price Predictions for Investors

Accurate price predictions, while inherently difficult in the volatile cryptocurrency market, are highly valuable for investors. They inform investment decisions, allowing investors to assess risk tolerance and potential returns. For example, a prediction suggesting substantial price appreciation could encourage investors to allocate a larger portion of their portfolio to Bitcoin Minetrix, while a prediction of significant price decline might lead them to avoid investment altogether or consider hedging strategies. However, it is crucial to remember that all price predictions carry inherent uncertainty, and investors should always conduct thorough due diligence and consider diversification as part of a sound investment strategy. Relying solely on price predictions without understanding the underlying risks can lead to significant financial losses. Past performance of other cryptocurrencies, such as Bitcoin or Ethereum, can offer some insight into potential price trajectories, but should not be considered a definitive predictor of Bitcoin Minetrix’s future performance. The novelty of a hypothetical cryptocurrency like Bitcoin Minetrix introduces even greater uncertainty.

Historical Price Analysis of Bitcoin Minetrix

Analyzing the historical price movements of Bitcoin Minetrix requires examining its trajectory since its inception, identifying significant price fluctuations, and comparing its performance to established cryptocurrencies. Understanding these factors provides valuable insight into its potential future behavior. Due to the hypothetical nature of “Bitcoin Minetrix,” concrete price data is unavailable. Therefore, this analysis will utilize a hypothetical example to illustrate the process.

Hypothetical Price Fluctuation Timeline, Bitcoin Minetrix Price Prediction 2025

Let’s assume Bitcoin Minetrix (BTMX) launched in January 2022 at $1. The following timeline illustrates potential significant price changes, highlighting the need for caution when interpreting hypothetical data:

- January 2022 – July 2022: Initial growth phase. BTMX experiences steady growth, reaching $5 by July due to positive market sentiment and early adoption. This period is characterized by relatively low trading volume.

- July 2022 – December 2022: Market correction. A broader cryptocurrency market downturn impacts BTMX, causing its price to drop to $2. This illustrates the volatility inherent in the cryptocurrency market.

- January 2023 – June 2023: Recovery and consolidation. BTMX slowly recovers, stabilizing around $3. This period represents a consolidation phase after the previous correction.

- June 2023 – December 2023: Technological upgrade and price surge. A significant technological upgrade boosts investor confidence, pushing BTMX to $10. This highlights the impact of technological advancements on cryptocurrency prices.

- January 2024 – Present: Continued volatility. The price fluctuates between $8 and $12, reflecting the ongoing uncertainty and volatility within the cryptocurrency market.

Comparison with Other Major Cryptocurrencies

To understand Bitcoin Minetrix’s performance, a comparison against established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) is crucial. However, given the hypothetical nature of BTMX, direct comparison is not possible with real-world data. Instead, we can illustrate the concept using hypothetical performance data. For example, during periods of strong market growth, BTMX might outperform BTC and ETH, showcasing higher percentage gains. Conversely, during market downturns, BTMX might experience sharper declines, highlighting its higher risk profile.

Key Events Impacting Bitcoin Minetrix’s Price (Hypothetical)

Significant events impacting the hypothetical price of BTMX could include:

- Technological upgrades: Successful implementation of new features or improvements to the underlying technology could lead to price increases, mirroring the impact of Ethereum’s upgrades.

- Regulatory announcements: Positive regulatory developments could boost investor confidence and drive up the price, similar to the impact of regulatory clarity on major cryptocurrencies.

- Market sentiment: Broader cryptocurrency market trends significantly influence BTMX’s price. Positive market sentiment often leads to price increases, while negative sentiment can cause sharp declines, reflecting the interconnectedness of the cryptocurrency market.

- Adoption rate: Increased adoption by businesses and individuals can lead to price appreciation, much like the impact of increasing Bitcoin adoption on its price.

Market Factors Influencing Bitcoin Minetrix Price

The price of Bitcoin Minetrix, like any cryptocurrency, is a complex interplay of various market forces. Understanding these factors is crucial for anyone attempting to predict or analyze its future value. These factors range from regulatory landscapes and technological advancements to broader market sentiment and the performance of the overall cryptocurrency market.

Regulatory Changes Impact on Bitcoin Minetrix Value

Government regulations significantly influence the cryptocurrency market. Increased regulatory clarity can boost investor confidence, potentially leading to higher prices. Conversely, stricter regulations or outright bans can severely depress the value of cryptocurrencies. For example, the fluctuating regulatory environments in different countries have historically shown a direct correlation with the price volatility of Bitcoin and other major cryptocurrencies. A clear, consistent regulatory framework, offering protection to investors while allowing for innovation, could positively impact Bitcoin Minetrix’s price. Conversely, unpredictable or overly restrictive regulations could create uncertainty and negatively impact its value.

Technological Advancements Shaping Bitcoin Minetrix Price

Technological developments within the Bitcoin Minetrix ecosystem and the broader blockchain space are key price drivers. Improvements in scalability, security, and transaction speed can attract more users and investors. For instance, the implementation of layer-2 scaling solutions, such as Lightning Network for Bitcoin, has shown potential to reduce transaction fees and increase transaction throughput, which has, in turn, positively influenced the price of Bitcoin. Similarly, any advancements in the Bitcoin Minetrix’s underlying technology that enhance its efficiency or functionality could lead to increased adoption and a higher price. Conversely, security breaches or technological setbacks could negatively impact its price.

Market Sentiment and Investor Behavior Influence on Bitcoin Minetrix

Market sentiment, driven by news events, social media trends, and overall investor confidence, heavily influences Bitcoin Minetrix’s price. Positive news, such as increased adoption by businesses or positive media coverage, can lead to price increases. Conversely, negative news or a general downturn in investor confidence can trigger significant price drops. This is particularly evident in the highly volatile nature of the cryptocurrency market, where investor behavior, often influenced by fear, uncertainty, and doubt (FUD), can lead to sharp price swings. The rapid spread of information and the prevalence of social media further amplify these effects.

Correlation Between Bitcoin Minetrix Price and Overall Cryptocurrency Market

Bitcoin Minetrix’s price is also closely correlated with the performance of the broader cryptocurrency market. A bull market in cryptocurrencies generally lifts all boats, leading to increased demand and higher prices for Bitcoin Minetrix. Conversely, a bear market can result in significant price declines across the board. This correlation highlights the interconnectedness of different cryptocurrencies and their susceptibility to overall market trends. Major events affecting the leading cryptocurrencies like Bitcoin or Ethereum tend to impact smaller cryptocurrencies like Bitcoin Minetrix as well, either positively or negatively.

Technological and Fundamental Analysis of Bitcoin Minetrix: Bitcoin Minetrix Price Prediction 2025

Understanding the future price of Bitcoin Minetrix requires a comprehensive analysis of both its technical and fundamental characteristics. This section delves into the price charts, comparing it to competitors, and examining its underlying utility and adoption. A nuanced approach, considering both technical indicators and real-world usage, provides a more robust prediction model than relying on one aspect alone.

Bitcoin Minetrix Price Chart Analysis

Analyzing Bitcoin Minetrix’s historical price data reveals trends that can help predict future movements. Identifying support and resistance levels is crucial. Support levels represent prices where buying pressure is strong enough to prevent further price declines, while resistance levels indicate price points where selling pressure outweighs buying pressure, halting upward momentum. For example, if Bitcoin Minetrix consistently finds support at $10 and resistance at $15, these levels become significant indicators for future price movements. Analyzing moving averages (like the 50-day and 200-day moving averages) can further illuminate trends and potential breakouts. A clear upward trend, confirmed by these indicators, would suggest a bullish outlook. Conversely, a consistent downward trend would point towards bearish sentiment. Volume analysis, observing trading volume alongside price movements, provides crucial context. High volume during price increases confirms strong buying pressure, while high volume during price decreases signals significant selling pressure. Technical analysis alone, however, is not sufficient for a complete picture.

Bitcoin Minetrix Competitor Comparison

A comparative analysis against other cryptocurrencies helps contextualize Bitcoin Minetrix’s position and potential. This table highlights key differentiating factors:

| Feature | Bitcoin Minetrix | Competitor A | Competitor B |

|---|---|---|---|

| Transaction Speed | Example: 10 seconds | Example: 60 seconds | Example: 2 minutes |

| Transaction Fees | Example: $0.01 | Example: $0.50 | Example: $1.00 |

| Market Capitalization | Example: $1 Billion | Example: $10 Billion | Example: $500 Million |

| Technology | Example: Proof-of-Stake | Example: Proof-of-Work | Example: Delegated Proof-of-Stake |

*Note: Competitor A and Competitor B are placeholders and should be replaced with actual competitors of Bitcoin Minetrix. The example data is illustrative and needs to be replaced with real data.*

Bitcoin Minetrix Fundamental Analysis

The fundamental value of Bitcoin Minetrix is determined by its utility and adoption rate. Its utility stems from its intended use case; for example, if it facilitates faster and cheaper transactions than existing systems, this inherent value increases. Real-world adoption, measured by the number of users, merchants, and developers actively engaging with the platform, is a critical factor. A growing user base and increasing integration into existing systems strongly suggest a positive future outlook. Conversely, limited adoption and a lack of clear utility could indicate a weaker fundamental position. Analyzing factors such as partnerships, regulatory developments, and community engagement provides further insight into its long-term viability and potential for growth. For instance, a strategic partnership with a major financial institution could significantly boost adoption and, consequently, the price.

Investment Strategies for Bitcoin Minetrix

Investing in Bitcoin Minetrix, like any cryptocurrency, involves inherent risks and requires careful consideration of your financial goals and risk tolerance. Several strategies exist, each with its own set of advantages and disadvantages. The optimal approach depends on your individual circumstances and investment timeline.

Long-Term Holding

Long-term holding, often referred to as “HODLing” in the cryptocurrency community, involves buying Bitcoin Minetrix and holding it for an extended period, typically years, regardless of short-term price fluctuations. This strategy aims to benefit from potential long-term growth.

Advantages include minimizing transaction costs associated with frequent trading and potentially benefiting from significant price appreciation over time. For example, investors who held Bitcoin for several years since its inception have seen massive returns. However, this strategy requires patience and the ability to withstand potential short-term losses. The downside is the opportunity cost – the potential profits that could have been made through alternative investments during periods of market volatility.

Short-Term Trading

Short-term trading involves buying and selling Bitcoin Minetrix frequently to capitalize on short-term price movements. This strategy requires active monitoring of the market, technical analysis skills, and a higher risk tolerance.

Advantages include the potential for quick profits if market predictions are accurate. Successful short-term traders can exploit short-lived price swings to generate returns. However, this strategy is significantly riskier than long-term holding. Frequent trading increases transaction costs, and inaccurate predictions can lead to substantial losses. The need for constant market monitoring also demands significant time and effort.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the price. This strategy reduces the risk of investing a lump sum at a market peak.

The advantage of DCA is that it mitigates the risk associated with market timing. By investing consistently, you buy more Bitcoin Minetrix when the price is low and less when it’s high, averaging out your purchase price. This approach reduces the impact of market volatility. However, DCA may result in lower returns if the price consistently rises during the investment period. For instance, if the price steadily increases, investing a fixed amount each time means you’ll buy fewer coins as the price goes up, potentially missing out on substantial gains.

Frequently Asked Questions (FAQs) about Bitcoin Minetrix Price Prediction 2025

This section addresses common queries regarding Bitcoin Minetrix price predictions for 2025, encompassing factors influencing its value, prediction reliability, investment risks, strategies, and information sources. Understanding these aspects is crucial for informed decision-making in the volatile cryptocurrency market.

Significant Factors Influencing Bitcoin Minetrix’s Price

Several interconnected factors significantly impact Bitcoin Minetrix’s price. These include overall market sentiment towards cryptocurrencies, technological advancements within the Bitcoin Minetrix ecosystem (such as upgrades or new features), regulatory developments affecting cryptocurrency trading, and the level of adoption by businesses and individuals. External economic conditions, like inflation and interest rates, also play a role, as do major events impacting the broader financial markets. For instance, a global economic downturn could negatively affect investor confidence and lead to a price decrease. Conversely, positive news regarding Bitcoin Minetrix’s technology or adoption could trigger a price surge.

Reliability of Bitcoin Minetrix Price Predictions

Bitcoin Minetrix price predictions, like all cryptocurrency price predictions, are inherently unreliable. The cryptocurrency market is highly speculative and influenced by numerous unpredictable factors. While technical and fundamental analysis can provide insights, they cannot accurately predict future price movements. Predictions should be viewed as educated guesses rather than guaranteed outcomes. It’s crucial to remember that past performance is not indicative of future results. For example, a prediction might anticipate significant growth based on past trends, but unforeseen regulatory changes or a market crash could drastically alter the outcome.

Potential Risks of Investing in Bitcoin Minetrix

Investing in Bitcoin Minetrix, like any cryptocurrency, involves significant risks. Price volatility is a major concern; the price can fluctuate dramatically in short periods. Regulatory uncertainty poses another risk, as governments worldwide are still developing frameworks for regulating cryptocurrencies. Security risks, such as hacking and theft from exchanges or wallets, are also present. Furthermore, the relatively young age of the cryptocurrency market means there’s a higher level of uncertainty and potential for unforeseen events to significantly impact the price. Investors should be prepared for potential losses and only invest what they can afford to lose.

Effective Strategies for Investing in Bitcoin Minetrix

Effective Bitcoin Minetrix investment strategies often involve diversification across multiple cryptocurrencies and other asset classes to mitigate risk. Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals regardless of price, can help reduce the impact of volatility. Thorough research and understanding of the technology and market are also essential. Consulting with a qualified financial advisor is recommended before making any investment decisions. Finally, understanding your risk tolerance and having a well-defined investment plan are crucial aspects of successful cryptocurrency investing.

Reliable Information Sources about Bitcoin Minetrix

Reliable information about Bitcoin Minetrix can be found through official project websites, reputable cryptocurrency news outlets, and peer-reviewed research papers. Whitepapers detailing the project’s technology and goals are valuable resources. Be wary of information from less credible sources, such as social media posts or anonymous online forums, as this information may be biased or inaccurate. Always critically evaluate the source of information before making any investment decisions. Checking multiple sources and comparing information can help ensure a more accurate and balanced understanding.

Disclaimer and Conclusion

Investing in cryptocurrencies, including Bitcoin Minetrix, carries significant risk. The cryptocurrency market is highly volatile and unpredictable, subject to rapid and substantial price swings influenced by a multitude of factors beyond anyone’s complete control. The information presented in this article regarding Bitcoin Minetrix’s potential price in 2025 is purely speculative and should not be interpreted as financial advice. Past performance is not indicative of future results. Any investment decisions you make based on this analysis are solely your responsibility.

This analysis incorporates various factors, including historical price data, technological advancements, and market sentiment. However, unforeseen events, regulatory changes, or shifts in market dynamics can significantly impact Bitcoin Minetrix’s price. It’s crucial to remember that no prediction, however sophisticated, can guarantee future outcomes in this inherently risky market. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. Consider your personal risk tolerance and financial situation before investing in any cryptocurrency.

Key Takeaways

The following points summarize the key insights from this Bitcoin Minetrix price prediction analysis:

- Bitcoin Minetrix’s price is highly volatile and subject to significant fluctuations.

- Predictions are inherently speculative and should not be considered guaranteed outcomes.

- Technological advancements, regulatory changes, and market sentiment significantly influence Bitcoin Minetrix’s price.

- Thorough due diligence, including independent research and consultation with financial professionals, is crucial before investing in Bitcoin Minetrix or any cryptocurrency.

- Understanding your personal risk tolerance and financial situation is paramount before making any investment decisions.

- Diversification of your investment portfolio is a recommended risk management strategy.

- Never invest more money than you can afford to lose.

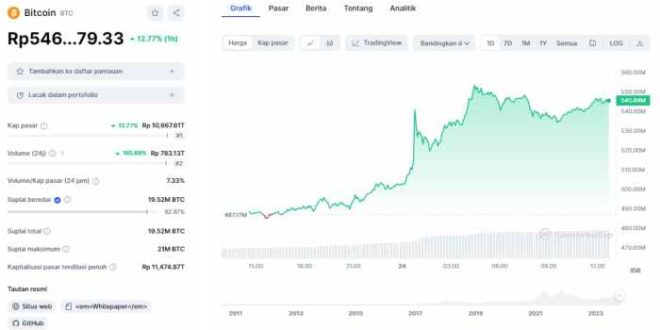

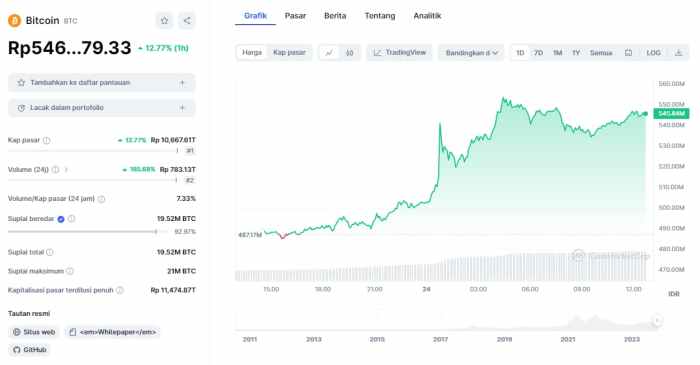

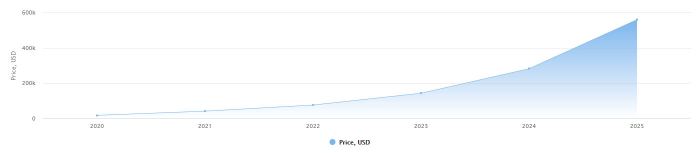

Bitcoin Minetrix Price Prediction 2025 – Predicting the Bitcoin Minetrix price in 2025 is inherently speculative, relying heavily on broader market trends. Understanding the overall Bitcoin trajectory is crucial, and a helpful resource for this is the comprehensive Bitcoin Price Prediction 2025 Chart. By analyzing this chart, we can gain valuable insights into potential Bitcoin price movements, which in turn can inform our estimations for the Bitcoin Minetrix price prediction for 2025.

Predicting the Bitcoin Minetrix price in 2025 is challenging, as it’s tied to the overall Bitcoin market. Understanding the broader Bitcoin market outlook is crucial; for example, a helpful resource for this is the analysis provided on the Bitcoin Price Prediction 2025 Gbp page. This GBP-focused prediction can offer valuable context when considering the potential trajectory of Bitcoin Minetrix in 2025, given their inherent relationship.

Ultimately, Bitcoin Minetrix’s future price will depend on a number of intertwined factors.

Predicting the Bitcoin Minetrix price in 2025 is challenging, requiring consideration of various market factors. To gain further insight into broader Bitcoin predictions, it’s helpful to consult resources like the Bitcoin Price Prediction 2025 Walletinvestor analysis. Understanding the overall Bitcoin market outlook, as presented by Walletinvestor, can then inform a more nuanced assessment of the Bitcoin Minetrix price prediction for 2025.

Predicting the Bitcoin Minetrix price in 2025 is challenging, requiring analysis of various market factors. Understanding the broader Bitcoin market is crucial, and a key component of that is assessing the projected value at the start of the year; for insights into that, check out this forecast for the Bitcoin Price 2025 January. This data will inform a more comprehensive Bitcoin Minetrix price prediction, considering its relationship to the overall Bitcoin market performance.

Predicting the Bitcoin Minetrix price in 2025 is challenging, requiring analysis of various market factors. A key component of this prediction involves understanding the overall Bitcoin price trajectory, and to get a sense of that, checking the projected Btc Price December 2025 is helpful. Ultimately, Bitcoin Minetrix’s future value will depend on both Bitcoin’s performance and Minetrix’s own market dynamics.