Predicting the Post-2025 Halving Market

The 2025 Bitcoin halving, reducing the block reward for miners by half, is a significant event anticipated to impact Bitcoin’s price. Predicting the precise market reaction, however, is inherently complex, influenced by a multitude of interacting factors. While historical precedent suggests a price surge following previous halvings, several variables could significantly alter this trajectory.

Bitcoin Next Halving After 2025 – Several factors will likely influence Bitcoin’s price post-2025 halving. These include the overall macroeconomic environment (inflation rates, interest rate policies), regulatory developments impacting cryptocurrency adoption globally, technological advancements within the Bitcoin ecosystem, and, crucially, the level of investor sentiment and demand. The interplay of these elements will shape the market’s response, making precise prediction a challenging endeavor.

Speculation around the Bitcoin next halving after 2025 is already rife, with many anticipating significant price movements. Pinpointing the exact date, however, requires knowing precisely when the next halving occurs, which is why understanding the answer to the question, “When In 2025 Is The Next Bitcoin Halving?” is crucial; you can find a detailed analysis of this on When In 2025 Is The Next Bitcoin Halving?

. This knowledge forms the bedrock for any serious prediction regarding Bitcoin’s trajectory post-2025 halving.

Market Predictions from Reputable Analysts

Numerous analysts offer varying predictions regarding Bitcoin’s price after the 2025 halving. These forecasts stem from diverse methodologies and underlying assumptions. For instance, some analysts base their projections on quantitative models incorporating historical price data and halving cycles, projecting substantial price increases. Others incorporate qualitative factors, such as regulatory changes or technological disruptions, leading to more conservative or even bearish outlooks. It’s crucial to remember that these are just predictions, not guarantees. A well-known example is PlanB’s Stock-to-Flow model, which historically predicted price increases based on Bitcoin’s scarcity, although its accuracy has been debated in recent times. Conversely, some analysts might cite concerns about macroeconomic instability or regulatory crackdowns as reasons for more modest price appreciation.

Potential Risks and Opportunities for Investors

Based on historical trends, the post-halving period presents both significant opportunities and considerable risks. Historically, the halving events have been followed by periods of increased price volatility. This volatility can create opportunities for investors to profit from price swings, but it also carries the risk of substantial losses if the market moves against their positions. The risk of regulatory uncertainty remains a significant factor. Government actions regarding Bitcoin and cryptocurrencies could significantly impact prices, creating both opportunities and risks for investors. For example, a country adopting Bitcoin as legal tender could lead to a surge in demand, while stricter regulations could dampen investor enthusiasm.

Scenario Analysis: Various Price Outcomes

Several scenarios can be envisioned, depending on various assumptions.

Scenario 1: High Adoption and Positive Regulation. This scenario assumes widespread global adoption of Bitcoin as a store of value and a medium of exchange, coupled with supportive regulatory frameworks. In this optimistic case, the halving could trigger a significant price surge, potentially exceeding previous post-halving price increases. This could be similar to the surge in price after the 2016 halving, although the magnitude would depend on the overall macroeconomic climate and other influencing factors. This scenario could see Bitcoin’s price reaching significantly higher levels than current valuations.

Predicting Bitcoin’s behavior after the 2025 halving is inherently speculative, but understanding the preceding halving cycles is crucial. To gain insight into potential price movements, analyzing the impact of previous halvings is vital, and a good resource for this is the article on Bitcoin Price Next Halving 2025. This analysis helps us to formulate more informed expectations regarding the Bitcoin Next Halving After 2025, though uncertainties remain.

Scenario 2: Moderate Adoption and Uncertain Regulation. This scenario assumes a moderate increase in Bitcoin adoption alongside a period of regulatory uncertainty. The halving would still likely lead to price increases, but at a slower pace and with greater volatility compared to the optimistic scenario. The price might rise gradually, interspersed with periods of consolidation or even temporary price declines, reflecting the uncertain regulatory environment.

Speculation around the Bitcoin next halving after 2025 is already generating buzz, with many anticipating significant price movements. To understand the future, however, we must first solidify our understanding of the preceding event; precisely when the Bitcoin Halving will occur in 2025 is crucial, and you can find the projected date at Bitcoin Halving 2025 Date.

This date provides a critical baseline for forecasting the impact of the subsequent halving and its potential effects on the Bitcoin market.

Scenario 3: Slow Adoption and Negative Regulation. In this pessimistic scenario, slow adoption rates and negative regulatory actions could significantly dampen the impact of the halving. Price increases might be minimal or even absent, potentially leading to a prolonged period of sideways trading or even price decreases. This scenario highlights the crucial role of regulatory clarity and broader market adoption in shaping Bitcoin’s price.

Speculation around the Bitcoin next halving after 2025 is already gaining traction, with many analysts examining potential price impacts. Understanding the previous halving cycles is crucial, and a great resource for predictions on the 2025 event is available at Bitcoin Halving Prediction 2025. This analysis helps contextualize expectations for the subsequent halving and its likely influence on Bitcoin’s future trajectory.

Therefore, studying past trends provides a valuable foundation for informed speculation about the next halving.

Bitcoin’s Long-Term Value Proposition

Bitcoin’s enduring appeal stems from a unique combination of factors that contribute to its long-term value proposition. Its decentralized nature, inherent scarcity, and growing adoption across various use cases position it as a compelling asset class for investors and users alike. This analysis delves into these aspects, comparing Bitcoin to traditional assets and alternative cryptocurrencies.

Bitcoin’s decentralized architecture, secured by a global network of nodes, eliminates single points of failure and censorship. This inherent resilience makes it a robust store of value, unlike fiat currencies subject to government control and inflation. The fixed supply of 21 million Bitcoin, a fundamental characteristic hardcoded into its protocol, ensures scarcity, a key driver of value appreciation over time. This scarcity contrasts sharply with inflationary fiat currencies and even precious metals whose supply can be influenced by mining operations. The potential use cases for Bitcoin extend beyond a simple store of value, encompassing peer-to-peer transactions, cross-border payments, and even decentralized finance (DeFi) applications, further solidifying its long-term potential.

Bitcoin as a Store of Value

Bitcoin’s role as a store of value is increasingly recognized, particularly in times of economic uncertainty. Its limited supply and decentralized nature make it a hedge against inflation and potential devaluation of traditional currencies. Unlike government-backed assets, Bitcoin’s value is not tied to a single entity or government’s policies. Historical data shows periods where Bitcoin’s price has significantly outperformed traditional assets like gold and stocks, demonstrating its potential as a portfolio diversifier. For instance, during periods of high inflation or geopolitical instability, Bitcoin has often seen increased demand, reflecting its perceived safety as a store of value. The comparison with gold is particularly relevant, as both are considered scarce assets, but Bitcoin offers superior portability and divisibility.

Bitcoin Compared to Alternative Cryptocurrencies

While Bitcoin is the most established cryptocurrency, a diverse ecosystem of alternative cryptocurrencies (altcoins) exists, each with unique features and potential. Altcoins often aim to improve upon Bitcoin’s limitations or offer distinct functionalities. For example, Ethereum focuses on smart contracts and decentralized applications, while other altcoins prioritize faster transaction speeds or enhanced privacy. However, Bitcoin maintains its first-mover advantage and network effect, which significantly contribute to its market dominance and overall security. The inherent volatility of many altcoins compared to Bitcoin’s relatively greater market maturity also presents a crucial difference. Bitcoin’s established track record and widespread adoption provide a level of stability that many altcoins still lack.

Bitcoin Compared to Gold and Other Assets

The following table summarizes the key advantages and disadvantages of Bitcoin compared to gold and other traditional assets:

| Feature | Bitcoin | Gold | Stocks |

|---|---|---|---|

| Scarcity | Programmatically limited to 21 million | Finite but subject to new discoveries | Potentially unlimited |

| Portability | Highly portable (digital) | Relatively less portable | Easily transferable |

| Divisibility | Highly divisible (up to 8 decimal places) | Limited divisibility | Highly divisible |

| Security | Secured by cryptographic hashing and a decentralized network | Physically secure, but vulnerable to theft | Subject to market risks and company failures |

| Volatility | High volatility, especially in the short term | Relatively low volatility | Moderate to high volatility |

Technological Advancements and Their Impact: Bitcoin Next Halving After 2025

Bitcoin’s scalability has long been a subject of discussion, particularly concerning its ability to handle a large volume of transactions efficiently. However, significant technological advancements are addressing these limitations, paving the way for wider adoption and increased usability. These improvements are not only enhancing transaction speeds but also significantly reducing fees and boosting the overall network’s efficiency.

Technological advancements are dramatically reshaping Bitcoin’s capabilities. Layer-2 scaling solutions, in particular, are proving crucial in improving transaction throughput and reducing congestion on the main Bitcoin blockchain. The impact of these advancements on transaction fees and network efficiency is substantial, promising a more user-friendly and cost-effective experience for individuals and businesses alike. Understanding the strengths and weaknesses of different scaling solutions is essential for navigating the evolving landscape of Bitcoin technology.

Layer-2 Scaling Solutions: An Overview

Layer-2 scaling solutions operate above the Bitcoin base layer, processing transactions off-chain before settling them on the main blockchain. This approach significantly reduces the load on the main network, enabling faster transaction processing and lower fees. Several prominent layer-2 solutions exist, each with its own set of advantages and disadvantages.

Comparison of Scaling Solutions

The following table compares some of the most prominent layer-2 scaling solutions:

| Solution | Strengths | Weaknesses |

|---|---|---|

| Lightning Network | Fast transactions, low fees, bidirectional payments. | Requires online connectivity for both parties, channel management complexity. |

| Liquid Network | Confidentiality, fast transactions, pegged to Bitcoin. | Requires participation from trusted parties (federated). |

| Rootstock (RSK) | Smart contract functionality, EVM compatibility. | More complex to use than simpler layer-2 solutions. |

Impact on Transaction Fees and Network Efficiency

The implementation and widespread adoption of layer-2 scaling solutions are expected to drastically reduce Bitcoin transaction fees. Currently, high transaction fees during periods of network congestion can be a barrier to entry for smaller transactions. Layer-2 solutions alleviate this by processing transactions off-chain, only requiring minimal on-chain confirmations. This leads to a more efficient network, capable of handling a much higher volume of transactions without sacrificing speed or affordability. For example, the Lightning Network has already demonstrated the ability to process millions of transactions per second with significantly lower fees compared to on-chain transactions.

Timeline of Key Technological Advancements

A clear timeline illustrates the progressive development and adoption of key Bitcoin technological advancements. While precise dates can vary depending on the metric used (e.g., initial implementation vs. widespread adoption), a general timeline can be constructed.

| Year | Advancement | Description |

|---|---|---|

| 2012 | First Lightning Network whitepaper | The foundational concept for the Lightning Network is introduced. |

| 2018 | Lightning Network mainnet launch | The Lightning Network goes live, allowing for faster and cheaper transactions. |

| 2019 | Significant growth of Lightning Network nodes and channels | Increased adoption and network capacity. |

| 2023-Present | Continued development and improvement of Layer-2 solutions | Ongoing refinements and innovation in scaling technologies. |

Regulatory Landscape and Its Influence

The regulatory landscape surrounding Bitcoin and other cryptocurrencies is rapidly evolving, presenting both opportunities and challenges for the digital asset’s future. Governmental actions, from outright bans to comprehensive regulatory frameworks, significantly influence Bitcoin’s price, adoption rates, and overall market stability. Understanding these diverse approaches is crucial for navigating the complexities of the crypto market post-2025.

The impact of regulatory actions on Bitcoin’s price can be dramatic. Periods of uncertainty, such as announcements of new regulations or crackdowns on exchanges, often lead to price volatility. Conversely, clear and predictable regulatory frameworks can foster investor confidence and potentially drive price appreciation. The level of regulatory clarity and consistency directly impacts market sentiment and, consequently, price fluctuations.

Regulatory Approaches Across Jurisdictions

Different countries have adopted vastly different approaches to regulating Bitcoin. Some, like El Salvador, have embraced Bitcoin as legal tender, while others have imposed outright bans. Many countries are pursuing a more nuanced approach, aiming to regulate certain aspects of the cryptocurrency market while allowing for innovation. This creates a complex global regulatory patchwork that influences how Bitcoin is used and traded internationally. For example, countries with strict KYC/AML (Know Your Customer/Anti-Money Laundering) regulations see reduced participation from privacy-focused users, while those with lighter touch regulations attract a wider range of users. This disparity creates varying levels of liquidity and trading volume across different exchanges.

Comparative Analysis of Regulatory Frameworks

A comparison of regulatory frameworks reveals a wide spectrum of approaches. For instance, the United States has a fragmented regulatory system, with different agencies overseeing different aspects of the crypto market. This lack of centralized regulation creates uncertainty and can hinder institutional adoption. In contrast, some European countries have implemented more comprehensive regulatory frameworks, aiming for a unified approach across the EU. These differences influence investor behavior, impacting capital flows and market development. Japan, for example, has a relatively mature regulatory framework for cryptocurrency exchanges, fostering a more stable and regulated market compared to some other jurisdictions. This demonstrates how different regulatory philosophies can yield vastly different market outcomes.

Global Regulatory Landscape

| Country/Region | Regulatory Approach | Key Features | Impact on Bitcoin Market |

|---|---|---|---|

| United States | Fragmented, evolving | Multiple agencies involved, unclear regulatory definitions | High volatility, potential for increased regulation |

| European Union | Towards a unified framework (MiCA) | Licensing requirements for crypto service providers, consumer protection measures | Increased regulatory clarity, potential for increased institutional adoption |

| Japan | Relatively mature and established | Strict licensing for exchanges, KYC/AML compliance | Stable market, higher level of institutional participation |

| El Salvador | Bitcoin as legal tender | Governmental adoption, integration into national financial system | Unique experiment with potential for wider adoption, but also significant risks |

Bitcoin Mining and its Sustainability

The environmental impact of Bitcoin mining is a significant concern, prompting ongoing discussions about its sustainability. The energy-intensive nature of the process, particularly its reliance on Proof-of-Work consensus, raises questions about its long-term viability in a world increasingly focused on climate change mitigation. However, the industry is actively exploring and implementing solutions to reduce its carbon footprint and transition towards a more environmentally responsible model.

The environmental impact of Bitcoin mining stems primarily from the high energy consumption required to secure the network and validate transactions. This energy demand translates directly into greenhouse gas emissions, depending on the energy sources used. While the exact figures are debated, the overall energy consumption of the Bitcoin network is substantial and has drawn criticism from environmental groups. However, it’s crucial to acknowledge the ongoing efforts to mitigate these impacts.

Renewable Energy Sources in Bitcoin Mining

The transition towards renewable energy sources is a crucial step in improving the sustainability of Bitcoin mining. Several mining operations are already actively adopting solar, wind, and hydroelectric power to reduce their reliance on fossil fuels. This shift not only decreases greenhouse gas emissions but also enhances the long-term viability of the industry by decoupling it from volatile fossil fuel prices. For example, some mining companies are establishing operations in regions with abundant renewable energy resources, such as Iceland, which boasts significant geothermal energy capacity. This geographical diversification allows for a more sustainable and cost-effective mining process. The implications of this transition are far-reaching, impacting not only the environmental footprint of Bitcoin but also its economic resilience.

Comparison of Mining Methods and Energy Consumption

Different Bitcoin mining methods exhibit varying levels of energy consumption. Application-Specific Integrated Circuits (ASICs) are currently the dominant technology, offering high hash rates but also significant energy demands. Alternative methods, such as mining pools that aggregate computational power, can potentially improve energy efficiency by optimizing resource allocation. However, the efficiency gains from these methods are often offset by increased network centralization. Furthermore, the geographical location of mining operations plays a crucial role in determining their overall energy consumption. Mining farms situated in regions with access to cheap and renewable energy sources will naturally have a lower carbon footprint compared to those reliant on fossil fuels. A comprehensive comparison requires considering not only the hardware but also the energy source and overall operational efficiency.

Hypothetical Sustainable Bitcoin Mining Operation, Bitcoin Next Halving After 2025

Imagine a sustainable Bitcoin mining operation located in a region with abundant geothermal energy. This facility would utilize geothermal power plants to supply its energy needs, effectively eliminating reliance on fossil fuels. The mining operation would employ state-of-the-art, energy-efficient ASICs, optimized for minimal power consumption. Waste heat generated by the mining hardware could be captured and repurposed for heating nearby buildings or greenhouses, further reducing the overall environmental impact. The facility would also implement robust monitoring systems to track energy usage and carbon emissions, allowing for continuous optimization and improvements in efficiency. Water cooling systems, utilizing recycled water, would be employed to manage the heat generated by the mining hardware, minimizing water consumption. This hypothetical operation represents a potential model for a more sustainable future for Bitcoin mining, demonstrating that environmentally conscious practices are feasible and achievable.

Frequently Asked Questions

This section addresses common queries regarding Bitcoin’s halving events, their impact on price, and the investment landscape surrounding them. Understanding these factors is crucial for anyone considering Bitcoin as an investment, particularly in the lead-up to and aftermath of a halving.

Bitcoin Halving: Significance

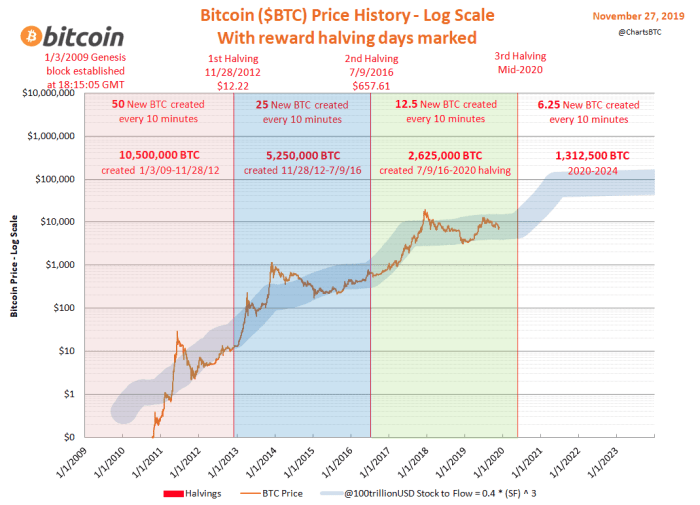

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, and it’s significant because it directly impacts the inflation rate of Bitcoin. By reducing the supply of newly minted coins, the halving can theoretically increase scarcity and potentially influence the price.

Halving’s Effect on Bitcoin’s Price

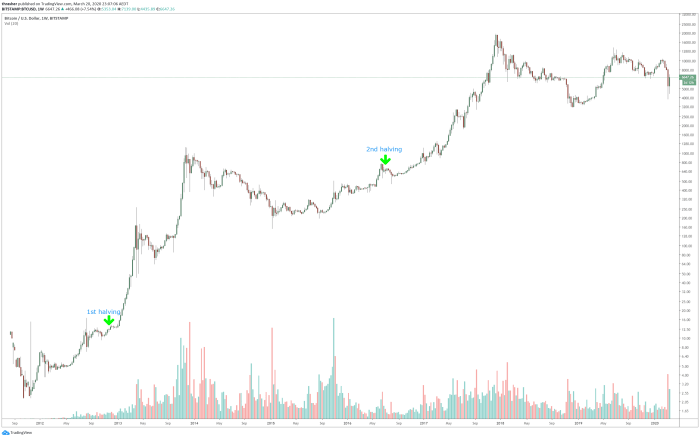

Historically, Bitcoin’s price has shown a tendency to increase in the period following a halving. The 2012 and 2016 halvings were followed by significant price rallies, though the timing and magnitude of these increases varied. However, it’s crucial to remember that correlation doesn’t equal causation. Other factors, such as market sentiment, regulatory changes, and technological advancements, also significantly influence Bitcoin’s price. Predicting the exact impact of a future halving is therefore impossible, and past performance is not indicative of future results. For example, the 2020 halving was followed by a substantial price increase, but this was also influenced by broader macroeconomic factors and increased institutional adoption.

Next Bitcoin Halving: Expected Date

The next Bitcoin halving is expected to occur in 2024. The exact date depends on the block time, which can fluctuate slightly. However, based on current block generation rates, it’s anticipated to happen around the middle to late spring of 2024. Precise calculations are often made closer to the date, as the block time variations become more accurately averaged.

Risks and Rewards of Investing After the Halving

Investing in Bitcoin after a halving presents both potential rewards and risks. The potential reward lies in the possibility of increased price appreciation due to reduced inflation and increased scarcity. However, the market is inherently volatile, and there’s no guarantee of price increases. Risks include potential price corrections, regulatory uncertainty, and the inherent volatility of the cryptocurrency market. Furthermore, the halving’s impact might be less pronounced than in previous cycles due to market maturity and increased institutional involvement. The 2020 halving, for instance, saw a significant price rise, but it was also part of a broader bull market influenced by multiple factors beyond just the halving. Therefore, a diversified investment strategy is crucial, and investors should only allocate capital they are prepared to potentially lose.

Speculation around Bitcoin’s next halving after 2025 is already generating buzz, with many anticipating significant price movements. Before we get there, however, the upcoming event to focus on is the Bitcoin April 2025 Halving , which will undoubtedly impact the market leading up to the subsequent halving. Understanding the dynamics of the 2025 halving is crucial for predicting the long-term trajectory of Bitcoin’s price beyond it.

Speculation is already rife regarding the Bitcoin next halving after 2025, with many analysts projecting significant price impacts. Understanding the mechanics of these events is crucial, and a good starting point is examining the specifics of the preceding halving. For a detailed look at the timing and implications of the 2025 halving, check out this informative resource on Bitcoin Halving Time 2025.

This knowledge will then better inform predictions about the subsequent halving and its potential market effects.