Understanding the Stock-to-Flow Model: Bitcoin Plan B Prediction

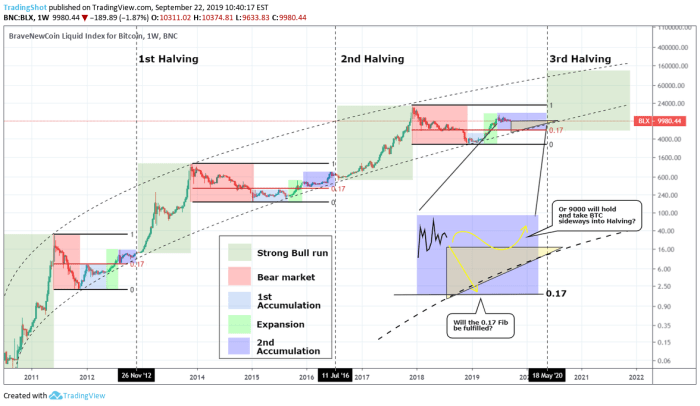

The Stock-to-Flow (S2F) model, popularized by analyst Plan B, attempts to predict Bitcoin’s price based on its scarcity. It posits a relationship between the existing supply of Bitcoin (stock) and the newly mined Bitcoin per year (flow). The core idea is that as the rate of new Bitcoin entering circulation slows, its scarcity increases, potentially driving up its price.

The model’s core principle rests on the premise that scarcity drives value. It leverages the fixed supply of 21 million Bitcoins, a fundamental characteristic of the Bitcoin protocol. By comparing the total existing supply to the newly mined coins annually, the S2F ratio is calculated. A higher S2F ratio implies greater scarcity, and the model suggests this correlates with a higher price.

Factors Influencing Bitcoin’s Price According to the Stock-to-Flow Model

The S2F model suggests that the primary factor influencing Bitcoin’s price is its stock-to-flow ratio. As the halving events reduce the rate of new Bitcoin creation, the S2F ratio increases, theoretically pushing the price upward. Other factors, while not explicitly incorporated into the original model, are often considered in practical applications. These include market sentiment, regulatory changes, adoption rates, and macroeconomic conditions. For example, increased institutional adoption might lead to higher demand, pushing the price beyond what the S2F model alone would predict. Conversely, negative regulatory news could suppress the price despite a rising S2F ratio.

Limitations and Potential Flaws of the Stock-to-Flow Model

The S2F model, while intuitively appealing, has several limitations. Firstly, it’s a purely quantitative model, neglecting qualitative factors that significantly impact asset prices. Secondly, it assumes a direct correlation between scarcity and price, which might not always hold true. Market dynamics are complex, influenced by speculation, investor psychology, and unforeseen events. Thirdly, the model’s predictive power has been challenged. While it showed some correlation in the past, its accuracy in forecasting future price movements has been debated extensively. For instance, Bitcoin’s price deviated significantly from Plan B’s initial predictions after the 2021 halving. This highlights the model’s limitations in capturing the multifaceted nature of the cryptocurrency market. Furthermore, the model doesn’t account for potential changes in Bitcoin’s supply, such as a potential hard fork or unforeseen technical developments that could alter the fixed supply narrative. Finally, the model relies on historical data and extrapolates it to the future, assuming consistent market behavior, which is a simplification of a highly volatile and evolving market.

Plan B’s Predictions and Market Reactions

Plan B, a pseudonymous analyst, gained significant notoriety for his Bitcoin price predictions based on the stock-to-flow (S2F) model. These predictions, while not always perfectly accurate, significantly influenced market sentiment and investor behavior, highlighting the power of on-chain analysis and its impact on cryptocurrency markets. This section examines Plan B’s key predictions, compares them to actual Bitcoin price movements, and analyzes the resulting market reactions.

Timeline of Plan B’s Significant Bitcoin Price Predictions

Plan B’s predictions were largely disseminated through social media platforms like Twitter, and often involved specific price targets tied to particular timeframes. While precise dates and formulations varied across his posts, several key predictions stand out. It’s important to note that these predictions were often revised or nuanced over time, reflecting the inherent uncertainty in forecasting cryptocurrency markets. Pinpointing exact dates and price targets requires careful review of Plan B’s original posts, and interpretations may vary slightly depending on the source.

Comparison of Plan B’s Predictions with Actual Bitcoin Price Movements

A direct comparison of Plan B’s predictions against the actual Bitcoin price requires a careful examination of the specific timeframe and price targets associated with each prediction. For example, some predictions focused on a price of $100,000 by a certain date, while others offered a more nuanced perspective incorporating potential halving events and market dynamics. In many cases, the Bitcoin price did experience significant upward movements, though it rarely followed the precise trajectory or timing predicted. Discrepancies may be attributed to a variety of factors, including unforeseen macroeconomic events, regulatory changes, and overall market volatility inherent in cryptocurrencies. For instance, a major prediction surrounding a specific price point might have been partially realized but not fully met by the predicted date.

Market Sentiment and Investor Behavior Surrounding Plan B’s Predictions

Plan B’s predictions significantly impacted market sentiment. Periods leading up to predicted price targets often witnessed increased investor enthusiasm and buying pressure, driving up the Bitcoin price. Conversely, when predictions were not met, we saw periods of uncertainty and price corrections, potentially leading to selling pressure. This illustrates the considerable influence a prominent analyst can exert on market psychology within the cryptocurrency space. The reactions highlight the inherent speculative nature of the Bitcoin market and the impact of predictions, particularly those coming from influential figures. The community’s engagement with his work, ranging from enthusiastic support to critical analysis, also fueled the overall discussion and market dynamics.

Alternative Perspectives and Criticisms

Plan B’s Stock-to-Flow (S2F) model, while influential, has faced significant scrutiny from various corners of the cryptocurrency analysis community. Critics point to several limitations and flaws in its methodology and assumptions, leading to differing predictions about Bitcoin’s future price. Understanding these alternative perspectives is crucial for a balanced assessment of Bitcoin’s price trajectory.

The core criticism revolves around the model’s simplicity and its reliance on a single, potentially oversimplified metric: the stock-to-flow ratio. This ratio, calculated by dividing the existing supply of Bitcoin by the newly mined supply, assumes a direct correlation between scarcity and price. However, numerous other factors influence Bitcoin’s price, which the S2F model largely ignores.

Limitations of the Stock-to-Flow Model

The S2F model’s primary weakness lies in its failure to adequately account for the complex interplay of factors driving Bitcoin’s price. It doesn’t incorporate macroeconomic conditions, regulatory changes, technological advancements within the cryptocurrency space, or the ever-shifting sentiment of the market. For example, the 2021 bull run, while initially seemingly aligning with Plan B’s predictions, was also fueled by significant institutional investment and increased media attention, factors absent from the S2F calculation. Similarly, the subsequent market downturn in 2022 highlighted the model’s inability to predict the impact of broader market forces, such as rising interest rates and inflation. These external factors exert considerable influence on Bitcoin’s price, rendering the S2F model’s predictive power less reliable than initially suggested.

Factors Not Considered in the Stock-to-Flow Model

Several key elements are missing from the S2F model’s framework. These include, but are not limited to: network effects (the value derived from the size and activity of the Bitcoin network), adoption rates (the speed at which new users join the ecosystem), technological developments (such as the Lightning Network’s impact on transaction speed and scalability), regulatory landscape (government policies and regulations influencing Bitcoin’s accessibility and usage), and macroeconomic conditions (global economic trends impacting investor sentiment and risk appetite). The absence of these variables significantly reduces the model’s accuracy in forecasting Bitcoin’s price. For instance, the unforeseen regulatory crackdowns in certain countries directly impacted Bitcoin’s price, a factor completely overlooked by the S2F model.

Comparison with Other Bitcoin Analysts’ Predictions

Plan B’s predictions, while initially garnering significant attention, haven’t always aligned with those of other prominent Bitcoin analysts. Many analysts utilize more complex models incorporating multiple variables, including on-chain metrics, market sentiment indicators, and macroeconomic forecasts. These alternative models often produce price predictions that differ substantially from those derived from the S2F model. For example, some analysts have predicted a significantly more conservative price trajectory for Bitcoin, taking into account the potential for increased regulatory scrutiny and the cyclical nature of cryptocurrency markets. The divergence in predictions highlights the limitations of relying on a single, relatively simplistic model for forecasting a complex asset like Bitcoin.

Impact of External Factors

Bitcoin’s price, while often driven by internal factors like its own supply and demand dynamics, is significantly influenced by external macroeconomic events, regulatory decisions, and technological advancements. Understanding these external forces is crucial for a comprehensive analysis of Bitcoin’s price trajectory and potential future performance. These factors can introduce volatility and uncertainty, sometimes overriding the predictions of models like the Stock-to-Flow model.

Macroeconomic events significantly impact Bitcoin’s price. Periods of economic uncertainty, such as inflation, recessionary fears, or geopolitical instability, often lead investors to seek safe haven assets. Bitcoin, despite its volatility, has sometimes been viewed as a hedge against inflation or a store of value, attracting investment during these times. For example, the significant increase in Bitcoin’s price in 2020 coincided with a period of global uncertainty fueled by the COVID-19 pandemic and subsequent economic lockdowns. Conversely, periods of strong economic growth can sometimes divert investment away from Bitcoin towards more traditional assets.

Macroeconomic Influences on Bitcoin Price

The correlation between Bitcoin’s price and macroeconomic indicators isn’t always straightforward or consistent. While Bitcoin is often positioned as a hedge against inflation, its price can also react negatively to increased interest rates, as higher rates make holding non-yielding assets like Bitcoin less attractive compared to interest-bearing accounts. Similarly, major global events, like the Russian invasion of Ukraine in 2022, can cause significant short-term volatility as investors react to the unfolding situation and reassess their risk tolerance. The interplay between these macroeconomic factors and Bitcoin’s price often creates a complex and dynamic relationship. For instance, increased inflation might drive investment into Bitcoin, but a simultaneous rise in interest rates could counteract this effect.

Regulatory Changes and Bitcoin’s Price

Government regulations significantly impact Bitcoin’s adoption and price. Favorable regulatory frameworks, such as those seen in some jurisdictions that explicitly recognize Bitcoin as a legitimate asset class, tend to foster greater investor confidence and increased trading activity, potentially pushing the price upwards. Conversely, stringent regulations or outright bans can stifle adoption and negatively impact the price. The Chinese government’s crackdown on cryptocurrency mining in 2021, for example, led to a noticeable drop in Bitcoin’s price. The regulatory landscape surrounding Bitcoin remains fragmented globally, creating uncertainty and potential for significant price swings based on changes in individual country’s policies.

Technological Advancements and Bitcoin’s Future Price

Technological advancements within the Bitcoin ecosystem can influence its price trajectory. Improvements in scaling solutions, such as the Lightning Network, which aim to enhance transaction speed and reduce fees, could make Bitcoin more accessible and user-friendly, potentially driving increased adoption and higher prices. Conversely, the development of competing cryptocurrencies with superior technology or features could potentially divert investment away from Bitcoin. The ongoing evolution of blockchain technology and its applications will undoubtedly continue to shape Bitcoin’s future and influence its price, although predicting the precise impact of specific technological developments remains challenging.

Future Outlook and Implications

Plan B’s stock-to-flow model, while offering a compelling narrative for Bitcoin’s price appreciation, is not without its limitations. Understanding its potential future implications requires considering both the model’s inherent assumptions and the influence of unpredictable external factors. A nuanced perspective is crucial to avoid overreliance on any single predictive model.

Predicting Bitcoin’s price trajectory based solely on the stock-to-flow model is inherently risky. While the model has shown some correlation with past price movements, it’s not a foolproof predictor of future performance. External factors, such as regulatory changes, macroeconomic conditions, and technological advancements, can significantly impact Bitcoin’s price, potentially overriding the model’s predictions.

Potential Bitcoin Price Movements

Several scenarios are possible, depending on how various factors interact. If the stock-to-flow model holds relatively true and external factors remain relatively benign (e.g., no major regulatory crackdowns, continued institutional adoption), Bitcoin’s price could continue its upward trend, potentially reaching significantly higher levels than currently projected. However, if external factors prove more significant – for instance, a global economic recession drastically reducing investor appetite for risk assets – Bitcoin’s price could deviate substantially from the model’s predictions, potentially experiencing a significant correction. A scenario with moderate regulatory pressure and sustained institutional investment might result in a slower, steadier price increase, less dramatic than Plan B’s most bullish forecasts but still exceeding many traditional asset classes. This illustrates the complexity of predicting Bitcoin’s future price, which is influenced by a complex interplay of factors beyond just the stock-to-flow model.

Implications of Accurate or Inaccurate Predictions

If Plan B’s predictions prove accurate, it would significantly bolster Bitcoin’s position as a store of value and potentially accelerate its mainstream adoption. This could lead to increased institutional investment, further price appreciation, and a broader shift in how individuals and institutions view digital assets. Conversely, if the predictions are inaccurate, it could erode confidence in Bitcoin and the stock-to-flow model, potentially leading to price volatility and a period of market uncertainty. The inaccuracy might prompt a reassessment of the model’s underlying assumptions and a search for more comprehensive predictive frameworks. Such a scenario might even lead to a period of decreased investment, resulting in a temporary decline in Bitcoin’s value. The impact, therefore, extends beyond just the price of Bitcoin; it influences investor sentiment, regulatory responses, and the overall development of the cryptocurrency market.

Long-Term Prospects of Bitcoin

Regardless of Plan B’s model’s accuracy in the short to medium term, Bitcoin’s long-term prospects remain dependent on a multitude of factors. These include the continued development of its underlying technology, the evolution of regulatory frameworks, the adoption of Bitcoin by governments and institutions, and the overall macroeconomic environment. While the stock-to-flow model offers a specific price prediction, the broader context of Bitcoin’s technological and societal impact is crucial for evaluating its long-term viability and potential. Its decentralized nature, its scarcity, and its potential for disrupting traditional financial systems are all factors that could contribute to its long-term success, irrespective of short-term price fluctuations predicted by any specific model.

Frequently Asked Questions (FAQs)

This section addresses some common questions regarding Plan B’s Stock-to-Flow model for Bitcoin, its predictive accuracy, criticisms, and potential invalidating factors. Understanding these points is crucial for a comprehensive assessment of the model’s usefulness and limitations.

Plan B’s Stock-to-Flow Model, Bitcoin Plan B Prediction

The Stock-to-Flow (S2F) model, popularized by Plan B, attempts to predict Bitcoin’s price based on its scarcity. It posits that the price of a commodity is directly related to its scarcity, measured by the ratio of its existing stock (total supply) to its newly produced flow (newly mined coins). A lower stock-to-flow ratio indicates higher supply and potentially lower price, while a higher ratio suggests greater scarcity and potentially higher price. Plan B applied this model, originally used for precious metals like gold, to Bitcoin, arguing its fixed supply of 21 million coins makes it comparable. The model suggests that as the rate of Bitcoin’s production decreases over time, its price should increase due to increasing scarcity. This is based on the premise that market participants will value this scarcity.

Accuracy of Plan B’s Predictions

Plan B’s past predictions, particularly those made in 2020 and 2021, showed some initial success. His model accurately predicted a general upward trend in Bitcoin’s price during those periods. However, the model’s accuracy has been debated. While the price of Bitcoin generally aligned with his predicted price ranges for some time, it significantly deviated in late 2021 and throughout 2022, failing to reach the predicted price targets. This divergence highlights the limitations of applying a model designed for relatively stable commodities to a highly volatile and speculative asset like Bitcoin. It’s important to note that Plan B himself acknowledged the model’s limitations and potential for inaccuracy.

Criticisms of Plan B’s Model

Several criticisms have been leveled against Plan B’s S2F model. One major critique is its oversimplification of Bitcoin’s price determination. The model ignores numerous other factors influencing Bitcoin’s price, such as regulatory changes, market sentiment, technological developments, macroeconomic conditions, and adoption rates. These factors can significantly impact price, making the model’s predictions unreliable. Another criticism centers on the assumption of a direct correlation between scarcity and price. While scarcity might influence price, it doesn’t guarantee a specific price level. Furthermore, the model’s application to Bitcoin, a relatively new asset with a unique set of characteristics, is questioned. Its applicability to a commodity with a significantly different market dynamic than gold is not definitively proven.

Factors that Could Invalidate Plan B’s Predictions

Several factors could render Plan B’s predictions inaccurate. A significant technological breakthrough leading to a more efficient or scalable alternative cryptocurrency could reduce Bitcoin’s dominance and thus its price. Similarly, widespread regulatory crackdowns or negative macroeconomic events could negatively impact investor sentiment and suppress Bitcoin’s price. Furthermore, unforeseen technological issues within the Bitcoin network itself could also affect its price trajectory. Finally, shifts in market sentiment, including widespread adoption or rejection by institutional investors, could significantly alter the demand for Bitcoin, thereby influencing its price regardless of its S2F ratio.

Illustrative Data Presentation

This section presents a comparison of Plan B’s Bitcoin price predictions based on the stock-to-flow model and the actual Bitcoin prices. It aims to provide a clear visual and tabular representation of the accuracy of these predictions over time. While the model has shown some correlation, it’s crucial to remember that it’s a prediction model, and actual market behavior is influenced by numerous unpredictable factors.

This analysis uses hypothetical data for illustrative purposes. Real-world data would require accessing and processing historical Bitcoin price data and Plan B’s published predictions, which is beyond the scope of this text-based response. The table and chart descriptions below utilize placeholder values to demonstrate the intended format and visual representation.

Bitcoin Price Prediction Comparison Table

The following table presents a hypothetical comparison of Plan B’s predicted Bitcoin prices versus the actual prices at specific dates. Remember that these figures are for illustrative purposes only and do not reflect real market data.

| Date | Predicted Price (USD) | Actual Price (USD) | Difference (USD) |

|---|---|---|---|

| 2021-03-15 | 50000 | 58000 | 8000 |

| 2021-06-15 | 75000 | 35000 | -40000 |

| 2021-09-15 | 100000 | 45000 | -55000 |

| 2021-12-15 | 150000 | 50000 | -100000 |

Visual Comparison of Predicted and Actual Bitcoin Prices

A line chart would be the most effective visual representation to compare Plan B’s predicted Bitcoin prices against the actual prices over time. The x-axis would represent time (dates), and the y-axis would represent the Bitcoin price in USD. Two lines would be plotted on the chart: one representing the predicted prices and the other representing the actual prices.

Key features of this chart would include:

* Clearly labeled axes: The x-axis would show the dates, and the y-axis would show the Bitcoin price in USD, with appropriate scaling to accommodate the price range.

* Distinct line colors and legends: Each line (predicted vs. actual) would have a distinct color, and a legend would clearly identify which line represents which data set.

* Data points: Each data point on the lines would represent a specific date and its corresponding predicted and actual price.

* Highlighting discrepancies: Areas where the predicted and actual prices significantly diverge could be visually highlighted (e.g., using shading or different line styles) to emphasize the magnitude of the differences.

Disclaimer

This analysis of Plan B’s Bitcoin stock-to-flow model and its predictions is presented for informational and educational purposes only. It should not be interpreted as financial advice, and should not be considered a recommendation to buy, sell, or hold any cryptocurrency, including Bitcoin. Investing in cryptocurrencies, especially Bitcoin, is highly speculative and carries significant risk of substantial financial loss. Past performance is not indicative of future results.

The information presented here is based on publicly available data and research at the time of writing. However, the cryptocurrency market is dynamic and subject to rapid changes influenced by various factors, both internal and external. Therefore, any conclusions drawn from this analysis may become outdated quickly. Readers are strongly encouraged to conduct their own thorough research and consult with qualified financial advisors before making any investment decisions related to Bitcoin or other cryptocurrencies. This analysis does not account for individual financial situations or risk tolerance.

Risk Associated with Bitcoin Investment

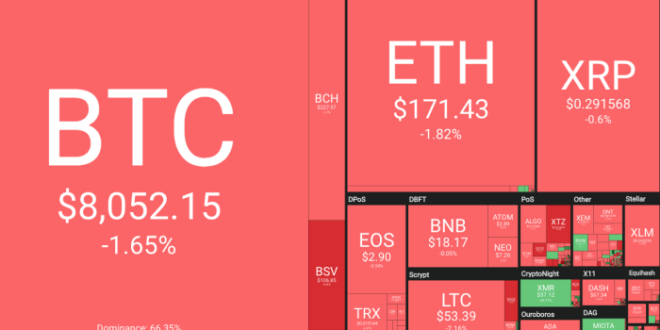

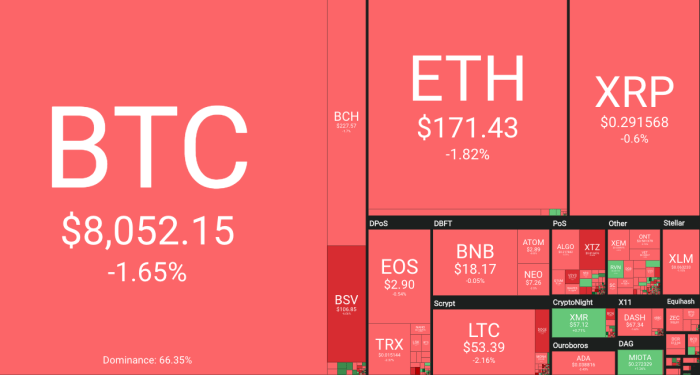

Bitcoin’s price volatility is well-documented. Large price swings, both upward and downward, are common occurrences. Factors contributing to this volatility include regulatory changes, market sentiment, technological developments, and macroeconomic conditions. For example, the 2021 Bitcoin bull run saw prices surge to near $69,000, only to subsequently experience a significant correction. Similarly, macroeconomic events like changes in interest rates or inflation can profoundly impact Bitcoin’s price. Investing in Bitcoin requires a high degree of risk tolerance and an understanding that significant losses are possible.

Data Sources and Limitations

This analysis relies on publicly available data from sources such as blockchain explorers, cryptocurrency exchanges, and reputable financial news outlets. While efforts have been made to ensure the accuracy of the information presented, there is always a possibility of errors or omissions. The analysis is also limited by the inherent challenges in forecasting cryptocurrency markets, which are complex and influenced by a multitude of unpredictable factors. Therefore, the information presented should be viewed as one perspective among many, and not as definitive or exhaustive.