Bitcoin’s Role in the Global Financial System (April 2025): Bitcoin Prediction 2025 April

By April 2025, Bitcoin’s integration into the global financial system is likely to be more pronounced than it is today, though the extent remains uncertain. Its role will depend on several factors, including regulatory developments, technological advancements, and overall market sentiment. While widespread adoption as a primary currency might not be fully realized, Bitcoin’s influence as a store of value and an alternative asset class will likely be substantial.

Bitcoin’s interaction with traditional financial instruments in April 2025 is expected to be multifaceted. We may see increased use of Bitcoin-backed loans and derivatives, alongside the growth of institutional investment vehicles specifically designed to manage Bitcoin exposure. Furthermore, the development of more sophisticated financial products leveraging Bitcoin’s blockchain technology is anticipated. This could include decentralized finance (DeFi) applications offering enhanced lending and borrowing mechanisms, potentially bypassing traditional intermediaries.

Bitcoin’s Challenges and Opportunities, Bitcoin Prediction 2025 April

Bitcoin faces significant challenges in achieving widespread acceptance. Regulatory uncertainty remains a major hurdle, with differing approaches across jurisdictions creating complexity and potentially hindering cross-border transactions. Scalability issues, concerning the speed and cost of transactions, continue to be addressed, although layer-2 solutions are expected to alleviate some of these concerns by April 2025. Volatility, a characteristic feature of Bitcoin, presents another obstacle to its wider adoption as a medium of exchange. However, opportunities abound. Bitcoin’s decentralized nature offers a potential solution to issues of censorship and control inherent in traditional financial systems. Its transparency and immutability, facilitated by the blockchain, could improve efficiency and reduce fraud in certain financial transactions. Growing institutional interest, coupled with technological advancements, could mitigate some of the current limitations and drive broader acceptance.

Bitcoin Integration Across Sectors

Several sectors are poised to benefit from Bitcoin integration. The remittance market, currently plagued by high fees and slow processing times, could see significant disruption as Bitcoin offers a cheaper and faster alternative for international money transfers. Supply chain management could also leverage Bitcoin’s transparency and traceability features to improve efficiency and accountability. For example, tracking the movement of goods and verifying authenticity could be facilitated using blockchain technology, minimizing fraud and enhancing trust. Furthermore, the art and collectibles market could see continued adoption of Bitcoin as a payment method and a means to facilitate fractional ownership of high-value assets. The gaming industry is another potential area for Bitcoin integration, with non-fungible tokens (NFTs) built on the Bitcoin blockchain becoming more prevalent, providing players with unique in-game assets and collectibles.

Frequently Asked Questions about Bitcoin Prediction for April 2025

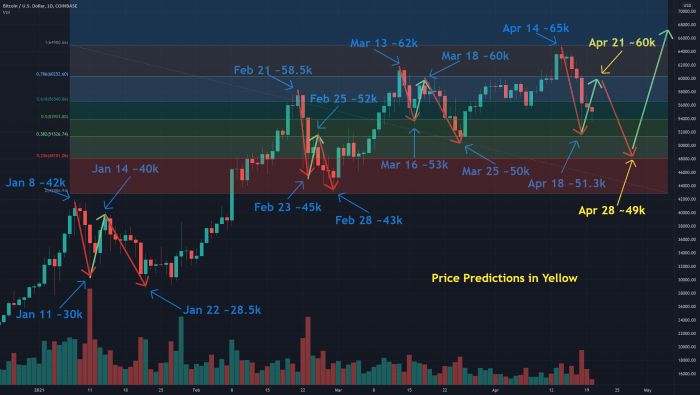

Predicting Bitcoin’s price is inherently speculative, but by analyzing market trends and considering various factors, we can formulate educated estimations for April 2025. The following sections address common questions regarding Bitcoin’s potential performance and investment implications during that period.

Bitcoin’s Potential Price in April 2025

Reaching $100,000 by April 2025 is a significant target, requiring substantial growth from current levels. Several factors could contribute to such a surge, including widespread institutional adoption, increased regulatory clarity, and continued technological advancements within the Bitcoin ecosystem. However, significant headwinds remain, including macroeconomic uncertainty, regulatory crackdowns in certain jurisdictions, and the inherent volatility of the cryptocurrency market. Historical price movements show periods of explosive growth followed by sharp corrections, making any precise prediction highly uncertain. While a $100,000 price point is possible, it’s by no means guaranteed, and a more conservative estimate might be a more prudent approach. Consider the price trajectory of other assets, such as gold or tech stocks, which also experience periods of rapid growth and subsequent corrections, to better understand the inherent risk involved.

Uncertainties Affecting Bitcoin’s Price in April 2025

Several major uncertainties could significantly impact Bitcoin’s price in April 2025. Global macroeconomic conditions, including inflation rates, interest rate policies, and geopolitical events, can dramatically influence investor sentiment and risk appetite. Regulatory developments, both supportive and restrictive, in key markets like the US, EU, and China, will also play a crucial role. Technological advancements, such as the development of competing cryptocurrencies or improvements in Bitcoin’s scalability, could also affect its market dominance and price. Furthermore, the overall sentiment within the cryptocurrency market, influenced by news events, technological breakthroughs, and investor confidence, is a significant unpredictable factor. For example, a major security breach affecting a large cryptocurrency exchange could trigger a widespread market downturn, impacting Bitcoin’s price regardless of its underlying fundamentals.

Safety of Investing in Bitcoin in April 2025

Investing in Bitcoin in April 2025, like any investment, carries inherent risks and potential rewards. Bitcoin’s price volatility is a significant concern; its value can fluctuate dramatically in short periods. Security risks, including hacking and theft from exchanges or personal wallets, are also present. Regulatory uncertainty, the potential for government intervention, and the overall immaturity of the cryptocurrency market add to the risk profile. However, the potential for high returns remains a significant incentive. Bitcoin’s limited supply, its decentralized nature, and its growing adoption as a store of value and a means of payment offer long-term growth potential. A balanced approach involves careful risk assessment, diversification of investments, and a thorough understanding of the technology and market dynamics before committing capital. Investing only what one can afford to lose is a crucial principle to follow.

Alternative Cryptocurrencies to Consider

While Bitcoin remains the dominant cryptocurrency, several alternatives offer potentially interesting investment opportunities. Ethereum, for instance, underpins a thriving decentralized application (dApp) ecosystem and its smart contract functionality provides a foundation for numerous projects. Solana, known for its high transaction speeds, is another example of a platform with significant potential. However, it’s crucial to note that alternative cryptocurrencies also carry significant risks, often higher than Bitcoin due to their smaller market capitalization and potentially less established infrastructure. Thorough research and due diligence are essential before investing in any cryptocurrency, considering factors such as the project’s team, technology, community support, and overall market potential. Remember that past performance is not indicative of future results and all cryptocurrencies are subject to significant price volatility.

Predicting Bitcoin’s price in April 2025 is challenging, heavily influenced by various factors. A key element to consider is the upcoming Bitcoin Halving in 2024, and its potential impact on the market. For insightful analysis on this, check out this resource on Bitcoin Halving 2025 % Prediction to better understand its projected influence. Ultimately, understanding the halving’s effect is crucial for any comprehensive Bitcoin Prediction 2025 April forecast.

Predicting Bitcoin’s price in April 2025 is challenging, but a key factor to consider is the upcoming Bitcoin halving. For insightful analysis on the halving’s potential impact, check out this resource on Halving Bitcoin 2025 Binance which could significantly influence Bitcoin’s trajectory leading up to and beyond April 2025. Ultimately, the Bitcoin Prediction 2025 April will depend on many interacting factors.

Predicting Bitcoin’s price in April 2025 is challenging, but a key factor to consider is the upcoming Bitcoin halving. To understand its impact, it’s crucial to learn more about this event; you can find a detailed explanation by visiting this helpful resource: What Is The Bitcoin Halving 2025. Understanding the halving’s effect on Bitcoin’s supply will significantly improve any Bitcoin Prediction 2025 April analysis.

Predicting Bitcoin’s price in April 2025 requires considering various factors, including the upcoming halving event. A key element in any Bitcoin Prediction 2025 April analysis is understanding the potential impact of the halving, which you can explore further in this insightful resource on the 2025 Bitcoin Halving Price Prediction. Ultimately, this prediction will heavily influence overall Bitcoin price forecasts for April 2025 and beyond.

Predicting Bitcoin’s price in April 2025 is challenging, but understanding the upcoming halving is crucial. For those interested in a French perspective on this significant event, I recommend checking out this resource on the Halving Bitcoin 2025 Francais to gain further insight. This information should help refine any Bitcoin Prediction 2025 April models you’re working with.

Bitcoin predictions for April 2025 are highly speculative, often focusing on the impact of the upcoming halving. Understanding the potential effects requires considering the broader implications, which is why examining forecasts like those found in this insightful article on Bitcoin Prediction After Halving 2025 is crucial. Ultimately, these analyses help to contextualize the April 2025 Bitcoin predictions and provide a more comprehensive perspective.