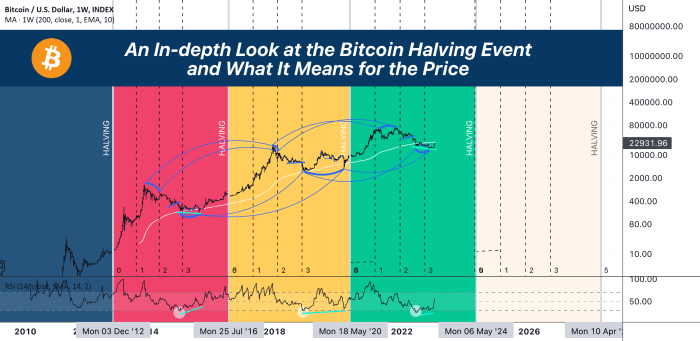

Bitcoin’s Price History and Halving Cycles

Bitcoin’s price has exhibited a fascinating correlation with its halving events, periods where the rate of newly mined Bitcoin is cut in half. Analyzing these cycles provides valuable insights into potential future price movements, though it’s crucial to remember that past performance is not indicative of future results. Numerous factors beyond the halving itself significantly impact Bitcoin’s price.

Bitcoin’s price history demonstrates a general upward trend following each halving, although the timing and magnitude of price increases have varied considerably. The halving events act as a significant deflationary pressure on the supply of Bitcoin, theoretically increasing its scarcity and value. However, the actual price impact is complex and depends on a multitude of interacting market forces.

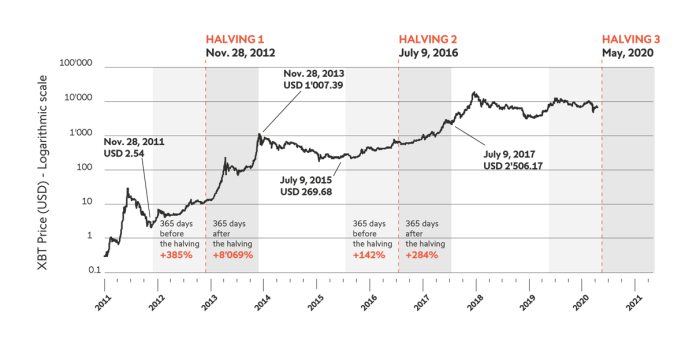

Bitcoin Halving Events and Subsequent Price Movements

The first Bitcoin halving occurred in November 2012, reducing the block reward from 50 BTC to 25 BTC. The price at the time was approximately $12. Over the following year, the price increased to roughly $1,000, a significant surge. The second halving took place in July 2016, lowering the block reward to 12.5 BTC. Bitcoin’s price around this time was approximately $650, and it subsequently rose to nearly $20,000 by December 2017. The third halving occurred in May 2020, with the block reward reduced to 6.25 BTC. Bitcoin’s price was around $9,000 at the time, eventually reaching a high of approximately $69,000 in November 2021. While each halving has been followed by a significant price increase, the timing and extent of these increases have varied substantially.

Market Conditions Surrounding Bitcoin Halvings

The market conditions surrounding each Bitcoin halving have shown both similarities and differences. A common thread is increased anticipation leading up to the event, often resulting in price increases before the halving itself. This is driven by speculation about the future scarcity of Bitcoin. However, the broader macroeconomic climate and overall investor sentiment have varied significantly across the three halvings. The 2012 halving occurred during a relatively nascent stage of the cryptocurrency market, with limited institutional involvement. The 2016 halving saw increased institutional interest and mainstream media coverage. The 2020 halving coincided with a global pandemic and a period of unprecedented monetary easing, factors that likely contributed to the subsequent price surge.

Factors Influencing Bitcoin’s Price Before, During, and After Halvings

Several factors beyond the halving itself influence Bitcoin’s price. These include: regulatory developments, technological advancements, macroeconomic conditions (such as inflation and interest rates), adoption rates, media sentiment, and the overall level of investor confidence. For instance, positive regulatory announcements or significant technological upgrades tend to boost investor confidence, leading to price increases. Conversely, negative news or regulatory crackdowns can trigger price drops. The interplay of these factors makes predicting Bitcoin’s price following a halving exceptionally challenging. While the halving creates a predictable reduction in supply, the demand side remains highly dynamic and susceptible to numerous external influences.

Factors Influencing Bitcoin’s Price After the 2025 Halving: Bitcoin Prediction After 2025 Halving

Predicting Bitcoin’s price after the 2025 halving is inherently complex, relying on a confluence of macroeconomic conditions, regulatory landscapes, technological advancements, and market sentiment. While the halving itself is a significant event, reducing the rate of new Bitcoin creation, its impact on price is intertwined with broader economic and technological forces.

Macroeconomic Factors

Macroeconomic factors exert considerable influence on Bitcoin’s price. High inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, rising interest rates, making traditional investments more attractive, could lead to capital flowing away from Bitcoin, suppressing its price. Global economic growth or recession significantly impacts risk appetite; strong growth may see investors allocating more capital to riskier assets like Bitcoin, while a recession might lead to a flight to safety, reducing demand. The correlation between Bitcoin’s price and the Consumer Price Index (CPI), a measure of inflation, provides a historical example of this relationship.

Regulatory Changes and Governmental Policies, Bitcoin Prediction After 2025 Halving

Governmental policies and regulations play a crucial role. Favorable regulatory frameworks, such as those seen in some jurisdictions that have embraced Bitcoin as a legitimate asset class, can boost investor confidence and increase adoption. Conversely, stringent regulations or outright bans, as seen in some countries, can negatively impact Bitcoin’s price by limiting access and creating uncertainty. The varying regulatory approaches across different countries exemplify this variability. For instance, El Salvador’s adoption of Bitcoin as legal tender contrasts sharply with China’s ban.

Technological Advancements and Adoption Rate

Technological advancements within the Bitcoin ecosystem, such as the development of the Lightning Network for faster and cheaper transactions, can enhance its usability and appeal. Wider adoption, driven by increased merchant acceptance and user-friendliness, is likely to increase demand and consequently, price. The increasing use of Bitcoin for cross-border payments highlights this potential for growth.

Institutional Investment and Market Sentiment

Institutional investment, particularly from large corporations and investment funds, can significantly impact Bitcoin’s price. Large-scale purchases can drive up demand and price, while significant sell-offs can trigger downward pressure. Market sentiment, driven by news events, social media trends, and overall investor confidence, also plays a critical role. Periods of high optimism often correlate with price increases, while fear and uncertainty can lead to price drops. For example, the entry of MicroStrategy and Tesla into the Bitcoin market significantly impacted its price.

Comparative Analysis of Price Predictions

Numerous reputable sources offer Bitcoin price predictions, though these should be viewed with caution due to the inherent volatility of the cryptocurrency market. Some analysts predict a substantial price increase post-2025 halving, pointing to the historical precedent of previous halvings and increasing institutional adoption. Others are more conservative, citing macroeconomic uncertainties and regulatory risks as potential headwinds. A comparative analysis reveals a wide range of predictions, highlighting the difficulty of accurately forecasting Bitcoin’s future price. For instance, some predict prices exceeding $100,000, while others suggest more moderate increases or even potential price corrections. These varying predictions underscore the speculative nature of the market.

Supply and Demand Dynamics Post-Halving

The 2025 Bitcoin halving will significantly impact the cryptocurrency’s price through its effect on supply and demand. Understanding the interplay of these two fundamental economic forces is crucial for predicting potential price movements. While predicting the future is inherently uncertain, analyzing historical trends and considering various economic factors allows for a reasoned assessment of possible scenarios.

The reduced Bitcoin supply after the halving is a key driver of potential price increases. Halvings, which occur approximately every four years, cut the rate at which new Bitcoins are mined in half. This inherently decreases the influx of new Bitcoin into the market, potentially creating scarcity and driving up demand, all else being equal. Historically, Bitcoin’s price has shown upward trends following previous halvings, although the magnitude and duration of these increases have varied.

Impact of Reduced Bitcoin Supply

The reduced supply of newly mined Bitcoin after the 2025 halving will likely exert upward pressure on its price. This is a fundamental principle of economics: when supply decreases and demand remains constant or increases, the price tends to rise. The halving event itself acts as a significant catalyst for this dynamic. However, the extent of the price increase will depend on the concurrent level of demand. For example, if demand remains relatively stagnant after the halving, the price increase might be more modest than if demand significantly increases. Conversely, a decrease in demand could mitigate or even negate the price-increasing effect of reduced supply.

Potential Changes in Bitcoin Demand

Demand for Bitcoin is influenced by numerous factors, including investor sentiment, regulatory developments, technological advancements, and macroeconomic conditions. Following the 2025 halving, increased institutional adoption, growing awareness among retail investors, or positive regulatory shifts could boost demand, amplifying the price increase driven by reduced supply. Conversely, negative news, regulatory crackdowns, or a general downturn in the cryptocurrency market could suppress demand, potentially weakening or even reversing the positive price effect of the halving. The overall macroeconomic climate also plays a significant role; periods of economic uncertainty can drive investors towards Bitcoin as a safe haven asset, increasing demand.

Interaction of Supply and Demand

The interaction between supply and demand will ultimately determine Bitcoin’s price trajectory after the 2025 halving. The reduced supply acts as a foundational element, creating a potential for price appreciation. However, the level of demand will determine the magnitude of this appreciation. A strong increase in demand coupled with reduced supply could lead to a significant price surge. Conversely, weak or declining demand could lead to a more moderate price increase or even a price decline despite the halving. This interplay is complex and influenced by numerous interconnected factors, making precise predictions challenging.

Hypothetical Price Movement Scenario

Let’s consider a hypothetical scenario. Assume that the 2025 halving reduces the rate of Bitcoin creation by 50%, as expected. If, simultaneously, institutional investment increases significantly, leading to a 30% rise in demand, we might see a substantial price increase, perhaps exceeding previous halving cycles. For example, if Bitcoin’s price is $30,000 before the halving, this scenario could potentially push the price to $60,000 or even higher within a year or two post-halving. Conversely, if demand remains relatively flat or decreases due to negative market sentiment, the price increase might be more modest, perhaps reaching only $40,000-$45,000 in the same timeframe. This illustrates how the interplay of supply and demand, influenced by various market forces, determines the final price outcome. This is a simplified model; real-world scenarios are far more complex and involve numerous additional variables.

Potential Price Scenarios After the 2025 Halving

Predicting Bitcoin’s price after the 2025 halving is inherently speculative, given the volatile nature of the cryptocurrency market. However, by considering historical trends, macroeconomic factors, and prevailing market sentiment, we can Artikel three plausible price scenarios: bullish, bearish, and neutral. These scenarios are not mutually exclusive and the actual outcome may fall somewhere between them or even deviate significantly.

Bitcoin Price Scenarios Post-2025 Halving

The following table summarizes three potential price scenarios for Bitcoin following the 2025 halving. These scenarios are based on different assumptions about the broader economic climate, regulatory developments, and overall investor confidence.

| Scenario | Price Range (USD) | Underlying Assumptions | Potential Catalysts |

|---|---|---|---|

| Bullish | $150,000 – $250,000+ | Strong global macroeconomic conditions; continued institutional adoption; positive regulatory developments; sustained retail investor interest; high demand exceeding supply post-halving. A narrative emerges of Bitcoin as a hedge against inflation and a store of value. | Successful Bitcoin ETF approval; significant institutional investments; positive macroeconomic news driving investors to safe-haven assets; widespread adoption in emerging markets; technological advancements improving Bitcoin’s scalability and efficiency. A similar situation to the 2021 bull run, albeit potentially more sustained. |

| Bearish | $20,000 – $50,000 | Global economic downturn; increased regulatory scrutiny and crackdowns; lack of significant institutional investment; negative news cycles impacting investor confidence; a period of prolonged uncertainty. | Major security breaches or hacks; significant regulatory setbacks leading to stricter controls or bans; a global recession impacting investor risk appetite; prolonged bear market sentiment; a lack of innovation or compelling use cases beyond speculation. This scenario could mirror the extended bear market following the 2018 halving. |

| Neutral | $50,000 – $100,000 | Moderate economic growth; a mix of positive and negative regulatory developments; steady institutional adoption but no massive influx; a relatively balanced supply and demand dynamic. | Gradual institutional adoption continues; regulatory clarity emerges, but with some restrictions; macroeconomic conditions remain relatively stable; Bitcoin consolidates its position as a significant asset class. This scenario represents a period of sideways movement and consolidation following the initial halving impact, similar to the period between the 2016 and 2020 halvings. |

Bullish Scenario Narrative

In a bullish scenario, the 2025 halving acts as a significant catalyst, triggering a renewed surge in Bitcoin’s price. Strong macroeconomic conditions, perhaps fueled by recovery from a prior downturn or sustained growth, create a favorable environment for risk-on investments. Institutional adoption accelerates, with significant investments flowing into Bitcoin from pension funds, corporations, and other large players. Positive regulatory developments in key jurisdictions further bolster confidence, attracting a wave of new retail investors. The narrative of Bitcoin as a safe haven asset and a hedge against inflation gains further traction, driving demand well beyond the reduced supply resulting from the halving. The price could see exponential growth, exceeding previous all-time highs significantly.

Bearish Scenario Narrative

Conversely, a bearish scenario paints a picture of significant headwinds for Bitcoin. A global economic downturn, potentially triggered by geopolitical instability or persistent inflation, could significantly dampen investor risk appetite. Increased regulatory scrutiny and potential crackdowns in major markets could further erode confidence. Institutional investment remains subdued, and retail investors become hesitant amidst negative news cycles and a general lack of bullish momentum. The reduced supply from the halving is not enough to offset the decreased demand, leading to a prolonged period of price stagnation or decline.

Neutral Scenario Narrative

The neutral scenario depicts a more moderate outcome. Economic growth remains steady but not spectacular, and regulatory developments are mixed, with some positive steps balanced by ongoing uncertainty. Institutional adoption continues at a gradual pace, without the dramatic influx seen in a bullish scenario. The halving’s impact on price is noticeable but not overwhelmingly dramatic, leading to a period of sideways trading and consolidation. Bitcoin maintains its position as a significant asset class, but its price remains within a relatively predictable range.

Bitcoin Prediction After 2025 Halving – Predicting Bitcoin’s trajectory after the 2025 halving is a complex endeavor, relying heavily on understanding the event’s impact on supply. To gain a better grasp of this pivotal moment, it’s crucial to examine the mechanics of the Halving Of Bitcoin 2025 , as it directly influences the rate of new Bitcoin entering circulation. This, in turn, significantly impacts future price predictions and market dynamics following the halving event.

Predicting Bitcoin’s trajectory after the 2025 halving is a complex endeavor, relying heavily on understanding the event’s impact on supply. To gain a better grasp of this pivotal moment, it’s crucial to examine the mechanics of the Halving Of Bitcoin 2025 , as it directly influences the rate of new Bitcoin entering circulation. This, in turn, significantly impacts future price predictions and market dynamics following the halving event.

Predicting Bitcoin’s trajectory after the 2025 halving is a complex endeavor, relying heavily on understanding the event’s impact on supply. To gain a better grasp of this pivotal moment, it’s crucial to examine the mechanics of the Halving Of Bitcoin 2025 , as it directly influences the rate of new Bitcoin entering circulation. This, in turn, significantly impacts future price predictions and market dynamics following the halving event.

Predicting Bitcoin’s trajectory after the 2025 halving is a complex endeavor, relying heavily on understanding the event’s impact on supply. To gain a better grasp of this pivotal moment, it’s crucial to examine the mechanics of the Halving Of Bitcoin 2025 , as it directly influences the rate of new Bitcoin entering circulation. This, in turn, significantly impacts future price predictions and market dynamics following the halving event.

Predicting Bitcoin’s trajectory after the 2025 halving is a complex endeavor, relying heavily on understanding the event’s impact on supply. To gain a better grasp of this pivotal moment, it’s crucial to examine the mechanics of the Halving Of Bitcoin 2025 , as it directly influences the rate of new Bitcoin entering circulation. This, in turn, significantly impacts future price predictions and market dynamics following the halving event.

Predicting Bitcoin’s trajectory after the 2025 halving is a complex endeavor, relying heavily on understanding the event’s impact on supply. To gain a better grasp of this pivotal moment, it’s crucial to examine the mechanics of the Halving Of Bitcoin 2025 , as it directly influences the rate of new Bitcoin entering circulation. This, in turn, significantly impacts future price predictions and market dynamics following the halving event.