Bitcoin Prediction April 2025: Bitcoin Prediction April 2025 Forbes

Forbes, a prominent financial publication, has offered various perspectives on Bitcoin’s future price, though not always explicitly stating a precise price target for a specific date like April 2025. Their analyses, however, provide valuable insights into their forecasting methodology and the factors they consider.

Forbes’ Past Bitcoin Price Predictions and Methodologies

While Forbes hasn’t issued a single, consistent Bitcoin price prediction methodology across all its articles, their analyses generally incorporate a blend of technical and fundamental analysis. Technical analysis often involves examining historical price charts, identifying trends, and using indicators like moving averages to project future price movements. Fundamental analysis, on the other hand, focuses on broader economic factors influencing Bitcoin’s value, such as adoption rates, regulatory changes, and macroeconomic conditions. For example, a bullish prediction might stem from increasing institutional adoption and a positive global economic outlook, while a bearish prediction might reflect concerns about regulatory crackdowns or a broader market downturn. It’s important to note that these predictions are often presented as expert opinions from various contributors rather than a singular, official Forbes forecast. Therefore, direct comparison of predictions across articles requires careful contextualization.

Economic and Technological Factors Considered by Forbes, Bitcoin Prediction April 2025 Forbes

Forbes’ analyses frequently consider macroeconomic factors such as inflation rates, interest rates, and overall market sentiment. A period of high inflation, for instance, might be interpreted as supportive of Bitcoin’s value as a hedge against inflation. Conversely, rising interest rates could potentially divert investment away from riskier assets like Bitcoin. Technological developments within the Bitcoin ecosystem, such as scaling solutions (Layer-2 technologies) or the emergence of new use cases for Bitcoin, also feature prominently in their analyses. For example, the successful implementation of the Lightning Network, which improves Bitcoin’s transaction speed and scalability, could be seen as a positive factor influencing its price. Conversely, a major security breach or a significant technological setback could have a negative impact.

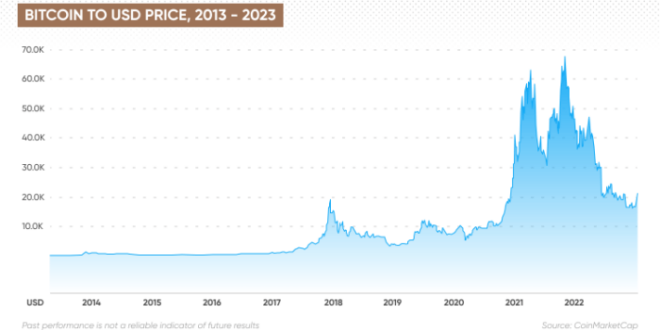

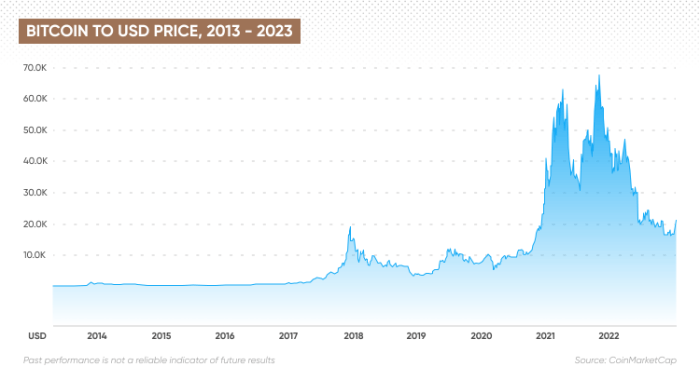

Comparison of Forbes’ Past Predictions with Actual Bitcoin Price Movements

Directly comparing Forbes’ past predictions with actual Bitcoin price movements requires specifying particular articles and their associated predictions. However, it’s generally observed that the cryptocurrency market’s volatility makes precise price predictions exceptionally challenging. Even the most sophisticated analyses can be significantly off the mark due to the influence of unforeseen events (e.g., the collapse of FTX). Past instances show that while Forbes’ contributors might have correctly identified broad trends (like periods of growth or decline), their specific price targets often deviate considerably from the actual market outcomes. This highlights the inherent uncertainty and risk associated with cryptocurrency investments.

Hypothetical Scenario: Forbes Revisits Prediction Methodology for April 2025

Imagine a scenario where, in late 2024, Forbes revisits its prediction methodology for April 2025. Let’s assume a global recession has subsided, but lingering inflation persists. Further, significant regulatory clarity regarding cryptocurrencies has emerged in major economies, creating a more stable regulatory environment. In this scenario, Forbes might incorporate these factors into their analysis. They might use sophisticated econometric models that account for various macroeconomic indicators, incorporating data on inflation, interest rates, and regulatory developments. Furthermore, they could factor in the adoption rates of Bitcoin among institutional investors and the progress made in Bitcoin’s underlying technology. Based on this hypothetical analysis, Forbes might project a price range for April 2025 that reflects the interplay of these positive and negative factors. For example, they might predict a price range of $50,000 to $80,000, reflecting the positive impact of regulatory clarity and continued institutional adoption, while acknowledging the ongoing risk associated with macroeconomic uncertainty. This prediction would be significantly different from predictions made without considering the resolution of the global recession and regulatory clarity.

Bitcoin Prediction April 2025 Forbes – Predicting Bitcoin’s price in April 2025, as Forbes might attempt, is inherently speculative. However, a key factor influencing such predictions is the Bitcoin halving, a significant event impacting supply and potentially price. To understand this crucial element, it’s helpful to learn more about what exactly the halving entails, as explained in this informative article: Que Es El Halving Bitcoin 2025.

Therefore, considering the halving’s impact is essential for any serious Bitcoin price forecast for April 2025.

Forbes’ Bitcoin prediction for April 2025 often focuses on macroeconomic factors influencing the cryptocurrency market. To gain a fuller perspective, it’s helpful to consider predictions extending into the following month; for instance, you might find the insights offered at Bitcoin Prediction May 2025 valuable. Understanding May’s potential trajectory can provide context for evaluating the April forecasts presented by Forbes, offering a more comprehensive outlook.

While Forbes’ Bitcoin prediction for April 2025 offers one perspective, it’s crucial to consider a broader timeframe. For a more comprehensive outlook, checking predictions extending into the fall is advisable; for instance, you might find the analysis at Bitcoin Price Prediction September 2025 helpful. Ultimately, comparing various predictions, including those from Forbes and others covering September, provides a more nuanced understanding of potential Bitcoin value in April 2025.

Predicting Bitcoin’s price in April 2025, as Forbes might attempt, is inherently speculative. However, a key factor influencing such predictions is the Bitcoin halving events. To understand the impact of past halvings, it’s helpful to review the facts; you can check Did Bitcoin Halving Happen 2025 to get some context. This information is crucial for assessing potential future price movements and refining any Bitcoin Prediction April 2025 Forbes might offer.

Forbes’ Bitcoin predictions for April 2025 are highly anticipated, especially considering the significant impact of upcoming events on the cryptocurrency’s price. A key factor influencing these predictions is the 2025 Bitcoin Halving Event , which is expected to reduce the rate of new Bitcoin creation and potentially impact market dynamics. Therefore, understanding this halving is crucial when considering any Bitcoin price forecasts for April 2025.

Speculating on Bitcoin’s price in April 2025, as Forbes and others have attempted, is inherently challenging. A key factor influencing such predictions is the upcoming Bitcoin halving, a significant event affecting Bitcoin’s supply. To keep track of the precise date and countdown for this pivotal moment, check out this helpful resource: Bitcoin Halving 2025 Date And Countdown Btc Clock.

Understanding the halving’s timing is crucial for informed speculation about Bitcoin’s value in April 2025 and beyond.