Bitcoin Price Prediction August 2025: Bitcoin Prediction August 2025

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is akin to navigating a stormy sea without a compass. The market is notoriously volatile, influenced by a complex interplay of technological advancements, regulatory changes, macroeconomic conditions, and, perhaps most significantly, the collective psychology of investors. While historical data can offer some insight, it’s crucial to remember that past performance is not indicative of future results in this highly speculative arena. Attempts to pinpoint an exact price for August 2025 are inherently speculative, but examining various factors allows us to explore plausible scenarios.

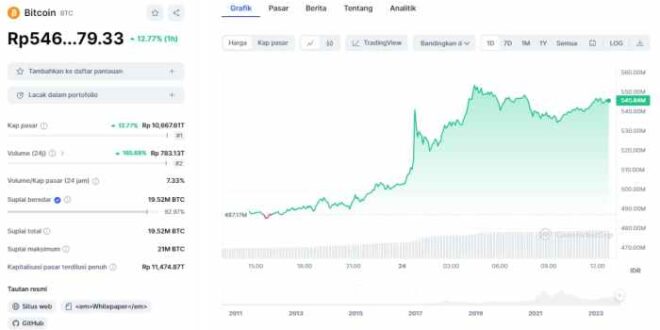

Bitcoin’s history is a rollercoaster ride. From its humble beginnings in 2009, when it traded at virtually zero, Bitcoin experienced periods of explosive growth, punctuated by dramatic crashes. The 2017 bull run saw Bitcoin reach nearly $20,000, followed by a significant correction. Subsequent years have witnessed further volatility, influenced by events such as Elon Musk’s tweets, regulatory crackdowns in certain countries, and the overall adoption rate by businesses and individuals. These fluctuations highlight the inherent risk and reward associated with Bitcoin investment.

Bitcoin Price Scenarios in August 2025: Exploring Potential Outcomes

This article aims to explore several potential price scenarios for Bitcoin in August 2025, considering various factors that could influence its value. We will examine optimistic, pessimistic, and most likely scenarios, acknowledging the inherent uncertainty involved in such predictions. This analysis will not provide a definitive answer but rather offer a framework for understanding the possibilities. We will draw upon historical trends, current market sentiment, and expert opinions to construct plausible price ranges. It is crucial to remember that these are educated guesses, and the actual price could differ significantly.

Factors Influencing Bitcoin’s Price

Predicting Bitcoin’s price in August 2025 requires considering a complex interplay of factors. While no one can definitively state the price, understanding these influences allows for a more informed assessment of potential trajectories. These factors can be broadly categorized into macroeconomic conditions, technological advancements, regulatory landscapes, market sentiment, and geopolitical events.

Macroeconomic Factors and Bitcoin’s Price

Macroeconomic factors significantly impact Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, rising interest rates can reduce investment in riskier assets like Bitcoin, leading to price decreases as investors seek safer, higher-yield alternatives. Global economic conditions, such as recessions or periods of strong growth, also play a crucial role. A global recession might decrease Bitcoin’s price due to reduced risk appetite, while robust global growth could boost investor confidence and increase demand. The correlation between Bitcoin’s price and macroeconomic indicators is not always direct or consistent, however, and other factors often play a more significant role. For example, the 2022 bear market saw both high inflation and rising interest rates, which contributed to a significant price decline, while the 2021 bull market saw a period of relatively low inflation and interest rates.

Technological Advancements and Bitcoin’s Price

Technological advancements within the Bitcoin ecosystem can substantially influence its price. Layer-2 scaling solutions, such as the Lightning Network, aim to improve transaction speed and reduce fees, making Bitcoin more usable for everyday transactions. Widespread adoption of these solutions could boost Bitcoin’s utility and potentially drive up its price. Increased institutional adoption, with larger companies and financial institutions holding Bitcoin as an asset, signifies growing acceptance and legitimacy, which can also positively impact its price. The growing institutional adoption of Bitcoin is evidenced by the increasing number of publicly traded companies holding Bitcoin on their balance sheets, as well as the growth of Bitcoin-related investment products offered by traditional financial institutions.

Regulatory Developments and Bitcoin’s Price

Regulatory developments across different jurisdictions have a varied and often unpredictable impact on Bitcoin’s price. Favorable regulations, such as clear legal frameworks for Bitcoin trading and investment, can boost investor confidence and increase price. Conversely, restrictive regulations or outright bans can negatively affect Bitcoin’s price by limiting its accessibility and adoption. The regulatory landscape is highly fragmented, with different countries adopting vastly different approaches. For instance, El Salvador’s adoption of Bitcoin as legal tender had a short-term positive impact on the price, while China’s crackdown on cryptocurrency mining led to a significant price drop. The evolving regulatory environment remains a significant source of both opportunity and risk for Bitcoin.

Market Sentiment and Bitcoin’s Price

Market sentiment, encompassing media coverage, investor confidence, and overall market mood, is a powerful driver of Bitcoin’s price. Positive media coverage and increased investor confidence can fuel price increases through increased demand. Conversely, negative news or declining investor confidence can lead to price drops as investors sell off their holdings. The impact of social media and online forums on market sentiment is also significant, with viral trends and social media hype frequently influencing price volatility. For example, Elon Musk’s tweets have been shown to correlate with significant price swings in Bitcoin.

Geopolitical Events and Bitcoin’s Price, Bitcoin Prediction August 2025

Geopolitical events can significantly influence Bitcoin’s price. Periods of global instability or uncertainty can increase demand for Bitcoin as a safe haven asset, leading to price increases. Conversely, positive geopolitical developments might lead investors to shift their focus to other asset classes, potentially resulting in price decreases. The war in Ukraine, for example, led to increased volatility in the cryptocurrency market as investors sought refuge in alternative assets, including Bitcoin. Similarly, any major geopolitical shifts or unforeseen events can create significant market uncertainty, impacting Bitcoin’s price accordingly.

Potential Bitcoin Price Scenarios in August 2025

Predicting the price of Bitcoin in August 2025 involves considerable uncertainty, given the volatile nature of the cryptocurrency market. However, by considering various macroeconomic factors, technological advancements, and regulatory developments, we can Artikel three plausible scenarios: a bullish, a neutral, and a bearish outlook. These scenarios are not exhaustive, but they represent a range of possibilities based on current trends and informed speculation.

Bitcoin Price Scenarios: August 2025

The following table presents three distinct price scenarios for Bitcoin in August 2025, each with its supporting factors and potential risks. These scenarios are based on a combination of technical analysis, fundamental analysis, and consideration of potential external events. It’s crucial to remember that these are merely estimations and the actual price could deviate significantly.

| Scenario | Price Target (USD) | Supporting Factors | Potential Risks |

|---|---|---|---|

| Bullish | $200,000 | Widespread institutional adoption, positive regulatory developments globally, continued technological advancements (Layer-2 scaling solutions, improved privacy features), sustained macroeconomic uncertainty driving investors towards Bitcoin as a safe haven asset. Increased demand from emerging markets. Successful Bitcoin ETF approval in major markets. | Regulatory crackdown in key jurisdictions, a major security breach impacting confidence, unexpected technological setbacks, a significant macroeconomic downturn overshadowing Bitcoin’s appeal as a safe haven. Market manipulation. |

| Neutral | $80,000 | Continued adoption, but at a slower pace than the bullish scenario. Regulatory uncertainty persists in some regions, limiting widespread institutional investment. Technological advancements are incremental rather than revolutionary. Macroeconomic conditions remain relatively stable. | Increased competition from alternative cryptocurrencies, lack of significant technological breakthroughs, prolonged regulatory uncertainty hindering growth, a sudden shift in investor sentiment. |

| Bearish | $30,000 | Significant regulatory hurdles, a major security incident eroding trust, a global economic recession reducing investor risk appetite, increased competition from other digital assets, negative media coverage impacting public perception. A large-scale sell-off by major holders. | The potential for a prolonged bear market, impacting investor confidence and potentially leading to a further price decline. Difficult to predict the extent of the price drop in this scenario. |

Bitcoin Adoption and Market Maturity

Predicting Bitcoin’s price in August 2025 requires considering not only short-term market fluctuations but also the long-term effects of increasing adoption and market maturity. These factors will significantly influence price volatility and overall stability. The interplay between institutional investment, governmental regulation, and growing user base will shape Bitcoin’s trajectory.

Increased institutional and governmental adoption of Bitcoin could dramatically impact its price. The entry of large financial institutions and the acceptance of Bitcoin as a legitimate asset by governments would inject significant capital into the market, increasing demand and potentially driving up the price. This is analogous to the effect of major corporations adopting the internet in the late 1990s, which fueled substantial growth in the tech sector. Conversely, negative regulatory actions could severely dampen market enthusiasm and lead to price declines.

Institutional Investment and Governmental Regulation

The growing acceptance of Bitcoin by institutional investors, such as hedge funds and asset management firms, signifies a shift towards mainstream adoption. Their participation introduces a new level of liquidity and stability to the market, potentially reducing volatility in the long term. Governmental regulation, while potentially limiting, also adds legitimacy and clarity to the market, attracting further investment. For example, the increasing number of Bitcoin ETFs approved in various jurisdictions demonstrates this trend. However, overly restrictive regulations could stifle innovation and adoption, negatively impacting the price. A balanced regulatory approach is crucial for healthy market growth.

Market Maturity and Price Volatility

As the Bitcoin market matures, we can expect to see a decrease in price volatility. Early market cycles were characterized by significant price swings due to factors such as speculative trading and a lack of regulatory clarity. Increased institutional participation and a broader understanding of Bitcoin’s underlying technology should lead to a more stable price over time. This is similar to the maturation of the stock market, where volatility has decreased significantly compared to its earlier phases. However, unexpected events, such as major security breaches or significant regulatory changes, could still trigger short-term volatility.

Comparison to Previous Market Cycles

Analyzing previous Bitcoin market cycles can offer insights into potential future trends. The market has historically experienced periods of rapid growth followed by significant corrections. Understanding the drivers behind these cycles, such as technological advancements, regulatory changes, and macroeconomic factors, is crucial for predicting future price movements. For example, the 2017 bull market was largely driven by increased retail investor participation and media hype, while the subsequent bear market was characterized by regulatory uncertainty and market consolidation. Observing these patterns and considering the current market conditions can provide a framework for predicting future trends, though it’s important to remember that past performance is not necessarily indicative of future results.

Predicting Bitcoin’s price in August 2025 is challenging, but a key factor to consider is the impact of the upcoming halving. Understanding the historical correlation between Bitcoin halvings and subsequent price increases is crucial; for detailed information on the next halving, check out this resource on the Prossimo Halving Bitcoin 2025. This event will significantly influence the Bitcoin Prediction August 2025, making it a pivotal point in any forecast.

Predicting Bitcoin’s price in August 2025 is challenging, but a key factor to consider is the impact of the upcoming halving. Understanding the historical correlation between Bitcoin halvings and subsequent price increases is crucial; for detailed information on the next halving, check out this resource on the Prossimo Halving Bitcoin 2025. This event will significantly influence the Bitcoin Prediction August 2025, making it a pivotal point in any forecast.

Predicting Bitcoin’s price in August 2025 is challenging, but a key factor to consider is the impact of the upcoming halving. Understanding the historical correlation between Bitcoin halvings and subsequent price increases is crucial; for detailed information on the next halving, check out this resource on the Prossimo Halving Bitcoin 2025. This event will significantly influence the Bitcoin Prediction August 2025, making it a pivotal point in any forecast.

Predicting Bitcoin’s price in August 2025 is challenging, but a key factor to consider is the impact of the upcoming halving. Understanding the historical correlation between Bitcoin halvings and subsequent price increases is crucial; for detailed information on the next halving, check out this resource on the Prossimo Halving Bitcoin 2025. This event will significantly influence the Bitcoin Prediction August 2025, making it a pivotal point in any forecast.

Predicting Bitcoin’s price in August 2025 is challenging, given the inherent volatility of the cryptocurrency market. A key factor influencing this prediction is the 2025 Bitcoin halving, which will significantly reduce the rate of new Bitcoin creation. To understand the potential impact of this event, it’s helpful to consult resources like this analysis on the 2025 Bitcoin Halving Price Prediction , which offers insights into how the halving might affect Bitcoin’s price trajectory leading up to and beyond August 2025.

Therefore, understanding the halving is crucial for any serious Bitcoin prediction for August 2025.

Predicting Bitcoin’s price in August 2025 is challenging, given the inherent volatility of the cryptocurrency market. A key factor influencing this prediction is the 2025 Bitcoin halving, which will significantly reduce the rate of new Bitcoin creation. To understand the potential impact of this event, it’s helpful to consult resources like this analysis on the 2025 Bitcoin Halving Price Prediction , which offers insights into how the halving might affect Bitcoin’s price trajectory leading up to and beyond August 2025.

Therefore, understanding the halving is crucial for any serious Bitcoin prediction for August 2025.

Predicting Bitcoin’s price in August 2025 is challenging, given the inherent volatility of the cryptocurrency market. A key factor influencing this prediction is the 2025 Bitcoin halving, which will significantly reduce the rate of new Bitcoin creation. To understand the potential impact of this event, it’s helpful to consult resources like this analysis on the 2025 Bitcoin Halving Price Prediction , which offers insights into how the halving might affect Bitcoin’s price trajectory leading up to and beyond August 2025.

Therefore, understanding the halving is crucial for any serious Bitcoin prediction for August 2025.