Regulatory Landscape and its Influence

The regulatory landscape surrounding cryptocurrencies, particularly Bitcoin, is rapidly evolving and presents a significant factor influencing its price trajectory. Differing approaches across jurisdictions create both opportunities and challenges for Bitcoin’s future. Understanding these varied regulatory responses is crucial for predicting Bitcoin’s price in April 2025.

The global regulatory environment for Bitcoin is a patchwork of approaches. Some countries have embraced a relatively permissive stance, viewing Bitcoin as a potential driver of innovation and economic growth. Others have adopted a more cautious, even restrictive, approach, citing concerns about money laundering, terrorist financing, and market manipulation. This divergence in regulatory philosophies significantly impacts Bitcoin’s price and accessibility within each respective market.

Comparative Regulatory Approaches

Several countries exemplify the spectrum of regulatory approaches. El Salvador’s adoption of Bitcoin as legal tender represents a highly progressive stance, potentially boosting demand and price. In contrast, China’s outright ban on cryptocurrency trading and mining has demonstrably suppressed Bitcoin’s price in the past and continues to influence global sentiment. The European Union’s Markets in Crypto-Assets (MiCA) regulation, while aiming to provide a more standardized framework, presents a complex regulatory landscape that will take time to fully assess for its impact on price. The United States, meanwhile, is grappling with a fragmented regulatory environment, with different agencies overseeing various aspects of the cryptocurrency market. This lack of cohesive regulation introduces uncertainty that can affect Bitcoin’s price volatility.

Impact of Increased Regulatory Scrutiny or Adoption

Increased regulatory scrutiny, while potentially curbing illicit activities, could also stifle innovation and limit Bitcoin’s adoption. Conversely, clear and consistent regulatory frameworks could instill investor confidence, leading to increased institutional investment and price appreciation. The impact hinges on the specific nature of the regulations – whether they are overly restrictive or promote responsible growth. For example, stricter KYC/AML (Know Your Customer/Anti-Money Laundering) regulations might reduce illicit activities but could also hinder broader accessibility. Conversely, clear guidelines for tax treatment could enhance investor confidence and increase market participation.

Key Regulatory Developments and Their Anticipated Influence

The following points summarize key regulatory developments and their potential impact on Bitcoin’s price in April 2025:

- Increased adoption of stablecoins: Widespread adoption of regulated stablecoins could indirectly impact Bitcoin’s price by providing a more stable on-ramp for investors entering the crypto market. This could lead to increased liquidity and potentially higher Bitcoin prices.

- Implementation of MiCA in the EU: The full implementation of MiCA could bring greater clarity and standardization to the European crypto market, potentially attracting more institutional investors and driving up prices. However, overly stringent requirements could also hinder innovation and adoption.

- Further regulatory clarity in the US: A more unified and clear regulatory framework in the US, particularly concerning the classification of Bitcoin as a security or commodity, could significantly impact investor sentiment and price volatility. A favorable regulatory outcome could lead to increased institutional investment and price appreciation.

- Global regulatory cooperation: Increased international collaboration on cryptocurrency regulation could lead to a more stable and predictable global market, reducing price volatility and potentially boosting confidence.

Macroeconomic Factors and Bitcoin’s Price: Bitcoin Prediction For April 2025

Bitcoin, despite its decentralized nature, is not immune to the influence of macroeconomic forces. Its price is often correlated, albeit not always directly or predictably, with global economic trends, inflation rates, and interest rate policies. Understanding this relationship is crucial for navigating the volatile cryptocurrency market.

Bitcoin’s price often acts as a safe haven asset during times of economic uncertainty. When traditional markets experience volatility due to inflation or recession fears, investors may seek refuge in alternative assets perceived as less susceptible to these macroeconomic headwinds. Conversely, periods of strong economic growth and low inflation can sometimes lead to decreased interest in Bitcoin as investors allocate funds to more traditional, high-yield investments.

Past Macroeconomic Events and Bitcoin’s Price

Several past macroeconomic events have demonstrably influenced Bitcoin’s price. For example, the 2008 global financial crisis saw a surge in interest in Bitcoin as investors sought alternatives to traditional financial systems. Similarly, periods of high inflation, such as those witnessed in certain Latin American countries, have often led to increased Bitcoin adoption as a hedge against currency devaluation. Conversely, periods of rising interest rates, like those seen in late 2022, have often coincided with a decrease in Bitcoin’s price as investors shifted to higher-yielding assets. The quantitative easing policies implemented by central banks globally following the 2008 crisis also played a role in Bitcoin’s price appreciation. The injection of liquidity into the global economy contributed to a general increase in asset prices, including Bitcoin.

Potential Impact of Future Macroeconomic Scenarios on Bitcoin’s Price in April 2025

Predicting Bitcoin’s price with certainty is impossible, but analyzing potential macroeconomic scenarios can offer insights. If global inflation remains high in 2024 and 2025, leading central banks to continue raising interest rates, Bitcoin’s price might experience downward pressure. Conversely, a scenario involving a global recession coupled with high inflation (stagflation) could potentially boost Bitcoin’s price as investors seek a store of value outside traditional markets. A scenario of sustained economic growth with controlled inflation could lead to a more moderate Bitcoin price, reflecting a balanced allocation of investment capital.

Hypothetical Scenario: Macroeconomic Events and Bitcoin Price Impact, Bitcoin Prediction For April 2025

Let’s imagine a scenario for April 2025: A significant geopolitical event triggers a global recession, causing investors to flee traditional markets. Simultaneously, inflation remains stubbornly high, eroding the value of fiat currencies. In this hypothetical situation, increased demand for Bitcoin as a hedge against both economic downturn and inflation could drive its price significantly higher, potentially exceeding $100,000. Conversely, if the same geopolitical event leads to a swift and decisive response from central banks, resulting in controlled inflation and a quicker recovery, the impact on Bitcoin’s price might be less dramatic, perhaps settling around $50,000 – $70,000, depending on investor sentiment and other market factors. This illustrates how interwoven macroeconomic factors and Bitcoin’s price truly are.

Adoption and Market Sentiment

Bitcoin’s adoption and the prevailing market sentiment are crucial factors influencing its price trajectory. Understanding the current state of adoption across various sectors and the prevailing investor attitudes is key to forecasting Bitcoin’s potential in April 2025. This section will examine these aspects, highlighting key drivers and potential impacts.

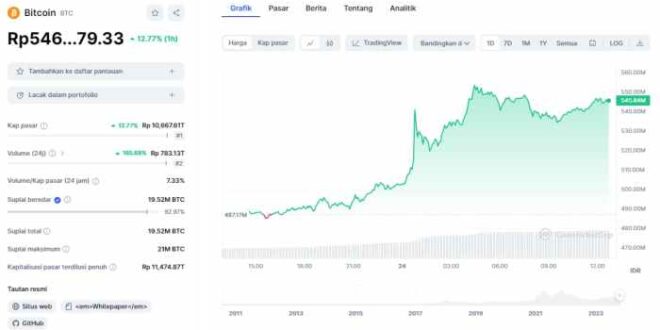

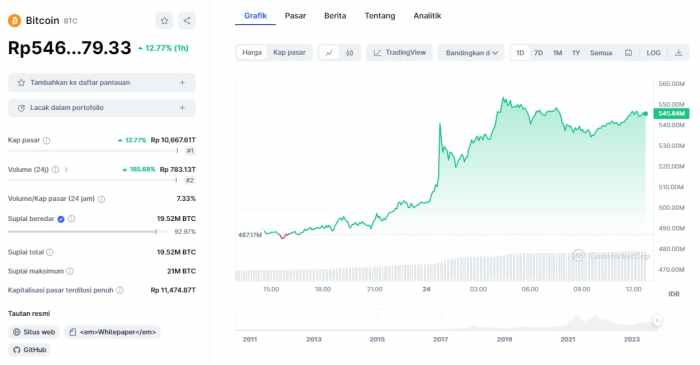

Bitcoin Prediction For April 2025 – Currently, Bitcoin adoption shows a mixed picture across different sectors. In the financial sector, some institutional investors have embraced Bitcoin as an asset class, while others remain hesitant due to regulatory uncertainty and volatility. The technology sector displays higher levels of adoption, with companies increasingly integrating Bitcoin into their payment systems or exploring blockchain technology for various applications. Retail adoption, while growing, is still relatively limited, hampered by factors like price volatility, user experience, and lack of widespread merchant acceptance.

Predicting Bitcoin’s price in April 2025 is challenging, but a key factor to consider is the upcoming halving event. To accurately gauge its impact, understanding the precise timing is crucial; you can find the exact date for the Bitcoin Halving in 2025 by checking this resource: Bitcoin Halving Exact Date 2025. This information is vital for formulating a more informed Bitcoin Prediction for April 2025, as the halving significantly influences the cryptocurrency’s supply and, consequently, its potential price movements.

Institutional Investor Influence

Institutional investors, including hedge funds, asset management firms, and corporations, play a significant role in shaping Bitcoin’s price. Their large-scale investments can inject substantial liquidity into the market, driving price increases. Conversely, significant sell-offs by these institutions can lead to sharp price corrections. For example, MicroStrategy’s substantial Bitcoin holdings have been cited as a factor supporting the cryptocurrency’s price in certain periods. The level of institutional participation, therefore, is a strong indicator of future price movements. A surge in institutional investment in 2025 could significantly boost Bitcoin’s price, while a retreat could have the opposite effect.

Market Sentiment Analysis

Market sentiment, encompassing investor confidence and overall public perception, is another critical factor. Positive sentiment, driven by factors like regulatory clarity, technological advancements, or increased institutional adoption, typically leads to higher prices. Conversely, negative sentiment, fueled by regulatory crackdowns, security breaches, or market crashes, can trigger significant price declines. Analyzing social media trends, news coverage, and investor surveys can provide insights into prevailing sentiment. For instance, a surge in positive news and social media chatter about Bitcoin’s potential use cases could significantly boost investor confidence and drive price appreciation. Conversely, negative news regarding a major security breach or a significant regulatory setback could negatively impact market sentiment and depress prices.

Factors Influencing Market Sentiment

Several factors can influence market sentiment. Regulatory developments, such as the implementation of clear and favorable regulatory frameworks, can boost investor confidence. Technological advancements, like the development of layer-2 scaling solutions, can improve Bitcoin’s usability and transaction speed, potentially increasing adoption and positive sentiment. Macroeconomic factors, such as inflation or economic uncertainty, can also influence investor appetite for Bitcoin as a hedge against inflation or a safe haven asset. Geopolitical events, such as international conflicts or shifts in global power dynamics, can also affect investor risk appetite and consequently impact Bitcoin’s price. For example, increased geopolitical instability might lead investors to seek refuge in Bitcoin, driving its price upwards.

Alternative Cryptocurrencies and Their Impact

The rise of Bitcoin has spurred the development of a diverse ecosystem of alternative cryptocurrencies, each with its unique features and functionalities. These altcoins, as they are often called, present both opportunities and challenges for Bitcoin’s future dominance. Understanding their impact is crucial for predicting Bitcoin’s price trajectory in 2025 and beyond. This section will compare Bitcoin with prominent alternatives, analyze their potential influence on Bitcoin’s market share, and explore the implications of cross-chain interoperability.

Bitcoin, Ethereum, and Solana represent three distinct approaches to blockchain technology. Bitcoin, the original cryptocurrency, focuses primarily on secure and decentralized value transfer. Ethereum, on the other hand, introduced smart contracts and decentralized applications (dApps), expanding the possibilities beyond simple transactions. Solana, a newer entrant, aims for high transaction speeds and scalability, addressing some of the limitations faced by Bitcoin and Ethereum.

Predicting Bitcoin’s price in April 2025 is challenging, but a key factor to consider is the upcoming halving event. To accurately gauge its impact, understanding the precise timing is crucial; you can find the exact date for the Bitcoin Halving in 2025 by checking this resource: Bitcoin Halving Exact Date 2025. This information is vital for formulating a more informed Bitcoin Prediction for April 2025, as the halving significantly influences the cryptocurrency’s supply and, consequently, its potential price movements.

Bitcoin’s Market Dominance and the Competition from Altcoins

The competitive landscape among cryptocurrencies is dynamic. While Bitcoin maintains a significant market share, altcoins are constantly vying for a larger piece of the pie. Ethereum’s success with DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens) has significantly impacted the overall cryptocurrency market, attracting considerable investment and attention away from Bitcoin. Solana’s focus on speed and scalability offers a compelling alternative for applications requiring high transaction throughput. The success of these altcoins can potentially erode Bitcoin’s market dominance, putting downward pressure on its price. However, Bitcoin’s first-mover advantage and established brand recognition continue to provide it with significant resilience. For example, during periods of market uncertainty, investors often flock back to Bitcoin as a “safe haven” asset.

Cross-Chain Interoperability and its Effect on Bitcoin’s Value

Cross-chain interoperability, the ability for different blockchains to communicate and interact with each other, is a rapidly developing area. The potential for seamless transfer of value and data between Bitcoin and other cryptocurrencies could significantly impact Bitcoin’s value. If successful, this could lead to increased liquidity and accessibility, potentially boosting Bitcoin’s adoption and price. Conversely, it could also lead to increased competition, as users might find it easier to switch between different cryptocurrencies based on their specific needs and preferences. The development of technologies like the Lightning Network, while enhancing Bitcoin’s scalability, also represents a step towards greater interoperability within the Bitcoin ecosystem itself.

Comparative Analysis of Cryptocurrencies

The following table provides a comparative analysis of Bitcoin, Ethereum, and Solana, highlighting their key features, strengths, and weaknesses.

Predicting Bitcoin’s price in April 2025 is challenging, but a key factor to consider is the upcoming halving event. To accurately gauge its impact, understanding the precise timing is crucial; you can find the exact date for the Bitcoin Halving in 2025 by checking this resource: Bitcoin Halving Exact Date 2025. This information is vital for formulating a more informed Bitcoin Prediction for April 2025, as the halving significantly influences the cryptocurrency’s supply and, consequently, its potential price movements.

| Cryptocurrency | Key Features | Strengths | Weaknesses |

|---|---|---|---|

| Bitcoin | Decentralized digital currency, secure transactions, limited supply | Established network, strong brand recognition, store of value | Slow transaction speeds, limited functionality beyond payments, high energy consumption |

| Ethereum | Smart contracts, decentralized applications (dApps), programmable blockchain | Wide range of applications, vibrant developer community, scalability improvements (e.g., Layer 2 solutions) | Transaction fees can be high, network congestion during peak times, complexity |

| Solana | High transaction throughput, fast confirmation times, smart contract functionality | Scalability, speed, relatively low transaction fees | Centralization concerns, history of network outages, relatively young ecosystem |

Potential Price Scenarios for April 2025

Predicting Bitcoin’s price is inherently speculative, influenced by a complex interplay of factors. While no one can definitively state Bitcoin’s price in April 2025, exploring plausible scenarios based on current trends and potential future developments offers valuable insight. The following Artikels three distinct scenarios – bullish, bearish, and neutral – each with its underlying assumptions and potential risks.

Bullish Scenario: Bitcoin Surges to $200,000

This scenario envisions a significant price increase driven by widespread institutional adoption, positive regulatory developments, and sustained macroeconomic stability. Imagine a future where major financial institutions actively integrate Bitcoin into their portfolios, driving demand. Simultaneously, regulatory clarity in key jurisdictions could boost investor confidence. A generally healthy global economy would further support this upward trend.

Supporting Factors: Increased institutional investment, positive regulatory changes (e.g., clearer guidelines for Bitcoin ETFs), continued technological advancements enhancing Bitcoin’s scalability and efficiency, growing mainstream adoption fueled by user-friendly interfaces and services, and a stable or mildly inflationary macroeconomic environment.

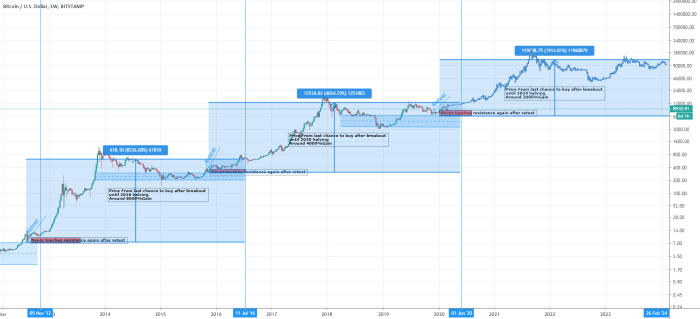

Risks: A sudden market correction due to unforeseen geopolitical events, a regulatory crackdown in major markets, or a significant technological vulnerability discovered in the Bitcoin network. The rapid price appreciation could also attract excessive speculation, leading to a subsequent bubble burst. This scenario assumes a continuation of current positive trends and the absence of major negative disruptions. For example, a scenario similar to the 2017 bull run, but potentially with more sustained institutional involvement.

Bearish Scenario: Bitcoin Falls to $30,000

This scenario assumes a less optimistic outlook, potentially triggered by a combination of factors. A global recession, for instance, could severely impact risk appetite, leading to investors liquidating their Bitcoin holdings. Increased regulatory scrutiny and uncertainty, coupled with the emergence of competing cryptocurrencies with superior technology, could further depress the price.

Supporting Factors: A global recession leading to decreased investor confidence and a flight to safety, increased regulatory pressure resulting in stricter trading restrictions or outright bans, the emergence of a superior cryptocurrency technology surpassing Bitcoin’s functionality, and a significant security breach or exploit within the Bitcoin network eroding trust.

Risks: The price could fall even further if the negative factors mentioned above intensify or if unforeseen black swan events occur. A prolonged bear market could lead to decreased developer activity and a decline in network security. This scenario mirrors the prolonged bear market experienced after the 2017 bull run, potentially extended and exacerbated by additional negative factors.

Neutral Scenario: Bitcoin Stabilizes Around $60,000

This scenario suggests a period of consolidation and sideways trading. It assumes a balance between positive and negative factors, resulting in moderate price fluctuations around the current price level (adjusted for inflation). While there might be some institutional adoption and technological advancements, these would be offset by macroeconomic uncertainties or regulatory headwinds.

Supporting Factors: Moderate institutional adoption, a period of regulatory uncertainty with no major positive or negative developments, steady technological improvements without revolutionary breakthroughs, and a relatively stable macroeconomic environment with moderate inflation.

Risks: The potential for either a bullish or bearish breakout remains, depending on which set of factors gains dominance. The prolonged period of sideways trading could lead to decreased investor interest and a subsequent sharp price movement in either direction. This scenario represents a more conservative outlook, similar to periods of consolidation observed in the past within Bitcoin’s price history.

Price Scenario Summary

| Scenario | Price Prediction (April 2025) | Supporting Factors | Risks |

|---|---|---|---|

| Bullish | $200,000 | High institutional adoption, positive regulation, macroeconomic stability | Market correction, regulatory crackdown, technological vulnerability |

| Bearish | $30,000 | Global recession, increased regulation, superior competitor technology | Further price decline, decreased developer activity |

| Neutral | $60,000 | Moderate adoption, regulatory uncertainty, steady technological progress | Potential for bullish or bearish breakout |

Frequently Asked Questions (FAQs)

Predicting the price of Bitcoin in April 2025, or any future date, is inherently complex and involves a degree of uncertainty. Several interconnected factors influence Bitcoin’s price, making precise forecasting extremely challenging. This section addresses common questions surrounding Bitcoin price prediction and risk management.

Bitcoin’s Most Likely Price in April 2025 and Factors Contributing to Uncertainty

Pinpointing a single “most likely” price for Bitcoin in April 2025 is impossible. Numerous variables contribute to price volatility, including macroeconomic conditions (e.g., inflation, interest rates, recessionary pressures), regulatory developments (e.g., government policies, legal frameworks), technological advancements (e.g., scaling solutions, new applications), market sentiment (e.g., investor confidence, media coverage), and the actions of large investors (e.g., institutional adoption, whale movements). For example, a sudden global economic downturn could significantly depress Bitcoin’s price, while widespread institutional adoption could drive it sharply upward. The interplay of these factors creates a highly dynamic and unpredictable market.

Reliability of Bitcoin Price Predictions and Forecasting Limitations

Bitcoin price predictions should be viewed with extreme caution. No model can perfectly account for the complex and often unpredictable forces at play. Past performance is not indicative of future results. Many predictions are based on speculative analysis, technical indicators, or subjective interpretations of market trends, rather than concrete data. Furthermore, the relatively young age of Bitcoin and its volatile nature make long-term forecasting exceptionally difficult. Predictions often fail to account for unforeseen events, such as regulatory crackdowns or technological breakthroughs, which can dramatically impact the market. Consider the 2022 cryptocurrency bear market, which significantly impacted the price of most cryptocurrencies, including Bitcoin, despite some bullish predictions in the preceding months.

Biggest Risks Associated with Investing in Bitcoin and Mitigation Strategies

Investing in Bitcoin carries significant risks. Price volatility is a primary concern, with substantial price swings occurring frequently. Security risks, such as hacking or loss of private keys, pose a threat to investors’ holdings. Regulatory uncertainty, involving potential government bans or restrictions, also presents a risk. Finally, the relatively nascent nature of the cryptocurrency market introduces inherent risks compared to more established asset classes. Mitigation strategies include diversification (spreading investments across different asset classes), secure storage practices (using hardware wallets), due diligence (thoroughly researching projects before investing), and a disciplined approach to risk management (avoiding emotional decision-making and investing only what one can afford to lose).

Protecting Against Bitcoin Price Volatility

Managing risk in a volatile market like Bitcoin’s requires a proactive approach. Dollar-cost averaging (investing a fixed amount of money at regular intervals, regardless of price) can help mitigate the impact of price fluctuations. Setting stop-loss orders (automatically selling Bitcoin when it reaches a predetermined price) can limit potential losses. Diversification, as mentioned earlier, is crucial. Finally, adopting a long-term investment strategy, rather than attempting to time the market, can help weather short-term price swings. It’s also important to stay informed about market developments and adjust investment strategies accordingly, without panicking due to short-term price changes.

Predicting Bitcoin’s price in April 2025 is challenging, but a key factor to consider is the upcoming halving event. To accurately gauge its impact, understanding the precise timing is crucial; you can find the exact date for the Bitcoin Halving in 2025 by checking this resource: Bitcoin Halving Exact Date 2025. This information is vital for formulating a more informed Bitcoin Prediction for April 2025, as the halving significantly influences the cryptocurrency’s supply and, consequently, its potential price movements.

Predicting Bitcoin’s price in April 2025 is challenging, but a key factor to consider is the upcoming halving event. To accurately gauge its impact, understanding the precise timing is crucial; you can find the exact date for the Bitcoin Halving in 2025 by checking this resource: Bitcoin Halving Exact Date 2025. This information is vital for formulating a more informed Bitcoin Prediction for April 2025, as the halving significantly influences the cryptocurrency’s supply and, consequently, its potential price movements.

Predicting Bitcoin’s price in April 2025 is challenging, but a key factor to consider is the upcoming halving event. To accurately gauge its impact, understanding the precise timing is crucial; you can find the exact date for the Bitcoin Halving in 2025 by checking this resource: Bitcoin Halving Exact Date 2025. This information is vital for formulating a more informed Bitcoin Prediction for April 2025, as the halving significantly influences the cryptocurrency’s supply and, consequently, its potential price movements.