Bitcoin Price Prediction for February 2025: Bitcoin Prediction For February 2025

Bitcoin, first introduced in 2009, has evolved from a niche digital currency to a globally recognized asset class. Its journey has been marked by periods of explosive growth and dramatic corrections, shaping its current standing as a volatile yet influential player in the financial landscape. Currently, Bitcoin’s market capitalization fluctuates significantly, influenced by a complex interplay of factors, and its price remains highly speculative.

Bitcoin’s price volatility is driven by a multitude of factors, including regulatory changes, macroeconomic conditions, technological advancements within the cryptocurrency space, and overall investor sentiment. News events, both positive and negative, regarding Bitcoin or the broader cryptocurrency market, can trigger substantial price swings. Furthermore, the limited supply of Bitcoin (21 million coins) contributes to its perceived scarcity and potential for future value appreciation, while simultaneously making it susceptible to dramatic price fluctuations based on changes in demand. Understanding these influences is crucial for any meaningful price prediction.

Bitcoin Price Prediction Challenges and Opportunities

Predicting Bitcoin’s price is inherently challenging due to its nascent nature and the inherent unpredictability of the market. However, opportunities exist for informed predictions by analyzing historical price data, considering macroeconomic trends, and assessing technological developments impacting the cryptocurrency sector. Successful predictions require a nuanced understanding of the complex interplay of these factors, acknowledging the inherent risks and limitations involved in forecasting such a volatile asset. For example, accurate prediction in 2020 would have been exceptionally difficult due to the unprecedented circumstances of the COVID-19 pandemic and its impact on global financial markets. The subsequent surge in Bitcoin’s price demonstrated the difficulty of accounting for unpredictable global events.

Factors Influencing Bitcoin’s Price Volatility

Several interconnected factors contribute to Bitcoin’s price volatility. These include macroeconomic factors like inflation and interest rates, regulatory developments in various jurisdictions, the adoption of Bitcoin by institutions and businesses, technological advancements within the blockchain ecosystem, and overall market sentiment. For instance, a period of high inflation might drive investors towards Bitcoin as a hedge against inflation, leading to a price increase. Conversely, stricter regulatory measures could negatively impact investor confidence and drive prices down. The adoption of Bitcoin by major financial institutions has historically been correlated with price increases, while periods of negative market sentiment, often fueled by news of hacks or regulatory crackdowns, can trigger significant price drops.

The Importance of Market Trend Analysis, Bitcoin Prediction For February 2025

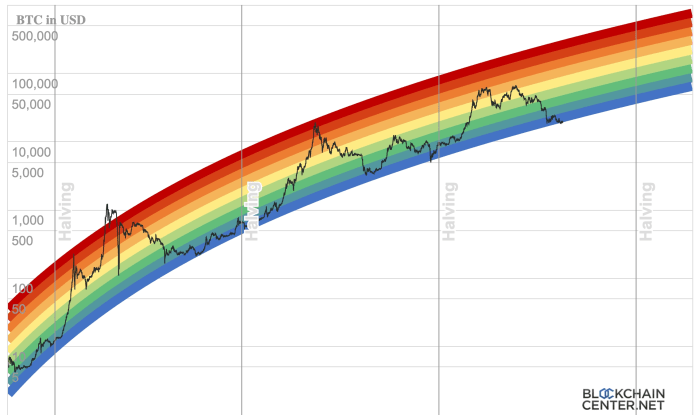

Before attempting any Bitcoin price prediction, a thorough analysis of existing market trends is paramount. This involves studying historical price data to identify patterns and cycles, analyzing trading volume and market sentiment indicators, and evaluating the influence of external factors such as macroeconomic conditions and regulatory developments. By understanding past performance and current market dynamics, one can form a more informed basis for forecasting future price movements. Ignoring these trends leads to unreliable predictions and increased risk of financial loss. For example, analyzing the historical correlation between Bitcoin’s price and the S&P 500 index can provide insights into potential future price movements based on macroeconomic forecasts.

Bitcoin Prediction For February 2025 – Predicting Bitcoin’s price in February 2025 is challenging, influenced by various factors including market sentiment and technological advancements. A key event impacting future price predictions is the Bitcoin halving, which significantly alters the rate of new Bitcoin creation. To understand the potential implications for February 2025, it’s crucial to know the exact date of the 2025 halving; you can find that information here: When Is The Bitcoin Halving 2025 Date.

This date will help refine predictions for Bitcoin’s price trajectory heading into February 2025.

Predicting Bitcoin’s price in February 2025 is challenging, heavily influenced by various factors including macroeconomic conditions and market sentiment. A key element to consider is the impact of the next Bitcoin halving, which will significantly alter the rate of new Bitcoin entering circulation. For insights into the timing and potential effects of this event, check out this resource on When Bitcoin Halving 2025 Prediction.

Understanding the halving’s projected timeline is crucial for formulating a more accurate Bitcoin price prediction for February 2025.

Predicting Bitcoin’s price in February 2025 is inherently challenging, relying heavily on various market factors. A key event influencing this prediction is the Bitcoin halving, significantly impacting its scarcity and potential price appreciation. To understand the timing of this crucial event, it’s helpful to consult resources like this one on Kapan Halving Bitcoin 2025 , which provides valuable insight into the halving’s date and its likely effect on Bitcoin’s trajectory by February 2025.

Therefore, the halving’s timing is a pivotal factor in any February 2025 price forecast.

Predicting Bitcoin’s price for February 2025 is challenging, given its inherent volatility. A key factor influencing these predictions is the 2024 halving event, significantly impacting the rate of new Bitcoin entering circulation. To understand the potential price implications of this halving, it’s helpful to consult resources such as this article on What Is Bitcoin Predicted Price In 2025 Halving?

which offers insights into potential price trajectories post-halving, and therefore influencing Bitcoin’s predicted value in February 2025. Ultimately, February 2025’s Bitcoin price will depend on a confluence of factors beyond the halving alone.

Predicting Bitcoin’s price in February 2025 is challenging, with various factors influencing its trajectory. A key event to consider when formulating any prediction is the impact of the next Bitcoin halving, significantly altering the rate of new Bitcoin entering circulation. To understand the timeline for this pivotal event, check out the details on the Bitcoin Halving Date In 2025 , which will undoubtedly play a role in shaping the market leading up to February 2025 and beyond.

Therefore, accurate Bitcoin price forecasting for February 2025 requires careful consideration of this halving event.

Predicting Bitcoin’s price for February 2025 requires considering various factors, including regulatory changes and overall market sentiment. To get a clearer picture of potential long-term trends, it’s helpful to examine forecasts further out; for instance, understanding the projected state of the market in September helps shape our understanding. For a perspective on the later part of the year, check out this analysis on Bitcoin Prediction September 2025 , which can inform our February 2025 predictions by highlighting potential overarching trends.