Bitcoin Price Prediction for March 2025

Bitcoin, since its inception, has demonstrated remarkable volatility, experiencing periods of explosive growth followed by significant corrections. Its journey has been shaped by a confluence of factors, including technological advancements, regulatory landscapes, macroeconomic trends, and investor sentiment. Predicting its future price remains inherently challenging, but analyzing past performance and current market dynamics allows us to formulate plausible scenarios.

Bitcoin’s Historical Price Performance and Influential Factors

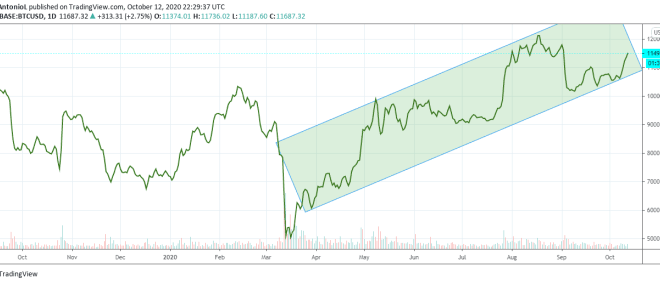

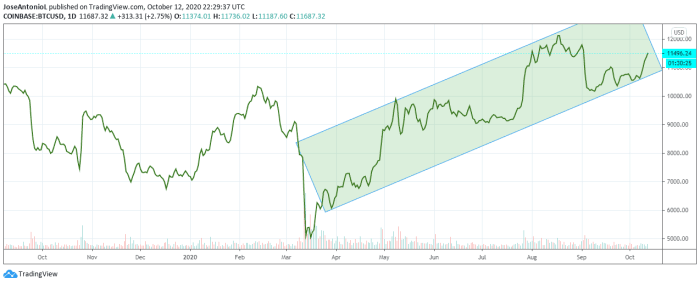

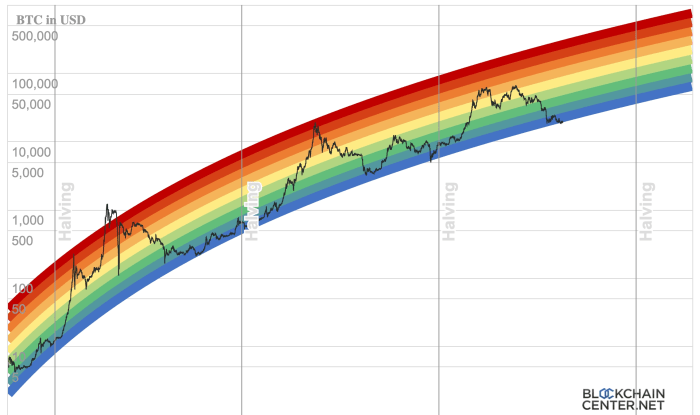

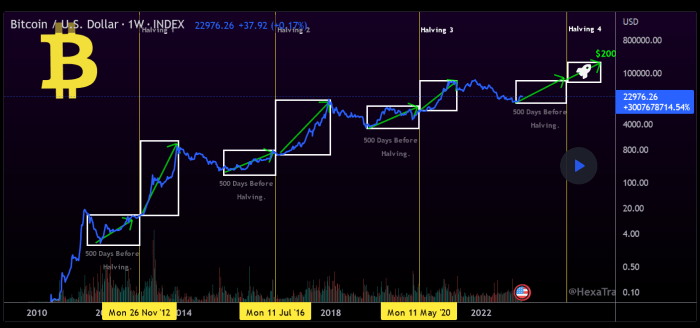

Bitcoin’s price has fluctuated dramatically since its creation. Early years saw slow growth, followed by periods of rapid appreciation, most notably in 2017 and 2021. These bull runs were often fueled by increased adoption, media attention, and speculation. Conversely, sharp price drops, or “bear markets,” have been triggered by events such as regulatory crackdowns, security breaches, or broader macroeconomic downturns. Factors such as technological upgrades (like the halving events that reduce Bitcoin’s inflation rate), institutional investment, and overall market sentiment have consistently played crucial roles in shaping its price trajectory. The 2022 bear market, for example, was partly attributed to rising inflation and increased interest rates globally.

Key Factors Shaping Bitcoin’s Price in March 2025

Several key factors will likely influence Bitcoin’s price by March 2025. Macroeconomic conditions, including inflation rates, interest rate policies, and global economic growth, will continue to play a significant role. Regulatory clarity or uncertainty in major markets (such as the US, EU, and China) will also heavily impact investor confidence and market participation. Technological advancements, such as the development of the Lightning Network for faster and cheaper transactions, and the broader adoption of Layer-2 scaling solutions, could boost Bitcoin’s usability and appeal. Finally, the overall adoption rate by institutions and individual investors, coupled with market sentiment, will remain pivotal in determining price movements.

Plausible Price Predictions for Bitcoin in March 2025

Predicting Bitcoin’s price with certainty is impossible. However, considering various scenarios, we can Artikel a range of plausible outcomes. The following table presents a range of predictions, acknowledging the inherent uncertainties involved:

| Scenario | Price Range (USD) | Rationale | Supporting Example |

|---|---|---|---|

| Extremely Bullish | $250,000 – $500,000 | Widespread adoption, significant institutional investment, positive macroeconomic environment. | Similar to the 2021 bull run, but sustained over a longer period. |

| Bullish | $100,000 – $250,000 | Continued institutional adoption, positive regulatory developments, moderate macroeconomic growth. | Comparable to the growth seen in the previous bull cycles, adjusted for market maturity. |

| Bearish | $30,000 – $80,000 | Negative macroeconomic conditions, increased regulatory scrutiny, reduced investor confidence. | Similar to the 2022 bear market, but with a potential for a slower recovery. |

| Extremely Bearish | Below $30,000 | Significant global economic downturn, major regulatory crackdowns, loss of investor confidence. | A scenario similar to the 2018 bear market, but potentially more prolonged. |

Influential Factors

Predicting Bitcoin’s price in March 2025 requires considering a multitude of factors, with macroeconomic conditions playing a particularly significant role. Global economic health, political stability, and shifts in monetary policy all exert considerable influence on Bitcoin’s volatility and potential price trajectory. Understanding these interconnected elements is crucial for forming a well-informed perspective.

Global inflation, recessionary risks, and interest rate adjustments significantly impact Bitcoin’s price. These macroeconomic factors influence investor sentiment, risk appetite, and the overall attractiveness of various asset classes, including Bitcoin.

Global Inflation and Recessionary Risks

High inflation erodes the purchasing power of fiat currencies, potentially driving investors towards alternative assets like Bitcoin as a hedge against inflation. Conversely, a recessionary environment might lead to decreased investor confidence and a sell-off in riskier assets, including Bitcoin. The severity and duration of inflationary pressures or a recession will determine the extent of Bitcoin’s price reaction. For example, the high inflation experienced in several countries in 2022 saw increased interest in Bitcoin as a store of value, but a subsequent tightening of monetary policy by central banks led to a significant correction in the cryptocurrency market.

Interest Rate Changes and Monetary Policy

Central banks’ decisions regarding interest rates directly impact the cost of borrowing and the attractiveness of yield-bearing assets. Higher interest rates generally reduce the appeal of riskier investments like Bitcoin, as investors might shift their funds towards safer, higher-yielding alternatives. Conversely, lower interest rates can make Bitcoin more attractive, potentially boosting its price. The Federal Reserve’s interest rate hikes in 2022, for instance, negatively impacted Bitcoin’s price, demonstrating the strong correlation between monetary policy and cryptocurrency markets.

Geopolitical Events and Global Financial Market Shifts

Geopolitical instability and significant events in global financial markets can trigger significant volatility in Bitcoin’s price. Unexpected political developments, international conflicts, or major financial crises can lead to increased uncertainty and risk aversion, potentially causing investors to liquidate their Bitcoin holdings. The Russian invasion of Ukraine in 2022, for example, initially caused a sharp drop in Bitcoin’s price as investors sought safe haven assets. Conversely, periods of global stability and economic growth can lead to increased investor confidence and higher Bitcoin prices.

US Dollar and Bitcoin Price Correlation

The US dollar’s strength often inversely correlates with Bitcoin’s price. A stronger dollar typically makes Bitcoin more expensive for holders of other currencies, potentially reducing demand. Conversely, a weaker dollar can increase the attractiveness of Bitcoin as an alternative investment, potentially driving its price higher. This relationship is not always straightforward, however, as other factors can influence Bitcoin’s price independently of the dollar’s value. The ongoing fluctuations in the dollar’s strength against other major currencies, including the Euro and the Yen, directly impact the global purchasing power of Bitcoin and, consequently, its price. Periods of dollar weakness have historically been associated with increases in Bitcoin’s price, suggesting a potential inverse correlation.

Influential Factors

The regulatory landscape surrounding cryptocurrencies, particularly Bitcoin, is a significant and dynamic factor influencing its price. Governmental actions and policies, both supportive and restrictive, can drastically alter investor sentiment and market stability, leading to substantial price fluctuations. Understanding the evolving regulatory approaches across different jurisdictions is crucial for predicting Bitcoin’s future price trajectory.

The impact of new regulations or laws on Bitcoin’s price is multifaceted. Favorable regulations, such as clear guidelines for taxation and trading, can boost investor confidence and increase market participation, potentially driving up the price. Conversely, overly restrictive or unclear regulations can create uncertainty, deter investment, and lead to price declines. For example, a complete ban on Bitcoin trading in a major economy could significantly impact its global value. Conversely, the establishment of a robust regulatory framework with clear legal definitions could instill confidence and attract institutional investors.

Regulatory Uncertainty and Investor Confidence

Regulatory uncertainty, characterized by a lack of clear and consistent rules governing cryptocurrency activities, is a major source of volatility in the Bitcoin market. Investors are hesitant to commit significant capital in the absence of a well-defined legal framework. This uncertainty can lead to sudden price drops as investors react to ambiguous pronouncements or perceived threats from regulatory bodies. The absence of consistent regulatory frameworks across different countries further exacerbates this uncertainty, making it challenging for investors to navigate the global Bitcoin market. This uncertainty can also hinder institutional adoption, as many large financial institutions require clear legal guidelines before investing in cryptocurrencies. Conversely, clarity and predictability in regulatory matters would significantly increase investor confidence and potentially lead to higher prices.

Comparative Regulatory Approaches

Different countries are adopting diverse approaches towards regulating Bitcoin and other cryptocurrencies. Some countries, like El Salvador, have embraced Bitcoin as legal tender, potentially boosting its price by increasing its adoption and usage. Other countries, like China, have implemented strict bans on cryptocurrency trading and mining, resulting in a significant negative impact on Bitcoin’s price. The European Union is developing a comprehensive regulatory framework for crypto assets (MiCA), aiming to balance innovation with consumer protection and financial stability. The impact of this framework on Bitcoin’s price remains to be seen, but it could significantly affect the European market. The United States, meanwhile, is still grappling with a fragmented regulatory landscape, with different agencies taking different approaches, leading to ongoing uncertainty. These contrasting approaches demonstrate the complex and varied ways in which governments are shaping the future of Bitcoin, with significant implications for its price.

Influential Factors

Technological advancements will significantly shape Bitcoin’s trajectory in the coming years, impacting both its adoption and price. These advancements are not isolated events but rather interconnected forces that influence each other and the overall cryptocurrency market. Understanding these factors is crucial for any prediction of Bitcoin’s future value.

Blockchain Technology Advancements and Bitcoin Adoption

Layer-2 scaling solutions, such as the Lightning Network, are designed to address Bitcoin’s scalability limitations. By processing transactions off-chain, these solutions significantly increase transaction speed and reduce fees. This improvement in efficiency makes Bitcoin more practical for everyday use, potentially driving wider adoption among both individuals and businesses. For example, the Lightning Network’s growing adoption for micropayments could revolutionize the way we handle online transactions, making Bitcoin a more viable alternative to traditional payment systems. The successful implementation and widespread adoption of these layer-2 solutions could lead to a surge in Bitcoin’s usage and consequently, its price. Conversely, limitations in the development or adoption of these technologies could hinder Bitcoin’s growth.

Institutional Adoption and Expanding Use Cases

Growing institutional interest in Bitcoin as a store of value and a hedge against inflation is a significant factor influencing its price. Large financial institutions, investment firms, and corporations are increasingly allocating a portion of their portfolios to Bitcoin, injecting significant capital into the market. Furthermore, the expansion of Bitcoin’s use cases beyond mere speculation, such as its integration into payment systems and decentralized finance (DeFi) applications, could further bolster its value. For instance, the increasing acceptance of Bitcoin by major retailers as a form of payment would significantly increase its transactional utility and market demand. This increased utility and institutional backing translate to a more stable and potentially higher price.

Impact of New Cryptocurrencies and Technologies, Bitcoin Prediction For March 2025

The emergence of new cryptocurrencies and competing technologies presents both challenges and opportunities for Bitcoin. While the appearance of new cryptocurrencies with innovative features could potentially draw investors away from Bitcoin, it also stimulates innovation within the broader crypto ecosystem. Bitcoin’s established market dominance and first-mover advantage, however, provide a strong foundation. For example, the emergence of Ethereum and its smart contract capabilities initially posed a threat, but Bitcoin has maintained its position as a leading store of value. The long-term impact of new technologies will depend on their ability to offer compelling advantages over Bitcoin’s established strengths. Ultimately, the cryptocurrency market is dynamic; the emergence of new technologies can either strengthen or weaken Bitcoin’s position, depending on the nature of the innovation and market response.

Bullish vs. Bearish Scenarios

Predicting Bitcoin’s price in March 2025 involves considering a range of possibilities, from significant gains to substantial losses. Understanding both bullish and bearish scenarios is crucial for informed decision-making. The following Artikels potential pathways for Bitcoin’s price movement, based on various influencing factors.

Bullish Scenario: March 2025

A bullish scenario for Bitcoin in March 2025 hinges on several key factors aligning favorably. Widespread adoption by institutional investors, coupled with continued technological advancements and positive regulatory developments, could propel Bitcoin’s price significantly higher. This scenario envisions a market where Bitcoin is increasingly viewed as a valuable store of value and a viable alternative to traditional financial assets.

Increased institutional adoption would likely drive demand, pushing prices upward. Imagine a scenario where several major financial institutions, like BlackRock, announce significant Bitcoin investments, triggering a wave of buying from other institutional players. Simultaneously, positive regulatory developments, such as clearer regulatory frameworks in major markets like the US and EU, could alleviate uncertainty and attract further investment. Technological advancements, such as the successful implementation of layer-2 scaling solutions, could enhance Bitcoin’s usability and transaction efficiency, leading to increased adoption and higher demand. This combination of factors could create a powerful upward pressure on Bitcoin’s price. For example, if these factors materialized, a price of $150,000 or more in March 2025 would be within the realm of possibility, mirroring the positive momentum seen in previous bull markets.

Bearish Scenario: March 2025

Conversely, a bearish scenario paints a picture of decreased investor confidence and negative market sentiment. Several factors could contribute to a significant price decline. A major regulatory crackdown, for instance, could severely impact Bitcoin’s price. Imagine a scenario where a major government bans Bitcoin trading or imposes extremely restrictive regulations, triggering widespread selling and a significant price drop. Similarly, a major global economic downturn could lead investors to liquidate their Bitcoin holdings to cover losses in other asset classes, driving down the price. Furthermore, the emergence of a more compelling alternative cryptocurrency with superior technology or features could divert investment away from Bitcoin, resulting in a price decline. A prolonged period of low transaction volume and subdued market activity could also contribute to a bearish market, limiting price appreciation. In a bearish scenario, Bitcoin’s price could fall considerably below its current value, potentially dropping to levels seen in previous bear markets. A price below $20,000, for instance, is a possibility if these factors align negatively.

Comparison of Bullish and Bearish Scenarios

The key difference between the bullish and bearish scenarios lies in the interplay of various market forces and external factors.

- Institutional Adoption: Bullish scenarios rely on increased institutional investment, while bearish scenarios anticipate limited or decreased participation.

- Regulatory Environment: Positive regulatory developments fuel bullish scenarios, whereas negative regulatory actions drive bearish outcomes.

- Technological Advancements: Successful scaling solutions and other technological improvements underpin bullish predictions, while technological stagnation or the emergence of superior competitors contribute to bearish projections.

- Macroeconomic Conditions: A robust global economy supports bullish scenarios, while a global recession or economic downturn fuels bearish predictions.

- Market Sentiment: Strong investor confidence and positive market sentiment are essential for a bullish outlook, whereas fear, uncertainty, and doubt (FUD) characterize bearish predictions.

The potential outcomes range from substantial price appreciation in a bullish scenario to significant price declines in a bearish one. The actual outcome will depend on the complex interplay of these and other factors.

Risk Assessment and Disclaimer

Investing in Bitcoin, like any other cryptocurrency, carries substantial risk. The market is notoriously volatile, meaning prices can fluctuate dramatically in short periods, leading to significant gains or losses. Understanding these risks is crucial before committing any capital.

The inherent volatility of Bitcoin stems from several factors, including regulatory uncertainty, market sentiment, technological advancements, and macroeconomic conditions. News events, whether positive or negative, can trigger sharp price swings, impacting investors’ portfolios significantly. For example, a sudden regulatory crackdown in a major market could cause a sharp price drop, while positive news about institutional adoption might lead to a rapid price surge. The lack of inherent value, unlike traditional assets like gold or real estate, also contributes to the volatility, as Bitcoin’s value is largely determined by supply and demand.

Bitcoin’s Price Volatility and Potential for Loss

Bitcoin’s price history demonstrates its extreme volatility. Periods of rapid growth have been followed by equally dramatic corrections. Investors should be prepared for the possibility of losing a substantial portion, or even all, of their investment. Past performance is not indicative of future results, and relying on past price movements to predict future outcomes is highly unreliable. Consider the significant price drop in 2018, where Bitcoin lost over 80% of its value from its peak, illustrating the potential for severe losses. This highlights the importance of careful risk management and diversification.

Limitations of Price Predictions

The Bitcoin price prediction for March 2025, or any future date, presented earlier should be viewed with extreme caution. Such predictions are inherently speculative and based on various assumptions and models that may not accurately reflect future market conditions. Numerous unforeseen events can significantly impact the price, rendering any prediction inaccurate. This prediction is for informational purposes only and should not be considered financial advice.

Importance of Independent Research and Professional Advice

Before investing in Bitcoin or any other cryptocurrency, it is crucial to conduct thorough independent research and understand the associated risks. This includes studying market trends, technological developments, and regulatory frameworks. Relying solely on external predictions, without your own due diligence, is ill-advised. Furthermore, it is strongly recommended that you seek advice from a qualified financial advisor before making any investment decisions. A financial advisor can help you assess your risk tolerance, diversify your portfolio appropriately, and make informed choices aligned with your financial goals and circumstances. They can provide personalized guidance based on your individual financial situation, which is crucial given the inherent risks involved in cryptocurrency investments.

Frequently Asked Questions (FAQs): Bitcoin Prediction For March 2025

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative. While various models and analyses exist, the cryptocurrency market is influenced by a multitude of unpredictable factors, making precise predictions extremely challenging. The following FAQs aim to address common concerns and provide helpful information based on current understanding and market trends.

Bitcoin’s Most Likely Price in March 2025

Pinpointing a single “most likely” price for Bitcoin in March 2025 is impossible. The price is subject to significant volatility and depends on a complex interplay of economic conditions, technological advancements, regulatory changes, and market sentiment. While some analysts might offer price targets based on their models, these should be viewed as educated guesses, not guarantees. For instance, some models might predict a price based on historical growth trends, while others might incorporate factors like adoption rates or the overall macroeconomic climate. These differing approaches often lead to vastly different price predictions. It’s crucial to remember that past performance is not indicative of future results.

Biggest Risks Associated with Bitcoin Investment

Investing in Bitcoin carries substantial risks. Volatility is paramount; Bitcoin’s price can fluctuate dramatically in short periods, leading to significant gains or losses. Regulatory uncertainty presents another challenge; governments worldwide are still developing frameworks for cryptocurrencies, and changes in regulations could impact Bitcoin’s value and accessibility. Security risks are also present; exchanges and individual wallets can be targets for hacking and theft, potentially resulting in the loss of funds. Finally, the relatively nascent nature of the cryptocurrency market introduces inherent uncertainties, making it a higher-risk investment compared to more established asset classes. Consider the 2022 cryptocurrency market crash as a prime example of these risks in action. Many investors experienced substantial losses due to the combined impact of regulatory uncertainty, macroeconomic factors, and the collapse of major players in the ecosystem.

Protecting Against Bitcoin Price Fluctuations

Several strategies can help mitigate the risks associated with Bitcoin’s price volatility. Diversification is key; don’t invest your entire portfolio in Bitcoin. Spread your investments across different asset classes, including stocks, bonds, and real estate, to reduce overall portfolio risk. Dollar-cost averaging (DCA) is another effective technique; instead of investing a lump sum, invest smaller amounts regularly over time. This strategy reduces the impact of short-term price fluctuations. Furthermore, thorough research and understanding of your risk tolerance are crucial before making any investment decisions. Consider consulting with a qualified financial advisor to develop an investment strategy tailored to your individual circumstances.

Reliable Information Sources on Bitcoin

Finding reliable information about Bitcoin is crucial for informed decision-making. Reputable financial news outlets such as the Wall Street Journal, Bloomberg, and Reuters often provide in-depth coverage of the cryptocurrency market. Academic research papers and publications from reputable institutions can offer insights into the technological aspects and economic implications of Bitcoin. Furthermore, dedicated cryptocurrency news websites and analysis platforms can provide up-to-date market information, although it’s essential to critically evaluate the source’s credibility and potential biases. Always be wary of information from unknown or unverified sources, particularly those promising guaranteed returns or overly optimistic predictions. Remember to cross-reference information from multiple sources to gain a comprehensive understanding.

Bitcoin Prediction For March 2025 – Predicting Bitcoin’s price in March 2025 is inherently speculative, but understanding key events significantly influences forecasts. A major factor to consider is the Bitcoin halving, scheduled for 2024, which will reduce the rate of new Bitcoin creation. To grasp the implications of this event on the market, it’s helpful to read more about What Does It Mean Bitcoin Halving 2025.

This understanding is crucial for forming a more informed opinion on Bitcoin’s potential value by March 2025.

Predicting Bitcoin’s price in March 2025 is inherently speculative, but understanding key events is crucial. A significant factor influencing these predictions is the upcoming Bitcoin halving, which will reduce the rate of new Bitcoin creation. To better grasp its impact, learn more about this event by checking out this resource on Que Es Halving Bitcoin 2025.

This understanding is essential for forming more informed predictions about Bitcoin’s potential value in March 2025.

Predicting Bitcoin’s price in March 2025 is challenging, but a key factor to consider is the impact of the upcoming halving. To accurately gauge this impact, understanding the precise Bitcoin Halving Date 2025 Time is crucial. This date significantly influences the supply dynamics of Bitcoin, which in turn, often affects its market price and therefore, predictions for March 2025 will need to take this into account.

Predicting Bitcoin’s price for March 2025 is inherently speculative, but understanding the impact of the 2025 halving is crucial. To gain insight into potential price movements after this event, it’s beneficial to review analyses such as the one found on this page: Bitcoin Price Post Halving 2025. Considering the reduced Bitcoin supply post-halving should inform any Bitcoin Prediction For March 2025, shaping expectations for the market.

Predicting Bitcoin’s price in March 2025 is challenging, influenced by numerous factors including regulatory changes and overall market sentiment. Understanding the long-term trajectory, however, requires considering future events like the next halving, which significantly impacts Bitcoin’s supply. To gain further insight into the implications of this pivotal event, you might find the information on Next Bitcoin Halving After 2025 helpful in refining your own Bitcoin Prediction For March 2025.

Ultimately, any prediction remains speculative.

Predicting Bitcoin’s price in March 2025 is challenging, influenced by numerous factors including macroeconomic conditions and technological advancements. A key element to consider is the impact of the 2024 Bitcoin halving, which you can explore using a helpful tool like the Bitcoin Halving 2025 Calculator to better understand potential supply-side effects. Ultimately, accurate prediction remains difficult, but understanding the halving’s influence is crucial for any Bitcoin price forecast for March 2025.