Bitcoin’s Price History and Trends Leading Up to 2025

Bitcoin’s price journey since its inception in 2009 has been nothing short of a rollercoaster, characterized by periods of explosive growth followed by significant corrections. Understanding these historical trends, the factors driving them, and drawing comparisons to past cycles can offer insights into potential price movements in 2025. This analysis will explore Bitcoin’s price history, highlighting key influences and attempting to project potential scenarios for the future.

Bitcoin’s early years saw a gradual price increase, largely driven by early adopters and a growing awareness of its decentralized nature. The first major bull market began around 2013, propelled by increased media attention and the emergence of major exchanges. This period saw prices surge from a few dollars to over $1,000 before a substantial correction. Subsequent bull markets, notably in 2017 and 2021, witnessed even more dramatic price increases, reaching all-time highs above $20,000 and $60,000 respectively, driven by factors including institutional investment, technological advancements, and macroeconomic uncertainty. Each bull market was followed by a significant bear market, with price drops of 80% or more, highlighting the inherent volatility of the cryptocurrency.

Key Factors Influencing Bitcoin’s Price, Bitcoin Prediction In December 2025

Several interconnected factors have consistently influenced Bitcoin’s price. Regulatory developments, both positive and negative, have had a significant impact. For instance, positive regulatory clarity in certain jurisdictions has often led to price increases, while regulatory crackdowns have resulted in market corrections. Technological advancements, such as the development of the Lightning Network improving transaction speed and scalability, have also played a role. Furthermore, macroeconomic events, including periods of high inflation or geopolitical instability, have often driven investors towards Bitcoin as a potential hedge against traditional assets. Finally, the narrative and sentiment surrounding Bitcoin, fueled by media coverage and social media trends, have also significantly impacted its price.

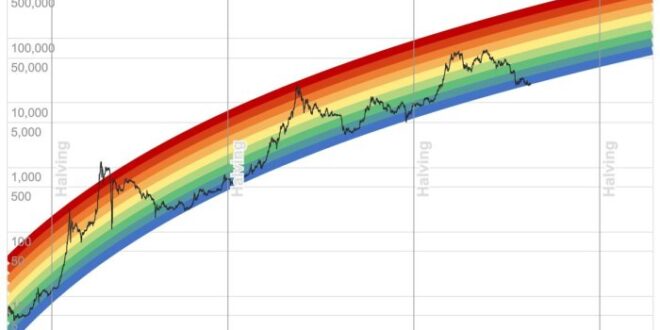

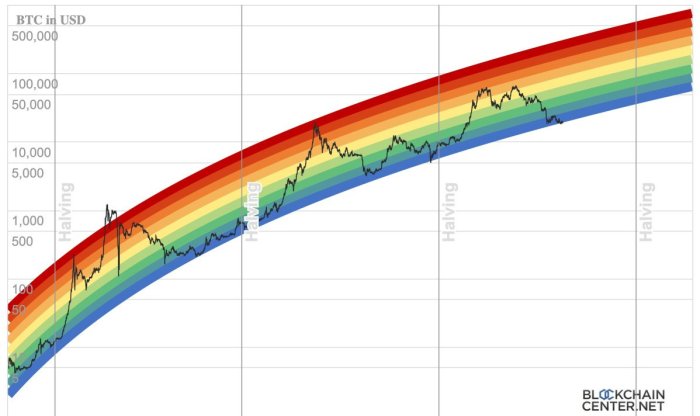

Comparison of Past Price Cycles and Potential Patterns in 2025

Analyzing Bitcoin’s past price cycles reveals a pattern of roughly four-year cycles, often coinciding with the halving events – a programmed reduction in Bitcoin’s block reward. These halvings historically have preceded significant bull markets, as the reduced supply creates scarcity and potentially increases demand. However, it’s crucial to note that these cycles are not perfectly predictable. External factors, such as regulatory changes and global economic conditions, can significantly influence the timing and magnitude of these cycles. Based on past cycles and considering potential future factors, several price scenarios for 2025 are possible, ranging from a continuation of the current bear market to a new all-time high.

Projected Price Scenarios for 2025 (Visual Representation)

Imagine a line graph charting Bitcoin’s price from its inception. The graph would show a series of sharp upward spikes (bull markets) followed by steep downward plunges (bear markets). The peaks of these cycles would gradually increase over time, reflecting the overall growth of the cryptocurrency. For 2025, three potential scenarios could be depicted: A pessimistic scenario would show the price remaining relatively flat or even declining slightly below current levels. A neutral scenario would depict a modest increase, potentially reaching levels similar to previous bull market peaks. An optimistic scenario would show a significant price surge, potentially surpassing previous all-time highs, driven by factors such as widespread institutional adoption and continued technological advancements. The graph would clearly illustrate the range of possibilities, emphasizing the inherent uncertainty in predicting future price movements.

Technological Advancements and Their Impact on Bitcoin’s Value

Bitcoin’s future price is intricately linked to its technological evolution. While its underlying blockchain remains robust, ongoing developments significantly influence transaction efficiency, user experience, and overall network scalability, impacting its value proposition and market competitiveness. These advancements directly address limitations inherent in the original Bitcoin protocol and are crucial for mass adoption.

Layer-2 scaling solutions are crucial for improving Bitcoin’s transaction throughput and reducing fees. The current Bitcoin network, while secure, can only process a limited number of transactions per second, leading to congestion and high fees during periods of high activity. These scaling solutions operate on top of the main Bitcoin blockchain, processing transactions off-chain before settling them on the main chain. This reduces the load on the main blockchain, resulting in faster and cheaper transactions.

Layer-2 Scaling Solutions and Transaction Efficiency

Layer-2 solutions, such as the Lightning Network, offer a significant improvement to Bitcoin’s scalability. By enabling off-chain transactions, the Lightning Network drastically reduces transaction fees and increases transaction speed. Imagine transferring small amounts of Bitcoin instantly and for a fraction of a cent, rather than waiting minutes or hours and paying several dollars in fees. This increased efficiency directly enhances Bitcoin’s usability for everyday transactions, potentially driving wider adoption and increasing demand, thus influencing its price. The success of various Layer-2 projects will be a key factor in determining Bitcoin’s ability to compete with faster, cheaper alternatives in the future. For example, if the Lightning Network reaches widespread adoption, facilitating millions of transactions per second, the Bitcoin network’s value proposition as a medium of exchange would be substantially enhanced.

The Lightning Network and Bitcoin Usability

The Lightning Network is a prime example of a Layer-2 solution that directly addresses Bitcoin’s scalability challenges. It works by creating payment channels between users, allowing for numerous transactions to occur off-chain. These transactions are only settled on the main Bitcoin blockchain periodically, minimizing the burden on the network. This approach dramatically reduces transaction fees and latency, making Bitcoin more practical for everyday payments and microtransactions. The widespread adoption of the Lightning Network could significantly improve Bitcoin’s usability and appeal to a broader range of users, including merchants and businesses, potentially driving increased demand and price appreciation. A successful and widely used Lightning Network would represent a substantial technological leap for Bitcoin, solidifying its position as a viable payment system.

Potential Upgrades and Hard Forks

While Bitcoin’s core protocol is designed for stability and security, potential upgrades and hard forks could introduce new features and functionalities. These changes might include improvements to privacy, enhanced security measures, or the addition of smart contract capabilities. However, the implementation of such upgrades requires community consensus and careful consideration to avoid disrupting the network’s stability. A successful upgrade could positively impact Bitcoin’s value by enhancing its capabilities and attracting new users. Conversely, a poorly executed hard fork or contentious upgrade could lead to uncertainty and potentially negatively affect the price. The history of cryptocurrency shows that successful upgrades often lead to price increases, while unsuccessful ones can cause price drops. Examples of successful upgrades in other cryptocurrencies have resulted in substantial short-term price rallies.

Bitcoin’s Technological Advancements Compared to Competitors

Bitcoin’s technological development pace is often compared to that of its competitors. While some altcoins might boast faster transaction speeds or more advanced smart contract functionalities, Bitcoin maintains a significant advantage in terms of its established network effect, security, and decentralization. The long-standing security and established reputation of Bitcoin are significant barriers to entry for competitors. While competitors may introduce innovative features, the security and network effect of Bitcoin remain powerful arguments in its favor. The ongoing development of Layer-2 solutions and potential future upgrades aims to bridge the gap between Bitcoin’s security and the enhanced functionality offered by some competitors. The success of these efforts will be crucial in determining Bitcoin’s long-term competitiveness and price trajectory.

Macroeconomic Factors and Their Influence on Bitcoin: Bitcoin Prediction In December 2025

Bitcoin’s price, despite its decentralized nature, is significantly influenced by macroeconomic factors. These external forces can create both opportunities and challenges for Bitcoin’s growth and adoption in 2025 and beyond. Understanding these influences is crucial for investors and analysts alike.

Inflation’s Impact on Bitcoin’s Price

High inflation erodes the purchasing power of fiat currencies. Historically, during periods of high inflation, investors often seek alternative assets perceived as hedges against inflation, such as gold and, increasingly, Bitcoin. If inflation remains elevated in 2025, Bitcoin could potentially see increased demand as investors seek to preserve their wealth. However, the impact is complex; high inflation might also lead to increased interest rates, which can negatively affect Bitcoin’s price (discussed below). The relationship isn’t always straightforward and depends on the overall market sentiment and investor confidence. For example, the significant inflation experienced in many countries in 2022 led to increased interest in Bitcoin as a potential inflation hedge, though the overall market conditions played a role in its price fluctuations.

Interest Rates and Bitcoin’s Value

Interest rate hikes by central banks, typically implemented to combat inflation, can negatively impact Bitcoin’s price. Higher interest rates make holding assets that don’t generate yield, like Bitcoin, less attractive. Investors might shift their funds to higher-yielding investments like bonds or savings accounts. Conversely, lower interest rates can make Bitcoin more appealing, as the opportunity cost of holding it decreases. The Federal Reserve’s interest rate adjustments in recent years provide a real-world example of this dynamic, showing a correlation between rate hikes and Bitcoin price dips.

Global Economic Uncertainty and Bitcoin

Periods of significant global economic uncertainty, such as recessions or geopolitical instability, often lead to increased volatility in financial markets. Bitcoin, being a relatively new and volatile asset, is particularly susceptible to these shifts. Investors might flock to safe-haven assets like gold during times of uncertainty, potentially leading to a decline in Bitcoin’s price. However, some investors might view Bitcoin as a hedge against systemic risk, leading to increased demand in such situations. The 2008 financial crisis, while predating Bitcoin’s widespread adoption, offers a historical parallel demonstrating how uncertainty can impact investor behavior towards perceived “safe” assets.

Government Regulations and Bitcoin Adoption

Government regulations and policies play a crucial role in shaping Bitcoin’s adoption and price. Favorable regulatory frameworks that promote clarity and encourage innovation can boost investor confidence and drive adoption. Conversely, restrictive regulations or outright bans can significantly hinder Bitcoin’s growth and depress its price. The varying approaches taken by different governments towards cryptocurrencies illustrate this point; countries with clear, supportive regulations often see higher levels of Bitcoin adoption and trading activity.

Geopolitical Events and Investor Sentiment

Geopolitical events, such as wars, political instability, or major international disputes, can significantly impact investor sentiment towards Bitcoin. These events can create uncertainty and risk aversion, leading investors to move towards safer assets. Conversely, some might see Bitcoin as a decentralized alternative to traditional financial systems, potentially increasing demand during times of geopolitical turmoil. The ongoing war in Ukraine, for instance, has shown how geopolitical events can influence both risk aversion and the search for alternative assets, impacting the price of Bitcoin and other cryptocurrencies.

Potential Macroeconomic Scenarios and Their Impact on Bitcoin’s Price in 2025

| Scenario | Inflation | Interest Rates | Bitcoin Price Prediction (USD) |

|---|---|---|---|

| Mild Inflation, Stable Rates | Low (2-3%) | Stable | $50,000 – $75,000 |

| High Inflation, Rising Rates | High (5%+) | Increasing | $30,000 – $50,000 |

| Recession, Low Rates | Low | Decreasing | $40,000 – $60,000 |

| Global Uncertainty, Volatile Rates | Variable | Volatile | $25,000 – $75,000 (High Volatility) |

Bitcoin Prediction In December 2025 – Predicting Bitcoin’s price in December 2025 is inherently speculative, but a key factor influencing any forecast is the upcoming halving. Understanding the timing of this event, as detailed on this helpful resource regarding Halving Bitcoin 2025 Kiedy , is crucial. This halving will significantly impact Bitcoin’s inflation rate, potentially affecting its price trajectory in December 2025 and beyond.

Predicting Bitcoin’s price in December 2025 is inherently challenging, given the cryptocurrency’s volatility. However, various analysts offer insights, and one prominent perspective is found by reviewing the Plan B Bitcoin Prediction 2025 , which provides a framework for understanding potential price trajectories. Ultimately, though, the actual Bitcoin price in December 2025 will depend on a multitude of factors beyond any single prediction.

Predicting Bitcoin’s price in December 2025 is inherently speculative, however, considering potential market shifts is crucial. A significant factor influencing Bitcoin’s trajectory could be a potential market correction; for insights into this possibility, check out this analysis on Bitcoin Crash 2025 Prediction. Understanding potential crashes helps refine predictions for December 2025, allowing for a more nuanced forecast of Bitcoin’s value.

Therefore, assessing both bullish and bearish scenarios is vital for a comprehensive Bitcoin prediction.

Predicting Bitcoin’s price in December 2025 is inherently speculative, however, considering potential market shifts is crucial. A significant factor influencing Bitcoin’s trajectory could be a potential market correction; for insights into this possibility, check out this analysis on Bitcoin Crash 2025 Prediction. Understanding potential crashes helps refine predictions for December 2025, allowing for a more nuanced forecast of Bitcoin’s value.

Therefore, assessing both bullish and bearish scenarios is vital for a comprehensive Bitcoin prediction.

Predicting Bitcoin’s price in December 2025 is inherently speculative, however, considering potential market shifts is crucial. A significant factor influencing Bitcoin’s trajectory could be a potential market correction; for insights into this possibility, check out this analysis on Bitcoin Crash 2025 Prediction. Understanding potential crashes helps refine predictions for December 2025, allowing for a more nuanced forecast of Bitcoin’s value.

Therefore, assessing both bullish and bearish scenarios is vital for a comprehensive Bitcoin prediction.

Predicting Bitcoin’s price in December 2025 is inherently speculative, however, considering potential market shifts is crucial. A significant factor influencing Bitcoin’s trajectory could be a potential market correction; for insights into this possibility, check out this analysis on Bitcoin Crash 2025 Prediction. Understanding potential crashes helps refine predictions for December 2025, allowing for a more nuanced forecast of Bitcoin’s value.

Therefore, assessing both bullish and bearish scenarios is vital for a comprehensive Bitcoin prediction.