Bitcoin Price Prediction January 2025

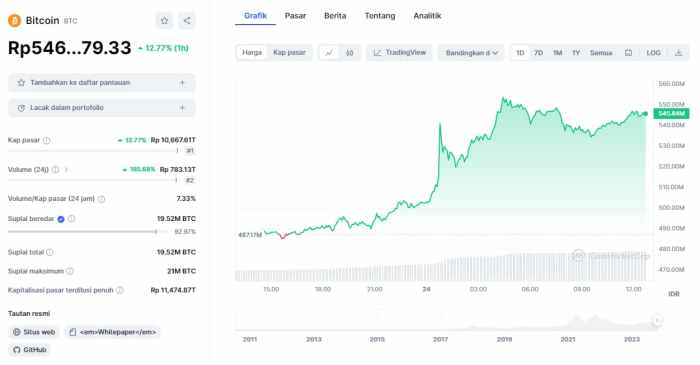

Bitcoin, the world’s first cryptocurrency, emerged in 2009, a decentralized digital currency operating independently of central banks. Its initial years saw slow adoption and relatively low value. However, over the past decade, Bitcoin has experienced periods of explosive growth, punctuated by significant corrections, establishing itself as a prominent asset class alongside traditional markets. Currently, it holds a substantial market capitalization and enjoys widespread recognition, albeit with considerable price volatility.

Bitcoin’s price volatility stems from a confluence of factors. These include the inherent speculative nature of the cryptocurrency market, influenced by investor sentiment, media coverage, and regulatory developments. Technological advancements, such as halving events (which reduce the rate of new Bitcoin creation), also significantly impact its supply and, consequently, its price. Furthermore, macroeconomic factors, such as inflation, geopolitical events, and the overall state of the global economy, play a crucial role in determining Bitcoin’s value. The relatively limited supply of Bitcoin (capped at 21 million coins) further contributes to its potential for price appreciation but also its susceptibility to price swings.

The significance of predicting Bitcoin’s price lies in its potential to inform investment strategies for individuals and institutions. Accurate price predictions could enable investors to maximize returns and mitigate risks. However, the limitations of such predictions are considerable. The cryptocurrency market is notoriously unpredictable, and numerous unforeseen events can drastically alter its trajectory. Any prediction is inherently speculative and subject to a high degree of uncertainty. Past performance is not indicative of future results, and relying solely on price predictions for investment decisions can be highly risky. For example, predicting Bitcoin’s price in 2017 based on its performance in the first half of the year would have significantly underestimated its peak later that year, while similarly, predictions made during its subsequent crash would have been inaccurate in the long term. Therefore, a balanced approach, incorporating fundamental analysis and risk management, is essential.

Factors Influencing Bitcoin Price Volatility

The price of Bitcoin is influenced by a complex interplay of factors. These include, but are not limited to, regulatory changes (positive or negative government stances on cryptocurrencies), technological advancements (new developments in blockchain technology), macroeconomic conditions (global economic growth or recession), and market sentiment (investor confidence and speculation). A significant regulatory crackdown in a major market, for example, could trigger a sharp price drop, while a positive announcement from a large institutional investor could propel the price upwards. Similarly, periods of high inflation may lead investors to seek refuge in Bitcoin as a hedge against currency devaluation, boosting its price. Conversely, a global economic downturn might lead investors to sell off riskier assets, including Bitcoin, resulting in a price decline.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of economic, political, and technological factors. While no one can definitively say what the price will be, analyzing these influences can provide a more informed perspective on potential price trajectories.

Macroeconomic Conditions and Bitcoin’s Value

Global macroeconomic conditions will significantly impact Bitcoin’s price. High inflation, for instance, could drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, a severe recession might lead to risk-aversion, causing investors to sell off assets like Bitcoin, resulting in a price decline. The strength of the US dollar, a dominant global currency, will also play a role; a strong dollar might negatively correlate with Bitcoin’s price, while a weakening dollar could boost it. For example, the 2022 inflationary environment saw increased Bitcoin adoption by some investors seeking inflation protection, leading to price increases during certain periods. However, the subsequent tightening of monetary policy and fears of recession also negatively impacted Bitcoin’s price later in the year.

Regulatory Changes and Government Policies

Government regulations and policies concerning cryptocurrencies will profoundly influence Bitcoin’s adoption and price. Clear and favorable regulatory frameworks could legitimize Bitcoin and encourage institutional investment, driving up the price. Conversely, restrictive regulations or outright bans could stifle adoption and negatively impact the price. The example of China’s 2021 ban on cryptocurrency transactions demonstrated a significant short-term negative impact on Bitcoin’s price. In contrast, jurisdictions with progressive regulatory approaches, like El Salvador’s adoption of Bitcoin as legal tender, could attract investment and increase its price.

Technological Advancements and Bitcoin’s Scalability

Technological advancements, particularly layer-2 scaling solutions like the Lightning Network, are crucial for Bitcoin’s future. Improved scalability reduces transaction fees and speeds up transaction times, making Bitcoin more user-friendly and potentially increasing demand. Increased adoption of layer-2 solutions could positively influence Bitcoin’s price by addressing its current limitations in terms of transaction throughput. The success of these scaling solutions is therefore directly tied to the long-term usability and attractiveness of Bitcoin, which in turn can affect its price.

Institutional Investment and Adoption

The level of institutional investment in Bitcoin will play a pivotal role in shaping its future price. Increased participation by large financial institutions, hedge funds, and corporations signifies greater legitimacy and potentially higher demand. For example, the gradual increase in Bitcoin holdings by publicly traded companies, although still relatively modest, signals a growing level of institutional confidence. Conversely, a significant withdrawal of institutional investment could lead to price drops, especially if it happens concurrently with other negative factors.

Geopolitical Events and Bitcoin’s Price Volatility

Geopolitical events, such as wars, political instability, or major economic sanctions, can significantly impact Bitcoin’s price. Periods of global uncertainty often lead to increased demand for Bitcoin as a safe haven asset, potentially driving up its price. The Russian invasion of Ukraine in 2022, for instance, saw some investors turn to Bitcoin as a hedge against geopolitical risk. However, the overall impact of such events can be complex and depends on many other concurrent factors.

Bitcoin Halving and its Price Trajectory

Bitcoin’s halving event, which reduces the rate of new Bitcoin creation, is a significant factor influencing its price. Historically, halving events have been followed by periods of price appreciation, though the timing and magnitude of these increases vary. This is primarily attributed to the reduced supply of new Bitcoin entering the market, potentially creating scarcity and driving up demand. However, the impact of a halving is not guaranteed, and other market forces will certainly play a role in determining the actual price movement. The halving events of 2012 and 2016 were followed by substantial price increases, although other factors also contributed to these upward trends.

Different Prediction Models and Approaches

Predicting Bitcoin’s price in January 2025, or any future date, is inherently challenging due to the cryptocurrency’s volatility and the influence of numerous interconnected factors. Several distinct approaches, each with its own strengths and weaknesses, are employed to attempt these predictions. Understanding these methodologies and their limitations is crucial for interpreting any forecast.

Predicting Bitcoin’s future price involves using a variety of models, each drawing on different data sets and analytical techniques. These models often offer differing outcomes, highlighting the inherent uncertainty in long-term cryptocurrency price forecasting.

Technical Analysis, Bitcoin Prediction January 2025

Technical analysis focuses on historical price and volume data to identify patterns and predict future price movements. This approach uses charts, indicators (like moving averages, RSI, MACD), and candlestick patterns to identify trends, support and resistance levels, and potential reversal points. While useful for short-term trading, its effectiveness in long-term predictions is debated. Strengths include its reliance on readily available data and the potential to identify short-term trends. Weaknesses include its inability to account for external factors like regulatory changes or technological breakthroughs, and the subjective interpretation of chart patterns, leading to inconsistent predictions. For example, a head and shoulders pattern might suggest a price decline, but this prediction could be invalidated by unexpected positive news.

Fundamental Analysis

Fundamental analysis considers factors influencing Bitcoin’s underlying value, such as adoption rate, network security, regulatory environment, and technological advancements. This approach aims to assess the intrinsic value of Bitcoin, and subsequently, its fair market price. Strengths include its focus on factors driving long-term value. However, weaknesses include the difficulty in accurately quantifying these factors and predicting their future impact. For instance, increased institutional adoption could drive the price up, but the extent of this increase is difficult to predict precisely. The model also struggles to incorporate the impact of market sentiment and speculative trading, which significantly affect short-term price fluctuations.

Quantitative Models

Quantitative models utilize statistical and mathematical methods to analyze historical data and forecast future prices. These models can incorporate various factors, including technical indicators, fundamental data, and even social media sentiment. Examples include time series analysis, machine learning algorithms, and econometric models. Strengths lie in their objectivity and ability to handle large datasets. However, weaknesses include their reliance on historical data (which may not accurately reflect future conditions), potential for overfitting (where the model fits the historical data too closely, failing to generalize to future data), and the difficulty in incorporating unforeseen events. A model trained on data from a period of high growth might not accurately predict a period of consolidation or decline.

Hypothetical Price Range Scenario

Based on these different models, a hypothetical price range for Bitcoin in January 2025 could be established. This range accounts for the inherent uncertainties and diverse predictions generated by the various approaches.

| Model | Predicted Price Range (USD) | Assumptions | Methodology |

|---|---|---|---|

| Technical Analysis (Bullish Scenario) | $150,000 – $200,000 | Continued adoption, positive regulatory developments, lack of major market crashes. | Trendline analysis, support and resistance levels, moving average convergence divergence (MACD) indicators. |

| Technical Analysis (Bearish Scenario) | $30,000 – $50,000 | Regulatory crackdowns, significant market downturn, loss of investor confidence. | Identifying bearish chart patterns, support breakdown. |

| Fundamental Analysis (Optimistic Scenario) | $100,000 – $180,000 | Widespread institutional adoption, successful scaling solutions, growing global demand. | Assessing market capitalization potential, network effects, and technological advancements. |

| Quantitative Model (Neutral Scenario) | $60,000 – $120,000 | Moderate adoption growth, balanced regulatory landscape, continued technological development. | Time series analysis incorporating historical price data, market sentiment indicators, and macroeconomic factors. |

Potential Scenarios for Bitcoin in January 2025: Bitcoin Prediction January 2025

Predicting Bitcoin’s price is inherently speculative, influenced by a complex interplay of factors. However, by examining current trends and potential future developments, we can Artikel three plausible scenarios for January 2025: a bullish, a bearish, and a neutral outlook. These scenarios are not mutually exclusive and the actual outcome might lie somewhere between them.

Bullish Scenario: Bitcoin Surges to New Heights

This scenario envisions a significant price increase for Bitcoin, potentially exceeding previous all-time highs. Several factors could contribute to this outcome. Widespread institutional adoption, fueled by increasing regulatory clarity and the maturation of Bitcoin as an asset class, could drive substantial demand. Furthermore, macroeconomic instability, such as persistent inflation or geopolitical uncertainty, might push investors towards Bitcoin as a safe haven asset. Technological advancements, like the successful implementation of the Lightning Network, improving transaction speeds and reducing fees, could also boost adoption and price.

This bullish scenario paints a picture of vibrant market sentiment, with widespread enthusiasm and positive media coverage. The adoption rate would be significantly higher, with Bitcoin integrated into mainstream financial systems and accepted by a large number of businesses and individuals. Technological innovations would be driving efficiency and scalability, solidifying Bitcoin’s position as a leading digital currency. Imagine a scenario where Bitcoin is not just a speculative asset but a recognized store of value and a widely used medium of exchange, similar to how gold functions in the current financial system.

Bearish Scenario: Bitcoin Experiences a Significant Price Correction

Conversely, a bearish scenario anticipates a considerable price drop. This could be triggered by a number of factors. Increased regulatory scrutiny, leading to stricter rules or even outright bans in key markets, could significantly dampen investor enthusiasm and reduce demand. A major security breach or a significant technological flaw in the Bitcoin network could also erode trust and lead to a price decline. Furthermore, a general economic downturn, potentially impacting investor risk appetite, could negatively impact Bitcoin’s price, as investors may liquidate their holdings to cover losses in other assets.

In this bearish scenario, market sentiment would be pessimistic, with widespread negativity and concerns about Bitcoin’s future. The adoption rate would likely stagnate or even decline, as uncertainty and negative media coverage deter potential users. Technological advancements might be overshadowed by security concerns or regulatory hurdles, hindering the network’s growth and overall utility. This could resemble the crypto winter of 2018-2019, but potentially on a larger scale, leading to prolonged periods of low prices and reduced trading volume.

Neutral Scenario: Bitcoin Consolidates and Stabilizes

This scenario projects a period of consolidation and sideways price movement for Bitcoin. Neither a significant bull run nor a sharp correction is anticipated. This could be the result of a balance between positive and negative factors. While institutional adoption continues, it might be offset by regulatory uncertainty or macroeconomic headwinds. Technological advancements could improve the network’s efficiency, but not enough to trigger a dramatic price surge.

In this neutral scenario, market sentiment would be relatively subdued, with neither significant optimism nor pessimism. The adoption rate would experience moderate growth, but without the explosive expansion seen in a bullish scenario. Technological developments would continue, but at a steady pace, without major breakthroughs or setbacks. This scenario would resemble a period of gradual maturation for Bitcoin, establishing it as a more stable, albeit less volatile, asset within the broader financial landscape. Think of it as a period of consolidation before the next major price movement, either upwards or downwards.

Bitcoin Prediction January 2025 – Predicting Bitcoin’s price in January 2025 is challenging, requiring consideration of various factors. A key influence will undoubtedly be the Bitcoin halving event in 2024, whose impact is extensively analyzed in this insightful resource: Bitcoin Prediction Halving 2025. Understanding the projected effects of the halving is crucial for forming a well-rounded prediction for Bitcoin’s value by January 2025.

Therefore, studying the halving’s potential consequences is essential for any Bitcoin price forecast for early 2025.

Predicting Bitcoin’s price in January 2025 is challenging, with various factors influencing its trajectory. A key event to consider when formulating any Bitcoin Prediction January 2025 is the upcoming Bitcoin halving; to understand its impact, check out this helpful resource explaining the mechanics: Que Es Halving Bitcoin 2025. Ultimately, the halving’s effect on scarcity and potential price increase will be a significant factor in any accurate Bitcoin Prediction January 2025.

Predicting Bitcoin’s price in January 2025 is challenging, with various factors influencing its trajectory. A key event to consider when formulating these predictions is the Bitcoin halving in 2024, and its potential impact on the price. To understand the possible price scenarios around that halving, it’s helpful to consult resources such as this analysis of the Bitcoin Price At Halving 2025 , which can inform projections for January 2025 and beyond.

Predicting Bitcoin’s price in January 2025 is challenging, influenced by various factors including macroeconomic conditions and technological advancements. A key event impacting future price is the Bitcoin halving, which significantly affects the rate of new Bitcoin creation. To understand the timeline for this crucial event, check out this resource: When Is The Halving Of Bitcoin 2025. Considering the halving’s impact on scarcity and potential market reactions is vital for any serious Bitcoin prediction for January 2025.

Predicting Bitcoin’s price in January 2025 requires considering various factors, including the upcoming halving event. For a detailed analysis of how the halving might impact Bitcoin’s price throughout 2025, including potential USD values, check out this comprehensive resource: Bitcoin Price Prediction 2025 Halving Usd. Understanding the implications of the halving is crucial for any Bitcoin prediction in January 2025, and this resource offers valuable insight into that process.

Predicting Bitcoin’s price in January 2025 requires considering various factors, including the upcoming halving event. For a detailed analysis of how the halving might impact Bitcoin’s price throughout 2025, including potential USD values, check out this comprehensive resource: Bitcoin Price Prediction 2025 Halving Usd. Understanding the implications of the halving is crucial for any Bitcoin prediction in January 2025, and this resource offers valuable insight into that process.