Bitcoin Prediction March 2025

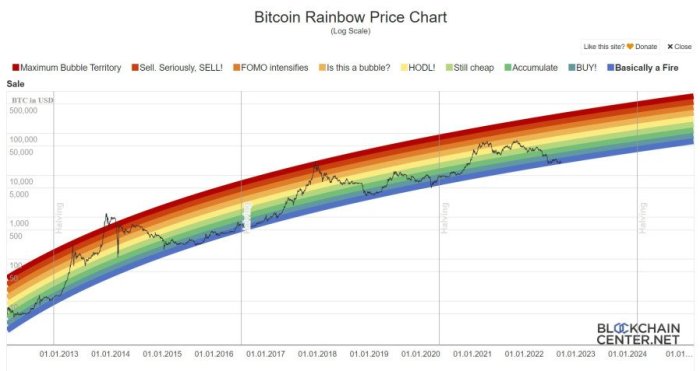

Bitcoin, the pioneering cryptocurrency, emerged in 2009, a decentralized digital currency operating independently of central banks. Its initial years saw slow adoption and minimal price fluctuations. However, over the past decade, Bitcoin has experienced periods of explosive growth interspersed with significant corrections, establishing itself as a prominent asset class, albeit a highly volatile one. Currently, Bitcoin holds a substantial market capitalization, influencing other cryptocurrencies and attracting both institutional and retail investors. Predicting its price in March 2025, however, presents a significant challenge.

The inherent volatility of Bitcoin is a primary obstacle to accurate price prediction. Unlike traditional assets with established valuation models, Bitcoin’s price is driven by a complex interplay of factors, often reacting swiftly to news events, regulatory changes, and market sentiment. This volatility makes forecasting exceptionally difficult, as even minor shifts in these factors can lead to substantial price swings. Historical price data, while informative, is not a reliable predictor of future performance due to the evolving nature of the cryptocurrency market and the introduction of new technologies and regulatory frameworks.

Factors Influencing Bitcoin’s Price Fluctuations

Historically, several key factors have significantly influenced Bitcoin’s price. These include macroeconomic conditions, such as inflation rates and global economic uncertainty, which often drive investors towards alternative assets like Bitcoin. Regulatory developments, both positive and negative, from governments worldwide have had a profound impact. For example, announcements of favorable regulatory frameworks in certain jurisdictions have historically led to price increases, while negative pronouncements or crackdowns have often resulted in significant price drops. Technological advancements within the Bitcoin network, such as upgrades to its underlying technology or the emergence of competing cryptocurrencies, also play a crucial role. Furthermore, the level of institutional adoption, with major companies and financial institutions investing in Bitcoin, influences its market price. Finally, public perception and media coverage, particularly around events like the collapse of major exchanges or significant price swings, significantly contribute to the volatility and the overall market sentiment surrounding Bitcoin. These interacting factors make predicting future price movements a complex undertaking.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, involving a confluence of economic, regulatory, technological, and market forces. While no one can definitively state the exact price, analyzing these key factors provides a framework for understanding potential price movements. This analysis will explore the major influences likely to shape Bitcoin’s value by March 2025.

Global Economic Conditions and Bitcoin Value

Global macroeconomic conditions significantly impact Bitcoin’s price. Periods of economic uncertainty, such as high inflation or recessionary fears, often see investors flock to Bitcoin as a hedge against inflation or a safe haven asset. Conversely, periods of strong economic growth might lead to reduced demand for Bitcoin as investors shift towards more traditional assets. For example, the 2022 inflation surge saw increased Bitcoin adoption as investors sought protection against currency devaluation. However, a robust global economy in 2025 could potentially reduce this demand, leading to price fluctuations.

Regulatory Changes and Government Policies

Government regulations and policies play a crucial role in Bitcoin’s adoption and price. Increased regulatory clarity and favorable legislation in major economies could boost investor confidence and drive institutional adoption, potentially increasing Bitcoin’s price. Conversely, restrictive regulations or outright bans could suppress price growth. The ongoing debate surrounding Bitcoin’s classification as a security or a commodity highlights the impact of regulatory uncertainty. A clear regulatory framework in key markets by 2025 could significantly influence its price trajectory. Conversely, inconsistent or hostile regulations in major jurisdictions could dampen investor enthusiasm.

Technological Advancements and Bitcoin Usability

Technological advancements, particularly layer-2 scaling solutions like the Lightning Network, are vital for improving Bitcoin’s usability and transaction speed. These solutions aim to address Bitcoin’s scalability challenges, making it more suitable for everyday transactions. Wider adoption of layer-2 solutions could lead to increased demand and potentially higher prices by reducing transaction fees and improving the overall user experience. Successful implementation and widespread adoption of these technologies by 2025 could significantly impact Bitcoin’s utility and, consequently, its price.

Institutional Investments and Widespread Adoption

Increased institutional investment and widespread adoption are key drivers of Bitcoin’s market capitalization and price. As more large financial institutions and corporations integrate Bitcoin into their portfolios, demand increases, leading to higher prices. The growing acceptance of Bitcoin as a legitimate asset class contributes to this trend. For example, the increased holdings of Bitcoin by publicly traded companies in recent years have demonstrably impacted its price. Continued institutional adoption and broader mainstream acceptance by 2025 will be a significant factor in its price.

Emerging Technologies and Trends

Several emerging technologies and trends could influence Bitcoin’s future. The development of central bank digital currencies (CBDCs) could present both challenges and opportunities. While CBDCs might compete with Bitcoin, they could also increase awareness of digital currencies, potentially benefiting Bitcoin indirectly. Similarly, advancements in blockchain technology beyond Bitcoin itself could impact the cryptocurrency market as a whole, potentially influencing Bitcoin’s position within that ecosystem. The evolution of decentralized finance (DeFi) and its interaction with Bitcoin could also play a significant role. The emergence of new, innovative technologies in the crypto space will have to be monitored closely for potential impacts on Bitcoin’s value and market position by 2025.

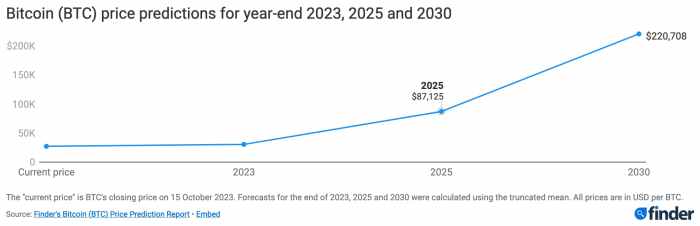

Potential Price Scenarios for Bitcoin in March 2025

Predicting the price of Bitcoin is inherently speculative, influenced by a complex interplay of factors. However, by considering current trends and potential future events, we can Artikel three plausible price scenarios for March 2025: a bullish, a neutral, and a bearish outlook. These scenarios are not exhaustive, and the actual price may fall outside these ranges.

Bullish Scenario: Bitcoin Surges Above $100,000

This scenario envisions a significantly higher Bitcoin price driven by widespread adoption, institutional investment, and positive regulatory developments. A key driver would be the continued maturation of the Bitcoin ecosystem, with increased usage for payments and decentralized finance (DeFi) applications. Furthermore, a substantial influx of institutional investment, driven by positive regulatory clarity and growing acceptance of Bitcoin as a legitimate asset class, would fuel the price increase.

| Scenario | Price Range (USD) | Underlying Assumptions |

|---|---|---|

| Bullish | $100,000 – $200,000 | Widespread adoption, significant institutional investment, positive regulatory environment, continued technological advancements. |

This surge would require several events to align. Firstly, major financial institutions would need to significantly increase their Bitcoin holdings, potentially driven by regulatory changes that explicitly allow for larger-scale investments. Secondly, the development and adoption of Bitcoin-based payment systems and DeFi applications would need to accelerate, showcasing its practical utility beyond speculation. Thirdly, a sustained period of global economic stability, or even a flight to safety into Bitcoin as a hedge against inflation in other markets, would further propel its value. An example of this could be seen in a scenario mirroring the 2021 bull run, but with even greater institutional participation and broader global adoption.

Neutral Scenario: Bitcoin Consolidates Around $50,000

This scenario projects a period of consolidation, with Bitcoin’s price remaining relatively stable around its current value (adjusted for inflation). This would involve a balance between positive and negative factors, leading to a period of less volatility compared to the previous years.

| Scenario | Price Range (USD) | Underlying Assumptions |

|---|---|---|

| Neutral | $40,000 – $60,000 | Continued institutional interest, but slower adoption rates, moderate regulatory uncertainty, and some macroeconomic headwinds. |

This outcome would necessitate a moderate level of institutional investment continuing, but without the explosive growth seen in the bullish scenario. Regulatory uncertainty could persist, preventing massive institutional inflows but not stifling smaller investments. Macroeconomic factors, such as inflation or interest rate changes, would play a more significant role in influencing price fluctuations, leading to a more sideways market movement rather than a clear upward or downward trend. A similar pattern could be seen as an extension of the current market consolidation, with minor corrections and recoveries but without significant price changes.

Bearish Scenario: Bitcoin Falls Below $20,000, Bitcoin Prediction March 2025

This scenario assumes a significant price decline due to a confluence of negative factors, including regulatory crackdowns, macroeconomic instability, and a loss of investor confidence. This could be triggered by a major global financial crisis or a series of negative regulatory announcements targeting cryptocurrencies.

| Scenario | Price Range (USD) | Underlying Assumptions |

|---|---|---|

| Bearish | $10,000 – $30,000 | Stringent regulatory measures, significant macroeconomic downturn, loss of investor confidence, and potential security breaches or major technological setbacks. |

Several events could contribute to this bearish scenario. A significant regulatory crackdown, perhaps triggered by concerns about money laundering or illicit activities, could severely impact investor sentiment. A global recession or a major financial crisis could lead to a widespread sell-off of risk assets, including Bitcoin. Furthermore, a major security breach or a significant technological setback affecting the Bitcoin network could erode confidence and trigger a price drop. This could resemble the market downturn seen in 2018, but potentially with more severe consequences due to the increased regulatory scrutiny and the broader macroeconomic context.

Risks and Opportunities Associated with Bitcoin Investment in 2025

Investing in Bitcoin in 2025 presents a complex landscape of potential rewards and significant risks. The cryptocurrency market is inherently volatile, and while Bitcoin’s decentralized nature and growing adoption offer compelling opportunities, investors must carefully consider the potential downsides before committing capital. A thorough understanding of both the risks and opportunities is crucial for informed decision-making.

The following sections detail potential risks and opportunities, categorized by their perceived severity and likelihood based on current market trends and expert analyses. These assessments are not guarantees, but rather informed projections based on available data.

Market Volatility and Price Fluctuations

Bitcoin’s price history is characterized by extreme volatility. Sharp price increases can be followed by equally dramatic drops, often driven by factors such as regulatory announcements, macroeconomic events, and market sentiment. For example, the 2022 cryptocurrency winter saw Bitcoin’s price fall by over 60% from its all-time high. This inherent volatility poses a significant risk to investors, particularly those with shorter-term investment horizons. While potential for high returns exists, the possibility of substantial losses is equally real. Sophisticated risk management strategies, including diversification and stop-loss orders, are essential to mitigate these risks.

Regulatory Uncertainty and Legal Risks

The regulatory landscape surrounding Bitcoin and cryptocurrencies remains largely undefined in many jurisdictions. Governments worldwide are grappling with how to regulate this nascent asset class, leading to uncertainty for investors. Changes in regulations, such as stricter KYC/AML (Know Your Customer/Anti-Money Laundering) requirements or outright bans, could significantly impact Bitcoin’s price and accessibility. Furthermore, the legal status of Bitcoin as property, security, or commodity varies across jurisdictions, creating potential legal complexities for investors. For instance, differing tax treatments across countries could lead to unexpected financial burdens.

Security Risks and Hacking

Bitcoin’s decentralized nature doesn’t eliminate the risk of theft or loss. Exchanges and individual wallets are vulnerable to hacking, and users can lose their Bitcoin through phishing scams or other security breaches. While blockchain technology is inherently secure, the points of entry and exit – exchanges and personal wallets – remain vulnerable targets for cybercriminals. Examples of high-profile exchange hacks have resulted in significant losses for investors, highlighting the importance of securing personal wallets and choosing reputable exchanges.

Technological Risks and Scalability Issues

Bitcoin’s scalability remains a subject of ongoing debate. The network’s transaction processing capacity is limited, leading to higher transaction fees during periods of high demand. Furthermore, technological advancements in the cryptocurrency space could render Bitcoin obsolete or less competitive. The emergence of faster, more efficient cryptocurrencies could potentially divert investment away from Bitcoin. For example, the rise of layer-2 scaling solutions for other cryptocurrencies could potentially impact Bitcoin’s dominance.

Opportunities for Profit and Growth

Despite the risks, Bitcoin’s long-term potential remains attractive to many investors. Its decentralized nature, limited supply (only 21 million Bitcoin will ever exist), and growing adoption as a store of value and medium of exchange present significant opportunities for profit and growth. Institutional adoption continues to grow, with major corporations adding Bitcoin to their balance sheets. Furthermore, the development of Bitcoin-related technologies, such as Lightning Network, could enhance scalability and usability, driving further adoption and price appreciation. The potential for Bitcoin to become a mainstream form of payment could also contribute significantly to its value.

Geopolitical and Macroeconomic Factors

Global economic instability and geopolitical events can significantly impact Bitcoin’s price. During periods of economic uncertainty, investors may flock to Bitcoin as a safe haven asset, driving up its price. Conversely, macroeconomic factors such as inflation or interest rate hikes can negatively affect Bitcoin’s value. For example, increased inflation could lead to a flight to safety in traditional assets, potentially reducing demand for Bitcoin. The interplay of these global events presents both risks and opportunities for Bitcoin investors.

Bitcoin’s Role in the Broader Cryptocurrency Market by 2025

By March 2025, Bitcoin’s position within the broader cryptocurrency market will likely be a complex interplay of established dominance and emerging challenges. While it currently holds a significant market share, the landscape is dynamic, and several factors could influence its future role. Predicting the precise market share is difficult, but analyzing current trends and potential developments offers valuable insight.

Bitcoin’s continued dominance hinges on several factors, including its established network effect, brand recognition, and perceived security. However, the rise of alternative cryptocurrencies with potentially superior technology or use cases could erode Bitcoin’s market share. The evolution of the cryptocurrency market will be crucial in determining Bitcoin’s long-term influence.

Bitcoin’s Market Dominance and Potential Shifts

Assessing Bitcoin’s market dominance in 2025 requires considering various competing cryptocurrencies. While Bitcoin currently enjoys a substantial lead, altcoins like Ethereum, Solana, and others could gain traction, potentially impacting Bitcoin’s market capitalization share. For instance, Ethereum’s growth in the decentralized finance (DeFi) space and its role in non-fungible token (NFT) markets could draw investment away from Bitcoin. The success of layer-2 scaling solutions on Ethereum could also reduce transaction fees and improve scalability, making it a more attractive alternative to Bitcoin for certain use cases. The emergence of entirely new blockchain technologies with superior features also presents a potential threat to Bitcoin’s dominance. A hypothetical scenario could involve a new cryptocurrency surpassing Bitcoin in market capitalization due to widespread adoption and technological advancements. This would mark a significant shift in the cryptocurrency landscape.

Bitcoin’s Influence on the Overall Cryptocurrency Market

Bitcoin’s performance significantly impacts the overall cryptocurrency market. Its price movements often correlate with the performance of other cryptocurrencies, creating a ripple effect. A bull run in Bitcoin typically leads to increased investor confidence and higher valuations across the board, while a Bitcoin bear market can trigger widespread sell-offs. This correlation is rooted in the perception of Bitcoin as a benchmark asset and the general sentiment within the crypto space. For example, a sharp drop in Bitcoin’s price in 2022 triggered a cascade effect, causing significant losses across the entire cryptocurrency market. Conversely, periods of Bitcoin price appreciation usually boost investor confidence in other cryptocurrencies, leading to a more positive overall market sentiment. Therefore, Bitcoin’s role as a bellwether asset is expected to persist in 2025.

Long-Term Outlook for Bitcoin Beyond March 2025: Bitcoin Prediction March 2025

Predicting the future of Bitcoin beyond March 2025 involves navigating a complex interplay of technological advancements, regulatory landscapes, and evolving market dynamics. While definitive predictions are impossible, analyzing current trends and potential developments allows us to formulate a plausible long-term outlook. This involves considering Bitcoin’s potential as a store of value and medium of exchange, along with the impact of future technological improvements and wider adoption.

Bitcoin’s long-term viability hinges on its ability to solidify its position as both a store of value and a medium of exchange. As a store of value, its limited supply of 21 million coins and its decentralized nature are key strengths, potentially offering protection against inflation and government manipulation. However, its volatility remains a significant hurdle to widespread adoption as a medium of exchange. The success of Bitcoin in this area depends on the development of faster, cheaper, and more user-friendly transaction solutions, as well as increased merchant acceptance. Consider the example of El Salvador, which adopted Bitcoin as legal tender. While initially met with mixed results, it highlights the potential, and the challenges, of Bitcoin’s transition into a widely accepted medium of exchange.

Bitcoin’s Technological Evolution

Technological advancements will play a crucial role in shaping Bitcoin’s future. The ongoing development of the Lightning Network, a layer-two scaling solution, aims to address Bitcoin’s scalability limitations, enabling faster and cheaper transactions. Improvements in privacy-enhancing technologies, such as CoinJoin, could also contribute to wider adoption by mitigating concerns about transaction transparency. Furthermore, research into quantum-resistant cryptography is vital to ensure Bitcoin’s long-term security against potential threats from future quantum computers. For instance, the development of Taproot, a significant upgrade to Bitcoin’s scripting language, improved transaction efficiency and privacy. Future upgrades may focus on further enhancing scalability, security, and privacy.

Impact on the Global Financial System

The widespread adoption of Bitcoin and other cryptocurrencies could significantly reshape the global financial system. Increased usage could challenge the dominance of traditional financial institutions, offering alternative payment systems and potentially disrupting existing financial infrastructures. The implications for central banks and regulatory bodies would be profound, requiring adaptation to the decentralized nature of cryptocurrencies. However, the integration of cryptocurrencies into the global financial system is likely to be a gradual process, subject to ongoing regulatory developments and technological advancements. The potential for increased financial inclusion in underserved populations is a positive aspect to consider, though the risks of financial instability and illicit activities need careful management.

Frequently Asked Questions (FAQs)

This section addresses some of the most common questions surrounding Bitcoin investment, focusing on risks, price drivers, long-term viability, and strategies for mitigating volatility. Understanding these aspects is crucial for making informed investment decisions.

Biggest Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries significant risks. Price volatility is paramount; Bitcoin’s price has historically experienced dramatic swings, sometimes exceeding 10% in a single day. This volatility stems from various factors including regulatory uncertainty, market sentiment, technological developments, and macroeconomic conditions. For example, the collapse of FTX in 2022 demonstrated the impact of a major exchange failure on market confidence, leading to a sharp Bitcoin price drop. Furthermore, the relatively nascent nature of the cryptocurrency market means it is susceptible to scams and hacks. Investors need to be aware of the risks of losing their entire investment due to exchange failures, security breaches, or unforeseen market crashes. Regulatory uncertainty also presents a significant risk, as governments worldwide are still developing their approaches to regulating cryptocurrencies. Changes in regulations could significantly impact Bitcoin’s price and accessibility. Finally, the lack of inherent value tied to a physical asset or government backing makes Bitcoin susceptible to speculative bubbles and busts.

Factors Driving Bitcoin’s Price in 2025

Several factors could significantly influence Bitcoin’s price in 2025. Adoption by institutional investors will likely play a major role. Increased institutional involvement often leads to greater price stability and higher valuations. Conversely, negative news or regulatory crackdowns from major governments could negatively impact investor confidence and subsequently the price. Technological advancements, such as improvements in scalability and transaction speed (Layer-2 solutions), could enhance Bitcoin’s usability and appeal, potentially driving up demand. Macroeconomic factors, such as inflation rates and global economic stability, also exert considerable influence. High inflation might push investors towards Bitcoin as a hedge against inflation, while a global recession could lead to decreased demand. Finally, the overall sentiment within the cryptocurrency market will continue to be a key driver. Positive news and successful adoption in emerging markets could fuel further price increases.

Bitcoin as a Long-Term Investment

Bitcoin’s long-term investment potential is a subject of ongoing debate. Arguments in favor highlight its scarcity (only 21 million Bitcoin will ever exist), its potential as a store of value, and its growing adoption as a payment method. The limited supply, combined with increasing demand, could lead to long-term price appreciation. However, it’s crucial to acknowledge the risks. The lack of intrinsic value, regulatory uncertainty, and the potential for disruptive technological advancements are all considerable downsides. Historically, Bitcoin has demonstrated significant price volatility, making it a high-risk investment. While it could potentially offer substantial returns in the long term, investors must be prepared for the possibility of significant losses. Comparing Bitcoin’s performance against traditional asset classes over extended periods is crucial for informed decision-making.

Protecting Against Bitcoin Price Volatility

Mitigating the risk associated with Bitcoin’s price volatility requires a strategic approach. Dollar-cost averaging (DCA) is a common strategy involving investing a fixed amount of money at regular intervals, regardless of price fluctuations. This reduces the impact of buying at market peaks. Diversification across various asset classes is also vital. Investing only a small portion of one’s portfolio in Bitcoin, alongside other assets like stocks, bonds, or real estate, helps reduce overall portfolio risk. Holding Bitcoin in a secure cold storage wallet reduces the risk of theft or loss due to exchange hacks or vulnerabilities. Finally, it’s crucial to have a well-defined risk tolerance and investment strategy. Only invest what you can afford to lose, and avoid emotional decision-making based on short-term price movements.

Bitcoin Prediction March 2025 – Predicting Bitcoin’s price in March 2025 is challenging, relying heavily on various factors including market sentiment and technological advancements. A key element influencing these predictions is the Bitcoin halving, a significant event that impacts the rate of new Bitcoin creation. To understand the context of future predictions, it’s crucial to know exactly when the next halving occurred; you can find that information by checking this resource: When Was The Bitcoin Halving 2025.

Understanding the timing of this halving is essential for informed speculation about Bitcoin’s price in March 2025.

Predicting Bitcoin’s price in March 2025 is inherently speculative, but a key factor influencing forecasts is the upcoming halving event. Understanding the historical impact of these halvings is crucial; for detailed information, check out this resource on the 2025 Bitcoin Halving Event. This event’s potential effects on scarcity and miner profitability will likely significantly shape Bitcoin’s trajectory leading up to and beyond March 2025.

Predicting Bitcoin’s price in March 2025 is challenging, influenced by numerous factors. A key element to consider is the impact of the 2024 halving, and its subsequent effect on the market. To understand potential price movements after this event, it’s helpful to consult resources like this analysis on the Bitcoin Price After Halving 2025 Usd , which can inform broader Bitcoin Prediction March 2025 forecasts.

Ultimately, however, market volatility remains a significant unknown.

Predicting Bitcoin’s price in March 2025 is challenging, relying heavily on various factors. A key element influencing this prediction is the Bitcoin Halving in 2024, and its potential impact on the market. To gain insight into the expected effects of this halving, you might find the analysis at Bitcoin Halving 2025 % Prediction helpful. Understanding the halving’s projected influence is crucial for forming a more accurate Bitcoin prediction for March 2025.

Predicting Bitcoin’s price in March 2025 is challenging, influenced by various factors including market sentiment and technological advancements. A key event to consider when formulating such a prediction is the Bitcoin halving, significantly impacting the supply of new Bitcoins. To understand the precise timing of this event, you can check the details on the Halving Date Bitcoin 2025 website, which will help inform any Bitcoin price prediction for March 2025 and beyond.

Predicting Bitcoin’s price in March 2025 is challenging, but a key factor to consider is the upcoming halving event. Understanding the impact of the halving on Bitcoin’s supply is crucial for any accurate forecast, and for that, you might find the article on Halving Bitcoin When 2025 insightful. Ultimately, this information will help refine your own Bitcoin Prediction March 2025 analysis.