Bitcoin’s Role in the Future of Finance

Bitcoin’s emergence has challenged the established order of global finance, presenting a potential paradigm shift in how value is stored, transferred, and accessed. Its decentralized nature, coupled with its cryptographic security, offers a compelling alternative to traditional financial systems, potentially revolutionizing various aspects of finance, from payments and remittances to investment and lending. This section explores Bitcoin’s disruptive potential and its prospects for broader adoption.

Bitcoin’s decentralized architecture stands in stark contrast to traditional financial systems, which are often centralized and controlled by intermediaries like banks and governments. This decentralization eliminates single points of failure and reduces the risk of censorship or manipulation. Unlike fiat currencies, Bitcoin’s supply is algorithmically limited, making it inherently deflationary and potentially a hedge against inflation. This characteristic is attractive to investors seeking to protect their wealth from economic uncertainties.

Bitcoin Compared to Other Cryptocurrencies and Traditional Assets

Bitcoin, while the first and most established cryptocurrency, differs significantly from its altcoin counterparts. Many altcoins focus on specific functionalities like smart contracts (Ethereum) or enhanced privacy (Monero), while Bitcoin prioritizes its role as a store of value and a medium of exchange. Its established network effect, extensive mining infrastructure, and brand recognition solidify its position as the dominant cryptocurrency. Compared to traditional assets like gold, Bitcoin offers several advantages, including higher liquidity and easier transferability, although its volatility remains a significant concern. Unlike government-backed currencies, Bitcoin’s value isn’t tied to a specific nation’s economic policy, making it potentially more resilient to geopolitical events. However, gold has a much longer track record of holding value and is less volatile in the long term. This comparison highlights the unique position Bitcoin occupies within the broader financial landscape.

Bitcoin’s Potential for Mainstream Adoption, Bitcoin Prediction Price 2025

The increasing acceptance of Bitcoin by institutional investors and larger corporations signals a growing confidence in its long-term viability. Companies like MicroStrategy and Tesla have made significant Bitcoin investments, indicating a shift in the perception of Bitcoin as a legitimate asset class. Furthermore, the development of Bitcoin-related infrastructure, such as custodial services and payment gateways, facilitates easier integration into existing financial systems. While widespread adoption remains dependent on several factors, including regulatory clarity and technological advancements, the current trajectory suggests an increasing likelihood of Bitcoin becoming a more integral part of the global financial system. The growing number of countries exploring Central Bank Digital Currencies (CBDCs) also points to a broader acceptance of digital currencies and may even indirectly boost Bitcoin’s adoption by highlighting the need for alternative decentralized systems. The ongoing development of the Lightning Network, a layer-two scaling solution, addresses Bitcoin’s scalability limitations, further enhancing its potential for mainstream use in everyday transactions.

Illustrative Example

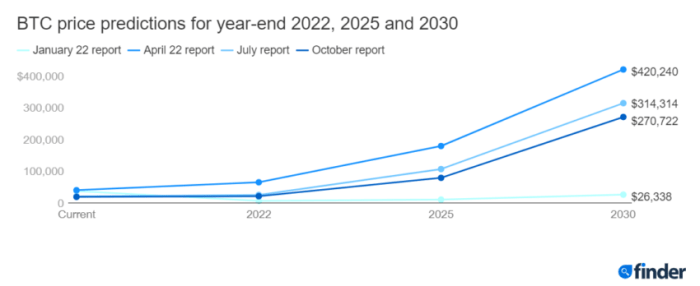

Predicting Bitcoin’s price trajectory is inherently speculative, influenced by numerous interconnected factors. However, visualizing potential price movements through hypothetical charts helps illustrate the range of possibilities. The following describes a hypothetical Bitcoin price chart from now until 2025, encompassing optimistic, pessimistic, and most likely scenarios. These scenarios are for illustrative purposes only and should not be considered financial advice.

This hypothetical chart would utilize a line graph, plotting Bitcoin’s price (in USD) on the vertical axis against time (in years) on the horizontal axis. Different colored lines would represent distinct scenarios. Key points, such as significant price peaks and troughs, would be clearly marked and labeled.

Bitcoin Price Trajectory Scenarios

The chart would depict three primary scenarios: a bullish (optimistic), a bearish (pessimistic), and a neutral (most likely) trajectory.

The bullish scenario line would show a steady, upward trend, potentially exceeding $100,000 by 2025, punctuated by periodic corrections but with a consistently upward bias. This scenario assumes widespread adoption, positive regulatory developments, and sustained institutional investment. One could envision a sharp rise following a halving event, similar to previous cycles, albeit at a much higher price point. For example, a price jump from $30,000 to $60,000 within six months, followed by a consolidation period before another significant upward move.

The bearish scenario line would display a downward trend, possibly falling below $20,000 by 2025. This scenario incorporates factors such as increased regulatory scrutiny, a major market crash affecting broader financial markets, or a loss of investor confidence. The line would show a more gradual decline, potentially with short-lived rallies, before settling at a lower price point. This could resemble the 2018 bear market, albeit with potentially deeper lows.

The neutral scenario line, presented as the most probable trajectory, would show a more moderate upward trend, reaching somewhere between $50,000 and $80,000 by 2025. This line would account for both periods of growth and periods of stagnation, reflecting the inherent volatility of the cryptocurrency market. It would incorporate factors from both bullish and bearish scenarios, resulting in a more balanced and realistic prediction. This could involve a gradual climb with several periods of consolidation, similar to Bitcoin’s price action in the years following its initial surge in popularity.

Frequently Asked Questions (FAQ): Bitcoin Prediction Price 2025

This section addresses common queries regarding Bitcoin’s price, investment potential, risk mitigation, and regulatory landscape. Understanding these factors is crucial for navigating the complexities of the cryptocurrency market.

Bitcoin’s Price Drivers

Several interconnected factors influence Bitcoin’s price. Supply and demand dynamics play a pivotal role; limited Bitcoin supply (21 million coins) contrasts with fluctuating demand driven by investor sentiment, adoption rates, and macroeconomic conditions. Regulatory developments, both positive and negative, significantly impact market confidence and price. Technological advancements, such as improved scalability solutions, also affect price, as do major events like halving events that reduce the rate of new Bitcoin creation. Finally, the overall sentiment in the broader financial markets and the perception of Bitcoin as a safe haven asset or a risky investment significantly affect its price. For example, during periods of economic uncertainty, investors may flock to Bitcoin, driving up its price, while periods of positive economic news might lead to investors shifting funds to more traditional assets.

Bitcoin as a Long-Term Investment

Bitcoin’s long-term investment potential is a subject of ongoing debate. While it offers the possibility of substantial returns due to its scarcity and potential for widespread adoption, it’s also associated with considerable risk. High price volatility is a major concern, with price swings of 10% or more in a single day not uncommon. Regulatory uncertainty in various jurisdictions poses another risk, potentially impacting accessibility and liquidity. However, proponents argue that Bitcoin’s decentralized nature, inherent scarcity, and growing acceptance as a store of value could lead to significant long-term appreciation. The long-term trajectory of Bitcoin remains uncertain, but its potential for substantial growth alongside significant risk needs careful consideration. For example, the price of Bitcoin has historically experienced significant bull and bear markets, with periods of substantial growth followed by sharp corrections.

Mitigating Bitcoin Price Volatility

Several strategies can help mitigate the risks associated with Bitcoin’s price volatility. Dollar-cost averaging (DCA), a strategy involving regular investments of a fixed amount regardless of price, reduces the impact of volatile price swings. Diversification across various asset classes, including traditional investments and other cryptocurrencies, helps spread risk. Holding Bitcoin for the long term allows for weathering short-term price fluctuations and potentially benefiting from long-term growth. Setting stop-loss orders can limit potential losses by automatically selling Bitcoin when it reaches a predetermined price. Finally, staying informed about market trends and news can help make more informed investment decisions. For instance, a diversified portfolio including stocks, bonds, and a small allocation to Bitcoin can reduce overall portfolio volatility compared to a portfolio solely invested in Bitcoin.

Regulatory Challenges Facing Bitcoin

Bitcoin faces various regulatory challenges globally. Governments are grappling with how to regulate cryptocurrencies, with varying approaches ranging from outright bans to comprehensive regulatory frameworks. Concerns about money laundering, tax evasion, and illicit activities associated with cryptocurrencies drive regulatory scrutiny. The lack of a unified global regulatory framework creates uncertainty and can hinder wider adoption. Differing regulatory approaches across jurisdictions can lead to fragmentation and complexities for businesses operating in the cryptocurrency space. For example, some countries have implemented stringent KYC/AML regulations for cryptocurrency exchanges, while others have adopted a more laissez-faire approach. This regulatory landscape continues to evolve, presenting both opportunities and challenges for Bitcoin’s future.

Bitcoin Prediction Price 2025 – Predicting the Bitcoin price in 2025 involves considering numerous factors, including regulatory changes and market sentiment. A granular look at a specific month within that year can offer valuable insight; for example, understanding the potential price movements in August is key. To gain perspective on this, check out this detailed analysis on Bitcoin Price Prediction August 2025.

This information can then be extrapolated to help formulate a more comprehensive prediction for the entire year of 2025.

Predicting the Bitcoin price in 2025 is a complex endeavor, with various factors influencing its trajectory. Understanding potential downsides is crucial, and for a comprehensive look at the pessimistic side, check out this analysis on Bitcoin Low Prediction 2025. Considering both bullish and bearish scenarios provides a more balanced perspective when formulating your own Bitcoin price prediction for 2025.

Predicting the Bitcoin price in 2025 is a complex endeavor, influenced by numerous factors. A key element to consider is the impact of the upcoming Bitcoin halving, which will significantly reduce the rate of new Bitcoin creation. For a detailed analysis of this event, check out the Bitcoin Halving 2025 Estimate report. Understanding the halving’s potential effects is crucial for forming a well-informed prediction about Bitcoin’s price trajectory in 2025.

Predicting the Bitcoin price in 2025 is a complex endeavor, influenced by numerous factors. Understanding related cryptocurrencies can provide additional context; for instance, exploring the potential of alternative projects like Bitcoin Vault offers valuable insight. To get a clearer picture of this specific altcoin’s trajectory, you might find the Bitcoin Vault Price Prediction 2025 analysis helpful.

Ultimately, this broader perspective can inform a more nuanced prediction for Bitcoin’s own price in 2025.

Predicting Bitcoin’s price in 2025 involves considering numerous factors, from regulatory changes to technological advancements. A granular look at specific months can provide a clearer picture; for instance, understanding the potential price trajectory in February is crucial. To gain insight into this, you might find the detailed analysis at Bitcoin Price Prediction For February 2025 helpful in building a more comprehensive Bitcoin Prediction Price 2025 forecast.

Predicting the Bitcoin price for 2025 is a complex task, involving numerous factors and varying expert opinions. A key element in forming a comprehensive 2025 prediction involves understanding the trajectory of the first month of that year; for insights into this, check out the detailed analysis provided at Bitcoin Price Prediction Jan 2025. This January forecast can significantly inform broader projections for Bitcoin’s value throughout the rest of 2025.

Predicting the Bitcoin price for 2025 is a complex task, involving numerous factors and varying expert opinions. A key element in forming a comprehensive 2025 prediction involves understanding the trajectory of the first month of that year; for insights into this, check out the detailed analysis provided at Bitcoin Price Prediction Jan 2025. This January forecast can significantly inform broader projections for Bitcoin’s value throughout the rest of 2025.