Macroeconomic Conditions and Bitcoin

Bitcoin’s price, while often touted as decentralized and immune to traditional market forces, is demonstrably influenced by macroeconomic conditions. Understanding these correlations is crucial for predicting its potential value in Summer 2025. The interplay between global economic health and Bitcoin’s performance is complex and multifaceted, but certain trends and indicators offer valuable insights.

Bitcoin’s price often acts as a safe haven asset during times of economic uncertainty, similar to gold. When traditional markets experience volatility, investors may flock to Bitcoin as a store of value, driving up its price. Conversely, periods of strong economic growth can sometimes lead to investors shifting funds back into more traditional investments, potentially causing Bitcoin’s price to decline. This dynamic is not always consistent, however, as various other factors can influence the market.

Key Macroeconomic Indicators Influencing Bitcoin’s Value

Several key macroeconomic indicators can significantly impact Bitcoin’s price in Summer 2025. These indicators provide a framework for understanding the broader economic landscape and its potential effect on investor sentiment towards Bitcoin. Analyzing these indicators in conjunction with other factors is essential for a comprehensive prediction.

- Inflation Rates: High inflation erodes the purchasing power of fiat currencies, potentially increasing the demand for Bitcoin as an inflation hedge. For example, during periods of high inflation in countries like Argentina or Venezuela, Bitcoin adoption has surged as citizens seek to protect their savings. Conversely, low inflation might reduce the incentive to invest in Bitcoin as a hedge against inflation.

- Interest Rates: Rising interest rates generally make holding Bitcoin less attractive, as investors can earn higher returns on less risky assets. Conversely, lower interest rates can make Bitcoin a more appealing investment option. The Federal Reserve’s monetary policy decisions in the US, for instance, significantly impact global interest rates and, consequently, Bitcoin’s price.

- Recessionary Fears: During periods of economic uncertainty and recessionary fears, investors often seek safe haven assets. Bitcoin, although volatile, has shown a tendency to act as a hedge against economic downturns, attracting investors seeking to preserve capital. The 2008 financial crisis, for example, saw a significant increase in Bitcoin’s adoption as a result of decreased trust in traditional financial institutions.

- Geopolitical Events: Global political instability and uncertainty can significantly impact investor confidence and market sentiment. Major geopolitical events, such as wars, sanctions, or political upheavals, can cause investors to move their assets into what they perceive as safer havens, potentially boosting Bitcoin’s price. The war in Ukraine, for example, led to a surge in interest in cryptocurrencies, including Bitcoin, as some investors sought to diversify their holdings outside of traditional markets.

Impact of Macroeconomic Events on Bitcoin’s Price

The impact of inflation, recession, or geopolitical events on Bitcoin’s price is complex and often unpredictable. While general trends can be observed, specific outcomes depend on a multitude of interacting factors.

A significant global recession could potentially increase demand for Bitcoin as a store of value and a hedge against inflation, leading to a price increase. However, a severe recession could also lead to a broad market sell-off, potentially dragging Bitcoin’s price down.

High inflation could drive demand for Bitcoin as an inflation hedge, leading to price appreciation. However, if inflation becomes hyperinflationary, it could lead to a collapse in the value of all assets, including Bitcoin.

Geopolitical instability could cause investors to seek safe-haven assets, driving up the price of Bitcoin. However, if the instability leads to a global economic crisis, it could also trigger a significant sell-off in Bitcoin.

Market Sentiment and Investor Behavior

Bitcoin’s price is highly susceptible to shifts in investor psychology and overall market sentiment. These factors, often intertwined and difficult to isolate, significantly influence buying and selling pressure, driving volatility and shaping price trends. Understanding these dynamics is crucial for navigating the Bitcoin market.

Investor psychology plays a pivotal role in Bitcoin’s price fluctuations. Periods of intense optimism, fueled by positive news or technological advancements, often lead to price surges as investors rush to buy, creating a “fear of missing out” (FOMO) effect. Conversely, periods of uncertainty or negative news can trigger widespread selling, driven by fear and a desire to minimize losses, leading to sharp price declines. This behavior often exhibits herd mentality, where investors mimic the actions of others, amplifying both upward and downward price movements. The 2017 Bitcoin bubble and subsequent crash serve as a prime example of this psychological effect.

Social Media and News Coverage Influence

Social media platforms and traditional news outlets significantly impact Bitcoin’s price by shaping public perception. Positive news coverage, such as institutional adoption or regulatory clarity, can boost investor confidence and drive price increases. Conversely, negative news, like security breaches or regulatory crackdowns, can trigger sell-offs. The influence of prominent figures on social media, particularly those with large followings, can also be substantial, with their opinions potentially swaying market sentiment and causing significant price swings. For instance, a tweet from a well-known figure endorsing or criticizing Bitcoin can cause immediate and substantial price movements. This highlights the power of information dissemination and its impact on investor behavior in the volatile cryptocurrency market.

The Role of Whales and Large Investors

Whales, or high-net-worth individuals and institutions controlling substantial amounts of Bitcoin, exert significant influence on market trends. Their trading activities can create substantial price movements, as their large buy or sell orders can easily overwhelm smaller traders. These whales often employ sophisticated trading strategies, including manipulating market sentiment through coordinated buying or selling, to maximize their profits. For example, a large institutional investor’s decision to accumulate Bitcoin can create a positive feedback loop, driving up demand and price. Conversely, a sudden large sell-off by a whale can trigger a cascade of selling, leading to a sharp price drop. This highlights the importance of monitoring the activities of large investors to gain insights into potential market shifts.

Adoption and Use Cases of Bitcoin

Bitcoin’s adoption is steadily increasing, driven by factors such as its decentralized nature, security features, and growing recognition as a store of value and alternative investment asset. This expanding adoption across various sectors is expected to significantly impact its price and overall market position by Summer 2025.

The integration of Bitcoin into mainstream finance and everyday transactions is a key driver of its increasing adoption. While still not universally accepted as a payment method, its use is expanding in e-commerce, particularly among businesses seeking to cater to a tech-savvy clientele and reduce transaction fees associated with traditional payment processors. Furthermore, the growing institutional investment in Bitcoin further fuels this trend, demonstrating a shift in perception from a niche asset to a potentially significant component of diversified investment portfolios.

Bitcoin Adoption in Payments

The use of Bitcoin as a payment method is gaining traction, albeit gradually. Several factors contribute to its slow but steady adoption in this area. Firstly, the volatility of Bitcoin’s price presents a significant challenge for merchants accepting it as payment. Price fluctuations can lead to unexpected gains or losses for businesses, making it a risky proposition for some. Secondly, the lack of widespread merchant acceptance remains a hurdle. While some large companies have begun accepting Bitcoin, many smaller businesses remain hesitant due to the perceived complexity and potential security risks associated with handling cryptocurrency transactions. However, the development of second-layer solutions like the Lightning Network, designed to improve Bitcoin’s scalability and reduce transaction fees, is addressing some of these concerns. We can anticipate increased adoption among businesses as these technologies mature and become more user-friendly. For example, the growing adoption of Lightning Network payment channels in El Salvador, where Bitcoin is legal tender, illustrates the potential for increased payment adoption in regions with supportive regulatory environments.

Bitcoin’s Impact on Price from Increased Adoption

Increased adoption of Bitcoin across various sectors is expected to exert upward pressure on its price. Higher demand, driven by increased usage as a payment method, investment vehicle, and store of value, will likely outweigh the supply, leading to price appreciation. However, this relationship is not linear. Other factors, such as macroeconomic conditions, regulatory changes, and competing cryptocurrencies, will also influence Bitcoin’s price. For instance, a global economic downturn could reduce investor appetite for riskier assets like Bitcoin, potentially dampening its price increase despite rising adoption. Conversely, positive regulatory developments or the successful integration of Bitcoin into established financial systems could significantly boost its price. A scenario where Bitcoin is widely accepted as a reserve asset by central banks, for example, could lead to a dramatic surge in its value.

Impact of New Use Cases on Bitcoin’s Value, Bitcoin Prediction Summer 2025

The emergence of novel use cases for Bitcoin holds the potential to significantly enhance its value. One example is the development of decentralized finance (DeFi) applications built on Bitcoin’s blockchain. These applications could unlock new functionalities and attract a broader user base, driving up demand. Another potential use case lies in the area of supply chain management. Bitcoin’s inherent transparency and immutability could be leveraged to create secure and traceable supply chains, reducing fraud and enhancing efficiency. The implementation of Bitcoin in such a manner could significantly increase its value as it becomes integrated into the core operations of numerous industries. Consider a scenario where a major global corporation integrates Bitcoin into its supply chain tracking system. The increased demand from this large-scale adoption alone could propel Bitcoin’s price significantly higher. The value would not only reflect its adoption in this sector but also demonstrate the broader applicability of its underlying technology beyond its traditional use as a currency or investment.

Potential Price Scenarios for Summer 2025

Predicting Bitcoin’s price is inherently speculative, influenced by a complex interplay of macroeconomic factors, technological advancements, and market sentiment. However, by considering various plausible scenarios, we can gain a better understanding of the potential range of outcomes for Summer 2025. The following three scenarios – bullish, bearish, and neutral – represent distinct possibilities, each based on specific assumptions about these influencing factors.

Bullish Scenario: Bitcoin Surges Above $100,000

This scenario envisions a significant surge in Bitcoin’s price, potentially exceeding $100,000 by Summer 2025. This outcome hinges on several key factors. Firstly, widespread institutional adoption could drive demand significantly. Large financial institutions increasingly recognize Bitcoin as a viable asset class, potentially leading to substantial investment inflows. Secondly, positive macroeconomic conditions, such as controlled inflation and sustained economic growth, could create a favorable environment for risk assets like Bitcoin. Thirdly, regulatory clarity in major jurisdictions could further boost investor confidence and attract new entrants to the market. Finally, successful scaling solutions and technological advancements, such as the Lightning Network, could enhance Bitcoin’s usability and transaction speed, making it more attractive for everyday use. This combination of factors could propel Bitcoin’s price to unprecedented heights. For example, a similar confluence of events in 2021 led to a significant price increase.

Bearish Scenario: Bitcoin Falls Below $20,000

Conversely, a bearish scenario suggests Bitcoin’s price could drop below $20,000 by Summer 2025. This outcome is predicated on several negative factors. A prolonged period of global economic recession, coupled with high inflation, could severely impact investor risk appetite, leading to a sell-off in cryptocurrencies. Increased regulatory scrutiny and potential bans in major markets could also significantly dampen investor enthusiasm and reduce liquidity. Furthermore, the emergence of competing cryptocurrencies with superior technology or features could divert investment away from Bitcoin. Lastly, a major security breach or scandal involving a significant Bitcoin exchange or related entity could severely erode confidence in the market. The combination of these adverse factors could push Bitcoin’s price considerably lower than its current levels. The 2018 bear market serves as a cautionary tale of how quickly sentiment can shift, leading to significant price declines.

Neutral Scenario: Bitcoin Trades Between $30,000 and $60,000

A neutral scenario suggests Bitcoin’s price will remain within a relatively stable range, fluctuating between $30,000 and $60,000 by Summer 2025. This outcome would likely reflect a period of consolidation and sideways trading. This scenario assumes a mixed macroeconomic environment, with neither significant economic growth nor a severe recession. Regulatory developments would be relatively neutral, neither overly restrictive nor excessively supportive. Technological advancements would continue at a steady pace, without any groundbreaking breakthroughs or setbacks. Investor sentiment would be relatively subdued, without any major shifts in bullish or bearish sentiment. This scenario represents a more balanced outlook, acknowledging the inherent volatility of the cryptocurrency market while avoiding extreme price predictions. Similar periods of consolidation have occurred in Bitcoin’s history, often preceding periods of more significant price movements.

Summary of Price Scenarios

| Scenario | Key Assumptions | Potential Price Range (Summer 2025) |

|---|---|---|

| Bullish | Widespread institutional adoption, positive macroeconomic conditions, regulatory clarity, technological advancements | >$100,000 |

| Bearish | Global recession, increased regulatory scrutiny, competition from other cryptocurrencies, major security breaches | <$20,000 |

| Neutral | Mixed macroeconomic environment, neutral regulatory developments, steady technological advancements, subdued investor sentiment | $30,000 – $60,000 |

Risks and Opportunities Associated with Bitcoin Investment

Investing in Bitcoin presents a unique blend of substantial risks and potentially significant rewards. The cryptocurrency market’s volatility is legendary, and understanding the inherent dangers is crucial before committing capital. However, the potential for substantial returns, coupled with the ongoing evolution of Bitcoin’s role in the global financial landscape, makes it an attractive asset for some investors. This section Artikels the key risks and opportunities associated with Bitcoin investment, alongside strategies for mitigating those risks.

Key Risks Associated with Bitcoin Investment

Bitcoin’s price is highly volatile, subject to dramatic swings driven by a variety of factors, including regulatory changes, market sentiment, technological developments, and macroeconomic conditions. These fluctuations can lead to significant losses in a short period. Furthermore, the decentralized nature of Bitcoin, while a strength for some, also means that there’s no central authority to protect investors from fraud or theft. Security breaches, hacking incidents, and the loss of private keys can result in the irreversible loss of funds. Finally, the regulatory landscape surrounding Bitcoin remains uncertain globally, with differing legal frameworks across jurisdictions potentially impacting its use and value. The lack of intrinsic value, unlike traditional assets like gold or real estate, also contributes to the inherent risk. For example, the 2022 Bitcoin bear market saw prices plummet by over 70% from their all-time high, illustrating the potential for substantial losses.

Potential Opportunities for Bitcoin Investors Through Summer 2025

Despite the risks, Bitcoin’s potential for long-term growth remains a significant draw for investors. Widespread adoption, increasing institutional investment, and the development of new Bitcoin-related technologies and services could drive price appreciation. The potential for Bitcoin to become a more widely accepted form of payment, particularly in emerging markets, also represents a substantial opportunity. Furthermore, the scarcity of Bitcoin – only 21 million coins will ever exist – could contribute to its value appreciation over time. The increasing integration of Bitcoin into the financial ecosystem, such as the growing number of companies accepting it as payment, further bolsters its potential for future growth. For example, the increasing acceptance of Bitcoin by major corporations could significantly impact its price trajectory.

Risk Mitigation Strategies for Bitcoin Investments

Effective risk mitigation involves a multi-faceted approach. Diversification is crucial; avoid investing your entire portfolio in Bitcoin. Instead, allocate a portion of your investment to Bitcoin while diversifying into other asset classes to reduce overall portfolio risk. Secure storage of Bitcoin is paramount; utilize hardware wallets or reputable exchanges with robust security measures to protect your holdings from theft or loss. Staying informed about market trends, regulatory developments, and technological advancements is essential. Thorough research and understanding of Bitcoin’s underlying technology and the factors that influence its price are vital for making informed investment decisions. Finally, adopting a long-term investment strategy, rather than attempting to time the market, can help mitigate the impact of short-term price volatility. For instance, dollar-cost averaging – investing a fixed amount at regular intervals – can help reduce the risk associated with market timing.

Frequently Asked Questions (FAQs): Bitcoin Prediction Summer 2025

This section addresses common queries regarding Bitcoin’s price, investment risks, and strategies for mitigating those risks. Understanding these factors is crucial for making informed investment decisions. The information provided here is for educational purposes and should not be considered financial advice.

Major Factors Influencing Bitcoin’s Price

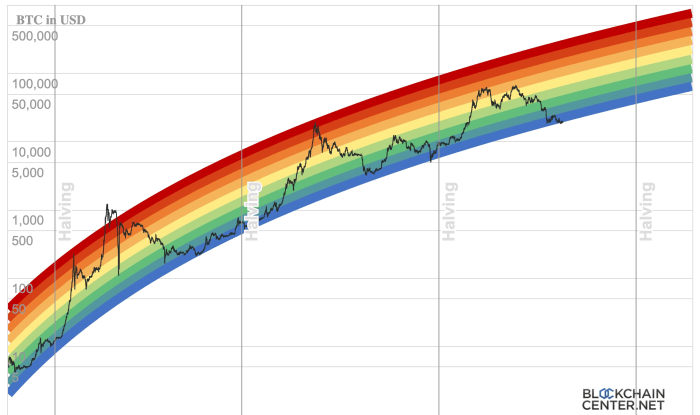

Bitcoin’s price is influenced by a complex interplay of factors. These include macroeconomic conditions (e.g., inflation, interest rates), regulatory developments (e.g., government policies), market sentiment (e.g., media coverage, investor confidence), technological advancements (e.g., network upgrades, scaling solutions), and adoption rates (e.g., increasing merchant acceptance, institutional investment). Supply and demand dynamics also play a significant role, with limited supply often driving price increases. For example, the halving events, which reduce the rate of new Bitcoin creation, have historically been followed by price increases.

Accuracy of Bitcoin Price Prediction

Accurately predicting Bitcoin’s price is inherently challenging. The cryptocurrency market is highly volatile and influenced by unpredictable events, making precise forecasting extremely difficult. While technical analysis and fundamental analysis can provide insights, they are not foolproof. Historical price movements are not necessarily indicative of future performance. Furthermore, external factors, such as unexpected regulatory changes or significant geopolitical events, can significantly impact the price regardless of any prediction. Consider the 2022 market downturn, triggered by multiple factors including rising interest rates and the collapse of TerraUSD – this highlighted the unpredictable nature of the market.

Potential Risks of Investing in Bitcoin

Investing in Bitcoin carries significant risks. Volatility is a primary concern; Bitcoin’s price can experience substantial fluctuations in short periods. Regulatory uncertainty, including potential government bans or restrictions, poses another risk. Security risks, such as hacking or theft from exchanges or personal wallets, are also present. Furthermore, the relatively young age of the cryptocurrency market means that long-term trends are still uncertain, and the market’s susceptibility to speculative bubbles cannot be ignored. Finally, the lack of intrinsic value, unlike traditional assets, makes Bitcoin’s price highly dependent on market sentiment.

Strategies for Mitigating Risks When Investing in Bitcoin

Several strategies can help mitigate the risks associated with Bitcoin investment. Diversification is key; spreading investments across different asset classes, not just Bitcoin, can reduce overall portfolio risk. Dollar-cost averaging (DCA), a strategy of investing a fixed amount of money at regular intervals, helps reduce the impact of volatility. Thorough research and due diligence are essential before investing, including understanding the technology, market dynamics, and associated risks. Secure storage of Bitcoin, using hardware wallets or reputable exchanges with robust security measures, is crucial to protect against theft. Finally, only investing what one can afford to lose is paramount, as significant losses are possible.

Disclaimer and Conclusion

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative. Numerous factors influence Bitcoin’s value, many of which are unpredictable and outside of anyone’s complete control. The information presented in this report is for informational purposes only and should not be construed as financial advice. Any investment decisions made based on the content within this report are solely at the reader’s own risk. We strongly encourage conducting thorough independent research and consulting with a qualified financial advisor before making any investment decisions related to Bitcoin.

This report aimed to provide a comprehensive overview of potential factors influencing Bitcoin’s price in Summer 2025. While we explored various scenarios, it’s crucial to remember that these are possibilities, not guarantees. The cryptocurrency market is highly volatile, and unexpected events can significantly impact prices.

Key Takeaways

This section summarizes the key findings and insights from our analysis of potential Bitcoin price scenarios for Summer 2025. Understanding these points is crucial for informed decision-making regarding Bitcoin investments.

- Bitcoin’s price is heavily influenced by macroeconomic conditions, including inflation rates, interest rate policies, and global economic growth. For example, periods of high inflation can drive demand for Bitcoin as a hedge against inflation, potentially increasing its price. Conversely, rising interest rates might decrease demand as investors seek higher returns in traditional markets.

- Market sentiment and investor behavior play a significant role in Bitcoin’s price fluctuations. Positive news and widespread adoption can lead to price increases, while negative news or regulatory uncertainty can trigger sell-offs. The 2021 bull market, for instance, was fueled by positive media coverage and increased institutional investment, while the subsequent bear market was partly driven by regulatory crackdowns in some countries.

- The expanding adoption and use cases of Bitcoin are likely to influence its long-term value. Increased adoption by businesses and institutions, as well as the development of new applications for Bitcoin’s underlying technology, could drive demand and increase its price. For example, the growing acceptance of Bitcoin as a payment method by major companies could boost its market value.

- Several price scenarios are possible for Summer 2025, ranging from significantly higher prices to lower prices, depending on the interplay of various factors. These scenarios highlight the inherent uncertainty and risk associated with Bitcoin investment. Predicting a precise price is not possible due to the market’s volatility and the multitude of influential factors.

- Investing in Bitcoin carries significant risks, including price volatility, regulatory uncertainty, and security risks. However, potential rewards can be substantial if the investment is successful. It is crucial to carefully assess these risks before investing.

Bitcoin Prediction Summer 2025 – Speculating on Bitcoin’s price in Summer 2025 requires considering various factors, including regulatory changes and market sentiment. To get a broader perspective, it’s helpful to examine longer-term forecasts, such as those provided by the comprehensive analysis found on this site: Price Prediction For Bitcoin 2025. Understanding the potential trajectory for the entire year will better inform any predictions specifically for Summer 2025 and help refine expectations for the Bitcoin price.

Predicting Bitcoin’s price in Summer 2025 is challenging, heavily influenced by factors like adoption rates and regulatory changes. Understanding the impact of halving events is crucial; to accurately assess this, you should check When Was The Last Bitcoin Halving 2025 as the reduced supply often precedes price increases. Therefore, considering the timing of the last halving is key to any informed Bitcoin Prediction Summer 2025.

Predicting Bitcoin’s price in Summer 2025 is challenging, requiring analysis of various factors. A key element to consider is the impact of the 2024 halving, which is thoroughly examined in this insightful German-language resource: Bitcoin Prognose Nach Halving 2025. Understanding the post-halving market dynamics is crucial for formulating any reasonable Bitcoin Prediction Summer 2025 forecast, given the historical correlation between halvings and subsequent price increases.

Predicting Bitcoin’s price in Summer 2025 is challenging, heavily influenced by various factors. A key element to consider is the impact of the upcoming halving event, which will significantly alter Bitcoin’s inflation rate. For insightful analysis on this crucial event, check out this resource on Prediccion Bitcoin Halving 2025 , which will inform your overall Bitcoin prediction for Summer 2025.

Understanding the halving’s effects is vital for any accurate forecast.

Predicting Bitcoin’s price in Summer 2025 is challenging, but understanding historical trends is crucial. A key factor to consider is the impact of the next Bitcoin halving, which significantly reduces the rate of new Bitcoin creation. For a visual representation of this event and its potential timeline, check out this helpful resource: Bitcoin Halving Chart 2025.

Analyzing this chart can offer valuable insights when formulating Bitcoin price predictions for Summer 2025, helping to inform more accurate estimations.

Predicting Bitcoin’s price in Summer 2025 is challenging, influenced by numerous factors. A key event impacting this prediction is the Bitcoin halving, which significantly affects the rate of new Bitcoin entering circulation. To understand the timing of this crucial event, check out this resource on When Will Bitcoin Halving 2025. Knowing the halving date helps refine our Bitcoin price estimations for Summer 2025, allowing for a more informed outlook.