Bitcoin Price Predictions for 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, given the cryptocurrency’s volatility and susceptibility to various market forces. However, several analysts and firms offer predictions based on different methodologies, providing a range of potential outcomes. Understanding these predictions requires careful consideration of the underlying assumptions and limitations of each model.

Factors Influencing Bitcoin Price Predictions

Several key factors contribute to the wide range of Bitcoin price predictions for 2025. These include macroeconomic conditions, such as inflation rates and global economic growth, which significantly impact investor sentiment and demand for alternative assets like Bitcoin. Technological advancements, including improvements in scalability and transaction speeds, can influence Bitcoin’s adoption rate and overall utility. Regulatory changes, both favorable and unfavorable, in various jurisdictions can significantly affect market accessibility and investor confidence. Finally, market sentiment, driven by news events, social media trends, and overall investor psychology, plays a crucial role in price fluctuations.

Comparison of Prediction Models

Different prediction models employ varying methodologies. Some rely on technical analysis, studying historical price patterns and trading volume to identify trends and predict future price movements. Others utilize fundamental analysis, focusing on factors such as Bitcoin’s adoption rate, network activity, and overall market capitalization. Quantitative models, often employing complex algorithms and machine learning techniques, are also used. Each methodology has strengths and weaknesses. Technical analysis, for example, can be highly subjective and prone to inaccuracies, while fundamental analysis may struggle to account for unforeseen events. Quantitative models, while sophisticated, rely heavily on the accuracy of the input data and the validity of the underlying assumptions.

Summary of Bitcoin Price Predictions for 2025

The following table summarizes key predictions from various sources, highlighting their methodologies and underlying assumptions. Note that these are just examples, and many other predictions exist, varying widely.

| Source | Prediction (USD) | Methodology | Assumptions |

|---|---|---|---|

| Analyst A (Example) | $100,000 – $150,000 | Fundamental Analysis (Adoption rate, market cap) | Continued institutional adoption, positive regulatory developments, stable macroeconomic conditions. |

| Firm B (Example) | $50,000 – $75,000 | Technical Analysis (Historical price patterns, trading volume) | Continuation of current market trends, moderate volatility. |

| Quantitative Model C (Example) | $70,000 – $120,000 | Quantitative Model (Machine learning, historical data) | Accuracy of input data, stable network activity, no major unforeseen events. |

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of macroeconomic factors, technological advancements, regulatory landscapes, and market sentiment. These elements are interconnected and influence each other, making accurate prediction challenging but not impossible to analyze.

Global Economic Conditions and Bitcoin’s Price

Global economic conditions significantly impact Bitcoin’s price. High inflation, often associated with a weakening currency, can drive investors towards Bitcoin as a hedge against inflation. Conversely, a recession might lead to risk-aversion, causing investors to sell Bitcoin and other risk assets in favor of safer investments like government bonds. Interest rate hikes by central banks, intended to curb inflation, can also influence Bitcoin’s price by affecting the opportunity cost of holding Bitcoin (the potential returns from investing in interest-bearing assets). For example, during periods of high inflation, like the late 2021 period, Bitcoin experienced significant price increases as investors sought inflation hedges. Conversely, during periods of rising interest rates, like the beginning of 2022, Bitcoin experienced price declines as investors moved to higher-yielding assets.

Technological Advancements and Bitcoin’s Price

Technological advancements within the Bitcoin ecosystem are crucial for its long-term price trajectory. Layer-2 scaling solutions, such as the Lightning Network, aim to increase transaction speed and reduce fees, making Bitcoin more usable for everyday transactions. Increased institutional adoption, with larger companies and financial institutions holding Bitcoin as a reserve asset, can lead to greater price stability and potentially higher valuations. For instance, MicroStrategy’s significant Bitcoin holdings have been cited as a factor contributing to increased institutional confidence. The successful implementation and adoption of these technologies could drive demand and potentially increase the price.

Regulatory Frameworks and Government Policies and Bitcoin’s Price

Government regulations and policies play a significant role in shaping Bitcoin’s price. Favorable regulatory frameworks that provide clarity and encourage innovation can boost investor confidence. Conversely, restrictive regulations or outright bans can suppress the price. Different countries are taking varying approaches, with some embracing Bitcoin and others adopting a more cautious or restrictive stance. The regulatory landscape is constantly evolving, and its impact on Bitcoin’s price will depend on the specifics of these policies. For example, El Salvador’s adoption of Bitcoin as legal tender had a noticeable impact, albeit temporary, on the price.

Market Sentiment and Bitcoin’s Price

Market sentiment, characterized by prevailing fear, uncertainty, and doubt (FUD) or excitement and hype, heavily influences Bitcoin’s price volatility. Periods of FUD, often triggered by negative news or regulatory uncertainty, can lead to sharp price drops. Conversely, periods of hype, fueled by positive news or technological breakthroughs, can drive significant price increases. The 2017 Bitcoin bubble and subsequent crash illustrate the powerful effect of market sentiment on price fluctuations. This is also significantly influenced by social media and mainstream media coverage.

Visual Representation of Interacting Factors

Imagine a central circle representing Bitcoin’s price. Four smaller circles, representing Global Economic Conditions, Technological Advancements, Regulatory Frameworks, and Market Sentiment, surround the central circle. Arrows connect each smaller circle to the central circle, indicating the influence of each factor on Bitcoin’s price. The arrows’ thickness varies to visually represent the strength of the influence at any given time. For instance, during periods of high inflation, the arrow from “Global Economic Conditions” to “Bitcoin’s Price” would be thicker, indicating a stronger positive influence. Similarly, during periods of negative news, the arrow from “Market Sentiment” would be thicker, indicating a stronger negative influence. The overlapping areas between the smaller circles illustrate the interconnectedness of these factors. For example, the overlapping area between “Technological Advancements” and “Market Sentiment” could highlight how positive technological news can fuel positive market sentiment.

Bitcoin’s Potential Role in the Future Financial System: Bitcoin Price 2025

Bitcoin’s emergence has sparked considerable debate about its potential to reshape the global financial landscape. Its decentralized nature and inherent resistance to censorship offer a compelling alternative to traditional systems, but significant hurdles remain before widespread adoption can be achieved. This section will explore Bitcoin’s potential as a store of value, medium of exchange, and unit of account, comparing it to traditional assets and examining the challenges and opportunities it presents.

Bitcoin as a Store of Value, Medium of Exchange, and Unit of Account

Bitcoin’s potential to function as a store of value, medium of exchange, and unit of account is a subject of ongoing discussion. Its limited supply of 21 million coins is often cited as a key factor contributing to its potential as a store of value, similar to gold. However, its volatility poses a significant challenge to its widespread acceptance as a medium of exchange for everyday transactions. As a unit of account, Bitcoin’s fluctuating value makes it less reliable than established fiat currencies for pricing goods and services. The future role of Bitcoin in these three functions depends largely on its price stability and the development of robust infrastructure supporting its use in everyday transactions.

Comparison of Bitcoin with Traditional Assets

The following table compares Bitcoin to traditional assets like gold, stocks, and bonds, highlighting their respective strengths and weaknesses as investments.

| Attribute | Bitcoin | Gold | Stocks | Bonds |

|---|---|---|---|---|

| Store of Value | High potential due to scarcity, but volatility is a concern. Its value is driven by speculation and adoption rate. | Historically strong, but subject to inflation and geopolitical risks. Its value is linked to industrial demand and safe haven status. | Potential for high growth, but also high risk. Value is tied to company performance and market sentiment. | Generally considered low-risk, offering stable returns. Value is linked to interest rates and creditworthiness of the issuer. |

| Medium of Exchange | Limited adoption due to volatility and transaction fees. Increasing adoption in specific niches. | Rarely used as a direct medium of exchange, primarily held as an asset. | Not directly used as a medium of exchange. | Not directly used as a medium of exchange. |

| Unit of Account | Limited use due to volatility. Pricing in Bitcoin can be challenging due to price fluctuations. | Historically used as a unit of account in some cultures, but not widely used in modern economies. | Not used as a unit of account. | Not used as a unit of account. |

| Volatility | High | Relatively low | Moderate to high | Relatively low |

| Regulation | Varying across jurisdictions, creating uncertainty. | Generally less regulated than financial assets. | Heavily regulated. | Heavily regulated. |

Impact of Bitcoin Adoption on the Traditional Financial System

Increased Bitcoin adoption could significantly impact the traditional financial system. For example, the rise of decentralized finance (DeFi) applications built on blockchain technology offers alternative financial services, potentially disrupting traditional banking and investment models. This could lead to increased competition, potentially lowering costs and improving access to financial services for some populations. However, it also presents regulatory challenges and potential risks to the stability of the existing financial system. The impact will depend heavily on the pace and scale of Bitcoin adoption, and the regulatory responses to its growth. Examples include the rise of crypto lending platforms and decentralized exchanges, which challenge traditional banking and brokerage services.

Challenges and Obstacles to Bitcoin’s Widespread Adoption

Several challenges hinder Bitcoin’s widespread adoption. These include its volatility, scalability limitations, regulatory uncertainty, environmental concerns related to its energy consumption, and the complexity involved in its use for everyday transactions. Overcoming these obstacles requires technological advancements, clear regulatory frameworks, and increased public understanding and trust. The ongoing debate surrounding Bitcoin’s environmental impact, for instance, is a significant hurdle to its broader acceptance. Addressing these challenges is crucial for Bitcoin to realize its full potential as a transformative force in the financial system.

Risks and Opportunities Associated with Bitcoin Investment in 2025

Investing in Bitcoin in 2025 presents a complex landscape of potential rewards and significant risks. While the cryptocurrency has demonstrated remarkable growth in the past, its inherent volatility and regulatory uncertainty make it a high-risk, high-reward investment. A thorough understanding of these factors is crucial for any prospective investor.

Potential Risks of Bitcoin Investment

Bitcoin’s price is notoriously volatile, subject to dramatic swings driven by market sentiment, regulatory news, technological advancements, and macroeconomic factors. A sudden downturn could lead to substantial losses, especially for investors who leverage their holdings. For example, the Bitcoin price crash of 2022, which saw a significant drop from its all-time high, serves as a stark reminder of this risk. Beyond price volatility, security concerns are paramount. The decentralized nature of Bitcoin, while a strength in many ways, also makes it vulnerable to hacking and theft if proper security measures aren’t implemented. Exchanges have been targeted in the past, resulting in significant losses for users. Finally, regulatory uncertainty remains a significant hurdle. Governments worldwide are still grappling with how to regulate cryptocurrencies, and changes in regulatory frameworks could significantly impact Bitcoin’s price and usability. The lack of consistent global regulation creates an unpredictable environment for investors.

Potential Opportunities for Bitcoin Investment, Bitcoin Price 2025

Despite the risks, Bitcoin offers compelling opportunities for investors. Its potential as a store of value, independent of traditional financial systems, attracts investors seeking diversification and protection against inflation. Bitcoin’s limited supply of 21 million coins could lead to increased scarcity and potentially higher prices in the future, as demand continues to grow. Furthermore, the increasing adoption of Bitcoin by institutional investors and large corporations signals growing acceptance and legitimacy, which could boost its price and stability. The development of the Lightning Network and other layer-two scaling solutions aims to address Bitcoin’s scalability limitations, potentially making it more practical for everyday transactions and further driving adoption. This could lead to increased demand and consequently higher prices.

Risk and Opportunity Comparison

The risks and opportunities associated with Bitcoin investment are intrinsically linked. The high volatility, while presenting a risk of substantial losses, also presents the potential for significant gains. Similarly, regulatory uncertainty, while creating unpredictability, could ultimately lead to clearer frameworks that enhance Bitcoin’s stability and legitimacy. Therefore, a balanced perspective acknowledges both sides of the coin – the potential for substantial returns must be weighed against the considerable risks involved. Successful Bitcoin investment requires a careful assessment of risk tolerance and a well-defined investment strategy.

Risk Management Strategies for Bitcoin Investors

Effective risk management is crucial for navigating the complexities of Bitcoin investment. A diversified portfolio, including other asset classes, helps mitigate the impact of Bitcoin’s volatility. Investors should only invest what they can afford to lose, avoiding leverage and over-exposure. Furthermore, utilizing secure storage methods, such as hardware wallets, significantly reduces the risk of theft or hacking. Staying informed about regulatory developments and market trends is also essential. Regularly reviewing and adjusting your investment strategy based on market conditions allows for adaptive risk management.

Risk Mitigation Strategies

- Diversify your investment portfolio to reduce overall risk.

- Only invest capital you can afford to lose.

- Use secure storage solutions, such as hardware wallets.

- Stay informed about market trends and regulatory developments.

- Regularly review and adjust your investment strategy.

- Avoid emotional decision-making; stick to your investment plan.

- Consider dollar-cost averaging to reduce the impact of volatility.

Frequently Asked Questions about Bitcoin’s Price in 2025

Predicting the price of Bitcoin is inherently speculative, as numerous factors influence its value. However, by analyzing current market trends, technological advancements, and regulatory developments, we can explore potential scenarios and address common questions regarding Bitcoin’s price in 2025. The following sections offer insights based on existing predictions and market analysis, acknowledging the inherent uncertainty involved.

Bitcoin Reaching $100,000 by 2025

Whether Bitcoin will reach $100,000 by 2025 is a highly debated topic. Some analysts, pointing to Bitcoin’s historical price growth and potential for wider adoption, predict such a surge. They cite factors like increasing institutional investment, growing global adoption, and the limited supply of Bitcoin as potential drivers. However, others express skepticism, highlighting the inherent volatility of the cryptocurrency market and the potential for regulatory hurdles or negative market sentiment to significantly impact its price. For example, the 2022 bear market demonstrated the significant price drops Bitcoin can experience. Therefore, while a $100,000 price point is within the realm of possibility for some analysts, it’s crucial to acknowledge the considerable uncertainty involved. The actual price will depend on a complex interplay of factors.

Investing in Bitcoin in 2023/2024

The question of whether it’s “too late” to invest in Bitcoin is subjective and depends on individual risk tolerance and investment goals. While Bitcoin’s price has experienced significant fluctuations, its history shows periods of substantial growth following market corrections. The potential for future growth remains, driven by factors such as increasing institutional adoption, the development of Bitcoin-related technologies, and the potential for Bitcoin to become a more established asset class. However, investing in Bitcoin carries significant risk. Its price is highly volatile, and investors could experience substantial losses. Therefore, thorough research and careful consideration of one’s risk tolerance are crucial before investing. A diversified investment strategy is also recommended to mitigate potential losses.

Biggest Threats to Bitcoin’s Price

Several factors pose significant threats to Bitcoin’s price. Regulatory uncertainty, particularly differing regulatory approaches across various jurisdictions, can create volatility and hinder adoption. Increased competition from alternative cryptocurrencies or technological advancements rendering Bitcoin obsolete could also negatively impact its value. Furthermore, negative media coverage, security breaches, or large-scale hacks targeting Bitcoin exchanges or wallets could erode investor confidence and lead to price drops. Finally, macroeconomic factors, such as global economic downturns or shifts in investor sentiment towards riskier assets, can significantly influence Bitcoin’s price.

Potential Long-Term Benefits of Holding Bitcoin

The potential long-term benefits of holding Bitcoin stem from its limited supply (21 million coins) and growing adoption as a store of value and a decentralized form of currency. Historically, Bitcoin’s price has shown a long-term upward trend, although with considerable volatility. Some investors view Bitcoin as a hedge against inflation and a potential alternative to traditional financial systems. However, it’s important to remember that past performance is not indicative of future results, and the long-term value of Bitcoin is highly uncertain. Holding Bitcoin for the long term requires a high risk tolerance and a belief in its underlying technology and future potential.

Protecting Against Bitcoin Price Volatility

Mitigating the risk associated with Bitcoin’s price volatility involves several strategies. Dollar-cost averaging, a strategy of investing a fixed amount of money at regular intervals regardless of price, can help reduce the impact of volatility. Diversification across different asset classes, including stocks, bonds, and other cryptocurrencies, can further lessen the overall risk. Finally, only investing what one can afford to lose is crucial. Avoid investing borrowed money or funds essential for daily living expenses. Furthermore, keeping abreast of market trends and news, understanding the underlying technology, and conducting thorough research before investing are essential steps in managing risk.

Bitcoin Price 2025 – Speculating on the Bitcoin price in 2025 involves considering various factors, including technological advancements and regulatory changes. A key aspect to explore is the potential for a significant bull run, as discussed in this insightful analysis: Bitcoin Price Prediction 2025 Bull Run. Understanding the predictions surrounding this potential bull market is crucial for forming a comprehensive view of Bitcoin’s price trajectory in 2025.

Therefore, further research into market trends will help to better understand the price fluctuations.

Speculating on the Bitcoin price in 2025 is a popular pastime, with various predictions circulating. For a well-regarded perspective, you might find the insights from a reputable source helpful, such as those offered in this article: Bitcoin Price Prediction 2025 Forbes. Ultimately, however, the actual Bitcoin price in 2025 will depend on numerous market factors and remains uncertain.

Predicting the Bitcoin price in 2025 is a complex endeavor, influenced by numerous factors. A key aspect to consider is the Bitcoin price in US dollars, which is often the benchmark. For a detailed analysis focusing specifically on this aspect, check out this resource on Bitcoin Price Dollar 2025 to gain further insight. Ultimately, understanding the dollar value is crucial for any comprehensive Bitcoin Price 2025 prediction.

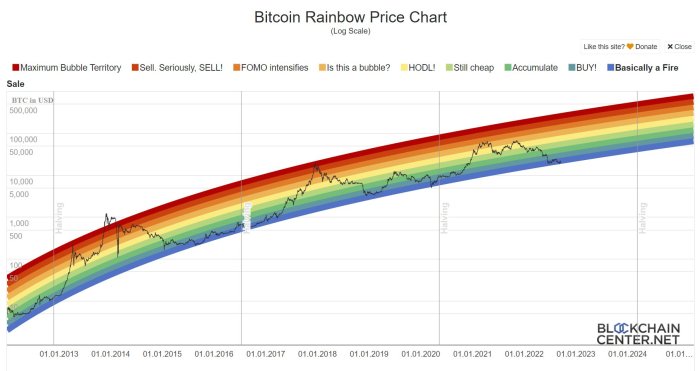

Speculating on the Bitcoin price in 2025 involves considering various factors, from technological advancements to regulatory changes. A helpful resource for visualizing potential scenarios is a comprehensive chart, such as the one available at Bitcoin Price Prediction 2025 Chart , which provides a visual representation of predicted price movements. Ultimately, the actual Bitcoin price in 2025 remains uncertain, dependent on market forces and unforeseen events.

Predicting the Bitcoin price in 2025 is a complex undertaking, influenced by numerous factors. Understanding the Canadian dollar’s potential impact is crucial, and for that, you might find the projections at Bitcoin Price Cad 2025 helpful. Ultimately, the Bitcoin price in 2025 will depend on global economic trends and the cryptocurrency’s continued adoption.