Bitcoin Price Predictions for 2025: Bitcoin Price 2025 Halving

The Bitcoin halving event, occurring approximately every four years, significantly reduces the rate at which new Bitcoins are created. This reduction in supply has historically been followed by periods of price appreciation, though the magnitude and duration of these price increases have varied. Predicting the Bitcoin price in 2025, however, is inherently speculative, influenced by numerous intertwined economic and market factors.

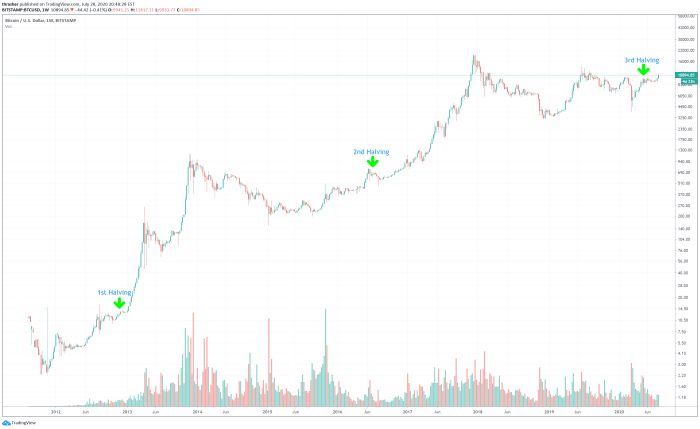

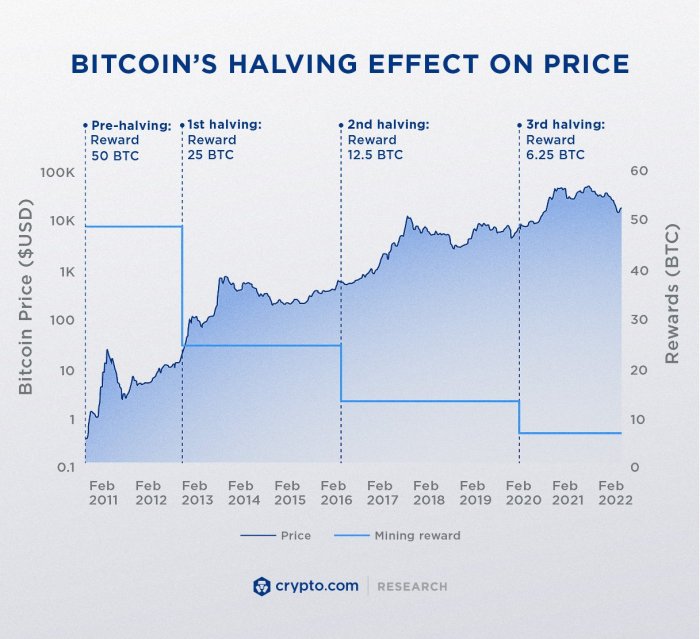

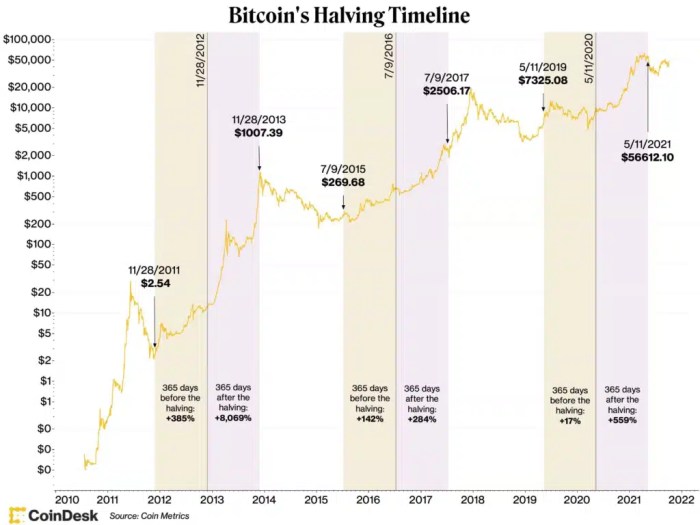

Historical Impact of Bitcoin Halving Events on Price

The first two Bitcoin halvings, in 2012 and 2016, were followed by substantial price increases. The 2012 halving saw Bitcoin’s price rise from around $5 to over $1,000 within two years. Similarly, the 2016 halving preceded a significant bull market that peaked in late 2017, pushing the price above $20,000. While correlation doesn’t equal causation, the historical data suggests a strong link between halving events and subsequent price appreciation, largely attributed to the decreasing supply of Bitcoin. However, it’s crucial to remember that other market forces, such as regulatory changes, technological advancements, and overall macroeconomic conditions, also play significant roles.

Factors Influencing Bitcoin’s Price Leading up to the 2025 Halving

Several factors will likely influence Bitcoin’s price trajectory in the lead-up to and following the 2025 halving. These include the overall state of the global economy, regulatory developments in major jurisdictions, the adoption rate of Bitcoin by institutions and individuals, and the level of competition from alternative cryptocurrencies. For example, a period of global economic uncertainty might drive investors towards Bitcoin as a safe haven asset, potentially boosting its price. Conversely, increased regulatory scrutiny could dampen investor enthusiasm. Technological advancements within the Bitcoin ecosystem, such as the Lightning Network’s improved scalability, could also positively influence price by enhancing usability and transaction efficiency.

Comparison of Previous Halving Cycles with the Anticipated 2025 Event

While the previous halvings offer valuable insights, it’s crucial to acknowledge significant differences between cycles. The market maturity in 2025 will be far greater than in 2012 or 2016. Bitcoin’s market capitalization and adoption are significantly higher now, meaning that the same percentage increase in price would represent a much larger dollar value change. Furthermore, the regulatory landscape is considerably more developed, potentially influencing price volatility and investor behavior. The increased institutional involvement also introduces new dynamics, as large-scale investors may react differently to the halving than individual retail investors.

Supply and Demand Dynamics Around the 2025 Halving

The 2025 halving will reduce the rate of Bitcoin creation by half, directly impacting the supply side of the equation. Assuming demand remains relatively constant or increases, this reduced supply should theoretically put upward pressure on price. However, the actual impact will depend on the interplay between supply and demand. If demand significantly outpaces the reduced supply, a substantial price increase is more likely. Conversely, if demand weakens or remains stagnant, the price impact of the halving might be less pronounced.

Hypothetical Price Scenario for Bitcoin in 2025

Predicting a specific price for Bitcoin in 2025 is impossible. However, considering the historical data, the anticipated supply reduction, and the potential influence of various market factors, a hypothetical scenario could involve a price range. Under a bullish scenario, where macroeconomic conditions are favorable, institutional adoption accelerates, and regulatory uncertainty diminishes, Bitcoin could reach prices significantly higher than its previous all-time high. For example, a price range of $150,000 to $250,000 might be plausible. Conversely, a bearish scenario, characterized by negative macroeconomic trends, increased regulatory pressure, or a significant loss of investor confidence, could result in a much lower price, perhaps remaining within the range of $50,000 to $100,000. These are purely speculative ranges, and the actual price will depend on a complex interplay of factors. It’s essential to remember that the cryptocurrency market is inherently volatile, and substantial price fluctuations are to be expected.

Factors Influencing Bitcoin’s Price Beyond the Halving

The Bitcoin halving in 2024 will undoubtedly have a significant impact on its price in 2025, but numerous other factors will also play crucial roles. Understanding these interconnected elements is vital for a comprehensive assessment of Bitcoin’s potential price trajectory. The interplay between macroeconomic conditions, regulatory landscapes, technological advancements, and institutional involvement will shape the market significantly.

Macroeconomic Factors and Bitcoin’s Price

Global economic conditions significantly influence Bitcoin’s price. Periods of economic uncertainty, inflation, or recession can drive investors towards Bitcoin as a hedge against inflation or a safe haven asset. Conversely, strong economic growth and stable markets might divert investment away from cryptocurrencies. For example, the 2022 bear market coincided with rising inflation and interest rates globally, impacting investor sentiment across asset classes, including Bitcoin. Conversely, periods of economic instability, such as the 2020 COVID-19 pandemic, saw a surge in Bitcoin’s price as investors sought alternative assets. The strength of the US dollar, a key global reserve currency, also affects Bitcoin’s price, as it is typically inversely correlated with the dollar’s value.

Regulatory Changes and Bitcoin’s Value

Regulatory clarity and acceptance are paramount for Bitcoin’s mainstream adoption. Favorable regulatory frameworks in major economies can boost investor confidence and increase institutional investment. Conversely, restrictive regulations or outright bans can negatively impact Bitcoin’s price and liquidity. The differing regulatory approaches across countries, from relatively permissive jurisdictions like El Salvador to more restrictive ones like China, illustrate the significant impact of government policy. A clear and consistent regulatory environment globally would likely foster greater stability and growth in the Bitcoin market.

Technological Advancements and Bitcoin’s Price Trajectory

Technological improvements within the Bitcoin ecosystem, such as layer-2 scaling solutions (like the Lightning Network), improved wallet security, and advancements in mining efficiency, can influence Bitcoin’s price. Increased transaction speeds and lower fees, resulting from technological advancements, could lead to wider adoption and increased demand, positively impacting price. Conversely, significant security breaches or technological limitations could negatively affect investor confidence and price. The ongoing development and implementation of these improvements are therefore crucial factors influencing Bitcoin’s future.

Institutional Adoption and Bitcoin’s Long-Term Price

The level of institutional adoption, including investment from corporations, hedge funds, and pension funds, significantly influences Bitcoin’s long-term price. Increased institutional investment brings greater legitimacy and stability to the market, often leading to price appreciation. Conversely, a decrease in institutional interest could negatively impact price. Examples such as MicroStrategy’s significant Bitcoin holdings demonstrate the potential impact of institutional adoption on price. The growing interest from institutional investors suggests a positive outlook for Bitcoin’s long-term price stability and growth.

Bitcoin ETF Approval and Price Effects

The approval of a Bitcoin exchange-traded fund (ETF) in a major market, such as the United States, could potentially have a significant positive impact on Bitcoin’s price. An ETF would provide a regulated and accessible investment vehicle for institutional and retail investors, increasing liquidity and potentially driving demand. The anticipation of ETF approval has already been a factor in the market’s price movements. However, the actual impact of ETF approval will depend on various factors, including the specific terms of the ETF and the overall market conditions at the time of its launch. The potential influx of new investment following ETF approval could lead to a substantial price increase.

Assessing Bitcoin’s Volatility in 2025

Predicting Bitcoin’s price volatility around the 2025 halving is inherently challenging due to the cryptocurrency’s complex and often unpredictable nature. However, by examining historical trends, analyzing influencing factors, and comparing it to other assets, we can develop a framework for understanding potential price fluctuations.

Bitcoin’s price volatility is a well-documented phenomenon. It’s characterized by significant price swings in relatively short periods, driven by a confluence of factors. Understanding these factors is crucial for investors to make informed decisions.

Factors Contributing to Bitcoin’s Price Volatility

Several factors contribute significantly to Bitcoin’s price volatility. These include macroeconomic conditions (inflation, interest rates, recessionary fears), regulatory changes, technological developments within the Bitcoin ecosystem (e.g., Lightning Network adoption), market sentiment (fear, uncertainty, and doubt, or FUD, versus hype and excitement), and large-scale trading activity (whale movements). For example, the 2022 bear market was significantly influenced by macroeconomic factors like rising interest rates and inflation, coupled with the collapse of several major crypto firms. Conversely, periods of strong institutional adoption and positive regulatory developments have historically led to bullish price action.

A Model of Potential Price Volatility

While precise prediction is impossible, we can construct a simplified model illustrating potential price volatility. Let’s assume a pre-halving price of $50,000. Based on historical halving cycles, we could see a range of outcomes. A conservative estimate might project a price range of $40,000 – $60,000 in the months leading up to the halving, driven by anticipation. Post-halving, the price could experience a significant surge, potentially reaching $70,000 – $100,000 within a year, if market sentiment remains positive and adoption continues to grow. However, a less optimistic scenario might see the price consolidate around $60,000, or even experience a temporary dip due to profit-taking or negative market events. This model emphasizes the wide range of potential outcomes. It’s crucial to remember that this is a simplified illustration and does not account for all possible scenarios. Actual price movements will be far more complex.

Comparison with Other Major Assets

Comparing Bitcoin’s volatility to other major assets like gold, the S&P 500, or the US dollar is crucial for context. Historically, Bitcoin has exhibited significantly higher volatility than these traditional assets. Gold, for example, is often seen as a safe haven asset, exhibiting lower volatility compared to Bitcoin. However, in times of significant macroeconomic uncertainty, the volatility of even traditionally stable assets can increase. In 2025, depending on the overall market conditions, Bitcoin’s volatility might still exceed that of gold and traditional stock indices, but the relative difference could vary depending on prevailing global economic conditions.

Risk Assessment for Bitcoin Investors in 2025

Investing in Bitcoin carries inherent risks. The high volatility Artikeld above represents a significant risk factor. Investors should only allocate capital they can afford to lose. Diversification across different asset classes is also highly recommended to mitigate risk. A thorough understanding of the technology, market dynamics, and regulatory landscape is crucial. Conducting thorough due diligence and consulting with a financial advisor are highly recommended before making any investment decisions.

Impact of Market Events on Bitcoin’s Price Volatility

Various market events can significantly impact Bitcoin’s price volatility. A major regulatory crackdown in a significant market could trigger a sharp price decline. Conversely, positive regulatory developments or large-scale institutional adoption could drive substantial price increases. Geopolitical events, such as international conflicts or significant economic shifts, can also influence Bitcoin’s price, often leading to increased volatility. Unexpected technological breakthroughs or vulnerabilities within the Bitcoin network could also have substantial effects on price, although the nature of these effects is difficult to predict.

Investment Strategies for Bitcoin in 2025

Navigating the cryptocurrency market, particularly Bitcoin, requires a well-defined investment strategy. The 2025 halving event will undoubtedly influence Bitcoin’s price, creating both opportunities and risks for investors. Understanding different approaches and implementing robust risk management techniques is crucial for success.

Bitcoin Investment Strategies for 2025

Several strategies can be employed to navigate Bitcoin’s price fluctuations in 2025. These strategies cater to varying risk tolerances and investment horizons. The choice depends heavily on individual circumstances and financial goals. For instance, a risk-averse investor might favor a dollar-cost averaging approach, while a more aggressive investor might consider leveraged trading (though this carries significant risk).

Risk Management Techniques for Bitcoin Investments

Effective risk management is paramount in Bitcoin investment. This involves limiting potential losses while maximizing potential gains. Diversification, stop-loss orders, and position sizing are key components of a robust risk management plan. For example, a stop-loss order automatically sells your Bitcoin if the price drops to a predetermined level, preventing further losses. Position sizing dictates the percentage of your investment portfolio allocated to Bitcoin, preventing overexposure to a single asset. Diversification across different cryptocurrencies reduces the impact of a single asset’s price decline on the overall portfolio.

Long-Term versus Short-Term Bitcoin Investment Strategies

Long-term strategies, often referred to as “HODLing” (holding on for dear life), focus on accumulating Bitcoin over an extended period, weathering short-term price volatility. This strategy benefits from the potential for long-term growth but requires patience and a tolerance for significant price swings. Short-term strategies, on the other hand, aim to profit from short-term price movements through active trading. This approach requires more market knowledge, technical analysis skills, and a higher risk tolerance. For example, a long-term investor might buy and hold Bitcoin for five years or more, while a short-term trader might aim for profits within days or weeks. The historical price action of Bitcoin demonstrates both the potential for significant long-term gains and the risk of substantial short-term losses.

Diversification within a Cryptocurrency Portfolio

Diversification is crucial for mitigating risk in any investment portfolio, and cryptocurrency investments are no exception. Instead of concentrating solely on Bitcoin, investors should consider diversifying across other cryptocurrencies with different characteristics and market dynamics. This approach reduces the impact of a potential downturn in Bitcoin’s price on the overall portfolio. For example, an investor might allocate a portion of their portfolio to Ethereum, Solana, or other altcoins, balancing exposure to different technologies and market trends. This reduces overall portfolio volatility compared to a portfolio solely invested in Bitcoin.

Considerations for Investors with Different Risk Tolerances

Risk tolerance plays a significant role in determining the appropriate investment strategy. Risk-averse investors should prioritize capital preservation and might opt for dollar-cost averaging (DCA), gradually accumulating Bitcoin over time regardless of price fluctuations. More aggressive investors with a higher risk tolerance might consider leveraged trading or investing in higher-risk altcoins, seeking potentially higher returns but accepting increased volatility and the possibility of greater losses. A conservative approach might involve allocating a small percentage of a portfolio to Bitcoin, while a more aggressive strategy could involve a larger percentage, even potentially exceeding the recommended diversification guidelines. The level of risk taken should always align with an investor’s financial situation and overall comfort level.

Bitcoin’s Long-Term Outlook Beyond 2025

Bitcoin’s future beyond 2025 is a subject of considerable speculation, driven by its unique properties and the evolving technological landscape. While predicting the precise trajectory is impossible, analyzing its potential as a store of value, medium of exchange, and considering potential technological advancements provides a framework for understanding its long-term prospects.

Bitcoin’s Long-Term Potential as a Store of Value and Medium of Exchange

Bitcoin’s appeal as a store of value rests on its limited supply (21 million coins) and decentralized nature, making it resistant to inflation and government control. However, its volatility poses a significant challenge to its widespread adoption as a medium of exchange. For Bitcoin to truly thrive as a medium of exchange, increased transaction speed and lower fees are crucial, requiring technological improvements and potentially layer-2 solutions. Its success in this area will depend on addressing scalability issues and user experience challenges. The acceptance of Bitcoin by major institutions and governments will also play a critical role in its long-term adoption as a medium of exchange. Historically, gold has served as a reliable store of value, and Bitcoin aims to replicate this role in the digital age, though its volatility currently hinders its complete fulfillment of this role.

Potential Technological Advancements Impacting Bitcoin’s Future

Several technological advancements could significantly shape Bitcoin’s future. The Lightning Network, a layer-2 scaling solution, aims to improve transaction speed and reduce fees, making Bitcoin more practical for everyday transactions. Research into improved consensus mechanisms, such as proof-of-stake alternatives, could enhance energy efficiency and potentially increase transaction throughput. Furthermore, advancements in privacy-enhancing technologies could address concerns about Bitcoin’s transparency, making it more attractive to users who value anonymity. These technological improvements are not guaranteed, but their success could substantially alter Bitcoin’s utility and adoption rate. For example, the widespread adoption of the Lightning Network could drastically reduce transaction fees, making Bitcoin transactions comparable to traditional payment systems in terms of cost.

Comparison of Bitcoin’s Long-Term Prospects with Alternative Cryptocurrencies

Bitcoin’s first-mover advantage and established brand recognition give it a significant head start over alternative cryptocurrencies. However, newer cryptocurrencies often offer improved features, such as faster transaction speeds or enhanced privacy. The long-term success of Bitcoin will depend on its ability to adapt and compete with these alternatives. Ethereum, for instance, with its smart contract functionality, has carved a distinct niche, attracting developers and businesses. While Bitcoin may maintain its position as a store of value, alternative cryptocurrencies might find success in other specific applications, leading to a diversified cryptocurrency landscape. The competition between Bitcoin and altcoins will likely continue to shape the future of the entire cryptocurrency market.

Factors Contributing to Bitcoin’s Continued Growth or Decline

Several factors will determine Bitcoin’s future trajectory. Regulatory clarity from governments worldwide will play a crucial role, as will the adoption of Bitcoin by major financial institutions. The overall macroeconomic environment, including inflation and interest rates, will also influence Bitcoin’s price and demand. Furthermore, technological advancements and the development of competing cryptocurrencies will impact Bitcoin’s market share and long-term viability. For instance, increased regulatory scrutiny could stifle Bitcoin’s growth, while widespread institutional adoption could significantly boost its price and market capitalization. Conversely, a major technological breakthrough in a competing cryptocurrency could potentially erode Bitcoin’s dominance.

Timeline of Potential Milestones for Bitcoin’s Future Development

Predicting precise dates is inherently speculative, but a potential timeline might include: Increased regulatory clarity within the next 5 years, widespread institutional adoption within the next 10 years, significant improvements in scalability and transaction speed within the next 15 years, and the potential for Bitcoin to become a more widely accepted medium of exchange within the next 20 years. These milestones are not certainties, but rather potential outcomes based on current trends and technological advancements. The actual timeline may differ significantly depending on various factors, including technological breakthroughs, regulatory changes, and macroeconomic conditions. For example, the development and adoption of a truly efficient and scalable layer-2 solution could significantly accelerate the timeline for widespread Bitcoin adoption as a medium of exchange.

Illustrative Data Representation

Understanding Bitcoin’s price behavior after previous halving events is crucial for informed speculation about its potential trajectory in 2025. Analyzing historical data allows us to identify trends and patterns, although it’s important to remember that past performance is not necessarily indicative of future results. The following table and chart offer visual representations of this historical data and potential future scenarios.

Bitcoin Price Performance After Previous Halvings, Bitcoin Price 2025 Halving

The table below compares Bitcoin’s price before and after its previous halving events. Note that the “Price After Halving” represents a price reached sometime after the halving event, not immediately following it. The time frame for reaching this “after” price varies.

| Date of Halving | Price Before Halving (USD) | Price After Halving (USD) | Percentage Change (%) |

|---|---|---|---|

| November 28, 2012 | ~13.00 | ~1000 | ~7600 |

| July 9, 2016 | ~650 | ~20000 | ~3000 |

| May 11, 2020 | ~8700 | ~64000 | ~736 |

Potential Bitcoin Price Scenarios for 2025

This chart illustrates three potential price scenarios for Bitcoin in 2025, based on different market conditions: a bullish scenario (high growth), a neutral scenario (moderate growth), and a bearish scenario (low growth or decline).

The chart would be a line graph with time (months of 2025) on the x-axis and Bitcoin price (in USD) on the y-axis. Three lines would represent the different scenarios:

* Bullish Scenario: This line would show a steep upward trend throughout 2025, potentially reaching prices significantly higher than the price before the halving. This scenario assumes widespread adoption, positive regulatory developments, and continued institutional investment. For example, it might show a price increase from $40,000 before the halving to $200,000 by the end of 2025.

* Neutral Scenario: This line would show a more moderate upward trend, with some fluctuations. This scenario assumes a relatively stable market with neither significant positive nor negative developments. The price might increase from $40,000 before the halving to $80,000 by the end of 2025.

* Bearish Scenario: This line would show a relatively flat or slightly downward trend. This scenario assumes negative regulatory changes, reduced investor confidence, or a broader economic downturn. The price might remain relatively stable around the pre-halving price or even experience a decline. For instance, the price might fall to $20,000 by the end of 2025.

The chart would include a legend clearly identifying each scenario. Data points for each scenario at key intervals (e.g., beginning, middle, and end of 2025) would be labeled for clarity. The y-axis would use a logarithmic scale to better represent the potentially large price range. The overall visual would clearly communicate the range of possible outcomes.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Bitcoin, its halving events, price predictions, and investment considerations. Understanding these points is crucial for navigating the complexities of the cryptocurrency market.

Bitcoin Halving Event and Price Impact

The Bitcoin halving is a programmed event that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and it cuts the block reward miners receive in half. Historically, halving events have been followed by periods of increased Bitcoin price, primarily due to the reduced supply creating potential scarcity. However, it’s important to remember that other factors also influence price movements.

Timing of the Next Bitcoin Halving

The next Bitcoin halving is expected to occur in 2024. The precise date depends on the Bitcoin network’s block time, but it’s generally anticipated to be around the middle of the year.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. Numerous factors influence Bitcoin’s price, including regulatory changes, market sentiment, technological advancements, macroeconomic conditions, and even social media trends. Any prediction is speculative and should be treated with a high degree of caution. Past performance is not indicative of future results. For example, predictions made before previous halvings have varied significantly from the actual outcomes.

Risks Associated with Bitcoin Investment

Investing in Bitcoin carries substantial risks. Its price is extremely volatile, meaning significant price swings in both directions are common. The cryptocurrency market is relatively unregulated in many jurisdictions, leading to potential security risks and scams. Furthermore, the value of Bitcoin is highly speculative and dependent on market forces, making it a high-risk investment unsuitable for those with a low risk tolerance. Losses can be substantial and potentially irreversible.

Reliable Sources of Bitcoin Information

Reliable information about Bitcoin can be found from reputable sources such as established financial news outlets (e.g., Bloomberg, Reuters, The Wall Street Journal), cryptocurrency-focused news websites (e.g., CoinDesk, Cointelegraph), and official Bitcoin documentation. It is crucial to be discerning about the information you consume, avoiding sources with clear biases or a history of spreading misinformation. Always conduct thorough research and consider consulting with a qualified financial advisor before making any investment decisions.