Factors Affecting Bitcoin’s Value

Predicting Bitcoin’s price in January 2025 requires considering a complex interplay of macroeconomic factors, regulatory changes, technological advancements, and market sentiment. While precise forecasting is impossible, analyzing these key influences provides a framework for understanding potential price movements.

Macroeconomic Factors and Bitcoin’s Price

Global macroeconomic conditions significantly influence Bitcoin’s value. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, rising interest rates can make holding Bitcoin less attractive compared to interest-bearing assets, potentially leading to price declines. Strong economic growth might divert investment away from riskier assets like Bitcoin towards more traditional investments. The correlation between Bitcoin and traditional markets is not always consistent; sometimes it acts as a safe haven, other times it mirrors the volatility of the stock market. For example, during periods of significant economic uncertainty, like the beginning of the COVID-19 pandemic, Bitcoin’s price initially dropped alongside stocks but then decoupled and saw substantial gains as investors sought alternative assets.

Regulatory Landscape and Bitcoin’s Price

Regulatory clarity and acceptance are crucial for Bitcoin’s price stability and growth. Favorable regulations in major jurisdictions can boost investor confidence, leading to increased adoption and higher prices. Conversely, stringent or unclear regulations can stifle growth and suppress prices. The differing approaches of countries like El Salvador (which has adopted Bitcoin as legal tender) and China (which has banned Bitcoin trading) highlight the significant impact of regulatory decisions. The regulatory environment is constantly evolving, and its impact on Bitcoin’s price in January 2025 remains uncertain, but it will be a major determining factor.

Technological Advancements and Bitcoin’s Price

Technological improvements within the Bitcoin ecosystem can positively impact its price. The Lightning Network, for example, aims to improve scalability and transaction speed, potentially making Bitcoin more suitable for everyday use. Taproot, an upgrade that enhances privacy and efficiency, could also increase adoption and appeal. Successful implementation and widespread adoption of such upgrades can significantly increase Bitcoin’s utility and desirability, influencing its price positively. However, the speed of adoption and the extent to which these upgrades solve existing limitations remain crucial considerations.

Bitcoin’s Price Performance Compared to Other Asset Classes

Comparing Bitcoin’s performance to other asset classes like gold and stocks provides valuable context. Gold, often viewed as a safe haven asset, has shown periods of positive correlation with Bitcoin, suggesting that both can benefit from times of economic uncertainty. However, Bitcoin’s volatility is significantly higher than that of gold. The correlation between Bitcoin and the stock market has been inconsistent, ranging from positive to negative depending on various factors. Understanding these relationships is essential for predicting potential future price movements. For instance, if the stock market experiences a significant downturn, Bitcoin’s price might react in several ways: it could mirror the downturn, act as a safe haven and appreciate, or decouple entirely, demonstrating its own unique market dynamics.

Institutional and Retail Adoption and Bitcoin’s Price

The level of adoption by both institutional and retail investors heavily influences Bitcoin’s price. Increased institutional investment, particularly from large corporations and financial institutions, can bring significant capital inflows, boosting demand and price. Simultaneously, growing retail investor participation expands the user base and increases liquidity, contributing to price stability and potential growth. However, a significant decrease in either institutional or retail interest could lead to price corrections. Examples such as MicroStrategy’s substantial Bitcoin investment showcase the potential impact of institutional adoption. Conversely, periods of reduced retail interest can lead to price declines.

Risk Assessment and Investment Strategies

Investing in Bitcoin, particularly with a target date like January 2025, requires a thorough understanding of the inherent risks and the development of a well-defined investment strategy. The cryptocurrency market is notoriously volatile, and Bitcoin, as the largest cryptocurrency, is subject to significant price swings influenced by a multitude of factors. A prudent approach necessitates careful consideration of risk tolerance and a diversified portfolio.

Potential Risks Associated with Bitcoin Investment

Bitcoin’s price is highly susceptible to market sentiment, regulatory changes, technological advancements, and macroeconomic conditions. Sharp price drops, sometimes exceeding 50% in a short period, are not uncommon. Security risks also exist, including the potential for hacking of exchanges or individual wallets, leading to loss of funds. Furthermore, the lack of regulatory clarity in many jurisdictions adds another layer of uncertainty. For example, the collapse of FTX in 2022 highlighted the risks associated with centralized exchanges and the importance of due diligence. The potential for complete loss of investment should be considered a significant risk.

Bitcoin Investment Strategies Based on Risk Tolerance and Investment Horizon, Bitcoin Price 2025 January

Investment strategies should align with individual risk profiles and time horizons. Investors with a high-risk tolerance and a long-term investment horizon (e.g., 5+ years) might employ a “buy and hold” strategy, accumulating Bitcoin over time regardless of short-term price fluctuations. Conversely, risk-averse investors with shorter time horizons might prefer dollar-cost averaging (DCA), investing a fixed amount regularly to mitigate the impact of volatility. Other strategies include trading based on technical analysis, which requires significant market expertise and understanding. It’s crucial to remember that past performance is not indicative of future results.

Diversified Portfolio Incorporating Bitcoin and Risk Mitigation Techniques

A diversified portfolio reduces overall risk by spreading investments across different asset classes. Including Bitcoin in a diversified portfolio can offer potential for high returns but should be balanced with less volatile assets like stocks, bonds, and real estate. Risk mitigation techniques include setting stop-loss orders to limit potential losses, diversifying across multiple cryptocurrency exchanges, and using cold storage for long-term Bitcoin holdings to enhance security. For instance, allocating 5-10% of a portfolio to Bitcoin, while the remainder is invested in established asset classes, can provide exposure to the cryptocurrency market without excessive risk.

Comparative Analysis of Bitcoin Investment Vehicles

Several vehicles facilitate Bitcoin investment, each with its own risk-reward profile. Spot trading involves buying and selling Bitcoin directly on an exchange at the current market price. Futures contracts allow investors to speculate on future Bitcoin prices, carrying higher risk due to leverage. Exchange-traded funds (ETFs) offer exposure to Bitcoin indirectly through a basket of assets, often reducing individual risks associated with direct Bitcoin ownership. The choice of investment vehicle depends on individual investment goals, risk tolerance, and understanding of each instrument’s characteristics. For example, ETFs are generally considered lower risk than spot trading or futures due to their diversification and regulatory oversight.

Evaluating Potential Return on Investment for Bitcoin in January 2025

Predicting Bitcoin’s price in January 2025 is inherently speculative. However, various price scenarios can be evaluated using different models, including technical analysis, fundamental analysis, and market sentiment indicators. For instance, a bullish scenario might predict a price of $100,000, while a bearish scenario might predict a price of $20,000. These scenarios should be considered in the context of historical price volatility and the influence of various market factors. It is crucial to acknowledge the significant uncertainty involved in any price prediction and to develop an investment strategy that accounts for a wide range of potential outcomes. A realistic approach would consider multiple scenarios and their associated probabilities.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Bitcoin’s price prediction for January 2025, associated risks, investment protection strategies, long-term prospects, and reliable information sources. Understanding these aspects is crucial for making informed investment decisions.

Potential Bitcoin Price Range in January 2025

Predicting Bitcoin’s price with certainty is impossible. However, we can explore various scenarios based on current market trends, technological advancements, regulatory developments, and macroeconomic factors. A conservative estimate might place the price somewhere between $50,000 and $100,000, reflecting a continuation of moderate growth. A more bullish scenario, considering widespread adoption and positive regulatory changes, could see prices exceeding $150,000. Conversely, a bearish scenario, influenced by significant regulatory crackdowns or a broader market downturn, might see prices fall below $30,000. The probabilities associated with each scenario are highly subjective and depend on numerous unpredictable variables. For example, a major technological breakthrough could dramatically shift the probabilities toward a higher price range. Conversely, a major global economic crisis could dramatically increase the likelihood of a lower price range. It’s important to remember that these are merely speculative possibilities, not guaranteed outcomes.

Biggest Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries significant risks. Volatility is a primary concern, with prices subject to dramatic swings in short periods. This volatility stems from Bitcoin’s relatively small market capitalization compared to traditional assets and its susceptibility to market sentiment shifts. Regulatory uncertainty poses another substantial risk; governments worldwide are still developing frameworks for cryptocurrencies, and changes in regulations can drastically impact Bitcoin’s value. Security risks, including exchange hacks and private key loss, are also considerable. Furthermore, the lack of intrinsic value, unlike gold or real estate, means Bitcoin’s value is entirely dependent on market demand. Finally, technological disruptions, such as the emergence of superior cryptocurrencies, could diminish Bitcoin’s dominance.

Protecting Bitcoin Investments from Volatility

Several strategies can mitigate the risks associated with Bitcoin investment volatility. Dollar-cost averaging, a method of investing fixed amounts at regular intervals regardless of price fluctuations, can reduce the impact of volatility. Diversification across different asset classes, including stocks, bonds, and real estate, is also crucial. Holding Bitcoin in a secure hardware wallet minimizes the risk of theft or loss from exchange hacks. Finally, employing stop-loss orders can limit potential losses by automatically selling Bitcoin when it reaches a predetermined price. It is important to note that no strategy guarantees complete protection against losses, but a combination of these approaches can significantly reduce risk.

Long-Term Prospects for Bitcoin

Bitcoin’s long-term prospects are a subject of ongoing debate. Some believe Bitcoin will become a mainstream form of payment and a significant store of value, potentially disrupting traditional financial systems. Others are more skeptical, citing concerns about scalability, regulation, and the emergence of competing technologies. The long-term success of Bitcoin will likely depend on its ability to overcome technological challenges, gain wider adoption, and navigate the evolving regulatory landscape. Factors such as increased institutional investment, improved infrastructure, and growing public awareness could contribute to its long-term success. However, significant unforeseen events could also negatively impact its long-term viability.

Resources for Learning More About Bitcoin

Numerous resources offer reliable information on Bitcoin and cryptocurrency investing. Reputable financial news outlets like the Wall Street Journal and Bloomberg provide regular coverage of the cryptocurrency market. Educational platforms such as Investopedia offer comprehensive articles and tutorials on various aspects of Bitcoin. Furthermore, research papers published by academic institutions and cryptocurrency-focused think tanks can provide in-depth analysis of Bitcoin’s technology and market dynamics. Finally, consulting with a qualified financial advisor is recommended before making any investment decisions.

Illustrative Data Representation (Table): Bitcoin Price 2025 January

Predicting the price of Bitcoin is inherently speculative, as numerous factors influence its value. The following table presents hypothetical price scenarios for January 2025, illustrating the range of possibilities based on differing market conditions. It’s crucial to remember that these are educated guesses, not guarantees. Actual prices may deviate significantly.

This table uses a simplified model to demonstrate the concept of price prediction based on various scenarios. Real-world prediction models would incorporate far more complex data and variables.

Bitcoin Price Predictions for January 2025

| Scenario | Predicted Price (USD) | Probability | Rationale |

|---|---|---|---|

| Bullish | $150,000 | 20% | Widespread adoption by institutions, positive regulatory developments, and continued technological advancements drive significant price increases. This scenario mirrors the rapid growth seen in previous bull markets, albeit with a higher starting point. Consider the 2017 bull run as a comparable, though not directly analogous, example. |

| Neutral | $50,000 | 60% | Market consolidation and sideways trading characterize this scenario. Regulatory uncertainty and macroeconomic factors could limit significant price movements, resulting in a relatively stable price range. This scenario aligns with historical periods of Bitcoin price stability following significant bull or bear markets. |

| Bearish | $20,000 | 20% | Negative regulatory actions, a global economic downturn, or a major security breach could trigger a significant price drop. This scenario reflects the potential for substantial corrections, similar to the bear market of 2018-2020. The prolonged bear market following the 2017 peak serves as a relevant case study, though the specific triggers and impacts might differ. |

Illustrative Data Representation (Image Description)

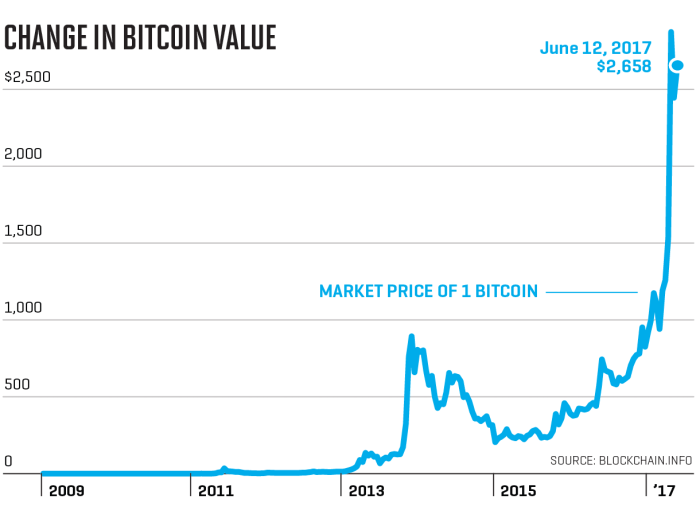

This section describes a hypothetical chart depicting Bitcoin’s price fluctuation from the present day to January 2025, considering various market scenarios. The chart’s design helps visualize potential price movements under different economic and market conditions. It’s important to remember that this is a hypothetical representation and actual price movements may differ significantly.

The chart employs a line graph format, with the horizontal (x-axis) representing time, spanning from the current date to January 2025, marked with monthly intervals. The vertical (y-axis) represents the Bitcoin price in US dollars, ranging from a conservative low of $10,000 to an optimistic high of $150,000. Three distinct lines illustrate different price trajectories.

Bitcoin Price Trajectories

The first line, colored blue, represents a bearish market scenario. This line shows a relatively flat trajectory, with gradual price declines interspersed with short-lived rallies, culminating in a price around $20,000 in January 2025. This scenario reflects a prolonged period of economic uncertainty and regulatory headwinds impacting investor confidence. For example, a major global recession or significant regulatory crackdown could contribute to such a bearish trend. The low point on this line might correspond to a period of intense selling pressure following a major negative news event.

The second line, colored green, represents a neutral market scenario. This line depicts a more stable price movement, fluctuating within a range of $30,000 to $60,000 throughout the period. This scenario suggests a market characterized by moderate growth and consolidation, with price fluctuations driven by typical market volatility. This could be similar to the price action seen in previous years where Bitcoin experienced periods of both upward and downward momentum without significant dramatic swings. The peak and trough points on this line would reflect periods of heightened buying and selling pressure, respectively, influenced by news and overall market sentiment.

The third line, colored red, represents a bullish market scenario. This line shows a significant upward trend, starting with a gradual increase followed by a steeper incline, reaching a price of approximately $100,000 by January 2025. This scenario assumes positive market sentiment driven by factors such as widespread adoption, institutional investment, and positive regulatory developments. This scenario could mirror the Bitcoin price surge seen in late 2020 and early 2021, driven by increased institutional interest and growing public awareness. The steepest incline on this line would likely coincide with a period of significant positive news or events that drastically boosted investor confidence.