Analyzing Plan B’s Track Record: Bitcoin Price 2025 Plan B

Plan B, a pseudonymous analyst known for his Bitcoin price models, has gained a significant following due to his publicly shared predictions. Analyzing his track record provides valuable insight into the complexities of Bitcoin price forecasting and the limitations of relying solely on on-chain metrics. While his models have generated considerable discussion, it’s crucial to objectively evaluate their accuracy and understand the factors influencing Bitcoin’s price beyond his predictions.

Accuracy of Plan B’s Bitcoin Price Predictions

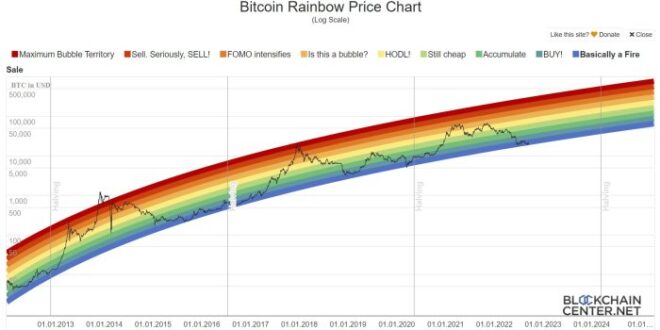

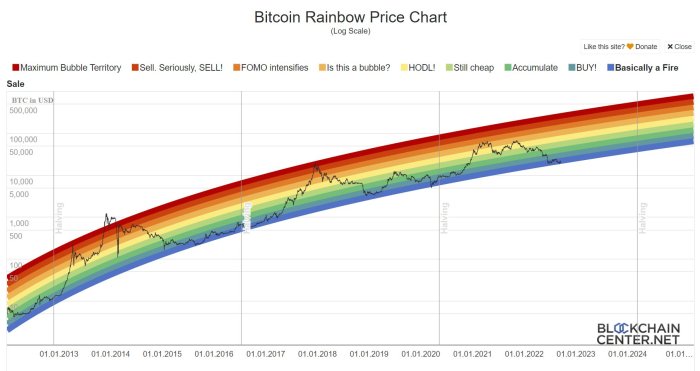

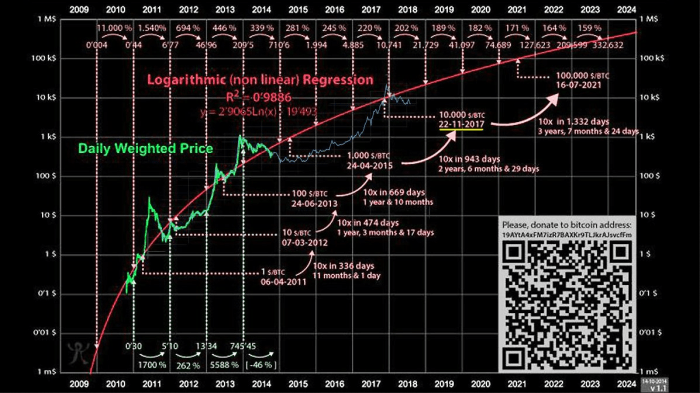

Plan B’s models, primarily based on on-chain data like the stock-to-flow (S2F) model, have had periods of both remarkable accuracy and significant deviation from actual market performance. His predictions, often presented as price targets for specific timeframes, have been widely cited and debated within the cryptocurrency community. It’s important to remember that these models are not foolproof and are subject to various external and internal factors.

Instances of Accurate and Inaccurate Predictions

- Accurate Predictions: Some of Plan B’s earlier predictions, particularly those aligning with periods of relatively stable market conditions and consistent Bitcoin adoption, showed remarkable alignment with the actual price. For example, certain price ranges predicted within specific timeframes were, at least partially, realized. However, pinpointing precise dates for price targets has proven consistently challenging.

- Significant Deviations: Other instances saw considerable divergence between Plan B’s predictions and actual market performance. These deviations were often linked to unforeseen events like regulatory crackdowns, macroeconomic shifts, or significant market manipulations. The rapid price swings characteristic of the cryptocurrency market made accurate long-term predictions extremely difficult, even with sophisticated models.

Limitations of Using On-Chain Data for Price Prediction

Solely relying on on-chain data for Bitcoin price prediction presents inherent limitations. While on-chain metrics like the stock-to-flow ratio can provide insights into supply dynamics, they often fail to account for the multitude of external factors that influence price. These models often assume a degree of market rationality and predictable behavior that doesn’t always hold true in the volatile cryptocurrency market. They struggle to account for unpredictable events that impact investor sentiment and market liquidity.

Impact of External Factors on Bitcoin’s Price

Numerous external factors significantly impact Bitcoin’s price, often overshadowing the influence of on-chain metrics.

- Regulatory Actions: Government regulations and policies concerning cryptocurrencies can dramatically influence investor confidence and trading volumes, leading to price fluctuations that are difficult to predict using purely on-chain data.

- Macroeconomic Conditions: Global economic events, such as inflation, recessionary fears, or shifts in monetary policy, often have a substantial impact on Bitcoin’s price as investors seek alternative assets or adjust their risk appetite.

- Market Sentiment and Media Coverage: Public perception, media narratives, and prominent figures’ opinions about Bitcoin can heavily influence investor sentiment, triggering price rallies or sell-offs that are not directly reflected in on-chain data.

- Technological Developments: Significant technological advancements within the Bitcoin ecosystem or competing cryptocurrencies can influence the market’s perception of Bitcoin’s long-term value and potential, leading to price adjustments.

Factors Affecting Bitcoin Price in 2025

Predicting Bitcoin’s price in 2025 is inherently challenging, given the cryptocurrency’s volatility and susceptibility to a multitude of interconnected factors. However, by analyzing key macroeconomic trends, regulatory landscapes, technological advancements, and institutional involvement, we can construct a framework for understanding potential price drivers. This analysis will explore the interplay of these elements, offering a nuanced perspective on the potential price trajectory.

Macroeconomic Factors

Macroeconomic conditions significantly influence Bitcoin’s price. Inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation. High inflation erodes the purchasing power of fiat currencies, making alternative stores of value like Bitcoin more attractive. Conversely, periods of low inflation might reduce the demand for Bitcoin as investors seek higher returns in traditional markets. Interest rate adjustments by central banks also play a crucial role. Rising interest rates typically increase the opportunity cost of holding Bitcoin, potentially leading to price declines as investors shift funds to higher-yielding assets. Conversely, low interest rates can stimulate investment in riskier assets like Bitcoin. Global economic growth influences investor sentiment; strong economic growth often correlates with increased risk appetite, potentially benefiting Bitcoin’s price. Conversely, economic downturns can trigger a flight to safety, negatively impacting Bitcoin’s price.

Regulatory Changes and Government Policies, Bitcoin Price 2025 Plan B

Government regulations and policies significantly impact Bitcoin’s price. Favorable regulatory frameworks, such as clear guidelines on taxation and licensing, can increase institutional adoption and investor confidence, potentially boosting the price. Conversely, restrictive regulations, including outright bans or excessive taxation, can suppress price growth. The evolving regulatory landscape across different jurisdictions presents a complex picture. For instance, a country adopting a pro-Bitcoin stance could attract investment and increase demand, whereas a crackdown in a major market could trigger a price correction. The level of regulatory clarity and consistency is also critical; uncertainty often leads to volatility.

Institutional Adoption

The increasing involvement of institutional investors is a key factor shaping Bitcoin’s price trajectory. Large-scale investments from corporations, hedge funds, and other institutional players can inject significant liquidity into the market, driving price increases. This increased participation also enhances Bitcoin’s legitimacy and reduces its perception as a solely speculative asset. Examples such as MicroStrategy’s substantial Bitcoin holdings demonstrate the growing confidence of institutional players. However, the extent of institutional adoption remains a significant unknown, making its future impact on price difficult to precisely quantify.

Emerging Technologies and Trends

Technological advancements and emerging trends can also significantly influence Bitcoin’s price. The development of layer-2 scaling solutions, for example, could enhance Bitcoin’s transaction speed and reduce fees, potentially making it more attractive for everyday use. The integration of Bitcoin with decentralized finance (DeFi) protocols could unlock new use cases and increase demand. Conversely, the emergence of competing cryptocurrencies with superior technology could potentially divert investment away from Bitcoin. Furthermore, advancements in quantum computing pose a long-term threat, though the timeline for such a threat remains uncertain.

Interplay of Factors: A Visual Representation

Imagine a multifaceted pyramid. At the base are the macroeconomic factors (inflation, interest rates, global economic growth), providing the foundational support for Bitcoin’s price. Above this base, we see two more layers: Regulatory Changes and Government Policies, and Institutional Adoption. These layers interact with and influence each other, affecting the stability and direction of the pyramid. At the apex of the pyramid sits Bitcoin’s price, directly influenced by the combined weight and interplay of the lower layers. Emerging technologies and trends act as external forces, potentially shifting the entire pyramid through their impact on the underlying layers. A strong base (favorable macro conditions) and supportive upper layers (positive regulation, high institutional adoption) will generally lead to a higher apex (higher Bitcoin price), while negative influences on the lower layers will exert downward pressure on the price.

Risks and Opportunities for Bitcoin Investors in 2025

Plan B’s Bitcoin price predictions, while offering exciting potential returns, also present significant risks. Investors must carefully weigh these factors against their own risk tolerance and financial goals before making any investment decisions. Understanding both the upside and downside potential is crucial for informed participation in the Bitcoin market.

Key Risks Associated with Bitcoin Investment Based on Plan B’s Projections

Plan B’s model, while influential, is not a guarantee of future price movements. Several factors could significantly impact Bitcoin’s price trajectory, potentially falling short of or exceeding Plan B’s predictions. These risks include regulatory uncertainty, macroeconomic shifts (like inflation or recession), technological disruptions within the cryptocurrency space (competing cryptocurrencies or improved blockchain technologies), and the ever-present risk of market manipulation and volatility. The inherent volatility of Bitcoin, even with a bullish forecast, necessitates a conservative approach for many investors. For example, a sudden negative regulatory announcement could trigger a sharp price drop, regardless of long-term predictions. Similarly, a global economic downturn could reduce investor appetite for risky assets like Bitcoin, irrespective of Plan B’s model.

Potential Opportunities for Bitcoin Investors Based on Plan B’s Price Predictions

If Plan B’s projections are accurate, or even partially realized, substantial returns are possible for investors who enter the market strategically. A significant price appreciation could lead to considerable capital gains. Opportunities also exist in diversifying investments within the crypto space, exploring Bitcoin-related services (such as mining or lending), and leveraging the potential of decentralized finance (DeFi) protocols built on the Bitcoin blockchain. Consider, for example, an investor who purchased Bitcoin at a relatively low price point and held it through a period of significant price appreciation as predicted by Plan B’s model; their returns could be exceptionally high. However, it’s crucial to remember that this is a high-risk, high-reward scenario.

Comparison of Different Bitcoin Investment Strategies Considering Plan B’s Forecast

Investors can adopt various strategies, each carrying different risk profiles. A long-term “hodling” strategy, based on the belief in Bitcoin’s long-term value, aligns well with Plan B’s model, but requires substantial risk tolerance and patience. Dollar-cost averaging (DCA), where investors invest fixed amounts at regular intervals regardless of price fluctuations, reduces risk by mitigating the impact of market volatility. Short-term trading, aiming to profit from short-term price movements, is extremely risky and is generally not compatible with Plan B’s long-term perspective. For instance, a long-term investor might allocate a portion of their portfolio to Bitcoin based on Plan B’s predictions, while a more risk-averse investor might use DCA to gradually increase their Bitcoin holdings over time.

Influence of Risk Tolerance and Investment Goals on Investment Decisions

Risk tolerance is paramount. Conservative investors with lower risk tolerance should limit their Bitcoin investment to a small portion of their overall portfolio, perhaps using DCA. Aggressive investors with higher risk tolerance might allocate a larger percentage, potentially taking on more risk for potentially higher rewards. Investment goals also play a crucial role. Investors aiming for long-term wealth accumulation might find Plan B’s model appealing, while those needing short-term returns should avoid Bitcoin’s inherent volatility. For example, an investor saving for retirement might allocate a small percentage to Bitcoin based on Plan B’s long-term outlook, while an investor needing funds for a down payment on a house would likely avoid such a high-risk investment.

Actionable Steps for Bitcoin Investors Based on Plan B’s Predictions and Risk Assessments

Before making any investment, thorough research is crucial. Understanding Bitcoin’s underlying technology, market dynamics, and associated risks is essential. Diversification is key; avoid investing all your funds in Bitcoin. Develop a clear investment strategy aligned with your risk tolerance and financial goals. Regularly review and adjust your investment strategy based on market conditions and your own circumstances. Seek advice from qualified financial professionals.

- Conduct thorough due diligence before investing in Bitcoin.

- Diversify your portfolio; do not put all your eggs in one basket.

- Establish a clear investment strategy based on your risk tolerance and financial goals.

- Monitor market conditions and adjust your strategy as needed.

- Consult with a qualified financial advisor before making significant investment decisions.

Frequently Asked Questions (FAQ) about Bitcoin Price 2025 and Plan B

This section addresses common queries regarding Plan B’s Bitcoin price predictions for 2025, their accuracy, and the broader factors influencing Bitcoin’s price trajectory. Understanding these points is crucial for informed investment decisions.

Plan B’s Bitcoin Price Prediction Model

Plan B’s Bitcoin price predictions are primarily based on the stock-to-flow (S2F) model. This model posits a correlation between Bitcoin’s scarcity (stock) and its price (flow). It essentially argues that as the rate of new Bitcoin creation slows down (decreasing flow), and the existing supply remains relatively constant (stock), the price should increase due to increasing scarcity. Plan B uses historical data and various metrics, including the halving events, to project future price movements. The model’s simplicity is one of its strengths, making it easily understandable, but its reliance on historical correlations is also a potential weakness.

Accuracy of Plan B’s Past Predictions

Plan B’s past predictions have had mixed results. While some of his earlier predictions aligned reasonably well with the actual price movements, particularly in the period leading up to and following the 2021 bull run, other predictions have fallen short. It’s important to note that these are predictions, not guarantees. The cryptocurrency market is highly volatile and susceptible to unforeseen events that can significantly impact prices, rendering even the most sophisticated models less accurate. For example, his prediction for Bitcoin’s price in late 2021 proved inaccurate due to several macro-economic factors and regulatory uncertainty.

Key Factors Influencing Bitcoin’s Price in 2025

Several factors will likely influence Bitcoin’s price in 2025. These include macroeconomic conditions (inflation, interest rates, economic growth), regulatory developments (adoption of Bitcoin as legal tender or increased regulation), technological advancements (layer-2 scaling solutions, improved security), and overall market sentiment (investor confidence, media coverage). The adoption rate by institutional investors and mainstream users will also play a significant role. For instance, increased institutional adoption could lead to higher demand and price appreciation, whereas negative regulatory changes could dampen investor enthusiasm and cause price declines.

Risks and Opportunities for Bitcoin Investors in 2025

Investing in Bitcoin carries significant risks. Price volatility is a major concern, with substantial price swings possible in short periods. Regulatory uncertainty, technological vulnerabilities, and market manipulation are also potential risks. However, opportunities exist for those willing to tolerate the risk. Bitcoin’s potential as a store of value, a hedge against inflation, and a decentralized alternative to traditional financial systems could lead to significant long-term price appreciation. Successful navigation of this market requires careful risk management, diversification, and a long-term investment horizon. Examples of successful long-term Bitcoin investors include early adopters who held their investments through market cycles.

Comparison of Plan B’s Model to Other Bitcoin Price Forecasts

Plan B’s S2F model is just one of many approaches used to forecast Bitcoin’s price. Other models incorporate factors like on-chain metrics, network growth, and sentiment analysis. These models often produce differing predictions, highlighting the inherent uncertainty in predicting cryptocurrency prices. It’s crucial to remember that no model can perfectly predict future price movements. Comparing multiple forecasts can provide a more nuanced understanding of the potential price range, though it’s not a guarantee of accuracy. Many analysts, for example, use a combination of quantitative and qualitative analysis to form their predictions, offering a more comprehensive perspective than a single model.