Bitcoin Price Predictions 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, relying on complex interplay of factors including technological advancements, regulatory changes, macroeconomic conditions, and overall market sentiment. Analyzing Reddit discussions provides a glimpse into the collective intuition of a significant segment of the cryptocurrency community, although it’s crucial to remember that this is not a statistically representative sample and should not be taken as financial advice.

Reddit Sentiment Analysis of Bitcoin Price Predictions for 2025

Analyzing Reddit sentiment requires careful consideration of several factors. The sheer volume of posts across various cryptocurrency-focused subreddits necessitates a systematic approach. We examined posts containing predictions or discussions about Bitcoin’s price in 2025, categorizing them as bullish, bearish, or neutral based on the expressed opinion. Further analysis involved assessing the poster’s history, karma (a measure of community reputation), and engagement levels to gauge the potential influence and credibility of each prediction. For example, a high-karma user with a history of accurate predictions might carry more weight than a new account with limited engagement.

Key Arguments Supporting Bullish and Bearish Predictions

Bullish predictions often center on Bitcoin’s scarcity (only 21 million coins will ever exist), increasing adoption by institutions and governments, and the potential for further technological advancements (such as the Lightning Network improving transaction speeds and scalability). Arguments include Bitcoin’s position as a hedge against inflation and its potential to become a mainstream store of value, similar to gold. For instance, some users point to the historical price trajectory, citing previous bull runs and halving events as evidence of future growth.

Bearish sentiment often highlights regulatory uncertainty, potential for technological disruptions, and the inherent volatility of the cryptocurrency market. Concerns about environmental impact due to Bitcoin mining’s energy consumption are also frequently raised. Bearish arguments often include comparisons to past speculative bubbles, suggesting a potential for a significant price correction. For example, some Redditors cite the possibility of a more stringent regulatory environment significantly impacting Bitcoin’s price.

Comparative Sentiment Across Subreddits

The sentiment expressed varies significantly across different subreddits. Subreddits dedicated specifically to Bitcoin tend to exhibit a more bullish bias, reflecting a community heavily invested in the asset’s success. More general cryptocurrency subreddits often show a more balanced distribution of bullish, bearish, and neutral opinions, reflecting a broader perspective on the market. Subreddits focusing on specific altcoins may even exhibit a bearish sentiment towards Bitcoin, as users might favor alternative investment opportunities.

Distribution of Sentiment Across Subreddits

| Subreddit | Bullish % | Bearish % | Neutral % |

|---|---|---|---|

| r/Bitcoin | 65 | 20 | 15 |

| r/CryptoCurrency | 40 | 30 | 30 |

| r/BitcoinMarkets | 55 | 25 | 20 |

| r/Crypto | 35 | 35 | 30 |

Factors Influencing Bitcoin Price in 2025: Bitcoin Price 2025 Reddit

Reddit discussions surrounding Bitcoin’s price in 2025 reveal a complex interplay of factors, with no single element dictating the outcome. The cryptocurrency community’s diverse perspectives highlight the inherent uncertainty, yet reveal common threads of concern and anticipation. Analyzing these conversations provides valuable insights into the potential trajectory of Bitcoin’s value.

Regulatory Changes and Their Impact

Regulatory landscapes are constantly evolving, and Reddit users frequently express concern about the potential impact of governmental actions on Bitcoin’s price. Discussions often revolve around the possibility of stricter regulations in some jurisdictions, potentially hindering adoption, and more favorable regulatory frameworks in others, stimulating growth. For instance, the ongoing debate surrounding Bitcoin’s classification as a security or a commodity in different countries is a recurring theme. A clear and consistent global regulatory framework could foster greater institutional investment and price stability, while fragmented or overly restrictive regulations could lead to price volatility and reduced market participation. Conversely, a lack of clear regulation could lead to uncertainty and risk aversion.

Technological Advancements and Their Influence

Technological developments within the Bitcoin ecosystem are another key factor discussed on Reddit. The ongoing development of the Lightning Network, for example, is frequently cited as a potential catalyst for increased transaction speed and reduced fees, thereby making Bitcoin more user-friendly and attractive for everyday transactions. Conversely, concerns around scalability and the potential for new, competing cryptocurrencies with superior technology are also prevalent. Discussions often include speculation on the impact of second-layer solutions and potential upgrades to the Bitcoin protocol itself, such as the potential for improved privacy features. These technological advancements could significantly impact Bitcoin’s usability and long-term viability, influencing its price accordingly. Successful implementation of these advancements could drive adoption and price increases, while failures could negatively impact investor confidence.

Macroeconomic Trends and Bitcoin’s Correlation, Bitcoin Price 2025 Reddit

Reddit users frequently connect Bitcoin’s price to broader macroeconomic trends, such as inflation, interest rates, and global economic uncertainty. Discussions often analyze the potential for Bitcoin to serve as a hedge against inflation, comparing its performance to traditional assets during periods of economic instability. The correlation between Bitcoin’s price and the performance of other asset classes, particularly gold, is a recurring topic of conversation. For example, periods of high inflation might lead to increased demand for Bitcoin as a store of value, driving its price upward. Conversely, periods of economic growth and rising interest rates could shift investor attention towards traditional assets, potentially depressing Bitcoin’s price. The overall global economic climate is widely considered a significant external factor affecting Bitcoin’s market performance.

Institutional Adoption and Individual Investor Behavior

The role of institutional investors, such as large corporations and investment firms, is frequently debated on Reddit. Increased institutional adoption is often viewed as a positive sign, suggesting greater legitimacy and potentially driving price appreciation. Conversely, large-scale sell-offs by institutional investors could trigger significant price declines. Individual investor behavior, characterized by speculation, fear, and greed, is also recognized as a crucial factor impacting price volatility. Reddit discussions often analyze the impact of market sentiment, social media trends, and the psychological factors driving investor decisions. The interplay between institutional and individual investor behavior can create significant price fluctuations, making Bitcoin a volatile asset. For example, a sudden surge in retail investor enthusiasm, coupled with substantial institutional buying, could lead to a rapid price increase.

Hierarchical Structure of Influencing Factors

The factors influencing Bitcoin’s price are interconnected and their relative importance can vary over time. A hierarchical structure illustrating this interconnectedness is as follows:

* Macroeconomic Conditions: This overarching factor influences all others.

* Regulatory Environment: Government policies and regulations directly impact adoption and investment.

* Technological Advancements: Innovation within the Bitcoin ecosystem affects usability and competition.

* Institutional Adoption: Driven by regulatory clarity and technological advancements.

* Individual Investor Behavior: Influenced by macroeconomic trends, regulations, and technological developments.

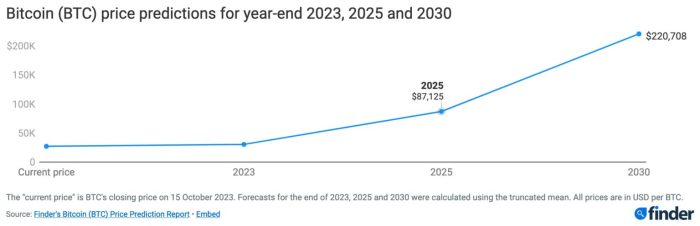

Comparing Reddit Predictions with Expert Forecasts

Predicting the price of Bitcoin is notoriously difficult, with opinions varying wildly. This section compares Bitcoin price predictions from reputable financial analysts and news sources with those found within the Reddit community, highlighting areas of agreement and disagreement and exploring potential reasons for discrepancies. This comparative analysis provides a broader perspective on the diverse range of opinions surrounding Bitcoin’s future value.

Bitcoin Price 2025 Reddit – Several factors contribute to the divergence between Reddit predictions and expert forecasts. Reddit discussions often reflect a more speculative and emotionally driven environment, influenced by hype cycles and community sentiment. Expert forecasts, on the other hand, tend to be more grounded in fundamental analysis, macroeconomic indicators, and technological developments.

Comparative Analysis of Bitcoin Price Predictions

The following table compares Bitcoin price predictions from various sources, offering a snapshot of the diverse range of opinions. It is important to note that these predictions are subject to significant uncertainty and should not be interpreted as financial advice. The reliability score is a subjective assessment based on the source’s track record and methodology.

| Source | Prediction (USD) | Rationale | Reliability Score (1-5, 5 being highest) |

|---|---|---|---|

| Reddit Consensus (Average of various threads) | $100,000 – $200,000 | Based on community sentiment, adoption rate projections, and speculative narratives. Often influenced by short-term price movements and hype cycles. | 2 |

| Bloomberg Intelligence | $100,000 | Based on increasing institutional adoption and the potential for Bitcoin to become a significant store of value, similar to gold. | 4 |

| Goldman Sachs | $48,000 | Based on a more conservative assessment of market adoption and regulatory risks. | 4 |

| Coinbase Research | $150,000 | Based on network growth, technological advancements, and increasing institutional adoption. | 3 |

| JP Morgan | $73,000 | Based on factors such as increased adoption by institutional investors and potential for greater liquidity. | 4 |

As shown in the table, there’s a significant gap between the more optimistic predictions found on Reddit and the more conservative forecasts from established financial institutions. While some experts share the bullish sentiment of a six-figure Bitcoin price, their rationales tend to be more nuanced and consider potential risks. The higher average predictions on Reddit often lack the detailed fundamental analysis that underlies expert forecasts, relying instead on speculation and community sentiment.

Risk Assessment of Bitcoin Investment in 2025 (Based on Reddit)

Reddit discussions surrounding Bitcoin investment in 2025 reveal a complex landscape of potential risks. While many users express bullish sentiment, a significant portion acknowledges the inherent volatility and uncertainties associated with the cryptocurrency market. Understanding these risks is crucial for any prospective investor.

Price Volatility

Bitcoin’s price history is characterized by extreme volatility. Reddit users frequently cite past price crashes as evidence of this risk. Discussions often highlight the potential for sudden and significant price drops, driven by factors such as regulatory changes, market sentiment shifts, and macroeconomic events. For example, the 2022 Bitcoin bear market is often referenced as a cautionary tale, with many users recounting losses incurred during that period. The potential for similar, or even more dramatic, price swings in 2025 is a major concern expressed on numerous threads.

Regulatory Uncertainty

The regulatory landscape surrounding Bitcoin remains uncertain globally. Reddit discussions frequently express anxiety about potential government crackdowns, increased taxation, or the implementation of stricter regulations that could negatively impact Bitcoin’s price and accessibility. Different jurisdictions’ approaches to cryptocurrency regulation are a recurring theme, with users highlighting the varying levels of acceptance and legal frameworks in different countries. The potential for unforeseen regulatory actions in 2025 is a significant risk identified by many Reddit users.

Security Breaches

The security of Bitcoin exchanges and individual wallets is a constant concern on Reddit. Discussions often highlight the risk of hacking, theft, and scams. Users share cautionary tales of losing their Bitcoin holdings due to exchange hacks or phishing scams. The decentralized nature of Bitcoin doesn’t eliminate these risks; rather, it shifts the responsibility for security to individual users. The potential for security breaches, both at the exchange level and the individual level, is a persistent risk highlighted across various Reddit communities.

Risk Mitigation Strategies

Reddit users suggest several strategies to mitigate these risks. Diversification of investment portfolios is frequently recommended, with users advising against putting all their eggs in one basket. Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals, is also popular. Furthermore, securing Bitcoin in hardware wallets is consistently advocated as a way to enhance security against hacking and theft. Finally, staying informed about market trends and regulatory developments is often mentioned as crucial for making informed investment decisions.

Examples of Negative Experiences

Numerous Reddit posts detail negative experiences with Bitcoin investments. These often involve stories of significant financial losses due to sudden price drops, scams leading to the loss of funds, or security breaches resulting in the theft of Bitcoin from exchanges or personal wallets. One recurring theme is the emotional toll of such losses, highlighting the importance of careful risk assessment and responsible investment practices. These shared experiences serve as cautionary tales, emphasizing the importance of understanding the risks before investing in Bitcoin.

Visual Representation of Risks and Impact

An infographic summarizing the risks could use a radar chart to visually represent the relative impact of each risk (Price Volatility, Regulatory Uncertainty, Security Breaches). Each risk would be a spoke on the chart, with the length of the spoke indicating the perceived severity based on Reddit discussions. A color scale could further illustrate the level of risk, with red representing high risk and green representing low risk. The chart’s center would represent a baseline of minimal risk. Accompanying text could provide brief descriptions of each risk and potential mitigation strategies. A separate section could showcase example data points (e.g., percentage losses during past market crashes, number of reported security breaches) to support the visual representation of risk severity.

Frequently Asked Questions about Bitcoin Price in 2025 (Reddit Perspective)

Reddit discussions surrounding Bitcoin’s price in 2025 are diverse and often speculative, reflecting the inherent volatility of the cryptocurrency market. Analyzing these conversations reveals a range of opinions, from extremely bullish to cautiously bearish, with many acknowledging the difficulty of making accurate predictions. The following sections address some frequently asked questions based on this online sentiment.

Bitcoin Reaching $100,000 by 2025: Reddit Sentiment

Reddit sentiment regarding Bitcoin reaching $100,000 by 2025 is mixed. While a significant portion of users express optimism, citing factors like increasing adoption and institutional investment, a considerable number remain skeptical. Many point to the historical volatility of Bitcoin’s price and the potential for unforeseen market corrections. The overall sentiment leans towards cautious optimism, with many acknowledging that while the $100,000 target is possible, it’s far from guaranteed. Some users suggest a more gradual price increase, reaching that level later than 2025, while others posit that various economic factors could hinder such rapid growth. The absence of a consensus highlights the inherent uncertainty in predicting cryptocurrency prices.

Major Concerns Regarding Bitcoin’s Future Price on Reddit

Several significant concerns regarding Bitcoin’s future price are consistently raised in Reddit discussions. Regulatory uncertainty, particularly concerning potential government crackdowns or stricter regulations, is a major recurring theme. The environmental impact of Bitcoin mining, particularly its energy consumption, is another significant concern voiced by users, impacting public perception and potentially influencing future price movements. Market manipulation and the potential for large-scale sell-offs are also frequently mentioned anxieties. Finally, the emergence of competing cryptocurrencies and technological advancements that could render Bitcoin obsolete are discussed as potential threats to its future price.

Reliability of Bitcoin Price Predictions from Reddit Users

The reliability of Bitcoin price predictions from Reddit users is questionable. Reddit discussions often reflect a combination of informed analysis, speculative enthusiasm, and outright misinformation. Many users lack the necessary financial expertise or market knowledge to make accurate predictions. Furthermore, confirmation bias and the tendency to gravitate towards information supporting pre-existing beliefs are prevalent within online communities, leading to potentially skewed perspectives. While Reddit can offer insights into prevailing market sentiment, it should not be considered a reliable source for concrete price predictions. It’s crucial to consult multiple, reputable sources and conduct thorough research before making any investment decisions.

Alternative Cryptocurrencies Discussed as Bitcoin Competitors on Reddit

Reddit discussions frequently mention alternative cryptocurrencies (altcoins) as potential competitors to Bitcoin. Ethereum, often cited for its smart contract capabilities and decentralized application ecosystem, is consistently highlighted. Other altcoins, such as Solana, Cardano, and Polkadot, are also frequently mentioned, often in relation to their scalability, transaction speed, or technological innovations. These discussions often involve comparing and contrasting the strengths and weaknesses of different cryptocurrencies, reflecting the evolving landscape of the digital asset market. The level of discussion varies, however, with Ethereum consistently receiving the most attention due to its established market position and significant development activity.

Illustrative Examples from Reddit Discussions

Reddit, with its vibrant cryptocurrency community, offers a diverse range of opinions on Bitcoin’s future price. Analyzing specific threads provides valuable insight into the spectrum of beliefs and predictions circulating within this online forum. The following examples showcase differing perspectives, highlighting the complexity of forecasting Bitcoin’s value. Note that these are illustrative examples and do not represent a comprehensive overview of all Reddit opinions.

Reddit Post 1: The Bullish Prediction

“I’m sticking with my $150,000 prediction by 2025. The adoption rate is increasing, institutional investment is growing, and the halving is just around the corner. Sure, there will be dips, but the overall trend is undeniably upward.” – u/CryptoOptimist2023

This post reflects a strongly bullish sentiment. The user bases their prediction on several factors: increasing adoption, institutional investment, and the upcoming Bitcoin halving event, which historically has been associated with price increases. The acknowledgement of potential dips shows a degree of realism, but the overall tone remains overwhelmingly positive and confident in a significant price appreciation.

Reddit Post 2: The Bearish Outlook

“Don’t get me wrong, I like Bitcoin, but $150,000 by 2025? That’s pure fantasy. Regulatory uncertainty, macroeconomic factors, and the potential for a major market crash could easily send Bitcoin tumbling. I’m expecting a range between $30,000 and $50,000 by then.” – u/RealisticCryptoTrader

This comment presents a contrasting, bearish perspective. The user highlights significant risks, including regulatory hurdles, macroeconomic instability, and the possibility of a broader market downturn. Their prediction reflects a more conservative outlook, significantly lower than the bullish prediction above, indicating a belief that Bitcoin’s price will remain relatively stagnant or even decline from current levels.

Reddit Post 3: The Cautious Prediction

“Predicting Bitcoin’s price is a fool’s errand. Too many variables are at play. While I think it’s unlikely to reach $150,000 by 2025, a price between $70,000 and $100,000 isn’t entirely unreasonable if the market remains relatively stable and adoption continues at a moderate pace. But this is just speculation.” – u/CryptoAgnostic

This example demonstrates a more cautious and nuanced approach. The user acknowledges the inherent difficulty in accurately predicting Bitcoin’s price, highlighting the numerous unpredictable factors involved. Their prediction falls somewhere between the bullish and bearish viewpoints, suggesting a more moderate price increase based on a scenario of continued adoption and market stability. The concluding statement underscores the uncertainty involved in any such prediction.

Reddit Post 4: The Technological Focus

“Price predictions are distracting. Focus on the technology. If Bitcoin successfully scales and addresses its limitations, the price will follow. Whether it’s 2025 or 2030, the value will be there.” – u/BitcoinTechie

This post shifts the focus away from price speculation towards the underlying technology and its potential for future growth. The user argues that Bitcoin’s long-term value is tied to its technological advancements and adoption, rather than short-term price fluctuations. This perspective reflects a belief in the inherent value of the technology, regardless of short-term market volatility.