Bitcoin Price Predictions for 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, as numerous intertwined factors influence its volatility. However, by analyzing past trends, current market conditions, and potential future developments, we can construct a range of plausible scenarios. These predictions should be viewed as informed speculation, not financial advice.

Potential Bitcoin Price Ranges for 2025

Several factors contribute to the wide range of potential Bitcoin prices in 2025. A bullish market, characterized by widespread adoption and positive regulatory developments, could lead to significantly higher prices. Conversely, a bearish market, marked by regulatory crackdowns or a broader economic downturn, could result in lower prices. A neutral scenario reflects a continuation of current trends, with moderate price fluctuations. We can consider a range spanning from a conservative estimate to a highly optimistic one. For instance, a conservative estimate might place Bitcoin’s price somewhere between $50,000 and $100,000 USD, while a highly bullish scenario could see it reach $250,000 USD or even higher. Conversely, a pessimistic scenario might see the price fall to below $30,000 USD.

Factors Influencing Bitcoin’s Price in 2025

Several key factors will significantly impact Bitcoin’s price trajectory in 2025. These include regulatory clarity (or lack thereof) in major global economies, the pace of institutional and retail adoption, technological advancements in the Bitcoin ecosystem (such as the Lightning Network’s scalability improvements), and broader macroeconomic conditions (like inflation, interest rates, and global economic growth). For example, widespread regulatory acceptance could unlock significant institutional investment, driving price increases. Conversely, stringent regulations could stifle growth and suppress prices. Similarly, a global recession could negatively impact investor sentiment and Bitcoin’s price.

Impact of Global Events on Bitcoin’s Price

Major global events can have a profound impact on Bitcoin’s price. Geopolitical instability, for example, often leads investors to seek safe haven assets, potentially increasing demand for Bitcoin. Conversely, a major global economic crisis could lead to a sell-off, driving the price down. The outcome of any significant global event is uncertain, making it difficult to predict its precise effect on Bitcoin’s price. However, historically, Bitcoin has demonstrated a capacity to act as a hedge against inflation and geopolitical uncertainty, potentially influencing its price in 2025.

Comparison of Bitcoin Price Prediction Models, Bitcoin Price 2025 Usd

Predicting future Bitcoin prices involves numerous assumptions and methodologies. Different models, using various inputs and algorithms, will yield varying results. The table below compares some potential models and their underlying assumptions, highlighting the inherent uncertainty in price prediction.

| Model | Assumptions | Predicted Price Range (USD) | Source/Methodology |

|---|---|---|---|

| Conservative Model | Slow adoption, moderate regulatory pressure, stable macroeconomic conditions | $50,000 – $100,000 | Based on historical price trends and conservative growth projections. |

| Neutral Model | Continued adoption, mixed regulatory landscape, moderate economic growth | $100,000 – $200,000 | Based on current market trends and average growth projections. |

| Bullish Model | Rapid adoption, positive regulatory developments, strong economic growth | $200,000 – $500,000+ | Based on optimistic adoption rates and significant institutional investment. |

| Bearish Model | Regulatory crackdowns, economic recession, negative investor sentiment | Below $30,000 | Based on scenarios involving significant negative market events. |

Factors Influencing Bitcoin’s Price

Bitcoin’s price is a complex interplay of various factors, making accurate prediction challenging. Understanding these influences is crucial for navigating the cryptocurrency market. These factors range from correlations with traditional assets to macroeconomic conditions and technological advancements.

Correlation with Other Assets

Bitcoin’s price often shows some correlation with other assets, although the strength and direction of these correlations can vary significantly over time. For instance, periods of high inflation or economic uncertainty can see investors flock to Bitcoin as a hedge against inflation, similar to how gold performs in such scenarios. Conversely, a strong US dollar can sometimes negatively impact Bitcoin’s price, as investors might shift funds into more stable assets. The relationship with other cryptocurrencies is also dynamic; a surge in the price of a major altcoin might draw investment away from Bitcoin, leading to a temporary dip. However, it’s important to remember that these correlations are not always consistent, and Bitcoin often behaves independently of traditional markets.

Macroeconomic Factors

Macroeconomic factors significantly influence Bitcoin’s price. High inflation, for example, can boost Bitcoin’s appeal as an inflation hedge, driving up demand and potentially its price. Conversely, rising interest rates, which increase the attractiveness of traditional investments like bonds, might lead to a decrease in Bitcoin’s value as investors seek higher returns in less volatile markets. Government regulations also play a substantial role; supportive regulations can increase investor confidence and boost the price, while restrictive measures can lead to price drops. The 2022 crypto winter, for instance, was partly fueled by rising interest rates and increased regulatory scrutiny.

Technological Developments

Technological advancements within the Bitcoin ecosystem directly affect its price. Successful scaling solutions, such as the Lightning Network, aim to improve transaction speed and reduce fees, making Bitcoin more practical for everyday use and potentially increasing its demand. The development of new applications built on Bitcoin’s blockchain, such as decentralized finance (DeFi) platforms or non-fungible token (NFT) marketplaces, can also generate excitement and drive up its price. Conversely, security vulnerabilities or technological setbacks could significantly damage investor confidence and depress the price.

Institutional vs. Retail Investor Influence

The participation of institutional investors and retail investors has differing effects on Bitcoin’s price volatility. Institutional investors, with their larger capital and more sophisticated trading strategies, tend to exert a stabilizing influence, mitigating short-term price swings. Their investments often signal confidence and can attract further investment. Retail investors, on the other hand, can be more susceptible to market sentiment and hype, leading to greater price volatility. FOMO (fear of missing out) and panic selling can contribute to significant price fluctuations. The 2021 Bitcoin bull run, for example, saw a substantial increase in both institutional and retail participation, leading to significant price increases, while subsequent market corrections showcased the impact of retail investor sentiment.

Bitcoin’s Long-Term Growth Potential: Bitcoin Price 2025 Usd

Bitcoin’s long-term growth potential is a subject of intense debate, fueled by its revolutionary technology and volatile price history. Understanding its past performance, comparing it to traditional assets, and analyzing its inherent characteristics are crucial to assessing its future trajectory. This section explores these aspects to provide a more comprehensive understanding of Bitcoin’s potential for sustained growth.

Bitcoin’s Historical Price Movements and Milestones

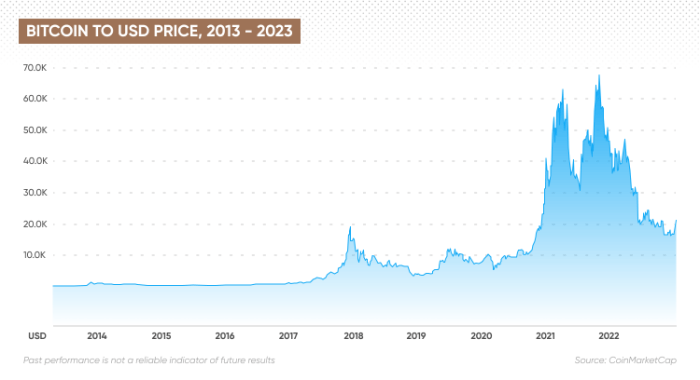

Analyzing Bitcoin’s price history reveals a pattern of significant growth punctuated by periods of sharp correction. The following timeline highlights key moments in Bitcoin’s journey:

- 2009: Bitcoin’s inception, with an initial value near zero.

- 2010: The first real-world transaction, where 10,000 BTC were used to purchase two pizzas, highlighting its early adoption and potential.

- 2011-2013: Early adoption and price volatility, with significant price increases followed by substantial drops. This period demonstrates Bitcoin’s inherent risk but also its potential for rapid appreciation.

- 2017: A significant bull market, pushing Bitcoin’s price to nearly $20,000, marking its entry into mainstream awareness.

- 2020-2021: Another bull run, reaching all-time highs above $60,000, demonstrating increasing institutional interest and adoption.

- 2022-Present: A period of price consolidation and correction, typical of a maturing asset class. This period reflects the inherent volatility of cryptocurrency markets, but also highlights its resilience.

Bitcoin’s Growth Potential Compared to Other Assets

Comparing Bitcoin’s potential to traditional assets like gold, stocks, and real estate reveals both similarities and differences. While gold has historically served as a store of value, its supply is not strictly limited, unlike Bitcoin. Stocks offer growth potential but are subject to company-specific risks. Real estate provides diversification and potential for rental income, but liquidity can be an issue. Bitcoin offers a unique combination of scarcity, decentralization, and potential for growth, though its volatility presents a higher risk profile compared to established assets. The long-term value proposition of Bitcoin is largely dependent on its continued adoption and the stability of the underlying blockchain technology.

Bitcoin’s Scarcity and Decentralized Nature

Bitcoin’s inherent scarcity, capped at 21 million coins, is a fundamental driver of its potential long-term value. This fixed supply contrasts sharply with fiat currencies, which are subject to inflationary pressures. Furthermore, its decentralized nature, operating on a public, immutable blockchain, eliminates the risk of manipulation by central authorities. This combination of scarcity and decentralization makes Bitcoin a compelling alternative to traditional financial systems and assets. The scarcity aspect creates a natural deflationary pressure, potentially driving up its value over time, while the decentralization aspect provides a level of security and trust that is not readily available in centralized systems.

Bitcoin’s Potential as a Mainstream Store of Value or Medium of Exchange

Bitcoin’s potential for mainstream adoption as a store of value or medium of exchange depends on several factors, including regulatory clarity, technological advancements, and widespread acceptance. While its volatility currently limits its widespread use as a medium of exchange, its growing acceptance as a store of value is evident in its increasing adoption by institutional investors. Further development of the Lightning Network and other second-layer scaling solutions could significantly improve transaction speeds and reduce fees, potentially paving the way for more widespread adoption as a medium of exchange. However, regulatory uncertainty remains a significant hurdle to overcome for wider mainstream adoption. The example of El Salvador adopting Bitcoin as legal tender demonstrates the potential, but also the challenges, associated with such a move.

Risks and Uncertainties Associated with Bitcoin

Investing in Bitcoin, while potentially lucrative, carries significant risks. Understanding these risks is crucial for making informed investment decisions and managing expectations. The inherent volatility, regulatory landscape, and environmental impact are key considerations.

Volatility and Price Fluctuations

Bitcoin’s price is notoriously volatile, experiencing dramatic swings in short periods. This high volatility stems from several factors, including market sentiment, regulatory announcements, and technological developments. For example, the price of Bitcoin can fluctuate by hundreds or even thousands of dollars in a single day, making it a high-risk investment compared to more stable assets. This volatility can lead to significant losses for investors who are not prepared for sudden price drops. Investors should carefully consider their risk tolerance before investing in Bitcoin.

Regulatory Uncertainty

The regulatory environment surrounding Bitcoin varies significantly across jurisdictions. Governments worldwide are still grappling with how to regulate cryptocurrencies, leading to uncertainty about the future legal status of Bitcoin. Changes in regulations can significantly impact Bitcoin’s price and adoption. For instance, a country banning Bitcoin transactions could lead to a sharp price decline. Conversely, favorable regulations could boost adoption and increase price. This uncertainty makes long-term planning challenging.

Security Risks

Bitcoin, like any digital asset, is susceptible to security breaches. Hacking of exchanges, theft of private keys, and scams are all potential risks. Investors need to take appropriate security measures, such as using secure wallets and employing strong password practices, to mitigate these risks. The high-profile Mt. Gox exchange hack in 2014, which resulted in the loss of millions of dollars worth of Bitcoin, serves as a stark reminder of the potential security risks involved.

Environmental Concerns

Bitcoin mining, the process of verifying and adding transactions to the blockchain, consumes significant amounts of energy. This energy consumption raises environmental concerns, particularly regarding carbon emissions. The energy intensity of Bitcoin mining varies depending on the energy sources used and the efficiency of mining hardware. Some argue that this energy consumption is unsustainable and could lead to increased regulation or reduced adoption. Potential solutions include transitioning to renewable energy sources for mining and developing more energy-efficient mining technologies.

Long-Term vs. Short-Term Risks

Holding Bitcoin long-term exposes investors to the risks of prolonged price downturns and potential regulatory changes. Short-term trading strategies, while potentially offering higher returns, expose investors to greater volatility and the need for constant market monitoring. The risk of market manipulation is also a concern in the short term. The long-term risks are generally less acute than the short-term risks due to time horizons allowing for averaging out price fluctuations, but they are still considerable. A long-term strategy requires a higher risk tolerance and a belief in Bitcoin’s long-term potential.

Bitcoin Price in 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, given the cryptocurrency’s volatile nature and susceptibility to numerous influencing factors. However, by analyzing various expert opinions, potential market scenarios, and regulatory impacts, we can explore a range of plausible price outcomes and the investment strategies they might suggest. This analysis will highlight the diversity of perspectives and the significant uncertainties involved.

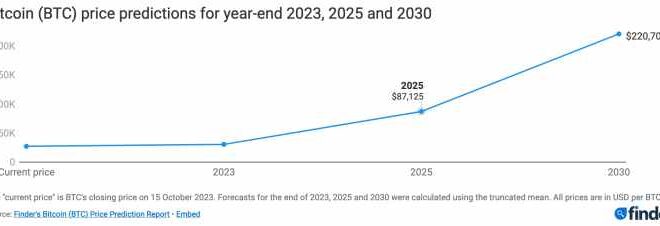

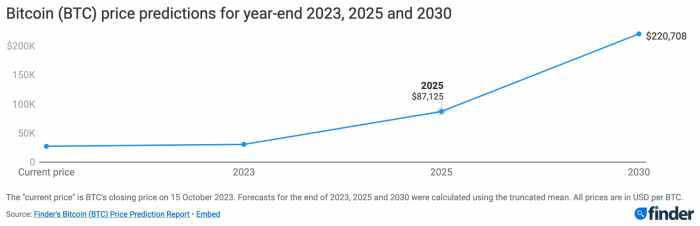

Divergent Bitcoin Price Predictions for 2025

Leading cryptocurrency analysts offer a wide spectrum of Bitcoin price predictions for 2025. Some analysts, based on bullish projections of widespread adoption and institutional investment, predict prices exceeding $100,000 or even significantly higher. Conversely, more conservative estimates, considering potential regulatory headwinds or market corrections, might forecast prices in the range of $50,000 to $75,000. These discrepancies stem from differing assumptions about factors like global economic conditions, technological advancements, and regulatory developments. For example, PlanB’s stock-to-flow model, while having proven inaccurate in the past, historically suggested significantly higher prices than have materialized. Conversely, more cautious analysts might point to historical price cycles and periods of market consolidation as justification for their lower projections.

Investment Strategies Based on Varying Price Predictions

The optimal investment strategy hinges heavily on the chosen price prediction. Investors anticipating a price above $100,000 might adopt a long-term “HODL” strategy (holding onto Bitcoin), potentially even leveraging their holdings through margin trading (though this carries significant risk). Those expecting a price closer to $50,000 might favor a more diversified approach, allocating a smaller percentage of their portfolio to Bitcoin and diversifying into other assets. A more conservative investor might opt for dollar-cost averaging (DCA), steadily acquiring Bitcoin over time regardless of short-term price fluctuations. Conversely, an investor with a very bullish outlook might consider purchasing Bitcoin derivatives, such as leveraged ETFs or futures contracts, to amplify potential gains (although this drastically increases risk).

Regulatory Impact on Bitcoin’s 2025 Price

Differing regulatory approaches across countries will significantly impact Bitcoin’s price. A nation adopting a largely favorable regulatory framework, promoting Bitcoin’s use as a legitimate financial instrument, could drive increased demand and potentially higher prices. Conversely, stringent regulations, including outright bans or excessive taxation, could suppress demand and lead to lower prices. The regulatory landscape is constantly evolving, with some countries embracing cryptocurrencies while others maintain a cautious or even hostile stance. For example, El Salvador’s adoption of Bitcoin as legal tender has had a notable, albeit complex, impact on its price, while China’s ban on cryptocurrency trading significantly impacted market sentiment and price. The lack of a globally unified regulatory framework introduces substantial uncertainty.

Psychological Factors Influencing Bitcoin’s Price

Market sentiment plays a crucial role in shaping Bitcoin’s price. Periods of heightened optimism, driven by positive news or technological advancements, often lead to price increases. Conversely, negative news or market corrections can trigger fear and selling pressure, leading to price declines. FOMO (fear of missing out) is a potent psychological factor, often driving rapid price increases as investors rush to buy Bitcoin fearing they will miss out on potential profits. Conversely, FUD (fear, uncertainty, and doubt) can spread rapidly, causing panic selling and sharp price drops. These psychological factors, often amplified by social media and news cycles, can significantly outweigh fundamental analysis in the short term, creating considerable price volatility.

Frequently Asked Questions (FAQ)

This section addresses some common questions regarding Bitcoin’s price and investment potential in 2025. It’s crucial to remember that predicting future prices is inherently speculative, and any forecast should be considered with caution.

Bitcoin’s Most Likely Price in 2025

Predicting the Bitcoin price in 2025 is extremely difficult. Numerous factors, including regulatory changes, technological advancements, and overall market sentiment, will significantly influence its value. While some analysts offer price targets ranging from tens of thousands to hundreds of thousands of dollars, these are based on various assumptions and models, and none can be guaranteed. The actual price could be significantly higher or lower depending on the interplay of these unpredictable forces. For example, widespread adoption by institutional investors could drive prices significantly upward, while a major regulatory crackdown could have the opposite effect. Therefore, it’s more prudent to focus on the underlying technology and its potential rather than specific price predictions.

Bitcoin as a Long-Term Investment

Bitcoin’s potential as a long-term investment is a complex issue. On one hand, its limited supply and growing adoption suggest potential for significant appreciation over time. The decentralized nature of Bitcoin, resistant to government control and inflation, is also attractive to some investors. On the other hand, Bitcoin’s price is extremely volatile, subject to wild swings that can wipe out significant portions of an investment in short periods. Furthermore, the regulatory landscape surrounding cryptocurrencies remains uncertain, posing potential risks. Investing in Bitcoin requires a high risk tolerance and a thorough understanding of the technology and the associated uncertainties. Consider the example of the 2017-2018 Bitcoin bull run followed by a sharp correction – a pattern that highlights the inherent volatility.

Protecting Against Bitcoin Price Volatility

Several strategies can mitigate the risks associated with Bitcoin’s price volatility. Diversification is key; don’t put all your investment eggs in one basket. Allocate only a portion of your portfolio to Bitcoin, balancing it with other asset classes like stocks, bonds, and real estate. Dollar-cost averaging is another effective approach. This involves investing a fixed amount of money at regular intervals, regardless of the price. This reduces the impact of buying high and selling low. For instance, investing $100 per week consistently will average out the price fluctuations over time. Finally, only invest what you can afford to lose, acknowledging that the possibility of losing your entire investment exists.

Biggest Threats to Bitcoin’s Future Price

Several factors pose significant threats to Bitcoin’s future price. Regulatory uncertainty remains a major concern; governments worldwide are still grappling with how to regulate cryptocurrencies, and stringent regulations could severely impact Bitcoin’s price. Technological advancements, such as the emergence of competing cryptocurrencies with superior features, could also pose a challenge. Economic downturns can also negatively affect Bitcoin’s price, as investors tend to sell off riskier assets during times of economic uncertainty. Finally, security breaches and hacks targeting exchanges or individual wallets remain a constant threat, impacting investor confidence and potentially leading to price drops.

Predicting the Bitcoin price in 2025 USD is challenging, with various factors influencing its trajectory. Understanding different prediction models is key, and a helpful resource for exploring potential scenarios is the Bitcoin Bx Price Prediction 2025 analysis. This provides insights that can contribute to a more informed perspective on the Bitcoin Price 2025 USD forecast, allowing for a more nuanced understanding of potential market movements.

Predicting the Bitcoin price in 2025 USD is challenging, with various factors influencing its trajectory. A key component of this prediction involves understanding the price throughout the year, particularly its performance in December. For specific insights into the potential Bitcoin value that month, check out this detailed analysis of the Bitcoin Price Dec 2025. Ultimately, the December price will significantly impact the overall 2025 USD average.

Predicting the Bitcoin price in 2025 in USD is challenging, with various factors influencing its trajectory. To gain a better understanding of potential future value, exploring different perspectives is key; a helpful resource is this article, What Will Bitcoin Be Worth 2025 , which offers insights into various predictions. Ultimately, the Bitcoin Price 2025 USD remains speculative, but informed analysis can offer a clearer picture.

Predicting the Bitcoin price in USD for 2025 is a complex task, influenced by various global economic factors. To gain a broader perspective, including the Indian Rupee market, it’s helpful to consult resources like this prediction: Bitcoin Price Prediction 2025 In Inr Forbes. Understanding the INR predictions can offer valuable insights into potential USD price fluctuations, given the interconnectedness of global cryptocurrency markets.

Therefore, a comprehensive analysis should consider both USD and INR forecasts for a more accurate Bitcoin Price 2025 Usd estimation.

Predicting the Bitcoin price in 2025 is challenging, with various factors influencing its potential value. To gain a broader perspective on long-term trends, it’s helpful to consider projections further out; for instance, check out this insightful article on What Will Bitcoin Price Be In 2030 to understand potential future scenarios. Understanding these longer-term predictions can help contextualize potential price points for Bitcoin in 2025.