Potential Factors Affecting Bitcoin’s Price in April 2025

Predicting Bitcoin’s price in April 2025 requires considering a complex interplay of macroeconomic factors, technological advancements, regulatory developments, and market sentiment. While precise prediction is impossible, analyzing these influences provides a framework for understanding potential price movements.

Macroeconomic Conditions and Bitcoin’s Value

Global macroeconomic conditions significantly influence Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, rising interest rates, often implemented to combat inflation, can make holding Bitcoin less attractive compared to interest-bearing assets, potentially depressing its price. Recessionary fears can also lead to risk aversion, causing investors to sell off assets like Bitcoin, resulting in price declines. The severity and duration of these macroeconomic factors will be crucial in determining Bitcoin’s price trajectory. For example, the 2022 bear market was largely attributed to rising interest rates and fears of a global recession.

Technological Developments and Bitcoin’s Price

Technological advancements within the Bitcoin ecosystem play a vital role in shaping its future. Layer-2 scaling solutions, such as the Lightning Network, aim to improve transaction speed and reduce fees, potentially increasing Bitcoin’s usability and attracting a wider range of users. Increased institutional adoption, with larger companies and financial institutions holding Bitcoin as a reserve asset or offering Bitcoin-related services, could also boost demand and price. The successful implementation and widespread adoption of these technologies would likely exert upward pressure on Bitcoin’s price. Conversely, significant technological setbacks or security vulnerabilities could have a negative impact.

Regulatory Landscapes and Bitcoin’s Price

The regulatory environment surrounding Bitcoin is a critical factor. Approval of a Bitcoin Exchange-Traded Fund (ETF) in major markets could significantly increase institutional investment and legitimize Bitcoin in the eyes of many investors, potentially driving up the price. Conversely, stricter government regulations, such as outright bans or heavy taxation, could negatively impact Bitcoin’s price by limiting its accessibility and appeal. The evolving regulatory landscape in different jurisdictions will be a key determinant of Bitcoin’s future price. The uncertainty surrounding regulation in various countries adds a layer of complexity to price forecasting.

Market Sentiment and Bitcoin’s Price

Market sentiment, encompassing the overall optimism or pessimism surrounding Bitcoin, heavily influences its price. A bullish market, characterized by widespread investor confidence and anticipation of future price increases, typically leads to higher prices. Conversely, a bearish market, driven by fear and uncertainty, can cause significant price drops. A sideways market, characterized by price consolidation and relatively low volatility, suggests a period of indecision and uncertainty. The prevailing market sentiment at any given time will significantly impact Bitcoin’s price in April 2025. News events, technological breakthroughs, and macroeconomic factors all contribute to shaping this sentiment.

Potential “Black Swan” Events and Bitcoin’s Price

Unforeseeable events, often referred to as “black swan” events, can have a disproportionately large impact on Bitcoin’s price. These could include major security breaches, unexpected regulatory crackdowns, significant geopolitical events, or the emergence of a competing cryptocurrency with superior technology. The probability of such events is inherently difficult to assess, but their potential impact on Bitcoin’s price should be considered. For example, a major security flaw discovered in the Bitcoin protocol could trigger a significant price decline.

Investment Strategies for April 2025: Bitcoin Price April 2025

Predicting Bitcoin’s price with certainty is impossible, but considering various scenarios allows for the development of adaptable investment strategies. We will Artikel approaches for bullish, bearish, and neutral price movements, emphasizing risk management throughout. Remember that these are strategies, not guarantees, and individual circumstances should always guide investment choices.

Investment Strategies Based on Price Scenarios

Different Bitcoin price predictions necessitate distinct investment approaches. A bullish market requires different tactics than a bearish or neutral one. Careful consideration of these scenarios is crucial for effective portfolio management.

Bullish Scenario: Bitcoin Price Significantly Higher in April 2025

In a bullish scenario, where Bitcoin’s price substantially increases, a strategy focused on maximizing gains is appropriate. This could involve holding existing Bitcoin, potentially leveraging (with caution) to amplify returns, or investing in Bitcoin-related companies (e.g., mining companies, exchange-traded funds). However, remember that even in a bull market, profit-taking at strategic intervals can mitigate risk. For example, one might set targets at 25%, 50%, and 75% gains, securing profits along the way.

Bearish Scenario: Bitcoin Price Significantly Lower in April 2025

A bearish outlook suggests a more conservative strategy. Shorting Bitcoin (borrowing and selling with the expectation of buying back later at a lower price) is a high-risk option for experienced traders only. Alternatively, a “wait-and-see” approach, holding cash or stablecoins, might be preferable, allowing for potential buying opportunities at lower prices. Diversification into other asset classes (gold, bonds, etc.) could also be beneficial to cushion potential losses.

Neutral Scenario: Bitcoin Price Remains Relatively Stable in April 2025

A neutral scenario, where the price remains relatively unchanged, suggests a balanced approach. Dollar-cost averaging (DCA), a strategy of investing a fixed amount at regular intervals regardless of price, could be effective. This mitigates the risk of buying high and selling low. Holding a diversified portfolio that includes both Bitcoin and other assets would also offer stability.

Risk Management Techniques for Bitcoin Investments

Effective risk management is paramount in any Bitcoin investment strategy. Several techniques can help mitigate potential losses.

Diversification

Diversification reduces risk by spreading investments across different asset classes. Holding a portion of your portfolio in Bitcoin, while allocating the rest to other assets like stocks, bonds, or real estate, can help limit losses if the Bitcoin market declines. For example, a 10% allocation to Bitcoin within a broader portfolio could significantly reduce the overall portfolio risk compared to a 100% Bitcoin allocation.

Dollar-Cost Averaging (DCA)

DCA involves investing a fixed amount of money at regular intervals (e.g., weekly or monthly). This strategy averages out the purchase price, reducing the impact of price volatility. Imagine investing $100 per week for a year – you’ll buy more Bitcoin when the price is low and less when it’s high.

Stop-Loss Orders

A stop-loss order automatically sells your Bitcoin if the price falls to a predetermined level. This limits potential losses, though it also carries the risk of selling prematurely if the price temporarily dips before recovering. For example, if you bought Bitcoin at $30,000, you might set a stop-loss order at $25,000 to protect against significant losses.

Factors to Consider When Making Investment Decisions in Bitcoin

Numerous factors influence Bitcoin’s price, and careful consideration of these factors is crucial for informed investment decisions.

Factors Influencing Bitcoin Investment Decisions

- Regulatory landscape: Government regulations and policies can significantly impact Bitcoin’s price and adoption.

- Technological advancements: Developments in blockchain technology and Bitcoin’s infrastructure can affect its value and utility.

- Market sentiment: Investor confidence and overall market trends play a crucial role in price fluctuations.

- Macroeconomic factors: Global economic conditions, inflation, and interest rates can influence Bitcoin’s price as an alternative asset.

- Adoption rate: Widespread adoption by businesses and individuals boosts demand and potentially increases the price.

- Competition: The emergence of competing cryptocurrencies can affect Bitcoin’s market share and price.

Illustrative Examples of Past Price Movements

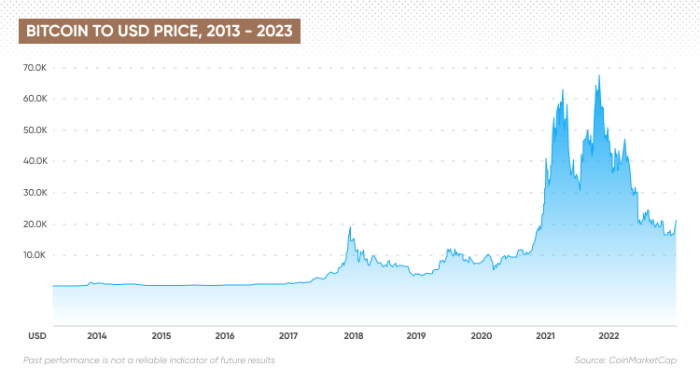

Analyzing Bitcoin’s past price fluctuations provides valuable context for understanding potential future movements. While past performance is not indicative of future results, studying significant price shifts helps identify recurring patterns and contributing factors. This analysis focuses on key bull and bear markets, highlighting the interplay of technological advancements, regulatory changes, macroeconomic conditions, and market sentiment.

Bitcoin’s price history is characterized by periods of explosive growth (bull runs) punctuated by sharp corrections (bear markets). Understanding these cycles requires examining the specific circumstances surrounding each major price movement. This examination can illuminate potential parallels with the current market environment and inform more nuanced predictions.

The 2017 Bull Run and Subsequent Crash, Bitcoin Price April 2025

The 2017 bull run saw Bitcoin’s price surge from around $1,000 to nearly $20,000 in a matter of months. This dramatic increase was fueled by several factors: increasing mainstream media attention, the emergence of Initial Coin Offerings (ICOs), and growing institutional interest. Speculative investment played a significant role, with many individuals entering the market hoping for quick profits. However, this rapid ascent was unsustainable. The lack of regulatory clarity, coupled with concerns about the underlying technology and market manipulation, led to a significant correction in 2018, pushing the price down to below $3,000. This period highlighted the volatility inherent in the cryptocurrency market and the risk associated with speculative bubbles.

The 2020-2021 Bull Run and the Subsequent Market Correction

The COVID-19 pandemic and subsequent economic uncertainty unexpectedly propelled Bitcoin’s price upward. This period saw increased adoption driven by factors including a flight to safety among investors seeking alternatives to traditional assets, growing institutional investment from companies like MicroStrategy, and the increasing acceptance of Bitcoin as a store of value. The price reached an all-time high of over $60,000 in late 2021. However, tightening monetary policies by central banks globally, alongside increased regulatory scrutiny and a general downturn in the broader technology sector, contributed to a subsequent market correction, leading to a substantial price decline.

Using Historical Data to Inform Future Predictions

Historical data, while not a crystal ball, offers valuable insights. By analyzing past bull and bear markets, we can identify potential leading indicators. For example, increased institutional investment, positive regulatory developments, and widespread adoption often correlate with price increases. Conversely, negative regulatory announcements, macroeconomic downturns, and market manipulation can trigger price drops. However, it’s crucial to remember that the cryptocurrency market is still relatively young and highly volatile. Unforeseen events, technological breakthroughs, or shifts in investor sentiment can significantly impact price movements, making accurate long-term predictions extremely challenging. Therefore, historical data should be considered one factor among many when assessing potential future price movements, not the sole determinant.

Frequently Asked Questions (FAQ)

Predicting the price of Bitcoin in April 2025, or any future date, is inherently speculative. Numerous factors, both internal to the cryptocurrency market and external to it (macroeconomic conditions, regulatory changes, technological advancements), will influence its price. While various models and analyses exist, none can definitively predict the future with certainty. This section addresses common questions surrounding Bitcoin’s price and investment strategies.

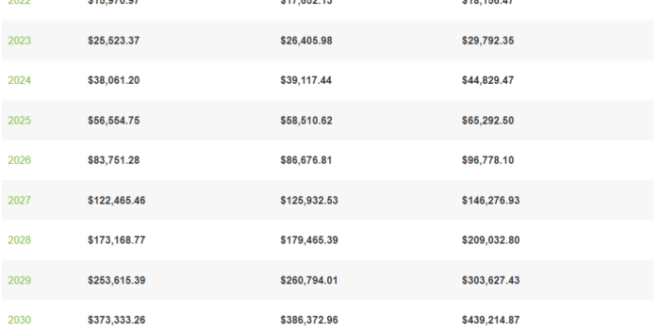

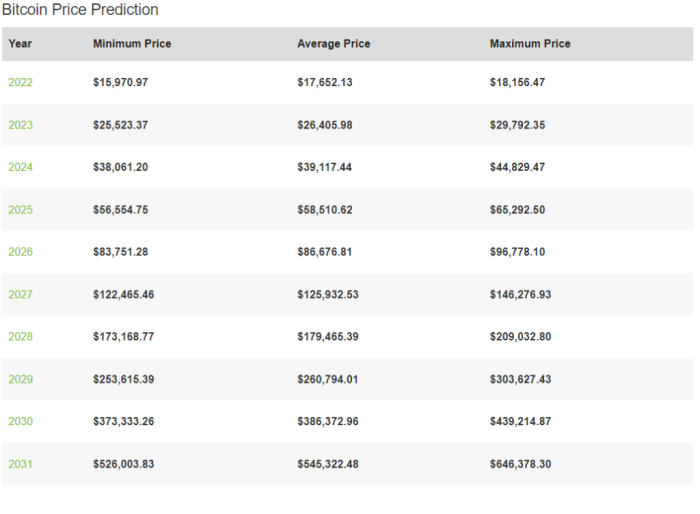

Bitcoin’s Most Likely Price in April 2025

Predicting a precise Bitcoin price for April 2025 is impossible. The cryptocurrency market is notoriously volatile, influenced by factors ranging from global economic trends to regulatory announcements and technological developments. While some analysts might offer price targets based on various models (e.g., stock-to-flow models), these should be viewed with considerable caution. Past performance is not indicative of future results. For example, Bitcoin’s price surged dramatically in 2021, only to experience significant corrections afterward. Therefore, any specific price prediction should be considered highly speculative and subject to a wide margin of error. A more realistic approach involves considering a range of possible outcomes, acknowledging the significant uncertainty involved.

Protecting Against Bitcoin Price Volatility

Mitigating risk in a volatile market like Bitcoin requires a multi-pronged strategy. Diversification is crucial. Don’t put all your eggs in one basket; allocate only a portion of your investment portfolio to Bitcoin. Dollar-cost averaging (DCA) is another effective strategy. Instead of investing a lump sum, invest smaller amounts regularly over time, averaging out the purchase price and reducing the impact of short-term price fluctuations. Holding Bitcoin for the long term can also help weather short-term volatility. Remember that past market corrections have been followed by periods of growth. Finally, understanding your own risk tolerance is paramount. Only invest an amount you are comfortable potentially losing.

Is it Too Late to Invest in Bitcoin?

Whether it’s “too late” to invest in Bitcoin depends entirely on your individual investment goals and risk tolerance. There’s no single right answer. While Bitcoin has experienced substantial growth since its inception, its future price is uncertain. However, many believe that Bitcoin’s underlying technology and potential as a decentralized store of value remain compelling. A long-term investment approach, employing strategies like DCA, can help mitigate risk and potentially benefit from long-term growth. Entering the market gradually, rather than making a large investment all at once, is often a prudent strategy. Consider your financial situation and investment timeline before making any decisions.

Potential Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries significant risks. Market manipulation, although difficult to prove definitively, remains a concern. Large-scale buying or selling by whales (individuals or entities holding significant amounts of Bitcoin) can create substantial price swings. Security breaches, particularly affecting exchanges or individual wallets, are another risk. Losing access to your private keys could result in the irreversible loss of your Bitcoin. Regulatory uncertainty is also a factor. Governments worldwide are still developing their approaches to regulating cryptocurrencies, and changes in regulation could significantly impact Bitcoin’s price and usability. Finally, the inherent volatility of the cryptocurrency market poses a significant risk to investors. Bitcoin’s price can fluctuate dramatically in short periods, leading to substantial gains or losses.

Disclaimer

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative. The cryptocurrency market is exceptionally volatile, influenced by a multitude of factors that are often unpredictable and can change rapidly. Any projections about Bitcoin’s price in April 2025, or any other future date, should be considered educated guesses at best, not guarantees. Past performance is not indicative of future results.

It is crucial to understand that investing in Bitcoin carries significant risk. You could lose some or all of your investment. The value of Bitcoin can fluctuate dramatically in short periods, influenced by factors such as regulatory changes, market sentiment, technological developments, and even social media trends. These fluctuations can lead to substantial financial losses if not managed carefully.

Risk Assessment and Due Diligence

Before investing in Bitcoin or any other cryptocurrency, it is imperative to conduct thorough due diligence. This includes understanding the underlying technology, assessing the risks involved, and evaluating your own risk tolerance. Consider consulting with a qualified financial advisor who can help you assess your investment goals and determine if Bitcoin aligns with your overall financial strategy. Remember, only invest what you can afford to lose. Do not base your investment decisions solely on predictions or forecasts, no matter how well-researched they may appear. A comprehensive understanding of the market and your personal financial situation is paramount.