Frequently Asked Questions (FAQs): Bitcoin Price At 2025

Predicting the future price of Bitcoin is inherently speculative, but understanding the factors influencing its value can provide a more informed perspective on potential price movements in 2025 and beyond. This section addresses some common questions surrounding Bitcoin’s price and investment strategies.

Bitcoin’s Most Likely Price in 2025

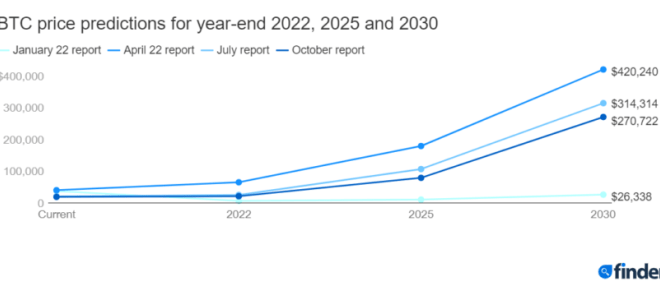

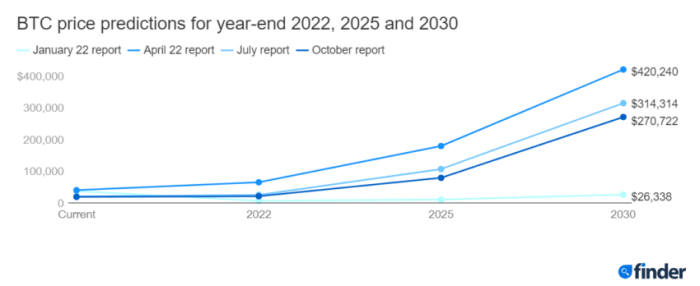

Pinpointing a precise Bitcoin price for 2025 is impossible. Numerous factors influence its value, including adoption rates, regulatory changes, macroeconomic conditions, technological advancements, and market sentiment. While some analysts offer price predictions, these should be viewed with caution. Instead of focusing on a specific number, it’s more constructive to consider the potential range of outcomes based on different scenarios. For example, widespread institutional adoption could drive significant price increases, whereas increased regulatory scrutiny or a major market downturn could lead to lower prices. Historical price volatility underscores the inherent uncertainty. Remember that past performance is not indicative of future results.

Investing in Bitcoin: Is it Too Late?, Bitcoin Price At 2025

Whether it’s “too late” to invest in Bitcoin depends entirely on individual risk tolerance and investment goals. While Bitcoin has experienced significant growth, its potential for future appreciation remains. However, it’s crucial to acknowledge the considerable volatility inherent in the cryptocurrency market. A potential downside risk exists, and investors could lose a substantial portion of their investment. Thorough research and a well-defined risk management strategy are essential before investing in Bitcoin or any cryptocurrency. Consider your personal financial situation and consult with a qualified financial advisor before making any investment decisions.

Protecting Against Bitcoin Price Volatility

Bitcoin’s price fluctuations present significant risk. Diversification is a key strategy to mitigate this risk. Don’t invest all your funds in Bitcoin; instead, allocate a portion of your investment portfolio to other asset classes, such as stocks, bonds, or real estate. This helps to balance potential gains and losses across different investments. Dollar-cost averaging is another useful technique. This involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy reduces the impact of buying high and selling low. Finally, only invest what you can afford to lose. Never invest borrowed money or funds you need for essential expenses.

Bitcoin’s Long-Term Prospects

The long-term prospects for Bitcoin are a subject of ongoing debate. Several factors could contribute to its continued growth and wider adoption, including its decentralized nature, potential for secure transactions, and growing recognition as a store of value. However, challenges remain, including scalability issues, regulatory uncertainty, and competition from other cryptocurrencies. A variety of scenarios are possible. Bitcoin could become a widely accepted global currency, a significant store of value alongside gold, or its influence could diminish over time. The future trajectory will depend on a complex interplay of technological advancements, regulatory decisions, and market forces. It is crucial to monitor these developments and adapt investment strategies accordingly.