Frequently Asked Questions (FAQs): Bitcoin Price Before Halving 2025

This section addresses common questions regarding the Bitcoin halving event in 2025 and its potential impact on Bitcoin’s price. Understanding these factors is crucial for navigating the cryptocurrency market leading up to this significant event.

The Bitcoin Halving and its Price Impact

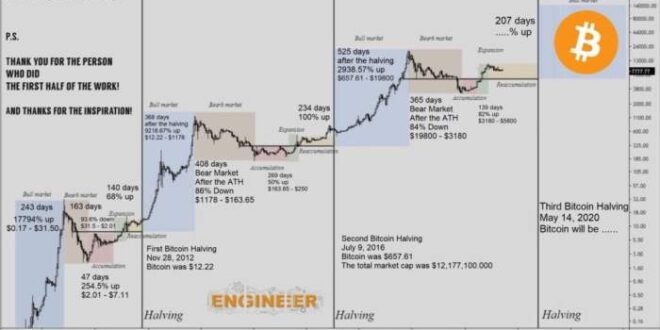

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by approximately half. This occurs roughly every four years. Because the supply of Bitcoin is limited to 21 million coins, the halving reduces the inflation rate of Bitcoin, theoretically increasing its scarcity and potentially driving up demand and price. However, the actual price impact is complex and depends on numerous other factors. Historically, halvings have been followed by periods of price appreciation, but this is not guaranteed.

Key Factors Influencing Bitcoin’s Price Before the 2025 Halving

Several interconnected factors will significantly influence Bitcoin’s price trajectory in the lead-up to the 2025 halving. These include macroeconomic conditions (global inflation, interest rates, recessionary fears), regulatory developments (government policies regarding cryptocurrencies), technological advancements (improvements in scaling solutions, adoption of Layer-2 technologies), and overall market sentiment (investor confidence, media coverage, and general adoption rates). For example, a period of high inflation could increase demand for Bitcoin as a hedge against inflation, driving up its price. Conversely, stringent regulations could dampen investor enthusiasm and suppress price growth.

Potential Price Scenarios for Bitcoin Before the 2025 Halving

Predicting Bitcoin’s price with certainty is impossible. However, considering historical trends and the factors mentioned above, several potential scenarios are plausible. A bullish scenario might see Bitcoin’s price steadily increase in anticipation of the halving, potentially reaching new all-time highs. A more moderate scenario could involve periods of volatility and sideways trading, with the price fluctuating within a certain range. A bearish scenario might involve a prolonged bear market, with the price remaining depressed despite the upcoming halving, possibly due to macroeconomic headwinds or negative regulatory developments. For example, the 2012 and 2016 halvings were followed by significant price increases, but the market conditions leading up to those events were vastly different from the current environment.

Regulatory Environment’s Impact on Bitcoin’s Price, Bitcoin Price Before Halving 2025

The regulatory environment significantly influences Bitcoin’s price. Clear and favorable regulations can foster investor confidence, leading to increased adoption and higher prices. Conversely, unclear, restrictive, or outright prohibitive regulations can dampen investor enthusiasm, potentially causing price declines. The regulatory landscape is constantly evolving, with different jurisdictions adopting varying approaches. A consistent and positive regulatory framework globally would likely support price growth, while inconsistent or overly restrictive regulations could negatively impact the price. For example, the increasing regulatory scrutiny in certain countries has led to price corrections in the past, highlighting the significant influence of regulatory actions on market sentiment.

Bitcoin Price Before Halving 2025 – Predicting the Bitcoin price before the 2025 halving is challenging, with various factors influencing its trajectory. Understanding the timing of this event is crucial for informed speculation, and you can find precise details regarding the date by checking this resource: Bitcoin Halving When 2025. The halving’s impact on the Bitcoin price before and after the event is a subject of ongoing debate among analysts and investors.

Predicting the Bitcoin price before the 2025 halving is challenging, with various factors influencing its trajectory. Understanding the timing of this event is crucial for informed speculation, and you can find precise details regarding the date by checking this resource: Bitcoin Halving When 2025. The halving’s impact on the Bitcoin price before and after the event is a subject of ongoing debate among analysts and investors.

Predicting the Bitcoin price before the 2025 halving is challenging, with various factors influencing its trajectory. Understanding the timing of this event is crucial for informed speculation, and you can find precise details regarding the date by checking this resource: Bitcoin Halving When 2025. The halving’s impact on the Bitcoin price before and after the event is a subject of ongoing debate among analysts and investors.

Predicting the Bitcoin price before the 2025 halving is challenging, influenced by numerous market factors. A key element in this prediction is the precise date of the halving itself, which you can find confirmed at Bitcoin Halving 2025 Date. Understanding this date is crucial because the halving historically precedes periods of price volatility, making accurate forecasting before it even more complex.

Therefore, while we anticipate price fluctuations, the exact trajectory remains uncertain.

Predicting the Bitcoin price before the 2025 halving is a complex undertaking, influenced by numerous market factors. Understanding the mechanics of the halving itself is crucial for any informed prediction; for detailed information, check out this comprehensive resource on Halving Bitcoin 2025. Ultimately, the price leading up to the event will depend on the interplay of anticipation surrounding the halving and other broader economic conditions.

Predicting the Bitcoin price before the 2025 halving is a complex undertaking, influenced by numerous market factors. Understanding the mechanics of the halving itself is crucial for any informed prediction; for detailed information, check out this comprehensive resource on Halving Bitcoin 2025. Ultimately, the price leading up to the event will depend on the interplay of anticipation surrounding the halving and other broader economic conditions.