Potential Price Scenarios for Bitcoin in 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, given the cryptocurrency’s volatility and dependence on various interconnected factors. However, by analyzing current market trends, technological advancements, and regulatory developments, we can construct plausible scenarios to illustrate potential price movements. These scenarios are not exhaustive and should be considered as potential outcomes, not definitive predictions.

Bullish Scenario: Bitcoin Surpasses $100,000

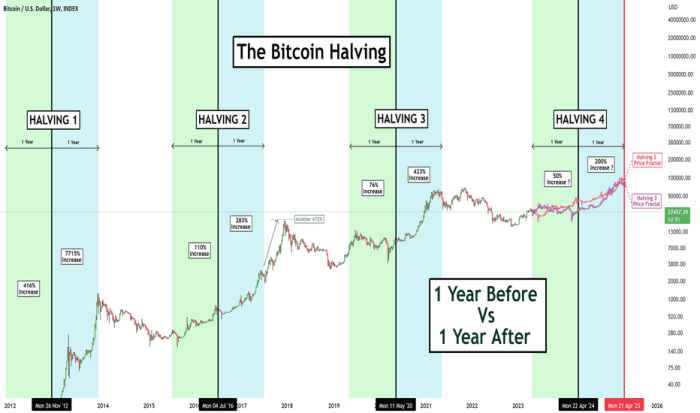

This scenario envisions a significant surge in Bitcoin’s price, potentially exceeding $100,000 by 2025. This bullish outlook is predicated on several key assumptions. Firstly, widespread institutional adoption continues to accelerate, with major corporations and financial institutions further integrating Bitcoin into their portfolios. Secondly, positive regulatory developments, such as clearer regulatory frameworks in major economies, could boost investor confidence and increase liquidity. Thirdly, continued technological advancements, such as the scaling solutions addressing transaction speed and fees, improve the overall usability and efficiency of the Bitcoin network. A successful Bitcoin halving event in 2024, reducing the rate of new Bitcoin creation, could also contribute to price appreciation due to decreased supply. This scenario mirrors the price growth experienced in previous bull runs, albeit at a potentially accelerated pace, fueled by increased global adoption and improved infrastructure. For example, the rapid adoption of Bitcoin by institutional investors like MicroStrategy and Tesla in previous years significantly impacted the price. A similar wave of institutional adoption, coupled with broader public acceptance, could propel Bitcoin to these price levels.

Bearish Scenario: Bitcoin Falls Below $20,000

This scenario explores a pessimistic outlook, with Bitcoin’s price potentially dropping below $20,000 by 2025. This bearish prediction is based on several factors. Firstly, a significant regulatory crackdown in key markets, leading to stricter regulations and limitations on Bitcoin trading and usage, could negatively impact investor sentiment. Secondly, a prolonged period of macroeconomic instability, including global recession or significant inflationary pressures, could cause investors to move away from riskier assets like Bitcoin. Thirdly, the emergence of a superior cryptocurrency, offering significantly improved features or scalability, could divert investment away from Bitcoin. A lack of significant technological advancements in the Bitcoin network itself could also contribute to a decline in value. Historically, periods of market uncertainty have led to significant Bitcoin price corrections. A repeat of the 2018 bear market, or even a more pronounced downturn, coupled with negative regulatory developments, could drive the price significantly lower.

Neutral Scenario: Bitcoin Consolidates Between $30,000 and $60,000

This scenario anticipates a period of consolidation for Bitcoin, with the price fluctuating within a range of $30,000 to $60,000 throughout 2025. This neutral outlook suggests a balance between bullish and bearish forces. While some positive developments, such as increased adoption in specific sectors or regions, could drive price increases, other factors, such as regulatory uncertainty or macroeconomic headwinds, could prevent a major price surge. This scenario assumes a relatively stable global economic environment and a gradual, rather than explosive, increase in Bitcoin adoption. This scenario reflects periods in Bitcoin’s history where price movements were less dramatic, marked by periods of sideways trading and gradual accumulation. It’s a scenario where neither strong bullish nor bearish forces dominate the market, resulting in a period of relative price stability within a defined range.

Risks and Opportunities Associated with Bitcoin in 2025

Predicting the future of Bitcoin, or any asset for that matter, is inherently speculative. However, by analyzing historical trends and current market dynamics, we can identify potential risks and opportunities associated with Bitcoin investment in 2025. Understanding these factors is crucial for informed decision-making.

Inherent Risks of Bitcoin Investment

Bitcoin’s price volatility is notorious. Sharp price swings, both upward and downward, are common. These fluctuations can lead to significant losses for investors, especially those with short-term investment horizons. For example, Bitcoin’s price experienced a dramatic drop in 2022, highlighting the potential for substantial losses. Beyond price volatility, regulatory uncertainty remains a considerable risk. Governments worldwide are still grappling with how to regulate cryptocurrencies, and changes in regulatory landscapes can significantly impact Bitcoin’s value and accessibility. Furthermore, the decentralized nature of Bitcoin, while often touted as a strength, also presents risks. The lack of a central authority means that there’s no recourse in case of theft, loss of private keys, or platform failures. Security breaches and hacking incidents, though less frequent than in earlier years, remain a concern, as exemplified by past exchanges’ vulnerabilities. Finally, the inherent speculative nature of Bitcoin investment makes it vulnerable to market sentiment and hype cycles. Bubbles and subsequent crashes are not uncommon in the cryptocurrency market.

Potential Opportunities for Profit and Growth

Despite the risks, Bitcoin offers several potential avenues for profit and growth. Its scarcity, with a fixed supply of 21 million coins, is a key factor driving potential long-term value appreciation. As adoption increases and institutional investors continue to enter the market, demand for Bitcoin could significantly outstrip supply, leading to price increases. Moreover, Bitcoin’s use cases are expanding beyond simply a speculative asset. Its potential as a store of value, a hedge against inflation, and a tool for cross-border payments are all contributing to its growing appeal. For example, the growing adoption of Bitcoin by companies like MicroStrategy and Tesla demonstrates the potential for institutional investment to drive up demand. The development of the Lightning Network and other scaling solutions aims to improve Bitcoin’s transaction speed and efficiency, further enhancing its usability and potential for widespread adoption.

Risk/Reward Ratio Compared to Traditional Assets

Comparing Bitcoin’s risk/reward ratio to traditional assets like stocks and bonds reveals a significant difference. Bitcoin’s volatility translates to a much higher potential for both significant gains and substantial losses compared to more established asset classes. Stocks, while subject to market fluctuations, generally exhibit less volatility than Bitcoin. Bonds, particularly government bonds, are considered relatively low-risk investments, but their returns are typically lower than Bitcoin’s potential upside. The risk/reward profile of Bitcoin is therefore substantially different and should be considered in the context of an investor’s overall portfolio and risk tolerance. An investor might compare the potential return of Bitcoin against the historically lower return of a government bond, acknowledging the far greater volatility.

Strategies for Mitigating Potential Risks

Several strategies can help mitigate the risks associated with Bitcoin investment. Diversification is key. Investing only a small portion of one’s portfolio in Bitcoin can help limit potential losses if the price declines. Dollar-cost averaging, a strategy involving investing a fixed amount of money at regular intervals regardless of price, can help reduce the impact of volatility. Thorough research and due diligence are also crucial. Understanding the technology behind Bitcoin, its potential use cases, and the regulatory landscape is essential for making informed investment decisions. Finally, securing one’s Bitcoin holdings through the use of secure hardware wallets and robust security practices is paramount to mitigating the risk of theft or loss. For instance, storing Bitcoin on a cold wallet, offline, significantly reduces the risk of hacking compared to leaving it on an exchange.

Investing in Bitcoin

Investing in Bitcoin, like any other asset class, requires careful consideration of various factors, including risk tolerance, investment goals, and market understanding. This section Artikels a practical approach to Bitcoin investment, encompassing purchasing, storage, strategic approaches, portfolio diversification, and risk management.

Purchasing and Storing Bitcoin

Acquiring Bitcoin typically involves using a cryptocurrency exchange. These platforms facilitate the buying and selling of Bitcoin using fiat currencies (like USD or EUR). The process generally involves creating an account, verifying your identity (KYC/AML compliance), linking a bank account or credit/debit card, and placing an order to buy Bitcoin. After purchase, securing your Bitcoin is paramount. This is usually achieved through the use of a cryptocurrency wallet, which can be either a software wallet (installed on your computer or mobile device) or a hardware wallet (a physical device designed for secure storage). Hardware wallets are generally considered more secure due to their offline nature, protecting your private keys from online threats. Choosing a reputable exchange and a secure wallet are crucial steps in protecting your investment.

Bitcoin Investment Strategies

Two prominent Bitcoin investment strategies are long-term holding (HODLing) and day trading. Long-term holding involves buying and holding Bitcoin for an extended period, typically years, aiming to benefit from potential long-term price appreciation. This strategy mitigates the impact of short-term price volatility. Day trading, conversely, focuses on short-term price fluctuations, attempting to profit from small price changes within a single day. This approach requires significant market knowledge, technical analysis skills, and a high risk tolerance due to its inherent volatility. Consider your personal risk tolerance and investment timeframe when selecting a strategy. For example, a risk-averse investor with a long-term horizon might favor HODLing, while a more risk-tolerant investor with the time and expertise could consider day trading.

Portfolio Diversification

Diversification is a fundamental principle of sound investment management. It involves spreading investments across different asset classes to reduce overall portfolio risk. While Bitcoin can be a part of a diversified portfolio, relying solely on Bitcoin is considered highly risky. A well-diversified portfolio might include traditional assets like stocks, bonds, and real estate, alongside alternative investments like Bitcoin. The proportion of Bitcoin within a portfolio should depend on individual risk tolerance and financial goals. For instance, a portfolio might allocate 5% to 10% to Bitcoin, while the remaining portion is invested in more established asset classes. This approach helps mitigate losses should the Bitcoin market experience a downturn.

Risk Management and Responsible Investing

Investing in Bitcoin involves significant risks. The cryptocurrency market is known for its volatility, and Bitcoin’s price can fluctuate dramatically in short periods. Therefore, responsible investing practices are crucial. This includes only investing what you can afford to lose, conducting thorough research before making any investment decisions, and avoiding emotional decision-making. Staying informed about market trends and regulatory developments is also vital. Furthermore, securing your Bitcoin through a reputable wallet and adhering to best security practices is essential to mitigate the risk of theft or loss. Consider seeking advice from a qualified financial advisor before making any significant investment in Bitcoin. This ensures that your investment aligns with your overall financial goals and risk tolerance.

Bitcoin’s Long-Term Outlook Beyond 2025

Bitcoin’s future beyond 2025 hinges on several interconnected factors, ranging from technological advancements and regulatory landscapes to its adoption as a mainstream payment method and its role within a broader evolving financial ecosystem. Predicting its trajectory with certainty is impossible, but analyzing current trends and potential scenarios allows for a reasoned assessment of its long-term prospects.

Bitcoin’s potential for mainstream adoption depends significantly on improvements in scalability and transaction speed. Currently, Bitcoin’s relatively slow transaction speeds and high fees compared to traditional payment systems hinder widespread adoption for everyday purchases. However, ongoing developments such as the Lightning Network aim to address these limitations, potentially paving the way for Bitcoin to become a more practical and user-friendly payment option. Furthermore, increased merchant acceptance and the development of user-friendly wallets and interfaces are crucial for broader integration into the mainstream economy.

Factors Contributing to Bitcoin’s Long-Term Success or Failure

The long-term success or failure of Bitcoin will depend on a complex interplay of several factors. Technological advancements, such as improved scalability solutions and enhanced security protocols, are vital for maintaining its relevance and competitiveness. Regulatory clarity and acceptance by governments and financial institutions will also play a crucial role, shaping its legal status and influencing its adoption rate. Conversely, significant security breaches, regulatory crackdowns, or the emergence of superior alternative technologies could severely hamper its long-term growth. The level of public trust and understanding of Bitcoin will also significantly influence its adoption and long-term viability. A decline in public confidence could lead to a decrease in demand and value.

Comparison with Other Digital Assets

Bitcoin’s position within the broader cryptocurrency landscape is a key aspect of its long-term outlook. While Bitcoin enjoys first-mover advantage and brand recognition, competing cryptocurrencies offer potentially superior features, such as faster transaction speeds or lower fees. The emergence of decentralized finance (DeFi) platforms and other blockchain-based technologies also presents both opportunities and challenges. Bitcoin’s ability to maintain its dominance and adapt to the evolving cryptocurrency ecosystem will be crucial for its continued success. For example, Ethereum’s smart contract functionality has attracted significant investment and development, creating a strong competitor in the broader digital asset market. Bitcoin’s continued relevance will depend on its ability to innovate and remain competitive within this evolving landscape.

Bitcoin’s Role in the Future Financial Landscape, Bitcoin Price Chart 2025

Bitcoin’s future role in the financial landscape is a subject of much speculation. It could potentially serve as a store of value, a hedge against inflation, or a decentralized alternative to traditional financial systems. However, its volatility and regulatory uncertainty present significant hurdles to its widespread adoption as a primary currency. Its potential integration into existing financial systems, such as the development of Bitcoin-backed financial products, could also significantly influence its long-term impact. One possible scenario is the co-existence of Bitcoin alongside traditional fiat currencies and other digital assets, each fulfilling specific roles within a more diversified financial ecosystem. The level of regulatory oversight and the development of robust infrastructure will significantly shape the ultimate role Bitcoin plays in this future financial landscape. For instance, the potential for central bank digital currencies (CBDCs) could either complement or compete with Bitcoin’s position, depending on their design and adoption.

Frequently Asked Questions (FAQs) about Bitcoin Price in 2025

Predicting the price of Bitcoin in 2025, or any future date, is inherently speculative. Numerous factors influence its value, making precise forecasts impossible. However, we can analyze current trends and potential scenarios to address common questions about Bitcoin’s price and investment prospects in 2025.

Bitcoin Reaching $100,000 by 2025

The likelihood of Bitcoin reaching $100,000 by 2025 is uncertain. While some analysts predict this level based on factors like increasing adoption and limited supply, others express skepticism due to potential market corrections and regulatory uncertainty. Reaching this price would require sustained growth and significant market acceptance, surpassing previous bull market highs. Historical precedent shows Bitcoin’s price volatility; therefore, a $100,000 price point by 2025 is not guaranteed and depends on several converging factors, including macroeconomic conditions, regulatory developments, and technological advancements within the cryptocurrency space. For example, the 2017 bull run saw Bitcoin surge to almost $20,000, only to experience a significant correction. Similarly, a price surge to $100,000 would likely involve periods of both substantial growth and potential retracements.

Biggest Risks Associated with Investing in Bitcoin in 2025

Investing in Bitcoin carries significant risks. Volatility remains a primary concern; Bitcoin’s price can fluctuate dramatically in short periods. Regulatory uncertainty, differing regulations across jurisdictions, and potential government crackdowns pose considerable risks. Security breaches and hacking incidents targeting exchanges or individual wallets are another key risk, leading to potential loss of funds. Furthermore, the relatively nascent nature of the cryptocurrency market means there’s a higher chance of unforeseen events impacting its price and stability. Mitigation strategies include diversifying investments, only investing what you can afford to lose, and employing robust security measures for storing your Bitcoin.

Safe Storage Methods for Bitcoin

Securely storing Bitcoin is crucial. Hardware wallets, physical devices designed specifically for cryptocurrency storage, offer the highest level of security by keeping your private keys offline and protected from online threats. Software wallets, which are applications installed on your computer or smartphone, offer convenience but are more vulnerable to hacking if not properly secured. Paper wallets, which involve printing your public and private keys, provide offline security but carry the risk of physical loss or damage. Exchanges, while convenient for trading, are generally considered less secure for long-term storage due to the risk of hacking or exchange failures. The choice of storage method depends on your technical skills, risk tolerance, and the amount of Bitcoin you hold. It’s recommended to use a combination of methods for enhanced security and redundancy.

Bitcoin as a Good Long-Term Investment

Bitcoin’s potential as a long-term investment is a subject of ongoing debate. Arguments in favor include its limited supply, growing adoption as a store of value, and the potential for long-term appreciation. However, counterarguments highlight its price volatility, regulatory risks, and the possibility of competing cryptocurrencies or technologies rendering it obsolete. Ultimately, the suitability of Bitcoin as a long-term investment depends on individual risk tolerance, financial goals, and a thorough understanding of the market and its inherent risks. Past performance is not indicative of future results, and careful research and due diligence are essential before making any investment decisions.

Illustrative Example: Bitcoin Price Chart 2025

This section provides a hypothetical visualization of a Bitcoin price chart for 2025, illustrating potential price movements based on various market factors. Remember, this is a purely illustrative example and should not be considered financial advice. Actual price movements will depend on numerous unpredictable variables.

This hypothetical chart depicts Bitcoin’s price fluctuating throughout 2025, reflecting both periods of growth and correction. Key price points and trends are highlighted to demonstrate potential scenarios. The visualization is designed to be easily understood, even without the actual chart image.

Hypothetical Bitcoin Price Chart for 2025

Imagine a line graph with the x-axis representing the months of 2025 (January to December) and the y-axis representing the Bitcoin price in US dollars. The chart begins in January 2025 at a hypothetical price of $30,000. Throughout the first quarter (Q1), the price shows a gradual upward trend, reaching approximately $35,000 by March. This reflects potential positive market sentiment driven by increased institutional adoption or positive regulatory developments.

During Q2, the price experiences some volatility. A period of consolidation occurs around $35,000-$40,000, followed by a moderate dip to approximately $32,000 in June. This dip could be attributed to various factors, such as macroeconomic uncertainty or a temporary loss of investor confidence. However, the price recovers quickly and continues its upward trajectory in July.

In Q3, the price steadily increases, reaching a peak of around $45,000 in September. This reflects sustained positive momentum, perhaps driven by successful technological upgrades or positive news related to the Bitcoin ecosystem. October and November show a slight correction, with the price fluctuating between $40,000 and $45,000. This consolidation period is common in bull markets.

Finally, in December, the price concludes the year around $42,000. This reflects a slight pullback from the September peak but still represents a considerable year-on-year increase from the starting price of $30,000. The overall trend for the year is positive, with the price showing a net increase despite periods of volatility. The chart would visually represent this with a generally upward-sloping line, showing the overall positive trend while incorporating the fluctuations described above. The key price points ($30,000, $35,000, $40,000, $45,000) would be clearly marked on the graph. The visualization would clearly depict the periods of growth, consolidation, and correction.