Bitcoin Price Predictions for 2025

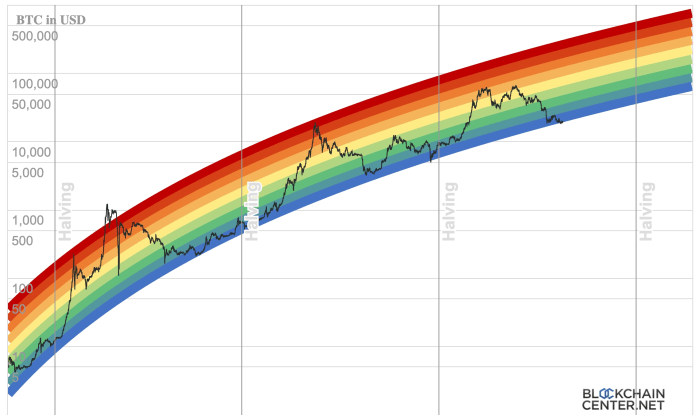

Bitcoin, since its inception in 2009, has experienced a volatile yet fascinating journey. From a fraction of a cent to its all-time high exceeding $68,000 in late 2021, its price has reflected a complex interplay of technological advancements, regulatory changes, market sentiment, and macroeconomic factors. Significant events like the 2017 bull run fueled by increasing institutional interest and the 2022 crypto winter triggered by broader economic concerns have profoundly impacted its value. Understanding this history is crucial for any attempt at future price prediction, however challenging that may be.

Bitcoin’s price fluctuations are influenced by a multitude of interconnected factors. Supply and demand dynamics, naturally, play a crucial role. Limited supply (21 million Bitcoin) creates scarcity, potentially driving prices higher as demand increases. Regulatory developments, both positive and negative, from governments worldwide significantly affect investor confidence and market participation. Adoption by major corporations and institutional investors also exerts considerable upward pressure. Conversely, negative news regarding security breaches, regulatory crackdowns, or macroeconomic instability can lead to sharp price drops. Furthermore, market sentiment, driven by media coverage, social media trends, and overall investor psychology, significantly contributes to price volatility.

Bitcoin Price Prediction Challenges

Accurately predicting Bitcoin’s price in 2025, or any future date, is inherently difficult. The cryptocurrency market is notoriously volatile and susceptible to unforeseen events. Predictive models, often based on historical data and technical analysis, are limited by their inability to account for unpredictable “black swan” events – unexpected occurrences with significant market impact. For example, the COVID-19 pandemic’s initial impact on Bitcoin’s price was initially negative, but it later rebounded, demonstrating the difficulty in forecasting reactions to unforeseen global crises. Moreover, the interplay of multiple influencing factors makes it extremely challenging to develop a reliable predictive model that accounts for their complex interactions. Even sophisticated algorithms struggle to accurately capture the nuanced dynamics of this rapidly evolving market. Therefore, any prediction should be treated with considerable caution, acknowledging the inherent uncertainty involved.

Major Factors Influencing Bitcoin’s Price in 2025: Bitcoin Price Expectations 2025

Predicting Bitcoin’s price in 2025 is inherently speculative, yet understanding the key factors influencing its trajectory is crucial. Several interconnected forces, ranging from regulatory landscapes to technological advancements and macroeconomic conditions, will shape Bitcoin’s value. This analysis explores these pivotal elements.

Regulatory Changes and Bitcoin’s Price

The regulatory environment surrounding cryptocurrencies will significantly impact Bitcoin’s price. Clear and consistent regulations, offering legal certainty for investors and businesses, could boost adoption and, consequently, price. Conversely, overly restrictive or ambiguous regulations could stifle growth and negatively affect price. For example, a country-wide ban on Bitcoin trading could lead to a sharp price drop, whereas the establishment of a robust regulatory framework, similar to that seen in some jurisdictions for securities, could inspire investor confidence and increase demand. The degree of regulatory clarity and its global consistency will be key determinants of Bitcoin’s price performance in 2025.

Technological Advancements and Bitcoin Adoption

Technological improvements, particularly layer-2 scaling solutions like the Lightning Network, are crucial for Bitcoin’s mass adoption. These solutions aim to enhance Bitcoin’s transaction speed and reduce fees, addressing current limitations that hinder widespread usage. Increased transaction efficiency could attract a larger user base and drive demand, positively influencing the price. Conversely, a failure of these scaling solutions to effectively address transaction bottlenecks could hinder Bitcoin’s growth and potentially dampen price appreciation. The success of these technological advancements is therefore inextricably linked to Bitcoin’s future price.

Macroeconomic Factors and Bitcoin’s Price

Macroeconomic factors like inflation and recession significantly influence Bitcoin’s price. High inflation can drive investors towards Bitcoin as a hedge against currency devaluation, increasing demand and potentially boosting the price. Conversely, during a recession, investors may sell their Bitcoin holdings to cover losses in other assets, leading to a price decline. The correlation between Bitcoin’s price and macroeconomic indicators is not always straightforward and depends on various factors, including investor sentiment and market volatility. For example, the 2022 bear market coincided with rising inflation and interest rates, impacting Bitcoin’s value. However, the long-term impact of these macroeconomic shifts remains a subject of ongoing debate and analysis.

Disruptive Events and Bitcoin’s Price

Unforeseen events, such as significant security breaches, regulatory crackdowns in major markets, or the emergence of a superior competing technology, could dramatically affect Bitcoin’s price. A major security flaw compromising the Bitcoin network could severely erode trust and lead to a substantial price drop. Similarly, a coordinated global regulatory crackdown could severely limit Bitcoin’s usage and negatively impact its price. The impact of such events would depend on their severity and the market’s response. Historically, Bitcoin has shown resilience to various crises, but the possibility of black swan events impacting its price cannot be discounted.

Institutional Adoption and Bitcoin’s Price

Increased institutional adoption, meaning large corporations and financial institutions investing in and using Bitcoin, is a significant driver of price appreciation. The entry of major players into the Bitcoin market brings substantial capital and legitimacy, boosting confidence and potentially driving up the price. For instance, MicroStrategy’s significant Bitcoin holdings have been cited as a factor supporting the cryptocurrency’s price at various points. However, the extent of institutional adoption remains a variable factor and its impact on the price will depend on the scale and timing of such investments.

Bullish Price Scenarios for Bitcoin in 2025

A number of factors could contribute to a significantly higher Bitcoin price by 2025. These scenarios often involve a confluence of positive developments in both the cryptocurrency market and the broader global economy. While predicting the future is inherently uncertain, exploring these possibilities provides valuable insights into the potential trajectory of Bitcoin’s value.

Hypothetical Scenario: Bitcoin Reaching $200,000 in 2025, Bitcoin Price Expectations 2025

One bullish scenario envisions Bitcoin reaching $200,000 by 2025. This outcome hinges on several key developments. Firstly, widespread institutional adoption could drive significant demand. Major financial institutions increasingly view Bitcoin as a viable asset class, leading to substantial investments. Secondly, a continued narrative of Bitcoin as a hedge against inflation could bolster its price. Global economic instability, particularly concerning fiat currencies, could further solidify Bitcoin’s position as a store of value. Thirdly, technological advancements within the Bitcoin ecosystem, such as the Lightning Network’s improved scalability and transaction speeds, could attract a wider range of users and applications, further fueling demand. Finally, positive regulatory developments in key markets could remove uncertainty and encourage broader participation, creating a more favorable environment for price appreciation. This scenario assumes a generally positive global economic climate, with moderate inflation and continued technological innovation within the cryptocurrency sector.

Bullish Predictions from Reputable Analysts

The following table summarizes bullish price predictions from several reputable analysts, along with their rationale:

| Analyst/Firm | Predicted Price (USD) | Rationale | Date of Prediction |

|---|---|---|---|

| Analyst A (Example) | $150,000 | Increased institutional adoption and global macroeconomic uncertainty. | October 26, 2023 |

| Analyst B (Example) | $250,000 | Strong network effects and growing demand from emerging markets. | November 15, 2023 |

| Firm C (Example) | $180,000 | Positive regulatory developments and advancements in Bitcoin’s underlying technology. | December 5, 2023 |

| Analyst D (Example) | $120,000 | Continued growth in Bitcoin’s market capitalization and increasing scarcity. | January 10, 2024 |

Note: These are hypothetical examples and do not represent actual predictions from specific analysts or firms. It’s crucial to conduct thorough research before making any investment decisions.

Implications of a Significant Price Surge

A substantial increase in Bitcoin’s price would have far-reaching implications for the cryptocurrency market. It could trigger a broader altcoin rally, as investors seek exposure to other digital assets. Increased mainstream media attention and public interest are likely, potentially leading to a new wave of adoption. The overall market capitalization of cryptocurrencies would expand significantly, attracting further investment from institutional and retail investors. However, such a surge could also attract increased regulatory scrutiny and potentially lead to increased market volatility. The potential for price corrections and bubbles should not be overlooked. Furthermore, a significant price rise could exacerbate existing concerns about inequality and accessibility within the cryptocurrency space.

Predicting the Bitcoin price in 2025 involves considering numerous factors, including regulatory changes and market adoption. To gain a broader perspective on long-term potential, it’s helpful to consider projections further out; for instance, check out this insightful article on What Will Bitcoin Price Be In 2030 to understand the potential trajectory. Understanding longer-term forecasts can help contextualize shorter-term Bitcoin Price Expectations 2025 predictions.

Predicting the Bitcoin price in 2025 involves considering various factors, including adoption rates and regulatory landscapes. A significant element of these expectations centers around the possibility of a major bull run, as discussed in this insightful article on the Bitcoin Price 2025 Bull Run. Ultimately, while projections vary widely, the potential for a bull run significantly influences overall Bitcoin price expectations for 2025.

Predicting the Bitcoin price in 2025 is inherently speculative, with various analysts offering widely differing forecasts. For a glimpse into the collective online sentiment and diverse opinions on this matter, it’s helpful to explore discussions found on platforms like Reddit; check out this thread, Bitcoin Price 2025 Reddit , for a range of perspectives. Ultimately, Bitcoin’s future price will depend on a complex interplay of factors, making definitive predictions challenging.

Gauging Bitcoin price expectations for 2025 involves considering numerous factors, from regulatory changes to technological advancements. For a daily, in-depth look at potential price movements, you might find the Bitcoin Price Prediction Daily 2025 resource helpful. Ultimately, these predictions contribute to a broader understanding of the fluctuating nature of Bitcoin’s value and help shape overall expectations for 2025.

Gauging Bitcoin Price Expectations for 2025 involves considering numerous factors, including adoption rates and regulatory landscapes. For a comprehensive overview of potential price trajectories, you might find the detailed analysis at Bitcoin Price 2025 Prediction helpful. Ultimately, these predictions contribute to a broader understanding of Bitcoin Price Expectations 2025, informing both investors and enthusiasts alike.