Bitcoin Price Prediction for 2025: Bitcoin Price In 2025

Bitcoin, the world’s first cryptocurrency, has experienced a tumultuous journey since its inception in 2009. From a negligible value to reaching all-time highs exceeding $68,000, its price has demonstrated remarkable volatility, often driven by speculative trading and external market forces. Understanding its past performance is crucial to attempting any prediction for the future, but it’s important to remember that any price prediction is inherently speculative.

Predicting Bitcoin’s price in 2025 requires considering several interconnected factors. Market sentiment, driven by media coverage, technological advancements within the cryptocurrency space, and the overall adoption rate, plays a significant role. Regulatory frameworks, varying widely across jurisdictions, can dramatically influence accessibility and investment confidence. Technological upgrades to the Bitcoin network, such as the Lightning Network improving transaction speeds and reducing fees, could also affect price. Finally, macroeconomic conditions, including inflation rates, economic growth, and geopolitical events, can have a profound impact on the value of all assets, including Bitcoin.

Factors Influencing Bitcoin’s Price

Bitcoin’s price is not determined by a single factor but rather a complex interplay of market forces. The overall sentiment surrounding Bitcoin, whether positive or negative, directly impacts investor behavior and trading volume. Positive news, such as increased institutional adoption or successful technological upgrades, tends to drive prices upward, while negative news, such as regulatory crackdowns or security breaches, can lead to price declines. For example, Elon Musk’s tweets have historically shown a correlation with short-term price fluctuations. Regulation remains a key uncertainty. Stringent regulations can stifle growth and limit accessibility, while a more favorable regulatory environment could encourage broader adoption and increase demand. Technological advancements, such as layer-2 scaling solutions, aim to improve Bitcoin’s efficiency and usability, potentially boosting its long-term appeal and value. Macroeconomic factors such as inflation and economic downturns can also influence Bitcoin’s price, as investors may seek alternative assets during times of economic uncertainty. The 2022 bear market, for instance, saw Bitcoin’s price plummet alongside a global stock market downturn.

Scope of this Article

This article aims to provide a reasoned overview of potential factors that could influence Bitcoin’s price in 2025. We will explore various market analyses, considering historical trends, technological developments, and macroeconomic forecasts to offer a balanced perspective on possible price scenarios. Readers can expect to gain a better understanding of the complexities involved in predicting Bitcoin’s future price and the various factors that will likely play a role. It is crucial to remember that this is not financial advice, and any investment decisions should be made after thorough independent research and consideration of personal risk tolerance.

Factors Affecting Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, relying on a confluence of factors that interact in unpredictable ways. While no single element guarantees a specific price point, understanding these key influences offers a clearer picture of potential price movements. This analysis explores the significant factors expected to shape Bitcoin’s value in 2025.

Regulatory Changes and Bitcoin’s Price

Government regulations globally will significantly impact Bitcoin’s price trajectory in 2025. Clear and consistent regulatory frameworks, providing legal certainty for Bitcoin transactions and businesses, could boost investor confidence and drive price increases. Conversely, restrictive or unclear regulations could stifle adoption and lead to price declines. For instance, a country-wide ban on Bitcoin trading, similar to China’s 2021 ban, could temporarily depress the price, while the adoption of a clear regulatory framework in a major economy like the US could trigger a positive price response. The level of regulatory clarity and consistency across different jurisdictions will play a crucial role.

Technological Developments and Bitcoin Adoption

Technological advancements within the Bitcoin ecosystem are poised to influence both adoption and price. The Lightning Network, for example, aims to improve scalability and transaction speed, making Bitcoin more practical for everyday use. Wider adoption of the Lightning Network could lead to increased demand and potentially higher prices. Similarly, Taproot, an upgrade improving transaction privacy and efficiency, could enhance Bitcoin’s appeal to both individuals and institutions, positively impacting its price. These advancements aim to address some of Bitcoin’s current limitations, thereby increasing its usability and attractiveness.

Macroeconomic Factors and Bitcoin’s Price

Macroeconomic conditions, including inflation, interest rates, and global economic growth, exert considerable influence on Bitcoin’s price. High inflation, for example, can drive investors towards Bitcoin as a hedge against inflation, potentially increasing its demand and price. Conversely, rising interest rates might divert investment away from riskier assets like Bitcoin towards higher-yielding bonds, potentially suppressing its price. Global economic downturns can also negatively impact Bitcoin’s price, as investors might sell off assets to mitigate losses. The correlation between Bitcoin’s price and macroeconomic indicators is not always straightforward and can be influenced by other factors, but it remains a significant driver.

Institutional Adoption and Investment

Growing institutional adoption and investment are key factors in shaping Bitcoin’s price. As more large corporations, financial institutions, and investment funds allocate capital to Bitcoin, the demand for Bitcoin increases, potentially driving up its price. Examples such as MicroStrategy’s substantial Bitcoin holdings demonstrate the potential impact of institutional investment. Increased institutional involvement can bring greater legitimacy and stability to the market, potentially reducing volatility in the long term, though short-term price fluctuations can still occur.

Market Sentiment and Speculation

Market sentiment and speculation play a significant role in Bitcoin’s price volatility. Periods of intense positive sentiment, fueled by news events or technological breakthroughs, can lead to rapid price increases, often driven by speculative trading. Conversely, negative news or regulatory uncertainty can trigger sharp price drops, reflecting the market’s emotional response. Social media trends, news coverage, and influencer opinions can all contribute to these shifts in sentiment, highlighting the influence of speculative forces on Bitcoin’s price. This volatility, while a characteristic feature of Bitcoin, is a key factor to consider when assessing its future price.

Potential Price Scenarios for Bitcoin in 2025

Predicting the price of Bitcoin is inherently speculative, given its volatile nature and dependence on numerous interconnected factors. However, by analyzing current trends and historical data, we can construct plausible scenarios for Bitcoin’s price in 2025, ranging from optimistic to pessimistic outlooks. These scenarios consider factors such as regulatory developments, macroeconomic conditions, technological advancements, and overall market sentiment.

Bitcoin Price Scenarios in 2025

The following table Artikels three distinct price scenarios for Bitcoin in 2025: a bullish scenario, a bearish scenario, and a neutral scenario. Each scenario is supported by a combination of factors and assigned a probability, acknowledging the inherent uncertainty involved in such predictions. Note that these are just potential outcomes and the actual price could fall outside these ranges.

| Scenario | Price Range (USD) | Supporting Factors | Probability |

|---|---|---|---|

| Bullish | $150,000 – $250,000 | Widespread institutional adoption; positive regulatory developments globally; continued technological advancements enhancing scalability and efficiency; increasing demand driven by inflation hedging and decentralized finance (DeFi) growth; sustained positive market sentiment. This scenario mirrors the rapid price appreciation seen in previous bull runs, though on a potentially larger scale. For example, the 2020-2021 bull run saw Bitcoin surge from around $10,000 to nearly $65,000 in less than a year, illustrating the potential for exponential growth. | 30% |

| Bearish | $20,000 – $40,000 | Increased regulatory scrutiny and crackdowns; a prolonged global economic downturn; major security breaches or hacks impacting investor confidence; significant technological challenges hindering adoption; a shift in investor sentiment towards alternative assets. This scenario considers the possibility of a prolonged crypto winter, similar to the 2018-2019 period, where Bitcoin’s price fell drastically. Several factors could contribute to this, including negative macroeconomic conditions or significant regulatory setbacks. | 20% |

| Neutral | $50,000 – $100,000 | A mix of positive and negative factors balancing each other out; moderate institutional adoption; relatively stable macroeconomic conditions; incremental technological improvements; a period of consolidation and sideways price movement after a potential bull run. This scenario represents a more moderate outlook, assuming a period of consolidation after potential price fluctuations. This is a relatively common scenario for Bitcoin, where price action is less volatile and shows gradual growth. This scenario assumes a more stable environment than either the bullish or bearish ones. | 50% |

Risks and Opportunities Associated with Bitcoin Investment in 2025

Investing in Bitcoin in 2025 presents a complex interplay of potential rewards and significant risks. While the cryptocurrency’s decentralized nature and potential for high returns are alluring, investors must carefully consider the inherent volatility and regulatory landscape before committing capital. A thorough understanding of both the opportunities and threats is crucial for informed decision-making.

Bitcoin Investment Risks in 2025

The inherent volatility of Bitcoin remains a primary concern. Its price has historically experienced dramatic swings, influenced by factors ranging from regulatory announcements to market sentiment and technological developments. For instance, the 2021 bull run saw Bitcoin reach an all-time high, followed by a significant correction. Such volatility can lead to substantial losses for investors who are not prepared for sudden price drops. Beyond price fluctuations, security breaches targeting exchanges or individual wallets pose a constant threat. The irreversible nature of cryptocurrency transactions means that losses due to hacking or theft can be difficult, if not impossible, to recover. Finally, regulatory uncertainty continues to be a significant risk. Governments worldwide are still grappling with how to regulate cryptocurrencies, and changes in policy could significantly impact Bitcoin’s price and usability. The lack of a unified global regulatory framework adds to the complexity and uncertainty.

Bitcoin Investment Opportunities in 2025

Despite the risks, Bitcoin offers several compelling opportunities. Its decentralized nature makes it an attractive asset for portfolio diversification, providing exposure to an asset class that is largely uncorrelated with traditional markets. This lack of correlation can help to mitigate overall portfolio risk. Furthermore, some investors view Bitcoin as a potential inflation hedge. Unlike fiat currencies, Bitcoin’s supply is capped at 21 million coins, making it a potentially deflationary asset. In periods of high inflation, this scarcity could drive up Bitcoin’s value, preserving purchasing power. Finally, ongoing technological advancements in the Bitcoin ecosystem, such as the Lightning Network for faster and cheaper transactions, could further enhance its utility and attract more users and investors, thereby increasing its value.

Risk-Reward Profile Compared to Other Asset Classes

Comparing Bitcoin’s risk-reward profile to other asset classes requires a nuanced approach. Compared to traditional investments like bonds or index funds, Bitcoin offers significantly higher potential returns but also carries considerably higher risk. Bonds typically offer lower returns with relatively low risk, while stocks provide a moderate risk-reward balance. However, the high volatility and regulatory uncertainty associated with Bitcoin make it a far riskier investment than either bonds or stocks. The risk-reward profile of Bitcoin is closer to that of alternative investments such as commodities or precious metals, which also exhibit price volatility but can offer diversification benefits within a broader portfolio. The ultimate choice depends on an investor’s risk tolerance, investment horizon, and overall financial goals. A well-diversified portfolio may include a small allocation to Bitcoin, but it should never represent the entirety of an investment strategy.

Bitcoin’s Long-Term Outlook Beyond 2025

Bitcoin’s future beyond 2025 is a subject of much speculation, but its underlying technology and growing adoption suggest a significant role in the evolving financial landscape. While predicting precise price movements is impossible, analyzing current trends and potential developments offers valuable insight into Bitcoin’s long-term potential as both a store of value and a medium of exchange.

The long-term viability of Bitcoin hinges on several factors, including technological advancements, regulatory clarity, and widespread adoption. Its decentralized nature, limited supply, and increasing institutional interest all contribute to its potential as a hedge against inflation and a store of value, similar to gold. However, challenges such as scalability issues, environmental concerns related to energy consumption, and the volatility inherent in its price remain significant hurdles.

Bitcoin as a Store of Value

Bitcoin’s limited supply of 21 million coins is a key factor supporting its potential as a store of value. This inherent scarcity, coupled with increasing demand, is expected to drive its value upwards over the long term. This contrasts with fiat currencies, which are susceptible to inflation through government printing. Historical examples, such as the increasing value of gold throughout history due to its scarcity, offer a parallel for understanding Bitcoin’s potential. The growing institutional adoption of Bitcoin as a part of their treasury reserves further strengthens its position as a long-term asset.

Bitcoin as a Medium of Exchange, Bitcoin Price In 2025

While Bitcoin’s volatility currently limits its widespread use as a daily medium of exchange, technological advancements like the Lightning Network aim to improve transaction speeds and reduce fees. Increased adoption by merchants and businesses could eventually make Bitcoin a more practical payment method. The success of this depends on factors such as regulatory frameworks, user-friendliness, and the development of robust infrastructure. Consider the example of PayPal’s integration of cryptocurrency payments; as similar initiatives expand, Bitcoin’s usability as a medium of exchange will increase.

Challenges and Opportunities Beyond 2025

The future of Bitcoin is not without challenges. Scalability remains a concern, requiring ongoing technological development to handle a growing number of transactions. Regulatory uncertainty in different jurisdictions presents another obstacle, potentially hindering widespread adoption. Furthermore, the environmental impact of Bitcoin mining is a significant issue that requires innovative solutions, such as the transition to renewable energy sources. However, these challenges also present opportunities for innovation and improvement. The development of more energy-efficient mining techniques, for example, is a key area of focus. Moreover, the ongoing evolution of the Bitcoin ecosystem, with new applications and services emerging, is expected to drive its long-term growth and relevance.

Bitcoin’s Role in the Future of Finance and Technology

Bitcoin’s influence extends beyond its role as a currency or asset. Its underlying blockchain technology has the potential to revolutionize various sectors, including supply chain management, digital identity, and voting systems. The decentralized and transparent nature of blockchain offers increased security and efficiency compared to traditional centralized systems. The increasing integration of blockchain technology into various aspects of daily life is likely to drive further demand for Bitcoin and other cryptocurrencies. Consider the potential for blockchain to streamline cross-border payments or enhance data security in healthcare; these applications demonstrate the broader impact of the technology beyond just Bitcoin’s price.

Frequently Asked Questions (FAQs) about Bitcoin Price in 2025

Predicting the price of Bitcoin is inherently speculative, but understanding the factors influencing its value and considering various scenarios can help investors navigate the market. This FAQ section addresses common questions surrounding Bitcoin’s potential price in 2025.

Bitcoin Reaching $100,000 by 2025

Reaching a price of $100,000 by 2025 is a possibility for Bitcoin, but not a certainty. Several factors would need to align for this to happen, including widespread institutional adoption, continued technological advancements, and sustained positive macroeconomic conditions. Conversely, factors like increased regulation, significant security breaches, or a general downturn in the cryptocurrency market could prevent it from reaching this milestone. While some analysts predict such high prices based on models incorporating factors like market capitalization and adoption rates, others remain cautious, pointing to the inherent volatility of the cryptocurrency market. For example, the 2017 bull run saw Bitcoin reach nearly $20,000, only to experience a significant correction. Therefore, while $100,000 is within the realm of possibility, it’s crucial to approach such predictions with a healthy dose of skepticism.

The Timeliness of Investing in Bitcoin

Whether it’s “too late” to invest in Bitcoin is a subjective question dependent on individual risk tolerance and investment goals. Bitcoin’s price has historically demonstrated significant volatility, experiencing both substantial gains and losses. While past performance doesn’t guarantee future results, the long-term trajectory of Bitcoin’s price remains a topic of debate amongst experts. Some argue that Bitcoin’s adoption as a store of value and its limited supply make it a potentially lucrative long-term investment. Others caution against the risks associated with its volatility and the potential for regulatory changes. Ultimately, the decision to invest in Bitcoin is a personal one, and investors should carefully consider their financial situation and risk tolerance before making any investment decisions. Diversification is also key; placing all your investment capital in Bitcoin is generally not advisable.

Risks Associated with Bitcoin Investment

Investing in Bitcoin carries inherent risks. Its price is highly volatile, subject to significant fluctuations influenced by market sentiment, regulatory changes, technological advancements, and macroeconomic factors. Security risks, including hacking and theft from exchanges or personal wallets, are also significant concerns. Furthermore, the regulatory landscape surrounding Bitcoin remains uncertain, and changes in regulations could negatively impact its price and accessibility. The lack of intrinsic value, unlike traditional assets like gold or real estate, also contributes to its risk profile. Bitcoin’s price is largely driven by speculation and market demand, making it susceptible to market bubbles and crashes. Past examples of significant price drops serve as reminders of these risks.

Safeguarding Bitcoin Investments

Safeguarding Bitcoin investments involves a multi-faceted approach. Choosing reputable and secure exchanges for trading and storage is crucial. Utilizing hardware wallets, which store private keys offline, offers a higher level of security compared to software wallets. Diversifying investments across different asset classes is a sound strategy to mitigate risk. Thoroughly researching and understanding the technology and risks associated with Bitcoin before investing is essential. Staying informed about market trends and regulatory changes is equally important. Furthermore, only invest what you can afford to lose. Remember, the cryptocurrency market is highly volatile, and losses are a possibility.

Illustrative Examples

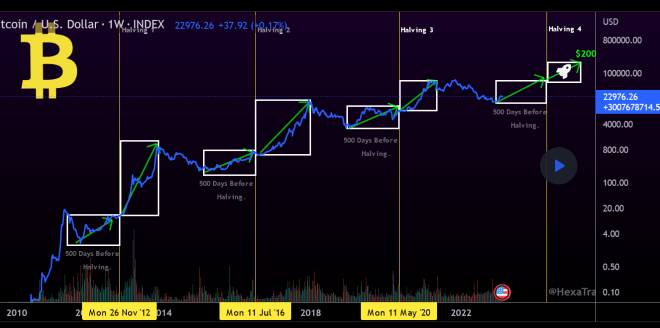

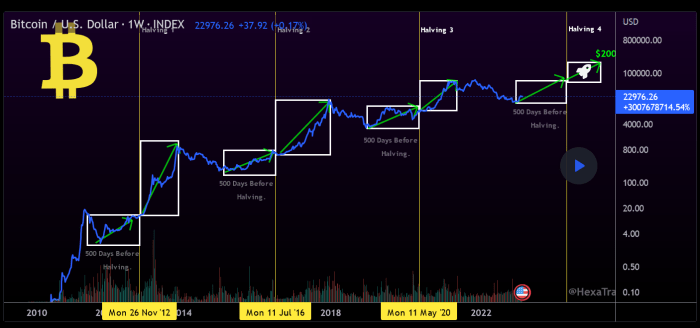

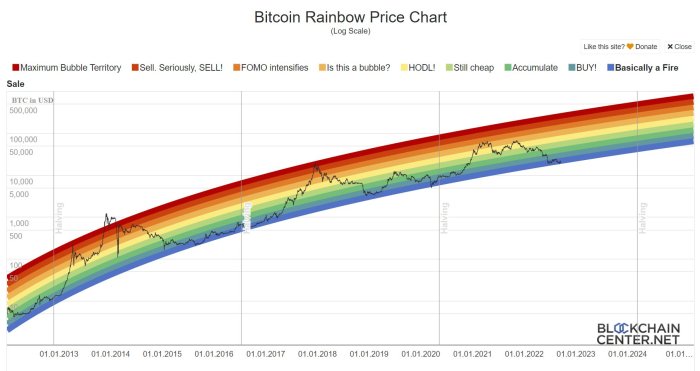

Visual representations can help clarify the potential price trajectories of Bitcoin in 2025. The following descriptions Artikel hypothetical charts illustrating the bullish, bearish, and neutral price scenarios, along with a graph showing the correlation between Bitcoin’s price and a macroeconomic indicator.

Hypothetical Bitcoin Price Chart: Three Scenarios

This chart would display Bitcoin’s price on the vertical (Y) axis, measured in US dollars, and time on the horizontal (X) axis, ranging from January 1st, 2025 to December 31st, 2025. Three distinct lines would represent the bullish, bearish, and neutral scenarios. The bullish scenario would show a steadily rising price throughout the year, perhaps starting at $30,000 and reaching $60,000 or higher by year’s end. Data points would be plotted monthly, showing consistent upward momentum. The bearish scenario would depict a declining price, possibly starting at $30,000 and falling to $15,000 or lower, with data points illustrating a consistent downward trend. The neutral scenario would show a relatively flat price, fluctuating within a range (e.g., $25,000 to $35,000) throughout the year, with data points reflecting limited price movement. Key trends, such as periods of increased volatility or consolidation, would be clearly visible. For example, a sharp price drop in the bearish scenario might be linked to a specific regulatory event, while a period of consolidation in the neutral scenario could reflect market uncertainty.

Bitcoin Price Correlation with Inflation Rate

This graph would depict the relationship between Bitcoin’s price (Y-axis, in US dollars) and the inflation rate (X-axis, as a percentage) over a specified period, perhaps the last five years. Each data point would represent a specific month or quarter, showing the corresponding Bitcoin price and inflation rate. The graph would aim to visually demonstrate the correlation, if any, between these two variables. For example, if a positive correlation exists, the graph would show that as the inflation rate rises, Bitcoin’s price also tends to rise, perhaps suggesting Bitcoin acts as a hedge against inflation. Conversely, a negative correlation would show an inverse relationship, where a rise in inflation leads to a fall in Bitcoin’s price. A weak or no correlation would show a scattered pattern with no clear trend. The graph would include a line of best fit to visualize the overall trend and its strength. Real-world examples, such as periods of high inflation (e.g., during specific economic crises) and their impact on Bitcoin’s price, could be highlighted to support the observations from the graph. This would help contextualize the observed correlation.

Predicting the Bitcoin price in 2025 is inherently speculative, relying on numerous factors including adoption rates and regulatory landscapes. For a diverse range of opinions and perspectives on this complex topic, you might find it helpful to check out the discussions on Bitcoin Price 2025 Reddit , where users share their analyses and predictions. Ultimately, the Bitcoin price in 2025 remains uncertain, but informed speculation is key to navigating this volatile market.

Speculating on the Bitcoin price in 2025 involves considering numerous factors, including technological advancements and regulatory changes. A key element in these predictions is the potential for another significant bull run, as discussed in detail within this insightful analysis: Bitcoin Price Prediction 2025 Bull Run. Ultimately, the Bitcoin price in 2025 remains subject to market volatility and unforeseen events, making accurate forecasting challenging.

Predicting the Bitcoin price in 2025 is challenging, with various factors influencing its trajectory. Understanding regional variations is crucial, and a key aspect is the potential impact of India’s adoption. For specific insights into the Indian market, you might find this resource helpful: Bitcoin Price 2025 In India. Ultimately, the global Bitcoin price in 2025 will depend on a complex interplay of technological advancements, regulatory changes, and overall market sentiment.

Predicting the Bitcoin price in 2025 is inherently speculative, relying on various factors like adoption rates and regulatory changes. However, online discussions offer valuable insights; for instance, you can find a wealth of opinions and predictions on the matter by checking out the lively conversations on Bitcoin Price 2025 Reddit. Ultimately, the Bitcoin price in 2025 will depend on the interplay of these factors and market sentiment.

Predicting the Bitcoin price in 2025 is inherently speculative, relying on various factors like adoption rates and regulatory changes. However, online discussions offer valuable insights; for instance, you can find a wealth of opinions and predictions on the matter by checking out the lively conversations on Bitcoin Price 2025 Reddit. Ultimately, the Bitcoin price in 2025 will depend on the interplay of these factors and market sentiment.