Bitcoin Price Predictions for 2025

Bitcoin’s price has experienced dramatic swings since its inception. From a fraction of a penny to its all-time high exceeding $68,000, its journey has been marked by periods of explosive growth followed by significant corrections. Several factors have influenced this volatility, including regulatory changes, technological advancements, macroeconomic conditions, and market sentiment. Understanding these influences is crucial when attempting to forecast future price movements.

The cryptocurrency market, and Bitcoin in particular, is inherently volatile. Unlike traditional asset classes, Bitcoin’s price isn’t tied to a physical commodity or government-backed currency. Its value is largely determined by supply and demand, making it susceptible to rapid and unpredictable fluctuations driven by news events, investor psychology, and technological developments. For example, the announcement of a major institutional adoption can trigger a sharp price increase, while negative regulatory news can lead to a significant drop.

Challenges in Predicting Bitcoin’s Long-Term Price

Accurately predicting Bitcoin’s price in 2025, or any long-term timeframe, presents significant challenges. The cryptocurrency market is relatively young and still evolving, making historical data less reliable for long-term forecasting than in more established markets. Furthermore, predicting future technological advancements, regulatory landscapes, and macroeconomic factors—all of which profoundly impact Bitcoin’s price—is inherently difficult. Consider the unexpected impact of the COVID-19 pandemic on the global economy and its subsequent influence on Bitcoin’s price as an illustration of the unpredictable nature of external factors. Even sophisticated quantitative models struggle to account for the unpredictable nature of human behavior and market sentiment, which significantly impact asset prices. Therefore, any prediction should be viewed with considerable skepticism and treated as speculation rather than a definitive forecast.

Factors Influencing Bitcoin’s Price in 2025: Bitcoin Price In 2025

Predicting Bitcoin’s price in 2025 is inherently complex, depending on a confluence of economic, regulatory, technological, and market factors. While no one can definitively state the price, understanding these influential elements allows for a more informed assessment of potential price trajectories.

Macroeconomic Conditions and Bitcoin’s Value

Global macroeconomic conditions significantly impact Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against currency devaluation, potentially increasing demand and price. Conversely, a recession might lead to risk aversion, causing investors to sell off assets like Bitcoin, resulting in a price decline. The strength of the US dollar, a dominant global currency, also plays a role; a strengthening dollar can negatively correlate with Bitcoin’s price, as investors may shift towards more stable assets. The 2022 bear market, for example, coincided with rising inflation and interest rates, demonstrating this correlation.

Regulatory Changes and Government Policies

Government regulations and policies globally will play a crucial role. Clear, consistent, and investor-friendly regulations could boost institutional adoption and increase Bitcoin’s legitimacy, potentially driving up its price. Conversely, overly restrictive or inconsistent regulations could stifle growth and suppress the price. The varying approaches of different countries towards cryptocurrencies, ranging from outright bans to regulatory frameworks, will create a fragmented landscape impacting price discovery and liquidity. For example, a major country adopting a clear regulatory framework for Bitcoin could trigger a significant price surge.

Technological Advancements and Adoption Rates

Technological advancements, such as layer-2 scaling solutions like the Lightning Network, aim to improve Bitcoin’s transaction speed and reduce fees. Widespread adoption of these solutions could increase Bitcoin’s usability and appeal to a broader range of users and businesses, potentially driving price appreciation. Conversely, the failure of these solutions to gain traction could limit Bitcoin’s scalability and hinder price growth. The success of layer-2 solutions is directly linked to their ease of use and integration into existing financial systems.

Competition and Technological Disruptions

The emergence of competing cryptocurrencies with superior technology or features could pose a threat to Bitcoin’s dominance and price. Innovations in blockchain technology, such as improved consensus mechanisms or entirely new approaches to decentralized finance (DeFi), could also disrupt the market. For example, the rise of Ethereum and its DeFi ecosystem has presented a challenge to Bitcoin’s dominance, diverting some investment and attention. However, Bitcoin’s established first-mover advantage and brand recognition remain significant strengths.

Institutional Investment and Market Sentiment

Institutional investment plays a vital role in shaping Bitcoin’s price. Increased participation from large financial institutions, such as investment firms and hedge funds, can inject significant capital into the market, leading to price increases. Conversely, a withdrawal of institutional investment could trigger sell-offs and price declines. Market sentiment, driven by news events, technological breakthroughs, or regulatory developments, significantly influences investor behavior and consequently, Bitcoin’s price. Positive news tends to generate buying pressure, while negative news can lead to selling pressure. The impact of Elon Musk’s tweets on Bitcoin’s price serves as a prime example of market sentiment’s influence.

Bullish and Bearish Price Scenarios for 2025

Predicting the price of Bitcoin is inherently speculative, yet by analyzing potential market forces, we can construct plausible scenarios for its value in 2025. These scenarios, while not exhaustive, illustrate the range of possibilities depending on the interplay of various factors.

Bullish Bitcoin Price Scenario for 2025: Reaching $150,000

A significantly higher Bitcoin price in 2025 hinges on several converging factors. Widespread institutional adoption, coupled with increasing regulatory clarity and the maturation of the Bitcoin ecosystem, could drive substantial price appreciation.

This bullish scenario envisions a price target of $150,000 by the end of 2025. This is predicated on several key developments:

- Increased Institutional Investment: Major financial institutions further embrace Bitcoin as a legitimate asset class, allocating a larger percentage of their portfolios to it. This could be fueled by a desire for diversification, inflation hedging, and exposure to a rapidly growing digital asset market. Similar to the increased institutional interest seen in 2020-2021, a renewed wave of adoption could significantly impact demand.

- Global Macroeconomic Instability: Persistent global inflation and economic uncertainty could push investors towards Bitcoin as a safe haven asset, increasing demand and driving prices higher. This mirrors the behavior seen during periods of market volatility in the past, where Bitcoin’s price often rises in correlation with anxieties surrounding traditional financial markets.

- Technological Advancements: Significant improvements in Bitcoin’s scalability and transaction speed, such as the widespread adoption of the Lightning Network, could enhance its usability and appeal to a wider range of users and businesses. This increased efficiency could lead to higher transaction volume and consequently, higher demand.

- Regulatory Clarity: More favorable regulatory frameworks in key jurisdictions could boost investor confidence and unlock institutional investment, further pushing the price upwards. A clear regulatory landscape would reduce uncertainty and attract larger institutional players who are currently hesitant due to regulatory ambiguity.

Bearish Bitcoin Price Scenario for 2025: Falling to $25,000

Conversely, a bearish scenario could see Bitcoin’s price fall significantly below its current levels. This scenario relies on several negative factors that could depress demand and trigger price declines.

This bearish scenario projects a price target of $25,000 by the end of 2025. This is based on the following considerations:

- Increased Regulatory Scrutiny: Stringent regulations and outright bans in major markets could severely limit Bitcoin’s accessibility and adoption, suppressing demand and driving down its price. This could mirror the impact of regulatory crackdowns seen in certain countries in the past, leading to significant price corrections.

- Technological Limitations: Failure to address Bitcoin’s scalability and transaction speed issues could hinder its wider adoption and limit its potential as a mainstream payment system. This could lead to a decline in its appeal as a viable alternative to existing financial systems.

- Market Manipulation and Security Breaches: Major security breaches or instances of market manipulation could erode investor confidence and trigger a sell-off, resulting in a substantial price drop. Historical examples of large-scale hacks and scams have demonstrated the potential for such events to negatively impact Bitcoin’s price.

- Economic Downturn: A severe global recession could lead investors to liquidate their riskier assets, including Bitcoin, to preserve capital. This could cause a significant price decline, similar to what was observed during the 2008 financial crisis and its subsequent impact on various asset classes.

Comparison of Bullish and Bearish Scenarios

The bullish and bearish scenarios presented represent two extremes of a wide spectrum of possibilities. The key difference lies in the prevailing market sentiment, regulatory environment, and technological developments. The bullish scenario relies on positive developments across various fronts, fostering increased adoption and driving price appreciation. The bearish scenario, conversely, hinges on negative events that could severely curtail Bitcoin’s growth and trigger a price decline. The ultimate price of Bitcoin in 2025 remains highly uncertain and depends on the complex interplay of these and other factors. The degree of regulatory clarity, the pace of technological advancement, and the overall macroeconomic environment will be crucial in determining which scenario prevails.

Technical Analysis and Price Predictions

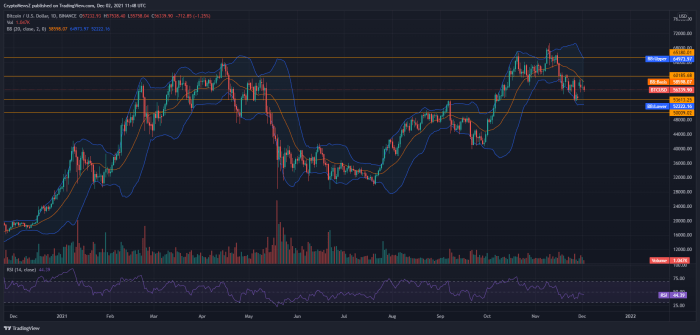

Technical analysis uses historical price and volume data to predict future price movements. While not foolproof, it provides valuable insights for traders and investors, especially when combined with fundamental analysis. Understanding key indicators and recognizing recurring patterns can help in formulating trading strategies, though it’s crucial to acknowledge its limitations in predicting long-term trends.

Moving Averages

Moving averages smooth out price fluctuations, revealing underlying trends. A simple moving average (SMA) calculates the average price over a specific period (e.g., 50-day SMA, 200-day SMA). An exponential moving average (EMA) gives more weight to recent prices, making it more responsive to current market sentiment. For Bitcoin, observing the relationship between short-term (e.g., 50-day) and long-term (e.g., 200-day) SMAs can indicate potential buy or sell signals. A “golden cross” (short-term MA crossing above the long-term MA) is often seen as a bullish signal, while a “death cross” (the opposite) suggests a bearish trend. For example, a golden cross in late 2020 preceded a significant price surge.

Relative Strength Index (RSI)

The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. It ranges from 0 to 100. Readings above 70 generally suggest an overbought market, indicating a potential price correction, while readings below 30 signal an oversold market, potentially suggesting a price rebound. However, RSI can produce false signals, especially during strong trends. For instance, Bitcoin has stayed above 70 for extended periods during bull runs, demonstrating the limitations of relying solely on this indicator.

Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that compares two moving averages to generate buy/sell signals. It consists of a MACD line (difference between two EMAs) and a signal line (EMA of the MACD line). Crossovers between these lines, as well as divergences between the MACD line and the price chart, can suggest potential trend changes. A bullish crossover (MACD line crossing above the signal line) often precedes price increases, while a bearish crossover suggests a potential decline. Analyzing the MACD alongside other indicators provides a more comprehensive picture of market dynamics. The 2017 Bitcoin bull run showed strong divergence between price and MACD before the eventual correction.

Historical Price Patterns and Implications for 2025

Bitcoin’s price history exhibits recurring patterns, including cyclical bull and bear markets. Analyzing past cycles, such as the 2017 and 2021 bull runs, reveals potential similarities in price action, duration, and subsequent corrections. While past performance doesn’t guarantee future results, identifying similar patterns can offer potential insights into 2025. For example, observing the time elapsed between halving events (reduction in Bitcoin’s block reward) and subsequent price surges could inform predictions. However, it’s crucial to remember that external factors can significantly alter these patterns.

Limitations of Technical Analysis for Long-Term Predictions

Technical analysis primarily focuses on short-to-medium-term price movements. Predicting long-term price movements (like Bitcoin’s price in 2025) solely based on technical indicators is inherently unreliable. Unforeseen events, regulatory changes, technological advancements, and shifts in market sentiment can drastically impact prices, rendering technical predictions inaccurate. Therefore, relying solely on technical analysis for long-term forecasts is ill-advised. It is more effective as a tool to manage risk and identify potential entry/exit points within the broader market context.

Fundamental Analysis and Bitcoin’s Value

Bitcoin’s value proposition rests on a confluence of fundamental factors, making it a unique asset class distinct from traditional currencies and investments. Understanding these fundamentals is crucial for assessing its long-term potential and predicting its price trajectory. This section will delve into the core elements driving Bitcoin’s value and explore its potential roles in the global financial system.

Bitcoin’s value stems from its inherent properties and its growing adoption. These factors interact and influence each other, creating a complex but ultimately compelling case for Bitcoin’s long-term viability. While its price is volatile in the short term, fundamental analysis offers a longer-term perspective on its potential.

Bitcoin’s Scarcity

Bitcoin’s fixed supply of 21 million coins is a cornerstone of its value proposition. Unlike fiat currencies, which central banks can print at will, diluting their value, Bitcoin’s scarcity is programmed into its code. This inherent limitation creates a deflationary pressure, potentially making it a hedge against inflation. As demand increases and the supply remains constant, the price is expected to rise, mirroring the principles of supply and demand in a limited-resource market. This scarcity is analogous to precious metals like gold, which also derive value from their limited availability.

Decentralization and Security

Bitcoin operates on a decentralized network, meaning no single entity controls it. This contrasts sharply with traditional financial systems, which are often centralized and susceptible to manipulation or censorship. The decentralized nature of Bitcoin enhances its security and resilience, making it resistant to government intervention or single points of failure. The network’s security is maintained through cryptographic hashing and a distributed consensus mechanism, making it extremely difficult to alter the blockchain or double-spend bitcoins. This robust security contributes to Bitcoin’s trustworthiness and appeal as a store of value.

Bitcoin’s Potential Roles in the Financial System

Bitcoin’s potential as a store of value, medium of exchange, and unit of account is actively being explored. Its use as a store of value is already evident, with many investors holding Bitcoin as a hedge against inflation and economic uncertainty. However, its adoption as a medium of exchange faces challenges related to volatility and transaction fees. While Bitcoin’s transaction speed and fees are improving, widespread adoption as a daily payment method requires further technological advancements and regulatory clarity. Its use as a unit of account, where prices are denominated in Bitcoin, is still limited, although some businesses already accept Bitcoin as payment.

Long-Term Growth Potential

The long-term growth potential of Bitcoin hinges on continued adoption and technological advancements. Increased institutional investment, regulatory clarity, and the development of scalable solutions are crucial factors. While predicting future price is inherently speculative, a fundamental analysis suggests that Bitcoin’s long-term growth potential is significant, driven by its unique characteristics and increasing global awareness. For example, the increasing adoption of Bitcoin by institutional investors, such as MicroStrategy and Tesla, signals a growing acceptance of Bitcoin as a valuable asset within traditional financial portfolios. These investments, alongside the growing number of Bitcoin ATMs and merchant acceptance, suggest a steady, if volatile, path towards broader adoption. However, regulatory uncertainty in various jurisdictions remains a significant factor influencing its long-term trajectory.

Risk Assessment and Investment Strategies

Investing in Bitcoin, like any other asset class, involves inherent risks. Understanding these risks and implementing appropriate investment strategies is crucial for mitigating potential losses and achieving your financial goals. This section Artikels the major risks associated with Bitcoin and explores various investment approaches tailored to different risk tolerances.

Major Risks Associated with Bitcoin Investment

Bitcoin’s price volatility is notorious. Sharp price swings, both upward and downward, are common. For example, Bitcoin’s price experienced significant gains in 2020 and 2021, followed by a substantial correction in 2022. This volatility makes it challenging to predict price movements and can lead to significant losses for investors who are not prepared for such fluctuations. Regulatory uncertainty poses another substantial risk. Governments worldwide are still developing their regulatory frameworks for cryptocurrencies, and changes in regulations can significantly impact Bitcoin’s price and accessibility. Security risks, including hacking and theft from exchanges or personal wallets, are also a major concern. Investors need to take precautions to secure their Bitcoin holdings through the use of robust security measures.

Investment Strategies for Bitcoin

Several investment strategies cater to different risk profiles. Long-term holding, often referred to as “HODLing,” involves buying Bitcoin and holding it for an extended period, regardless of short-term price fluctuations. This strategy is suitable for investors with a high risk tolerance and a long-term investment horizon. Dollar-cost averaging (DCA) is a strategy where investors invest a fixed amount of money at regular intervals, regardless of the price. This mitigates the risk of investing a lump sum at a market peak. For example, investing $100 per week consistently reduces the impact of price volatility. Short-term trading involves buying and selling Bitcoin frequently to capitalize on short-term price movements. This strategy is highly risky and requires significant market knowledge and expertise. It is generally not recommended for inexperienced investors.

Diversification Strategies to Mitigate Risk

Diversification is a crucial risk management technique. Investing solely in Bitcoin exposes you to significant risk. A diversified portfolio includes other asset classes, such as stocks, bonds, real estate, and other cryptocurrencies, to reduce overall portfolio volatility. The proportion of Bitcoin in your portfolio should depend on your risk tolerance and investment goals. For instance, a conservative investor might allocate only a small percentage (e.g., 5-10%) of their portfolio to Bitcoin, while a more aggressive investor might allocate a larger percentage (e.g., 20-30%). It’s important to remember that diversification does not eliminate risk entirely, but it helps to reduce the impact of any single investment’s poor performance on the overall portfolio. Diversification across different asset classes can help cushion against losses from Bitcoin’s price volatility or regulatory changes.

Bitcoin Price in 2025

Predicting the price of Bitcoin in 2025 remains a challenging task, even for seasoned experts. Numerous factors, ranging from macroeconomic conditions to regulatory changes and technological advancements, influence its volatility. While precise predictions are impossible, examining expert opinions and prevailing market sentiment offers valuable insights into potential price trajectories. This section analyzes various expert forecasts and the overall market mood surrounding Bitcoin’s future value.

Expert Price Predictions for Bitcoin in 2025, Bitcoin Price In 2025

A range of predictions for Bitcoin’s price in 2025 exists among prominent analysts and industry figures. It’s crucial to remember that these are opinions, not guarantees, and are often based on different underlying assumptions and methodologies. For example, some analysts might heavily weigh macroeconomic factors like inflation, while others might focus more on adoption rates and technological developments. These differing perspectives lead to a wide spectrum of predictions. Some experts, particularly those bullish on Bitcoin’s long-term potential, have suggested price targets exceeding $100,000 or even higher. Conversely, more conservative or bearish analysts might predict significantly lower prices, perhaps in the tens of thousands of dollars, reflecting concerns about regulatory uncertainty or market corrections. The lack of consensus underscores the inherent uncertainty involved in forecasting asset prices.

Market Sentiment Towards Bitcoin in 2025

Market sentiment toward Bitcoin fluctuates considerably, influenced by news events, regulatory developments, and overall economic conditions. Periods of strong positive sentiment, often fueled by media hype or significant technological advancements, tend to drive price increases. Conversely, negative news, such as regulatory crackdowns or major market crashes, can lead to significant price drops and a bearish market sentiment. Currently, sentiment appears mixed, with some investors maintaining a long-term bullish outlook while others remain cautious, given Bitcoin’s inherent volatility. Tracking sentiment indicators like social media mentions, news articles, and investor surveys can offer a glimpse into the prevailing market mood, although these should be interpreted cautiously. It is important to note that market sentiment is often a lagging indicator and doesn’t always accurately predict future price movements.

Limitations of Relying on Expert Opinions for Investment Decisions

While expert opinions provide valuable context and insights, relying solely on them for investment decisions is unwise. Experts themselves can disagree significantly, and their predictions are not infallible. Furthermore, many predictions are based on assumptions that might prove incorrect. Unforeseen events, such as unexpected technological breakthroughs or geopolitical shifts, can dramatically alter Bitcoin’s price trajectory, rendering even the most well-informed predictions obsolete. Therefore, a comprehensive investment strategy should incorporate multiple sources of information, including technical and fundamental analysis, risk assessment, and a clear understanding of one’s own risk tolerance. Treating expert opinions as one piece of the puzzle, rather than the definitive answer, is crucial for making informed investment decisions.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Bitcoin’s price trajectory and investment considerations in 2025. Understanding these factors is crucial for informed decision-making in the volatile cryptocurrency market.

Significant Factors Influencing Bitcoin’s Price in 2025

Several interconnected factors will likely shape Bitcoin’s price in 2025. These include macroeconomic conditions (global inflation, interest rates, recessionary fears), regulatory developments (government policies on cryptocurrencies in major economies), technological advancements (scaling solutions, new applications of blockchain technology), and market sentiment (investor confidence, media coverage, and overall cryptocurrency adoption). For instance, a global recession could drive investors towards Bitcoin as a safe haven asset, potentially increasing its price. Conversely, stringent regulations could dampen investor enthusiasm and lead to price declines.

Reliability of Bitcoin Price Predictions

Bitcoin price predictions are inherently unreliable. The cryptocurrency market is notoriously volatile and influenced by numerous unpredictable factors. While technical and fundamental analyses can provide insights, they cannot definitively predict future prices. Many predictions are based on speculative models and past performance, which are not always indicative of future results. It’s essential to treat all predictions with a healthy dose of skepticism and avoid basing investment decisions solely on them. For example, predictions made in 2021 for Bitcoin’s price in 2022 were widely inaccurate, highlighting the inherent uncertainty in forecasting cryptocurrency prices.

Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries significant risks. Its price is highly volatile, subject to dramatic swings in short periods. Regulatory uncertainty poses another risk, as governments worldwide are still developing their approaches to cryptocurrencies. Security risks, including hacking and theft from exchanges or personal wallets, are also a concern. Furthermore, the lack of intrinsic value, unlike traditional assets, makes Bitcoin’s price entirely dependent on market sentiment and speculation. Investors should be prepared for potential substantial losses. The collapse of the FTX exchange in 2022 serves as a stark reminder of the risks involved in cryptocurrency investments.

Suitable Investment Strategies for Bitcoin

Appropriate Bitcoin investment strategies depend on individual risk tolerance and financial goals. A common approach is dollar-cost averaging (DCA), where investors regularly invest a fixed amount regardless of price fluctuations. This mitigates the risk of investing a large sum at a market peak. Diversification is also crucial; investors should not allocate a disproportionate amount of their portfolio to Bitcoin. Holding Bitcoin long-term (HODLing) is another strategy based on the belief in Bitcoin’s long-term growth potential. However, it also carries the risk of prolonged periods of price stagnation or decline. Before adopting any strategy, thorough research and consultation with a financial advisor are recommended.

Reliable Sources of Information on Bitcoin’s Price and Market Trends

Reliable information on Bitcoin’s price and market trends can be found from reputable sources such as established cryptocurrency exchanges (Coinbase, Binance, Kraken), financial news outlets (Bloomberg, Reuters, The Wall Street Journal), and dedicated cryptocurrency market analysis websites (CoinMarketCap, CoinGecko). It’s crucial to be discerning and avoid sources with obvious biases or a lack of transparency. Always cross-reference information from multiple sources to get a well-rounded perspective. Following reputable analysts and researchers in the cryptocurrency space can also be helpful, but remember to critically evaluate their insights.

Illustrative Example: Bitcoin Price Chart Projection

This hypothetical Bitcoin price chart for 2025 depicts a volatile yet ultimately bullish year, influenced by several key market events and underlying trends. The projection assumes a continued adoption of Bitcoin as a store of value and a growing acceptance within institutional investment portfolios. However, it also acknowledges the inherent volatility of the cryptocurrency market and the potential for significant corrections.

The year begins with Bitcoin trading around $30,000, recovering from a late 2024 correction. Throughout the first quarter, a period of consolidation occurs, with price fluctuating between $28,000 and $35,000. Trading volume remains relatively moderate, indicating a period of sideways movement and uncertainty among investors. A strong support level is established around $28,000, representing a significant psychological barrier and a key area where buyers are likely to step in.

Price Fluctuations and Key Events

The second quarter sees a surge in price driven by positive regulatory developments in a major global economy. This event, combined with increasing institutional investment, pushes Bitcoin above its previous all-time high, reaching $45,000 by June. Trading volume significantly increases during this period, reflecting the heightened market activity and investor enthusiasm. Resistance is met around $48,000, leading to a short-term pullback. This pullback is healthy and could be considered a normal consolidation period after a significant price surge. The $40,000 level acts as a strong support level during this correction.

Support and Resistance Levels

The second half of the year experiences more pronounced fluctuations. A major market correction in late summer, potentially triggered by macroeconomic factors like rising interest rates or geopolitical instability, sees the price drop to $35,000. This drop, however, proves to be a buying opportunity, as many investors view it as a temporary setback. The $35,000 level serves as a robust support level. As the year progresses, a new upward trend begins, driven by growing adoption in emerging markets and technological advancements within the Bitcoin ecosystem. The price steadily rises, reaching $55,000 by December, establishing a new resistance level around $60,000. Throughout this period, trading volume remains high, demonstrating sustained investor interest. This final price is heavily influenced by the positive narrative around Bitcoin’s growing legitimacy and usefulness.

Overall Market Trends and Volume

The overall trend throughout 2025 is bullish, despite the expected corrections and volatility. The increasing institutional adoption and positive regulatory developments contribute to a higher average price compared to the beginning of the year. Trading volume generally increases as the price rises, reflecting the heightened market activity and investor participation. The hypothetical chart demonstrates a year of significant price movement, highlighting the inherent risk and reward associated with investing in Bitcoin. The projection assumes that positive market sentiment will ultimately outweigh negative factors, leading to a year-end price above the initial price point. However, unforeseen events could easily alter this projection.

Speculating on the Bitcoin price in 2025 involves considering various factors, including the upcoming halving event. A key element in these predictions is understanding the potential impact of reduced Bitcoin supply, which is extensively discussed in this insightful analysis: Bitcoin Price Prediction After Halving 2025. Ultimately, the Bitcoin price in 2025 will depend on a complex interplay of market forces and technological advancements.

Predicting the Bitcoin price in 2025 is a complex endeavor, influenced by various factors including adoption rates and regulatory changes. To gain some insight into potential price trajectories, you might find this resource helpful: Bitcoin Price In 2025. Ultimately, the future Bitcoin price remains speculative, but analyzing predictions can offer a better understanding of the cryptocurrency’s potential.

Speculating on the Bitcoin price in 2025 involves considering numerous factors, including technological advancements and regulatory changes. To gain a better understanding of potential price trajectories, it’s helpful to consult expert analyses such as the comprehensive report found at Bitcoin Price 2025 Prediction. Ultimately, the Bitcoin price in 2025 remains uncertain, but informed predictions can offer valuable insight into this volatile market.

Predicting the Bitcoin price in 2025 is inherently speculative, yet many analysts are focusing on the potential for a significant price surge. A key factor in these projections is the anticipated Bitcoin Price 2025 Bull Run , which could significantly influence the overall value. Ultimately, the actual Bitcoin price in 2025 will depend on various market forces and technological advancements.

Predicting the Bitcoin price in 2025 is challenging, with various factors influencing its trajectory. A key aspect to consider is the Bitcoin price in US dollars, which is crucial for understanding its overall value. For detailed projections on this, check out this informative resource on Bitcoin Price Dollar 2025. Ultimately, the Bitcoin price in 2025 will depend on a complex interplay of market forces and technological advancements.