Bitcoin Price Prediction in 2025 (INR)

Predicting the price of Bitcoin, a highly volatile asset, is inherently challenging. Numerous factors, both internal to the cryptocurrency market and external to the global economy, influence its value, particularly within the specific context of the Indian Rupee. This analysis explores potential price ranges for Bitcoin in 2025, considering various scenarios and influential factors.

Factors Influencing Bitcoin’s Price in the Indian Market

Several key factors impact Bitcoin’s price in India. These include global Bitcoin adoption rates, the overall health of the global and Indian economies, regulatory developments within India, and the level of investor sentiment both domestically and internationally. Increased institutional investment and broader acceptance by Indian businesses could drive up the price, while negative regulatory changes or a global economic downturn could lead to price decreases. The rupee’s exchange rate against the US dollar also plays a significant role, as Bitcoin is primarily priced in USD. A weakening rupee would likely increase the INR price of Bitcoin, all else being equal.

Potential Bitcoin Price Ranges in Indian Rupees for 2025

Predicting a precise Bitcoin price is impossible. However, based on various forecasting models and considering both bullish and bearish scenarios, a plausible range for Bitcoin’s price in Indian Rupees by 2025 could be between ₹20,00,000 and ₹80,00,000. A bullish scenario, characterized by widespread adoption and positive regulatory developments, could push the price towards the higher end of this range. Conversely, a bearish scenario, potentially driven by a global economic crisis or stricter regulations, might result in a price closer to the lower end. These figures are estimations and should not be considered financial advice.

Impact of Global Economic Events on Bitcoin Price in India

Global economic events significantly influence Bitcoin’s price in India. A global recession, for example, could lead to investors seeking safe haven assets, potentially driving down the price of Bitcoin. Conversely, periods of high inflation or geopolitical instability might increase demand for Bitcoin as a hedge against these risks, potentially boosting its price. Major events like a significant change in US monetary policy or a major global conflict can cause substantial volatility in Bitcoin’s price, impacting the Indian market as well.

Role of Regulatory Changes in India on Bitcoin’s Price

Regulatory changes in India have a profound impact on Bitcoin’s price. Clearer regulatory frameworks could attract more institutional investment and increase market confidence, leading to price increases. Conversely, stricter regulations or outright bans could significantly depress the price. The current regulatory landscape in India is still evolving, making it difficult to predict the precise impact of future regulatory decisions on Bitcoin’s price. A more favorable regulatory environment is likely to positively impact Bitcoin’s price in India.

Comparison of Bitcoin Price Prediction Models

Predicting future prices relies on various models, each with its own assumptions and limitations. The following table compares several hypothetical models and their projected Bitcoin prices in INR for 2025:

| Prediction Model | Methodology | Projected Price (₹) | Assumptions |

|---|---|---|---|

| Model A (Conservative) | Based on historical price trends and economic indicators | 25,00,000 | Moderate global adoption, stable Indian economy |

| Model B (Moderate) | Combines technical analysis with macroeconomic factors | 40,00,000 | Increased global adoption, moderate regulatory changes |

| Model C (Bullish) | Focuses on widespread adoption and institutional investment | 60,00,000 | High global adoption, positive regulatory environment |

| Model D (Bearish) | Considers potential global economic downturn and stricter regulations | 20,00,000 | Low global adoption, negative regulatory changes |

Factors Affecting Bitcoin’s Value in India: Bitcoin Price In 2025 In Indian Rupees

Bitcoin’s price in India, denominated in Indian Rupees (INR), is influenced by a complex interplay of global and local factors. Understanding these dynamics is crucial for anyone considering investing in this volatile asset class. While global trends significantly impact Bitcoin’s value, the Indian context adds unique layers of complexity.

Indian Rupee Volatility and Bitcoin’s Price

Fluctuations in the value of the Indian Rupee against other major currencies, particularly the US dollar, directly influence Bitcoin’s INR price. Since Bitcoin is primarily priced in USD, a weakening Rupee makes Bitcoin more expensive in INR terms, and vice-versa. For instance, if the USD appreciates against the INR, the same amount of USD needed to buy one Bitcoin will translate to a higher INR cost. This creates an additional layer of risk for Indian investors beyond the inherent volatility of Bitcoin itself. This relationship is not always linear, however, as other market forces can influence the overall price.

Bitcoin’s Performance Compared to Other Indian Investment Options

Bitcoin’s performance in India needs to be assessed against traditional investment avenues like gold, real estate, and the stock market. While Bitcoin has shown periods of substantial growth, its extreme volatility makes it a riskier investment compared to more stable options like gold or government bonds. The stock market offers potential for higher returns but also carries considerable risk. A comparative analysis, considering risk-adjusted returns over various time horizons, is necessary for a rational investment decision. For example, while Bitcoin might offer significantly higher returns than fixed deposits in a bull market, it also carries a much higher potential for losses during a bear market.

Key Macroeconomic Indicators Impacting Bitcoin’s Value in India, Bitcoin Price In 2025 In Indian Rupees

Several macroeconomic indicators in India can affect Bitcoin’s price. Inflation rates, interest rates set by the Reserve Bank of India (RBI), and overall economic growth directly influence investor sentiment and capital flows. High inflation might push investors towards Bitcoin as a hedge against inflation, while increased interest rates could make other investment options more attractive, potentially reducing demand for Bitcoin. Similarly, periods of strong economic growth could lead to increased investment in riskier assets, including Bitcoin, while economic uncertainty might cause investors to move towards safer havens.

Cryptocurrency Adoption Rate in India and its Correlation with Price

The increasing adoption of cryptocurrencies in India is a key factor influencing its price. Wider acceptance, increased regulatory clarity (or lack thereof), and the growth of cryptocurrency exchanges and related services all contribute to price movements. Greater adoption typically leads to increased demand, potentially driving prices higher. Conversely, negative regulatory developments or a decrease in public trust can lead to decreased demand and lower prices. The recent increase in the number of Indian users on cryptocurrency exchanges is a case in point, indicating a growing interest and potentially influencing price trends.

Risks and Opportunities of Investing in Bitcoin in India

Before investing in Bitcoin in India, it’s crucial to weigh the potential risks and opportunities:

- High Volatility: Bitcoin’s price is notoriously volatile, experiencing significant price swings in short periods. This poses a considerable risk to investors.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies in India is still evolving, creating uncertainty for investors.

- Security Risks: Cryptocurrency exchanges and wallets are potential targets for hacking and theft, leading to potential losses for investors.

- Market Manipulation: The relatively small size of the cryptocurrency market makes it susceptible to manipulation by large players.

- Potential for High Returns: Despite the risks, Bitcoin has historically delivered high returns, making it an attractive investment for some.

- Technological Innovation: The underlying blockchain technology continues to evolve, offering potential for future growth and innovation.

- Hedging Against Inflation: Some investors see Bitcoin as a hedge against inflation, particularly in economies with unstable currencies.

Investing in Bitcoin in India

Investing in Bitcoin in India presents both significant opportunities and considerable risks. Understanding the tax implications, navigating the exchange landscape, and implementing robust security measures are crucial for navigating this volatile market successfully. This section will provide a practical guide to help you make informed decisions.

Bitcoin Tax Implications in India

The Indian government currently taxes Bitcoin and other cryptocurrencies as assets. This means profits from selling Bitcoin are taxed as capital gains. Short-term capital gains (STCG), realized within one year of purchase, are taxed at your applicable income tax slab rate. Long-term capital gains (LTCG), realized after one year, are taxed at 20% with an indexation benefit. It’s essential to maintain accurate records of all Bitcoin transactions for tax reporting purposes. Ignoring these tax obligations can lead to significant penalties. Consult a tax professional for personalized advice based on your individual circumstances and investment strategy.

Buying and Selling Bitcoin in India: A Step-by-Step Guide

Investing in Bitcoin in India involves several steps. First, you need to choose a reputable cryptocurrency exchange operating in India. Next, complete the KYC (Know Your Customer) process, which typically involves providing identification documents. After verifying your identity, you can fund your exchange account through various methods, such as bank transfers or UPI payments. Once your account is funded, you can purchase Bitcoin. To sell, you simply place a sell order on the exchange, and the funds will be credited to your account. Remember to factor in trading fees charged by the exchange. Always exercise caution and verify the authenticity of the exchange before depositing funds.

Comparison of Bitcoin Exchanges in India

Several cryptocurrency exchanges operate in India, each with its strengths and weaknesses. For example, one exchange might offer lower trading fees but have a less user-friendly interface, while another might prioritize security but charge higher fees. Consider factors like fees, security measures, trading volume, user interface, customer support, and available cryptocurrencies when choosing an exchange. Researching and comparing multiple exchanges before committing your funds is crucial. Remember that the regulatory landscape for cryptocurrency exchanges in India is constantly evolving, so staying informed about updates is vital.

Security Measures for Bitcoin Investments in India

Protecting your Bitcoin investments requires a multi-layered approach. This includes using strong, unique passwords for your exchange accounts and employing two-factor authentication (2FA) whenever possible. Consider using a hardware wallet for storing larger amounts of Bitcoin, as these offer significantly enhanced security compared to software wallets. Regularly review your exchange account activity for any unauthorized transactions. Be wary of phishing scams and avoid clicking on suspicious links. Educate yourself about common cryptocurrency scams to protect yourself from fraud. Diversifying your investment portfolio beyond just Bitcoin can also reduce risk.

Investing in Bitcoin in India: A Flowchart

[A flowchart illustrating the process would be included here. The flowchart would visually represent the steps: Choosing an exchange, KYC verification, Account funding, Bitcoin purchase, Selling Bitcoin, Withdrawal of funds, and at each stage, branching pathways representing risk mitigation strategies such as thorough research of the exchange, using strong passwords, employing 2FA, using a hardware wallet, regular account monitoring, and diversifying investments.] The flowchart would clearly show how each step relates to minimizing risks associated with Bitcoin investment.Bitcoin’s Future in India

Bitcoin’s long-term prospects in India are a complex interplay of technological potential, regulatory hurdles, and evolving public perception. While widespread adoption as a primary payment method remains uncertain in the near future, the underlying blockchain technology offers significant opportunities for the Indian economy. The growth trajectory is likely to be influenced by government policies, technological advancements, and the overall global cryptocurrency market.

Bitcoin as a Mainstream Payment Method in India

The potential for Bitcoin to become a mainstream payment method in India faces significant challenges. Current regulatory uncertainty and a lack of widespread merchant acceptance hinder its adoption for everyday transactions. However, if regulatory clarity emerges and user-friendly platforms are developed, Bitcoin could gradually gain traction, particularly among younger demographics and tech-savvy individuals. The success hinges on addressing concerns about volatility and security, along with the development of robust infrastructure for seamless Bitcoin transactions. A successful integration would require a substantial shift in consumer behavior and merchant acceptance. Consider the example of mobile payment systems like PhonePe and Paytm; their widespread adoption illustrates the potential for a new payment system to gain traction if it offers convenience and security. Bitcoin’s potential lies in offering a decentralized alternative, reducing reliance on traditional banking systems.

Expert Opinions on Bitcoin’s Long-Term Growth in India

While concrete predictions vary widely, many experts believe Bitcoin holds long-term growth potential in India. Some analysts suggest that increased regulatory clarity and a growing understanding of cryptocurrency could drive adoption. The large, young, and tech-savvy population of India presents a significant market for cryptocurrency. However, others express caution, citing the inherent volatility of Bitcoin and the potential for regulatory crackdowns. The overall sentiment leans towards cautious optimism, with the long-term outlook dependent on several factors including global market trends, regulatory frameworks, and technological innovations within the cryptocurrency space. For instance, if India were to create a supportive regulatory environment similar to that of Singapore, it could potentially unlock significant growth.

Impact of Blockchain Technology on the Indian Economy

Beyond Bitcoin itself, the underlying blockchain technology holds immense potential for transforming various sectors of the Indian economy. Supply chain management, voting systems, and digital identity verification are just a few areas where blockchain’s transparency and security could improve efficiency and reduce fraud. For example, tracking the movement of goods across India’s vast supply chains could significantly reduce counterfeiting and streamline logistics. The potential for financial inclusion through blockchain-based solutions also presents a significant opportunity, particularly in reaching underserved populations. The development and adoption of blockchain solutions in India will require substantial investment in infrastructure and education, along with supportive government policies.

Challenges and Opportunities Facing Bitcoin Adoption in India

The adoption of Bitcoin in India faces significant challenges, including regulatory uncertainty, security concerns, and a lack of widespread public understanding. The government’s stance on cryptocurrencies remains ambiguous, leading to uncertainty among investors and businesses. Furthermore, the volatility of Bitcoin prices poses a significant risk for users. However, opportunities exist in the form of a large and growing young population receptive to new technologies, a burgeoning fintech sector, and the potential for Bitcoin to address financial inclusion challenges. Overcoming these challenges requires a collaborative effort between the government, the private sector, and educational institutions to promote responsible innovation and educate the public about the risks and benefits of cryptocurrencies.

Projected Growth Trajectory of Bitcoin in India until 2025

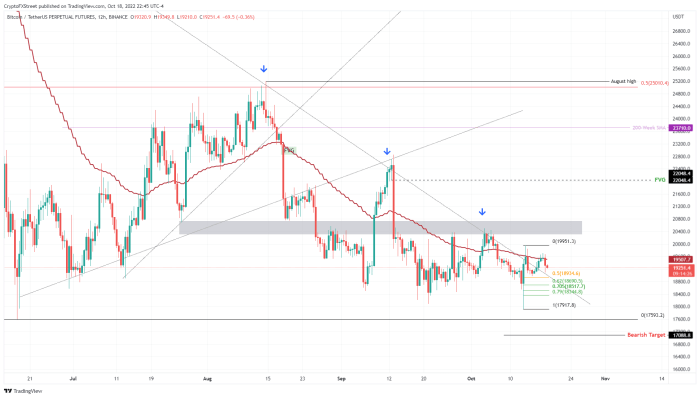

Imagine a graph with the X-axis representing time (from the present to 2025) and the Y-axis representing Bitcoin’s price in Indian Rupees. The trajectory would not be a straight line but rather a series of fluctuating waves. Initially, the line might show a relatively slow and steady climb, reflecting gradual adoption and increasing awareness. However, this growth would be punctuated by periods of sharp increases and decreases, mirroring the inherent volatility of the cryptocurrency market. Significant regulatory announcements or global market trends could trigger substantial price swings. Towards 2025, the projection depends heavily on the regulatory landscape and overall market sentiment. A positive regulatory environment and increasing institutional investment could lead to a more sustained upward trend, whereas negative news or tighter regulations could cause a downturn. The overall shape would be a somewhat upward-trending curve, but with significant fluctuations along the way, reflecting the unpredictable nature of the cryptocurrency market. The specific price points are impossible to predict accurately, given the many influencing factors.

Frequently Asked Questions (FAQs)

Investing in Bitcoin, especially in a rapidly developing market like India, involves navigating a complex landscape of regulations, risks, and opportunities. Understanding the potential pitfalls and benefits is crucial before making any investment decisions. The following section addresses some common concerns and questions regarding Bitcoin investment in India.

Potential Risks of Investing in Bitcoin in India

Investing in Bitcoin carries inherent risks, amplified by the volatile nature of the cryptocurrency market. Price fluctuations can be dramatic, leading to significant losses in a short period. Regulatory uncertainty in India, while improving, still presents a risk factor. The lack of consumer protection specifically for cryptocurrency investments is another concern. Furthermore, the decentralized nature of Bitcoin makes it susceptible to hacking and theft, requiring users to take stringent security measures. Finally, the speculative nature of Bitcoin means its value is heavily influenced by market sentiment and can be easily manipulated. For example, a sudden negative news report could trigger a sharp price drop, impacting investors’ portfolios.

Methods of Buying Bitcoin in India

Several methods exist for purchasing Bitcoin in India. The most common involves using cryptocurrency exchanges. These platforms allow users to buy and sell Bitcoin using Indian Rupees (INR). Some exchanges offer peer-to-peer (P2P) trading, where individuals can directly transact with each other. Another option, although less common, is through Bitcoin ATMs, which offer a more immediate and tangible way to purchase Bitcoin. Finally, some brokers facilitate Bitcoin purchases, integrating them into their investment portfolios. It’s crucial to research and choose a reputable platform before initiating any transaction. Consider factors such as security measures, fees, and customer support.

Bitcoin’s Legal Status in India

Currently, there’s no specific law in India that outright bans Bitcoin. However, the regulatory landscape is still evolving. The government has expressed concerns about the use of cryptocurrencies for illicit activities, such as money laundering and tax evasion. While not explicitly illegal, the lack of a comprehensive regulatory framework creates uncertainty. The government is actively working on developing a regulatory framework, which could involve licensing requirements for exchanges or the introduction of a central bank digital currency (CBDC). The situation is dynamic, and investors should stay informed about the latest developments.

Tax Implications of Bitcoin Trading in India

The taxation of Bitcoin transactions in India is subject to income tax laws. Profits from Bitcoin trading are considered as capital gains and are taxed accordingly. Short-term capital gains (STCG), realized within one year of investment, are taxed at the investor’s applicable slab rate. Long-term capital gains (LTCG), realized after one year, are taxed at 20% with indexation benefits. Furthermore, any income derived from Bitcoin mining or staking activities is also taxable. It’s crucial to maintain accurate records of all transactions to comply with tax regulations and avoid potential penalties. Seeking professional tax advice is recommended to ensure compliance with the evolving tax laws surrounding cryptocurrencies.

Best Bitcoin Exchanges in India

Several cryptocurrency exchanges operate in India, each offering varying features and services. Choosing the “best” exchange depends on individual needs and priorities. Factors to consider include security measures, fees, ease of use, and the range of cryptocurrencies offered. Some popular exchanges in India include WazirX, CoinDCX, and CoinSwitch Kuber. It is vital to thoroughly research and compare different platforms before making a choice, focusing on factors like security protocols, transaction fees, customer support responsiveness, and the overall user experience. Always prioritize reputable and regulated exchanges to mitigate risks.

Predicting the Bitcoin price in 2025 in Indian Rupees is challenging, dependent on numerous factors influencing global markets. A key aspect to consider is the Bitcoin price in December 2025, a month that often reflects yearly trends; you can find projections on this at Bitcoin Price December 2025. Understanding this potential December value will provide valuable insight into forecasting the overall Bitcoin price trajectory for the entire year in Indian Rupees.

Predicting the Bitcoin price in 2025 in Indian Rupees is challenging, dependent on numerous factors influencing global markets. A key aspect to consider is the Bitcoin price in December 2025, a month that often reflects yearly trends; you can find projections on this at Bitcoin Price December 2025. Understanding this potential December value will provide valuable insight into forecasting the overall Bitcoin price trajectory for the entire year in Indian Rupees.

Predicting the Bitcoin price in 2025 in Indian Rupees is challenging, dependent on numerous factors influencing global markets. A key aspect to consider is the Bitcoin price in December 2025, a month that often reflects yearly trends; you can find projections on this at Bitcoin Price December 2025. Understanding this potential December value will provide valuable insight into forecasting the overall Bitcoin price trajectory for the entire year in Indian Rupees.

Predicting the Bitcoin price in 2025 in Indian Rupees is challenging, influenced by numerous global factors. Understanding potential fluctuations requires considering related cryptocurrencies; for example, a helpful resource for comparative analysis is the Baby Bitcoin Price Prediction 2025 which offers insights into altcoin market trends. Ultimately, the Bitcoin price in INR in 2025 will depend on a complex interplay of market forces.